Key Insights

The North America military helicopters market, encompassing the United States, Canada, and Mexico, is poised for significant expansion. This growth is fueled by escalating defense budgets, strategic modernization initiatives, and the increasing demand for advanced rotorcraft in diverse military operations. The market is projected to reach a size of $13.1 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period. Key growth drivers include multi-mission helicopters, crucial for operations such as search and rescue, troop transport, and combat support, alongside transport helicopters, essential for large-scale troop and cargo deployment. Leading manufacturers like Textron Inc., Lockheed Martin Corporation, Airbus SE, The Boeing Company, MD Helicopters LLC, and Leonardo S.p.A. are actively innovating to deliver cutting-edge solutions and meet evolving military requirements. Technological advancements, including enhanced avionics, improved survivability, and increased payload capacities, are further propelling market growth. While budgetary constraints and shifting defense priorities may present moderate challenges, the market is expected to sustain its upward trajectory from 2025 to 2033, driven by ongoing modernization programs and the imperative for advanced helicopter technologies to counter emerging threats.

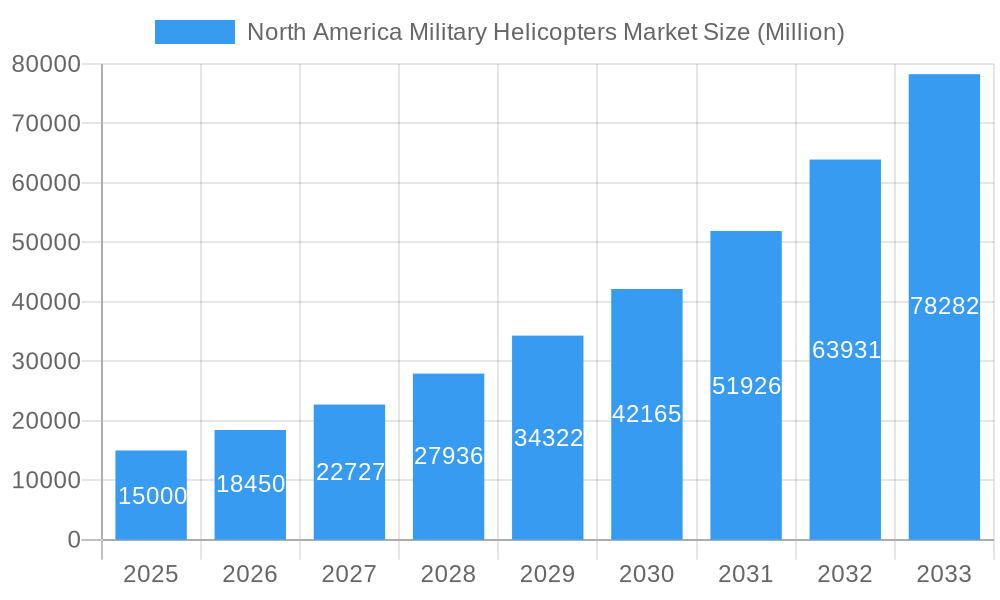

North America Military Helicopters Market Market Size (In Billion)

The substantial market size projected for 2025 underscores significant investment in North America's military helicopter capabilities. The analysis of market segments highlights a strong emphasis on multi-mission and transport helicopters, reflecting the varied operational needs of regional armed forces. Future market expansion will likely be influenced by the development of next-generation helicopters featuring integrated unmanned systems, advanced sensor technology, and enhanced network connectivity. Government policies fostering technological innovation and domestic manufacturing will also contribute to market growth. Competitive dynamics will continue to shape the landscape, with major manufacturers prioritizing research and development to maintain a competitive edge. Within North America, the United States is expected to remain the dominant market due to its substantial defense expenditure and robust military infrastructure, while Canada and Mexico are anticipated to experience steady growth aligned with their respective defense modernization strategies.

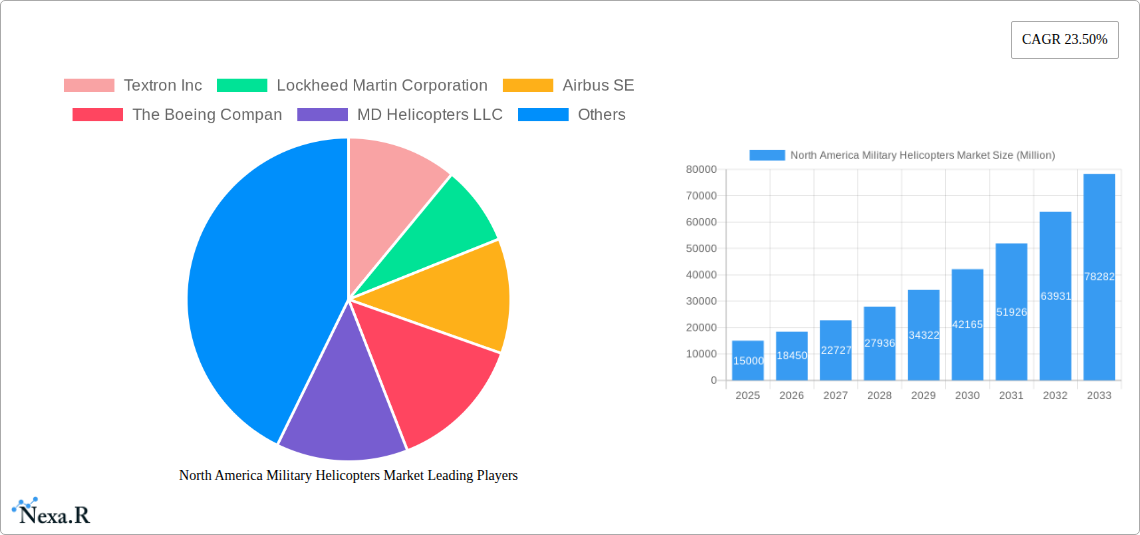

North America Military Helicopters Market Company Market Share

North America Military Helicopters Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America military helicopters market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. The market is segmented by body type (Multi-Mission Helicopter, Transport Helicopter, Others) and country (United States, Canada, Mexico, Rest of North America). This report is invaluable for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market.

North America Military Helicopters Market Dynamics & Structure

The North American military helicopter market is characterized by a moderate level of concentration, with a few major players dominating the landscape. Market share is estimated to be distributed as follows in 2025: Boeing (xx%), Lockheed Martin (xx%), Textron (xx%), Airbus (xx%), and others (xx%). Technological innovation, driven by advancements in avionics, propulsion systems, and materials science, is a key driver of growth. Stringent regulatory frameworks, including safety and environmental regulations, shape the market dynamics. The market also faces competition from alternative platforms, such as unmanned aerial vehicles (UAVs), particularly in certain mission roles. The aging helicopter fleets of North American militaries present a significant opportunity for replacement and modernization, and this has fostered M&A activity. In the period 2019-2024, an estimated xx M&A deals involving military helicopter companies took place.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Technological Innovation: Advancements in avionics, propulsion systems, and materials science are key drivers.

- Regulatory Framework: Stringent safety and environmental regulations influence market dynamics.

- Competitive Substitutes: UAVs pose a challenge, especially for specific mission profiles.

- End-User Demographics: Primarily the US military, followed by Canadian and Mexican forces.

- M&A Trends: Significant M&A activity driven by fleet modernization and technological integration.

North America Military Helicopters Market Growth Trends & Insights

The North America military helicopters market is projected to witness significant growth over the forecast period (2025-2033). The market size is expected to reach xx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fueled by several factors, including increasing defense budgets, modernization of existing fleets, and the demand for advanced capabilities in various military operations. The adoption rate of new technologies, such as advanced sensors, improved communication systems, and increased autonomy features, will further propel market growth. Shifting consumer behavior towards more sophisticated and technologically advanced platforms is observed.

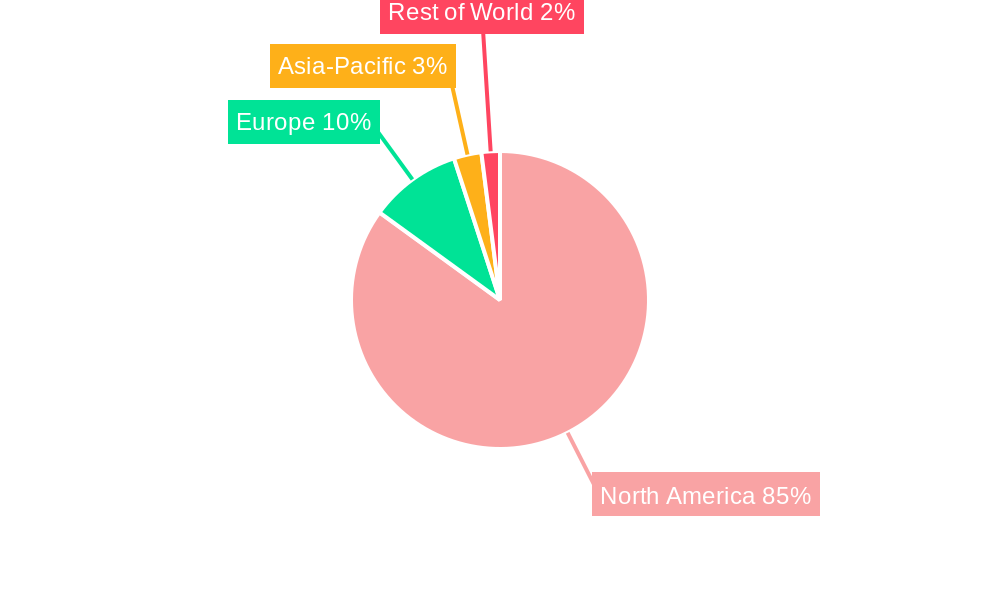

Dominant Regions, Countries, or Segments in North America Military Helicopters Market

The United States dominates the North American military helicopters market, owing to its substantial defense budget and large military fleet. The US market is estimated to hold xx% of the total market share in 2025. The Multi-Mission Helicopter segment holds a significant portion of the market, driven by its versatility and adaptability to various mission requirements. Transport helicopters also represent a substantial segment, primarily utilized for troop and equipment transport. Canada and Mexico exhibit comparatively smaller market sizes, but modernization initiatives and increasing defense spending suggest potential for future growth.

- United States: Largest market share due to substantial defense spending and fleet size. Key drivers include modernization programs and ongoing military operations.

- Multi-Mission Helicopters: Dominant segment due to versatility and applicability across various missions.

- Transport Helicopters: Significant segment driven by the need for troop and equipment transport.

- Canada and Mexico: Smaller markets, but with growth potential driven by increasing defense budgets and modernization plans.

North America Military Helicopters Market Product Landscape

The North American military helicopter market showcases a wide array of products characterized by advanced technologies and capabilities. Modern helicopters incorporate advanced avionics, including sophisticated navigation systems, improved sensor integration, and enhanced communication capabilities. Propulsion systems are increasingly efficient and powerful, while materials science has led to lighter and more durable airframes. These features provide enhanced performance, survivability, and mission effectiveness. Unique selling propositions include enhanced situational awareness, improved operational efficiency, and advanced payload capabilities.

Key Drivers, Barriers & Challenges in North America Military Helicopters Market

Key Drivers:

- Increasing defense budgets across North America

- Modernization of aging helicopter fleets

- Growing demand for advanced capabilities in military operations

Key Challenges and Restraints:

- High procurement costs of advanced helicopters

- Supply chain disruptions impacting production timelines and costs (estimated impact of xx% on production costs in 2024)

- Stringent regulatory requirements and certification processes

Emerging Opportunities in North America Military Helicopters Market

- Growing demand for unmanned and autonomous helicopter systems

- Expansion into emerging applications such as search and rescue, disaster relief, and border security

- Increased focus on sustainability and environmentally friendly technologies in helicopter design and operation.

Growth Accelerators in the North America Military Helicopters Market Industry

Technological advancements, including the integration of artificial intelligence and advanced materials, are crucial growth accelerators. Strategic partnerships between manufacturers and defense agencies foster innovation and technological integration. Furthermore, expansion into new markets such as special operations, counter-terrorism, and humanitarian aid missions will fuel market expansion.

Key Players Shaping the North America Military Helicopters Market Market

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- MD Helicopters LLC

- Leonardo S.p.A

Notable Milestones in North America Military Helicopters Market Sector

- December 2022: The US Army awarded a contract to Textron Inc.'s Bell unit for next-generation helicopters, aiming to replace aging UH-60 Black Hawk helicopters.

- March 2023: Boeing secured a contract to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers (Australia and Egypt), valued at USD 1.95 million.

- May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters and related equipment to Germany, worth USD 8.5 billion.

In-Depth North America Military Helicopters Market Market Outlook

The North American military helicopters market holds immense future potential, driven by continuous technological advancements, the need for fleet modernization, and expanding operational demands. Strategic partnerships, investments in R&D, and the exploration of new applications will shape market dynamics. The market is poised for sustained growth, offering significant opportunities for manufacturers and industry stakeholders.

North America Military Helicopters Market Segmentation

-

1. Body Type

- 1.1. Multi-Mission Helicopter

- 1.2. Transport Helicopter

- 1.3. Others

North America Military Helicopters Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Military Helicopters Market Regional Market Share

Geographic Coverage of North America Military Helicopters Market

North America Military Helicopters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Military Helicopters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Multi-Mission Helicopter

- 5.1.2. Transport Helicopter

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Boeing Compan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MD Helicopters LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Leonardo S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: North America Military Helicopters Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Military Helicopters Market Share (%) by Company 2025

List of Tables

- Table 1: North America Military Helicopters Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 2: North America Military Helicopters Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Military Helicopters Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 4: North America Military Helicopters Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Military Helicopters Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Military Helicopters Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Military Helicopters Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Military Helicopters Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the North America Military Helicopters Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, MD Helicopters LLC, Leonardo S p A.

3. What are the main segments of the North America Military Helicopters Market?

The market segments include Body Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 billion to Germany.March 2023: Boeing has been awarded a contract by the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers. The US government announced USD 1.95 million, indicating that the helicopter will be delivered to the US military and overseas buyers - specifically Australia and Egypt - as a part of the paramilitary process to the Foreign Service (FMS) from the US government. Contract completion is expected by the end of 2027.December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Military Helicopters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Military Helicopters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Military Helicopters Market?

To stay informed about further developments, trends, and reports in the North America Military Helicopters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence