Key Insights

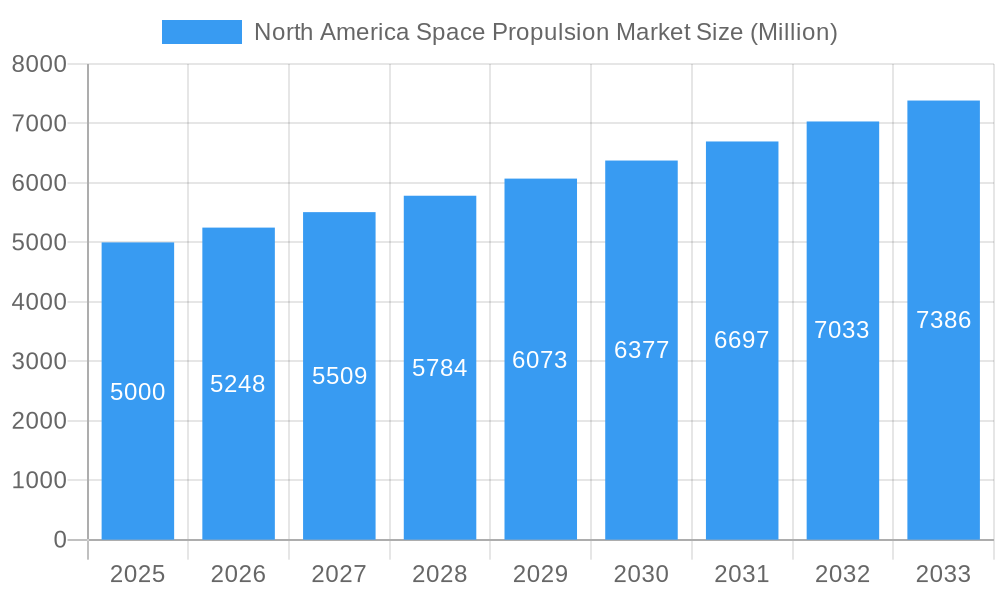

The North America space propulsion market, encompassing the United States and Canada, is experiencing robust growth, driven by increasing government and private investment in space exploration and defense initiatives. A Compound Annual Growth Rate (CAGR) of 4.96% from 2019 to 2024 suggests a consistently expanding market, projected to continue its upward trajectory through 2033. Key drivers include the rising demand for smaller, more efficient satellites for Earth observation, communication, and navigation, alongside the ambitions of both governmental agencies like NASA and commercial entities like SpaceX for deep-space missions. Technological advancements in electric propulsion systems, offering higher specific impulse and reduced propellant consumption compared to traditional chemical propulsion, are further fueling market expansion. While the market faces challenges such as high development costs and regulatory hurdles, these are largely offset by the significant long-term potential for profit and national security implications. Segmentation by propulsion technology (electric, gas-based, liquid fuel) reveals a strong emphasis on electric propulsion due to its cost-effectiveness and efficiency, particularly for smaller satellite missions. The dominance of the United States within the North American market reflects its significant role in global space exploration and its advanced technological capabilities.

North America Space Propulsion Market Market Size (In Billion)

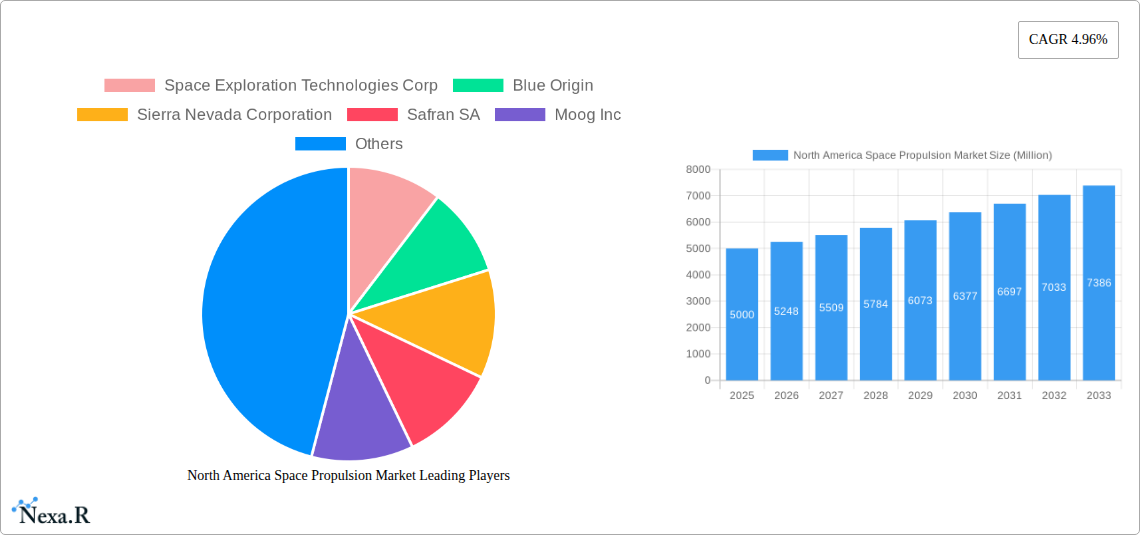

The competitive landscape is characterized by a mix of established aerospace giants like Northrop Grumman and Safran SA, alongside innovative startups such as Space Exploration Technologies Corp (SpaceX) and Blue Origin. These companies are constantly innovating, leading to the development of more advanced and reliable propulsion systems. This competition fosters innovation and drives down costs, ultimately benefiting the overall market. Looking ahead, the increasing focus on reusable launch vehicles and the exploration of new propellants, such as advanced solid propellants and hybrid systems, will continue to shape the market's trajectory. The market size in 2025 is estimated to be significantly large, given the steady growth. While precise figures are not provided, considering the CAGR and market trends, a conservative estimate places the 2025 market size in the billions of US dollars. The continued expansion is expected throughout the forecast period (2025-2033), driven by the factors mentioned above, solidifying North America's position as a leading player in the global space propulsion sector.

North America Space Propulsion Market Company Market Share

This in-depth report provides a comprehensive analysis of the North America space propulsion market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is an invaluable resource for industry professionals, investors, and anyone seeking to understand the complexities and opportunities within this dynamic sector. The market is segmented by country (United States, Canada) and propulsion technology (Electric, Gas-based, Liquid Fuel).

North America Space Propulsion Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the North America space propulsion market. The market is characterized by a moderate level of concentration, with key players vying for market share. Technological innovation, driven by the demand for more efficient and reliable propulsion systems, is a major driver. Regulatory frameworks, particularly those related to safety and environmental impact, play a significant role. The emergence of electric propulsion is disrupting the traditional gas-based and liquid fuel segments. M&A activity has been moderate in recent years, with strategic acquisitions aimed at enhancing technological capabilities and expanding market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Strong emphasis on electric propulsion, miniaturization, and increased efficiency.

- Regulatory Framework: Stringent safety and environmental regulations influencing technology adoption.

- Competitive Substitutes: Limited direct substitutes, but competition exists across different propulsion technologies.

- End-User Demographics: Primarily government agencies (NASA, CSA), defense contractors, and commercial space companies.

- M&A Trends: Moderate activity, focusing on technology acquisition and geographic expansion. Approximately xx M&A deals were recorded between 2019 and 2024.

North America Space Propulsion Market Growth Trends & Insights

The North America space propulsion market is experiencing robust growth, driven by increasing space exploration activities, commercial space launches, and the growing adoption of electric propulsion technology. The market size, valued at xx million in 2025, is projected to reach xx million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by significant investments in space exploration programs, the expansion of satellite constellations, and the increasing demand for more efficient and cost-effective propulsion systems. Technological advancements are accelerating adoption rates, leading to market penetration improvements in both governmental and commercial sectors. Consumer behavior shifts toward sustainability are influencing the increased adoption of electric propulsion systems.

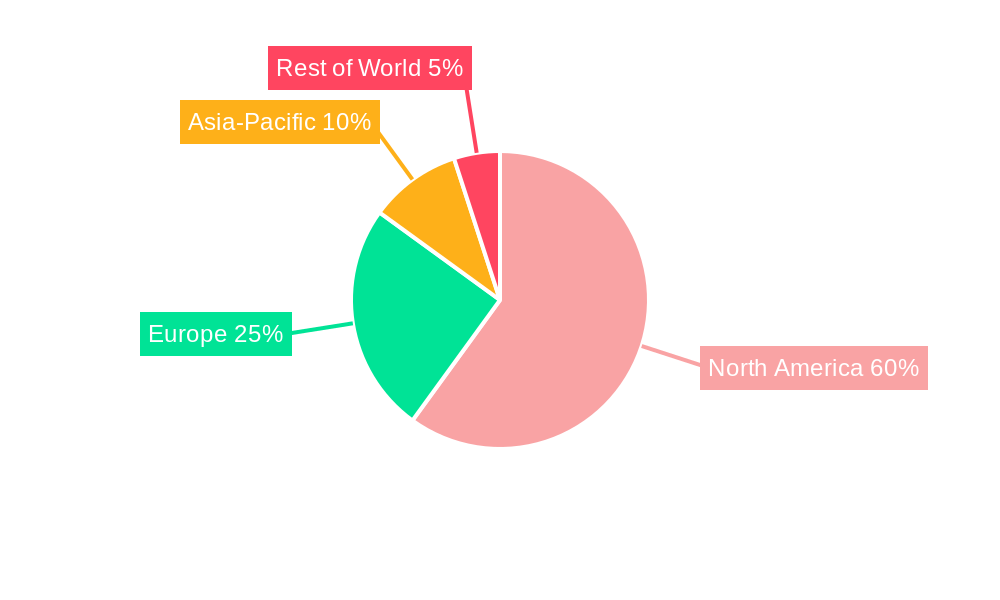

Dominant Regions, Countries, or Segments in North America Space Propulsion Market

The United States dominates the North America space propulsion market, owing to its robust space industry, substantial government investments, and the presence of major players like SpaceX and Blue Origin. The strong presence of NASA and other government agencies, coupled with a well-established infrastructure for space research and development, fuels market growth within the US. While Canada has a smaller but growing presence, its market share is significantly lower than the United States. Within propulsion technologies, liquid fuel propulsion currently holds the largest market share, but electric propulsion is experiencing the highest growth rate due to its increasing efficiency and cost-effectiveness.

- United States: Dominates the market due to strong government spending, established aerospace industry, and presence of major players.

- Canada: Smaller market share but growing, driven by increasing investment in space exploration and satellite technologies.

- Liquid Fuel Propulsion: Currently holds the largest market share.

- Electric Propulsion: Demonstrates the fastest growth rate due to efficiency and cost advantages.

North America Space Propulsion Market Product Landscape

The North America space propulsion market offers a diverse range of products, including liquid fuel engines, solid rocket motors, electric thrusters, and hybrid propulsion systems. These products cater to various applications, such as satellite launches, deep-space exploration, and orbital maneuvering. Recent innovations focus on increasing fuel efficiency, reducing weight, and enhancing reliability. The unique selling propositions often revolve around higher thrust-to-weight ratios, improved fuel efficiency, and extended operational lifespans. Technological advancements, such as the development of advanced materials and more sophisticated control systems, drive product innovation and market competitiveness.

Key Drivers, Barriers & Challenges in North America Space Propulsion Market

Key Drivers:

- Increased government spending on space exploration.

- Growing commercial space industry.

- Technological advancements in electric propulsion.

- Demand for more efficient and reliable propulsion systems.

Key Barriers & Challenges:

- High research and development costs.

- Stringent regulatory requirements.

- Supply chain disruptions impacting component availability.

- Intense competition from established players. The competitive pressure restricts profit margins for new entrants with approx. xx% of profit margin reduction projected over the next decade.

Emerging Opportunities in North America Space Propulsion Market

Emerging opportunities exist in the development of advanced electric propulsion systems, miniaturized thrusters for small satellites, and hybrid propulsion technologies combining the advantages of different systems. Untapped markets include small satellite constellations and deep-space missions requiring highly efficient and long-duration propulsion. Growing demand for sustainable space technologies will drive the adoption of electric propulsion, creating significant opportunities for innovative companies.

Growth Accelerators in the North America Space Propulsion Market Industry

Long-term growth in the North America space propulsion market will be driven by advancements in electric propulsion technology, increased collaboration between government agencies and private companies, and expanding global space exploration activities. Strategic partnerships aimed at sharing resources and expertise will be crucial. Expansion into new markets, such as space tourism and asteroid mining, will further stimulate growth.

Key Players Shaping the North America Space Propulsion Market Market

Notable Milestones in North America Space Propulsion Market Sector

- February 2023: Thales Alenia Space contracted with KARI to provide integrated electric propulsion for the GEO-KOMPSAT-3 satellite. This signifies growing adoption of electric propulsion technology.

- February 2023: NASA's LSP awarded Blue Origin the ESCAPADE contract, utilizing New Glenn reusable technology. This highlights the increasing preference for reusable launch vehicles.

- December 2023: NASA awarded Blue Origin a NASA Launch Services II IDIQ contract for launching various satellites using New Glenn. This signifies a significant win for Blue Origin and its reusable launch vehicle technology.

In-Depth North America Space Propulsion Market Market Outlook

The future of the North America space propulsion market appears bright, with strong growth prospects driven by increasing demand for space-based services, technological advancements, and government investments. Strategic partnerships and collaborations will become increasingly crucial for success, and companies that can adapt to changing technological landscapes will be best positioned for growth. The market presents significant opportunities for companies specializing in electric propulsion, reusable launch vehicles, and advanced materials. The continuous push for cost-effectiveness and sustainability will further shape the market's future.

North America Space Propulsion Market Segmentation

-

1. Propulsion Tech

- 1.1. Electric

- 1.2. Gas based

- 1.3. Liquid Fuel

North America Space Propulsion Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Space Propulsion Market Regional Market Share

Geographic Coverage of North America Space Propulsion Market

North America Space Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Product innovation in propulsion technology is expected to boost growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Space Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.1.1. Electric

- 5.1.2. Gas based

- 5.1.3. Liquid Fuel

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Blue Origin

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sierra Nevada Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moog Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ariane Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OHB SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Busek Co Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thale

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Northrop Grumman Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: North America Space Propulsion Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Space Propulsion Market Share (%) by Company 2025

List of Tables

- Table 1: North America Space Propulsion Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 2: North America Space Propulsion Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: North America Space Propulsion Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 4: North America Space Propulsion Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States North America Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Space Propulsion Market?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the North America Space Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Blue Origin, Sierra Nevada Corporation, Safran SA, Moog Inc, Ariane Group, OHB SE, Busek Co Inc, Thale, Northrop Grumman Corporation.

3. What are the main segments of the North America Space Propulsion Market?

The market segments include Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Product innovation in propulsion technology is expected to boost growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: NASA awarded Blue Origin a NASA Launch Services II Indefinite Delivery Indefinite Quantity (IDIQ) contract to launch planetary, Earth observation, exploration, and scientific satellites for the agency aboard New Glenn, Blue Origin's orbital reusable launch vehicle.February 2023: NASA's Launch Services Program (LSP) awarded Blue Origin the Escape and Plasma Acceleration and Dynamics Explorers (ESCAPADE) contract. Under the contract Blue Origin will provide its New Glenn reusable technology for the mission.February 2023: Thales Alenia Space has contracted with the Korea Aerospace Research Institute (KARI) to provide the integrated electric propulsion on their GEO-KOMPSAT-3 (GK3) satellite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Space Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Space Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Space Propulsion Market?

To stay informed about further developments, trends, and reports in the North America Space Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence