Key Insights

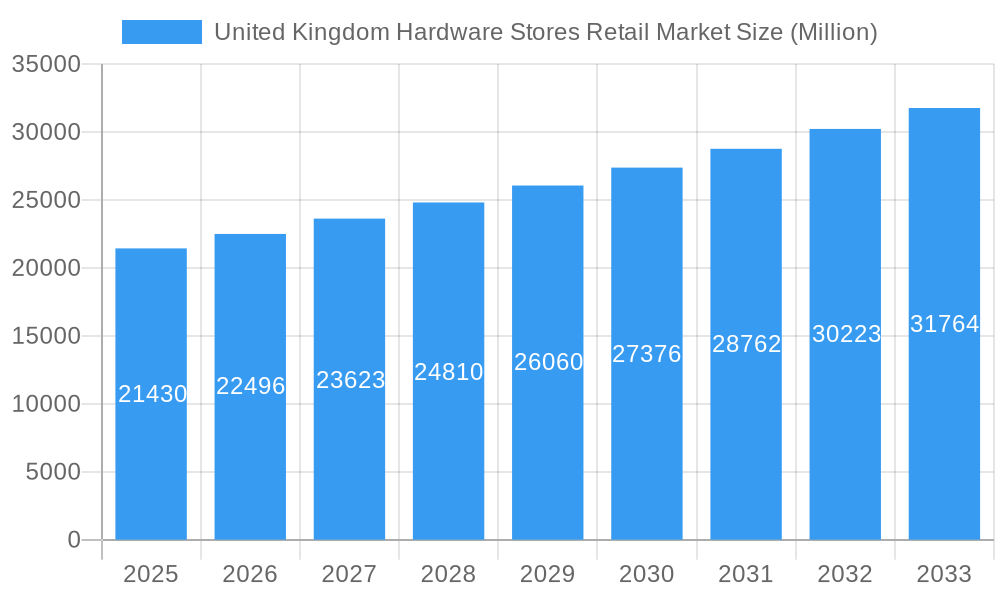

The United Kingdom hardware stores retail market, valued at approximately £21.43 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 5.01% from 2025 to 2033. This growth is driven by several key factors. Firstly, the ongoing trend of home improvement and DIY projects, fueled by rising disposable incomes and a preference for personalized living spaces, continues to boost demand for hardware products. Secondly, the increasing popularity of online retail channels, offering convenience and broader product selections, is contributing to market expansion. Furthermore, a growing emphasis on sustainability and eco-friendly building materials presents new opportunities for retailers to cater to environmentally conscious consumers. However, the market faces certain challenges. Economic fluctuations and potential increases in raw material costs can impact profitability. Additionally, intense competition among established players like Kingfisher PLC, Travis Perkins PLC, and Homebase, alongside the emergence of smaller, specialized retailers, necessitates strategic differentiation and efficient supply chain management. The market is segmented by product type (e.g., tools, building materials, paint), distribution channel (online, brick-and-mortar), and geographic region, providing opportunities for targeted marketing strategies.

United Kingdom Hardware Stores Retail Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a significant expansion of the UK hardware stores retail market, driven by ongoing consumer demand and market diversification. Major players are likely to focus on enhancing their omnichannel presence, improving customer experience through personalized services and loyalty programs, and strategically expanding product portfolios to cater to evolving market needs. The success of individual businesses will hinge on their ability to effectively navigate competitive pressures, adapt to technological advancements, and respond dynamically to shifts in consumer preferences and economic conditions. The emergence of innovative products and sustainable practices will also play a crucial role in shaping the market’s future trajectory.

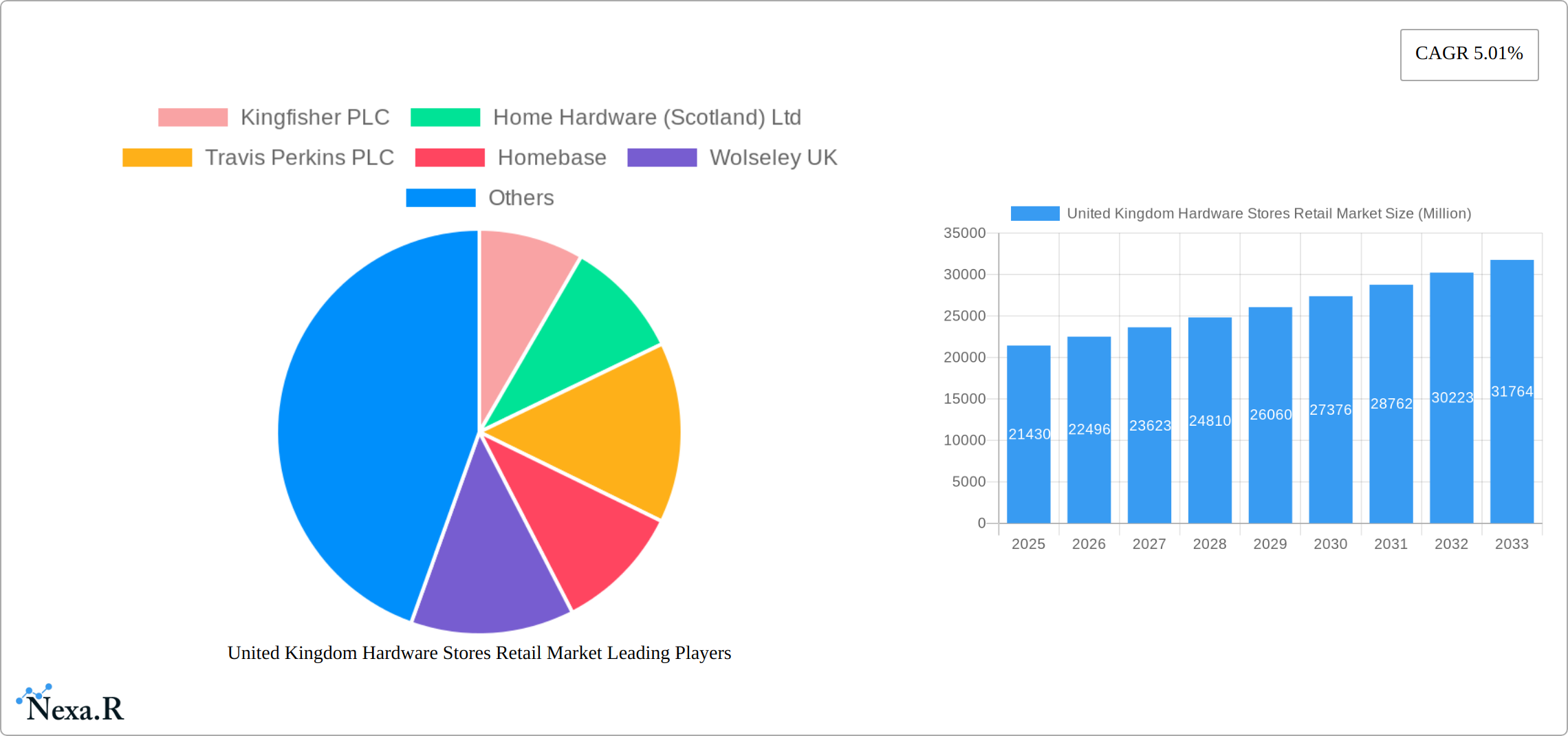

United Kingdom Hardware Stores Retail Market Company Market Share

United Kingdom Hardware Stores Retail Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom hardware stores retail market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market of Home Improvement Retail and its child market, Hardware Stores Retail, providing granular insights into market segmentation, key players, and emerging opportunities. Market values are presented in million units.

United Kingdom Hardware Stores Retail Market Dynamics & Structure

This section analyzes the UK hardware stores retail market's structure, focusing on market concentration, technological advancements, regulatory landscape, competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of large national chains and smaller independent retailers.

- Market Concentration: The market exhibits moderate concentration, with a few major players holding significant market share, while numerous smaller players cater to niche segments. Kingfisher PLC and Travis Perkins PLC are dominant players, holding an estimated xx% and xx% market share respectively in 2025. The remaining market share is distributed among numerous smaller players.

- Technological Innovation: Online retail and digitalization are driving innovation, with companies investing in e-commerce platforms and omnichannel strategies. However, traditional brick-and-mortar stores still hold significance due to the tangible nature of many hardware products.

- Regulatory Framework: Building regulations and product safety standards significantly impact the market. Compliance costs can be a barrier for smaller players.

- Competitive Substitutes: Online marketplaces and DIY superstores offer substitute products, putting pressure on traditional hardware stores.

- End-User Demographics: The primary end-users are homeowners, DIY enthusiasts, professional contractors, and businesses. Shifting demographics and increasing DIY culture influence market demand.

- M&A Trends: The past five years have witnessed xx M&A deals in the UK hardware retail sector, primarily focused on consolidation and expansion into new geographical areas. Many deals involved smaller regional players being acquired by larger chains.

United Kingdom Hardware Stores Retail Market Growth Trends & Insights

This section leverages extensive market research and up-to-the-minute data to provide a comprehensive and granular analysis of the UK hardware stores retail market's growth trajectory. We delve deep into adoption rates of new technologies, the impact of significant technological disruptions, and the evolving tapestry of consumer preferences that are shaping the sector.

The UK hardware stores retail market demonstrated a robust Compound Annual Growth Rate (CAGR) of approximately [Insert specific historical CAGR]% during the historical period (2019-2024), culminating in a significant market valuation of [Insert specific historical market size] million units in 2024. The digital transformation of the sector is evident, with online hardware sales capturing an estimated [Insert specific online penetration]% market share in 2025, a figure poised for steady expansion. This growth is intrinsically linked to enhanced internet penetration across the nation and a growing consumer appetite for the convenience and accessibility that online platforms offer. Disruptive technologies are actively redefining the market landscape. Innovations such as the integration of augmented reality (AR) for immersive product visualization and the implementation of sophisticated inventory management systems are streamlining operations and improving customer experiences. Furthermore, a palpable consumer shift towards sustainability and eco-conscious purchasing is profoundly influencing product development strategies and driving demand for greener alternatives.

Looking ahead, the forecast period (2025-2033) anticipates a dynamic CAGR of [Insert specific forecast CAGR]%. This projected growth will be propelled by a confluence of factors, including sustained momentum in home improvement activities, a flourishing construction and renovation sector, and the enduring popularity of DIY culture, which continues to empower individuals to undertake a wide array of projects.

Dominant Regions, Countries, or Segments in United Kingdom Hardware Stores Retail Market

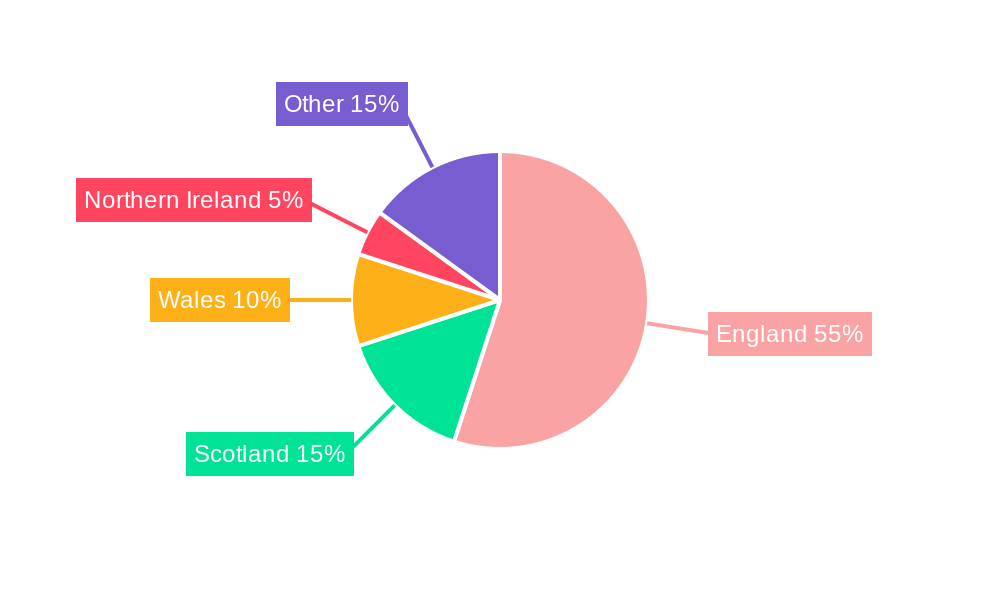

The South East and London regions dominate the UK hardware stores retail market due to factors such as higher population density, affluence, and increased housing construction. The growth in these regions is fueled by strong economic activity, a thriving housing market, and readily available infrastructure supporting construction and renovation projects.

- Key Drivers:

- Higher population density.

- Higher disposable income.

- Robust housing market.

- Well-developed infrastructure.

- Government incentives and grants for home improvements.

The market dominance is evident in their higher market share and faster growth rates compared to other regions. However, growth potential exists in other regions through targeted expansion strategies and tailored product offerings.

United Kingdom Hardware Stores Retail Market Product Landscape

The UK hardware stores retail market is characterized by an expansive and ever-evolving product portfolio, encompassing an extensive array of essential items. This includes a comprehensive selection of professional and DIY tools, a diverse range of building materials crucial for construction and renovation, a wide spectrum of home improvement supplies designed to enhance living spaces, and robust outdoor equipment catering to gardening and landscaping needs. Recent product innovations are a testament to the industry's forward-thinking approach. These advancements prominently feature the seamless integration of smart home technology into traditional hardware products, offering enhanced connectivity and control. A significant emphasis is also placed on the development and availability of eco-friendly and sustainable alternatives, meeting growing environmental concerns. Furthermore, the market is witnessing the introduction of specialized tools meticulously engineered for specific DIY projects, empowering consumers with greater precision and efficiency. These innovations collectively underscore a heightened focus on elevating customer convenience, championing environmental responsibility, and optimizing product performance.

Key Drivers, Barriers & Challenges in United Kingdom Hardware Stores Retail Market

Key Drivers: Increasing disposable income, government initiatives supporting home improvements, a rising DIY culture, and the growth of the construction industry are primary drivers. Technological advancements such as e-commerce and innovative product designs further fuel market growth.

Key Challenges: Supply chain disruptions, fluctuations in raw material prices, intense competition, and evolving consumer demands pose significant challenges. Brexit's impact on import costs and trade regulations adds to the complexity of operating in this market. The rise of online retailers also presents a significant challenge to traditional brick-and-mortar stores.

Emerging Opportunities in United Kingdom Hardware Stores Retail Market

The UK hardware stores retail market is ripe with burgeoning opportunities poised to drive future expansion. A key area of potential lies in the strategic enhancement and broad expansion of e-commerce capabilities, ensuring seamless online purchasing experiences for a wider customer base. The growing demand for specialized niche markets presents another significant avenue, particularly in areas such as sustainable building materials and bespoke home renovation solutions. Furthermore, the increasing consumer desire for personalized and customized services, from tailored product recommendations to in-home consultations, offers a compelling opportunity for differentiation. Untapped potential also exists within rural and underserved areas, where establishing convenient access to hardware supplies could foster significant market penetration. The development and adoption of innovative retail concepts, such as experiential showrooms and subscription-based service models, are also expected to play a pivotal role in unlocking new growth frontiers.

Growth Accelerators in the United Kingdom Hardware Stores Retail Market Industry

The trajectory of the United Kingdom hardware stores retail market is being significantly propelled by several key growth accelerators. Strategic partnerships and collaborations across the value chain, from manufacturers to retailers, are fostering innovation and expanding market reach. Technological breakthroughs in both product development, leading to more efficient and feature-rich offerings, and supply chain management, ensuring greater agility and cost-effectiveness, are critical drivers. Market expansion into new geographical areas, both domestically and potentially internationally, presents substantial opportunities for scaling operations. Crucially, a sustained and increasing investment in the research, development, and promotion of sustainable and eco-friendly products is not only meeting evolving consumer demands but also creating entirely new market segments and driving significant commercial success.

Key Players Shaping the United Kingdom Hardware Stores Retail Market Market

- Kingfisher PLC

- Home Hardware (Scotland) Ltd

- Travis Perkins PLC

- Homebase

- Wolseley UK

- Ferguson PLC

- The Range

- Hampstead Hardware

- Malletts Home Hardware

- Stax Trade Centres Limited

Notable Milestones in United Kingdom Hardware Stores Retail Market Sector

- December 2023: Kingfisher PLC expands its collaboration with CitrusAd to introduce retail media opportunities.

- October 2023: Travis Perkins PLC announces a five-year fleet management partnership with Zenith.

In-Depth United Kingdom Hardware Stores Retail Market Market Outlook

The UK hardware stores retail market is poised for continued growth, driven by sustained investment in infrastructure, ongoing home improvement activity, and the increasing adoption of e-commerce. Strategic partnerships, technological innovation, and expansion into niche markets will be crucial for long-term success. The focus on sustainability and customer experience will further shape the market's future trajectory.

United Kingdom Hardware Stores Retail Market Segmentation

-

1. Product Type

- 1.1. Door Hardware

- 1.2. Building Materials

- 1.3. Kitchen and Toilet Product

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Offline Stores

- 2.2. Online Stores

United Kingdom Hardware Stores Retail Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Hardware Stores Retail Market Regional Market Share

Geographic Coverage of United Kingdom Hardware Stores Retail Market

United Kingdom Hardware Stores Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus on DIY; Growing Trend of Home Improvement and Renovation Projects

- 3.3. Market Restrains

- 3.3.1. Increased Focus on DIY; Growing Trend of Home Improvement and Renovation Projects

- 3.4. Market Trends

- 3.4.1. The Growing Emphasis on DIY Projects is Boosting the Demand for the Hardware Retail Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Hardware Stores Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Door Hardware

- 5.1.2. Building Materials

- 5.1.3. Kitchen and Toilet Product

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Stores

- 5.2.2. Online Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kingfisher PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Home Hardware (Scotland) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Travis Perkins PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Homebase

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wolseley UK

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ferguson PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Range

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hampstead Hardware

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Malletts Home Hardware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Stax Trade Centres Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kingfisher PLC

List of Figures

- Figure 1: United Kingdom Hardware Stores Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Hardware Stores Retail Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United Kingdom Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United Kingdom Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United Kingdom Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: United Kingdom Hardware Stores Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Hardware Stores Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: United Kingdom Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: United Kingdom Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: United Kingdom Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: United Kingdom Hardware Stores Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Hardware Stores Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Hardware Stores Retail Market?

The projected CAGR is approximately 5.01%.

2. Which companies are prominent players in the United Kingdom Hardware Stores Retail Market?

Key companies in the market include Kingfisher PLC, Home Hardware (Scotland) Ltd, Travis Perkins PLC, Homebase, Wolseley UK, Ferguson PLC, The Range, Hampstead Hardware, Malletts Home Hardware, Stax Trade Centres Limited.

3. What are the main segments of the United Kingdom Hardware Stores Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus on DIY; Growing Trend of Home Improvement and Renovation Projects.

6. What are the notable trends driving market growth?

The Growing Emphasis on DIY Projects is Boosting the Demand for the Hardware Retail Market.

7. Are there any restraints impacting market growth?

Increased Focus on DIY; Growing Trend of Home Improvement and Renovation Projects.

8. Can you provide examples of recent developments in the market?

In December 2023, Kingfisher, the global home improvement retailer, expanded its collaboration with CitrusAd to introduce retail media opportunities for third-party brands across its banners, beginning with B&Q.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Hardware Stores Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Hardware Stores Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Hardware Stores Retail Market?

To stay informed about further developments, trends, and reports in the United Kingdom Hardware Stores Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence