Key Insights

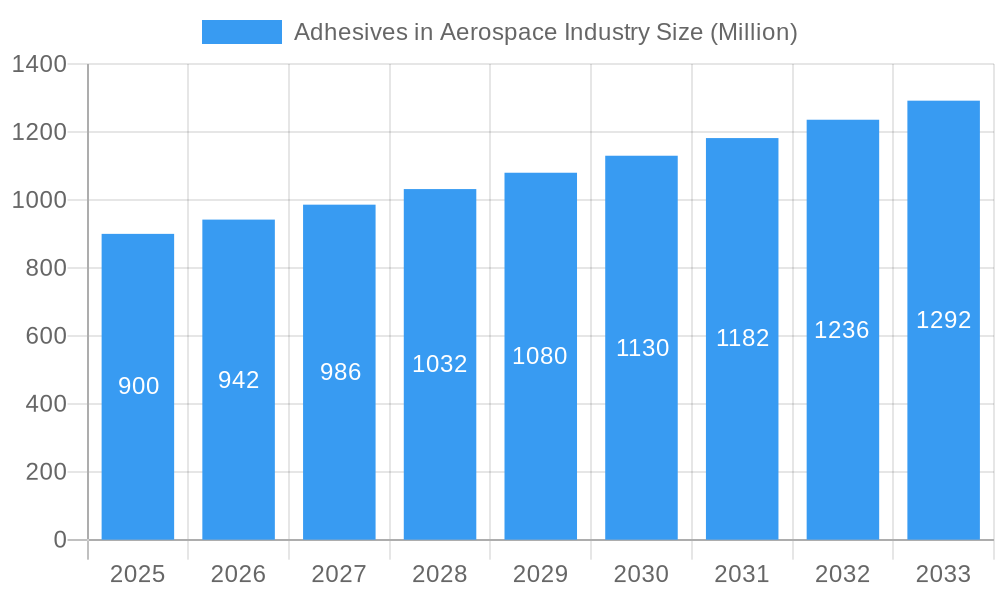

The global Adhesives in Aerospace Industry is poised for robust growth, with an estimated market size of $0.9 billion in 2025. This expansion is driven by a CAGR of 4.71%, indicating a healthy and consistent upward trajectory throughout the forecast period of 2025-2033. The increasing demand for lightweight, high-performance materials in aircraft construction is a primary catalyst. Modern aerospace designs heavily rely on advanced adhesives to bond dissimilar materials like composites, metals, and plastics, thereby reducing overall aircraft weight. This weight reduction translates directly into improved fuel efficiency, lower emissions, and enhanced performance, making adhesives indispensable for next-generation aircraft development. Furthermore, the industry's relentless pursuit of enhanced structural integrity, durability, and safety, especially in critical aircraft components, further fuels the adoption of sophisticated adhesive solutions that offer superior bonding strength and resistance to extreme environmental conditions, including temperature fluctuations, vibration, and chemical exposure. The increasing complexity of aircraft interiors and the need for efficient assembly processes also contribute significantly to market expansion, as adhesives offer a more streamlined and reliable alternative to traditional fastening methods like riveting.

Adhesives in Aerospace Industry Market Size (In Million)

The market is segmented across various technologies, resin types, function types, and end-uses, reflecting the diverse applications of adhesives in aerospace. Waterborne, solvent-borne, and reactive technologies cater to specific manufacturing needs and environmental regulations, with a notable trend towards eco-friendlier, low-VOC (Volatile Organic Compound) waterborne and reactive adhesives. Epoxy, polyurethane, and silicone resins are prominent due to their exceptional mechanical properties, thermal stability, and chemical resistance, making them ideal for demanding aerospace applications. Structural adhesives, crucial for load-bearing applications, are experiencing significant demand, while non-structural adhesives are vital for interior fittings and less critical components. Both Original Equipment Manufacturer (OEM) and Maintenance, Repair, and Operations (MRO) sectors are key consumers, with MRO activities expected to grow as the global aircraft fleet ages, requiring regular maintenance and component replacement where adhesives play a crucial role in repairs and refurbishments. Regions like Asia Pacific, led by China and India, are emerging as significant growth hubs due to expanding aviation infrastructure and increasing defense spending.

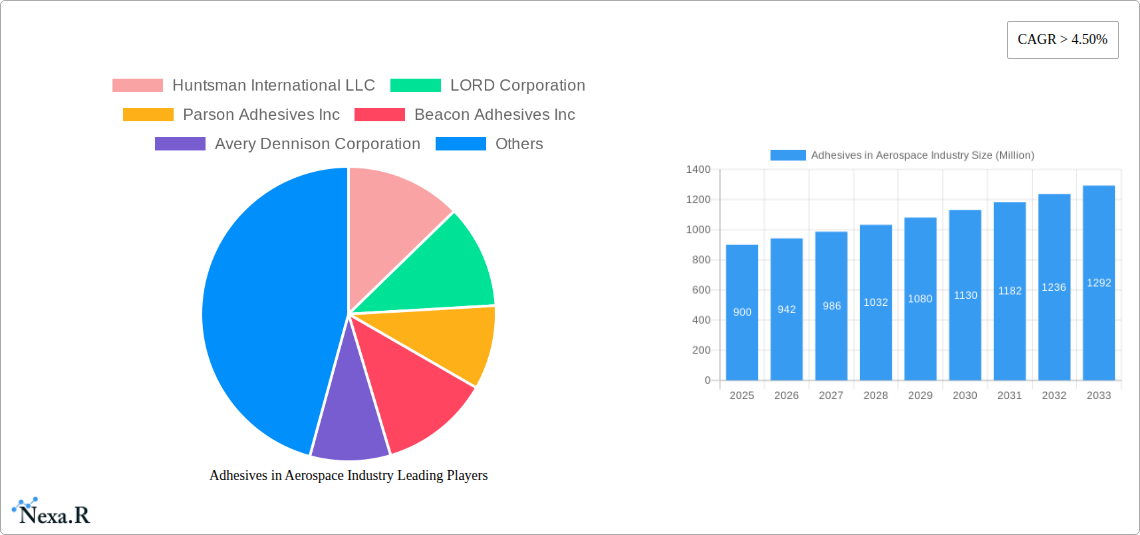

Adhesives in Aerospace Industry Company Market Share

Unlocking the Future of Flight: Comprehensive Report on Adhesives in the Aerospace Industry

This in-depth market research report delves into the dynamic Adhesives in Aerospace Industry, offering a crucial analysis of its evolution, growth trajectories, and future potential. Spanning from 2019 to 2033, with a detailed focus on the Base Year 2025 and Forecast Period 2025–2033, this report is your definitive guide to understanding the market dynamics, technological advancements, and strategic opportunities shaping this critical sector.

This report is designed to equip Aerospace Adhesives Manufacturers, Aircraft Component Suppliers, MRO providers, Material Scientists, R&D professionals, and Investment Analysts with actionable insights. We meticulously analyze the Parent Market (Aerospace Materials Market) and Child Markets (specific adhesive chemistries and applications) to provide a holistic view. The global Aerospace Adhesives Market Size is projected to reach $XX billion by 2033, exhibiting a robust CAGR of X.X%.

Keywords: Aerospace Adhesives, Aircraft Adhesives, Structural Adhesives, Non-Structural Adhesives, Epoxy Adhesives Aerospace, Polyurethane Adhesives Aerospace, Silicone Adhesives Aerospace, Waterborne Aerospace Adhesives, Solvent-borne Aerospace Adhesives, Reactive Aerospace Adhesives, OEM Aerospace Adhesives, MRO Aerospace Adhesives, Aerospace Bonding Solutions, Lightweighting Aerospace Materials, High-Performance Adhesives Aerospace, Aviation Adhesives Market, Aircraft Manufacturing Adhesives, Future of Flight Adhesives.

Adhesives in Aerospace Industry Market Dynamics & Structure

The Adhesives in Aerospace Industry is characterized by a moderately concentrated market, driven by stringent regulatory frameworks and the relentless pursuit of technological innovation for enhanced aircraft performance, safety, and lightweighting. Key drivers include advancements in resin chemistries and application technologies, alongside increasing demand for sustainable and eco-friendly bonding solutions. Competitive substitutes such as mechanical fasteners and welding are continuously being challenged by the superior strength-to-weight ratios and design flexibility offered by advanced adhesives. End-user demographics are shifting towards a greater emphasis on lifecycle cost reduction and improved fuel efficiency, directly impacting adhesive selection. Mergers and acquisitions (M&A) trends highlight a strategic consolidation aimed at expanding product portfolios and geographical reach, with an estimated X significant M&A deals recorded during the Historical Period (2019-2024). Innovation barriers remain high due to the extensive qualification and certification processes required for aerospace applications.

- Market Concentration: Moderately concentrated, with a few key players holding significant market share.

- Technological Innovation Drivers: Demand for lightweighting, improved fuel efficiency, enhanced durability, and reduced manufacturing complexity.

- Regulatory Frameworks: Stringent FAA, EASA, and other aviation authority regulations influencing product development and certification.

- Competitive Product Substitutes: Mechanical fasteners, rivets, welding, and other joining methods.

- End-User Demographics: Focus on commercial aviation, defense, and space exploration sectors, with increasing demand for sustainable solutions.

- M&A Trends: Strategic acquisitions to gain market share, expand product offerings, and acquire new technologies. Estimated M&A deal volume: XX billion USD (2019-2024).

Adhesives in Aerospace Industry Growth Trends & Insights

The Adhesives in Aerospace Industry is poised for substantial growth, driven by an increasing demand for advanced composite materials and a persistent need for weight reduction in aircraft manufacturing. The market size is projected to expand significantly from an estimated $XX billion in 2025 to $XX billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of X.X% during the forecast period. Adoption rates of high-performance adhesives are accelerating as manufacturers recognize their ability to enhance structural integrity, improve fatigue resistance, and simplify assembly processes compared to traditional methods. Technological disruptions, such as the development of novel epoxy, polyurethane, and silicone-based formulations, alongside advanced reactive adhesive systems, are revolutionizing bonding capabilities. Consumer behavior shifts are evident, with a growing preference for adhesives that offer reduced volatile organic compounds (VOCs) and contribute to the overall sustainability of aircraft production. The penetration of structural adhesives in primary aircraft structures is steadily increasing, a testament to their proven reliability and performance benefits.

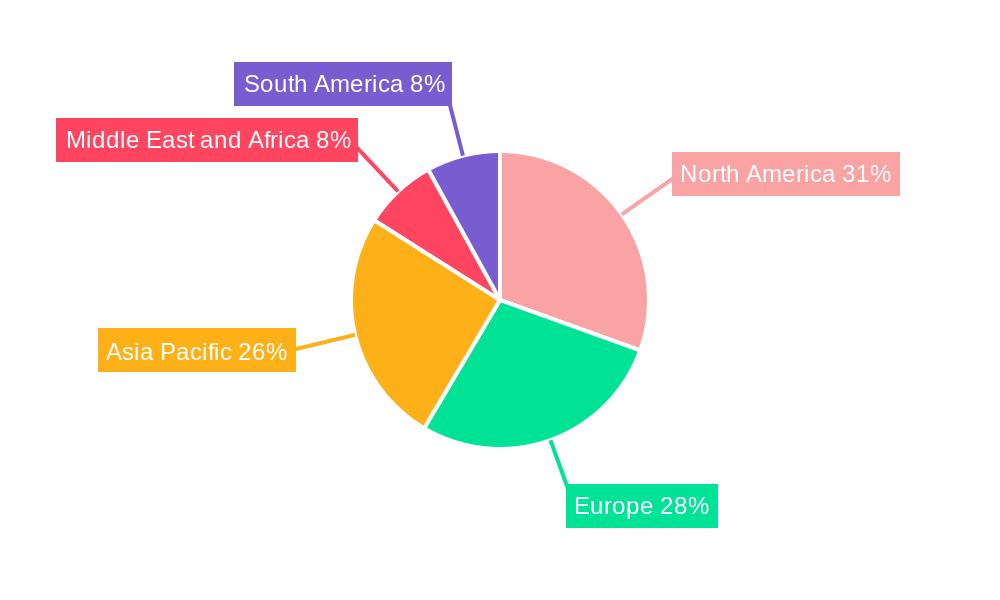

Dominant Regions, Countries, or Segments in Adhesives in Aerospace Industry

The North America region is identified as the dominant force in the Adhesives in Aerospace Industry, largely propelled by its established aerospace manufacturing base, significant defense spending, and robust research and development infrastructure. Within North America, the United States stands out as a leading country, home to major aerospace conglomerates and a thriving ecosystem of adhesive suppliers. Among the segments, Structural Adhesives are a primary growth driver, accounting for a substantial market share due to their critical role in aircraft assembly, from wing bonding to fuselage construction. In terms of Resin Type, Epoxy adhesives command a significant portion of the market due to their exceptional mechanical properties, thermal stability, and chemical resistance, making them ideal for demanding aerospace applications. The Original Equipment Manufacturer (OEM) end-use segment is overwhelmingly dominant, representing the largest share of adhesive consumption as new aircraft are manufactured.

- Leading Region: North America.

- Key Drivers: Extensive aerospace manufacturing capabilities, strong government support for aviation innovation, and a high concentration of leading aerospace companies.

- Market Share Dominance: Estimated to hold XX% of the global market share in 2025.

- Leading Country: United States.

- Dominance Factors: Presence of major aircraft manufacturers (Boeing), extensive defense contracts, and advanced research institutions.

- Dominant Segment (Function Type): Structural Adhesives.

- Growth Potential: Critical for lightweighting, composite bonding, and ensuring structural integrity. Expected to witness steady demand driven by new aircraft development.

- Dominant Resin Type: Epoxy.

- Performance Metrics: High tensile strength, excellent adhesion to diverse substrates, and resistance to extreme temperatures and environmental conditions.

- Dominant End-use: Original Equipment Manufacturer (OEM).

- Market Share: Accounts for an estimated XX% of the overall market, driven by the continuous production of new aircraft fleets.

Adhesives in Aerospace Industry Product Landscape

The product landscape of Adhesives in Aerospace Industry is characterized by continuous innovation aimed at enhancing performance, durability, and processing efficiency. Leading players are actively developing advanced formulations such as high-temperature resistant epoxies, toughened polyurethanes, and specialized silicone adhesives for demanding applications like engine components and interior fittings. Innovations also focus on the development of reactive adhesives that offer rapid curing times and excellent bond strength for automated assembly processes. These products are crucial for bonding composite structures, metallic components, and dissimilar materials, contributing to lighter, stronger, and more fuel-efficient aircraft. The unique selling propositions lie in their ability to withstand extreme environmental conditions, vibration, and fatigue, while meeting stringent aerospace certification requirements.

Key Drivers, Barriers & Challenges in Adhesives in Aerospace Industry

Key Drivers: The Adhesives in Aerospace Industry is propelled by the incessant demand for lightweighting to improve fuel efficiency and reduce emissions, advancements in composite materials that necessitate advanced bonding solutions, and the drive for simplified manufacturing processes and reduced assembly times. Technological innovation in adhesive chemistries, offering superior mechanical strength, thermal stability, and environmental resistance, further fuels market growth.

Key Barriers & Challenges: Significant barriers include the extremely rigorous and time-consuming certification processes mandated by aviation authorities, which can lead to high development costs and prolonged market entry. Supply chain disruptions, particularly for specialized raw materials, pose a significant challenge. Competitive pressures from established joining methods and the high initial investment required for adopting new adhesive technologies also restrain growth. Ensuring long-term durability and reliability under extreme aerospace operating conditions remains a paramount concern.

Emerging Opportunities in Adhesives in Aerospace Industry

Emerging opportunities in the Adhesives in Aerospace Industry lie in the development of bio-based and sustainable adhesive formulations that cater to the growing environmental consciousness in the aviation sector. The increasing adoption of additive manufacturing (3D printing) in aerospace presents opportunities for specialized adhesives designed for bonding printed components. Furthermore, the expansion of regional aerospace manufacturing hubs in emerging economies and the growing demand for aftermarket services and repairs (MRO) for aging aircraft fleets offer untapped market potential. The development of smart adhesives with embedded sensors for structural health monitoring also represents a significant innovative frontier.

Growth Accelerators in the Adhesives in Aerospace Industry Industry

Growth accelerators for the Adhesives in Aerospace Industry are intrinsically linked to the ongoing global trend towards more fuel-efficient and environmentally friendly aircraft. The rapid advancement and widespread adoption of lightweight composite materials in aircraft construction directly translate into increased demand for high-performance structural adhesives. Strategic partnerships between adhesive manufacturers and aircraft OEMs, focused on collaborative research and development for next-generation aircraft, are also significant growth catalysts. Furthermore, government initiatives and investments in aerospace research and development, aimed at fostering innovation and domestic manufacturing capabilities, are expected to provide a strong impetus for market expansion.

Key Players Shaping the Adhesives in Aerospace Industry Market

- Huntsman International LLC

- LORD Corporation

- Parson Adhesives Inc

- Beacon Adhesives Inc

- Avery Dennison Corporation

- Solvay

- L&L Products

- Hexcel Corporation

- Henkel AG & Company KGaA

- Hybond

- Hernon Manufacturing Inc

- Permabond LLC

- Arkema Group (Bostik SA)

- Dymax Corporation

- DELO Industrie Klebstoffe GmbH & Co KGaA

- PPG Industries Inc

- Royal Adhesives & Sealants

- Master Bond Inc

- Hylomar Group

- 3M Company

Notable Milestones in Adhesives in Aerospace Industry Sector

- July 2022: Hexcel Corporation joined Spirit AeroSystems Europe in a strategic collaboration at its Aerospace Innovation Centre (AIC) to develop more sustainable aircraft manufacturing technologies for future aircraft production.

- March 2022: Solvay and Wichita State University's National Institute for Aviation Research (NIAR) announced a partnership on research and materials development at NIAR's facilities in Wichita, Kansas. The partnership is aimed at developing future solutions to bolster the aviation industry and create opportunities for companies of all sizes to revolutionize the future of flight.

In-Depth Adhesives in Aerospace Industry Market Outlook

The Adhesives in Aerospace Industry is set for sustained growth, driven by the ongoing push for lighter, more fuel-efficient aircraft and the increasing utilization of advanced composite materials. Strategic collaborations, such as those between Hexcel Corporation and Spirit AeroSystems, and Solvay's partnership with Wichita State University's NIAR, underscore the industry's commitment to innovation and sustainability. These alliances are pivotal in accelerating the development and adoption of novel bonding solutions that meet the evolving demands of next-generation aircraft. The market outlook remains highly positive, with significant opportunities for companies that can offer high-performance, certified, and environmentally conscious adhesive technologies.

Adhesives in Aerospace Industry Segmentation

-

1. Technology

- 1.1. Waterborne

- 1.2. Solvent-borne

- 1.3. Reactive

-

2. Resin Type

- 2.1. Epoxy

- 2.2. Polyurethane

- 2.3. Silicone

- 2.4. Other Resin Types

-

3. Function type

- 3.1. Structural

- 3.2. Non-Structural

-

4. End-use

- 4.1. Original Equipment Manufacturer (OEM)

- 4.2. Maintenance Repair and Operations (MRO)

Adhesives in Aerospace Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia and New Zealand

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Adhesives in Aerospace Industry Regional Market Share

Geographic Coverage of Adhesives in Aerospace Industry

Adhesives in Aerospace Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of Composites in Aircraft Manufacturing; Increasing Government Spending On Defense in the United States; Rising Demand for Aircraft in Asia-Pacific and Middle-East

- 3.3. Market Restrains

- 3.3.1. Poor Performance in Extremely Low Temperature and High Vacuum Environment

- 3.4. Market Trends

- 3.4.1. OEM End-User Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adhesives in Aerospace Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Waterborne

- 5.1.2. Solvent-borne

- 5.1.3. Reactive

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Epoxy

- 5.2.2. Polyurethane

- 5.2.3. Silicone

- 5.2.4. Other Resin Types

- 5.3. Market Analysis, Insights and Forecast - by Function type

- 5.3.1. Structural

- 5.3.2. Non-Structural

- 5.4. Market Analysis, Insights and Forecast - by End-use

- 5.4.1. Original Equipment Manufacturer (OEM)

- 5.4.2. Maintenance Repair and Operations (MRO)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. North America

- 5.5.3. Europe

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Asia Pacific Adhesives in Aerospace Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Waterborne

- 6.1.2. Solvent-borne

- 6.1.3. Reactive

- 6.2. Market Analysis, Insights and Forecast - by Resin Type

- 6.2.1. Epoxy

- 6.2.2. Polyurethane

- 6.2.3. Silicone

- 6.2.4. Other Resin Types

- 6.3. Market Analysis, Insights and Forecast - by Function type

- 6.3.1. Structural

- 6.3.2. Non-Structural

- 6.4. Market Analysis, Insights and Forecast - by End-use

- 6.4.1. Original Equipment Manufacturer (OEM)

- 6.4.2. Maintenance Repair and Operations (MRO)

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. North America Adhesives in Aerospace Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Waterborne

- 7.1.2. Solvent-borne

- 7.1.3. Reactive

- 7.2. Market Analysis, Insights and Forecast - by Resin Type

- 7.2.1. Epoxy

- 7.2.2. Polyurethane

- 7.2.3. Silicone

- 7.2.4. Other Resin Types

- 7.3. Market Analysis, Insights and Forecast - by Function type

- 7.3.1. Structural

- 7.3.2. Non-Structural

- 7.4. Market Analysis, Insights and Forecast - by End-use

- 7.4.1. Original Equipment Manufacturer (OEM)

- 7.4.2. Maintenance Repair and Operations (MRO)

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe Adhesives in Aerospace Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Waterborne

- 8.1.2. Solvent-borne

- 8.1.3. Reactive

- 8.2. Market Analysis, Insights and Forecast - by Resin Type

- 8.2.1. Epoxy

- 8.2.2. Polyurethane

- 8.2.3. Silicone

- 8.2.4. Other Resin Types

- 8.3. Market Analysis, Insights and Forecast - by Function type

- 8.3.1. Structural

- 8.3.2. Non-Structural

- 8.4. Market Analysis, Insights and Forecast - by End-use

- 8.4.1. Original Equipment Manufacturer (OEM)

- 8.4.2. Maintenance Repair and Operations (MRO)

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Adhesives in Aerospace Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Waterborne

- 9.1.2. Solvent-borne

- 9.1.3. Reactive

- 9.2. Market Analysis, Insights and Forecast - by Resin Type

- 9.2.1. Epoxy

- 9.2.2. Polyurethane

- 9.2.3. Silicone

- 9.2.4. Other Resin Types

- 9.3. Market Analysis, Insights and Forecast - by Function type

- 9.3.1. Structural

- 9.3.2. Non-Structural

- 9.4. Market Analysis, Insights and Forecast - by End-use

- 9.4.1. Original Equipment Manufacturer (OEM)

- 9.4.2. Maintenance Repair and Operations (MRO)

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Adhesives in Aerospace Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Waterborne

- 10.1.2. Solvent-borne

- 10.1.3. Reactive

- 10.2. Market Analysis, Insights and Forecast - by Resin Type

- 10.2.1. Epoxy

- 10.2.2. Polyurethane

- 10.2.3. Silicone

- 10.2.4. Other Resin Types

- 10.3. Market Analysis, Insights and Forecast - by Function type

- 10.3.1. Structural

- 10.3.2. Non-Structural

- 10.4. Market Analysis, Insights and Forecast - by End-use

- 10.4.1. Original Equipment Manufacturer (OEM)

- 10.4.2. Maintenance Repair and Operations (MRO)

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Huntsman International LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LORD Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Parson Adhesives Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beacon Adhesives Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avery Dennison Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Solvay

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 L&L Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hexcel Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Henkel AG & Company KGaA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hybond

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hernon Manufacturing Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Permabond LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Arkema Group (Bostik SA)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dymax Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DELO Industrie Klebstoffe GmbH & Co KGaA

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 PPG Industries Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Royal Adhesives & Sealants*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Master Bond Inc

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Hylomar Group

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 3M Company

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Huntsman International LLC

List of Figures

- Figure 1: Global Adhesives in Aerospace Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Adhesives in Aerospace Industry Volume Breakdown (Kiloton, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Adhesives in Aerospace Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 4: Asia Pacific Adhesives in Aerospace Industry Volume (Kiloton), by Technology 2025 & 2033

- Figure 5: Asia Pacific Adhesives in Aerospace Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: Asia Pacific Adhesives in Aerospace Industry Volume Share (%), by Technology 2025 & 2033

- Figure 7: Asia Pacific Adhesives in Aerospace Industry Revenue (undefined), by Resin Type 2025 & 2033

- Figure 8: Asia Pacific Adhesives in Aerospace Industry Volume (Kiloton), by Resin Type 2025 & 2033

- Figure 9: Asia Pacific Adhesives in Aerospace Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 10: Asia Pacific Adhesives in Aerospace Industry Volume Share (%), by Resin Type 2025 & 2033

- Figure 11: Asia Pacific Adhesives in Aerospace Industry Revenue (undefined), by Function type 2025 & 2033

- Figure 12: Asia Pacific Adhesives in Aerospace Industry Volume (Kiloton), by Function type 2025 & 2033

- Figure 13: Asia Pacific Adhesives in Aerospace Industry Revenue Share (%), by Function type 2025 & 2033

- Figure 14: Asia Pacific Adhesives in Aerospace Industry Volume Share (%), by Function type 2025 & 2033

- Figure 15: Asia Pacific Adhesives in Aerospace Industry Revenue (undefined), by End-use 2025 & 2033

- Figure 16: Asia Pacific Adhesives in Aerospace Industry Volume (Kiloton), by End-use 2025 & 2033

- Figure 17: Asia Pacific Adhesives in Aerospace Industry Revenue Share (%), by End-use 2025 & 2033

- Figure 18: Asia Pacific Adhesives in Aerospace Industry Volume Share (%), by End-use 2025 & 2033

- Figure 19: Asia Pacific Adhesives in Aerospace Industry Revenue (undefined), by Country 2025 & 2033

- Figure 20: Asia Pacific Adhesives in Aerospace Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 21: Asia Pacific Adhesives in Aerospace Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Adhesives in Aerospace Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: North America Adhesives in Aerospace Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 24: North America Adhesives in Aerospace Industry Volume (Kiloton), by Technology 2025 & 2033

- Figure 25: North America Adhesives in Aerospace Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 26: North America Adhesives in Aerospace Industry Volume Share (%), by Technology 2025 & 2033

- Figure 27: North America Adhesives in Aerospace Industry Revenue (undefined), by Resin Type 2025 & 2033

- Figure 28: North America Adhesives in Aerospace Industry Volume (Kiloton), by Resin Type 2025 & 2033

- Figure 29: North America Adhesives in Aerospace Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 30: North America Adhesives in Aerospace Industry Volume Share (%), by Resin Type 2025 & 2033

- Figure 31: North America Adhesives in Aerospace Industry Revenue (undefined), by Function type 2025 & 2033

- Figure 32: North America Adhesives in Aerospace Industry Volume (Kiloton), by Function type 2025 & 2033

- Figure 33: North America Adhesives in Aerospace Industry Revenue Share (%), by Function type 2025 & 2033

- Figure 34: North America Adhesives in Aerospace Industry Volume Share (%), by Function type 2025 & 2033

- Figure 35: North America Adhesives in Aerospace Industry Revenue (undefined), by End-use 2025 & 2033

- Figure 36: North America Adhesives in Aerospace Industry Volume (Kiloton), by End-use 2025 & 2033

- Figure 37: North America Adhesives in Aerospace Industry Revenue Share (%), by End-use 2025 & 2033

- Figure 38: North America Adhesives in Aerospace Industry Volume Share (%), by End-use 2025 & 2033

- Figure 39: North America Adhesives in Aerospace Industry Revenue (undefined), by Country 2025 & 2033

- Figure 40: North America Adhesives in Aerospace Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 41: North America Adhesives in Aerospace Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: North America Adhesives in Aerospace Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Europe Adhesives in Aerospace Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 44: Europe Adhesives in Aerospace Industry Volume (Kiloton), by Technology 2025 & 2033

- Figure 45: Europe Adhesives in Aerospace Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 46: Europe Adhesives in Aerospace Industry Volume Share (%), by Technology 2025 & 2033

- Figure 47: Europe Adhesives in Aerospace Industry Revenue (undefined), by Resin Type 2025 & 2033

- Figure 48: Europe Adhesives in Aerospace Industry Volume (Kiloton), by Resin Type 2025 & 2033

- Figure 49: Europe Adhesives in Aerospace Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 50: Europe Adhesives in Aerospace Industry Volume Share (%), by Resin Type 2025 & 2033

- Figure 51: Europe Adhesives in Aerospace Industry Revenue (undefined), by Function type 2025 & 2033

- Figure 52: Europe Adhesives in Aerospace Industry Volume (Kiloton), by Function type 2025 & 2033

- Figure 53: Europe Adhesives in Aerospace Industry Revenue Share (%), by Function type 2025 & 2033

- Figure 54: Europe Adhesives in Aerospace Industry Volume Share (%), by Function type 2025 & 2033

- Figure 55: Europe Adhesives in Aerospace Industry Revenue (undefined), by End-use 2025 & 2033

- Figure 56: Europe Adhesives in Aerospace Industry Volume (Kiloton), by End-use 2025 & 2033

- Figure 57: Europe Adhesives in Aerospace Industry Revenue Share (%), by End-use 2025 & 2033

- Figure 58: Europe Adhesives in Aerospace Industry Volume Share (%), by End-use 2025 & 2033

- Figure 59: Europe Adhesives in Aerospace Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: Europe Adhesives in Aerospace Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 61: Europe Adhesives in Aerospace Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Europe Adhesives in Aerospace Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: South America Adhesives in Aerospace Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 64: South America Adhesives in Aerospace Industry Volume (Kiloton), by Technology 2025 & 2033

- Figure 65: South America Adhesives in Aerospace Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 66: South America Adhesives in Aerospace Industry Volume Share (%), by Technology 2025 & 2033

- Figure 67: South America Adhesives in Aerospace Industry Revenue (undefined), by Resin Type 2025 & 2033

- Figure 68: South America Adhesives in Aerospace Industry Volume (Kiloton), by Resin Type 2025 & 2033

- Figure 69: South America Adhesives in Aerospace Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 70: South America Adhesives in Aerospace Industry Volume Share (%), by Resin Type 2025 & 2033

- Figure 71: South America Adhesives in Aerospace Industry Revenue (undefined), by Function type 2025 & 2033

- Figure 72: South America Adhesives in Aerospace Industry Volume (Kiloton), by Function type 2025 & 2033

- Figure 73: South America Adhesives in Aerospace Industry Revenue Share (%), by Function type 2025 & 2033

- Figure 74: South America Adhesives in Aerospace Industry Volume Share (%), by Function type 2025 & 2033

- Figure 75: South America Adhesives in Aerospace Industry Revenue (undefined), by End-use 2025 & 2033

- Figure 76: South America Adhesives in Aerospace Industry Volume (Kiloton), by End-use 2025 & 2033

- Figure 77: South America Adhesives in Aerospace Industry Revenue Share (%), by End-use 2025 & 2033

- Figure 78: South America Adhesives in Aerospace Industry Volume Share (%), by End-use 2025 & 2033

- Figure 79: South America Adhesives in Aerospace Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: South America Adhesives in Aerospace Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 81: South America Adhesives in Aerospace Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Adhesives in Aerospace Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Adhesives in Aerospace Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 84: Middle East and Africa Adhesives in Aerospace Industry Volume (Kiloton), by Technology 2025 & 2033

- Figure 85: Middle East and Africa Adhesives in Aerospace Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 86: Middle East and Africa Adhesives in Aerospace Industry Volume Share (%), by Technology 2025 & 2033

- Figure 87: Middle East and Africa Adhesives in Aerospace Industry Revenue (undefined), by Resin Type 2025 & 2033

- Figure 88: Middle East and Africa Adhesives in Aerospace Industry Volume (Kiloton), by Resin Type 2025 & 2033

- Figure 89: Middle East and Africa Adhesives in Aerospace Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 90: Middle East and Africa Adhesives in Aerospace Industry Volume Share (%), by Resin Type 2025 & 2033

- Figure 91: Middle East and Africa Adhesives in Aerospace Industry Revenue (undefined), by Function type 2025 & 2033

- Figure 92: Middle East and Africa Adhesives in Aerospace Industry Volume (Kiloton), by Function type 2025 & 2033

- Figure 93: Middle East and Africa Adhesives in Aerospace Industry Revenue Share (%), by Function type 2025 & 2033

- Figure 94: Middle East and Africa Adhesives in Aerospace Industry Volume Share (%), by Function type 2025 & 2033

- Figure 95: Middle East and Africa Adhesives in Aerospace Industry Revenue (undefined), by End-use 2025 & 2033

- Figure 96: Middle East and Africa Adhesives in Aerospace Industry Volume (Kiloton), by End-use 2025 & 2033

- Figure 97: Middle East and Africa Adhesives in Aerospace Industry Revenue Share (%), by End-use 2025 & 2033

- Figure 98: Middle East and Africa Adhesives in Aerospace Industry Volume Share (%), by End-use 2025 & 2033

- Figure 99: Middle East and Africa Adhesives in Aerospace Industry Revenue (undefined), by Country 2025 & 2033

- Figure 100: Middle East and Africa Adhesives in Aerospace Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 101: Middle East and Africa Adhesives in Aerospace Industry Revenue Share (%), by Country 2025 & 2033

- Figure 102: Middle East and Africa Adhesives in Aerospace Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 3: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 4: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Resin Type 2020 & 2033

- Table 5: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Function type 2020 & 2033

- Table 6: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Function type 2020 & 2033

- Table 7: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by End-use 2020 & 2033

- Table 8: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by End-use 2020 & 2033

- Table 9: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 11: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 12: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 13: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 14: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Resin Type 2020 & 2033

- Table 15: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Function type 2020 & 2033

- Table 16: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Function type 2020 & 2033

- Table 17: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by End-use 2020 & 2033

- Table 18: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by End-use 2020 & 2033

- Table 19: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 21: China Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: China Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 23: India Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 25: Japan Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Japan Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: South Korea Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: South Korea Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: Australia and New Zealand Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Australia and New Zealand Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 35: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 36: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Resin Type 2020 & 2033

- Table 37: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Function type 2020 & 2033

- Table 38: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Function type 2020 & 2033

- Table 39: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by End-use 2020 & 2033

- Table 40: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by End-use 2020 & 2033

- Table 41: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 43: United States Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: United States Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 45: Canada Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Canada Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 47: Mexico Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Mexico Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 49: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 50: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 51: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 52: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Resin Type 2020 & 2033

- Table 53: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Function type 2020 & 2033

- Table 54: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Function type 2020 & 2033

- Table 55: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by End-use 2020 & 2033

- Table 56: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by End-use 2020 & 2033

- Table 57: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 59: Germany Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Germany Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 61: United Kingdom Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: United Kingdom Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 63: Italy Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Italy Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 65: France Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: France Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 67: Spain Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: Spain Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 69: Rest of Europe Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: Rest of Europe Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 71: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 72: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 73: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 74: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Resin Type 2020 & 2033

- Table 75: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Function type 2020 & 2033

- Table 76: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Function type 2020 & 2033

- Table 77: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by End-use 2020 & 2033

- Table 78: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by End-use 2020 & 2033

- Table 79: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 80: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 81: Brazil Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: Brazil Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 83: Argentina Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Argentina Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 85: Rest of South America Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: Rest of South America Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 87: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 88: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 89: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 90: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Resin Type 2020 & 2033

- Table 91: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Function type 2020 & 2033

- Table 92: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Function type 2020 & 2033

- Table 93: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by End-use 2020 & 2033

- Table 94: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by End-use 2020 & 2033

- Table 95: Global Adhesives in Aerospace Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 96: Global Adhesives in Aerospace Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 97: Saudi Arabia Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 98: Saudi Arabia Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 99: South Africa Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 100: South Africa Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 101: Rest of Middle East and Africa Adhesives in Aerospace Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 102: Rest of Middle East and Africa Adhesives in Aerospace Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adhesives in Aerospace Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Adhesives in Aerospace Industry?

Key companies in the market include Huntsman International LLC, LORD Corporation, Parson Adhesives Inc, Beacon Adhesives Inc, Avery Dennison Corporation, Solvay, L&L Products, Hexcel Corporation, Henkel AG & Company KGaA, Hybond, Hernon Manufacturing Inc, Permabond LLC, Arkema Group (Bostik SA), Dymax Corporation, DELO Industrie Klebstoffe GmbH & Co KGaA, PPG Industries Inc, Royal Adhesives & Sealants*List Not Exhaustive, Master Bond Inc, Hylomar Group, 3M Company.

3. What are the main segments of the Adhesives in Aerospace Industry?

The market segments include Technology, Resin Type, Function type, End-use.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Composites in Aircraft Manufacturing; Increasing Government Spending On Defense in the United States; Rising Demand for Aircraft in Asia-Pacific and Middle-East.

6. What are the notable trends driving market growth?

OEM End-User Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Poor Performance in Extremely Low Temperature and High Vacuum Environment.

8. Can you provide examples of recent developments in the market?

July 2022: Hexcel Corporation joined Spirit AeroSystems Europe in a strategic collaboration at its Aerospace Innovation Centre (AIC) to develop more sustainable aircraft manufacturing technologies for future aircraft production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adhesives in Aerospace Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adhesives in Aerospace Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adhesives in Aerospace Industry?

To stay informed about further developments, trends, and reports in the Adhesives in Aerospace Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence