Key Insights

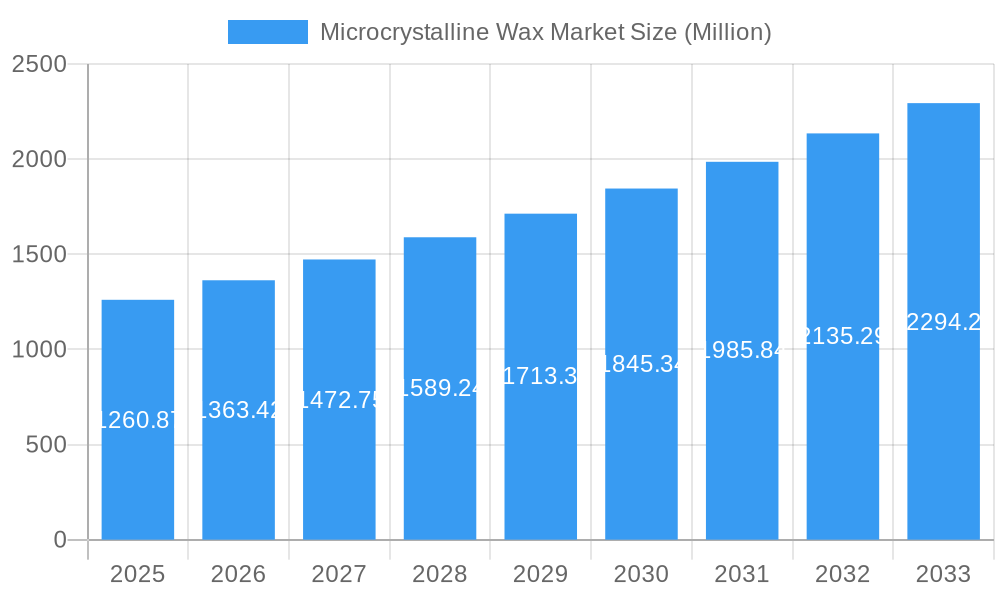

The global Microcrystalline Wax market is poised for significant expansion, demonstrating a robust CAGR of 8.15% and a projected market size of $1,260.87 Million by 2025. This growth is underpinned by increasing demand across diverse applications, with Cosmetics and Personal Care emerging as a key consumer sector. The versatility of microcrystalline wax, derived from crude oil, allows for its utilization in a wide array of products, from high-end beauty formulations to essential industrial applications like adhesives and candle making. The market's upward trajectory is also fueled by advancements in refining processes, leading to waxes with tailored properties that meet specific industry needs. Furthermore, the growing emphasis on premium and specialized personal care products, where microcrystalline wax plays a crucial role in texture and stability, is a major growth driver. Emerging economies, particularly in the Asia Pacific region, are expected to contribute substantially to this market growth due to rising disposable incomes and increasing adoption of sophisticated consumer goods.

Microcrystalline Wax Market Market Size (In Billion)

Despite the strong growth outlook, the market faces certain restraints. Fluctuations in crude oil prices, the primary source of microcrystalline wax, can impact raw material costs and consequently affect market profitability. Additionally, the development of sustainable and bio-based alternatives in certain applications could pose a competitive challenge in the long term. However, the inherent performance characteristics and cost-effectiveness of microcrystalline wax are likely to maintain its competitive edge in many segments. The market is characterized by a competitive landscape with several established players, including Blended Waxes Inc., Alpha Wax, and Koster Keunen, actively innovating and expanding their product portfolios. The strategic focus on research and development to create specialized grades of microcrystalline wax for niche applications, alongside geographical expansion, will be critical for companies to capitalize on the market's immense potential in the coming years.

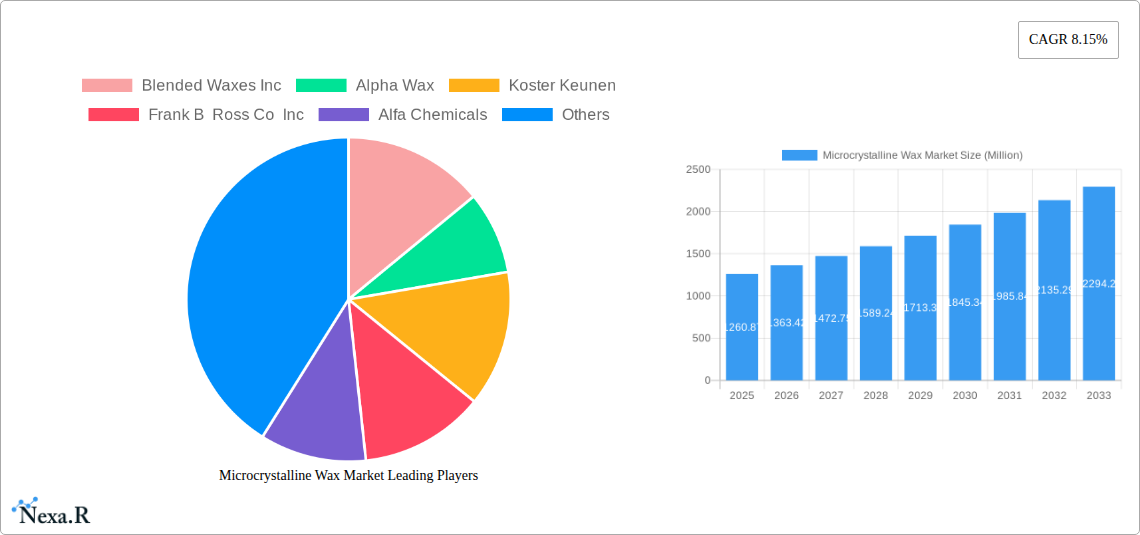

Microcrystalline Wax Market Company Market Share

Microcrystalline Wax Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a meticulously researched analysis of the global Microcrystalline Wax Market, providing critical insights into its dynamics, growth trajectories, and future potential. Covering the Study Period 2019–2033, with a Base Year and Estimated Year of 2025, and a detailed Forecast Period of 2025–2033, this report is an essential resource for industry professionals seeking to understand market evolution, competitive landscapes, and emerging opportunities.

The report delves into key segments, including Type (Flexible, Hard) and Application (Cosmetics and Personal Care, Candles, Adhesives, Packaging, Rubber, Other Applications). We also explore the parent market (Petroleum Wax Market) and its related child markets to offer a holistic view of the industry. All monetary values are presented in Million Units for clear financial understanding.

Microcrystalline Wax Market Dynamics & Structure

The Microcrystalline Wax Market exhibits a moderately concentrated structure, with key players like Blended Waxes Inc, Alpha Wax, Koster Keunen, Frank B Ross Co Inc, Alfa Chemicals, Paramelt BV, Industrial Raw Materials LLC, Clarus Specialty Products LLC, The International Group Inc, Sasol, British Wax Ltd, NIPPON SEIRO CO LTD, Indian Oil Corporation Ltd, Strahl & Pitsch Inc, and Sonneborn LLC holding significant market shares. Technological innovation is a primary driver, with ongoing advancements in extraction and refining processes enhancing wax purity and performance characteristics. Regulatory frameworks, particularly concerning product safety and environmental impact in applications like cosmetics and packaging, influence product development and market access. Competitive product substitutes, such as paraffin wax and synthetic waxes, present a constant challenge, forcing manufacturers to focus on the unique properties of microcrystalline wax – its flexibility, tackiness, and superior binding capabilities. End-user demographics are shifting, with increasing demand from burgeoning economies and a growing preference for natural and sustainable ingredients in the Cosmetics and Personal Care sector, creating nuanced market demands. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios and geographical reach. For instance, the recent sale of Sasol's European wax business to AWAX Group signifies consolidation and strategic realignment within the industry. While M&A deal volumes have seen fluctuations, strategic acquisitions remain a key tool for market players to gain competitive advantage and access new technologies or markets. The dominance of large-scale producers and the cost-effectiveness of raw material sourcing are critical factors in maintaining market concentration.

Microcrystalline Wax Market Growth Trends & Insights

The Microcrystalline Wax Market is poised for robust growth, driven by an expanding array of applications and evolving consumer preferences. The market size evolution is a testament to the increasing demand across diverse sectors. In the Cosmetics and Personal Care industry, microcrystalline wax serves as a vital emulsifier, thickener, and stabilizer in formulations such as lipsticks, creams, and lotions, benefiting from the consistent global rise in personal grooming and beauty expenditure. The Candle market, a traditional stronghold, continues to contribute significantly due to microcrystalline wax's desirable properties like low shrinkage and excellent scent throw, particularly in premium and decorative candles. Furthermore, the expanding Packaging sector, especially for food and pharmaceuticals, utilizes microcrystalline wax for its excellent barrier properties, providing protection against moisture and oxygen, thereby extending product shelf life. The Adhesives segment also leverages the tackiness and flexibility of microcrystalline wax in hot-melt adhesives.

Technological disruptions, while present, are largely focused on optimizing production efficiency and enhancing product quality rather than radical material substitution. Adoption rates for microcrystalline wax are steadily increasing, particularly in developing regions where industrialization and consumer spending are on an upward trajectory. Consumer behavior shifts towards products with enhanced performance and sensory appeal are directly benefiting microcrystalline wax, especially in high-value applications. The growing awareness of the sustainability profile of waxes, though complex for petroleum-derived products, is also driving innovation in sourcing and manufacturing. The projected CAGR for the microcrystalline wax market is expected to be around 5.2% during the forecast period (2025-2033). Market penetration in emerging economies is a key growth indicator, with increasing adoption in Rubber manufacturing for anti-ozonation and reinforcing properties, and in Other Applications such as polishes, crayons, and electrical insulation. Understanding these nuanced trends is crucial for stakeholders to capitalize on the expansive opportunities within the global microcrystalline wax landscape.

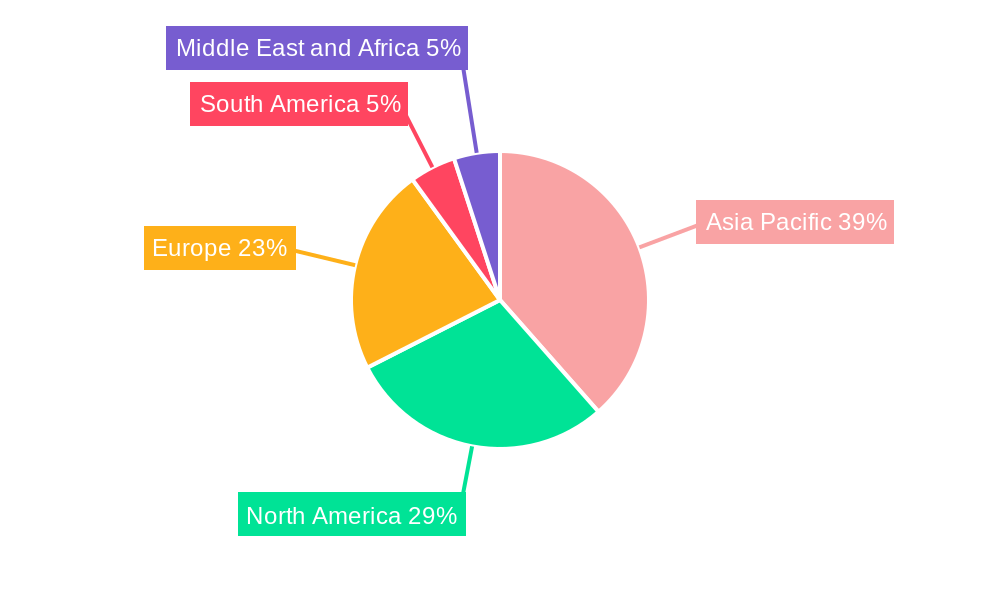

Dominant Regions, Countries, or Segments in Microcrystalline Wax Market

The Microcrystalline Wax Market is experiencing dynamic growth across various regions and segments, with distinct factors contributing to their dominance. Asia Pacific, particularly countries like China and India, is emerging as a leading region, driven by rapid industrialization, a burgeoning manufacturing base, and a rapidly growing consumer market for cosmetics and personal care products. The significant investments in infrastructure development and the presence of major refining capabilities in this region further bolster its position. North America and Europe remain substantial markets due to the mature Cosmetics and Personal Care industry, stringent quality standards, and a well-established Packaging sector demanding high-performance waxes.

Within the Type segment, the Flexible microcrystalline wax category is witnessing accelerated demand. Its inherent plasticity and adhesion properties make it indispensable in applications requiring moldability and a non-brittle finish, such as in specialized adhesives and coatings. The Hard microcrystalline wax, while essential in applications like certain candle formulations and industrial greases, faces a more stable but less explosive growth trajectory compared to its flexible counterpart.

The Application segment presents a more nuanced picture of dominance. The Cosmetics and Personal Care segment consistently holds a significant market share, fueled by continuous product innovation and a growing global demand for beauty and grooming products. Following closely, the Packaging industry's reliance on microcrystalline wax for barrier properties and protective coatings in food and pharmaceutical packaging solidifies its importance. The Candles segment, though mature, remains a steady contributor, especially in the premium and artisanal candle markets. Emerging applications in the Adhesives and Rubber industries are exhibiting promising growth rates, driven by the unique performance attributes microcrystalline wax offers in these sectors. For instance, the Adhesives segment is benefiting from the need for enhanced bonding in various manufacturing processes, while the Rubber sector utilizes its protective qualities against degradation. Economic policies promoting manufacturing and export, coupled with strong domestic demand, are key drivers for regional dominance, particularly in the Asia Pacific. The market share for microcrystalline wax in the Cosmetics and Personal Care segment is estimated to be around 35%, with Packaging following at approximately 20%.

Microcrystalline Wax Market Product Landscape

The Microcrystalline Wax Market product landscape is characterized by continuous innovation focused on enhancing purity, tailored melting points, and improved performance attributes for specific applications. Manufacturers are developing specialized grades of microcrystalline wax to meet stringent industry standards, particularly in Cosmetics and Personal Care and Packaging. Product innovations often revolve around creating waxes with higher tensile strength, greater flexibility at lower temperatures, and improved oil-binding capacities. For instance, advancements in refining techniques allow for the production of microcrystalline waxes with exceptionally low odor and color, making them ideal for high-end cosmetic formulations. Unique selling propositions include waxes with precise viscosity control for hot-melt adhesives and grades with enhanced thermal stability for demanding industrial applications. Technological advancements are also exploring sustainable sourcing and production methods, though petroleum-based microcrystalline wax remains dominant. Performance metrics such as penetration, congealing point, and oil content are meticulously controlled to ensure consistency and suitability for diverse end-uses, from the smooth glide of lipstick to the protective barrier of a food wrap.

Key Drivers, Barriers & Challenges in Microcrystalline Wax Market

Key Drivers:

- Growing Demand from Cosmetics and Personal Care: The increasing global consumer expenditure on beauty and personal care products fuels demand for microcrystalline wax as an essential ingredient in formulations like lipsticks, creams, and lotions.

- Expanding Packaging Industry: The need for effective barrier properties against moisture and oxygen in food and pharmaceutical packaging provides a significant growth avenue for microcrystalline wax.

- Versatile Applications: The inherent properties of microcrystalline wax, including its tackiness, flexibility, and binding capabilities, make it indispensable in diverse applications such as adhesives, candles, and rubber manufacturing.

- Technological Advancements: Ongoing innovations in refining and extraction processes lead to higher purity and customized grades, meeting specific industry requirements.

- Emerging Economies: Rapid industrialization and rising disposable incomes in developing regions are creating new markets and increasing consumption of microcrystalline wax.

Key Barriers & Challenges:

- Volatile Crude Oil Prices: As a petroleum-derived product, the price of microcrystalline wax is subject to fluctuations in crude oil prices, impacting manufacturing costs and end-product pricing. The market experiences volatility due to its dependence on crude oil prices, with an estimated impact of +/- 8% on pricing during periods of significant price swings.

- Competition from Substitutes: Paraffin waxes and synthetic alternatives offer competitive pricing and performance characteristics, posing a continuous challenge to market share.

- Environmental Concerns and Regulations: Increasing scrutiny on petroleum-based products and evolving environmental regulations can impact production processes and market acceptance, requiring continuous compliance and innovation in sustainability.

- Supply Chain Disruptions: Geopolitical factors, natural disasters, and logistical challenges can disrupt the supply chain of crude oil and refined wax products, affecting availability and pricing.

- Limited Awareness in Niche Applications: While established in many sectors, raising awareness and driving adoption of microcrystalline wax in less explored niche applications can be a significant challenge.

Emerging Opportunities in Microcrystalline Wax Market

Emerging opportunities in the Microcrystalline Wax Market lie in the development of specialized, high-purity grades for niche pharmaceutical applications, such as controlled-release drug delivery systems. The growing trend towards natural and bio-based ingredients, while a challenge, also presents an opportunity for manufacturers to explore novel extraction and purification methods that enhance the sustainability profile of microcrystalline wax, potentially creating a "greener" alternative within its category. Furthermore, advancements in material science are opening doors for microcrystalline wax in high-performance coatings and advanced composites. The expanding e-commerce sector also presents opportunities for optimized packaging solutions leveraging the protective properties of microcrystalline wax.

Growth Accelerators in the Microcrystalline Wax Market Industry

The Microcrystalline Wax Market is propelled by several growth accelerators. Technological breakthroughs in refining and blending processes enable the creation of highly specialized waxes with tailored properties, catering to the increasingly sophisticated demands of end-user industries. Strategic partnerships between wax manufacturers and key consumers, particularly in the Cosmetics and Personal Care and Packaging sectors, foster collaborative innovation and market penetration. For instance, partnerships focused on developing biodegradable wax formulations could significantly expand market reach. Market expansion strategies, including the penetration of untapped geographical regions and the development of novel applications in areas like advanced materials and sustainable packaging, are also critical accelerators for long-term growth. The continued investment in research and development to enhance product performance and address evolving consumer preferences will further solidify the market's upward trajectory.

Key Players Shaping the Microcrystalline Wax Market Market

- Blended Waxes Inc

- Alpha Wax

- Koster Keunen

- Frank B Ross Co Inc

- Alfa Chemicals

- Paramelt BV

- Industrial Raw Materials LLC

- Clarus Specialty Products LLC

- The International Group Inc

- Sasol

- British Wax Ltd

- NIPPON SEIRO CO LTD

- Indian Oil Corporation Ltd

- Strahl & Pitsch Inc

- Sonneborn LLC

Notable Milestones in Microcrystalline Wax Market Sector

- August 2022: Chennai Petroleum Corporation Limited (CPCL) has formed a partnership with Indian Oil Corporation and other seed equity investors. The joint venture will build a 9 MMTPA refinery at the Cauvery Basin Refinery in the India-Tamil Nadu district of Nagapattinam. The cost of the 9 MMTPA refinery project is expected to be USD 3.84 billion. This development signals significant investment in refining capacity in India, potentially impacting the future supply and availability of petroleum-derived products, including microcrystalline wax.

- March 2022: Sasol sold its European wax business to AWAX Group. Hywax GmbH will be the name of the company, which will have two production facilities. This strategic divestment and acquisition signifies consolidation within the European wax market, impacting competitive dynamics and production capabilities in the region.

In-Depth Microcrystalline Wax Market Market Outlook

The Microcrystalline Wax Market is projected for sustained and dynamic growth, fueled by its indispensable role across a widening spectrum of industries. Key growth accelerators, including continuous technological innovation in wax refinement and formulation, are enabling the development of specialized products that meet increasingly stringent performance demands. Strategic collaborations between major wax producers and end-user giants in sectors like Cosmetics and Personal Care and Packaging are fostering synergistic advancements and driving market penetration into new territories. Furthermore, the growing emphasis on sustainable practices within the chemical industry presents an opportunity for manufacturers to innovate and position their offerings as more environmentally conscious alternatives, thereby unlocking new market segments. The expansion into emerging economies and the exploration of novel applications in advanced materials and specialized coatings are poised to be significant drivers of future market potential, ensuring a robust outlook for microcrystalline wax manufacturers and stakeholders.

Microcrystalline Wax Market Segmentation

-

1. Type

- 1.1. Flexible

- 1.2. Hard

-

2. Application

- 2.1. Cosmetics and Personal Care

- 2.2. Candles

- 2.3. Adhesives

- 2.4. Packaging

- 2.5. Rubber

- 2.6. Other Applications

Microcrystalline Wax Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Microcrystalline Wax Market Regional Market Share

Geographic Coverage of Microcrystalline Wax Market

Microcrystalline Wax Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Personal Care Industry in the Asia-Pacific Region; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Impact of the COVID-19 Pandemic

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Cosmetics and Personal Care Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microcrystalline Wax Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flexible

- 5.1.2. Hard

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cosmetics and Personal Care

- 5.2.2. Candles

- 5.2.3. Adhesives

- 5.2.4. Packaging

- 5.2.5. Rubber

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Microcrystalline Wax Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flexible

- 6.1.2. Hard

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cosmetics and Personal Care

- 6.2.2. Candles

- 6.2.3. Adhesives

- 6.2.4. Packaging

- 6.2.5. Rubber

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Microcrystalline Wax Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flexible

- 7.1.2. Hard

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cosmetics and Personal Care

- 7.2.2. Candles

- 7.2.3. Adhesives

- 7.2.4. Packaging

- 7.2.5. Rubber

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Microcrystalline Wax Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flexible

- 8.1.2. Hard

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cosmetics and Personal Care

- 8.2.2. Candles

- 8.2.3. Adhesives

- 8.2.4. Packaging

- 8.2.5. Rubber

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Microcrystalline Wax Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flexible

- 9.1.2. Hard

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cosmetics and Personal Care

- 9.2.2. Candles

- 9.2.3. Adhesives

- 9.2.4. Packaging

- 9.2.5. Rubber

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Microcrystalline Wax Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Flexible

- 10.1.2. Hard

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Cosmetics and Personal Care

- 10.2.2. Candles

- 10.2.3. Adhesives

- 10.2.4. Packaging

- 10.2.5. Rubber

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Blended Waxes Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alpha Wax

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koster Keunen

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Frank B Ross Co Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alfa Chemicals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Paramelt BV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Industrial Raw Materials LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clarus Specialty Products LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The International Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sasol

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 British Wax Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NIPPON SEIRO CO LTD

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Indian Oil Corporation Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Strahl & Pitsch Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sonneborn LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Blended Waxes Inc

List of Figures

- Figure 1: Global Microcrystalline Wax Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Microcrystalline Wax Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Microcrystalline Wax Market Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Microcrystalline Wax Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Microcrystalline Wax Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Microcrystalline Wax Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Microcrystalline Wax Market Revenue (Million), by Application 2025 & 2033

- Figure 8: Asia Pacific Microcrystalline Wax Market Volume (K Tons), by Application 2025 & 2033

- Figure 9: Asia Pacific Microcrystalline Wax Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Microcrystalline Wax Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Microcrystalline Wax Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Microcrystalline Wax Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Microcrystalline Wax Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Microcrystalline Wax Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Microcrystalline Wax Market Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Microcrystalline Wax Market Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Microcrystalline Wax Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Microcrystalline Wax Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Microcrystalline Wax Market Revenue (Million), by Application 2025 & 2033

- Figure 20: North America Microcrystalline Wax Market Volume (K Tons), by Application 2025 & 2033

- Figure 21: North America Microcrystalline Wax Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Microcrystalline Wax Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Microcrystalline Wax Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Microcrystalline Wax Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Microcrystalline Wax Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Microcrystalline Wax Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Microcrystalline Wax Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Microcrystalline Wax Market Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Microcrystalline Wax Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Microcrystalline Wax Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Microcrystalline Wax Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Microcrystalline Wax Market Volume (K Tons), by Application 2025 & 2033

- Figure 33: Europe Microcrystalline Wax Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Microcrystalline Wax Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Microcrystalline Wax Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Microcrystalline Wax Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Microcrystalline Wax Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Microcrystalline Wax Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Microcrystalline Wax Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Microcrystalline Wax Market Volume (K Tons), by Type 2025 & 2033

- Figure 41: South America Microcrystalline Wax Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Microcrystalline Wax Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Microcrystalline Wax Market Revenue (Million), by Application 2025 & 2033

- Figure 44: South America Microcrystalline Wax Market Volume (K Tons), by Application 2025 & 2033

- Figure 45: South America Microcrystalline Wax Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Microcrystalline Wax Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Microcrystalline Wax Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Microcrystalline Wax Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Microcrystalline Wax Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Microcrystalline Wax Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Microcrystalline Wax Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Microcrystalline Wax Market Volume (K Tons), by Type 2025 & 2033

- Figure 53: Middle East and Africa Microcrystalline Wax Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Microcrystalline Wax Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Microcrystalline Wax Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Microcrystalline Wax Market Volume (K Tons), by Application 2025 & 2033

- Figure 57: Middle East and Africa Microcrystalline Wax Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Microcrystalline Wax Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Microcrystalline Wax Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Microcrystalline Wax Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Microcrystalline Wax Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Microcrystalline Wax Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Microcrystalline Wax Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Microcrystalline Wax Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Microcrystalline Wax Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Microcrystalline Wax Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Microcrystalline Wax Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Microcrystalline Wax Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Microcrystalline Wax Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Microcrystalline Wax Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Microcrystalline Wax Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Microcrystalline Wax Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Global Microcrystalline Wax Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Microcrystalline Wax Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: ASEAN Countries Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: ASEAN Countries Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Global Microcrystalline Wax Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Microcrystalline Wax Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Global Microcrystalline Wax Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Microcrystalline Wax Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Global Microcrystalline Wax Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Microcrystalline Wax Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: United States Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: United States Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Canada Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Canada Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Mexico Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Mexico Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Global Microcrystalline Wax Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Microcrystalline Wax Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 39: Global Microcrystalline Wax Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Microcrystalline Wax Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 41: Global Microcrystalline Wax Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Microcrystalline Wax Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: Germany Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Germany Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: United Kingdom Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Italy Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: France Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Europe Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Microcrystalline Wax Market Revenue Million Forecast, by Type 2020 & 2033

- Table 54: Global Microcrystalline Wax Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 55: Global Microcrystalline Wax Market Revenue Million Forecast, by Application 2020 & 2033

- Table 56: Global Microcrystalline Wax Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 57: Global Microcrystalline Wax Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Microcrystalline Wax Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 59: Brazil Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Brazil Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Argentina Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Argentina Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Rest of South America Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of South America Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: Global Microcrystalline Wax Market Revenue Million Forecast, by Type 2020 & 2033

- Table 66: Global Microcrystalline Wax Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 67: Global Microcrystalline Wax Market Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global Microcrystalline Wax Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 69: Global Microcrystalline Wax Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Microcrystalline Wax Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 71: Saudi Arabia Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: South Africa Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Microcrystalline Wax Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Microcrystalline Wax Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microcrystalline Wax Market?

The projected CAGR is approximately 8.15%.

2. Which companies are prominent players in the Microcrystalline Wax Market?

Key companies in the market include Blended Waxes Inc, Alpha Wax, Koster Keunen, Frank B Ross Co Inc, Alfa Chemicals, Paramelt BV, Industrial Raw Materials LLC, Clarus Specialty Products LLC, The International Group Inc, Sasol, British Wax Ltd, NIPPON SEIRO CO LTD, Indian Oil Corporation Ltd, Strahl & Pitsch Inc, Sonneborn LLC.

3. What are the main segments of the Microcrystalline Wax Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1,260.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Personal Care Industry in the Asia-Pacific Region; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Cosmetics and Personal Care Industry.

7. Are there any restraints impacting market growth?

Impact of the COVID-19 Pandemic.

8. Can you provide examples of recent developments in the market?

August 2022: Chennai Petroleum Corporation Limited (CPCL) has formed a partnership with Indian Oil Corporation and other seed equity investors. The joint venture will build a 9 MMTPA refinery at the Cauvery Basin Refinery in the India-Tamil Nadu district of Nagapattinam. The cost of the 9 MMTPA refinery project is expected to be USD 3.84 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microcrystalline Wax Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microcrystalline Wax Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microcrystalline Wax Market?

To stay informed about further developments, trends, and reports in the Microcrystalline Wax Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence