Key Insights

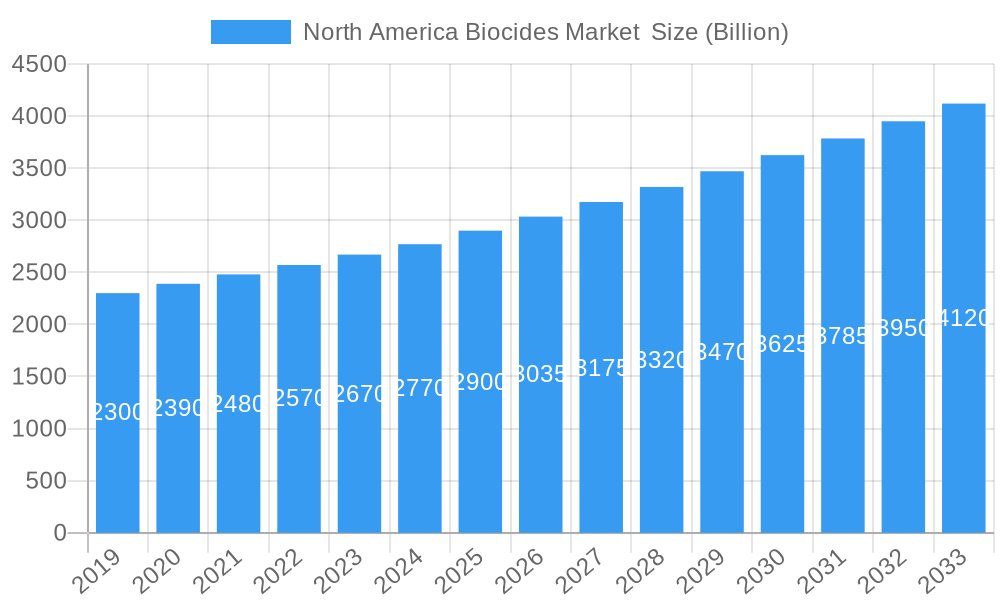

The North American biocides market is poised for significant expansion, projected to reach $2.9 Billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.5%, indicating sustained momentum through 2033. A primary driver of this upward trend is the increasing demand for effective antimicrobial solutions across diverse sectors. In the water treatment industry, stringent regulations and growing concerns about water quality necessitate the use of biocides to control microbial contamination in potable water, wastewater, and industrial water systems. The pharmaceutical and personal care sectors also contribute significantly, driven by the constant need for preservatives in cosmetics, pharmaceuticals, and hygiene products to ensure product safety and efficacy. Furthermore, the wood preservation segment benefits from the demand for durable construction materials and the protection of wood products from decay and insect infestation, especially in regions with extensive forestry and construction activities.

North America Biocides Market Market Size (In Billion)

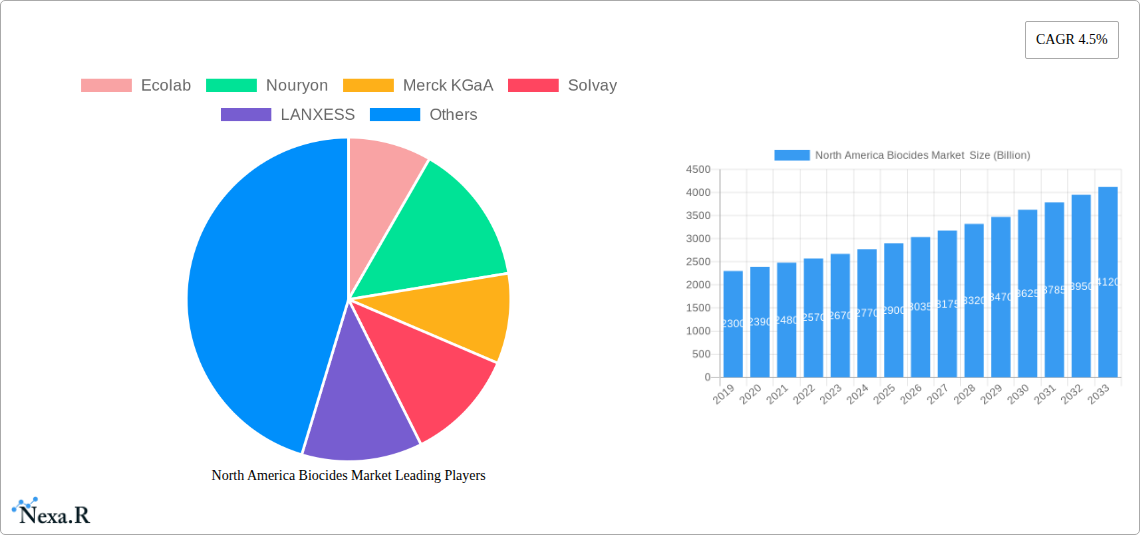

The market's trajectory is further shaped by several key trends, including the growing adoption of sustainable and environmentally friendly biocides, driven by increasing regulatory scrutiny and consumer preference for greener alternatives. Innovations in formulation technologies are also enhancing the efficacy and safety profiles of biocides. However, the market faces certain restraints, such as the rising costs of raw materials and stringent regulatory frameworks governing the approval and use of biocides, which can impact market accessibility and profitability. Geographically, North America, encompassing the United States, Canada, and Mexico, represents a crucial market due to its established industrial infrastructure, advanced technological adoption, and a strong focus on public health and environmental safety. Key players like Ecolab, Nouryon, Merck KGaA, Solvay, and LANXESS are actively investing in research and development to introduce novel solutions and expand their market reach within this dynamic landscape.

North America Biocides Market Company Market Share

North America Biocides Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the North America Biocides Market, a critical sector for safeguarding public health, industrial processes, and material integrity. Explore the intricate dynamics, growth trajectories, and future potential of this burgeoning market, encompassing water treatment biocides, pharmaceutical and personal care biocides, wood preservation biocides, food and beverage biocides, and paints and coatings biocides. With a comprehensive study period from 2019 to 2033, including a base year of 2025 and a detailed forecast period of 2025–2033, this report offers unparalleled insights for industry professionals, investors, and stakeholders. The report quantifies market size and value in Billion units, providing a clear understanding of its economic significance.

North America Biocides Market Market Dynamics & Structure

The North America Biocides Market exhibits a moderately concentrated structure, with a handful of key players holding significant market share. Technological innovation remains a paramount driver, with ongoing research and development focused on more effective, environmentally friendly, and targeted biocidal solutions. Regulatory frameworks, particularly in the United States and Canada, play a crucial role in shaping market entry and product approval processes, influencing the adoption of specific chemistries. Competitive product substitutes, such as antimicrobial additives and alternative preservation methods, present a dynamic landscape that necessitates continuous innovation from biocide manufacturers. End-user demographics are evolving, with increasing demand for sustainable and bio-based biocides across various applications. Mergers and acquisitions (M&A) trends are notable, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the historical period saw several strategic acquisitions aimed at consolidating market positions and enhancing R&D prowess.

- Market Concentration: Moderately concentrated, with leading global chemical companies dominating.

- Technological Innovation: Driven by the need for greener chemistries, enhanced efficacy, and broader spectrum activity.

- Regulatory Influence: Stringent regulations in the U.S. (EPA) and Canada (PMRA) shape product development and market access.

- Competitive Landscape: Competition from alternative preservation technologies and emerging bio-based solutions.

- End-User Demand: Growing preference for sustainable and biodegradable biocides.

- M&A Activity: Strategic consolidation to gain market share and technological advantages.

North America Biocides Market Growth Trends & Insights

The North America Biocides Market is poised for robust growth, driven by escalating demand for enhanced hygiene and sanitation across diverse sectors. The water treatment biocide segment, a cornerstone of the market, is experiencing substantial expansion due to increasing industrialization, stringent wastewater management regulations, and the growing need for safe drinking water. Similarly, the pharmaceutical and personal care biocide market is benefiting from heightened consumer awareness regarding product safety and shelf-life, alongside continuous innovation in skincare and cosmetic formulations. The food and beverage biocide sector is witnessing significant traction driven by the imperative to prevent spoilage, extend shelf life, and ensure food safety. Furthermore, the paints and coatings biocide market is expanding, fueled by the construction industry's demand for durable and mold-resistant coatings, especially in humid climates. The wood preservation biocide segment also contributes to market growth, driven by the need to protect timber from decay and insect infestation in construction and outdoor applications. The market's trajectory is further influenced by the adoption of advanced delivery systems and the development of novel, broad-spectrum biocidal agents that offer improved performance and reduced environmental impact. Emerging economies within North America are also presenting new avenues for growth, as industrial infrastructure develops and hygiene standards improve. The projected Compound Annual Growth Rate (CAGR) for the forecast period is expected to be approximately 6.5%, reaching an estimated market size of $15.8 Billion in 2025 and projected to reach $25.6 Billion by 2033.

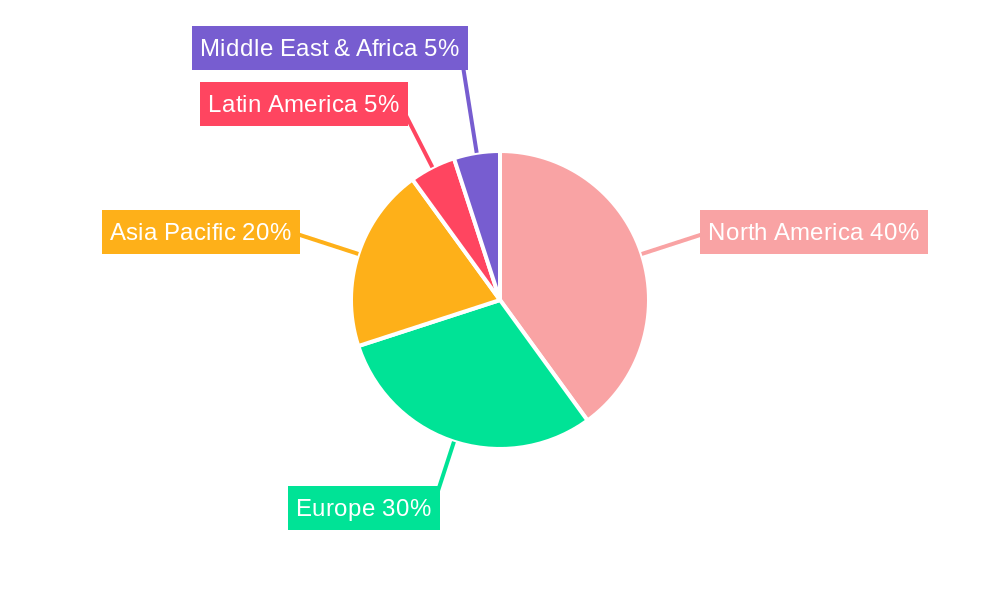

Dominant Regions, Countries, or Segments in North America Biocides Market

The United States stands as the dominant region within the North America Biocides Market, accounting for a substantial market share. This dominance is propelled by its large industrial base, advanced technological infrastructure, and a highly regulated environment that mandates the use of biocides in critical applications. The water treatment biocide application segment is a significant growth engine within the U.S., driven by massive investments in municipal water purification, industrial process water management, and stringent environmental discharge regulations. The pharmaceutical and personal care sectors also contribute substantially to the U.S. market, reflecting a high consumer demand for safe and effective personal hygiene products and pharmaceuticals. The Mexico market, while smaller, presents a rapidly growing opportunity, fueled by increasing foreign investment in manufacturing and a burgeoning consumer base demanding improved hygiene standards in food and beverage processing. The Canada market, characterized by stringent environmental policies and a focus on sustainable solutions, also plays a crucial role, particularly in segments like wood preservation and industrial water treatment. The expansion of the construction sector and a growing awareness of material longevity are key drivers in these segments.

- United States Dominance: Large industrial footprint, robust regulatory framework, and high consumer demand for hygiene.

- Water Treatment Segment: Primary growth driver due to industrialization and water safety concerns.

- Pharmaceutical & Personal Care: Fueled by consumer awareness and product innovation.

- Mexico's Growth Potential: Emerging manufacturing hub and increasing demand for hygiene standards.

- Canada's Sustainable Focus: Emphasis on environmentally friendly biocides, especially in wood preservation.

- Paints & Coatings: Driven by infrastructure development and demand for protective coatings.

North America Biocides Market Product Landscape

The North America Biocides Market is characterized by a diverse product landscape, featuring a range of chemistries designed for specific applications. Innovations are centered on developing biocides with enhanced efficacy, reduced toxicity, and improved biodegradability. Key product categories include oxidizing biocides like chlorine and bromine, non-oxidizing biocides such as quaternary ammonium compounds (QACs) and isothiazolinones, and emerging bio-based biocides derived from natural sources. The performance metrics of these products are evaluated based on their spectrum of activity, kill rate, residual effect, and compatibility with other chemical formulations. Unique selling propositions often lie in their ability to address specific microbial challenges, such as biofilm formation in water systems or microbial spoilage in paints and coatings. Technological advancements are focused on microencapsulation for controlled release and synergistic formulations that optimize performance while minimizing environmental impact.

Key Drivers, Barriers & Challenges in North America Biocides Market

Key Drivers: The North America Biocides Market is propelled by several critical factors. Increasing global demand for clean water and stringent regulations for its treatment are significant drivers, especially in the water treatment biocide segment. Heightened consumer awareness regarding hygiene and product safety is fueling demand in the pharmaceutical and personal care and food and beverage sectors. Growth in the construction industry, leading to increased demand for durable and protected materials, drives the paints and coatings and wood preservation segments. Technological advancements in developing more effective and environmentally sustainable biocides also act as a strong impetus for market growth.

Barriers & Challenges: Despite the growth prospects, the market faces several hurdles. Stringent regulatory approval processes for new biocides can be time-consuming and costly, acting as a significant barrier to entry. Growing environmental concerns and the push for greener alternatives are creating challenges for traditional, less sustainable biocidal chemistries. Supply chain disruptions and volatile raw material prices can impact production costs and product availability, posing a threat to market stability. Intense competition from both established players and emerging market entrants can lead to price pressures and reduced profit margins, demanding continuous innovation and cost optimization.

Emerging Opportunities in North America Biocides Market

Emerging opportunities in the North America Biocides Market lie in the development and adoption of novel, sustainable biocide formulations. The increasing consumer and regulatory push towards bio-based and biodegradable biocides presents a significant untapped market. Advanced antimicrobial materials and smart packaging solutions incorporating biocides offer innovative applications in food preservation and healthcare. Furthermore, the growing focus on preventing antimicrobial resistance (AMR) through targeted and judicious use of biocides is creating opportunities for specialized and highly effective solutions. The expansion of industrial water treatment in emerging manufacturing hubs within North America also presents considerable growth potential.

Growth Accelerators in the North America Biocides Market Industry

Several catalysts are accelerating the growth of the North America Biocides Market. Technological breakthroughs in biotechnology are enabling the development of novel, bio-derived biocides with improved efficacy and reduced environmental impact. Strategic partnerships between chemical manufacturers and end-user industries are fostering innovation and accelerating the adoption of new solutions. Market expansion strategies, including entering niche applications and underserved geographical regions within North America, are also contributing to sustained growth. Furthermore, the increasing emphasis on circular economy principles and the development of biocides that facilitate waste reduction and resource efficiency are acting as significant growth accelerators.

Key Players Shaping the North America Biocides Market Market

- Ecolab

- Nouryon

- Merck KGaA

- Solvay

- LANXESS

- BASF SE

- Arxada AG

- Kemira

- Valtris Specialty Chemicals

- The Lubrizol Corporation

- Baker Hughes Company

- Veolia

- Albemarle Corporation

- Clariant AG

- Lenntech B V

Notable Milestones in North America Biocides Market Sector

- 2019: Launch of new bio-based preservative systems for personal care products, addressing growing consumer demand for natural ingredients.

- 2020: Significant increase in demand for disinfectants and sanitizers due to the global pandemic, driving innovation in broad-spectrum biocides.

- 2021: Acquisition of key biocide manufacturers by larger chemical conglomerates to expand product portfolios and market reach.

- 2022: Introduction of advanced water treatment biocides with enhanced biofilm control capabilities, addressing industrial water challenges.

- 2023: Growing focus on developing biocides compliant with evolving REACH and FIFRA regulations, emphasizing environmental safety.

- 2024: Emergence of novel biocides utilizing nanotechnology for improved efficacy and targeted delivery in paints and coatings.

In-Depth North America Biocides Market Market Outlook

The future outlook for the North America Biocides Market is exceptionally positive, characterized by sustained growth and significant opportunities for innovation. Growth accelerators such as the increasing demand for water treatment, advancements in sustainable biocide technologies, and stringent hygiene regulations will continue to propel the market forward. Strategic collaborations and expansions into emerging applications like advanced material preservation and sustainable agriculture will unlock new revenue streams. The market is expected to witness a steady shift towards bio-based and low-toxicity biocides, reflecting evolving consumer preferences and regulatory landscapes. Overall, the North America Biocides Market is poised for substantial expansion, driven by its indispensable role in safeguarding public health, industrial efficiency, and material longevity.

North America Biocides Market Segmentation

-

1. Application

- 1.1. Water Treatment

- 1.2. Pharmaceutical and Personal Care

- 1.3. Wood Preservation

- 1.4. Food and Beverage

- 1.5. Paints and Coatings

- 1.6. Other Ap

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Biocides Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Biocides Market Regional Market Share

Geographic Coverage of North America Biocides Market

North America Biocides Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption in Wood Preservation; Growing Pharmaceutical Consumption; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies; Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Wood Preservation Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Biocides Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Water Treatment

- 5.1.2. Pharmaceutical and Personal Care

- 5.1.3. Wood Preservation

- 5.1.4. Food and Beverage

- 5.1.5. Paints and Coatings

- 5.1.6. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Biocides Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Water Treatment

- 6.1.2. Pharmaceutical and Personal Care

- 6.1.3. Wood Preservation

- 6.1.4. Food and Beverage

- 6.1.5. Paints and Coatings

- 6.1.6. Other Ap

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada North America Biocides Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Water Treatment

- 7.1.2. Pharmaceutical and Personal Care

- 7.1.3. Wood Preservation

- 7.1.4. Food and Beverage

- 7.1.5. Paints and Coatings

- 7.1.6. Other Ap

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Mexico North America Biocides Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Water Treatment

- 8.1.2. Pharmaceutical and Personal Care

- 8.1.3. Wood Preservation

- 8.1.4. Food and Beverage

- 8.1.5. Paints and Coatings

- 8.1.6. Other Ap

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Ecolab

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nouryon

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Merck KGaA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Solvay

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 LANXESS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BASF SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Arxada AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kemira

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Valtris Specialty Chemicals

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 The Lubrizol Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Baker Hughes Company

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Veolia

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Albemarle Corporation

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Clariant AG

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 Lenntech B V

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.1 Ecolab

List of Figures

- Figure 1: North America Biocides Market Revenue Breakdown (Billion, %) by Product 2025 & 2033

- Figure 2: North America Biocides Market Share (%) by Company 2025

List of Tables

- Table 1: North America Biocides Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 2: North America Biocides Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: North America Biocides Market Revenue Billion Forecast, by Geography 2020 & 2033

- Table 4: North America Biocides Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 5: North America Biocides Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 6: North America Biocides Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: North America Biocides Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 8: North America Biocides Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: North America Biocides Market Revenue Billion Forecast, by Geography 2020 & 2033

- Table 10: North America Biocides Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: North America Biocides Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 12: North America Biocides Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: North America Biocides Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 14: North America Biocides Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: North America Biocides Market Revenue Billion Forecast, by Geography 2020 & 2033

- Table 16: North America Biocides Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 17: North America Biocides Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 18: North America Biocides Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: North America Biocides Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 20: North America Biocides Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: North America Biocides Market Revenue Billion Forecast, by Geography 2020 & 2033

- Table 22: North America Biocides Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: North America Biocides Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 24: North America Biocides Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Biocides Market ?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Biocides Market ?

Key companies in the market include Ecolab, Nouryon, Merck KGaA, Solvay, LANXESS, BASF SE, Arxada AG, Kemira, Valtris Specialty Chemicals, The Lubrizol Corporation, Baker Hughes Company, Veolia, Albemarle Corporation, Clariant AG, Lenntech B V.

3. What are the main segments of the North America Biocides Market ?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.9 Billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption in Wood Preservation; Growing Pharmaceutical Consumption; Other Drivers.

6. What are the notable trends driving market growth?

Wood Preservation Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies; Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Biocides Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Biocides Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Biocides Market ?

To stay informed about further developments, trends, and reports in the North America Biocides Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence