Key Insights

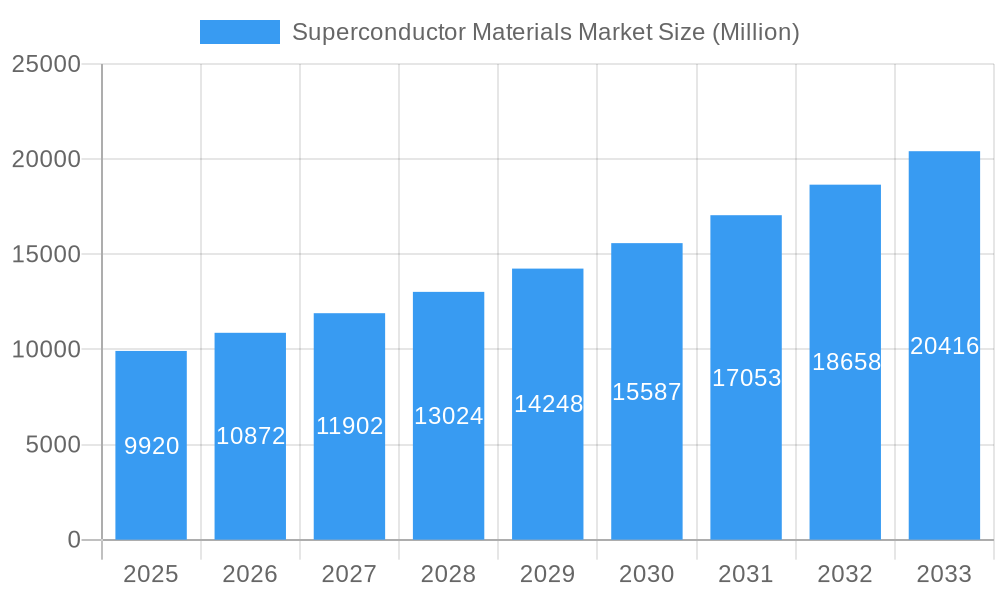

The global Superconductor Materials Market is poised for significant expansion, with an estimated market size of USD 9.92 billion in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 9.5% through 2033. This impressive growth trajectory is propelled by several key drivers, including the relentless advancement in superconducting technology, increasing demand for high-efficiency energy transmission and storage solutions, and the burgeoning adoption of superconducting materials in critical sectors like medical imaging (MRI), high-speed transportation (maglev trains), and advanced electronics. The unique properties of superconductors, such as zero electrical resistance and the Meissner effect, make them indispensable for applications demanding exceptional performance and energy savings. Furthermore, ongoing research and development efforts focused on creating more accessible and cost-effective superconducting materials are expected to broaden their application scope and fuel market penetration.

Superconductor Materials Market Market Size (In Billion)

The market is segmented into Low-temperature Superconducting (LTS) Materials and High-temperature Superconducting (HTS) Materials, with HTS materials gaining increasing traction due to their ability to operate at higher temperatures, reducing the need for complex and costly cooling systems. Key end-user industries driving this demand include the medical sector, where MRI scanners represent a significant application, followed by electronics, with burgeoning use in quantum computing and advanced sensors. The Asia Pacific region, particularly China and Japan, is anticipated to lead market growth due to substantial investments in research and development, supportive government policies, and a strong industrial base. While the market presents immense opportunities, potential restraints such as the high cost of manufacturing and the technical challenges associated with widespread implementation of superconducting technologies need to be addressed to unlock the full market potential.

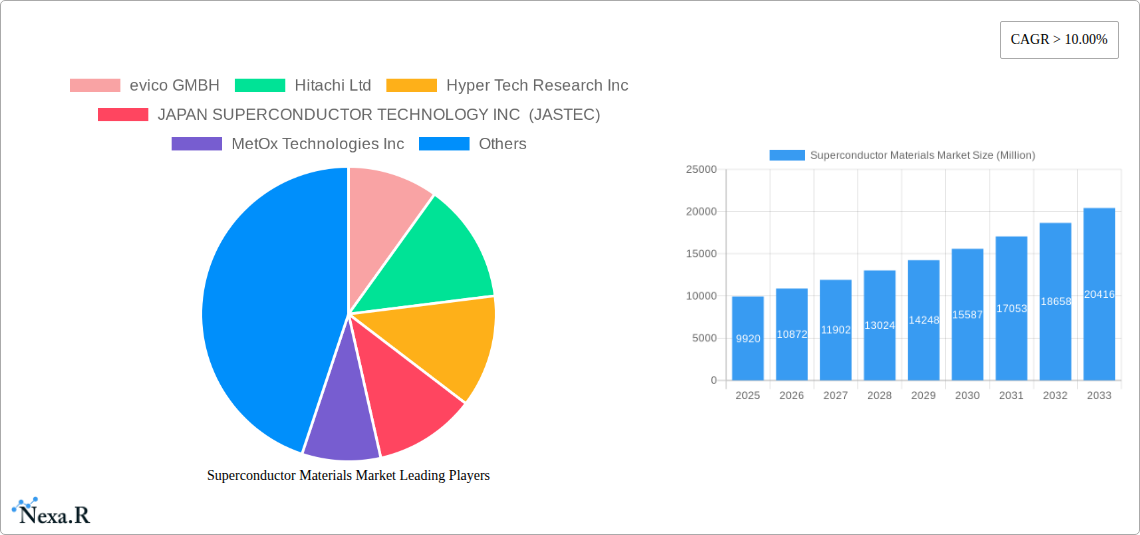

Superconductor Materials Market Company Market Share

Superconductor Materials Market: Revolutionizing Technology with Zero Resistance

This comprehensive report delves into the dynamic superconductor materials market, a sector poised for exponential growth driven by groundbreaking advancements and increasing demand across diverse industries. Explore the intricate landscape of superconducting materials, from low-temperature superconducting materials (LTS) to cutting-edge high-temperature superconducting materials (HTS). Uncover market trends, growth forecasts, and the competitive strategies of key players like evico GMBH, Hitachi Ltd, and Sumitomo Electric Industries Ltd. This report provides an in-depth analysis of the superconductor market size, its CAGR, and future outlook from 2019 to 2033, offering critical insights for stakeholders in the medical, electronics, and other burgeoning end-user industries.

Superconductor Materials Market Dynamics & Structure

The superconductor materials market exhibits a moderately concentrated structure, with a few dominant players like Hitachi Ltd, Sumitomo Electric Industries Ltd, and NEXANS holding significant market share. Technological innovation is the primary driver, fueled by ongoing research into materials with higher critical temperatures and improved performance. Regulatory frameworks, while nascent in some regions, are evolving to support the widespread adoption of superconducting technologies in power transmission, transportation, and medical imaging. Competitive product substitutes include advanced conventional conductors and emerging energy-efficient technologies, though superconductors offer unparalleled zero-loss energy transmission. End-user demographics are shifting towards research institutions, advanced manufacturing, and the healthcare sector, with increasing demand for MRI machines and particle accelerators. Mergers and acquisitions (M&A) are strategically shaping the landscape, with companies like SuperPower Inc. and Superconductor Technologies Inc. actively participating in consolidation to enhance R&D capabilities and market reach. The market is projected to be valued at approximately $12 billion in 2025, with a notable upward trajectory.

- Market Concentration: Moderate, with key players dominating innovation and production.

- Technological Innovation Drivers: Pursuit of higher critical temperatures, increased current densities, and enhanced material stability.

- Regulatory Frameworks: Emerging standards and government incentives for advanced materials and energy efficiency.

- Competitive Product Substitutes: Advanced conventional conductors, exotic alloys, and next-generation energy technologies.

- End-user Demographics: Research & development, medical imaging, high-energy physics, power transmission, and advanced electronics.

- M&A Trends: Strategic acquisitions and partnerships to consolidate intellectual property and expand market access.

Superconductor Materials Market Growth Trends & Insights

The superconductor materials market is experiencing robust growth, projected to expand significantly from an estimated $12 billion in 2025 to over $28 billion by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 11.5%. This expansion is propelled by relentless technological innovation and the increasing adoption of superconducting technologies across a spectrum of industries. The high-temperature superconducting materials (HTS) segment, in particular, is witnessing accelerated growth due to its less stringent cooling requirements, making it more practical for widespread commercial applications. Market penetration is steadily increasing, driven by the inherent advantages of superconductors, such as zero energy loss during electrical transmission, significantly reducing operational costs and environmental impact in sectors like power grids and electric transportation.

Technological disruptions are a constant feature, with ongoing research into new material compositions and manufacturing processes aimed at achieving higher critical temperatures, enhanced mechanical strength, and greater cost-effectiveness. For instance, the discovery of one-way superconductivity without magnetic fields, as achieved by researchers at TU Delft in April 2022, signifies a paradigm shift, potentially leading to hundreds of times faster electronics with zero energy loss. Consumer behavior shifts are subtle but impactful; industries are increasingly prioritizing energy efficiency and sustainability, making superconducting solutions highly attractive. The medical industry continues to be a major consumer, with superconducting magnets being indispensable for advanced MRI scanners. Philips' research partnership with MagCorp in December 2022 to explore superconducting magnets that do not require ultra-low temperature cooling further underscores the trend towards more accessible and energy-efficient medical devices.

The electronics sector is another key growth area, with superconductors offering the potential for ultra-fast computing, advanced sensor technologies, and highly efficient power electronics. The increasing sophistication of quantum computing and advanced sensor networks is creating new avenues for superconductor adoption. The transition from historical data (2019-2024) to the base year (2025) and the subsequent forecast period (2025-2033) indicates a sustained and accelerating growth trajectory. The market is evolving from niche applications to mainstream integration, driven by a confluence of scientific breakthroughs, industrial demand for performance enhancement, and global efforts towards energy conservation.

Dominant Regions, Countries, or Segments in Superconductor Materials Market

The high-temperature superconducting materials (HTS) segment is currently the dominant force driving the global superconductor materials market, projected to hold a significant market share of approximately 65% by 2025. This dominance stems from the inherent advantages of HTS materials, including their ability to operate at temperatures achievable with less expensive cryocooling methods, such as liquid nitrogen, as opposed to the ultra-low temperatures required for low-temperature superconducting materials (LTS). This operational flexibility makes HTS more amenable to a wider range of commercial applications where extreme cooling is impractical or cost-prohibitive.

Within the end-user industries, the medical sector remains a cornerstone of the superconductor market. Superconducting magnets are critical components in Magnetic Resonance Imaging (MRI) scanners, which are essential for advanced diagnostic imaging. The growing global demand for healthcare services, coupled with the continuous innovation in medical imaging technology, ensures a steady and increasing demand for superconducting materials. The market share for the medical segment is estimated to be around 40% of the total superconductor materials market in 2025.

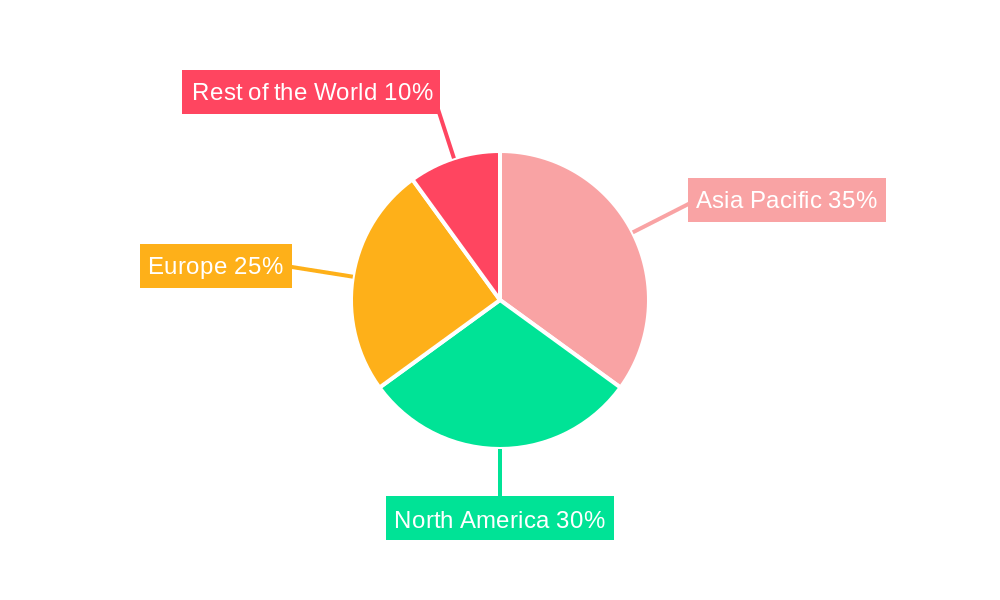

Geographically, Asia Pacific is emerging as a dominant region, driven by robust investments in research and development, expanding manufacturing capabilities, and supportive government policies for advanced materials and renewable energy initiatives. Countries like China, Japan, and South Korea are at the forefront of superconductor research and commercialization. Japan, with its historical leadership in superconductivity research and companies like JAPAN SUPERCONDUCTOR TECHNOLOGY INC (JASTEC) and Sumitomo Electric Industries Ltd, continues to be a major player. China's rapid industrialization and significant investment in high-speed rail and advanced power grids are also propelling its demand for superconducting materials.

The electronics sector is another significant growth driver, with superconductors enabling advancements in areas such as high-speed computing, advanced sensors, and efficient power electronics. The burgeoning field of quantum computing, which heavily relies on superconducting circuits, represents a future growth frontier. While currently holding a smaller market share than medical, its rapid innovation and potential for disruptive applications suggest a substantial upward trajectory.

The dominance of HTS, the strong reliance on the medical sector, and the burgeoning influence of the Asia Pacific region collectively shape the current landscape of the superconductor materials market. Economic policies that encourage innovation, infrastructure development in areas like high-speed rail and smart grids, and a growing awareness of energy efficiency are key factors fueling this growth.

Superconductor Materials Market Product Landscape

The superconductor materials market is characterized by a diverse product landscape focused on enhancing performance and expanding application reach. Key innovations revolve around developing materials with higher critical temperatures (Tc), improved critical current densities (Jc), and greater mechanical strength. Low-temperature superconducting materials (LTS), such as Niobium-Titanium (NbTi) and Niobium-Tin (Nb3Sn), continue to be vital for applications requiring extreme magnetic fields, like particle accelerators and research magnets. Simultaneously, high-temperature superconducting materials (HTS), including Yttrium Barium Copper Oxide (YBCO) and Bismuth Strontium Calcium Copper Oxide (BSCCO), are gaining prominence due to their operational advantages at higher temperatures. These materials are finding increasing use in applications like superconducting magnetic energy storage (SMES), fault current limiters, and advanced power transmission cables, offering zero energy loss and higher efficiency. Companies are continuously refining manufacturing processes for these materials, focusing on cost reduction and scalability to meet the growing demand.

Key Drivers, Barriers & Challenges in Superconductor Materials Market

Key Drivers:

The superconductor materials market is propelled by significant drivers including the increasing global demand for energy efficiency and power transmission solutions. The inherent zero-resistance property of superconductors offers unparalleled energy savings, making them attractive for grid modernization and high-speed rail. Technological advancements, particularly in the development of high-temperature superconducting materials (HTS), are expanding the range of feasible applications by reducing cooling complexities and costs. Furthermore, substantial investments in research and development by governments and private entities, coupled with growing applications in sectors like medical imaging (MRI), particle physics, and advanced electronics, are creating a strong market pull.

Barriers & Challenges:

Despite the promising outlook, the superconductor materials market faces several barriers. The high cost of manufacturing and processing superconducting materials remains a significant challenge, limiting widespread adoption, especially for large-scale infrastructure projects. The requirement for cryogenic cooling, though reduced for HTS, still adds complexity and operational expense. Supply chain vulnerabilities for rare earth elements and critical raw materials essential for some superconductor compositions can lead to price volatility and availability issues. Additionally, developing robust and standardized testing and certification protocols for superconducting components is an ongoing challenge. Regulatory hurdles and a lack of widespread technical expertise also present restraints to market expansion. The market is estimated to face potential supply chain disruptions that could impact the availability of crucial raw materials, potentially adding 5-10% to material costs in the short term.

Emerging Opportunities in Superconductor Materials Market

Emerging opportunities in the superconductor materials market are vast and transformative. The development of fault current limiters and superconducting transformers presents a significant opportunity for enhancing the stability and efficiency of electricity grids, particularly in regions undergoing modernization. The burgeoning quantum computing industry is a major growth avenue, with superconducting qubits being a leading technology in this field. Advancements in medical technology beyond MRI, such as superconducting components for advanced cancer therapies and compact, high-field magnets for portable diagnostic devices, offer substantial potential. Furthermore, the exploration of superconductors for fusion energy reactors represents a long-term, high-impact opportunity. The exploration of novel superconducting materials with even higher critical temperatures and improved mechanical properties is also an ongoing area of opportunity, promising to unlock new applications in aerospace and advanced transportation.

Growth Accelerators in the Superconductor Materials Market Industry

Several key catalysts are accelerating the growth of the superconductor materials market. Continued breakthroughs in materials science, leading to superconductors with higher critical temperatures and improved performance characteristics, are paramount. Strategic partnerships and collaborations between research institutions and industry players, like the collaboration between Philips and MagCorp for advanced MR magnets, are crucial for translating laboratory discoveries into commercial products. Government funding and incentives for clean energy technologies and advanced manufacturing are also significant growth accelerators, particularly in regions investing in smart grid infrastructure and high-speed rail. The increasing focus on energy efficiency and sustainability across all industries creates a strong market pull for superconducting solutions. Furthermore, the development of more cost-effective and scalable manufacturing techniques will be instrumental in driving wider adoption and market expansion.

Key Players Shaping the Superconductor Materials Market Market

- evico GMBH

- Hitachi Ltd

- Hyper Tech Research Inc

- JAPAN SUPERCONDUCTOR TECHNOLOGY INC (JASTEC)

- MetOx Technologies Inc

- NEXANS

- Sumitomo Electric Industries Ltd

- Super Conductor Materials Inc

- Superconductor Technologies Inc

- SuperPower Inc

- Western Superconducting Technologies CoLtd

Notable Milestones in Superconductor Materials Market Sector

- December 2022: Philips entered into a research partnership with US magnet solutions provider MagCorp to explore superconducting magnets for MR scanners that do not require cooling to ultra-low temperatures (-452 °F or -269 °C) using liquid helium. This development signals a push towards more accessible and energy-efficient medical imaging solutions.

- April 2022: Mazhar Ali, an associate professor, and his research group at TU Delft discovered one-way superconductivity without magnetic fields. This breakthrough has the potential to revolutionize electronics by enabling devices hundreds of times faster with zero energy loss.

In-Depth Superconductor Materials Market Market Outlook

The superconductor materials market is on a robust growth trajectory, driven by ongoing technological advancements and an increasing global emphasis on energy efficiency and high-performance applications. The continued development of high-temperature superconducting materials (HTS) is expected to unlock a wider array of commercial uses, reducing cooling complexities and costs. Key growth accelerators include significant R&D investments, strategic industry partnerships aimed at product commercialization, and supportive government policies for advanced technologies. Emerging opportunities in quantum computing, advanced medical devices, and enhanced power grid infrastructure promise to further propel market expansion. With an estimated market value of approximately $12 billion in 2025, the market is poised for substantial growth, with future projections indicating a sustained upward trend driven by innovation and expanding application landscapes.

Superconductor Materials Market Segmentation

-

1. Product Type

- 1.1. Low-temperature Superconducting Materials (LTS)

- 1.2. High-temperature Superconducting Materials (HTS)

-

2. End-user Industry

- 2.1. Medical

- 2.2. Electronics

- 2.3. Other End-user Industries

Superconductor Materials Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

- 4. Rest of the World

Superconductor Materials Market Regional Market Share

Geographic Coverage of Superconductor Materials Market

Superconductor Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Expenditures on Medical Machinery and Equipment; Growing Demand from the Electronics Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Expenditures on Medical Machinery and Equipment; Growing Demand from the Electronics Industry

- 3.4. Market Trends

- 3.4.1. Medical Sector is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Superconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Low-temperature Superconducting Materials (LTS)

- 5.1.2. High-temperature Superconducting Materials (HTS)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Medical

- 5.2.2. Electronics

- 5.2.3. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Superconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Low-temperature Superconducting Materials (LTS)

- 6.1.2. High-temperature Superconducting Materials (HTS)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Medical

- 6.2.2. Electronics

- 6.2.3. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Superconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Low-temperature Superconducting Materials (LTS)

- 7.1.2. High-temperature Superconducting Materials (HTS)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Medical

- 7.2.2. Electronics

- 7.2.3. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Superconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Low-temperature Superconducting Materials (LTS)

- 8.1.2. High-temperature Superconducting Materials (HTS)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Medical

- 8.2.2. Electronics

- 8.2.3. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Superconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Low-temperature Superconducting Materials (LTS)

- 9.1.2. High-temperature Superconducting Materials (HTS)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Medical

- 9.2.2. Electronics

- 9.2.3. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 evico GMBH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hitachi Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyper Tech Research Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 JAPAN SUPERCONDUCTOR TECHNOLOGY INC (JASTEC)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MetOx Technologies Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NEXANS

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sumitomo Electric Industries Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Super Conductor Materials Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Superconductor Technologies Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 SuperPower Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Western Superconducting Technologies CoLtd *List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 evico GMBH

List of Figures

- Figure 1: Global Superconductor Materials Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Superconductor Materials Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Superconductor Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Superconductor Materials Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Superconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Superconductor Materials Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Superconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Superconductor Materials Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: North America Superconductor Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Superconductor Materials Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Superconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Superconductor Materials Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Superconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Superconductor Materials Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Superconductor Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Superconductor Materials Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Superconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Superconductor Materials Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Superconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Superconductor Materials Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Rest of the World Superconductor Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of the World Superconductor Materials Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Superconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Superconductor Materials Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Superconductor Materials Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Superconductor Materials Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Superconductor Materials Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Superconductor Materials Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Superconductor Materials Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Superconductor Materials Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Superconductor Materials Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Superconductor Materials Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Global Superconductor Materials Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Superconductor Materials Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Superconductor Materials Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Superconductor Materials Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Superconductor Materials Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Superconductor Materials Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Superconductor Materials Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global Superconductor Materials Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Superconductor Materials Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Superconductor Materials Market?

The projected CAGR is approximately 9.5%.

2. Which companies are prominent players in the Superconductor Materials Market?

Key companies in the market include evico GMBH, Hitachi Ltd, Hyper Tech Research Inc, JAPAN SUPERCONDUCTOR TECHNOLOGY INC (JASTEC), MetOx Technologies Inc, NEXANS, Sumitomo Electric Industries Ltd, Super Conductor Materials Inc, Superconductor Technologies Inc, SuperPower Inc, Western Superconducting Technologies CoLtd *List Not Exhaustive.

3. What are the main segments of the Superconductor Materials Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Expenditures on Medical Machinery and Equipment; Growing Demand from the Electronics Industry.

6. What are the notable trends driving market growth?

Medical Sector is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Expenditures on Medical Machinery and Equipment; Growing Demand from the Electronics Industry.

8. Can you provide examples of recent developments in the market?

December 2022: Philips entered into a research partnership with US magnet solutions provider MagCorp to explore superconducting magnets for MR scanners that do not require cooling to ultra-low temperatures (-452 °F or -269 °C) using liquid helium.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Superconductor Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Superconductor Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Superconductor Materials Market?

To stay informed about further developments, trends, and reports in the Superconductor Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence