Key Insights

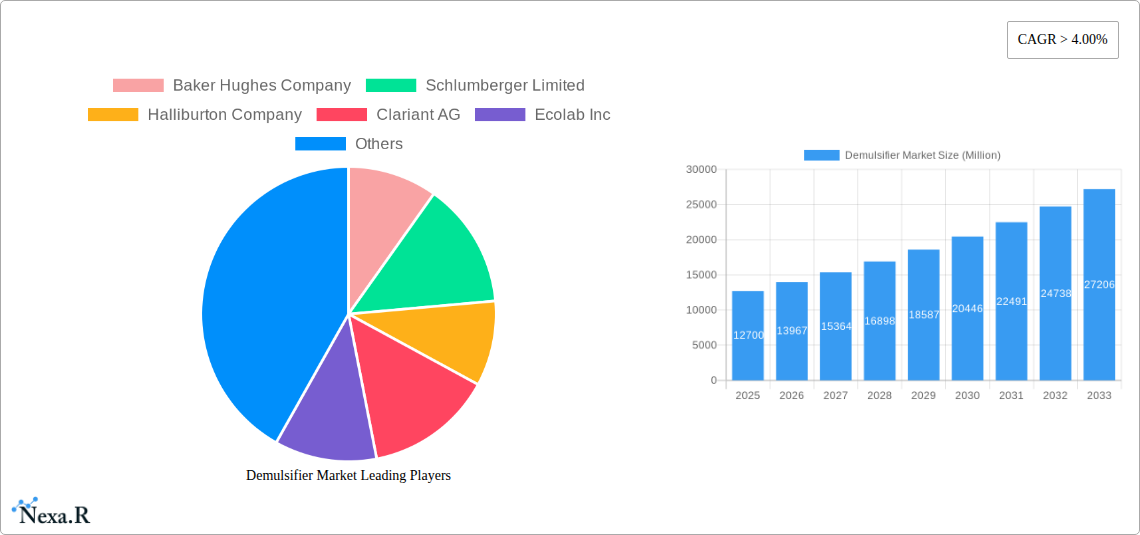

The global Demulsifier Market is poised for significant expansion, projected to reach $12.7 billion in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.91% through the forecast period. This substantial growth is primarily fueled by the escalating demand for crude oil processing and refining activities worldwide, particularly in emerging economies. The increasing complexity of crude oil extraction, often involving emulsified water, necessitates the extensive use of demulsifiers to efficiently separate oil and water, thereby optimizing production yields and minimizing operational costs. Furthermore, stringent environmental regulations aimed at reducing water pollution from oil spills and industrial wastewater are acting as a significant catalyst for the adoption of advanced demulsifier technologies. The market is also witnessing a rising trend in the development of eco-friendly and bio-based demulsifiers, driven by a growing emphasis on sustainable practices within the oil and gas industry.

Demulsifier Market Market Size (In Billion)

The market's trajectory is further supported by increasing investments in the upstream oil and gas sector and the continuous need to enhance the efficiency of petrochemical operations. Key applications like sludge oil treatment and petro-refineries are expected to dominate demand, with oil-based power plants and lubricant manufacturing also contributing substantially. While the market presents a bright outlook, certain restraints, such as fluctuating crude oil prices and the development of alternative separation technologies, could pose challenges. However, the inherent necessity of demulsification in oil production and processing, coupled with ongoing technological advancements in product formulation, suggests sustained market momentum. The competitive landscape is characterized by the presence of established global players and emerging regional manufacturers, all vying for market share through product innovation and strategic collaborations.

Demulsifier Market Company Market Share

Demulsifier Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global demulsifier market, forecasting significant growth driven by rising crude oil production, stringent environmental regulations, and increasing demand for efficient oil-water separation technologies. Covering the study period from 2019 to 2033, with a base year of 2025, this report offers critical insights into market dynamics, growth trends, regional dominance, product innovations, and the competitive landscape. We delve into the intricate workings of the parent demulsifier market and its crucial child markets, providing a holistic view for industry professionals, investors, and stakeholders.

Demulsifier Market Market Dynamics & Structure

The demulsifier market is characterized by moderate to high concentration, with a few key players holding significant market share, alongside a growing number of regional and specialized manufacturers. Technological innovation is a primary driver, with companies investing heavily in developing advanced demulsifier formulations that offer superior efficiency, reduced environmental impact, and cost-effectiveness. The regulatory framework, particularly concerning wastewater discharge and environmental protection in the oil and gas sector, plays a crucial role in shaping market demand and product development. Competitive product substitutes, such as mechanical separation techniques, exist but often lack the efficiency and cost-effectiveness of chemical demulsifiers for large-scale operations. End-user demographics are primarily concentrated within the upstream and midstream oil and gas industries, petrochemicals, and lubricant manufacturing, with a growing interest from the oil-based power generation sector. Mergers and acquisitions (M&A) are an ongoing trend, as larger companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, in the historical period (2019-2024), several strategic acquisitions were observed, aiming to consolidate market share and integrate innovative solutions. Innovation barriers primarily revolve around the complexity of crude oil emulsions, requiring highly tailored solutions, and the significant R&D investment needed for developing novel, eco-friendly demulsifiers.

- Market Concentration: Dominated by key players, with opportunities for niche market players.

- Technological Innovation: Focus on eco-friendly, high-efficiency, and cost-effective solutions.

- Regulatory Framework: Driven by environmental protection and wastewater discharge standards.

- Competitive Landscape: Chemical demulsifiers vs. mechanical separation; ongoing R&D to enhance performance.

- End-User Demographics: Oil & gas (upstream, midstream), petrochemicals, lubricants, and power generation.

- M&A Trends: Strategic acquisitions for portfolio expansion and market consolidation.

- Innovation Barriers: Complexity of emulsions, high R&D costs, and stringent performance requirements.

Demulsifier Market Growth Trends & Insights

The global demulsifier market is poised for robust growth, projected to reach $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.X% during the forecast period (2025–2033). This expansion is underpinned by the persistent demand for crude oil, a fluctuating but ultimately growing energy requirement, and the ever-present need for efficient separation processes in oil extraction and refining. The increasing complexity of crude oil reserves, including heavier and more challenging emulsions, necessitates the use of advanced demulsifier technologies. Furthermore, heightened environmental consciousness and stricter regulations on wastewater discharge from oil facilities are compelling operators to adopt more effective and environmentally benign demulsifier solutions. This trend is particularly evident in regions with extensive offshore oil operations and mature refining infrastructure.

Adoption rates for advanced demulsifier formulations are on the rise as their superior performance and potential for reduced operational costs become more apparent. Technological disruptions are primarily focused on developing bio-based and biodegradable demulsifiers, alongside formulations that are effective across a wider range of temperatures and salinities. Consumer behavior shifts are also playing a role, with a growing preference for suppliers that demonstrate a commitment to sustainability and offer customized solutions. The market penetration of specialized demulsifiers for specific crude oil types and processing challenges is expected to deepen. The historical period (2019–2024) witnessed a steady increase in the demand for oil-soluble demulsifiers, driven by enhanced oil recovery techniques.

Looking ahead, the market size evolution will be significantly influenced by global energy policies, advancements in extraction technologies, and the exploration of unconventional oil reserves. The estimated market size for 2025 stands at $XX billion. The demand for water-soluble demulsifiers is also expected to see substantial growth, particularly in applications involving produced water treatment. The underlying principle of maximizing oil recovery while minimizing environmental impact remains the core driver for innovation and market expansion in the demulsifier sector.

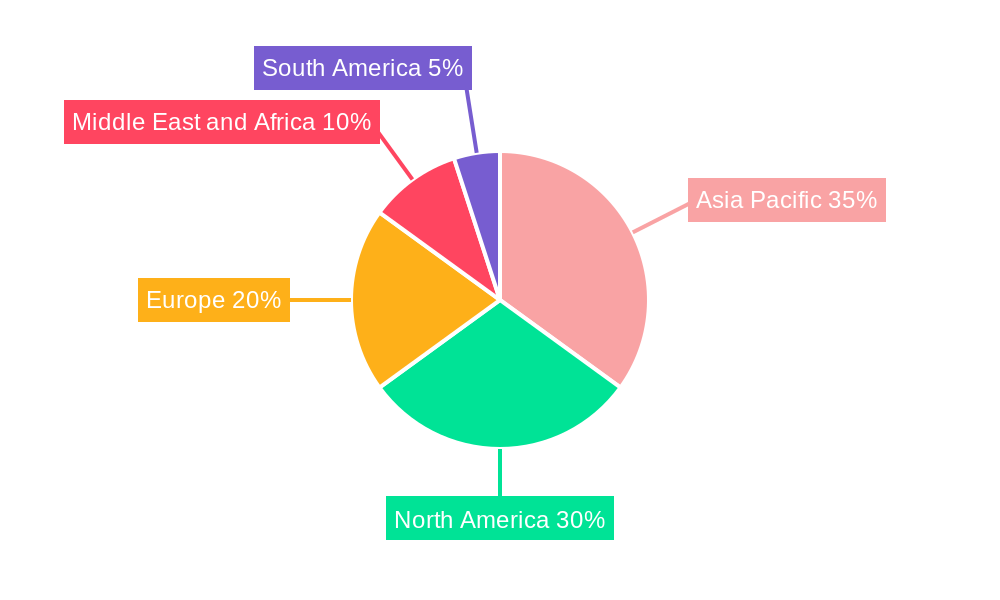

Dominant Regions, Countries, or Segments in Demulsifier Market

The Crude Oil Processing segment is identified as a dominant driver within the demulsifier market, due to the sheer volume of crude oil that undergoes separation processes globally. Petro Refineries represent another substantial segment, requiring efficient demulsifiers for various stages of refining to ensure product quality and operational efficiency. The Asia Pacific region is emerging as a dominant force in the demulsifier market, propelled by its rapidly expanding oil and gas industry, significant refining capacity, and increasing investments in petrochemicals. Countries like China and India are at the forefront, with substantial crude oil import and processing activities, driving a consistent demand for demulsifiers.

Key Drivers for Dominance:

Asia Pacific:

- Economic Policies: Favorable government policies supporting the oil and gas sector and downstream industries.

- Infrastructure Development: Massive investments in refining capacity, pipelines, and port facilities.

- Growing Energy Demand: Rapid industrialization and urbanization fueling energy consumption, particularly from crude oil.

- Increasing Crude Oil Imports: Reliance on imported crude oil necessitates efficient processing and separation.

- Market Share: Asia Pacific is estimated to hold a market share of XX% in 2025, with a projected growth of X.X% CAGR.

Dominant Segments:

- Crude Oil Processing:

- Market Size: Estimated to be $XX billion in 2025, contributing XX% to the overall market.

- Growth Drivers: Increasing global crude oil production, enhanced oil recovery (EOR) techniques, and the need for efficient separation of water and solids from crude.

- Technological Advancements: Demand for high-performance demulsifiers effective in challenging conditions.

- Petro Refineries:

- Market Size: Estimated to be $XX billion in 2025, contributing XX% to the overall market.

- Growth Drivers: Stringent product quality standards, operational efficiency demands, and environmental regulations regarding wastewater treatment.

- Segment Share: Represents a significant portion due to the continuous operation and processing of various crude grades.

- Crude Oil Processing:

The dominance of these regions and segments is further reinforced by ongoing technological advancements in demulsifier formulations tailored to specific crude oil characteristics and processing requirements. North America and the Middle East also represent significant markets, driven by their extensive crude oil reserves and refining capacities, respectively. However, the rapid pace of industrial expansion and increasing energy consumption in Asia Pacific positions it as the leading growth engine for the demulsifier market in the coming years.

Demulsifier Market Product Landscape

The demulsifier market's product landscape is dynamic, driven by continuous innovation focused on enhancing separation efficiency, reducing environmental impact, and improving cost-effectiveness. Key product innovations include the development of advanced formulations such as polymeric demulsifiers, microemulsion-based demulsifiers, and eco-friendly bio-based demulsifiers. These products offer superior performance in breaking complex emulsions encountered in crude oil processing, sludge oil treatment, and petrochemical operations. For instance, novel oil-soluble demulsifiers are now formulated to exhibit faster action times and lower dosage requirements, leading to significant operational cost savings for end-users. Simultaneously, water-soluble demulsifiers are being engineered for better biodegradability and reduced toxicity, aligning with stringent environmental regulations. The performance metrics that define product success include interfacial tension reduction, emulsion breaking time, water droplet coalescence, and emulsion stability, with leading products excelling in these areas.

Key Drivers, Barriers & Challenges in Demulsifier Market

Key Drivers:

- Increasing Global Crude Oil Production: Higher extraction rates directly translate to greater demand for demulsifiers in separation processes.

- Stringent Environmental Regulations: Growing pressure to reduce pollutants and treat wastewater effectively mandates the use of high-performance, eco-friendly demulsifiers.

- Advancements in Oilfield Technologies: Enhanced oil recovery (EOR) methods often produce more complex emulsions, requiring specialized demulsifier solutions.

- Growth in Petrochemical Industry: Expansion in petrochemical production necessitates efficient separation of hydrocarbons, boosting demulsifier demand.

- Demand for Operational Efficiency: Cost-conscious operators seek demulsifiers that improve throughput and reduce processing time.

Barriers & Challenges:

- Complexity of Crude Oil Emulsions: The diverse nature of crude oil and varying emulsion compositions make it challenging to develop universal demulsifier solutions.

- Fluctuating Crude Oil Prices: Volatility in oil prices can impact exploration and production budgets, indirectly affecting demand for chemicals.

- Regulatory Hurdles for New Formulations: Obtaining approvals for novel chemical formulations can be a lengthy and expensive process.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials for demulsifier production.

- Competition from Alternative Technologies: While chemical demulsifiers are dominant, advancements in mechanical separation can pose a competitive threat in certain niche applications.

- Environmental Concerns with Certain Chemicals: Some traditional demulsifiers may raise environmental concerns, driving a shift towards greener alternatives and increasing R&D costs.

Emerging Opportunities in Demulsifier Market

Emerging opportunities in the demulsifier market are primarily driven by the pursuit of sustainable solutions and the expansion into new application areas. The growing demand for bio-based and biodegradable demulsifiers presents a significant avenue for growth, catering to the increasing environmental consciousness of industries and regulatory bodies. Furthermore, the development of demulsifiers specifically designed for unconventional oil sources, such as heavy crude and oil sands, offers untapped market potential. The offshore oil and gas sector, with its unique separation challenges, continues to be a fertile ground for innovation in demulsifier technology. As industries like lubricant manufacturing increasingly focus on efficient waste oil processing, there's an emerging opportunity for specialized demulsifiers to address these specific needs.

Growth Accelerators in the Demulsifier Market Industry

Several catalysts are accelerating the growth of the demulsifier market. Technological breakthroughs in nanotechnology are leading to the development of more efficient demulsifier formulations with enhanced surface activity. Strategic partnerships between chemical manufacturers and oilfield service companies are crucial for co-developing tailored solutions and expanding market reach. Furthermore, the increasing exploration and production activities in frontier regions, coupled with the need to optimize production from mature fields, are significant growth accelerators. The global push towards cleaner energy production also indirectly benefits the demulsifier market, as efficient separation is critical for various stages of refining and processing, even for fuels derived from traditional sources.

Key Players Shaping the Demulsifier Market Market

- Baker Hughes Company

- Schlumberger Limited

- Halliburton Company

- Clariant AG

- Ecolab Inc

- BASF SE

- Akzo Nobel NV

- Croda International PLC

- The Dow Chemical Company

- Dorf Ketal

- PT Eonchemicals Putra

- National Chemical & Petroleum Industries Co (NCPI)

Notable Milestones in Demulsifier Market Sector

- 2019: Introduction of novel bio-based demulsifier formulations targeting reduced environmental impact.

- 2020: Major players enhanced R&D investments to develop demulsifiers effective for complex shale oil emulsions.

- 2021: Increased M&A activity as larger companies acquired smaller, innovative chemical producers.

- 2022: Significant focus on digital solutions for demulsifier performance monitoring and optimization in upstream operations.

- 2023: Development of multi-functional demulsifiers offering corrosion inhibition and scale prevention alongside emulsion breaking.

- 2024: Emergence of more concentrated and highly efficient demulsifier formulations leading to reduced transportation costs.

In-Depth Demulsifier Market Market Outlook

The outlook for the demulsifier market remains exceptionally positive, driven by sustained global energy demand and an unyielding commitment to environmental stewardship. Growth accelerators such as technological innovation in sustainable chemistry, coupled with strategic collaborations across the value chain, will continue to propel the market forward. The increasing complexity of crude oil reserves, particularly in challenging environments, will necessitate more sophisticated and tailored demulsifier solutions, creating opportunities for specialized product development. As industries worldwide strive for greater operational efficiency and reduced environmental footprints, the demand for high-performance, cost-effective, and eco-friendly demulsifiers is set to surge. The market is expected to witness a steady expansion in its overall value, with a significant emphasis on innovation and sustainability as key differentiators for market leaders and emerging players alike.

Demulsifier Market Segmentation

-

1. Type

- 1.1. Water Soluble

- 1.2. Oil Soluble

-

2. Application

- 2.1. Sludge Oil Treatment

- 2.2. Petro Refineries

- 2.3. Crude Oil Processing

- 2.4. Oil-based Power Plants

- 2.5. Lubricant Manufacturing

- 2.6. Other Applications

Demulsifier Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Demulsifier Market Regional Market Share

Geographic Coverage of Demulsifier Market

Demulsifier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Increasing Production of Crude Oil; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand from Increasing Production of Crude Oil; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Demand from Increasing Production of Crude Oil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Demulsifier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Water Soluble

- 5.1.2. Oil Soluble

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sludge Oil Treatment

- 5.2.2. Petro Refineries

- 5.2.3. Crude Oil Processing

- 5.2.4. Oil-based Power Plants

- 5.2.5. Lubricant Manufacturing

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Demulsifier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Water Soluble

- 6.1.2. Oil Soluble

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Sludge Oil Treatment

- 6.2.2. Petro Refineries

- 6.2.3. Crude Oil Processing

- 6.2.4. Oil-based Power Plants

- 6.2.5. Lubricant Manufacturing

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Demulsifier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Water Soluble

- 7.1.2. Oil Soluble

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Sludge Oil Treatment

- 7.2.2. Petro Refineries

- 7.2.3. Crude Oil Processing

- 7.2.4. Oil-based Power Plants

- 7.2.5. Lubricant Manufacturing

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Demulsifier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Water Soluble

- 8.1.2. Oil Soluble

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Sludge Oil Treatment

- 8.2.2. Petro Refineries

- 8.2.3. Crude Oil Processing

- 8.2.4. Oil-based Power Plants

- 8.2.5. Lubricant Manufacturing

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Demulsifier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Water Soluble

- 9.1.2. Oil Soluble

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Sludge Oil Treatment

- 9.2.2. Petro Refineries

- 9.2.3. Crude Oil Processing

- 9.2.4. Oil-based Power Plants

- 9.2.5. Lubricant Manufacturing

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Demulsifier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Water Soluble

- 10.1.2. Oil Soluble

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Sludge Oil Treatment

- 10.2.2. Petro Refineries

- 10.2.3. Crude Oil Processing

- 10.2.4. Oil-based Power Plants

- 10.2.5. Lubricant Manufacturing

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baker Hughes Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Schlumberger Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Halliburton Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Clariant AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ecolab Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Akzo Nobel NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Croda International PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Dow Chemical Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dorf Ketal

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PT Eonchemicals Putra

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 National Chemical & Petroleum Industries Co (NCPI)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 *List not exhaustive*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Baker Hughes Company

List of Figures

- Figure 1: Global Demulsifier Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Demulsifier Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Demulsifier Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Demulsifier Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Demulsifier Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Demulsifier Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Demulsifier Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Demulsifier Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Demulsifier Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Demulsifier Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America Demulsifier Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Demulsifier Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Demulsifier Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Demulsifier Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Demulsifier Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Demulsifier Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe Demulsifier Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Demulsifier Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Demulsifier Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Demulsifier Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Demulsifier Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Demulsifier Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Demulsifier Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Demulsifier Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Demulsifier Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Demulsifier Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Demulsifier Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Demulsifier Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Demulsifier Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Demulsifier Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Demulsifier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Demulsifier Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Demulsifier Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Demulsifier Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Demulsifier Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Demulsifier Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Demulsifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Demulsifier Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Demulsifier Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Demulsifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Demulsifier Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Demulsifier Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Demulsifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: France Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Demulsifier Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Demulsifier Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Demulsifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Demulsifier Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Demulsifier Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Demulsifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Demulsifier Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Demulsifier Market?

The projected CAGR is approximately 9.91%.

2. Which companies are prominent players in the Demulsifier Market?

Key companies in the market include Baker Hughes Company, Schlumberger Limited, Halliburton Company, Clariant AG, Ecolab Inc, BASF SE, Akzo Nobel NV, Croda International PLC, The Dow Chemical Company, Dorf Ketal, PT Eonchemicals Putra, National Chemical & Petroleum Industries Co (NCPI), *List not exhaustive*List Not Exhaustive.

3. What are the main segments of the Demulsifier Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Increasing Production of Crude Oil; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from Increasing Production of Crude Oil.

7. Are there any restraints impacting market growth?

; Growing Demand from Increasing Production of Crude Oil; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Demulsifier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Demulsifier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Demulsifier Market?

To stay informed about further developments, trends, and reports in the Demulsifier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence