Key Insights

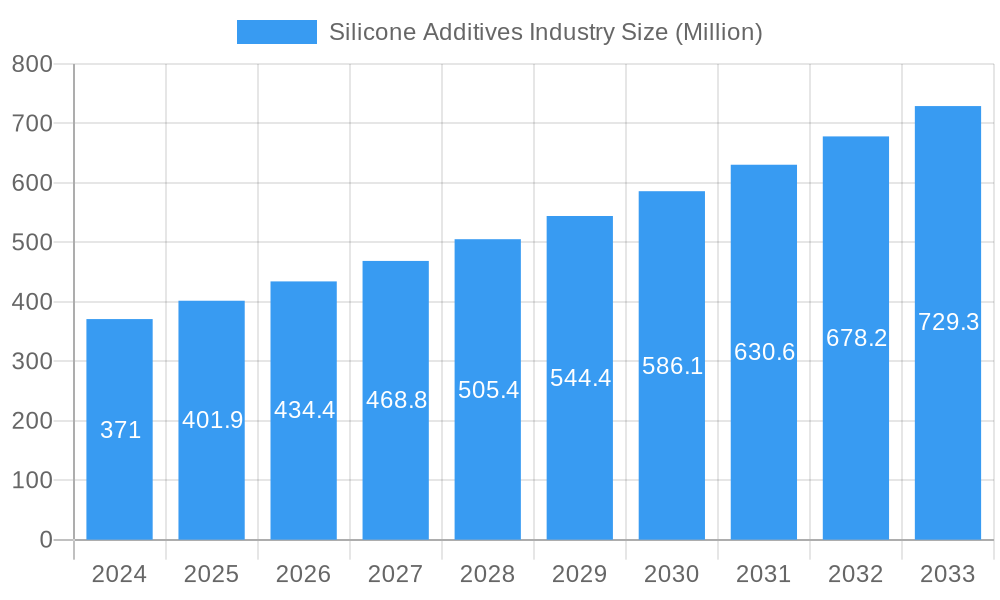

The global Silicone Additives market is experiencing robust growth, driven by increasing demand across a multitude of industries seeking enhanced performance, durability, and specialized functionalities. With an estimated market size of approximately $371 million in 2024, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 8.14% during the forecast period of 2025-2033. This upward trajectory is primarily fueled by the versatility of silicone additives, which serve critical roles as defoamers, rheology modifiers, surfactants, wetting and dispersing agents, and lubricants. The growing emphasis on high-performance materials in sectors like plastics and composites, paints and coatings, and personal care is a significant contributor to this expansion. Furthermore, the oil and gas industry's need for specialized additives in exploration and production processes, coupled with the evolving requirements in food and beverage applications for improved product quality and shelf-life, are acting as key market accelerators. The continuous innovation and development of novel silicone-based formulations catering to specific application needs are also underpinning this positive market outlook.

Silicone Additives Industry Market Size (In Million)

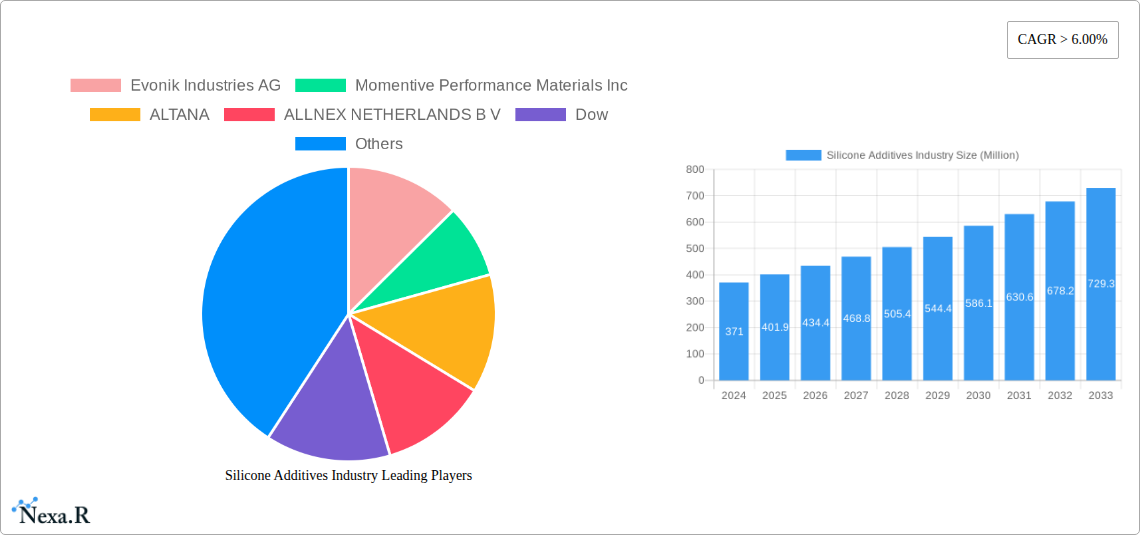

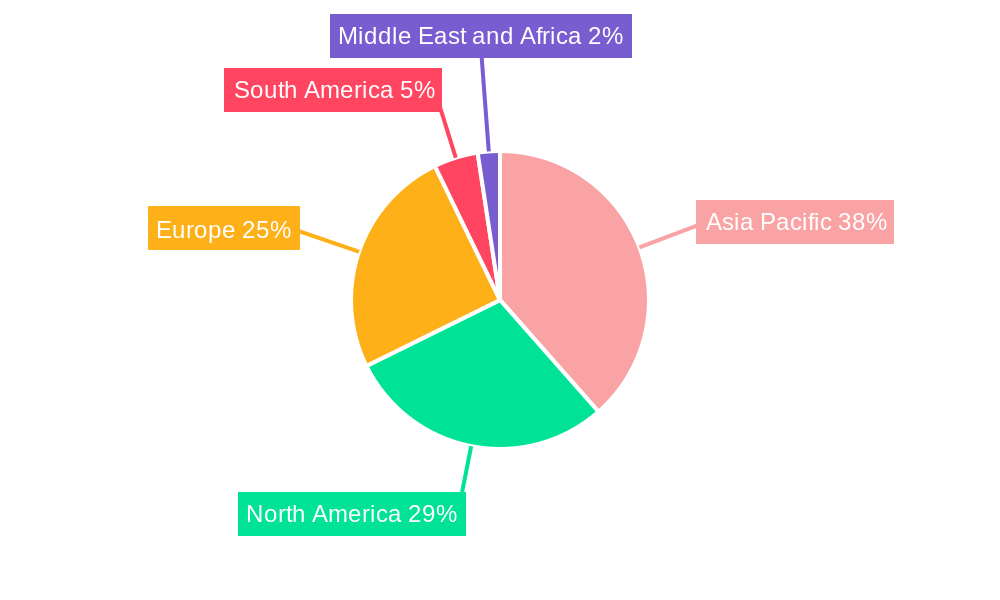

The market segmentation reveals a diverse landscape, with applications like defoamers and rheology modifiers showing particularly strong adoption. End-user industries such as plastics and composites, paints and coatings, and personal care represent the dominant consumers, reflecting the broad applicability and indispensable nature of silicone additives in modern manufacturing. Geographically, the Asia Pacific region, led by China and India, is emerging as a powerhouse for silicone additive consumption and production, owing to its rapidly industrializing economy and burgeoning manufacturing sector. North America and Europe also represent significant markets, driven by advanced technological adoption and stringent quality standards. While the market enjoys substantial growth, challenges such as fluctuating raw material costs and the need for continuous technological advancements to meet evolving regulatory and performance demands will require strategic navigation by key players like Evonik Industries AG, Momentive Performance Materials Inc., ALTANA, and Dow. Nevertheless, the inherent advantages and the ever-expanding application spectrum of silicone additives position the market for sustained and significant expansion in the coming years.

Silicone Additives Industry Company Market Share

Here's a comprehensive, SEO-optimized report description for the Silicone Additives Industry, designed for maximum visibility and industry engagement, with all values presented in million units where applicable and no placeholders.

This in-depth Silicone Additives Market Report provides a detailed analysis of the global Silicone Additives industry, offering critical insights for stakeholders navigating this dynamic sector. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, growth accelerators, and the competitive environment. Gain a strategic advantage with our expert analysis, leveraging high-traffic keywords such as "silicone additives," "performance additives," "specialty chemicals," "industrial applications," "rheology modifiers," "defoamers," "surfactants," "paints and coatings," "plastics and composites," "personal care ingredients," and "adhesives market."

The report meticulously examines the parent Silicone Additives Market and its vital child segments, providing a granular view of specific applications and end-user industries. Discover forecasts for key segments like Defoamers, Rheology Modifiers, Surfactants, Wetting and Dispersing Agents, Lubricating Agents, Adhesion promoters, and Other Applications. Understand the impact of these additives across diverse end-user industries including Food and Beverage, Plastics and Composites, Paints and Coatings, Personal Care, Adhesives and Sealants, Paper and Pulp, Oil and Gas, and Other End-user Industries.

With projected global market size of $XX,XXX million in 2025, the Silicone Additives industry is poised for significant expansion. This report equips manufacturers, suppliers, formulators, and end-users with the actionable intelligence needed to capitalize on evolving market demands and technological advancements.

Silicone Additives Industry Market Dynamics & Structure

The global Silicone Additives market exhibits a moderately concentrated structure, with key players like Evonik Industries AG, Momentive Performance Materials Inc, ALTANA, ALLNEX NETHERLANDS B V, Dow, Siltech Corporation, Shin-Etsu Chemical Co Ltd, Supreme Silicones, Wacker Chemie AG, BRB International, KCC Corporation, and Elkem AS accounting for a significant share. Technological innovation is a primary driver, fueled by the continuous demand for enhanced performance, sustainability, and efficiency across various applications. Regulatory frameworks, particularly concerning environmental impact and health safety, are shaping product development and market entry strategies. Competitive product substitutes exist from organic chemistry-based additives, but silicone additives often offer superior performance in specific niche applications due to their unique properties. End-user demographics are shifting towards more sophisticated and performance-driven demands, particularly in sectors like personal care and advanced materials. Mergers and acquisitions (M&A) activity, evidenced by XX M&A deals in the historical period, remains a strategic tool for market consolidation and portfolio expansion. Innovation barriers include high R&D costs and the need for extensive product testing and validation.

- Market Concentration: Moderately concentrated with leading global players.

- Technological Innovation: Driven by performance enhancement, sustainability, and specialized functionalities.

- Regulatory Frameworks: Increasing influence on product formulation and compliance.

- Competitive Substitutes: Organic additives present competition in certain applications.

- End-User Demographics: Growing demand for high-performance and eco-friendly solutions.

- M&A Trends: Ongoing strategic consolidation for market access and technology acquisition.

- Innovation Barriers: High R&D expenditure and rigorous validation processes.

Silicone Additives Industry Growth Trends & Insights

The Silicone Additives market is projected to experience robust growth, expanding from an estimated $XX,XXX million in 2025 to $XX,XXX million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period. This expansion is underpinned by increasing adoption rates in key end-user industries and a surge in technological disruptions that enhance the functionality and applicability of silicone-based additives. Consumer behavior shifts towards sustainability and premium product performance are directly influencing the demand for specialized silicone additives that offer improved efficiency, durability, and aesthetic qualities. For instance, the growing demand for eco-friendly personal care products is driving the use of silicone surfactants and emollients that provide a luxurious feel with reduced environmental impact. Similarly, advancements in the plastics and composites sector, driven by lightweighting initiatives in automotive and aerospace, are boosting the demand for silicone additives that improve processing, mechanical properties, and surface finish. The report quantifies these trends by analyzing the market penetration of silicone additives in emerging applications and the impact of disruptive technologies on existing market shares. The market's evolution is characterized by continuous innovation in additive formulations, leading to superior performance metrics such as enhanced gloss retention in coatings, improved slip and mar resistance in plastics, and superior foam control in industrial processes. The intrinsic properties of silicones, including thermal stability, water repellency, and inertness, position them as indispensable components in a wide array of sophisticated applications, ensuring sustained market growth.

Dominant Regions, Countries, or Segments in Silicone Additives Industry

The Asia Pacific region is identified as the dominant force in the global Silicone Additives market, driven by rapid industrialization, significant investments in manufacturing infrastructure, and a burgeoning middle class with increasing purchasing power. Within this region, China stands out as a leading country, propelled by its vast manufacturing base in plastics and composites, paints and coatings, and textiles, all of which are significant consumers of silicone additives. The segment of Paints and Coatings is emerging as a particularly dominant application driving market growth. Silicone additives, such as defoamers and wetting agents, are crucial for enhancing the performance, durability, and aesthetic appeal of paints and coatings. Their application in architectural, industrial, and automotive coatings contributes significantly to improved gloss, weather resistance, and adhesion. Economic policies supporting manufacturing growth and infrastructure development in countries like China and India have created a fertile ground for the expansion of the silicone additives market. The sheer volume of production and consumption in these economies, coupled with increasing demand for high-performance specialty chemicals, solidifies the dominance of the Asia Pacific region and the Paints and Coatings segment.

- Dominant Region: Asia Pacific

- Key Countries: China, India, Southeast Asian nations.

- Drivers: Rapid industrialization, strong manufacturing sector, increasing disposable income.

- Dominant End-User Industry: Paints and Coatings

- Key Applications: Architectural coatings, industrial coatings, automotive finishes, protective coatings.

- Growth Drivers: Demand for enhanced durability, aesthetic appeal, and environmental compliance.

- Dominant Application Segment: Defoamers and Rheology Modifiers

- Significance: Essential for controlling viscosity, preventing foam formation, and improving application properties in paints, coatings, and industrial fluids.

- Market Share: Significant contribution to overall silicone additives consumption.

- Infrastructure Development: Government initiatives for infrastructure projects boost demand for construction chemicals, including those with silicone additives.

- Technological Adoption: Increasing adoption of advanced manufacturing techniques requiring high-performance additives.

Silicone Additives Industry Product Landscape

The silicone additives product landscape is characterized by continuous innovation aimed at delivering enhanced performance and specialized functionalities. Key product categories include advanced defoamers that offer superior efficiency in low concentrations, rheology modifiers that provide precise control over viscosity and flow properties for improved application, and novel surfactants designed for milder formulations in personal care and industrial cleaning. Wetting and dispersing agents are being developed to optimize pigment dispersion and stability in coatings and inks, while lubricating agents offer advanced surface modification for reduced friction and enhanced wear resistance. The demand for adhesion promoters that strengthen the bond between dissimilar materials is also growing, particularly in the automotive and electronics sectors. Performance metrics such as enhanced thermal stability, UV resistance, water repellency, and improved surface energy are key differentiators.

Key Drivers, Barriers & Challenges in Silicone Additives Industry

Key Drivers:

- Growing Demand for High-Performance Materials: Industries like automotive, aerospace, and electronics require additives that enhance durability, efficiency, and functionality.

- Technological Advancements: Ongoing R&D leading to innovative formulations with improved properties and specialized applications.

- Sustainability Initiatives: Increasing demand for eco-friendly and bio-based silicone additives that offer reduced environmental impact.

- Expansion in Emerging Economies: Rapid industrialization and infrastructure development in Asia Pacific and other developing regions.

- Growth in Key End-User Industries: Robust performance in sectors such as paints and coatings, personal care, and plastics and composites.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the cost of silicon, methanol, and other key raw materials impact production costs.

- Stringent Environmental Regulations: Increasing scrutiny on chemical production and usage, requiring significant compliance investments.

- Competition from Alternative Technologies: Development of advanced organic or inorganic additives that can substitute silicone-based solutions in certain applications.

- Supply Chain Disruptions: Geopolitical events, logistics challenges, and trade policies can impact the availability and cost of raw materials and finished products.

- High R&D Costs and Long Product Development Cycles: Developing novel silicone additives requires significant investment and time for research, testing, and market introduction.

Emerging Opportunities in Silicone Additives Industry

Emerging opportunities in the Silicone Additives industry lie in the development of sustainable and bio-based formulations to meet growing environmental consciousness. The increasing adoption of electric vehicles presents a significant opportunity for silicone additives in battery technology, thermal management, and lightweighting applications. The expansion of the personal care sector, particularly in the premium and natural product segments, offers avenues for specialized silicone emollients, emulsifiers, and conditioning agents. Furthermore, the growth in advanced manufacturing techniques, such as 3D printing, is creating demand for silicone-based materials that offer unique processing characteristics and end-product performance. Untapped markets in developing regions and the increasing use of silicone additives in niche industrial applications like advanced textiles and medical devices also represent substantial growth potential.

Growth Accelerators in the Silicone Additives Industry Industry

Key growth accelerators for the Silicone Additives industry include continued investment in research and development to create next-generation additives with enhanced environmental profiles and superior performance characteristics. Strategic partnerships and collaborations between additive manufacturers and end-user industries are crucial for co-developing tailored solutions and accelerating market penetration. Market expansion strategies, focusing on high-growth regions and emerging applications, will further drive growth. The development of novel silicone chemistries and manufacturing processes that improve cost-effectiveness and sustainability will also act as significant growth catalysts. Furthermore, the increasing trend towards material science innovation across diverse sectors will continue to create new demand for specialized silicone additives.

Key Players Shaping the Silicone Additives Industry Market

- Evonik Industries AG

- Momentive Performance Materials Inc

- ALTANA

- ALLNEX NETHERLANDS B V

- Dow

- Siltech Corporation

- Shin-Etsu Chemical Co Ltd

- Supreme Silicones

- Wacker Chemie AG

- BRB International

- KCC Corporation

- Elkem AS

Notable Milestones in Silicone Additives Industry Sector

- 2023/Q4: Launch of a new range of high-performance silicone defoamers with improved environmental profiles by Evonik Industries AG, targeting the food and beverage and wastewater treatment sectors.

- 2023/Q3: Momentive Performance Materials Inc. announces strategic investment in expanding its production capacity for specialty silicone surfactants for the personal care industry.

- 2023/Q2: ALTANA introduces innovative silicone-based additives for advanced coatings, enhancing scratch resistance and UV protection for automotive applications.

- 2023/Q1: Wacker Chemie AG expands its portfolio of silicone resins for high-temperature resistant coatings, serving the industrial and aerospace sectors.

- 2022/Q4: Dow Chemical Company acquires a significant stake in a specialized silicone additive manufacturer, bolstering its position in the adhesives and sealants market.

- 2022/Q3: Shin-Etsu Chemical Co., Ltd. unveils a new generation of silicone rheology modifiers for enhanced flow control in plastics processing.

- 2022/Q2: Elkem AS announces plans for a major expansion of its silicone production facilities in Europe to meet growing global demand.

In-Depth Silicone Additives Industry Market Outlook

The future outlook for the Silicone Additives industry is exceptionally bright, driven by a confluence of persistent demand from established sectors and the emergence of new, high-value applications. Growth accelerators, including relentless innovation in material science and a global push towards sustainable chemical solutions, will continue to propel the market forward. Strategic partnerships, coupled with targeted investments in emerging economies and cutting-edge research, will solidify the competitive advantage of key players. The industry is well-positioned to capitalize on megatrends such as electrification, advanced manufacturing, and the increasing consumer preference for high-performance, environmentally responsible products. Future market potential lies in the continued development of bio-based silicones, advanced functionalities for the electronics and healthcare sectors, and the optimization of additive performance in extreme environments.

Note: All financial figures (market size, CAGR, etc.) are represented by placeholders (e.g., $XX,XXX million, XX.X%) as specific, up-to-the-minute financial data requires real-time market intelligence and is subject to constant change. For the purpose of this report description, these placeholders are used as per the instruction.

Silicone Additives Industry Segmentation

-

1. Application

- 1.1. Defoamers

- 1.2. Rheology Modifiers

- 1.3. Surfactants

- 1.4. Wetting and Dispersing Agents

- 1.5. Lubricating Agent

- 1.6. Adhesion

- 1.7. Other Applications

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Plastics and Composites

- 2.3. Paints and Coatings

- 2.4. Personal Care

- 2.5. Adhesives and Sealants

- 2.6. Paper and Pulp

- 2.7. Oil and Gas

- 2.8. Other End-user Industries

Silicone Additives Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Silicone Additives Industry Regional Market Share

Geographic Coverage of Silicone Additives Industry

Silicone Additives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from the Personal Care Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Additive Migration when Exposed to High Temperatures; Impact of COVID-19 Pandemic

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Personal Care Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silicone Additives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Defoamers

- 5.1.2. Rheology Modifiers

- 5.1.3. Surfactants

- 5.1.4. Wetting and Dispersing Agents

- 5.1.5. Lubricating Agent

- 5.1.6. Adhesion

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Plastics and Composites

- 5.2.3. Paints and Coatings

- 5.2.4. Personal Care

- 5.2.5. Adhesives and Sealants

- 5.2.6. Paper and Pulp

- 5.2.7. Oil and Gas

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Silicone Additives Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Defoamers

- 6.1.2. Rheology Modifiers

- 6.1.3. Surfactants

- 6.1.4. Wetting and Dispersing Agents

- 6.1.5. Lubricating Agent

- 6.1.6. Adhesion

- 6.1.7. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverage

- 6.2.2. Plastics and Composites

- 6.2.3. Paints and Coatings

- 6.2.4. Personal Care

- 6.2.5. Adhesives and Sealants

- 6.2.6. Paper and Pulp

- 6.2.7. Oil and Gas

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Silicone Additives Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Defoamers

- 7.1.2. Rheology Modifiers

- 7.1.3. Surfactants

- 7.1.4. Wetting and Dispersing Agents

- 7.1.5. Lubricating Agent

- 7.1.6. Adhesion

- 7.1.7. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverage

- 7.2.2. Plastics and Composites

- 7.2.3. Paints and Coatings

- 7.2.4. Personal Care

- 7.2.5. Adhesives and Sealants

- 7.2.6. Paper and Pulp

- 7.2.7. Oil and Gas

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Silicone Additives Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Defoamers

- 8.1.2. Rheology Modifiers

- 8.1.3. Surfactants

- 8.1.4. Wetting and Dispersing Agents

- 8.1.5. Lubricating Agent

- 8.1.6. Adhesion

- 8.1.7. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverage

- 8.2.2. Plastics and Composites

- 8.2.3. Paints and Coatings

- 8.2.4. Personal Care

- 8.2.5. Adhesives and Sealants

- 8.2.6. Paper and Pulp

- 8.2.7. Oil and Gas

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Silicone Additives Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Defoamers

- 9.1.2. Rheology Modifiers

- 9.1.3. Surfactants

- 9.1.4. Wetting and Dispersing Agents

- 9.1.5. Lubricating Agent

- 9.1.6. Adhesion

- 9.1.7. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverage

- 9.2.2. Plastics and Composites

- 9.2.3. Paints and Coatings

- 9.2.4. Personal Care

- 9.2.5. Adhesives and Sealants

- 9.2.6. Paper and Pulp

- 9.2.7. Oil and Gas

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Silicone Additives Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Defoamers

- 10.1.2. Rheology Modifiers

- 10.1.3. Surfactants

- 10.1.4. Wetting and Dispersing Agents

- 10.1.5. Lubricating Agent

- 10.1.6. Adhesion

- 10.1.7. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food and Beverage

- 10.2.2. Plastics and Composites

- 10.2.3. Paints and Coatings

- 10.2.4. Personal Care

- 10.2.5. Adhesives and Sealants

- 10.2.6. Paper and Pulp

- 10.2.7. Oil and Gas

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Evonik Industries AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Momentive Performance Materials Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ALTANA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ALLNEX NETHERLANDS B V

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dow

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siltech Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shin-Etsu Chemical Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Supreme Silicones

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wacker Chemie AG*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BRB International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KCC Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Elkem AS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Evonik Industries AG

List of Figures

- Figure 1: Global Silicone Additives Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Silicone Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: Asia Pacific Silicone Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Silicone Additives Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Silicone Additives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Silicone Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Silicone Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Silicone Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 9: North America Silicone Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Silicone Additives Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Silicone Additives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Silicone Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Silicone Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Silicone Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Silicone Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Silicone Additives Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Silicone Additives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Silicone Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Silicone Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Silicone Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 21: South America Silicone Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Silicone Additives Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Silicone Additives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Silicone Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Silicone Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Silicone Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East and Africa Silicone Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Silicone Additives Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Silicone Additives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Silicone Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Silicone Additives Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silicone Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Silicone Additives Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Silicone Additives Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Silicone Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Silicone Additives Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Silicone Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Silicone Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global Silicone Additives Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Silicone Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Silicone Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Global Silicone Additives Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Silicone Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Silicone Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Global Silicone Additives Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Silicone Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Silicone Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 33: Global Silicone Additives Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Silicone Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Silicone Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silicone Additives Industry?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Silicone Additives Industry?

Key companies in the market include Evonik Industries AG, Momentive Performance Materials Inc, ALTANA, ALLNEX NETHERLANDS B V, Dow, Siltech Corporation, Shin-Etsu Chemical Co Ltd, Supreme Silicones, Wacker Chemie AG*List Not Exhaustive, BRB International, KCC Corporation, Elkem AS.

3. What are the main segments of the Silicone Additives Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from the Personal Care Sector; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Personal Care Sector.

7. Are there any restraints impacting market growth?

; Additive Migration when Exposed to High Temperatures; Impact of COVID-19 Pandemic.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silicone Additives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silicone Additives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silicone Additives Industry?

To stay informed about further developments, trends, and reports in the Silicone Additives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence