Key Insights

The global Green Ammonia market is poised for exceptional growth, projected to reach an estimated USD 475.2 million in 2025. This significant expansion is driven by a burgeoning demand for sustainable and decarbonized solutions across various industries. The CAGR of 32% highlights the rapid adoption of green ammonia as a key enabler of the energy transition. A primary driver is its critical role in the fertilizers sector, where it offers a low-carbon alternative to conventional ammonia production, thereby reducing the environmental footprint of agriculture. Beyond agriculture, the maritime/shipping fuel segment is emerging as a substantial growth area, with the industry actively seeking cleaner propulsion methods to meet stringent environmental regulations and reduce greenhouse gas emissions. Power generation also represents a significant application, with green ammonia being explored as a carbon-neutral fuel source for electricity production. Emerging applications, such as its use as a hydrogen carrier, further underscore its versatility and potential to support the broader hydrogen economy.

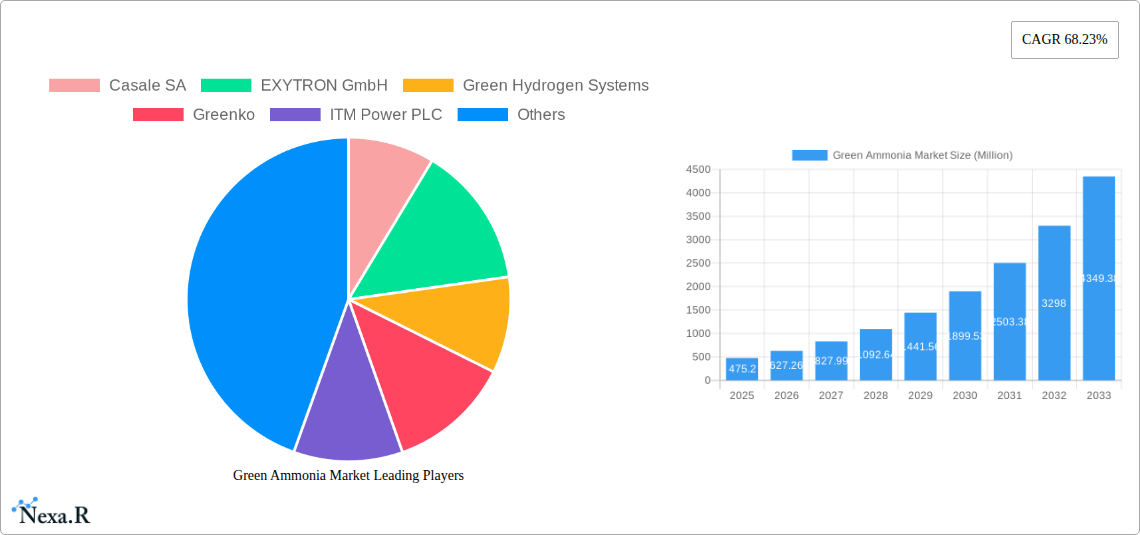

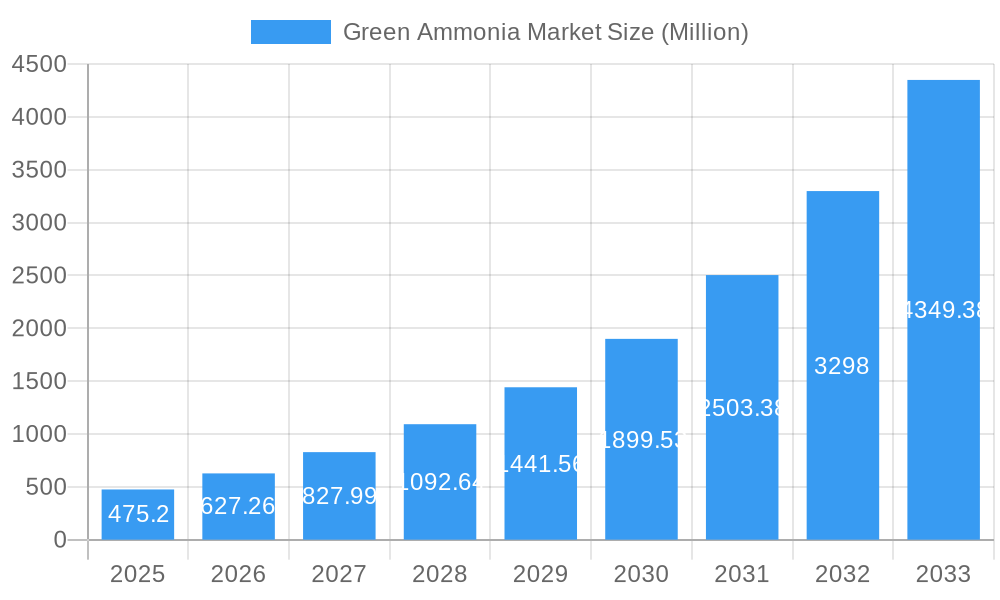

Green Ammonia Market Market Size (In Million)

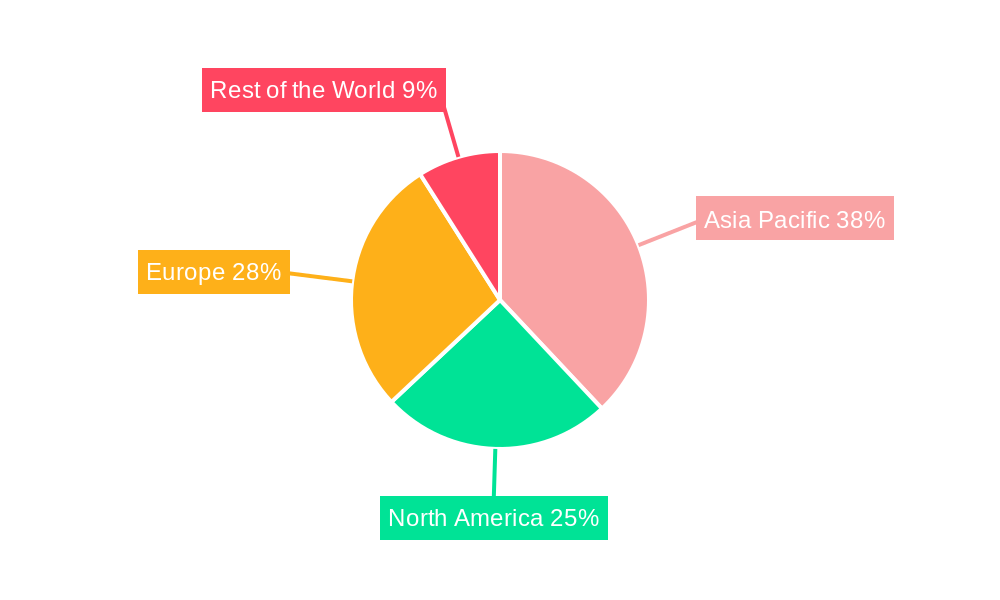

The market is characterized by robust innovation and strategic investments from key industry players like Casale SA, Siemens Energy, and Nel ASA, who are at the forefront of developing advanced production technologies. The competitive landscape is dynamic, with companies focusing on scaling up production capacity and improving cost-efficiency to meet the increasing demand. Geographically, Asia Pacific, particularly China and India, is expected to lead market expansion due to strong governmental support for renewable energy initiatives and a large agricultural base. Europe is also a significant market, driven by ambitious climate targets and a well-established industrial infrastructure. While the growth trajectory is steep, challenges such as the high initial cost of green ammonia production and the need for extensive infrastructure development for widespread adoption remain key considerations. However, ongoing technological advancements and increasing policy support are expected to mitigate these restraints, paving the way for a transformative impact of green ammonia on global sustainability efforts.

Green Ammonia Market Company Market Share

Global Green Ammonia Market Report: Navigating Decarbonization with Sustainable Nitrogen Solutions

Unlock the future of sustainable energy and agriculture with this comprehensive report on the Green Ammonia Market. This in-depth analysis dives deep into the transformative potential of green ammonia, a key enabler of global decarbonization efforts. Discover how advancements in green hydrogen production and electrolysis are fueling the rapid growth of this pivotal industry. Our report provides granular insights into market dynamics, growth trends, regional dominance, product innovations, and the crucial drivers and challenges shaping this evolving landscape. From revolutionizing fertilizers to powering maritime shipping and generating clean energy, green ammonia is poised to redefine industrial sustainability. This report is essential for stakeholders seeking to capitalize on opportunities in renewable energy, decarbonization technologies, and the future of chemical production.

The study encompasses a comprehensive analysis from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, followed by a robust forecast period from 2025 to 2033. Historical data from 2019 to 2024 provides crucial context for understanding market evolution.

Green Ammonia Market Market Dynamics & Structure

The global Green Ammonia market is characterized by a moderate to high market concentration, with a blend of established chemical giants and agile green technology innovators. Technological innovation is the primary driver, with significant R&D investment focused on improving the efficiency and cost-effectiveness of green hydrogen production via electrolysis and subsequent ammonia synthesis. Regulatory frameworks are increasingly supportive, with governments worldwide implementing ambitious decarbonization targets and offering incentives for renewable energy projects, including green ammonia production. Competitive product substitutes, while present in some applications (e.g., traditional ammonia for fertilizers), are gradually being challenged by the environmental imperatives driving demand for green alternatives. End-user demographics are shifting towards industries with strong ESG mandates and a need for sustainable feedstock and fuel solutions. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to consolidate expertise, secure market share, and accelerate their green ammonia strategies.

- Market Concentration: Dominated by a few key players with significant investment capacity, but with a growing number of specialized technology providers entering the market.

- Technological Innovation Drivers: Advancements in electrolyzer technology (PEM, Alkaline, Solid Oxide), catalyst development for ammonia synthesis, and renewable energy integration are critical.

- Regulatory Frameworks: Carbon pricing mechanisms, renewable energy mandates, and supportive policies for green hydrogen are crucial.

- Competitive Product Substitutes: Traditional (grey/blue) ammonia in fertilizers, fossil fuels in power generation and shipping.

- End-User Demographics: Agriculture, shipping, power generation, industrial gas users, and hydrogen storage/transport.

- M&A Trends: Increasing consolidation to achieve scale, secure technology, and expand geographical reach. For instance, significant capital is being deployed into green ammonia projects by major energy companies and chemical producers.

Green Ammonia Market Growth Trends & Insights

The Green Ammonia market is experiencing exponential growth, driven by a confluence of factors pushing towards a low-carbon economy. The market size, valued at approximately USD 1,500 million in 2025, is projected to reach USD 12,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 30% during the forecast period. This robust expansion is fueled by increasing global demand for sustainable fertilizers, the urgent need for decarbonizing the maritime shipping sector, and the potential of green ammonia as a clean energy carrier and for power generation. Adoption rates are accelerating as the cost of renewable electricity decreases and technological advancements make green ammonia production more economically viable. Key technological disruptions include the scaling up of green hydrogen production facilities and the development of more efficient Haber-Bosch process alternatives for ammonia synthesis. Consumer behavior shifts are evident, with industries actively seeking suppliers committed to environmental responsibility and seeking to reduce their carbon footprint. The market penetration of green ammonia, though currently nascent, is set to skyrocket as large-scale projects come online and regulatory pressures intensify.

Dominant Regions, Countries, or Segments in Green Ammonia Market

The Fertilizers segment is the dominant application within the Green Ammonia market, accounting for an estimated 65% of market share in 2025, with a projected valuation of USD 975 million. This dominance stems from the agricultural sector's inherent reliance on ammonia as a crucial component for nitrogen-based fertilizers, coupled with increasing pressure to adopt sustainable agricultural practices and reduce the carbon footprint of food production. Regions with strong agricultural bases and proactive decarbonization policies are leading this segment.

Key Drivers in Fertilizers:

- Food Security & Sustainable Agriculture: Growing global population necessitates increased food production, driving demand for fertilizers.

- Decarbonization Mandates in Agriculture: Governments and industry bodies are pushing for greener fertilizer production to reduce agriculture's environmental impact.

- Cost Competitiveness: As green ammonia production scales up, its cost is expected to become more competitive with traditional ammonia, especially with carbon pricing.

- European Union (EU) Green Deal: Policies promoting sustainable agriculture and reduced emissions are significant drivers in Europe.

Dominance Factors:

- Established Infrastructure: Existing distribution networks for ammonia in the agricultural sector provide a foundation for the transition to green ammonia.

- Volume Demand: The sheer scale of global fertilizer consumption ensures a substantial and consistent demand for ammonia.

- Technological Maturation: While still evolving, the technology for producing green ammonia suitable for fertilizer production is more advanced than for some other emerging applications.

While fertilizers hold the current lead, the Maritime/Shipping Fuel segment is the fastest-growing application, with an estimated CAGR of over 40% during the forecast period. This is driven by the International Maritime Organization's (IMO) stringent regulations on greenhouse gas emissions and the search for viable low-carbon fuel alternatives. Regions with major shipping hubs and strong commitments to decarbonization, such as Europe and Asia-Pacific, are at the forefront of this shift.

Green Ammonia Market Product Landscape

The product landscape of the Green Ammonia market is characterized by innovations focused on achieving high purity and efficiency in production and application. Key product developments revolve around the integration of advanced electrolyzer technologies (PEM, Alkaline, Solid Oxide) with highly efficient ammonia synthesis reactors. Companies are developing modular and scalable green ammonia production facilities, catering to diverse demand needs. Performance metrics being optimized include energy consumption per ton of ammonia produced, the carbon intensity of the feedstock (renewable electricity), and the overall cost-effectiveness of the production process. Unique selling propositions include the complete elimination of Scope 1 and 2 emissions during production, enabling a truly sustainable nitrogen cycle. Technological advancements are also being made in the handling and storage of ammonia for its use as a marine fuel and hydrogen carrier, ensuring safety and logistical efficiency.

Key Drivers, Barriers & Challenges in Green Ammonia Market

Key Drivers:

- Global Decarbonization Imperative: Stringent climate targets and growing corporate ESG commitments are the primary catalysts, driving demand for low-carbon alternatives across industries.

- Advancements in Green Hydrogen Production: Declining costs of renewable energy and improvements in electrolyzer efficiency are making green hydrogen, the feedstock for green ammonia, more accessible and affordable.

- Decarbonization of Maritime Shipping: The International Maritime Organization's (IMO) regulations are creating significant demand for alternative fuels like green ammonia.

- Fertilizer Industry's Sustainability Push: The agricultural sector is increasingly seeking greener alternatives to conventional ammonia to reduce its environmental impact.

Barriers & Challenges:

- High Production Costs: Currently, green ammonia production is more expensive than traditional "grey" ammonia, largely due to the cost of renewable electricity and electrolyzers. The projected cost reduction is estimated to be around 20-25% by 2030.

- Infrastructure Development: The establishment of new renewable energy sources, electrolysis plants, and ammonia storage and transport infrastructure requires substantial investment.

- Energy Intensity of Production: The Haber-Bosch process, while efficient, is energy-intensive, and scaling up green ammonia production requires immense amounts of renewable energy.

- Regulatory Uncertainty and Policy Support: While improving, a consistent and long-term policy framework is needed to de-risk investments and incentivize adoption.

- Safety Concerns: Ammonia is toxic and corrosive, requiring specialized handling, storage, and transportation protocols.

Emerging Opportunities in Green Ammonia Market

Emerging opportunities in the Green Ammonia market lie in its versatility as a hydrogen carrier and its potential for grid-scale energy storage. As a hydrogen carrier, green ammonia can facilitate the long-distance, safe, and cost-effective transport of hydrogen produced from renewable sources. This opens up new markets for hydrogen utilization in regions with limited domestic renewable energy production. Furthermore, the development of efficient ammonia-to-power technologies presents an opportunity for grid stabilization and renewable energy integration, particularly in countries with high renewable energy penetration. Untapped markets in industrial feedstock for sectors beyond fertilizers are also emerging. The potential for blending green ammonia with conventional fuels in existing infrastructure, as seen in pilot projects, offers a transitional pathway to decarbonization.

Growth Accelerators in the Green Ammonia Market Industry

Several growth accelerators are poised to significantly boost the Green Ammonia market. Technological breakthroughs in next-generation electrolyzers, such as solid oxide electrolyzers (SOECs), promise higher efficiencies and lower costs. Strategic partnerships between renewable energy developers, ammonia producers, and end-users (shipping companies, fertilizer manufacturers) are crucial for de-risking investments and accelerating project development. Government incentives, including tax credits, subsidies, and carbon pricing mechanisms, play a vital role in bridging the cost gap with conventional ammonia. The expansion of dedicated green ammonia bunkering infrastructure at key ports worldwide will be a significant accelerator for its adoption as a marine fuel. The increasing availability of green hydrogen at competitive prices will directly translate into lower green ammonia production costs, further fueling market growth.

Key Players Shaping the Green Ammonia Market Market

- Casale SA

- EXYTRON GmbH

- Green Hydrogen Systems

- Greenko

- ITM Power PLC

- KAPSOM PLC

- MAN Energy Solutions

- McPhy Energy SA

- Nel ASA

- Siemens Energy

- Technip Energies NV

- thyssenkrupp Uhde GmbH

- Yara

Notable Milestones in Green Ammonia Market Sector

- November 2023: Adani Power initiated a pilot project for green ammonia combustion, aiming to co-fire up to 20% green ammonia in its coal-fired 330 MW Unit at the Mundra plant in Gujarat, India, as part of its decarbonization strategy.

- February 2023: Uniper and Greenko signed an agreement for the annual purchase of 250,000 tons of green ammonia from Greenko’s Kakinada green ammonia project.

- December 2022: Moroccan state-owned company OCP announced a USD 13 billion investment for its Green Investment Strategy (2023-2027), with a target to produce 1 million tons of green ammonia by 2027, aiming to triple this to 3 million tons by 2032.

In-Depth Green Ammonia Market Market Outlook

The Green Ammonia market outlook is exceptionally positive, driven by the sustained global momentum towards decarbonization. The interplay of supportive government policies, continuous technological advancements in renewable energy and electrolysis, and increasing industry demand for sustainable solutions paints a robust growth trajectory. The strategic importance of green ammonia as a clean fuel for shipping, a critical component for sustainable agriculture, and a viable hydrogen carrier will continue to unlock significant market potential. Investments in large-scale production facilities and the development of the necessary infrastructure are expected to accelerate, further reducing production costs and enhancing market competitiveness. Strategic partnerships and M&A activities will likely intensify, consolidating expertise and driving innovation. The future holds substantial opportunities for companies that can effectively navigate the evolving regulatory landscape and capitalize on the growing demand for environmentally conscious industrial processes and energy solutions.

Green Ammonia Market Segmentation

-

1. Application

- 1.1. Fertilizers

- 1.2. Maritime/Shipping Fuel

- 1.3. Power Generation

- 1.4. Other Applications (Hydrogen Carrier, etc.)

Green Ammonia Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Green Ammonia Market Regional Market Share

Geographic Coverage of Green Ammonia Market

Green Ammonia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 82.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Agricultural Production; Rising Demand for Renewable Energy; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Agricultural Production; Rising Demand for Renewable Energy; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Agricultural Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fertilizers

- 5.1.2. Maritime/Shipping Fuel

- 5.1.3. Power Generation

- 5.1.4. Other Applications (Hydrogen Carrier, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Fertilizers

- 6.1.2. Maritime/Shipping Fuel

- 6.1.3. Power Generation

- 6.1.4. Other Applications (Hydrogen Carrier, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Fertilizers

- 7.1.2. Maritime/Shipping Fuel

- 7.1.3. Power Generation

- 7.1.4. Other Applications (Hydrogen Carrier, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Fertilizers

- 8.1.2. Maritime/Shipping Fuel

- 8.1.3. Power Generation

- 8.1.4. Other Applications (Hydrogen Carrier, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Green Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Fertilizers

- 9.1.2. Maritime/Shipping Fuel

- 9.1.3. Power Generation

- 9.1.4. Other Applications (Hydrogen Carrier, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Casale SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EXYTRON GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Green Hydrogen Systems

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Greenko

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ITM Power PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KAPSOM PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MAN Energy Solutions

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 McPhy Energy SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nel ASA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Siemens Energy

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Technip Energies NV

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 thyssenkrupp Uhde GmbH

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Yara*List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Casale SA

List of Figures

- Figure 1: Global Green Ammonia Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Green Ammonia Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: Asia Pacific Green Ammonia Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Green Ammonia Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Green Ammonia Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Green Ammonia Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Green Ammonia Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Green Ammonia Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Green Ammonia Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Green Ammonia Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Green Ammonia Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Green Ammonia Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Green Ammonia Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Green Ammonia Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Rest of the World Green Ammonia Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Green Ammonia Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Green Ammonia Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Green Ammonia Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Green Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: China Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: India Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Japan Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Korea Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Green Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Green Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Green Ammonia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Green Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: South America Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Middle East and Africa Green Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Ammonia Market?

The projected CAGR is approximately 82.63%.

2. Which companies are prominent players in the Green Ammonia Market?

Key companies in the market include Casale SA, EXYTRON GmbH, Green Hydrogen Systems, Greenko, ITM Power PLC, KAPSOM PLC, MAN Energy Solutions, McPhy Energy SA, Nel ASA, Siemens Energy, Technip Energies NV, thyssenkrupp Uhde GmbH, Yara*List Not Exhaustive.

3. What are the main segments of the Green Ammonia Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Agricultural Production; Rising Demand for Renewable Energy; Other Drivers.

6. What are the notable trends driving market growth?

Growing Agricultural Production.

7. Are there any restraints impacting market growth?

Increasing Agricultural Production; Rising Demand for Renewable Energy; Other Drivers.

8. Can you provide examples of recent developments in the market?

November 2023: Adani Power, as part of its decarbonization initiatives, started a pilot project for green ammonia combustion that will co-fire up to 20% green ammonia in its coal-fired 330 MW Unit at the Mundra plant in Gujarat, India.February 2023: Uniper and Greenko signed an agreement for the purchase of 250,000 tons of green ammonia per annum from Greenko’s Kakinada green ammonia project.December 2022: Moroccan state-owned company OCP announced an investment of USD 13 billion for its Green Investment Strategy for 2023-2027, as part of which the company aims to produce 1 million tons of green ammonia by 2027 and will triple it to 3 million tons by 2032.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Green Ammonia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Green Ammonia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Green Ammonia Market?

To stay informed about further developments, trends, and reports in the Green Ammonia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence