Key Insights

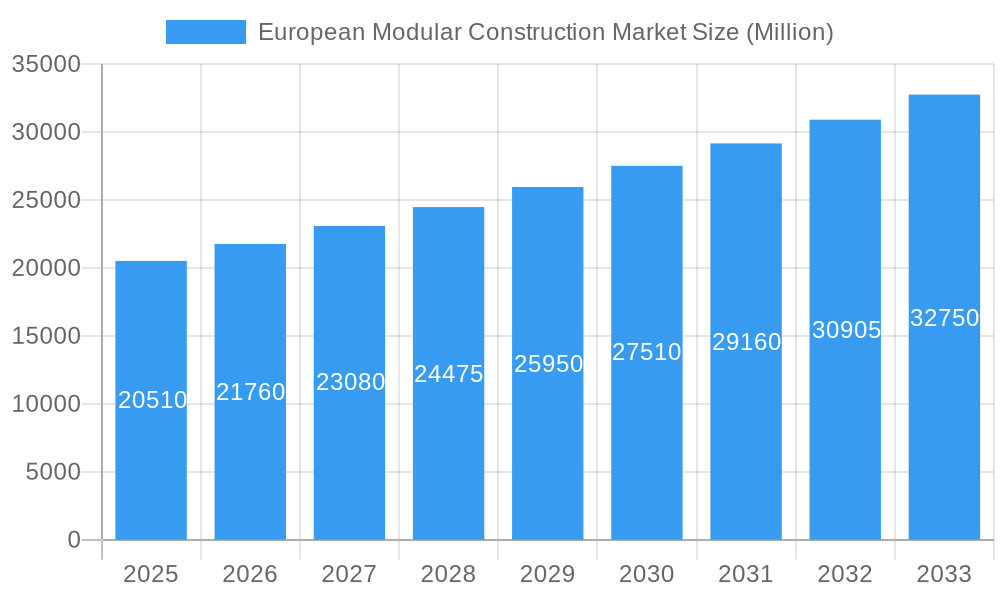

The European modular construction market is poised for substantial growth, with a projected market size of USD 20.51 billion in 2025. This expansion is driven by an anticipated Compound Annual Growth Rate (CAGR) of 6.1% throughout the forecast period of 2025-2033. This robust growth is primarily fueled by a confluence of factors. Increasing demand for sustainable building solutions, due to growing environmental consciousness and stricter regulations, is a significant driver. The inherent benefits of modular construction, such as faster project completion times, reduced waste generation, and enhanced cost predictability, are highly attractive to developers and end-users alike, particularly in the commercial and industrial sectors. Furthermore, advancements in construction technologies and materials are continuously improving the quality, design flexibility, and aesthetic appeal of modular buildings, breaking down previous perceptions and expanding their applicability.

European Modular Construction Market Market Size (In Billion)

The market's momentum is further propelled by a series of emerging trends that are reshaping the construction landscape. A notable trend is the increasing adoption of prefabricated elements in high-rise construction, demonstrating the scalability and structural integrity of modular solutions. The integration of smart technologies and building information modeling (BIM) within the modular construction process is enhancing efficiency, collaboration, and data management. While the market exhibits strong growth potential, certain restraints need to be addressed. Perceived limitations in design customization for highly specialized projects and initial higher upfront costs compared to traditional methods in some instances can pose challenges. However, the long-term cost savings and operational efficiencies typically outweigh these initial hurdles. The market is segmented by type into permanent and relocatable modules, and by material into steel, concrete, wood, and plastic, with each segment catering to diverse project requirements. The end-user industry spans commercial, industrial/institutional, and residential sectors, highlighting the versatility of modular construction across the economy.

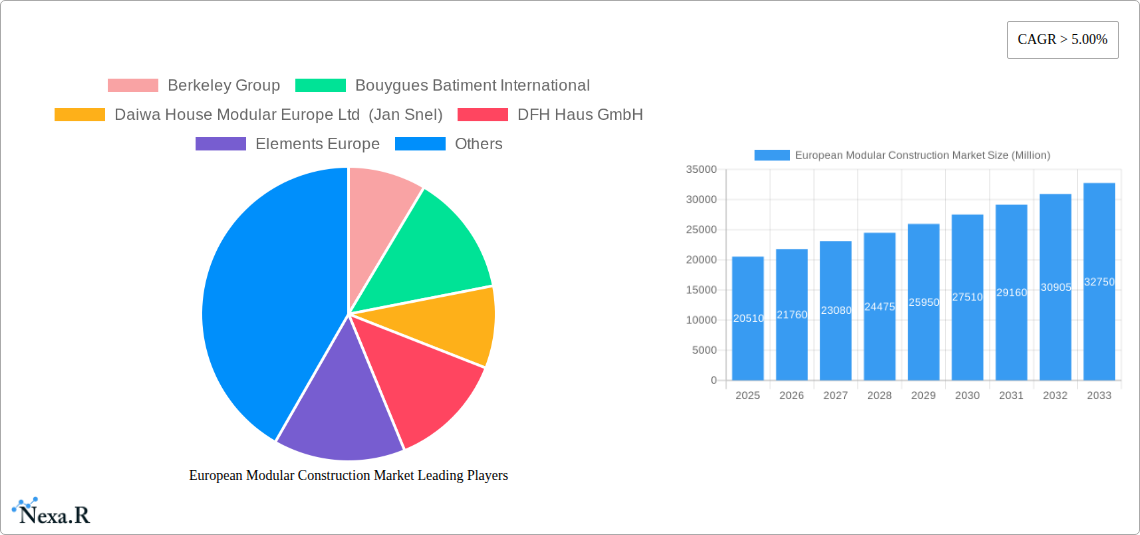

European Modular Construction Market Company Market Share

European Modular Construction Market: A Comprehensive Analysis of Growth, Trends, and Key Players (2019-2033)

This in-depth report offers a definitive analysis of the European Modular Construction Market, meticulously covering its dynamics, growth trajectories, dominant segments, product landscape, key drivers, emerging opportunities, and the pivotal role of leading companies. With a comprehensive study period from 2019 to 2033, featuring a base year of 2025 and a forecast period of 2025-2033, this report is your essential guide to understanding the future of construction in Europe. We explore parent and child markets with granular detail, providing actionable insights for investors, manufacturers, developers, and policymakers seeking to capitalize on the burgeoning modular construction sector. The report quantifies market evolution, market share, and CAGR, offering a data-driven perspective on a rapidly transforming industry.

European Modular Construction Market Market Dynamics & Structure

The European Modular Construction Market is characterized by a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is moderately fragmented, with a few dominant players and a significant number of emerging companies vying for market share. Technological innovation serves as a primary driver, fueled by advancements in digital design (BIM), robotics, and material science, enabling faster construction times and improved sustainability. Regulatory frameworks, particularly those related to building codes, sustainability mandates, and standardization, are evolving to accommodate and promote modular solutions. Competitive product substitutes, such as traditional site-built construction, are increasingly challenged by the cost-effectiveness, speed, and quality assurance offered by modular methods. End-user demographics are shifting, with a growing demand for flexible, sustainable, and affordable housing and commercial spaces. Mergers and acquisitions (M&A) trends are on the rise as larger firms seek to integrate modular capabilities and expand their market reach, bolstering market consolidation and innovation.

- Market Concentration: Fragmented with a growing trend towards consolidation.

- Technological Innovation Drivers: BIM integration, advanced robotics, AI in design and manufacturing, sustainable materials.

- Regulatory Frameworks: Increasing government support for offsite construction, evolving building standards.

- Competitive Product Substitutes: Traditional construction methods, pre-engineered building systems.

- End-User Demographics: Growing demand for affordable housing, sustainable buildings, and flexible workspaces.

- M&A Trends: Strategic acquisitions and joint ventures to enhance capabilities and market access.

European Modular Construction Market Growth Trends & Insights

The European Modular Construction Market is poised for substantial expansion, driven by a confluence of economic, social, and technological factors. The market size is projected to experience a significant upward trajectory, with an estimated market value of $38.2 billion in 2025, escalating to $75.9 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.1% during the forecast period. This growth is underpinned by increasing adoption rates across various end-user industries, spurred by the inherent advantages of modular construction, including accelerated project timelines, reduced on-site disruption, enhanced quality control, and a more predictable cost structure. Technological disruptions, such as the integration of Artificial Intelligence (AI) in design optimization and predictive maintenance, alongside advancements in prefabrication techniques and sustainable material development, are further accelerating market penetration. Consumer behavior is also evolving, with a growing preference for eco-friendly, energy-efficient, and aesthetically appealing buildings, which modular construction is increasingly adept at delivering. The residential sector, in particular, is witnessing a surge in demand for modular solutions due to housing affordability challenges and the desire for faster home delivery. The commercial sector is leveraging modularity for rapid deployment of retail spaces, offices, and hospitality units, while the industrial and institutional sectors are benefiting from its efficiency in constructing schools, hospitals, and manufacturing facilities. This market evolution signifies a paradigm shift in construction methodologies, moving towards industrialized processes that offer greater efficiency and sustainability.

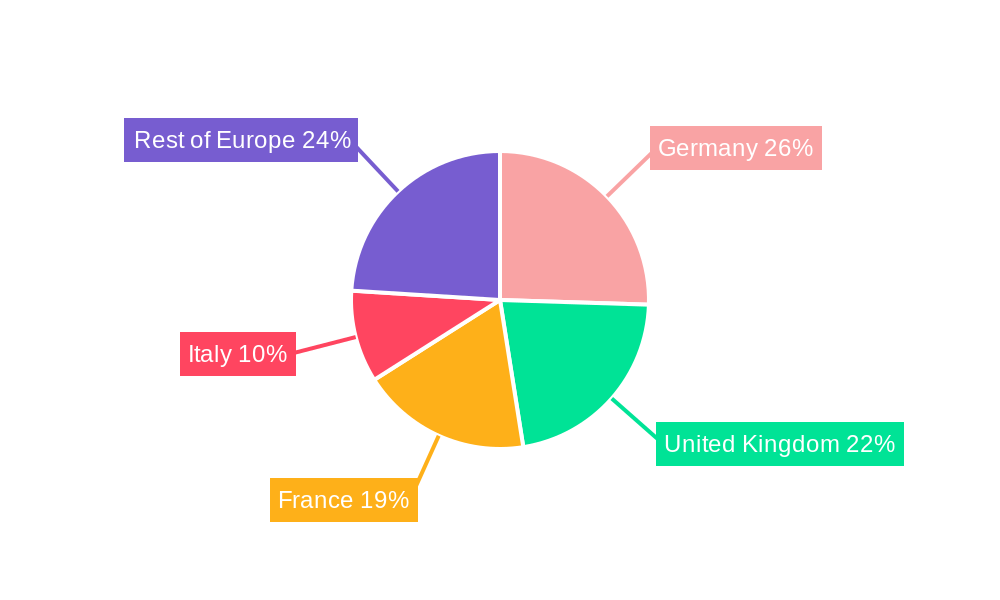

Dominant Regions, Countries, or Segments in European Modular Construction Market

The United Kingdom consistently emerges as a dominant force within the European Modular Construction Market. This leadership is attributed to a multifaceted combination of factors, including supportive government initiatives aimed at increasing housing supply and promoting offsite manufacturing, substantial investments in infrastructure projects that often incorporate modular solutions, and a well-established ecosystem of modular manufacturers and innovators. The UK's proactive stance on sustainable building practices and net-zero targets further bolsters the adoption of modular construction, which inherently offers reduced waste and improved energy efficiency.

Among the key segments driving market growth, the Permanent type of modular construction holds a significant share. This is largely due to the increasing acceptance of modular buildings as long-term, high-quality structures across residential, commercial, and institutional sectors, rather than temporary solutions. In terms of materials, Wood is a primary driver, owing to its sustainability, renewability, and excellent thermal insulation properties, aligning perfectly with Europe's green building agenda. The Residential end-user industry is by far the largest and fastest-growing segment, propelled by the urgent need for affordable housing, the desire for faster home delivery, and the increasing appeal of customizable, high-quality modular homes.

- Dominant Country: United Kingdom

- Key Drivers: Government support for offsite construction, large-scale infrastructure projects (e.g., HS2), strong focus on sustainability and energy efficiency, established modular manufacturing base.

- Market Share Contribution: Significant portion of European modular construction projects and investment.

- Growth Potential: Continued high demand driven by housing shortages and net-zero targets.

- Dominant Segment (Type): Permanent Modular Construction

- Key Drivers: Increasing acceptance as long-term solutions, superior quality and durability, cost-competitiveness for large-scale projects.

- Market Share: Outpacing relocatable modules in many sectors.

- Dominant Segment (Material): Wood

- Key Drivers: Sustainability credentials, excellent thermal performance, design flexibility, lower embodied carbon compared to other materials.

- Market Share: Leading material choice, especially in residential and low-rise commercial applications.

- Dominant Segment (End-user Industry): Residential

- Key Drivers: Housing affordability crisis, demand for faster home delivery, desire for quality and customizable homes, government incentives for new housing.

- Market Share: Largest and most dynamic segment, encompassing single-family homes, apartments, and student accommodation.

European Modular Construction Market Product Landscape

The European Modular Construction Market is witnessing a surge in product innovation, focusing on enhanced performance, sustainability, and user experience. Products range from prefabricated volumetric modules for entire buildings to modular components like wall panels, bathroom pods, and facade systems. Key applications span across residential housing, commercial offices, hotels, schools, healthcare facilities, and temporary structures. Performance metrics are increasingly being optimized for energy efficiency, acoustic insulation, structural integrity, and fire safety. Unique selling propositions include reduced construction waste, significantly shortened project timelines, and improved quality control achievable through factory-controlled manufacturing environments. Technological advancements are evident in the integration of smart building technologies, advanced insulation materials, and a growing emphasis on circular economy principles in product design and material selection. The market is moving towards more sophisticated, high-performance modular solutions that rival and often surpass traditional construction in terms of quality and sustainability.

Key Drivers, Barriers & Challenges in European Modular Construction Market

Key Drivers: The European Modular Construction Market is propelled by several significant forces. Technological advancements in Building Information Modeling (BIM), robotics, and advanced manufacturing techniques are streamlining design and production processes. Growing environmental concerns and stringent regulations promoting sustainability and energy efficiency are making modular construction, with its reduced waste and lower carbon footprint, increasingly attractive. The persistent shortage of skilled labor in traditional construction is also a major driver, as modular construction offers a more controlled and predictable workforce environment. Furthermore, the demand for faster project delivery times in various sectors, from residential to commercial, positions modular construction as a compelling solution. Government initiatives and incentives aimed at boosting housing supply and promoting innovation in the construction sector are also playing a crucial role.

- Technological Advancements: BIM, AI in design, advanced robotics.

- Sustainability Push: Reduced waste, lower carbon emissions, energy efficiency.

- Labor Shortages: Predictable workforce and factory-based production.

- Demand for Speed: Accelerated project completion times.

- Government Support: Incentives for affordable housing and innovation.

Barriers & Challenges: Despite its promising outlook, the market faces certain barriers and challenges. Perceptions of modular construction as being of lower quality or less aesthetically pleasing than traditional builds, though rapidly changing, still exist. High initial capital investment for setting up modular manufacturing facilities can be a deterrent for smaller companies. Complex and sometimes inconsistent building regulations across different European countries can create hurdles for cross-border projects. Supply chain disruptions, particularly for specialized components and materials, can impact production schedules and costs. Finally, the established nature of traditional construction methods and the associated inertia within the industry present a competitive challenge, requiring continuous education and advocacy to promote the benefits of modular solutions.

- Perception Issues: Lingering doubts about quality and aesthetics.

- High Initial Investment: Capital expenditure for manufacturing facilities.

- Regulatory Complexity: Inconsistent building codes across regions.

- Supply Chain Volatility: Potential disruptions for materials and components.

- Industry Inertia: Resistance to change from traditional construction practices.

Emerging Opportunities in European Modular Construction Market

Emerging opportunities in the European Modular Construction Market are abundant, driven by evolving societal needs and technological progress. The increasing demand for affordable and sustainable housing, particularly in urban centers, presents a significant untapped market. The rise of co-living spaces and flexible workspace solutions are ideally suited for modular construction's adaptability. Furthermore, the retrofitting and refurbishment of existing buildings using modular components offer a sustainable and efficient alternative to complete demolition and reconstruction. There's also a growing opportunity in the development of modular healthcare facilities and educational institutions, which require rapid deployment and high standards of hygiene and functionality. The integration of smart technologies and IoT into modular building systems opens up avenues for enhanced building management and occupant experience, creating value-added opportunities.

Growth Accelerators in the European Modular Construction Market Industry

Several key catalysts are accelerating long-term growth in the European Modular Construction Market. Continuous technological breakthroughs in areas like 3D printing of construction components and advanced materials are enhancing efficiency and design possibilities. Strategic partnerships and joint ventures between established construction firms and innovative modular manufacturers are facilitating market entry and scaling of operations. Growing investor confidence in the sector, driven by successful project deliveries and strong market performance, is leading to increased funding and capital investment. Market expansion strategies, including the development of standardized modular systems and a focus on mass customization, are making modular solutions more accessible and appealing to a broader customer base. The ongoing global push towards a circular economy is also a significant accelerator, as modular construction inherently supports material reuse and waste reduction.

Key Players Shaping the European Modular Construction Market Market

- Berkeley Group

- Bouygues Batiment International

- Daiwa House Modular Europe Ltd (Jan Snel)

- DFH Haus GmbH

- Elements Europe

- Karmod Prefabricated Technologies

- Laing O'Rourke Corpt Ltd

- Modulaire Group

- Modubuild

- Moelven Industrier ASA

- Skanska AB

Notable Milestones in European Modular Construction Market Sector

- October 2022: Japan's largest homebuilder, Daiwa House, announced their joint venture with Capital Bay to deliver modular construction across Europe. The JV will result in Capital Bay using modular construction units for its own projects and operator brands, but will also be offered to third-party customers in Europe.

- June 2022: HS2 Ltd. (High Speed 2 - a planned high-speed railway line in the UK) announced that Laing O'Rourke Delivery Ltd will build HS2's new Interchange Station in Solihull, at the heart of Britain's new high-speed rail network. The contract, which is worth up to GBP 370 million, will see them work with HS2 Ltd in two stages to finalize the detailed design and then build the landmark station over the next few years.

In-Depth European Modular Construction Market Market Outlook

The European Modular Construction Market is on an upward trajectory, driven by a sustained demand for efficient, sustainable, and cost-effective construction solutions. Growth accelerators such as advancements in digital construction technologies, increasing regulatory support for green building, and the persistent need for rapid housing development will continue to fuel market expansion. Strategic partnerships and investments in advanced manufacturing facilities will be crucial for scaling production and meeting growing demand. The future market potential lies in the further integration of smart technologies, the development of innovative material applications, and the expansion of modular solutions into diverse sectors beyond traditional residential and commercial uses. This report provides a comprehensive outlook, enabling stakeholders to strategically position themselves within this dynamic and evolving market.

European Modular Construction Market Segmentation

-

1. Type

- 1.1. Permanent

- 1.2. Relocatable

-

2. Material

- 2.1. Steel

- 2.2. Concrete

- 2.3. Wood

- 2.4. Plastic

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Industrial/Institutional

- 3.3. Residential

European Modular Construction Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

European Modular Construction Market Regional Market Share

Geographic Coverage of European Modular Construction Market

European Modular Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality

- 3.2.2 Eco-friendly Homes

- 3.3. Market Restrains

- 3.3.1 Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality

- 3.3.2 Eco-friendly Homes

- 3.4. Market Trends

- 3.4.1. Commercial Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Permanent

- 5.1.2. Relocatable

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Steel

- 5.2.2. Concrete

- 5.2.3. Wood

- 5.2.4. Plastic

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Industrial/Institutional

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Permanent

- 6.1.2. Relocatable

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Steel

- 6.2.2. Concrete

- 6.2.3. Wood

- 6.2.4. Plastic

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Commercial

- 6.3.2. Industrial/Institutional

- 6.3.3. Residential

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Permanent

- 7.1.2. Relocatable

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Steel

- 7.2.2. Concrete

- 7.2.3. Wood

- 7.2.4. Plastic

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Commercial

- 7.3.2. Industrial/Institutional

- 7.3.3. Residential

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Permanent

- 8.1.2. Relocatable

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Steel

- 8.2.2. Concrete

- 8.2.3. Wood

- 8.2.4. Plastic

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Commercial

- 8.3.2. Industrial/Institutional

- 8.3.3. Residential

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Permanent

- 9.1.2. Relocatable

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Steel

- 9.2.2. Concrete

- 9.2.3. Wood

- 9.2.4. Plastic

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Commercial

- 9.3.2. Industrial/Institutional

- 9.3.3. Residential

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Permanent

- 10.1.2. Relocatable

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Steel

- 10.2.2. Concrete

- 10.2.3. Wood

- 10.2.4. Plastic

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Commercial

- 10.3.2. Industrial/Institutional

- 10.3.3. Residential

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Berkeley Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bouygues Batiment International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daiwa House Modular Europe Ltd (Jan Snel)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DFH Haus GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Elements Europe

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Karmod Prefabricated Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Laing O'Rourke Corpt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Modulaire Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Modubuild

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Moelven Industrier ASA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Skanska AB*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Berkeley Group

List of Figures

- Figure 1: Global European Modular Construction Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Germany European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Germany European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Germany European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 5: Germany European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: Germany European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: Germany European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Germany European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Germany European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United Kingdom European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: United Kingdom European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: United Kingdom European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 13: United Kingdom European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: United Kingdom European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: United Kingdom European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: United Kingdom European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: United Kingdom European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: France European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: France European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: France European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 21: France European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: France European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: France European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: France European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: France European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Italy European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Italy European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Italy European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 29: Italy European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Italy European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Italy European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Italy European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Italy European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Europe European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Rest of Europe European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Rest of Europe European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 37: Rest of Europe European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Rest of Europe European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Rest of Europe European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Rest of Europe European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of Europe European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 3: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global European Modular Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 7: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 11: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 15: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 19: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 23: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Modular Construction Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the European Modular Construction Market?

Key companies in the market include Berkeley Group, Bouygues Batiment International, Daiwa House Modular Europe Ltd (Jan Snel), DFH Haus GmbH, Elements Europe, Karmod Prefabricated Technologies, Laing O'Rourke Corpt Ltd, Modulaire Group, Modubuild, Moelven Industrier ASA, Skanska AB*List Not Exhaustive.

3. What are the main segments of the European Modular Construction Market?

The market segments include Type, Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality. Eco-friendly Homes.

6. What are the notable trends driving market growth?

Commercial Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality. Eco-friendly Homes.

8. Can you provide examples of recent developments in the market?

October 2022 : Japan's largest homebuilder, Daiwa House, announced their joint venture with Capital Bay to deliver modular construction across Europe. The JV will result in Capital Bay using modular construction units for its own projects and operator brands, but will also be offered to third-party customers in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Modular Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Modular Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Modular Construction Market?

To stay informed about further developments, trends, and reports in the European Modular Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence