Key Insights

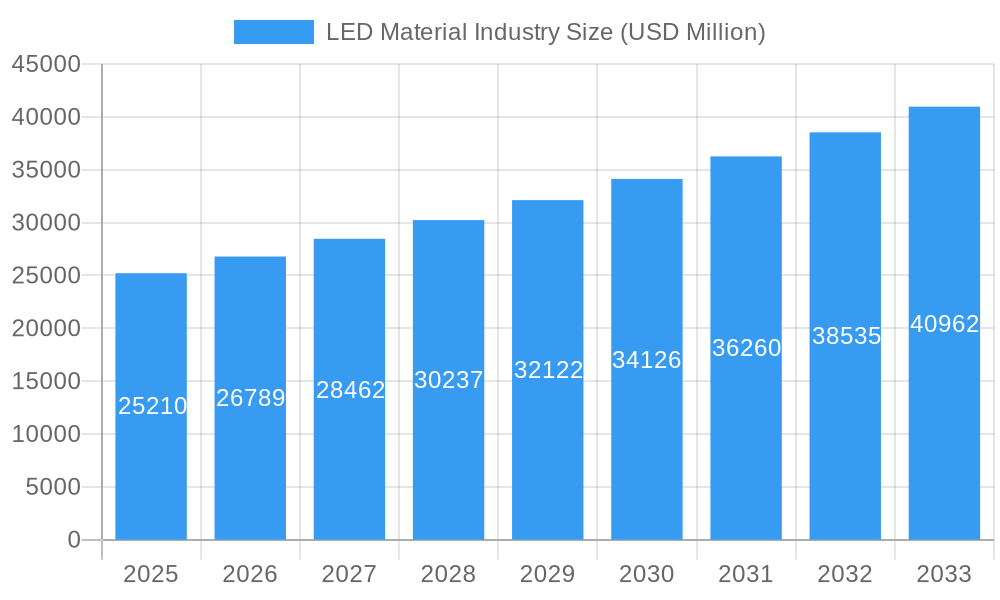

The global LED Material market is poised for significant expansion, projected to reach an estimated $25.21 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 6.25% through 2033. This impressive growth is primarily fueled by the escalating demand for energy-efficient lighting solutions across various sectors, including consumer electronics, automotive, and general illumination. Advancements in material science, leading to enhanced LED performance in terms of brightness, color rendering, and lifespan, are acting as key drivers. The continuous innovation in LED technology, enabling smaller form factors and greater integration into devices, further propels market expansion. Notably, the transition towards smart lighting systems and the increasing adoption of LEDs in automotive applications like adaptive headlights and interior lighting are creating substantial opportunities.

LED Material Industry Market Size (In Billion)

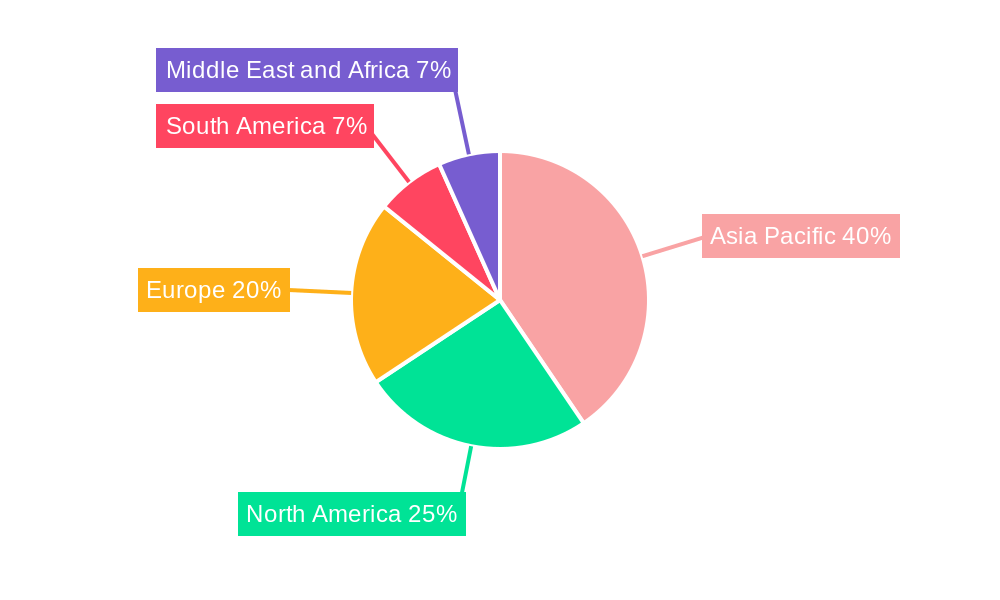

The market segmentation reveals a diverse landscape, with Wafer and Substrate materials holding significant market share due to their foundational role in LED manufacturing. However, the Epitaxy segment is expected to witness substantial growth as advanced epitaxy techniques enable the production of high-performance LEDs with tailored characteristics for specific applications. In terms of materials, Indium Gallide Nitrile (InGaN) and Aluminum Gallium Arsenide (AlGaAs) are critical for blue and red/green light emission, respectively, and their demand is closely tied to the growth of white LED production. The increasing prevalence of LEDs in smartphones, televisions, and wearable devices underscores the dominance of the Consumer Electronics application segment, while Automotive Lighting is emerging as a rapidly growing niche. Geographically, the Asia Pacific region, driven by its strong manufacturing base and burgeoning demand, is expected to lead the market, followed by North America and Europe.

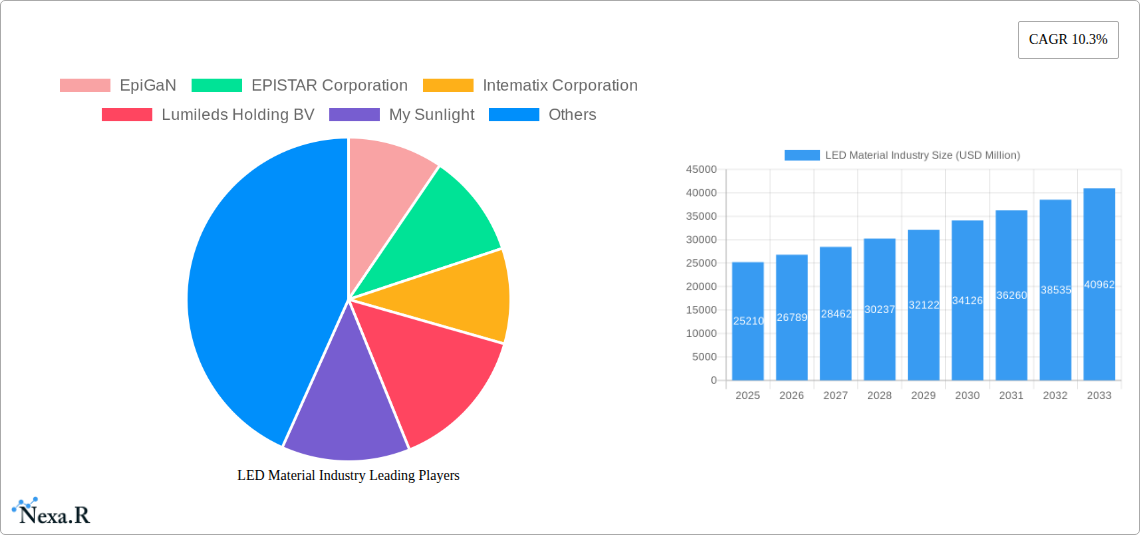

LED Material Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global LED Material Industry, providing critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. Covering a study period from 2019–2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to navigate the evolving LED material market. We meticulously examine key market segments, including wafer, substrate, epitaxy, and other types; Indium Gallide Nitrile (InGaN), Aluminum Gallium Indium Phosphide (AlGaInP), Aluminum Gallium Arsenide (AlGaAs), Gallium Phosphide (GaP), and other materials; and applications spanning consumer electronics, general lighting, automotive lighting, backlighting, and more.

This analysis delves into the parent market of LED Manufacturing Materials and its crucial child market of LED Chip Materials, offering a granular view of the value chain. The report quantifies market evolution, technological disruptions, and shifts in consumer behavior with actionable metrics like CAGR and market penetration. With a focus on high-traffic keywords, this report is optimized for maximum search engine visibility, ensuring industry professionals can easily access valuable intelligence.

LED Material Industry Market Dynamics & Structure

The LED Material Industry is characterized by a moderately concentrated market, with a few dominant players holding significant market share, particularly in the epitaxy and specialized material segments. Technological innovation serves as a primary driver, fueled by relentless demand for higher luminous efficacy, improved color rendering, and enhanced durability. Advancements in quantum dot technology, micro-LED materials, and sustainable material sourcing are reshaping product development. Regulatory frameworks, particularly concerning energy efficiency standards and environmental impact, are increasingly influencing material selection and manufacturing processes. While few direct substitutes exist for the core light-emitting properties of LEDs, energy-efficient fluorescent and incandescent lighting represent indirect competitive product substitutes, though their market share is steadily declining. End-user demographics are shifting towards a greater demand for smart lighting solutions, advanced displays, and energy-efficient automotive and industrial lighting. Mergers and acquisitions (M&A) are a notable trend, with larger material manufacturers acquiring specialized technology firms to enhance their product portfolios and market reach, thereby consolidating market power and accelerating innovation.

- Market Concentration: Dominated by key suppliers of high-purity precursor chemicals and advanced substrate materials.

- Technological Innovation: Focus on next-generation materials for micro-LEDs, flexible lighting, and improved thermal management.

- Regulatory Frameworks: Stringent energy efficiency mandates and RoHS compliance are key influencing factors.

- Competitive Product Substitutes: Traditional lighting technologies face significant market erosion due to LED efficiency.

- End-User Demographics: Growing demand from smart home, automotive, and advanced display markets.

- M&A Trends: Strategic acquisitions to gain access to novel material technologies and expand R&D capabilities.

LED Material Industry Growth Trends & Insights

The global LED Material Industry is poised for robust growth, projected to reach an estimated market size of $XX billion in 2025, with a compound annual growth rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is largely driven by the escalating adoption of LED technology across a myriad of applications, from general illumination to sophisticated display technologies and automotive lighting. The market's evolution has been marked by significant technological disruptions, including the rise of GaN-based materials for high-brightness LEDs and the emergence of perovskite and quantum dot technologies for advanced color tuning and efficiency gains. Consumer behavior is also playing a pivotal role; consumers are increasingly prioritizing energy efficiency, longevity, and the aesthetic benefits offered by LED lighting solutions, contributing to higher adoption rates in residential and commercial sectors. Furthermore, the burgeoning smart home market and the increasing integration of LEDs in Internet of Things (IoT) devices are creating new avenues for growth. The automotive sector's transition towards LED headlights, taillights, and interior lighting, driven by safety regulations and aesthetic demands, is a significant market penetration accelerator. In the consumer electronics segment, the pervasive use of LEDs in smartphones, tablets, televisions, and wearables continues to fuel demand. The report will leverage proprietary market intelligence, including detailed analysis of production capacities, raw material costs, and end-product demand forecasts, to deliver these insights. The increasing miniaturization of LEDs for micro-display applications in augmented reality (AR) and virtual reality (VR) devices represents a particularly dynamic growth area within the broader LED material landscape. The ongoing research and development into more sustainable and cost-effective manufacturing processes for LED materials will further solidify the market's upward trajectory. The shift from traditional lighting to solid-state lighting is nearly complete in many developed regions, but emerging economies present substantial untapped potential for growth in general lighting applications. The report meticulously quantifies market size evolution by tracking production volumes and average selling prices of key LED materials. Adoption rates are analyzed through the lens of new product introductions and their market reception, alongside the phase-out of older lighting technologies. Technological disruptions are detailed by examining breakthroughs in material science, epitaxy techniques, and packaging technologies that enhance LED performance and reduce costs. Consumer behavior shifts are mapped by analyzing trends in energy consciousness, demand for smart features, and preferences for specific color temperatures and lighting effects.

Dominant Regions, Countries, or Segments in LED Material Industry

Asia-Pacific stands as the dominant region in the LED Material Industry, propelled by its robust manufacturing infrastructure, significant government support for technological innovation, and a massive consumer base across diverse applications. Within this region, China leads in the production of LED chips and materials, driven by extensive domestic demand and export capabilities. South Korea and Taiwan are also critical players, particularly in advanced epitaxy and specialized LED materials, catering to the high-end consumer electronics and display markets. The dominance of the Asia-Pacific region is further reinforced by a strong ecosystem of raw material suppliers, epitaxy service providers, and downstream manufacturers, creating a synergistic growth environment.

Key Drivers in Asia-Pacific:

- Economic Policies: Government incentives for high-tech manufacturing and R&D investments.

- Infrastructure: Well-developed industrial parks and logistics networks facilitate production and distribution.

- Market Size: Enormous domestic demand for consumer electronics, general lighting, and automotive applications.

- Technological Advancement: Significant investment in cutting-edge research and development, particularly in micro-LED and advanced packaging.

Dominant Segments:

- Type: Epitaxy is a crucial segment due to its direct impact on LED performance and cost. Companies are continuously innovating in MOCVD (Metal-Organic Chemical Vapor Deposition) technology to improve material quality and wafer throughput.

- Material: Indium Gallide Nitrile (InGaN) is the cornerstone material for blue and green LEDs, which are fundamental to white LED creation. Its versatility and high performance make it a continuously sought-after material.

- Application: Consumer Electronics remains the largest application segment, driven by the ubiquitous use of LEDs in smartphones, televisions, and other portable devices. The demand for higher resolution displays and efficient backlighting fuels continuous growth in this area.

The market share for InGaN-based LEDs within the broader LED material market is estimated to be over XX% as of the base year 2025. The epitaxy segment accounts for approximately XX% of the total LED material market value. Consumer electronics contribute to over XX% of the total demand for LED materials. The report will further analyze the growth potential of emerging applications like automotive lighting, where the adoption of advanced LED technologies for headlights and interior lighting is rapidly increasing, and the unique material requirements for UV and IR LEDs used in sterilization and sensing applications. The competitive landscape within these dominant segments is characterized by intense innovation and a constant drive for cost optimization.

LED Material Industry Product Landscape

The LED Material Industry is defined by a landscape of highly specialized and performance-driven products. Key innovations center on developing materials that offer enhanced luminous efficacy, superior color rendering indices (CRIs), and extended operational lifetimes. For instance, advancements in Indium Gallide Nitrile (InGaN) epitaxy have led to higher quantum efficiency and narrower emission spectra, enabling brighter and more color-accurate LEDs. The introduction of novel substrate materials, such as sapphire and silicon carbide, with improved thermal conductivity and reduced defect densities, directly impacts the performance and reliability of the final LED chip. Unique selling propositions often lie in the purity of precursor chemicals, the precision of epitaxy layers, and the ability to engineer materials for specific wavelengths, catering to niche applications like horticulture lighting or medical phototherapy. Technological advancements in quantum dot technology, integrated into LED packages, are revolutionizing color conversion, allowing for wider color gamuts and more precise white light tuning, particularly beneficial for display and general lighting applications.

Key Drivers, Barriers & Challenges in LED Material Industry

The LED Material Industry is propelled by several key drivers, including the global push for energy efficiency and sustainability, driving the replacement of less efficient lighting technologies. Technological advancements in material science and manufacturing processes enable the creation of higher-performing and more cost-effective LEDs. The expanding applications of LEDs in automotive lighting, consumer electronics, and emerging areas like smart lighting and horticulture further fuel market growth. Government regulations promoting energy conservation and phasing out incandescent bulbs also act as significant catalysts.

Conversely, the industry faces notable barriers and challenges. The high initial cost of advanced material production and R&D can be a restraint. Supply chain volatility for critical raw materials, such as gallium and indium, can lead to price fluctuations and production disruptions. Intense competition among manufacturers, particularly in commoditized segments, exerts downward pressure on profit margins. Stringent environmental regulations regarding the disposal of electronic waste and the use of certain chemicals add complexity to manufacturing processes.

Emerging Opportunities in LED Material Industry

Emerging opportunities in the LED Material Industry are abundant, driven by continuous innovation and evolving market demands. The burgeoning micro-LED display market presents a significant growth avenue, requiring highly precise and defect-free materials for ultra-high-resolution screens in televisions, wearables, and AR/VR devices. The growing demand for UV-C LEDs for disinfection and sterilization applications, amplified by global health concerns, offers a substantial untapped market. Furthermore, the development of advanced materials for horticultural lighting, optimized for specific plant growth spectrums, is gaining traction. The integration of smart functionalities and connectivity into LED lighting systems creates opportunities for materials that enhance controllability and enable new IoT applications.

Growth Accelerators in the LED Material Industry Industry

Several catalysts are accelerating long-term growth in the LED Material Industry. Technological breakthroughs in material synthesis, such as advancements in metal-organic chemical vapor deposition (MOCVD) and atomic layer deposition (ALD) techniques, are crucial for producing higher quality materials at lower costs. Strategic partnerships between material suppliers, LED manufacturers, and end-product developers are vital for co-innovating and accelerating the adoption of new technologies. Market expansion strategies, particularly targeting developing economies with increasing demand for energy-efficient lighting and advanced electronics, represent a significant growth accelerator. The development of more sustainable and environmentally friendly LED materials and manufacturing processes will also be a key factor in driving future growth and market acceptance.

Key Players Shaping the LED Material Industry Market

- EpiGaN

- EPISTAR Corporation

- Intematix Corporation

- Lumileds Holding BV

- My Sunlight

- NICHIA CORPORATION

- OSRAM Opto Semiconductors GmbH

- Seoul Semiconductor Co Ltd

- Sumitomo Bakelite Co Ltd

- Wolfspeed A Cree Company

Notable Milestones in LED Material Industry Sector

- 2019: Significant advancements in InGaN epitaxy techniques leading to higher luminous efficacy.

- 2020: Increased demand for UV-C LEDs for sanitation applications.

- 2021: Growing investments in research for micro-LED materials and manufacturing.

- 2022: Development of new quantum dot materials for enhanced color performance in displays.

- 2023: Focus on sustainable sourcing and manufacturing of LED materials gains momentum.

- 2024: Emergence of silicon carbide substrates for high-power LED applications.

In-Depth LED Material Industry Market Outlook

The future of the LED Material Industry is exceptionally bright, fueled by ongoing technological innovation and expanding market applications. Growth accelerators such as breakthroughs in material science, enabling even higher energy efficiency and novel functionalities like embedded sensing, will continue to drive market expansion. Strategic partnerships will foster the development of integrated solutions, seamlessly blending lighting with smart technology. Market expansion into emerging economies, coupled with increasing demand for sophisticated lighting in automotive and display sectors, paints a picture of sustained, robust growth. The industry is on a trajectory to witness significant advancements in areas like quantum dot technology and micro-LED materials, solidifying its position as a critical enabler of next-generation technologies and sustainable lighting solutions. The estimated market size for 2033 is projected to reach $XX billion, with continued double-digit CAGR.

LED Material Industry Segmentation

-

1. Type

- 1.1. Wafer

- 1.2. Substrate

- 1.3. Epitaxy

- 1.4. Others

-

2. Material

- 2.1. Indium Gallide Nitrile

- 2.2. Aluminum Gallium Indium Phosphide

- 2.3. Aluminum Gallium Arsenide

- 2.4. Gallium Phosphide

- 2.5. Others

-

3. Application

- 3.1. Consumer Electronics

- 3.2. General Lighting

- 3.3. Automotive Lighting

- 3.4. Backlighting

- 3.5. Others

LED Material Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

LED Material Industry Regional Market Share

Geographic Coverage of LED Material Industry

LED Material Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Residential and Commercial Application; Rising Demand from Energy Efficient Lighting

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand from Residential and Commercial Application; Rising Demand from Energy Efficient Lighting

- 3.4. Market Trends

- 3.4.1. General Lighting Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LED Material Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wafer

- 5.1.2. Substrate

- 5.1.3. Epitaxy

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Indium Gallide Nitrile

- 5.2.2. Aluminum Gallium Indium Phosphide

- 5.2.3. Aluminum Gallium Arsenide

- 5.2.4. Gallium Phosphide

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer Electronics

- 5.3.2. General Lighting

- 5.3.3. Automotive Lighting

- 5.3.4. Backlighting

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific LED Material Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wafer

- 6.1.2. Substrate

- 6.1.3. Epitaxy

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Indium Gallide Nitrile

- 6.2.2. Aluminum Gallium Indium Phosphide

- 6.2.3. Aluminum Gallium Arsenide

- 6.2.4. Gallium Phosphide

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Consumer Electronics

- 6.3.2. General Lighting

- 6.3.3. Automotive Lighting

- 6.3.4. Backlighting

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America LED Material Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wafer

- 7.1.2. Substrate

- 7.1.3. Epitaxy

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Indium Gallide Nitrile

- 7.2.2. Aluminum Gallium Indium Phosphide

- 7.2.3. Aluminum Gallium Arsenide

- 7.2.4. Gallium Phosphide

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Consumer Electronics

- 7.3.2. General Lighting

- 7.3.3. Automotive Lighting

- 7.3.4. Backlighting

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe LED Material Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wafer

- 8.1.2. Substrate

- 8.1.3. Epitaxy

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Indium Gallide Nitrile

- 8.2.2. Aluminum Gallium Indium Phosphide

- 8.2.3. Aluminum Gallium Arsenide

- 8.2.4. Gallium Phosphide

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Consumer Electronics

- 8.3.2. General Lighting

- 8.3.3. Automotive Lighting

- 8.3.4. Backlighting

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America LED Material Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wafer

- 9.1.2. Substrate

- 9.1.3. Epitaxy

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Indium Gallide Nitrile

- 9.2.2. Aluminum Gallium Indium Phosphide

- 9.2.3. Aluminum Gallium Arsenide

- 9.2.4. Gallium Phosphide

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Consumer Electronics

- 9.3.2. General Lighting

- 9.3.3. Automotive Lighting

- 9.3.4. Backlighting

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa LED Material Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wafer

- 10.1.2. Substrate

- 10.1.3. Epitaxy

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Indium Gallide Nitrile

- 10.2.2. Aluminum Gallium Indium Phosphide

- 10.2.3. Aluminum Gallium Arsenide

- 10.2.4. Gallium Phosphide

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Consumer Electronics

- 10.3.2. General Lighting

- 10.3.3. Automotive Lighting

- 10.3.4. Backlighting

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 EpiGaN

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EPISTAR Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intematix Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lumileds Holding BV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 My Sunlight

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NICHIA CORPORATION

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OSRAM Opto Semiconductors GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seoul Semiconductor Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sumitomo Bakelite Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wolfspeed A Cree Company*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 EpiGaN

List of Figures

- Figure 1: Global LED Material Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific LED Material Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific LED Material Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific LED Material Industry Revenue (undefined), by Material 2025 & 2033

- Figure 5: Asia Pacific LED Material Industry Revenue Share (%), by Material 2025 & 2033

- Figure 6: Asia Pacific LED Material Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: Asia Pacific LED Material Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific LED Material Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Asia Pacific LED Material Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America LED Material Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: North America LED Material Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America LED Material Industry Revenue (undefined), by Material 2025 & 2033

- Figure 13: North America LED Material Industry Revenue Share (%), by Material 2025 & 2033

- Figure 14: North America LED Material Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: North America LED Material Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America LED Material Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: North America LED Material Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe LED Material Industry Revenue (undefined), by Type 2025 & 2033

- Figure 19: Europe LED Material Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe LED Material Industry Revenue (undefined), by Material 2025 & 2033

- Figure 21: Europe LED Material Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe LED Material Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Europe LED Material Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe LED Material Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe LED Material Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America LED Material Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America LED Material Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America LED Material Industry Revenue (undefined), by Material 2025 & 2033

- Figure 29: South America LED Material Industry Revenue Share (%), by Material 2025 & 2033

- Figure 30: South America LED Material Industry Revenue (undefined), by Application 2025 & 2033

- Figure 31: South America LED Material Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America LED Material Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America LED Material Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa LED Material Industry Revenue (undefined), by Type 2025 & 2033

- Figure 35: Middle East and Africa LED Material Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa LED Material Industry Revenue (undefined), by Material 2025 & 2033

- Figure 37: Middle East and Africa LED Material Industry Revenue Share (%), by Material 2025 & 2033

- Figure 38: Middle East and Africa LED Material Industry Revenue (undefined), by Application 2025 & 2033

- Figure 39: Middle East and Africa LED Material Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa LED Material Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa LED Material Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LED Material Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global LED Material Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 3: Global LED Material Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global LED Material Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global LED Material Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global LED Material Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 7: Global LED Material Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global LED Material Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Japan LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: South Korea LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global LED Material Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global LED Material Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 16: Global LED Material Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global LED Material Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: United States LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Canada LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Mexico LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global LED Material Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global LED Material Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 23: Global LED Material Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global LED Material Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Germany LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: France LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Italy LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global LED Material Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 31: Global LED Material Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 32: Global LED Material Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 33: Global LED Material Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Brazil LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Argentina LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global LED Material Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global LED Material Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 39: Global LED Material Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global LED Material Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: South Africa LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa LED Material Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Material Industry?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the LED Material Industry?

Key companies in the market include EpiGaN, EPISTAR Corporation, Intematix Corporation, Lumileds Holding BV, My Sunlight, NICHIA CORPORATION, OSRAM Opto Semiconductors GmbH, Seoul Semiconductor Co Ltd, Sumitomo Bakelite Co Ltd, Wolfspeed A Cree Company*List Not Exhaustive.

3. What are the main segments of the LED Material Industry?

The market segments include Type, Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Residential and Commercial Application; Rising Demand from Energy Efficient Lighting.

6. What are the notable trends driving market growth?

General Lighting Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Growing Demand from Residential and Commercial Application; Rising Demand from Energy Efficient Lighting.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LED Material Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LED Material Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LED Material Industry?

To stay informed about further developments, trends, and reports in the LED Material Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence