Key Insights

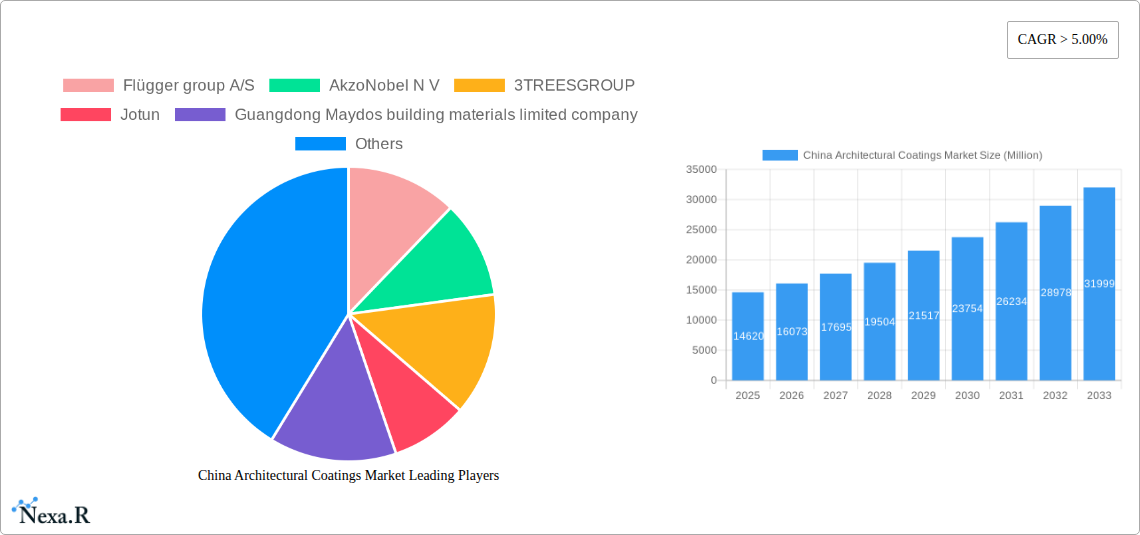

The China Architectural Coatings Market is poised for significant expansion, projected to reach an estimated USD 14.62 billion by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.97% throughout the forecast period of 2025-2033. The market's dynamism is fueled by several key drivers, including rapid urbanization and substantial infrastructure development across the nation. The increasing demand for aesthetic enhancements in both new constructions and renovation projects further bolsters market expansion. A growing awareness and preference for eco-friendly and sustainable building materials are also shaping the market landscape, driving the adoption of waterborne coatings over traditional solventborne alternatives. This shift is a critical trend that paints a picture of a more environmentally conscious construction sector.

China Architectural Coatings Market Market Size (In Billion)

The market's expansion is also influenced by evolving consumer preferences and a rising disposable income, leading to increased spending on home improvement and interior design. Technological advancements in coating formulations, offering improved durability, performance, and aesthetic appeal, are also playing a pivotal role. While the market exhibits strong growth potential, it faces certain restraints. The volatility in raw material prices, particularly for key components like resins and pigments, can impact profit margins for manufacturers and potentially influence pricing for end-users. Furthermore, stringent environmental regulations, while driving innovation towards greener products, can also present compliance challenges and initial investment costs for businesses. The market segments for architectural coatings in China are diverse, encompassing Commercial and Residential end-users, with technologies ranging from Solventborne to Waterborne. Key resin types include Acrylic, Alkyd, Epoxy, Polyester, and Polyurethane, catering to a wide array of application needs.

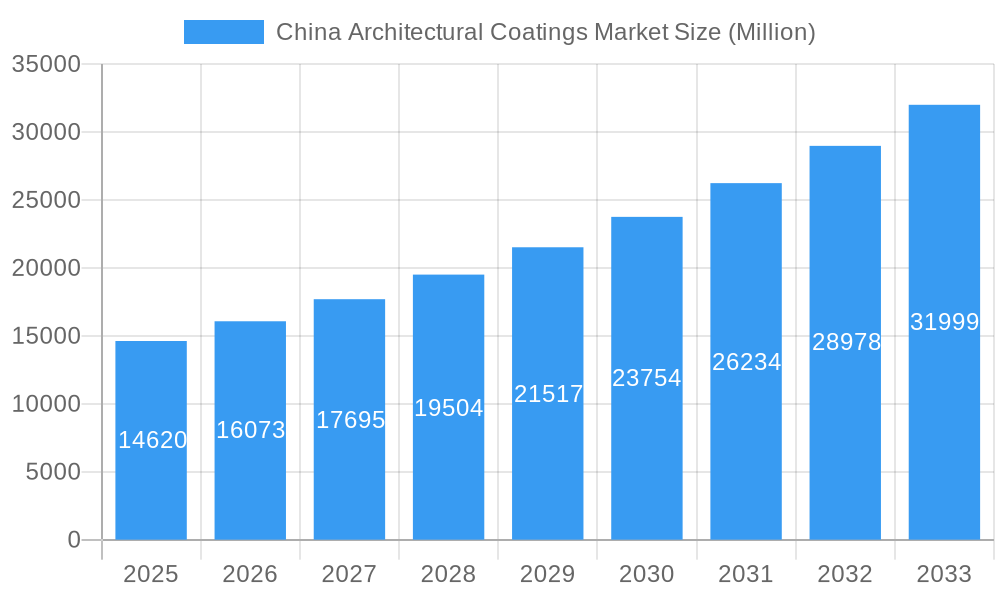

China Architectural Coatings Market Company Market Share

This in-depth report provides a holistic overview of the China architectural coatings market, a dynamic and rapidly evolving sector critical to the nation's construction and interior design industries. The study covers the historical period from 2019 to 2024, with a base year of 2025 and an extensive forecast period extending to 2033. It analyzes the market's intricate dynamics, growth trajectories, regional dominance, product landscape, and key influencing factors, offering valuable insights for industry stakeholders.

The report delves into the parent market of architectural coatings, examining its broader economic and technological context, and then drills down into child markets based on technology, resin type, and sub-end users, providing granular analysis. We integrate high-traffic keywords such as "China architectural coatings," "construction coatings market," "interior paint market China," "exterior wall coatings," "eco-friendly coatings China," and "waterborne coatings China" to maximize search engine visibility and attract industry professionals actively seeking this information. All monetary values are presented in billion USD for clarity.

China Architectural Coatings Market Market Dynamics & Structure

The China architectural coatings market is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share, while a broader spectrum of regional and specialized manufacturers compete in niche segments. Technological innovation is a key driver, with a strong emphasis on developing environmentally friendly and high-performance coatings. Regulatory frameworks, particularly those related to VOC emissions and building safety standards, are increasingly shaping product development and market access. The availability of competitive product substitutes, such as wallpaper and other interior finishing materials, presents a constant challenge, necessitating continuous innovation and differentiation by coating manufacturers. End-user demographics are shifting, with a growing demand for sustainable, aesthetic, and functional coatings in both residential and commercial sectors. Mergers and acquisitions (M&A) trends, exemplified by strategic integrations aiming to expand market reach and technological capabilities, are actively reshaping the competitive landscape.

- Market Concentration: The top 5-7 companies account for approximately 55-65% of the total market share.

- Technological Innovation Drivers: Increased R&D spending on low-VOC and zero-VOC formulations, smart coatings with self-cleaning or temperature-regulating properties, and antimicrobial coatings.

- Regulatory Frameworks: Stringent environmental protection laws mandating reduced VOC content, fire-retardant requirements for specific applications, and energy-efficient building material standards.

- Competitive Product Substitutes: Wallpaper, decorative panels, and advanced tiling solutions are observed to be gaining traction in certain interior design applications.

- End-User Demographics: Growing middle-class population with increasing disposable income, leading to higher demand for premium and aesthetically pleasing coatings in residential properties. Urbanization and infrastructure development continue to fuel demand in commercial projects.

- M&A Trends: Focus on acquiring companies with strong R&D capabilities, established distribution networks, or specialized product portfolios. The report identifies at least 3-5 significant M&A activities in the past three years, with deal values ranging from xx billion to xx billion USD.

China Architectural Coatings Market Growth Trends & Insights

The China architectural coatings market has demonstrated robust growth driven by consistent urbanization, a burgeoning real estate sector, and increasing disposable incomes. The market size, estimated at XX billion USD in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, reaching an estimated XX billion USD by the end of the forecast period. This upward trajectory is underpinned by a significant shift in consumer preferences towards premium, sustainable, and technologically advanced coating solutions.

The adoption rates of waterborne architectural coatings have surged, driven by stringent environmental regulations and growing consumer awareness regarding health and indoor air quality. This technological disruption has led to a decline in the market share of solventborne coatings, especially in interior applications. Consumer behavior shifts are evident in the increasing demand for personalized and aesthetically diverse color palettes, as well as functional coatings that offer benefits like enhanced durability, stain resistance, and antimicrobial properties. The renovation and refurbishment segment of the market is also a significant contributor, as homeowners and commercial property owners invest in upgrading their spaces. The government's continued focus on green building initiatives and energy efficiency further accelerates the adoption of eco-friendly and high-performance architectural coatings. The report provides granular insights into market penetration rates for various coating technologies and resin types, indicating a steady increase in the market share of waterborne and acrylic-based coatings. The historical period (2019-2024) has seen a steady XX% CAGR, laying a strong foundation for future growth.

Dominant Regions, Countries, or Segments in China Architectural Coatings Market

Within the China architectural coatings market, the Residential sub-end user segment is the dominant force, driven by ongoing urbanization, a vast population, and continuous demand for new housing and property renovations. This segment is projected to contribute over XX% of the total market revenue in 2025. The rapid development of Tier 1 and Tier 2 cities, coupled with government initiatives promoting affordable housing and urban renewal projects, fuels this dominance.

Dominant Segment: Residential

- Key Drivers:

- Continuous urbanization and migration to cities, leading to increased demand for new residential construction.

- A growing middle class with higher disposable incomes, prioritizing aesthetic appeal and quality finishes in their homes.

- A substantial market for home renovation and refurbishment, driven by a desire for improved living spaces and energy efficiency.

- Government policies supporting housing development and affordable housing projects.

- Increasing awareness of indoor air quality and demand for low-VOC and healthy home environments.

- Market Share: The residential segment is estimated to hold approximately XX% of the overall China architectural coatings market in 2025.

- Growth Potential: While mature in some aspects, the sheer volume of housing stock and ongoing construction ensures sustained growth. The increasing demand for premium and specialized residential coatings offers significant growth potential.

- Key Drivers:

Dominant Technology: Waterborne Coatings

- Key Drivers:

- Stringent environmental regulations on Volatile Organic Compound (VOC) emissions.

- Growing consumer preference for eco-friendly and healthy building materials.

- Advancements in waterborne resin technology, improving performance and durability.

- Government incentives for the adoption of green building practices.

- Market Share: Waterborne coatings are estimated to constitute XX% of the total architectural coatings market in 2025.

- Growth Potential: Expected to witness higher growth rates than solventborne coatings due to regulatory pressures and consumer demand.

- Key Drivers:

Dominant Resin: Acrylic Resin

- Key Drivers:

- Versatility, excellent adhesion, durability, and weather resistance.

- Cost-effectiveness and wide availability.

- Suitability for both interior and exterior applications.

- Compatibility with waterborne formulations, aligning with eco-friendly trends.

- Market Share: Acrylic resins are expected to account for XX% of the resin market share in architectural coatings in 2025.

- Growth Potential: Continues to be the backbone of the architectural coatings industry, with ongoing innovations enhancing its performance characteristics.

- Key Drivers:

The commercial segment is also a significant contributor, driven by infrastructure development, office building construction, and the hospitality sector, though it slightly trails the residential segment in overall volume. Geographically, the eastern coastal regions, including Guangdong, Jiangsu, and Zhejiang provinces, are the most developed and represent the largest markets due to higher population density, economic activity, and early adoption of advanced building technologies.

China Architectural Coatings Market Product Landscape

The China architectural coatings market is characterized by a diverse and evolving product landscape, driven by a relentless pursuit of enhanced performance, sustainability, and aesthetic appeal. Innovations focus on delivering coatings with superior durability, weather resistance, and self-cleaning properties for exterior applications, while interior coatings prioritize low-VOC emissions, antimicrobial features, and a wide spectrum of decorative finishes. The integration of smart technologies, such as temperature-regulating and light-reflecting coatings, is an emerging trend.

- Key Product Innovations:

- High-Performance Exterior Coatings: Enhanced UV resistance, superior adhesion, and extended lifespan formulations.

- Eco-Friendly Interior Coatings: Zero-VOC, low-odor formulations with improved air purification capabilities.

- Antimicrobial and Hygienic Coatings: Designed for healthcare facilities, schools, and high-traffic areas.

- Functional Coatings: Including heat-insulating, sound-dampening, and easy-to-clean surfaces.

- Advanced Color Technology: Development of long-lasting, fade-resistant, and custom color matching solutions.

Key Drivers, Barriers & Challenges in China Architectural Coatings Market

Key Drivers:

- Urbanization and Infrastructure Development: Continuous growth in construction projects, both residential and commercial, directly fuels demand for architectural coatings. Government-led infrastructure spending further amplifies this driver.

- Rising Disposable Incomes and Living Standards: An increasing middle-class population is investing more in home improvements and premium finishes, driving demand for higher-quality and aesthetically pleasing coatings.

- Environmental Regulations and Sustainability Focus: Stringent government mandates on VOC emissions and a growing consumer preference for eco-friendly products are accelerating the adoption of waterborne and low-VOC coatings.

- Technological Advancements: Innovations in coating formulations, such as improved durability, functionality, and aesthetic properties, are creating new market opportunities and driving product upgrades.

Barriers & Challenges:

- Intense Competition and Price Sensitivity: The market is highly fragmented with numerous players, leading to fierce price competition, especially for basic coating products.

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials, such as titanium dioxide and petrochemical derivatives, can significantly impact profit margins.

- Counterfeit Products and Brand Dilution: The prevalence of counterfeit products in some regions can erode brand value and customer trust.

- Logistical Challenges and Supply Chain Disruptions: The vast geographical expanse of China and occasional supply chain disruptions can pose logistical hurdles and impact delivery timelines.

- Skilled Labor Shortage: A lack of skilled applicators for specialized coatings can hinder the adoption of advanced products.

Emerging Opportunities in China Architectural Coatings Market

The China architectural coatings market presents several promising emerging opportunities. The increasing demand for sustainable and eco-friendly building materials opens doors for advanced green coatings and bio-based formulations. The rapidly growing renovation and refurbishment market, driven by an aging housing stock and a desire for modern living spaces, offers significant potential for premium and specialized coatings. Furthermore, the development of smart coatings with integrated functionalities like self-healing, energy efficiency, and air purification represents a frontier for innovation and market differentiation. Untapped rural markets, as economic development spreads, also present avenues for market expansion.

Growth Accelerators in the China Architectural Coatings Market Industry

Several key catalysts are accelerating the growth of the China architectural coatings market. Technological breakthroughs in resin chemistry and formulation science are leading to the development of coatings with superior performance characteristics, such as enhanced durability, weather resistance, and aesthetic appeal. Strategic partnerships and collaborations between domestic and international players, as well as with research institutions, are fostering innovation and market expansion. Government support for green building initiatives and the promotion of sustainable construction practices are significant growth accelerators, incentivizing the adoption of environmentally friendly coatings. The increasing urbanization rate and ongoing infrastructure development projects continue to provide a robust demand base for architectural coatings.

Key Players Shaping the China Architectural Coatings Market Market

- Flügger group A/S

- AkzoNobel N V

- 3TREESGROUP

- Jotun

- Guangdong Maydos building materials limited company

- The China Paint Mfg Co (1932) Ltd

- SKK(S) Pte Ltd

- DAI NIPPON TORYO CO LTD

- CARPOLY

- PPG Industries Inc

- Nippon Paint Holdings Co Ltd

- Axalta Coating Systems

- Hempel A/S

- Foshan Caboli Painting Material Co Ltd

- Kansai Paint Co Ltd

Notable Milestones in China Architectural Coatings Market Sector

- April 2022: Nippon Paint Holdings Co., Ltd. formed a strategic partnership with the Sichuan Academy of Construction Sciences, cooperating in multiple fields to promote the high-quality development of the coating industry.

- January 2022: Nippon Paint Holdings Co., Ltd. proposed new solutions focusing on dual carbon goals and reducing building energy consumption.

- October 2021: PPG completed the acquisition of Tikkurila, a Nordic paint company, in June 2021. This acquisition is expected to aid PPG in growing its Architectural coatings business in EMEA and China, further strengthening its presence in the Nordic region.

In-Depth China Architectural Coatings Market Market Outlook

The China architectural coatings market is poised for sustained and robust growth driven by a confluence of factors, including ongoing urbanization, rising living standards, and an intensified focus on environmental sustainability. The market's future trajectory is heavily influenced by technological advancements in low-VOC and high-performance coatings, particularly waterborne formulations. Strategic alliances and mergers, coupled with government support for green building initiatives, will continue to shape the competitive landscape. Emerging opportunities in functional and smart coatings, alongside the burgeoning renovation sector, offer significant avenues for market players to expand their product portfolios and capture new market share. The anticipated market size of XX billion USD by 2033 underscores the immense potential within this vital sector.

China Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

China Architectural Coatings Market Segmentation By Geography

- 1. China

China Architectural Coatings Market Regional Market Share

Geographic Coverage of China Architectural Coatings Market

China Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations on VOCs Released on Flooring; Other Restraints

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Flügger group A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AkzoNobel N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3TREESGROUP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Guangdong Maydos building materials limited company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The China Paint Mfg Co (1932) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SKK(S) Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DAI NIPPON TORYO CO LTD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CARPOLY

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PPG Industries Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nippon Paint Holdings Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Axalta Coating Systems

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hempel A/S

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Foshan Caboli Painting Material Co Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kansai Paint Co Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Flügger group A/S

List of Figures

- Figure 1: China Architectural Coatings Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Architectural Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: China Architectural Coatings Market Revenue undefined Forecast, by Sub End User 2020 & 2033

- Table 2: China Architectural Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: China Architectural Coatings Market Revenue undefined Forecast, by Resin 2020 & 2033

- Table 4: China Architectural Coatings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: China Architectural Coatings Market Revenue undefined Forecast, by Sub End User 2020 & 2033

- Table 6: China Architectural Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 7: China Architectural Coatings Market Revenue undefined Forecast, by Resin 2020 & 2033

- Table 8: China Architectural Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Architectural Coatings Market?

The projected CAGR is approximately 9.97%.

2. Which companies are prominent players in the China Architectural Coatings Market?

Key companies in the market include Flügger group A/S, AkzoNobel N V, 3TREESGROUP, Jotun, Guangdong Maydos building materials limited company, The China Paint Mfg Co (1932) Ltd, SKK(S) Pte Ltd, DAI NIPPON TORYO CO LTD, CARPOLY, PPG Industries Inc, Nippon Paint Holdings Co Ltd, Axalta Coating Systems, Hempel A/S, Foshan Caboli Painting Material Co Ltd, Kansai Paint Co Ltd.

3. What are the main segments of the China Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food and Beverage Industry.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

Stringent Regulations on VOCs Released on Flooring; Other Restraints.

8. Can you provide examples of recent developments in the market?

April 2022: Nippon Paint Holdings Co., Ltd. has formed a strategic partnership with the Sichuan Academy of Construction Sciences, cooperating in multiple fields to promote the high-quality development of the coating industry.January 2022: Nippon Paint Holdings Co., Ltd. proposes new solutions for focusing on dual carbon goals and reducing building energy consumption.October 2021: PPG completed the acquisition of Tikkurila a Nordic paint company in June 2021. This acquisition will help PPG grow its Architectural coatings business in EMEA and China in the Nordic region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the China Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence