Key Insights

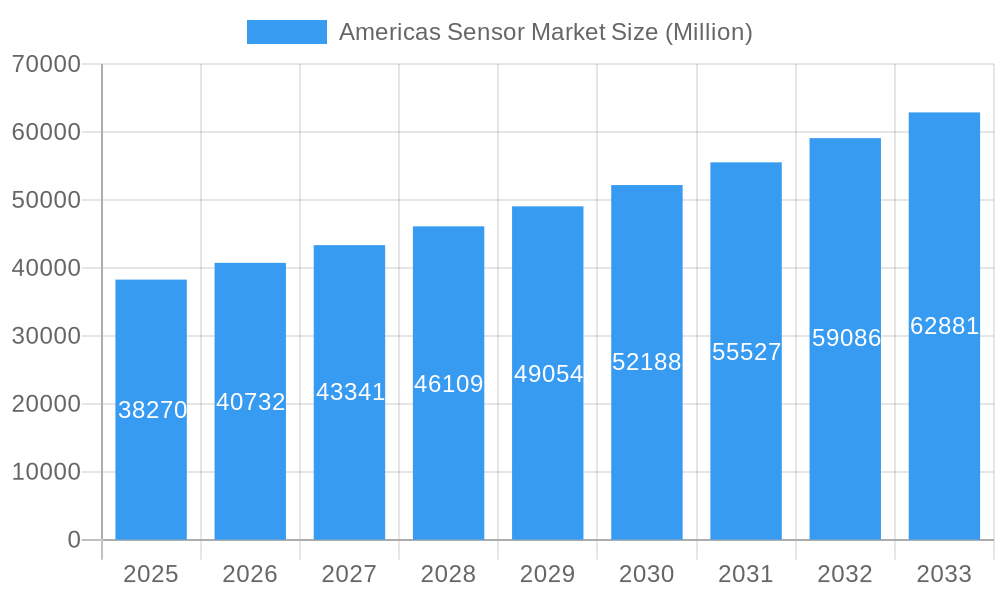

The Americas Sensor Market is poised for significant expansion, with a current market size estimated at 38,270 million USD and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.48% throughout the forecast period of 2025-2033. This growth is propelled by a confluence of powerful drivers, including the escalating adoption of the Internet of Things (IoT) across diverse industries, the relentless demand for enhanced automation in manufacturing and industrial processes, and the increasing integration of advanced sensor technologies in consumer electronics and automotive applications. The burgeoning smart home ecosystem, coupled with advancements in medical devices and wearables, further fuels this upward trajectory. The market is characterized by a diverse range of parameters measured, from fundamental temperature and pressure to sophisticated inertial and chemical sensing, catering to a broad spectrum of applications.

Americas Sensor Market Market Size (In Billion)

The prevailing trends in the Americas Sensor Market indicate a strong inclination towards miniaturization, increased power efficiency, and enhanced connectivity of sensor devices. Innovations in optical, electrical resistance, biosensor, and capacitive modes of operation are driving the development of more intelligent and versatile sensors. The automotive sector, in particular, is a major growth engine, driven by the proliferation of Advanced Driver-Assistance Systems (ADAS) and the ongoing development of autonomous vehicles. Consumer electronics, including smartphones, tablets, and wearable devices, continue to be significant contributors, while the energy, industrial, medical, and aerospace sectors present substantial opportunities for sensor integration. Despite the promising outlook, the market faces certain restraints, such as the high cost of advanced sensor development and manufacturing, potential data security and privacy concerns, and the need for standardization across various sensor technologies. Nevertheless, the overwhelming demand for data-driven insights and automated decision-making is expected to overcome these challenges, solidifying the Americas as a leading market for sensor innovation and deployment.

Americas Sensor Market Company Market Share

Americas Sensor Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the Americas sensor market, offering critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. With a focus on parent and child market segmentation, this research empowers industry professionals with actionable intelligence to navigate the evolving sensor ecosystem. The study covers the historical period of 2019–2024, with the base and estimated year set for 2025, and a comprehensive forecast period from 2025–2033. All quantitative values are presented in million units.

Americas Sensor Market Market Dynamics & Structure

The Americas sensor market is characterized by a moderately concentrated structure, with key players like Infineon Technologies AG, Honeywell International Inc, NXP Semiconductors NV, Siemens AG, and Omron Corporation dominating significant market shares. Technological innovation serves as the primary driver, fueled by escalating demand for IoT sensors, automotive sensors, and industrial sensors. The proliferation of smart devices and advancements in AI and machine learning are further accelerating the adoption of sophisticated sensor technologies. Regulatory frameworks, while evolving to ensure data privacy and security, generally foster innovation by setting industry standards. Competitive product substitutes exist, particularly in mature segments, driving continuous improvement in performance and cost-effectiveness. End-user demographics reveal a strong preference for integrated and miniaturized sensor solutions across consumer electronics and automotive sectors. Merger and acquisition (M&A) activities remain robust, as companies seek to expand their product portfolios, technological capabilities, and market reach. For instance, strategic acquisitions in the MEMS sensor and biometric sensor spaces are anticipated to reshape competitive dynamics.

- Market Concentration: Moderate, with a few key players holding substantial market share.

- Technological Innovation Drivers: IoT, AI/ML integration, miniaturization, demand for higher precision, smart city sensors.

- Regulatory Frameworks: Focus on data privacy, cybersecurity, and environmental standards.

- Competitive Product Substitutes: Constant innovation to outperform existing technologies, especially in temperature sensors and pressure sensors.

- End-User Demographics: Growing demand from Automotive, Consumer Electronics, Industrial, and Healthcare sectors.

- M&A Trends: Strategic acquisitions to gain access to new technologies and markets, particularly in advanced sensor technology.

Americas Sensor Market Growth Trends & Insights

The Americas sensor market is poised for significant expansion, driven by pervasive digitization and the increasing integration of intelligent sensing capabilities across virtually all industries. Market size evolution is projected to be robust, with adoption rates of advanced sensor technologies like LiDAR sensors and image sensors accelerating beyond initial forecasts. Technological disruptions, such as the development of novel materials for chemical sensors and the refinement of biosensors, are opening new application frontiers. Consumer behavior shifts towards personalized experiences, enhanced safety, and greater convenience are directly influencing the demand for smart devices equipped with a wide array of sensors. The automotive sensor market is a key growth engine, propelled by the surge in autonomous driving technology and advanced driver-assistance systems (ADAS). Similarly, the consumer electronics sensor market is witnessing sustained growth due to the proliferation of wearables, smart home devices, and high-performance mobile devices. The industrial sensor market is also experiencing a renaissance, with Industry 4.0 initiatives driving the adoption of sensors for predictive maintenance, process optimization, and enhanced automation. The projected Compound Annual Growth Rate (CAGR) for the Americas sensor market is expected to be in the range of 8–10% over the forecast period, indicating substantial market penetration and expansion.

Dominant Regions, Countries, or Segments in Americas Sensor Market

The United States stands as the dominant country within the Americas sensor market, driven by its robust technological innovation ecosystem, substantial R&D investments, and a high concentration of leading technology companies. Its advanced manufacturing capabilities and a significant consumer base for electronics and automobiles further bolster its market leadership.

- End-User Industry Dominance: The Automotive sector is a primary driver, with a massive demand for automotive sensors related to engine management, safety systems (e.g., ABS sensors, airbag sensors), and advanced driver-assistance systems (ADAS). The increasing adoption of electric vehicles (EVs) is creating new avenues for specialized sensors, such as battery management sensors.

- Parameter Dominance: Temperature and Pressure sensors represent foundational segments, with widespread application across all industries. However, growth is increasingly being propelled by Inertial sensors (accelerometers, gyroscopes) for motion sensing and navigation, and Environmental sensors for monitoring air quality and climate control. The demand for Proximity sensors is also surging, particularly in consumer electronics and industrial automation.

- Mode of Operation Dominance: Optical and Capacitive sensors continue to hold significant market share due to their versatility and cost-effectiveness. However, Piezoresistive sensors are gaining traction in pressure sensing applications, while LiDAR and Radar technologies are critical for the advancement of autonomous vehicles and sophisticated industrial automation. Image sensors are indispensable for automotive, consumer electronics, and surveillance applications.

- Geographic Influence: Within the US, regions with a strong presence of automotive manufacturing (e.g., Michigan, Ohio) and technology hubs (e.g., California, Texas) are key consumption centers. Canada is also a growing market, particularly in automotive and industrial applications. Brazil, while a developing market, shows strong potential in agriculture and industrial automation.

Americas Sensor Market Product Landscape

The Americas sensor market is characterized by continuous product innovation, focusing on enhanced accuracy, miniaturization, lower power consumption, and expanded functionality. Key applications span from sophisticated automotive sensors enabling autonomous driving to compact wearable device sensors for health monitoring and smart appliance sensors for improved home automation. Performance metrics such as increased sensitivity, faster response times, and wider operating temperature ranges are critical differentiators. For example, advancements in MEMS sensor technology are enabling the development of highly accurate and cost-effective inertial and pressure sensors. The integration of AI capabilities directly into sensors, often referred to as edge AI, is another significant trend, enabling real-time data processing and reducing reliance on cloud connectivity. Unique selling propositions often revolve around specific application benefits, such as the Mira050's high sensitivity for reduced device size in wearables, or the BMP384's ruggedness for harsh environments.

Key Drivers, Barriers & Challenges in Americas Sensor Market

The Americas sensor market is propelled by several key drivers, including the relentless advancement of the Internet of Things (IoT) ecosystem, the burgeoning demand for smart devices across consumer and industrial sectors, and the rapid evolution of the automotive sensor market driven by ADAS and autonomous driving technologies. Government initiatives promoting smart cities and Industry 4.0 further fuel adoption.

- Key Drivers:

- Proliferation of IoT devices and connected ecosystems.

- Increasing demand for automation and intelligence in industrial applications.

- Growth in the electric and autonomous vehicle sectors.

- Advancements in miniaturization and power efficiency of sensors.

- Rising adoption of wearable technology for health and fitness monitoring.

Conversely, the market faces significant barriers and challenges. Supply chain disruptions, particularly for specialized semiconductor components, can lead to production delays and increased costs. Stringent regulatory compliance for certain sensor types, especially in medical and aerospace applications, can be a hurdle. High initial investment costs for advanced sensor development and integration can also be a restraint for smaller companies. Intense competition from established players and emerging innovators exerts pressure on pricing and profit margins.

- Key Barriers & Challenges:

- Supply chain volatility and component shortages.

- Complex regulatory landscapes and certification processes.

- High R&D and integration costs for cutting-edge sensor technologies.

- Intensifying price competition and market saturation in some segments.

- Cybersecurity concerns related to sensitive sensor data.

Emerging Opportunities in Americas Sensor Market

Emerging opportunities in the Americas sensor market lie in the untapped potential of specialized applications and evolving consumer preferences. The growing demand for precision agriculture sensors to optimize crop yields and resource management presents a significant avenue. Furthermore, the expansion of the medical sensor market, driven by remote patient monitoring, advanced diagnostics, and personalized medicine, offers substantial growth prospects. The development of novel biosensors for rapid disease detection and the refinement of environmental sensors for hyper-local pollution monitoring are also key emerging areas. The increasing focus on sustainability and energy efficiency is creating opportunities for advanced energy sensors in smart grids and renewable energy systems.

Growth Accelerators in the Americas Sensor Market Industry

Catalysts driving long-term growth in the Americas sensor market are multifaceted, encompassing technological breakthroughs and strategic market expansion. The ongoing evolution of artificial intelligence (AI) and machine learning (ML) is a critical accelerator, enabling more sophisticated data analysis and predictive capabilities from sensor inputs. Strategic partnerships between sensor manufacturers and device OEMs are crucial for seamless integration and market penetration. Furthermore, the continuous miniaturization and cost reduction of sensor components, particularly in the realm of MEMS sensors, are making advanced sensing capabilities accessible to a broader range of applications and price points, thereby expanding the overall market reach.

Key Players Shaping the Americas Sensor Market Market

- Infineon Technologies AG

- Honeywell International Inc

- NXP Semiconductors NV

- Siemens AG

- Omron Corporation

- Omega Engineering Inc

- Sick AG

- BOSCH Sensortech GmbH

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Rockwell Automation Inc

- ABB Limited

- AMS AG

Notable Milestones in Americas Sensor Market Sector

- January 2023: OSRAM announced the launch of its new product, the Mira050, a 2.3 x 2.8 mm, 0.5 Mpixel pipelined, high-sensitivity, global shutter CMOS image sensor. Due to the Mira050's high sensitivity to visible and near-infrared (NIR) light, wearable and mobile devices' size and power consumption can be decreased. The Mira050 can be used for 3D depth sensing for face recognition in smart door locks, eye tracking, gesture tracking, and contextual awareness in AR/VR/MR headsets.

- February 2022: BOSCH announced the launch of the BMP384, a rugged barometric pressure sensor that offers market-leading accuracy in a compact package. Together with the required integration concept, the new sensor's innovative housing design uses a special gel to prevent the ingress of primary water, other liquids and dust. OEMs can easily integrate barometric pressure sensors into products that require a high degree of robustness.

In-Depth Americas Sensor Market Market Outlook

The Americas sensor market outlook is exceptionally promising, driven by sustained demand for smart and connected solutions across all key sectors. Growth accelerators, including the integration of AI at the edge, advancements in materials science for novel sensor functionalities, and the continuous pursuit of miniaturization and energy efficiency, will further propel market expansion. Strategic investments in research and development by leading players, coupled with an increasing number of collaborations between technology providers and end-users, will foster innovation and unlock new application areas. The Americas sensor market is poised to witness robust growth, presenting significant opportunities for companies that can deliver high-performance, cost-effective, and intelligent sensing solutions to meet the evolving demands of a digitally transforming world.

Americas Sensor Market Segmentation

-

1. Parameters Measured

- 1.1. Temperature

- 1.2. Pessure

- 1.3. Level

- 1.4. Flow

- 1.5. Proximity

- 1.6. Environmental

- 1.7. Chemical

- 1.8. Inertial

- 1.9. Magnetic

- 1.10. Vibration

- 1.11. Other Parameters Measured

-

2. Mode of Operations

- 2.1. Optical

- 2.2. Electrical Resistance

- 2.3. Biosenser

- 2.4. Piezoresistive

- 2.5. Image

- 2.6. Capacitive

- 2.7. Piezoelectric

- 2.8. LiDAR

- 2.9. Radar

- 2.10. Other Modes of Operation

-

3. End-user Industry

- 3.1. Automotive

-

3.2. Consumer Electronics

- 3.2.1. Smartphones

- 3.2.2. Tablets, Laptops, and Computers

- 3.2.3. Wearable Devices

- 3.2.4. Smart Appliances or Devices

- 3.2.5. Other Consumer Electronics

- 3.3. Energy

- 3.4. Industrial and Other

- 3.5. Medical and Wellness

- 3.6. Construction, Agriculture, and Mining

- 3.7. Aerospace

- 3.8. Defense

-

4. Geography

-

4.1. Americas

- 4.1.1. United States

- 4.1.2. Canada

- 4.1.3. Brazil

-

4.1. Americas

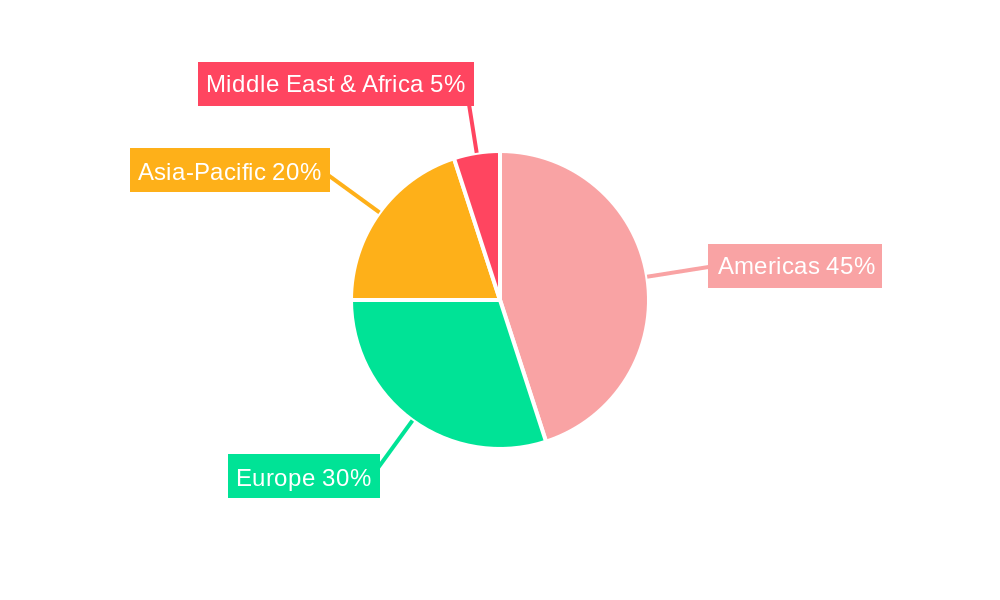

Americas Sensor Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Brazil

Americas Sensor Market Regional Market Share

Geographic Coverage of Americas Sensor Market

Americas Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Smartphoes and Other Electronics Devices; Growing Advancement in Automation Sector

- 3.3. Market Restrains

- 3.3.1. Design Complexity and Performance Limitations in High-power Applications

- 3.4. Market Trends

- 3.4.1. Increasing Use of Smartphones and Other Electronic Devices to Bolster Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 5.1.1. Temperature

- 5.1.2. Pessure

- 5.1.3. Level

- 5.1.4. Flow

- 5.1.5. Proximity

- 5.1.6. Environmental

- 5.1.7. Chemical

- 5.1.8. Inertial

- 5.1.9. Magnetic

- 5.1.10. Vibration

- 5.1.11. Other Parameters Measured

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operations

- 5.2.1. Optical

- 5.2.2. Electrical Resistance

- 5.2.3. Biosenser

- 5.2.4. Piezoresistive

- 5.2.5. Image

- 5.2.6. Capacitive

- 5.2.7. Piezoelectric

- 5.2.8. LiDAR

- 5.2.9. Radar

- 5.2.10. Other Modes of Operation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Consumer Electronics

- 5.3.2.1. Smartphones

- 5.3.2.2. Tablets, Laptops, and Computers

- 5.3.2.3. Wearable Devices

- 5.3.2.4. Smart Appliances or Devices

- 5.3.2.5. Other Consumer Electronics

- 5.3.3. Energy

- 5.3.4. Industrial and Other

- 5.3.5. Medical and Wellness

- 5.3.6. Construction, Agriculture, and Mining

- 5.3.7. Aerospace

- 5.3.8. Defense

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Americas

- 5.4.1.1. United States

- 5.4.1.2. Canada

- 5.4.1.3. Brazil

- 5.4.1. Americas

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NXP Semiconductors NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Omron Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Omega Engineering Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sick AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BOSCH Sensortech GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TE Connectivity Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Texas Instruments Incorporated

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rockwell Automation Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ABB Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AMS AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Americas Sensor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Americas Sensor Market Share (%) by Company 2025

List of Tables

- Table 1: Americas Sensor Market Revenue Million Forecast, by Parameters Measured 2020 & 2033

- Table 2: Americas Sensor Market Revenue Million Forecast, by Mode of Operations 2020 & 2033

- Table 3: Americas Sensor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Americas Sensor Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Americas Sensor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Americas Sensor Market Revenue Million Forecast, by Parameters Measured 2020 & 2033

- Table 7: Americas Sensor Market Revenue Million Forecast, by Mode of Operations 2020 & 2033

- Table 8: Americas Sensor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Americas Sensor Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Americas Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Americas Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Americas Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Brazil Americas Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Sensor Market?

The projected CAGR is approximately 6.48%.

2. Which companies are prominent players in the Americas Sensor Market?

Key companies in the market include Infineon Technologies AG, Honeywell International Inc, NXP Semiconductors NV, Siemens AG, Omron Corporation*List Not Exhaustive, Omega Engineering Inc, Sick AG, BOSCH Sensortech GmbH, TE Connectivity Ltd, Texas Instruments Incorporated, Rockwell Automation Inc, ABB Limited, AMS AG.

3. What are the main segments of the Americas Sensor Market?

The market segments include Parameters Measured, Mode of Operations, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Smartphoes and Other Electronics Devices; Growing Advancement in Automation Sector.

6. What are the notable trends driving market growth?

Increasing Use of Smartphones and Other Electronic Devices to Bolster Market Growth.

7. Are there any restraints impacting market growth?

Design Complexity and Performance Limitations in High-power Applications.

8. Can you provide examples of recent developments in the market?

January 2023: OSRAM announced the launch of its new product, the Mira050, a 2.3 x 2.8 mm, 0.5 Mpixel pipelined, high-sensitivity, global shutter CMOS image sensor. Due to the Mira050's high sensitivity to visible and near-infrared (NIR) light, wearable and mobile devices' size and power consumption can be decreased. The Mira050 can be used for 3D depth sensing for face recognition in smart door locks, eye tracking, gesture tracking, and contextual awareness in AR/VR/MR headsets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Sensor Market?

To stay informed about further developments, trends, and reports in the Americas Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence