Key Insights

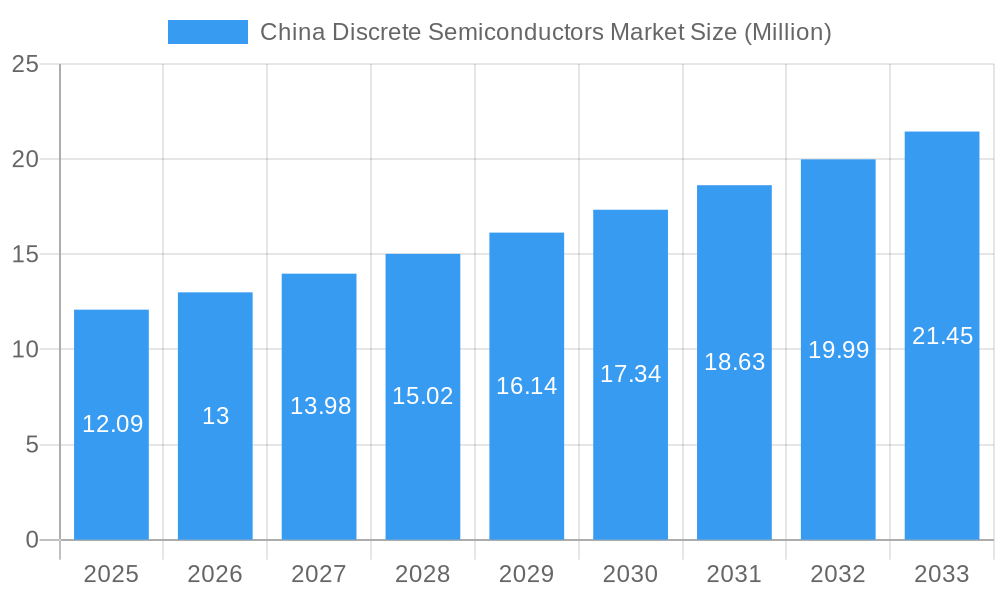

The China Discrete Semiconductors Market is poised for significant expansion, projected to reach USD 12.09 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 7.61% through 2033. This dynamic growth is primarily fueled by the relentless surge in demand across key end-user verticals such as Automotive, Consumer Electronics, and Industrial applications. The burgeoning electric vehicle (EV) sector, coupled with the pervasive adoption of advanced consumer gadgets and the ongoing industrial automation initiatives, are collectively driving the need for a diverse range of discrete semiconductor components. Specifically, power transistors, including MOSFETs and IGBTs, are witnessing accelerated demand due to their critical role in power management and control within these rapidly evolving industries. Furthermore, the expanding 5G infrastructure deployment and the increasing complexity of communication devices are also contributing to the market's upward trajectory, necessitating a consistent supply of high-performance diodes and rectifiers.

China Discrete Semiconductors Market Market Size (In Million)

The market's expansion is further bolstered by China's strategic focus on indigenous semiconductor manufacturing and technological advancement. While the market exhibits strong growth potential, certain restraining factors warrant attention. These include the ongoing global supply chain volatilities, which can impact component availability and pricing, and the intense price competition among manufacturers. Nevertheless, the persistent innovation in semiconductor technology, with an emphasis on developing more efficient and compact discrete components, is expected to mitigate these challenges. Emerging trends such as the integration of discrete semiconductors into more sophisticated System-in-Package (SiP) solutions and the increasing use of wide-bandgap semiconductors like Silicon Carbide (SiC) for high-power applications will continue to shape the market landscape, presenting new opportunities for growth and technological leadership.

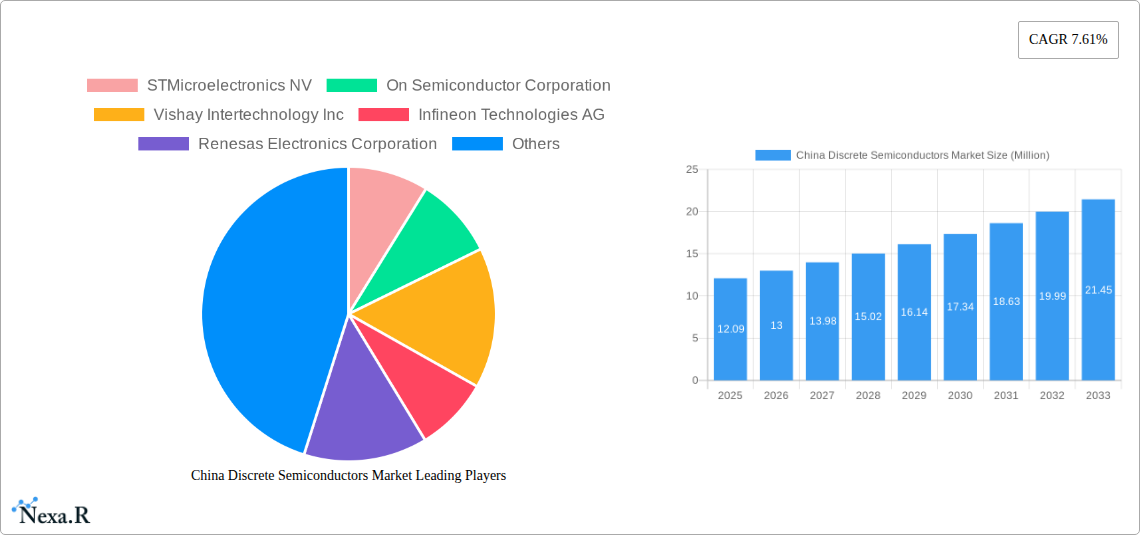

China Discrete Semiconductors Market Company Market Share

China Discrete Semiconductors Market: Comprehensive Market Analysis and Forecast 2019–2033

This in-depth report provides a holistic analysis of the China Discrete Semiconductors Market, a critical sector fueling the nation's technological advancement. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and the competitive strategies of leading players. Our analysis offers invaluable insights into discrete semiconductor applications, power semiconductors, diode market trends, transistor market growth, and the impact of automotive semiconductors, consumer electronics components, and industrial electronics demand on the Chinese market. Values are presented in Million units.

China Discrete Semiconductors Market Market Dynamics & Structure

The China Discrete Semiconductors Market is characterized by a dynamic and evolving landscape, driven by relentless technological innovation and a rapidly expanding industrial base. Market concentration is observed among major global and domestic players, with increasing emphasis on advanced MOSFET power transistors and IGBT power transistors due to their critical role in energy efficiency and power management. Technological innovation is primarily propelled by the demand for higher performance, smaller form factors, and enhanced reliability across various end-user verticals. Regulatory frameworks, while fostering growth through supportive policies for the semiconductor industry, also introduce compliance considerations for manufacturers. Competitive product substitutes exist, particularly with the rise of integrated circuits in certain applications, but discrete semiconductors retain their dominance in specialized high-power and high-frequency scenarios. End-user demographics are shifting towards more sophisticated requirements in the automotive sector, driven by electric vehicle adoption, and the consumer electronics segment, fueled by 5G deployment and smart device proliferation. Mergers and acquisitions (M&A) trends are indicative of consolidation efforts and strategic expansions, aimed at strengthening market position and acquiring specialized technologies.

- Market Concentration: Dominated by a mix of global giants and burgeoning domestic players.

- Technological Innovation Drivers: Miniaturization, increased power density, enhanced efficiency, and wider operating temperature ranges for power semiconductor devices.

- Regulatory Frameworks: Government incentives for domestic production and R&D, alongside evolving environmental and safety standards.

- Competitive Product Substitutes: Integrated power modules and advanced ICs in some consumer-facing applications.

- End-User Demographics: Growing demand for high-performance components in EVs, industrial automation, and advanced communication systems.

- M&A Trends: Strategic acquisitions to gain technological edge and market access, particularly in advanced materials and manufacturing processes.

China Discrete Semiconductors Market Growth Trends & Insights

The China Discrete Semiconductors Market has witnessed substantial growth and is poised for continued expansion throughout the forecast period. This growth is intrinsically linked to China's robust manufacturing sector and its strategic focus on becoming a global leader in advanced technologies. The market size evolution has been consistently upward, driven by increasing adoption rates across key end-user verticals. Technological disruptions, such as advancements in silicon carbide (SiC) and gallium nitride (GaN) technologies for high-power applications, are reshaping the market, enabling greater efficiency and performance in sectors like electric vehicles and renewable energy. Consumer behavior shifts towards more sophisticated and energy-efficient electronic devices further fuel demand for high-quality discrete semiconductors. The estimated market size for 2025 is significant, with a projected Compound Annual Growth Rate (CAGR) indicating a strong upward trajectory for the discrete semiconductor market. Market penetration is deep across industrial applications and is rapidly expanding in the automotive sector, especially for components in electric vehicle powertrains and advanced driver-assistance systems (ADAS). The ongoing digital transformation across all industries necessitates reliable and efficient discrete semiconductor solutions, from basic rectifiers and thyristors to advanced power transistors. The shift towards localized production and supply chain resilience further underpins the sustained growth of this critical market. The increasing complexity of electronic systems, from advanced communication infrastructure to smart grid technologies, demands a diverse range of discrete semiconductor components, ensuring sustained market vitality.

Dominant Regions, Countries, or Segments in China Discrete Semiconductors Market

Within the China Discrete Semiconductors Market, the Power Transistor segment, particularly MOSFET Power Transistors and IGBT Power Transistors, stands out as the primary growth engine, followed closely by Diodes and Rectifiers. The dominance of these segments is driven by their indispensable role in power management and conversion across a multitude of applications. The Automotive end-user vertical is emerging as a leading driver of market growth, propelled by the exponential rise of electric vehicles (EVs) and the increasing integration of advanced electronics in traditional internal combustion engine vehicles. The demand for efficient power electronics in EV powertrains, charging infrastructure, and battery management systems is immense.

The Industrial end-user vertical remains a significant contributor, with discrete semiconductors powering automation systems, renewable energy infrastructure (solar and wind power converters), industrial power supplies, and motor control applications. The ongoing industrial upgrading and the drive for greater energy efficiency in manufacturing processes are key factors bolstering this segment. The Communication sector, fueled by the rapid deployment of 5G networks and the proliferation of data centers, also presents substantial demand for high-frequency and high-performance discrete semiconductor components.

Geographically, regions with strong manufacturing bases and significant investment in new energy vehicles and advanced industrial development, such as the Yangtze River Delta and the Pearl River Delta, are leading the market growth. These regions benefit from supportive government policies, robust infrastructure, and a concentrated presence of key end-user industries.

- Dominant Segments:

- Power Transistors: Especially MOSFET Power Transistors and IGBT Power Transistors, critical for power conversion and efficiency.

- Diodes & Rectifiers: Essential for current rectification and voltage regulation in a wide array of electronic circuits.

- Leading End-User Verticals:

- Automotive: Driven by the EV revolution and advanced vehicle electronics.

- Industrial: Fueled by automation, renewable energy, and energy efficiency initiatives.

- Communication: Supported by 5G infrastructure and data center expansion.

- Key Growth Drivers in Dominant Regions:

- Economic Policies: Government support for the semiconductor industry and strategic emerging industries.

- Infrastructure Development: Investments in 5G networks, EV charging infrastructure, and smart grids.

- Manufacturing Prowess: Concentration of key end-user industries, driving localized demand.

- Technological Adoption: High rate of adoption of advanced technologies in automotive and industrial sectors.

China Discrete Semiconductors Market Product Landscape

The China Discrete Semiconductors Market product landscape is characterized by continuous innovation aimed at enhancing performance, efficiency, and reliability. Key product developments include advancements in power MOSFETs with lower on-resistance and faster switching speeds, enabling greater energy efficiency in power supplies and motor drives. IGBT modules are evolving with higher voltage and current ratings, crucial for high-power applications in renewable energy and electric vehicle powertrains. The introduction of new materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) is enabling discrete components with superior thermal performance and higher operating frequencies, paving the way for next-generation power electronics. Diodes are being optimized for faster recovery times and lower leakage currents, while thyristors are seeing improved turn-off characteristics for high-power switching applications. These innovations cater to the growing demand for compact, efficient, and robust semiconductor solutions across various sectors.

Key Drivers, Barriers & Challenges in China Discrete Semiconductors Market

Key Drivers: The China Discrete Semiconductors Market is primarily propelled by the surging demand from the burgeoning automotive sector, especially electric vehicles, which require advanced power management solutions. Government initiatives supporting domestic semiconductor manufacturing and R&D play a crucial role. The rapid expansion of consumer electronics and communication infrastructure, including 5G deployment, also fuels demand. Technological advancements in power semiconductors, leading to increased efficiency and smaller footprints, are key economic drivers.

Barriers & Challenges: Significant challenges include intense global competition, requiring continuous investment in advanced manufacturing capabilities. Supply chain disruptions, particularly concerning raw materials and manufacturing equipment, pose a considerable risk. High capital expenditure for state-of-the-art fabrication facilities is a substantial barrier. Furthermore, dependence on imported advanced materials and intellectual property in some areas can hinder rapid domestic innovation. Navigating complex and evolving international trade regulations also presents a challenge.

Emerging Opportunities in China Discrete Semiconductors Market

Emerging opportunities in the China Discrete Semiconductors Market lie in the continued expansion of the electric vehicle ecosystem, demanding high-performance power transistors and diodes for battery management, charging systems, and powertrains. The growing adoption of renewable energy sources like solar and wind power creates significant demand for industrial IGBT modules and thyristors in power conversion systems. The push for smart manufacturing and industrial automation opens avenues for specialized power semiconductors with enhanced reliability and faster switching speeds. Furthermore, the development of advanced communication technologies beyond 5G and the Internet of Things (IoT) will require innovative discrete components for signal processing and power management.

Growth Accelerators in the China Discrete Semiconductors Market Industry

Several catalysts are accelerating the growth of the China Discrete Semiconductors Market. The robust government support through policies like the "Made in China 2025" initiative and significant R&D funding is a primary accelerator. Strategic partnerships between domestic and international players, fostering technology transfer and joint development, are vital. The relentless drive for technological self-sufficiency and the focus on reducing reliance on imported components are pushing innovation and domestic production capacity. The increasing integration of discrete semiconductors into emerging technologies like AI-powered devices and advanced robotics also serves as a significant growth accelerator.

Key Players Shaping the China Discrete Semiconductors Market Market

- STMicroelectronics NV

- On Semiconductor Corporation

- Vishay Intertechnology Inc

- Infineon Technologies AG

- Renesas Electronics Corporation

- Texas Instrument Inc

- Qorvo Inc

- Microchip Technology Inc

- Diodes Incorporated

- Wolfspeed Inc

- Rohm Co Ltd

Notable Milestones in China Discrete Semiconductors Market Sector

- April 2024: Fuji Electric Co. Ltd (FE) introduced its latest offering, the HPnC Series. This new line features large-capacity industrial IGBT modules specifically designed for applications such as power converters in solar and wind energy systems. By enhancing both current and voltage ratings, these products boost the capacity and shrink the footprint of the power converters they're integrated into. This, in turn, aids in cutting down power generation expenses.

- March 2024: Infineon introduced the first product in its new advanced MOSFET technology OptiMOS 7 80 V: The IAUCN08S7N013 features a significantly increased power density and is available in the versatile, robust and high-current SSO8 5 x 6 mm² SMD package. The OptiMOS 7 80 V offering perfectly matches the upcoming 48 V board net applications. It is designed specifically for the high performance, high quality, and robustness needed for demanding automotive applications like automotive DC-DC converters in EVs, 48 V motor control, for electric power steering (EPS).

In-Depth China Discrete Semiconductors Market Market Outlook

The future outlook for the China Discrete Semiconductors Market is exceptionally bright, driven by its pivotal role in powering the nation's technological ambitions. Growth accelerators, including the continued surge in electric vehicle production, the expansion of renewable energy infrastructure, and the ongoing digital transformation across all industries, will sustain robust demand. Strategic investments in domestic manufacturing capabilities and ongoing R&D for next-generation materials like SiC and GaN will further solidify China's position in the global discrete semiconductor landscape. The market's future potential lies in its ability to innovate and adapt to the evolving needs of high-growth sectors, ensuring continued expansion and technological leadership.

China Discrete Semiconductors Market Segmentation

-

1. Type

- 1.1. Diode

- 1.2. Small Signal Transistor

-

1.3. Power Transistor

- 1.3.1. MOSFET Power Transistor

- 1.3.2. IGBT Power Transistor

- 1.3.3. Other Power Transistors

- 1.4. Rectifier

- 1.5. Thyristor

-

2. End-user Vertical

- 2.1. Automotive

- 2.2. Consumer Electronics

- 2.3. Communication

- 2.4. Industrial

- 2.5. Other End-user Verticals

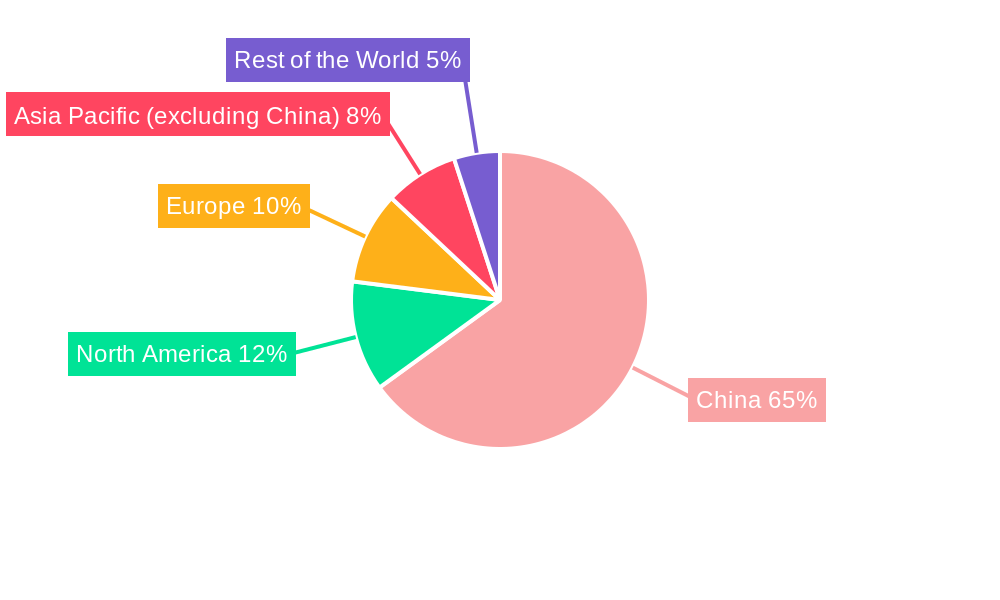

China Discrete Semiconductors Market Segmentation By Geography

- 1. China

China Discrete Semiconductors Market Regional Market Share

Geographic Coverage of China Discrete Semiconductors Market

China Discrete Semiconductors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in 5G Technology; Rising Demand for High-Energy and Power-Efficient Devices in the Automotive and Electronics Segment; Rising Demand for Electronic Components

- 3.3. Market Restrains

- 3.3.1. Advancements in 5G Technology; Rising Demand for High-Energy and Power-Efficient Devices in the Automotive and Electronics Segment; Rising Demand for Electronic Components

- 3.4. Market Trends

- 3.4.1. Consumer Electronics is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Discrete Semiconductors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diode

- 5.1.2. Small Signal Transistor

- 5.1.3. Power Transistor

- 5.1.3.1. MOSFET Power Transistor

- 5.1.3.2. IGBT Power Transistor

- 5.1.3.3. Other Power Transistors

- 5.1.4. Rectifier

- 5.1.5. Thyristor

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics

- 5.2.3. Communication

- 5.2.4. Industrial

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 STMicroelectronics NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 On Semiconductor Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vishay Intertechnology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Renesas Electronics Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Texas Instrument Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qorvo Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microchip Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Diodes Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wolfspeed Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rohm Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 STMicroelectronics NV

List of Figures

- Figure 1: China Discrete Semiconductors Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Discrete Semiconductors Market Share (%) by Company 2025

List of Tables

- Table 1: China Discrete Semiconductors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Discrete Semiconductors Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: China Discrete Semiconductors Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: China Discrete Semiconductors Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 5: China Discrete Semiconductors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Discrete Semiconductors Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China Discrete Semiconductors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: China Discrete Semiconductors Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: China Discrete Semiconductors Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: China Discrete Semiconductors Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 11: China Discrete Semiconductors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Discrete Semiconductors Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Discrete Semiconductors Market?

The projected CAGR is approximately 7.61%.

2. Which companies are prominent players in the China Discrete Semiconductors Market?

Key companies in the market include STMicroelectronics NV, On Semiconductor Corporation, Vishay Intertechnology Inc, Infineon Technologies AG, Renesas Electronics Corporation, Texas Instrument Inc, Qorvo Inc, Microchip Technology Inc, Diodes Incorporated, Wolfspeed Inc, Rohm Co Ltd.

3. What are the main segments of the China Discrete Semiconductors Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in 5G Technology; Rising Demand for High-Energy and Power-Efficient Devices in the Automotive and Electronics Segment; Rising Demand for Electronic Components.

6. What are the notable trends driving market growth?

Consumer Electronics is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Advancements in 5G Technology; Rising Demand for High-Energy and Power-Efficient Devices in the Automotive and Electronics Segment; Rising Demand for Electronic Components.

8. Can you provide examples of recent developments in the market?

April 2024: Fuji Electric Co. Ltd (FE) introduced its latest offering, the HPnCSeries. This new line features large-capacity industrial IGBT modules specifically designed for applications such as power converters in solar and wind energy systems. By enhancing both current and voltage ratings, these products boost the capacity and shrink the footprint of the power converters they're integrated into. This, in turn, aids in cutting down power generation expenses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Discrete Semiconductors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Discrete Semiconductors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Discrete Semiconductors Market?

To stay informed about further developments, trends, and reports in the China Discrete Semiconductors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence