Key Insights

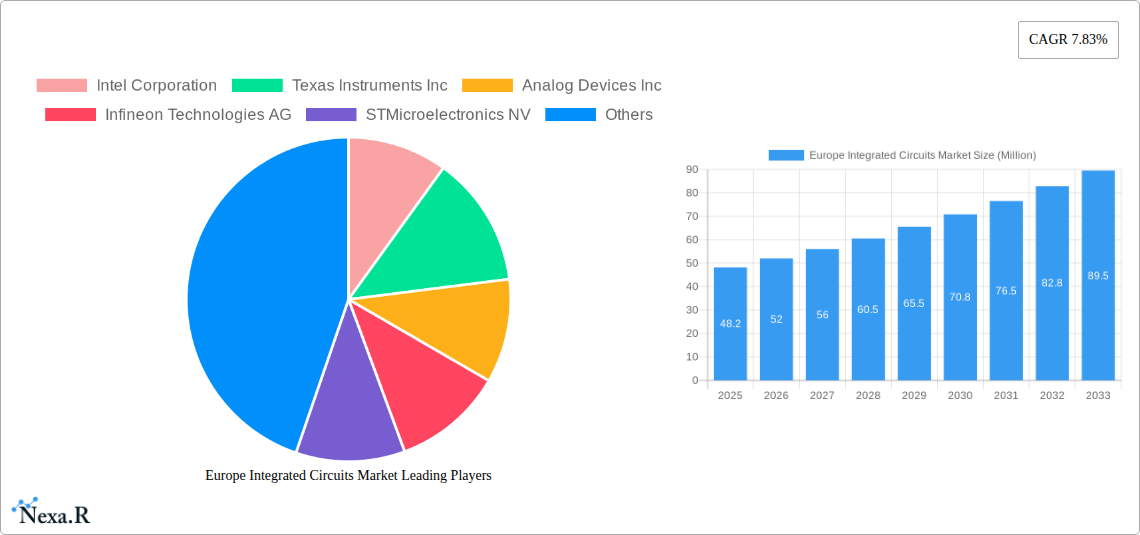

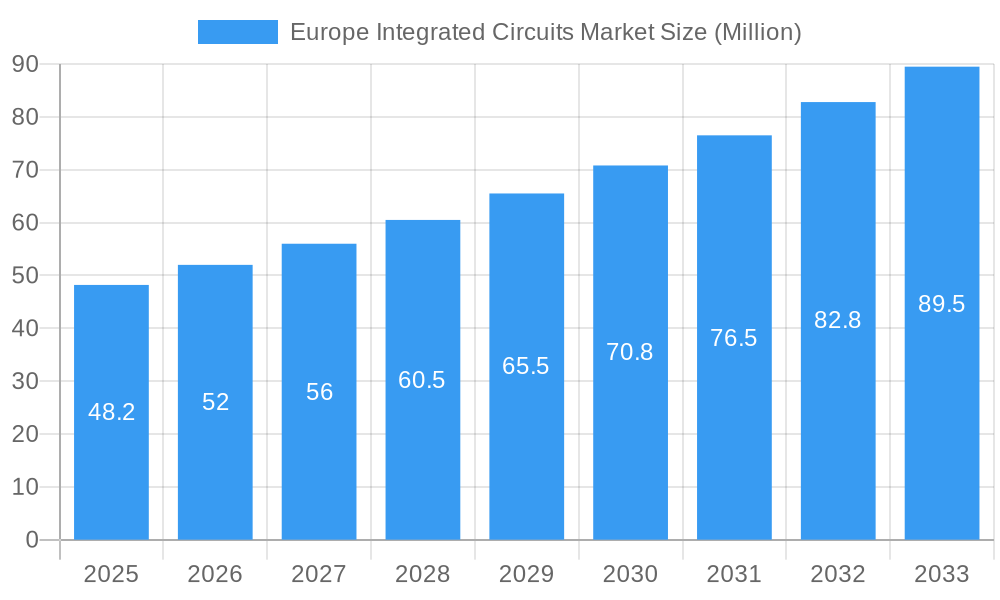

The European Integrated Circuits (ICs) market is poised for significant expansion, currently valued at an estimated 48.20 Million Euros. This robust growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 7.83% from 2025 to 2033. This upward trajectory is primarily fueled by escalating demand across key end-user industries. The consumer electronics sector, driven by the proliferation of smart devices, wearables, and advanced home entertainment systems, represents a major consumption hub for various IC types, including logic ICs and memory components. Furthermore, the automotive industry's rapid embrace of electrification, autonomous driving technologies, and advanced driver-assistance systems (ADAS) necessitates a substantial increase in high-performance microprocessors (MPUs) and microcontrollers (MCUs). The IT & Telecommunications sector also plays a critical role, with ongoing upgrades to 5G infrastructure and the burgeoning demand for data processing and storage solutions bolstering the market for advanced microprocessors and specialized logic ICs.

Europe Integrated Circuits Market Market Size (In Million)

The European IC market's growth is further propelled by prevailing trends such as the increasing integration of AI and machine learning capabilities into everyday devices, driving demand for powerful digital signal processors (DSPs) and specialized AI accelerators. Miniaturization and enhanced power efficiency remain paramount, influencing the development and adoption of advanced analog ICs and low-power memory solutions. However, the market faces certain restraints, including the complex and capital-intensive nature of semiconductor manufacturing, potential supply chain disruptions, and the stringent regulatory landscape in Europe concerning data privacy and technological standards, which can impact the pace of adoption and product development. Despite these challenges, the strategic focus on domestic semiconductor production and innovation within Europe, coupled with robust investment in research and development, is expected to create a favorable environment for sustained market expansion.

Europe Integrated Circuits Market Company Market Share

Here is a compelling, SEO-optimized report description for the Europe Integrated Circuits Market:

Europe Integrated Circuits Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed examination of the Europe Integrated Circuits (IC) Market, offering critical insights into its dynamics, growth trends, and future trajectory. Covering the period from 2019 to 2033, with a focus on the Base Year 2025, this analysis is essential for stakeholders seeking to understand the competitive landscape, technological advancements, and market opportunities within the European semiconductor industry. We delve into key market segments, including Analog ICs, Logic ICs, Memory ICs, and various Micro ICs (Microprocessors, Microcontrollers, Digital Signal Processors), and their penetration across vital end-user industries such as Consumer Electronics, Automotive, IT & Telecommunications, Manufacturing & Automation, and Other sectors. The report highlights the strategic importance of European semiconductor manufacturing and the burgeoning demand for advanced semiconductor solutions across the continent.

Europe Integrated Circuits Market Market Dynamics & Structure

The Europe Integrated Circuits Market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and intense competition. Market concentration is influenced by a mix of established global giants and emerging European players, with a significant portion of the market dominated by a few key companies. Technological innovation remains a primary driver, fueled by substantial R&D investments aimed at developing smaller, more powerful, and energy-efficient ICs. The regulatory landscape, particularly initiatives supporting European chip manufacturing and the Chips Act, plays a crucial role in shaping market entry and growth. Competitive product substitutes are continuously emerging, pushing for greater performance and cost-effectiveness. End-user demographics are shifting, with a growing demand for sophisticated ICs in sectors like automotive and industrial automation. Mergers and acquisitions (M&A) are a notable trend, as companies seek to consolidate market share, acquire new technologies, and expand their product portfolios. For instance, the historical period (2019-2024) likely saw xx M&A deals, indicating ongoing consolidation. Barriers to innovation include high capital expenditure requirements for advanced fabrication, complex design cycles, and stringent intellectual property protection laws.

- Market Concentration: Dominated by a few key global players with increasing focus on European domestic production.

- Technological Innovation Drivers: Miniaturization, AI integration, increased processing power, and energy efficiency.

- Regulatory Frameworks: EU Chips Act, support for R&D, and trade policies influencing global supply chains.

- Competitive Product Substitutes: Advanced packaging technologies, System-on-Chip (SoC) integration, and alternative materials.

- End-User Demographics: Growing demand from the automotive sector (EVs, ADAS), industrial automation, and smart consumer electronics.

- M&A Trends: Strategic acquisitions to gain access to advanced technologies and market segments.

Europe Integrated Circuits Market Growth Trends & Insights

The Europe Integrated Circuits Market is poised for substantial growth, driven by robust demand from key end-user industries and supportive government initiatives. The market size evolution is projected to be significant, with a Compound Annual Growth Rate (CAGR) of xx% projected for the forecast period (2025–2033). Adoption rates for advanced ICs are accelerating, particularly in the automotive sector, where the transition to electric vehicles (EVs) and the implementation of advanced driver-assistance systems (ADAS) necessitate high-performance and specialized semiconductor devices. Technological disruptions, such as the advancements in artificial intelligence (AI) and the Internet of Things (IoT), are creating new avenues for IC applications, driving demand for specialized processors and memory solutions. Consumer behavior shifts towards more connected and intelligent devices further amplify this trend. The report's analysis, leveraging predictive analytics and market intelligence, will detail how these factors translate into tangible market expansion. For example, the market penetration of microcontrollers in the automotive segment is expected to reach xx% by 2030. The increasing complexity of electronic systems in modern vehicles, coupled with the growing adoption of advanced driver-assistance systems (ADAS) and the electrification of powertrains, is a significant catalyst. Furthermore, the expansion of 5G infrastructure across Europe fuels the demand for high-speed communication ICs used in smartphones, network equipment, and IoT devices. The industrial sector's ongoing digital transformation, including the implementation of Industry 4.0 principles, is driving the demand for automation solutions powered by sophisticated microcontrollers and processors. Consumer electronics, a perennial strong performer, continues to see innovation in areas like wearables, smart home devices, and augmented/virtual reality (AR/VR) systems, all of which rely heavily on advanced ICs. The report will provide specific market size figures in Million units for each segment and end-user industry, offering a granular view of the market's expansion.

Dominant Regions, Countries, or Segments in Europe Integrated Circuits Market

The Europe Integrated Circuits Market exhibits regional and segmental dominance driven by distinct economic, technological, and policy factors. Germany consistently emerges as a leading country, owing to its robust automotive industry, strong manufacturing base, and significant investments in research and development, particularly in Automotive ICs and industrial automation. The Automotive end-user industry stands out as a primary growth engine, demanding high-performance Microprocessors (MPU) and Microcontrollers (MCU) for advanced functionalities, alongside specialized Analog ICs for power management and sensor applications.

- Leading Country: Germany, driven by its automotive and manufacturing sectors.

- Key Drivers: Strong automotive production, Industry 4.0 initiatives, and government support for R&D in semiconductors.

- Market Share (Automotive ICs): Estimated at xx% of the total European market in 2025.

- Dominant Segment (End-User Industry): Automotive.

- Growth Potential: Fueled by electrification, autonomous driving, and connectivity features.

- Demand for: High-performance MPUs, MCUs, and analog ICs for power management and sensor integration.

- Dominant Segment (Type): Analog ICs and Micro ICs (specifically Microcontrollers and Microprocessors).

- Analog ICs: Crucial for interfacing with the physical world, essential in automotive, industrial, and consumer electronics for signal conditioning, power management, and sensing.

- Micro ICs: Powering complex functionalities in vehicles, industrial machinery, and advanced consumer devices. The demand for sophisticated MCUs and MPUs is directly linked to the increasing complexity and computational needs of these applications.

- Key Drivers of Dominance:

- Economic Policies: Government incentives and regulations promoting domestic semiconductor production and innovation, such as the EU Chips Act.

- Infrastructure: Advanced automotive manufacturing facilities, robust industrial automation infrastructure, and widespread deployment of telecommunications networks.

- Technological Advancement: Leading research institutions and industrial players driving innovation in IC design and application.

Europe Integrated Circuits Market Product Landscape

The Europe Integrated Circuits Market product landscape is dynamic, characterized by continuous innovation and diversification. Manufacturers are focusing on developing highly integrated and specialized ICs tailored to specific applications. Key advancements include the development of ultra-low power Analog ICs for IoT devices and advanced power management ICs (PMICs) for longer battery life in portable consumer electronics. Logic ICs are evolving with increased speed and reduced power consumption for high-performance computing and communication systems. The Memory segment sees innovation in high-density and high-speed solutions, particularly for data-intensive applications. Within the Micro segment, Microprocessors (MPU) are becoming more powerful with multi-core architectures and AI acceleration capabilities, while Microcontrollers (MCU) are offering enhanced integration and real-time processing for embedded systems. Digital Signal Processors (DSP) are critical for audio, video, and communication processing, with ongoing improvements in efficiency and processing power. These product innovations are directly addressing the demands of the automotive sector for autonomous driving and infotainment, the consumer electronics market for smarter and more connected devices, and the manufacturing industry for enhanced automation and control.

Key Drivers, Barriers & Challenges in Europe Integrated Circuits Market

The Europe Integrated Circuits Market is propelled by several key drivers. Technological advancements in areas like AI, 5G, and IoT are creating unprecedented demand for sophisticated ICs. Government initiatives, notably the EU Chips Act, aim to bolster domestic semiconductor manufacturing and R&D, fostering a more resilient supply chain and encouraging innovation. The automotive industry's rapid transition towards electric vehicles and autonomous driving systems is a significant growth accelerator, demanding advanced ICs for performance, safety, and efficiency. The increasing adoption of automation in manufacturing and the expansion of smart cities also contribute to market growth.

- Key Drivers:

- Technological Advancements: AI, 5G, IoT, and Edge Computing integration.

- Government Initiatives: EU Chips Act and regional funding for semiconductor R&D and manufacturing.

- Automotive Sector Growth: Electrification, ADAS, and autonomous driving technologies.

- Industrial Automation: Industry 4.0 adoption and smart manufacturing.

Conversely, the market faces significant barriers and challenges. High capital expenditure required for leading-edge semiconductor fabrication facilities poses a substantial hurdle for new entrants and even established players. The global shortage of skilled labor in semiconductor design and manufacturing continues to be a pressing issue. Geopolitical uncertainties and supply chain disruptions, exacerbated by global events, create volatility and impact production timelines. Intense global competition from established Asian and North American players also presents a challenge for European manufacturers to gain market share.

- Barriers & Challenges:

- High Capital Expenditure: Requirement for advanced fabrication plants (fabs).

- Skilled Labor Shortage: Demand for specialized engineers and technicians.

- Supply Chain Volatility: Dependence on global raw materials and manufacturing processes.

- Intense Global Competition: From established players in Asia and North America.

- Regulatory Hurdles: Complex compliance requirements for product safety and environmental standards.

Emerging Opportunities in Europe Integrated Circuits Market

Emerging opportunities within the Europe Integrated Circuits Market are diverse and promising. The growing demand for edge AI applications presents a significant avenue for advanced processors and AI-specific ICs that enable on-device intelligence, reducing latency and improving privacy. The expansion of renewable energy technologies, such as advanced solar inverters and grid management systems, requires specialized power management and control ICs. Furthermore, the burgeoning Internet of Medical Things (IoMT) sector, driven by the need for remote patient monitoring and advanced diagnostic tools, is creating demand for low-power, high-precision sensors and communication ICs. The ongoing development of smart infrastructure, including smart grids and intelligent transportation systems, offers further opportunities for customized IC solutions. The increasing focus on sustainability and circular economy principles within the EU is also expected to drive demand for energy-efficient ICs and those manufactured using more sustainable processes.

Growth Accelerators in the Europe Integrated Circuits Market Industry

Several catalysts are accelerating the long-term growth of the Europe Integrated Circuits Market. The continued push for digital transformation across all industries, from healthcare to logistics, fuels the demand for increasingly sophisticated semiconductor solutions. Strategic partnerships between semiconductor manufacturers, research institutions, and end-user companies are fostering a collaborative ecosystem that drives innovation and accelerates product development cycles. Investments in advanced packaging technologies are crucial for enhancing IC performance, miniaturization, and power efficiency, directly addressing market needs. The strong emphasis on sustainability and energy efficiency within the European Union is also a significant growth driver, pushing for the development of ICs that minimize energy consumption. Market expansion strategies, including the development of specialized ICs for emerging applications and the strengthening of domestic manufacturing capabilities, will further solidify Europe's position in the global semiconductor landscape.

Key Players Shaping the Europe Integrated Circuits Market Market

- Intel Corporation

- Texas Instruments Inc

- Analog Devices Inc

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Microchip Technology Inc

- Renesas Electronics Corporation

- MediaTek Inc

Notable Milestones in Europe Integrated Circuits Market Sector

- June 2024: Asahi Kasei Microdevices launched a new line of integrated circuits (ICs) offering advanced capabilities in a more compact package than previous solutions. The CQ36 series of digital output coreless current sensor ICs caters to the growing robotics market. The series features a built-in Delta-Sigma (ΔΣ) modulator, enabling the IC to replace traditional shunt resistors and isolated analog-to-digital converters (ADCs) in a single package.

- May 2024: Apogee Semiconductor Inc. launched the AF54RHC GEO family of radiation-hardened integrated circuits (ICs) designed for MEO, GEO, and deep space missions. The AF54RHC GEO family features essential capabilities for GEO applications, including a required 300 krad (Si) total ionizing dose (TID) performance and greater than 80 MeV·mg/cm² single event effect (SEE) performance. These ICs operate from 1.65 V to 5.5 V and are available in TSSOP 14 and TSSOP 20-pin packages that follow a QML-P “like” flow.

In-Depth Europe Integrated Circuits Market Market Outlook

The Europe Integrated Circuits Market is set for a period of robust growth, underpinned by significant investments in R&D, supportive government policies, and strong demand from key industries. The EU Chips Act is a pivotal factor, expected to stimulate substantial growth in European semiconductor manufacturing and innovation, thereby reducing reliance on external supply chains. Emerging opportunities in areas like AI at the edge, advanced automotive electronics, and IoMT will drive the demand for specialized and high-performance ICs. Continued technological breakthroughs in areas such as heterogeneous integration and advanced packaging will further enhance the capabilities and competitiveness of European chip manufacturers. Strategic collaborations and the expansion of the semiconductor talent pool are crucial for sustaining this growth trajectory. The outlook indicates a market that is not only expanding in volume but also increasing in technological sophistication, solidifying its importance in the global digital economy.

Europe Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

- 1.4.3. Digital Signal Processors

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunications

- 2.4. Manufacturing & Automation

- 2.5. Other En

Europe Integrated Circuits Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Integrated Circuits Market Regional Market Share

Geographic Coverage of Europe Integrated Circuits Market

Europe Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Penetration of Smartphones

- 3.2.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1 Increasing Penetration of Smartphones

- 3.3.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.4. Market Trends

- 3.4.1. Memory Segment is Expected to Have a Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.1.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunications

- 5.2.4. Manufacturing & Automation

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intel Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Analog Devices Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NXP Semiconductors NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 On Semiconductor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microchip Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Renesas Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MediaTek Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Intel Corporation

List of Figures

- Figure 1: Europe Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Integrated Circuits Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Integrated Circuits Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Integrated Circuits Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Integrated Circuits Market?

The projected CAGR is approximately 7.83%.

2. Which companies are prominent players in the Europe Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, MediaTek Inc.

3. What are the main segments of the Europe Integrated Circuits Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

Memory Segment is Expected to Have a Significant Growth Rate.

7. Are there any restraints impacting market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

8. Can you provide examples of recent developments in the market?

June 2024: Asahi Kasei Microdevices launched a new line of integrated circuits (ICs) offering advanced capabilities in a more compact package than previous solutions. The CQ36 series of digital output coreless current sensor ICs caters to the growing robotics market. The series features a built-in Delta-Sigma (ΔΣ) modulator, enabling the IC to replace traditional shunt resistors and isolated analog-to-digital converters (ADCs) in a single package.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the Europe Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence