Key Insights

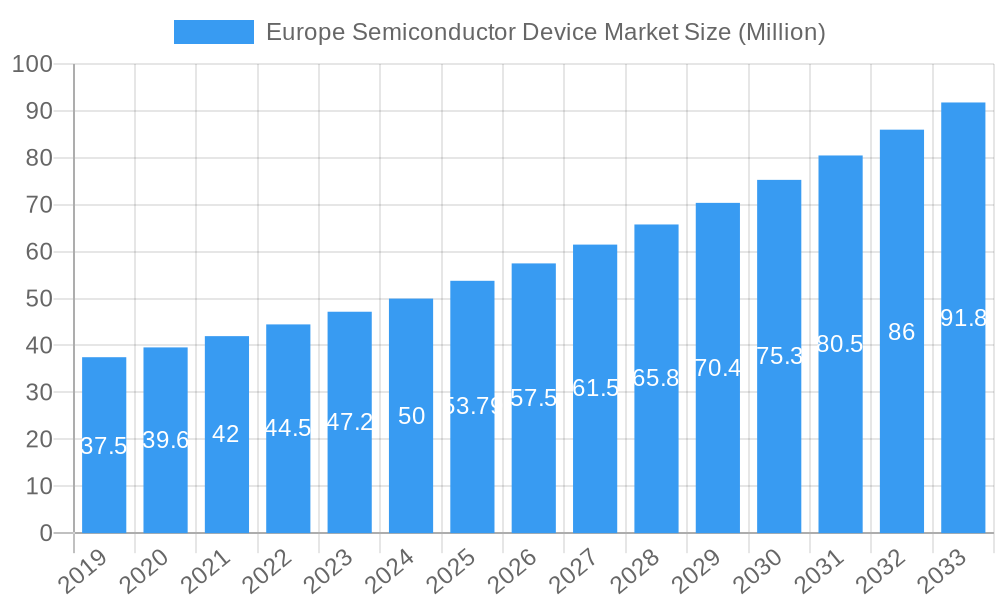

The Europe Semiconductor Device Market is poised for significant expansion, projected to reach USD 53.79 Billion by 2025. This growth is propelled by a robust CAGR of 6.24% over the forecast period, indicating sustained momentum driven by escalating demand across key end-user verticals. The automotive sector, in particular, is a major growth engine, fueled by the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), both of which are heavily reliant on sophisticated semiconductor solutions. Similarly, the burgeoning communication sector, encompassing 5G rollout and IoT deployments, requires advanced processors, memory, and integrated circuits to support higher data speeds and increased connectivity. Consumer electronics, industrial automation, and computing/data storage segments further contribute to this upward trajectory, driven by innovation and the continuous need for more powerful and efficient semiconductor components.

Europe Semiconductor Device Market Market Size (In Million)

Emerging trends such as the miniaturization of devices, the development of AI-powered chips, and the growing emphasis on energy-efficient semiconductors are shaping the market landscape. While these trends present substantial opportunities, certain restraints, including supply chain volatilities and rising raw material costs, could pose challenges. Nevertheless, strategic investments in research and development, coupled with government initiatives to bolster domestic semiconductor manufacturing capabilities within Europe, are expected to mitigate these challenges. Key segments driving market growth include Integrated Circuits (ICs), particularly analog and logic ICs, and microcontrollers (MCUs) essential for embedded systems. The European market is characterized by the presence of major global players and a growing focus on specialized semiconductor solutions catering to specific industry needs.

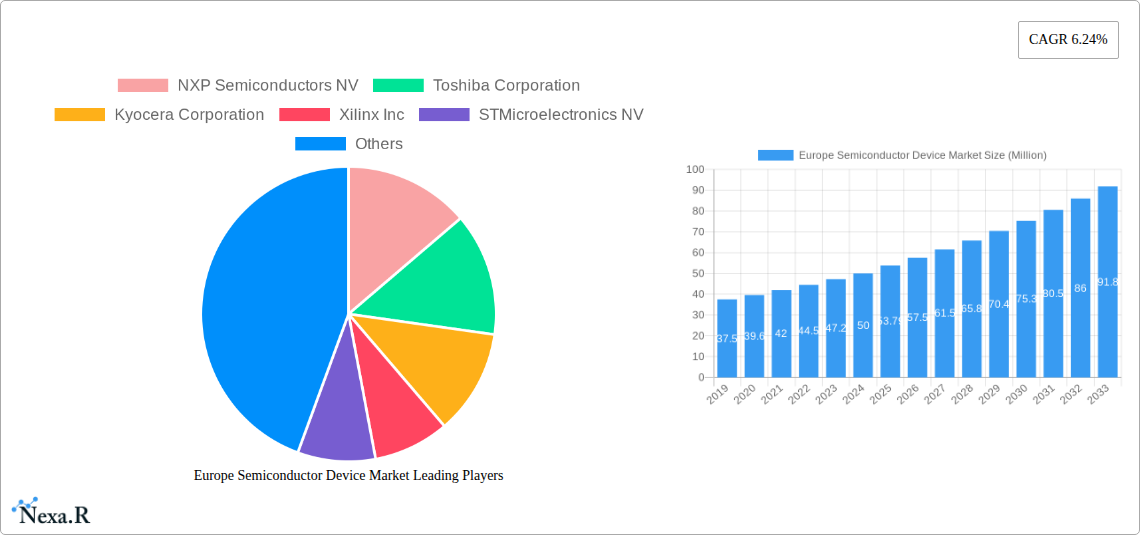

Europe Semiconductor Device Market Company Market Share

Europe Semiconductor Device Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report offers a definitive analysis of the Europe Semiconductor Device Market, providing critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study is essential for industry professionals seeking to understand and capitalize on the evolving European semiconductor ecosystem. With a focus on parent and child markets, this report delves into Discrete Semiconductors, Optoelectronics, Sensors and Actuators, Integrated Circuits (Analog, Logic, Memory), and Micro (Microprocessors (MPU), Microcontrollers (MCU), Digital Signal Processors), examining their interplay and individual growth trajectories. The analysis also thoroughly scrutinizes key end-user verticals including Automotive, Communication (Wired and Wireless), Consumer, Industrial, Computing/Data Storage, and Other End Users, identifying their specific demands and contributions to market expansion. All values are presented in Million units.

Europe Semiconductor Device Market Market Dynamics & Structure

The Europe Semiconductor Device Market is characterized by a moderately concentrated structure, with key global players like Intel Corporation, NXP Semiconductors NV, and STMicroelectronics NV holding significant market share. Technological innovation remains the primary driver, fueled by ongoing advancements in AI, IoT, 5G, and electric vehicles, necessitating the development of more powerful, energy-efficient, and specialized semiconductor solutions. Regulatory frameworks, particularly the European Chips Act, are increasingly influencing the market by encouraging domestic production and R&D investment, aiming to reduce reliance on external supply chains. While direct competitive product substitutes are limited within specific semiconductor categories, advancements in alternative technologies or materials can pose indirect threats. End-user demographics are shifting, with a growing demand for semiconductors in the automotive and industrial sectors, driven by autonomous driving technologies and smart manufacturing initiatives. Mergers and acquisitions (M&A) are a notable trend, with companies strategically consolidating to enhance their product portfolios, expand their geographical reach, and gain access to new technologies. The European Union's commitment to bolstering its semiconductor manufacturing capabilities through strategic investments and partnerships underscores a growing emphasis on supply chain resilience and technological sovereignty. For instance, the European Semiconductor Manufacturing Company (ESMC) initiative signifies a concerted effort to establish advanced fabrication capabilities.

- Market Concentration: Moderately concentrated with dominant global players.

- Key Innovation Drivers: AI, IoT, 5G, Electric Vehicles, Advanced Computing.

- Regulatory Influence: European Chips Act promoting domestic production and R&D.

- End-User Shift: Increasing demand from Automotive and Industrial sectors.

- M&A Trends: Strategic consolidations for portfolio expansion and technology access.

- Investment in Manufacturing: Initiatives like ESMC to enhance European semiconductor capacity.

Europe Semiconductor Device Market Growth Trends & Insights

The Europe Semiconductor Device Market is poised for robust growth, driven by a confluence of technological advancements and strategic initiatives aimed at bolstering the region's semiconductor manufacturing capabilities. The market size is projected to witness a significant expansion over the forecast period, propelled by increasing adoption rates of advanced technologies across various end-user verticals. The burgeoning demand for sophisticated semiconductors in the automotive sector, particularly for electric vehicles (EVs), autonomous driving systems, and advanced driver-assistance systems (ADAS), is a primary growth accelerator. Similarly, the communication sector, with the ongoing rollout of 5G networks and the proliferation of connected devices, requires high-performance and specialized integrated circuits. The industrial sector is also experiencing a semiconductor renaissance, driven by the adoption of Industry 4.0 principles, automation, and the Industrial Internet of Things (IIoT), which necessitate intelligent sensors, microcontrollers, and power management ICs. Consumer electronics continue to be a significant market, with demand for more powerful processors and memory in smartphones, wearables, and smart home devices.

Technological disruptions, such as the miniaturization of components, the development of novel materials like gallium nitride (GaN) and silicon carbide (SiC) for power electronics, and advancements in AI-driven chip design, are further fueling market growth. Consumer behavior shifts towards more connected and data-intensive experiences are also driving demand for advanced semiconductor solutions. The European Union's proactive policies, including the European Chips Act, are instrumental in stimulating investment in research, development, and manufacturing infrastructure, fostering a more self-sufficient and innovative semiconductor ecosystem within the region. This is expected to lead to increased production of cutting-edge semiconductor devices, catering to both domestic and global demand. The market penetration of advanced semiconductor technologies is anticipated to deepen across all key verticals, reflecting a sustained upward trend in market size. Specific metrics such as Compound Annual Growth Rate (CAGR) will be elaborated in the full report to provide a granular understanding of this expansion. The overarching trend indicates a dynamic and rapidly evolving market, characterized by continuous innovation and increasing demand for high-performance semiconductor solutions. The integration of semiconductors into everyday life, from advanced medical devices to smart grids, underscores their foundational role in future technological progress. The European Semiconductor Manufacturing Company (ESMC), a joint venture involving major industry players, exemplifies the strategic intent to strengthen the European manufacturing base.

Dominant Regions, Countries, or Segments in Europe Semiconductor Device Market

The Europe Semiconductor Device Market exhibits strong growth driven by several key regions, countries, and specific market segments. Geographically, Germany stands out as a dominant country due to its robust automotive industry and significant manufacturing base, which are major consumers of advanced semiconductor devices. Its commitment to research and development, coupled with substantial investments in semiconductor manufacturing facilities, positions it as a leader. The automotive end-user vertical is a paramount driver of growth across Europe, demanding a wide array of semiconductors including microcontrollers (MCUs), microprocessors (MPUs), sensors and actuators, and discrete semiconductors for power management and safety systems. The increasing electrification of vehicles, the pursuit of autonomous driving, and the integration of advanced infotainment systems necessitate a continuous supply of high-performance and specialized chips.

Within the Device Type segmentation, Integrated Circuits (ICs), particularly Analog ICs and Microcontrollers (MCUs), are experiencing substantial demand. Analog ICs are crucial for signal processing and power management in virtually all electronic devices, while MCUs are the brains behind countless embedded systems, from engine control units in cars to industrial automation equipment. The Micro segment, encompassing Microprocessors (MPUs) and Microcontrollers (MCUs), is also a significant contributor, powering the increasing computational needs of modern applications.

- Dominant Country: Germany, due to its strong automotive sector and manufacturing capabilities.

- Key End-User Vertical: Automotive, driven by electrification, autonomous driving, and ADAS.

- Dominant Device Type Segment: Integrated Circuits (ICs), specifically Analog ICs and Microcontrollers (MCUs).

- Growth Drivers in Germany: Strong automotive demand, government incentives for R&D and manufacturing, and established industrial infrastructure.

- Market Share & Growth Potential: Germany is expected to maintain a significant market share, with high growth potential in specialized automotive and industrial semiconductor applications. The increasing focus on cybersecurity within automotive systems also drives demand for secure MCUs and processors.

The Industrial end-user vertical is another pivotal segment, fueled by the adoption of Industry 4.0, smart factories, and automation. This sector requires a broad spectrum of semiconductors, including sensors for data acquisition, MCUs for control systems, and power discretes for efficient energy management. The push for energy efficiency and sustainability in industrial processes further amplifies the demand for advanced semiconductor solutions. Countries like France and Italy are also significant contributors to the market, with strong industrial and automotive sectors respectively. The communication sector, driven by the ongoing deployment of 5G infrastructure and the expansion of IoT devices, is also a major consumer of high-frequency components, processors, and memory chips. The European Union's collective efforts, through initiatives like the European Chips Act, are designed to strengthen manufacturing capabilities across the continent, leading to a more balanced and resilient supply chain and potentially boosting the dominance of European-based manufacturing.

Europe Semiconductor Device Market Product Landscape

The Europe Semiconductor Device Market is witnessing a dynamic product landscape characterized by relentless innovation and increasing specialization. Manufacturers are focusing on developing high-performance, energy-efficient, and compact semiconductor solutions to meet the evolving demands of advanced applications. Key product innovations include the proliferation of Gallium Nitride (GaN) and Silicon Carbide (SiC) power semiconductors, which offer superior efficiency and higher operating temperatures for applications in electric vehicles, renewable energy systems, and industrial power supplies. Furthermore, there's a growing emphasis on advanced microcontrollers (MCUs) with integrated AI capabilities for edge computing, enabling intelligent decision-making closer to the data source. The development of highly integrated System-on-Chips (SoCs) for communication devices, featuring enhanced processing power and connectivity options, is also a significant trend. Applications range from sophisticated automotive safety systems and advanced driver-assistance systems (ADAS) to next-generation communication infrastructure and intelligent industrial automation.

Key Drivers, Barriers & Challenges in Europe Semiconductor Device Market

Key Drivers:

The Europe Semiconductor Device Market is primarily propelled by the burgeoning demand for semiconductors in the automotive sector, driven by the rapid adoption of electric vehicles, autonomous driving technologies, and advanced infotainment systems. The ongoing digital transformation across industries, including manufacturing and healthcare, fuels the need for industrial automation, IoT devices, and advanced computing solutions. The strategic initiatives like the European Chips Act are a significant catalyst, incentivizing domestic production, research, and development, thereby fostering innovation and reducing supply chain dependencies. The advancement of 5G technology and the expansion of the Internet of Things (IoT) ecosystem further create substantial demand for high-performance connectivity and processing chips.

Barriers & Challenges:

A significant challenge facing the Europe Semiconductor Device Market is the high cost of semiconductor manufacturing, particularly for leading-edge nodes, requiring substantial capital investment and advanced infrastructure. Global supply chain vulnerabilities, highlighted by recent disruptions, continue to pose a risk, impacting raw material availability and production timelines. Intense global competition, especially from established Asian and American players, presents a continuous challenge for European manufacturers. Talent shortages in specialized engineering and manufacturing roles can hinder expansion and innovation efforts. Navigating complex and evolving regulatory landscapes across different European countries can also create hurdles.

Emerging Opportunities in Europe Semiconductor Device Market

Emerging opportunities in the Europe Semiconductor Device Market lie in the continued growth of specialized power semiconductors for the burgeoning electric vehicle (EV) and renewable energy sectors, with GaN and SiC technologies poised for significant expansion. The increasing demand for edge AI processing capabilities in industrial automation, smart cities, and autonomous systems presents a lucrative avenue for advanced microcontrollers and specialized AI accelerators. The ongoing development of next-generation communication technologies beyond 5G, such as 6G, will necessitate innovative semiconductor solutions for higher bandwidth and lower latency. Furthermore, there is a growing opportunity in secure semiconductor design and manufacturing to address escalating cybersecurity concerns across all end-user verticals, aligning with the EU's focus on digital sovereignty.

Growth Accelerators in the Europe Semiconductor Device Market Industry

Several key catalysts are accelerating growth within the Europe Semiconductor Device Market. The strong and consistent demand from the automotive sector, driven by electrification and autonomous technologies, is a primary growth accelerator. Significant government support and funding, as exemplified by the European Chips Act, are critical in fostering innovation, expanding manufacturing capacity, and attracting investment. Strategic partnerships and collaborations between semiconductor manufacturers, research institutions, and end-users are crucial for accelerating product development and market adoption. The continuous drive towards miniaturization and increased performance in consumer electronics and computing also fuels demand for advanced semiconductor components.

Key Players Shaping the Europe Semiconductor Device Market Market

- NXP Semiconductors NV

- Toshiba Corporation

- Kyocera Corporation

- Xilinx Inc

- STMicroelectronics NV

- Qualcomm Incorporated

- Samsung Electronics Co Ltd

- ON Semiconductor Corporation

- Nvidia Corporation

- Intel Corporation

Notable Milestones in Europe Semiconductor Device Market Sector

- April 2024: Infineon Technologies AG inks a multi-year collaboration with Amkor Technology, Inc. to bolster its outsourced backend manufacturing presence in Europe, jointly operating a specialized packaging and testing facility at Amkor's Porto manufacturing hub.

- August 2023: TSMC, Robert Bosch GmbH, Infineon Technologies AG, and NXP Semiconductors N.V. announce plans to invest in the European Semiconductor Manufacturing Company (ESMC) GmbH in Dresden, Germany, to enhance cutting-edge semiconductor manufacturing services, particularly for the automotive and industrial sectors. This initiative is contingent on public funding and falls under the European Chips Act.

In-Depth Europe Semiconductor Device Market Market Outlook

The Europe Semiconductor Device Market is set for a period of sustained growth, driven by a robust combination of technological advancements and strategic governmental support. The automotive industry's relentless pursuit of electrification and autonomous capabilities will continue to be a dominant force, creating significant demand for sophisticated semiconductor components. Government initiatives, such as the European Chips Act, are crucial for bolstering local manufacturing capabilities, fostering innovation, and ensuring a more resilient supply chain. Emerging opportunities in edge AI, advanced connectivity, and secure semiconductor solutions will further shape the market's trajectory. Strategic partnerships and continuous R&D investment will be paramount for companies seeking to maintain a competitive edge and capitalize on the evolving technological landscape, promising a dynamic and expansionary outlook for the European semiconductor ecosystem.

Europe Semiconductor Device Market Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors and Actuators

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.5. Micro

- 1.5.1. Microprocessors (MPU)

- 1.5.2. Microcontrollers (MCU)

- 1.5.3. Digital Signal Processors

-

2. End-user Vertical

- 2.1. Automotive

- 2.2. Communication (Wired and Wireless)

- 2.3. Consumer

- 2.4. Industrial

- 2.5. Computing/Data Storage

- 2.6. Other End Users

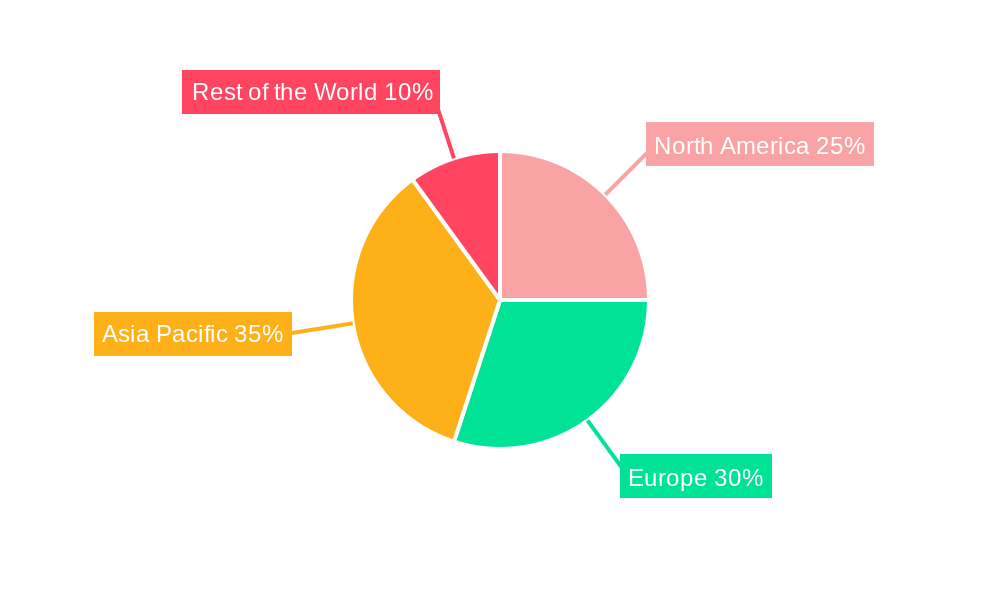

Europe Semiconductor Device Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Semiconductor Device Market Regional Market Share

Geographic Coverage of Europe Semiconductor Device Market

Europe Semiconductor Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Technologies like IoT and AI; Rising Demand for Consumer Electronics Goods

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Rising Demand for Consumer Electronics Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Semiconductor Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors and Actuators

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.5. Micro

- 5.1.5.1. Microprocessors (MPU)

- 5.1.5.2. Microcontrollers (MCU)

- 5.1.5.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Automotive

- 5.2.2. Communication (Wired and Wireless)

- 5.2.3. Consumer

- 5.2.4. Industrial

- 5.2.5. Computing/Data Storage

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NXP Semiconductors NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kyocera Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xilinx Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qualcomm Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung Electronics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ON Semiconductor Corporatio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nvidia Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 NXP Semiconductors NV

List of Figures

- Figure 1: Europe Semiconductor Device Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Semiconductor Device Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Semiconductor Device Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Europe Semiconductor Device Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Europe Semiconductor Device Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Semiconductor Device Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 5: Europe Semiconductor Device Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Europe Semiconductor Device Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Semiconductor Device Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Europe Semiconductor Device Market?

Key companies in the market include NXP Semiconductors NV, Toshiba Corporation, Kyocera Corporation, Xilinx Inc, STMicroelectronics NV, Qualcomm Incorporated, Samsung Electronics Co Ltd, ON Semiconductor Corporatio, Nvidia Corporation, Intel Corporation.

3. What are the main segments of the Europe Semiconductor Device Market?

The market segments include Device Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Technologies like IoT and AI; Rising Demand for Consumer Electronics Goods.

6. What are the notable trends driving market growth?

Rising Demand for Consumer Electronics Goods.

7. Are there any restraints impacting market growth?

Lack of Awareness.

8. Can you provide examples of recent developments in the market?

April 2024 - Infineon Technologies AG, a prominent player in power systems and IoT, is bolstering its outsourced backend manufacturing presence in Europe. The company has unveiled a strategic, multi-year collaboration with Amkor Technology, Inc., a key player in semiconductor packaging and testing. As part of this partnership, both entities will jointly run a specialized packaging and testing facility at Amkor's Porto manufacturing hub.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Semiconductor Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Semiconductor Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Semiconductor Device Market?

To stay informed about further developments, trends, and reports in the Europe Semiconductor Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence