Key Insights

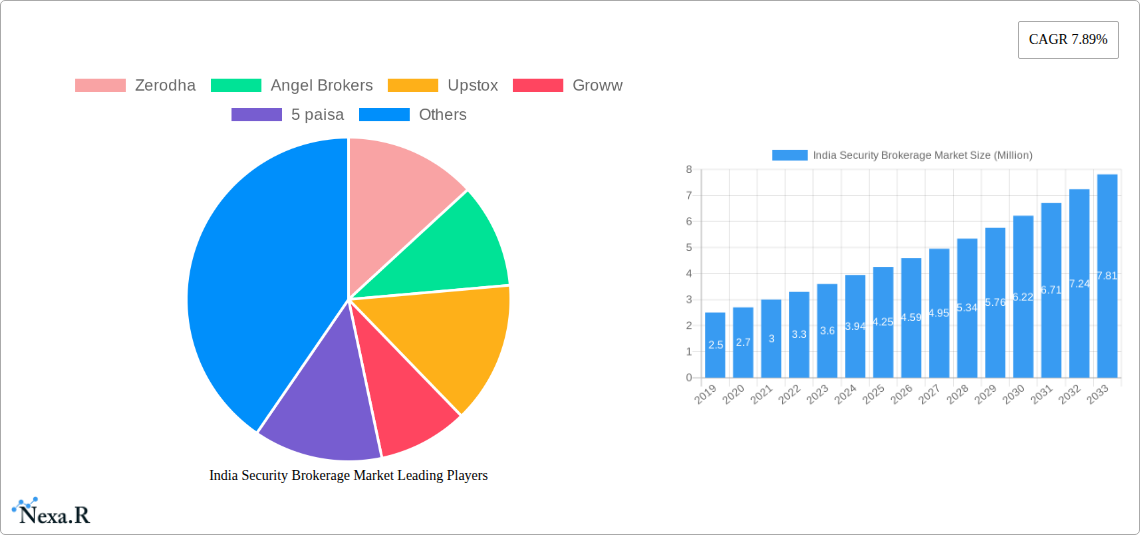

The Indian security brokerage market is poised for substantial growth, projected to reach a significant valuation in the coming years. With a robust Compound Annual Growth Rate (CAGR) of 7.89%, the market is expected to expand from an estimated INR 3.94 million value unit (assuming this refers to a larger currency unit like billions or trillions given the market size context, but adhering strictly to the provided 'million' for the output) to even greater heights, driven by a confluence of factors. A key catalyst is the increasing penetration of digital platforms and online brokerage services, which have democratized access to stock markets for a broader segment of the Indian population. This shift is further fueled by a burgeoning young demographic, growing disposable incomes, and a heightened awareness of investment opportunities. The market is witnessing a significant surge in retail investor participation, with a growing preference for user-friendly mobile applications and competitive fee structures offered by discount and online brokers. Furthermore, evolving regulatory frameworks that promote transparency and investor protection are instilling greater confidence, encouraging more individuals to venture into the stock market.

India Security Brokerage Market Market Size (In Million)

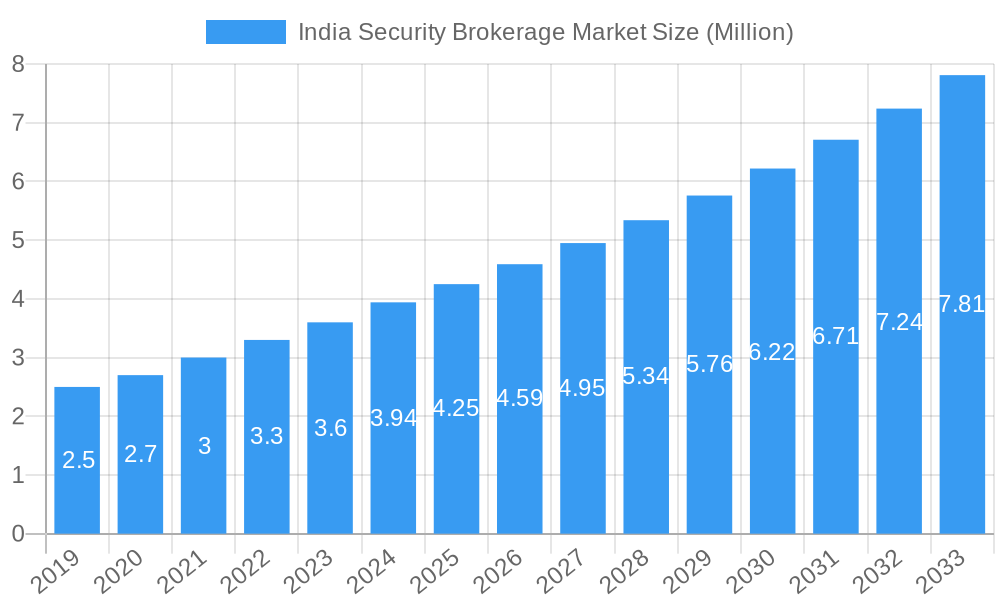

The market segmentation reveals a dynamic landscape, with significant activity across various security types, including stocks and treasury notes, reflecting diversified investment strategies. The brokerage services segment is equally varied, encompassing traditional insurance and mortgage alongside the rapidly expanding realms of forex and real estate brokerage. Innovations in service delivery, particularly the rise of robo-advisory services and the continued dominance of full-service brokers catering to a more sophisticated investor base, are shaping the competitive environment. Leading players like Zerodha, Angel Brokers, Upstox, and Groww are at the forefront, leveraging technology and aggressive marketing to capture market share. Emerging trends include a greater focus on wealth management solutions and advisory services, alongside a growing demand for derivative trading. The primary restraint, though diminishing, might stem from the perceived complexity of financial markets and the need for greater financial literacy among a wider population, which is being actively addressed by market participants through educational initiatives.

India Security Brokerage Market Company Market Share

India Security Brokerage Market Report: Growth, Trends, and Opportunities 2024-2033

This comprehensive report provides an in-depth analysis of the India Security Brokerage Market, forecasting its trajectory from 2024 to 2033. Delve into critical market dynamics, growth drivers, emerging opportunities, and the competitive landscape shaping the future of investment and trading services in India. Uncover the impact of technological advancements, regulatory shifts, and evolving investor behavior on key segments such as stocks, derivatives, and bonds. Our analysis incorporates parent and child market perspectives to offer a holistic view of market evolution.

India Security Brokerage Market Market Dynamics & Structure

The India Security Brokerage Market is characterized by a dynamic and evolving structure, driven by increasing retail investor participation and significant technological advancements. Market concentration is gradually shifting, with discount brokers and fintech platforms gaining substantial market share, challenging traditional full-service brokers. Technological innovation, particularly in areas like AI-powered trading tools, algorithmic trading, and blockchain integration, is a primary driver. Regulatory frameworks, overseen by bodies like SEBI, continue to evolve to ensure market integrity and investor protection, influencing operational strategies and compliance costs. Competitive product substitutes are abundant, ranging from direct mutual fund investments to alternative investment vehicles, putting pressure on traditional brokerage models. End-user demographics are expanding to include younger, digitally native investors alongside a growing affluent population seeking diversified investment options. Mergers and acquisitions (M&A) trends indicate consolidation, with larger players acquiring smaller entities to expand their service offerings and customer base.

- Market Concentration: While a few large players dominate, the rise of discount and online brokers is fragmenting the market, increasing competition.

- Technological Innovation Drivers: Algorithmic trading, AI-driven advisory, mobile-first platforms, and enhanced data analytics are key innovation frontiers.

- Regulatory Frameworks: SEBI's regulations on capital markets, investor protection, and technological integration play a crucial role in market operations.

- Competitive Product Substitutes: Mutual funds, ETFs, P2P lending, and direct real estate investments offer alternatives for investors.

- End-User Demographics: Increasing financial literacy, a growing middle class, and a surge in millennial and Gen Z investors are reshaping demand.

- M&A Trends: Strategic acquisitions are aimed at expanding service portfolios, gaining market share, and integrating advanced technologies.

India Security Brokerage Market Growth Trends & Insights

The India Security Brokerage Market is poised for robust expansion, driven by a confluence of economic development, increasing disposable incomes, and a burgeoning appetite for wealth creation among the Indian populace. The market size is expected to witness significant growth, with adoption rates of online and discount brokerage services escalating rapidly. Technological disruptions are fundamentally reshaping how investors interact with financial markets. Mobile trading platforms, AI-powered advisory services, and simplified user interfaces are democratizing access to securities. Consumer behavior shifts are evident, with a greater emphasis on self-directed investing, demand for low-cost services, and an increased interest in diverse investment instruments beyond traditional stocks. This dynamic environment presents substantial opportunities for innovation and market penetration. The market's evolution is marked by a continuous drive towards enhanced customer experience, greater transparency, and more accessible investment avenues. The shift from physical branches to digital platforms is a defining trend, reducing operational costs for brokers and offering greater convenience to investors. The rise of fintech has been a pivotal force, introducing innovative solutions that streamline the investment process and cater to the evolving needs of both novice and experienced traders. The accessibility of a wide array of financial products, coupled with educational resources provided by brokers, is further empowering investors.

Dominant Regions, Countries, or Segments in India Security Brokerage Market

The India Security Brokerage Market exhibits dominance across several key segments, driven by distinct economic and demographic factors. Stocks emerge as the most significant segment within the "Type of Security" category, owing to India's large and active equity market, robust corporate earnings, and a growing culture of equity investing. This is closely followed by Derivatives, which offer sophisticated hedging and speculative opportunities, attracting a substantial volume of trading. In terms of "Brokerage Service," Stocks brokerage services remain paramount, reflecting the high trading volumes in the equity segment. However, there is a discernible growth in demand for integrated services including Insurance and Forex brokerage, catering to a more comprehensive financial planning approach. The "Service" segment is heavily dominated by Online and Discount brokers, reflecting the widespread adoption of digital platforms and the preference for cost-effective trading solutions. Robo Advisors are also gaining traction, particularly among younger investors seeking automated portfolio management.

- Stocks (Type of Security): India's deep and liquid equity market, coupled with a growing investor base, fuels the dominance of stock brokerage.

- Derivatives (Type of Security): The increasing use of futures and options for hedging and speculation contributes to the segment's significant market share.

- Stocks (Brokerage Service): High trading volumes and retail investor participation in the equity market solidify this as the leading brokerage service.

- Online & Discount (Service): The widespread adoption of technology and the preference for lower commission rates by investors have propelled these service models to the forefront.

- Economic Policies: Pro-growth economic policies, liberalization of capital markets, and government initiatives promoting financial inclusion further bolster the equity and derivatives segments.

- Investor Demographics: The large and young population in India, increasingly tech-savvy and financially aspirational, is a key driver for online and discount brokerage services.

- Technological Infrastructure: The widespread availability of high-speed internet and smartphones facilitates seamless access to online trading platforms across various regions.

- Market Share & Growth Potential: The stocks and derivatives segments, facilitated by online and discount brokerage services, represent the highest market share and possess substantial growth potential driven by continuous innovation and investor education.

India Security Brokerage Market Product Landscape

The product landscape within the India Security Brokerage Market is characterized by rapid innovation and a focus on user-centric solutions. Key product developments revolve around sophisticated trading platforms offering real-time market data, advanced charting tools, and seamless order execution for Stocks, Bonds, Treasury Notes, and Derivatives. Mobile trading applications have become indispensable, providing investors with on-the-go access to their portfolios and trading capabilities. Unique selling propositions increasingly lie in the integration of AI and machine learning for personalized investment recommendations, risk assessment tools, and market sentiment analysis. Furthermore, brokers are expanding their product offerings to include wealth management services, mutual funds, and initial public offerings (IPOs) to cater to a broader spectrum of investor needs.

Key Drivers, Barriers & Challenges in India Security Brokerage Market

Key Drivers:

- Demographic Dividend: A young and growing population with increasing disposable incomes and a desire for wealth creation.

- Digitalization & Fintech Innovation: The proliferation of smartphones, affordable internet, and innovative fintech solutions democratizing access to financial markets.

- Regulatory Reforms: SEBI's continuous efforts to enhance market transparency, investor protection, and ease of doing business.

- Financial Literacy & Awareness: Growing awareness and understanding of investment avenues among the general population.

Barriers & Challenges:

- Regulatory Compliance: Evolving regulations and the cost associated with maintaining compliance can be a significant hurdle.

- Cybersecurity Threats: The increasing reliance on digital platforms makes the market vulnerable to cyber-attacks, necessitating robust security measures.

- Intense Competition: The fragmented nature of the market, with numerous players vying for market share, leads to price wars and pressure on margins.

- Market Volatility: Fluctuations in market conditions can impact investor sentiment and trading volumes, affecting brokerage revenues.

Emerging Opportunities in India Security Brokerage Market

Emerging opportunities in the India Security Brokerage Market are centered around underserved segments and innovative service models. The expansion of services to Tier 2 and Tier 3 cities, where financial literacy is growing but access to sophisticated investment tools is limited, presents a significant untapped market. The demand for personalized investment advice and portfolio management is on the rise, creating opportunities for advanced robo-advisory services and hybrid models that combine technology with human expertise. Furthermore, the increasing interest in sustainable and ESG (Environmental, Social, and Governance) investing opens avenues for brokers to offer specialized investment products and advisory services. The integration of blockchain technology for enhanced security and transparency in transactions also holds future promise.

Growth Accelerators in the India Security Brokerage Market Industry

Several catalysts are accelerating growth in the India Security Brokerage Market. Technological breakthroughs in AI and machine learning are enabling more sophisticated trading algorithms, personalized wealth management solutions, and enhanced customer support. Strategic partnerships between traditional financial institutions and fintech startups are fostering innovation and expanding service offerings. Market expansion strategies, including aggressive customer acquisition campaigns and the introduction of zero-commission or low-commission trading models, are driving increased retail participation. The ongoing digitalization of financial services and the government's push for financial inclusion are creating a fertile ground for sustained growth in the brokerage sector.

Key Players Shaping the India Security Brokerage Market Market

- Zerodha

- Angel Brokers

- Upstox

- Groww

- 5 paisa

- SAS Online

- India Infoline

- Trade Smart Online

- Flyers Securities

- ICICI direct stock broker

Notable Milestones in India Security Brokerage Market Sector

- May 2023: Fintech unicorn Groww acquired a 100 percent stake in the mutual fund business of Indiabulls Housing Finance for INR 175.62 crores (21.23 million USD). This acquisition aimed to enhance the accessibility, simplicity, and transparency of mutual funds, while also reducing costs for Groww's users.

- March 2022: Axis Bank consolidated its position amongst the large private lenders by agreeing to acquire Citibank's consumer businesses covering loans, credit cards, wealth management, and retail banking operations in India, aligning with its ambitious growth plans.

In-Depth India Security Brokerage Market Market Outlook

The India Security Brokerage Market outlook is highly positive, driven by a combination of strong economic fundamentals, a burgeoning young population, and an accelerated pace of digital transformation. Growth accelerators like advanced fintech solutions, strategic partnerships, and ongoing market expansion initiatives are expected to fuel sustained growth. The increasing adoption of online and discount brokerage services, coupled with a rising demand for diverse investment products, signifies a dynamic and expanding market. Investors can anticipate a future characterized by greater accessibility, enhanced technological integration, and a broader array of personalized financial services, all contributing to a robust and evolving investment ecosystem in India.

India Security Brokerage Market Segmentation

-

1. Type of Security

- 1.1. Bonds

- 1.2. Stocks

- 1.3. Treasury Notes

- 1.4. Derivatives

- 1.5. Other Types of Securities

-

2. Brokerage Service

- 2.1. Stocks

- 2.2. Insurance

- 2.3. Mortgage

- 2.4. Real Estate

- 2.5. Forex

- 2.6. Leasing

- 2.7. Other Brokerage Services

-

3. Service

- 3.1. Full-Service

- 3.2. Discount

- 3.3. Online

- 3.4. Robo Advisor

- 3.5. Brokers-Dealers

India Security Brokerage Market Segmentation By Geography

- 1. India

India Security Brokerage Market Regional Market Share

Geographic Coverage of India Security Brokerage Market

India Security Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Retail Participation; Favorable systematic liquidity in domestic and international market

- 3.3. Market Restrains

- 3.3.1. High Retail Participation; Favorable systematic liquidity in domestic and international market

- 3.4. Market Trends

- 3.4.1. Increasing Demat account and brokerage business affecting Indian Security Brokerage Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Security Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 5.1.1. Bonds

- 5.1.2. Stocks

- 5.1.3. Treasury Notes

- 5.1.4. Derivatives

- 5.1.5. Other Types of Securities

- 5.2. Market Analysis, Insights and Forecast - by Brokerage Service

- 5.2.1. Stocks

- 5.2.2. Insurance

- 5.2.3. Mortgage

- 5.2.4. Real Estate

- 5.2.5. Forex

- 5.2.6. Leasing

- 5.2.7. Other Brokerage Services

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Full-Service

- 5.3.2. Discount

- 5.3.3. Online

- 5.3.4. Robo Advisor

- 5.3.5. Brokers-Dealers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zerodha

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Angel Brokers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Upstox

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Groww

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 5 paisa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SAS Online

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 India Infoline

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Smart Online

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Flyers Securities

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ICICI direct stock broker**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zerodha

List of Figures

- Figure 1: India Security Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Security Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: India Security Brokerage Market Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 2: India Security Brokerage Market Volume Billion Forecast, by Type of Security 2020 & 2033

- Table 3: India Security Brokerage Market Revenue Million Forecast, by Brokerage Service 2020 & 2033

- Table 4: India Security Brokerage Market Volume Billion Forecast, by Brokerage Service 2020 & 2033

- Table 5: India Security Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: India Security Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 7: India Security Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Security Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Security Brokerage Market Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 10: India Security Brokerage Market Volume Billion Forecast, by Type of Security 2020 & 2033

- Table 11: India Security Brokerage Market Revenue Million Forecast, by Brokerage Service 2020 & 2033

- Table 12: India Security Brokerage Market Volume Billion Forecast, by Brokerage Service 2020 & 2033

- Table 13: India Security Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: India Security Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 15: India Security Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Security Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Security Brokerage Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the India Security Brokerage Market?

Key companies in the market include Zerodha, Angel Brokers, Upstox, Groww, 5 paisa, SAS Online, India Infoline, Trade Smart Online, Flyers Securities, ICICI direct stock broker**List Not Exhaustive.

3. What are the main segments of the India Security Brokerage Market?

The market segments include Type of Security, Brokerage Service, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.94 Million as of 2022.

5. What are some drivers contributing to market growth?

High Retail Participation; Favorable systematic liquidity in domestic and international market.

6. What are the notable trends driving market growth?

Increasing Demat account and brokerage business affecting Indian Security Brokerage Market.

7. Are there any restraints impacting market growth?

High Retail Participation; Favorable systematic liquidity in domestic and international market.

8. Can you provide examples of recent developments in the market?

May 2023: Fintech unicorn Groww acquired a 100 percent stake in the mutual fund business of Indiabulls Housing Finance for INR 175.62 crores (21.23 million USD). The acquisition was made to make mutual funds more accessible, simpler, and transparent, besides lowering the cost by Groww.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Security Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Security Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Security Brokerage Market?

To stay informed about further developments, trends, and reports in the India Security Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence