Key Insights

The Indian dental insurance market is poised for remarkable growth, projected to reach USD 10.3 billion by 2025, driven by a robust CAGR of 16% over the forecast period. This significant expansion is fueled by increasing awareness of oral hygiene and its direct correlation with overall health. Growing disposable incomes, a burgeoning middle class, and a greater emphasis on preventive healthcare are key catalysts. The corporate sector's increasing adoption of comprehensive employee benefits, including dental coverage, further bolsters market penetration. Furthermore, the rising prevalence of dental ailments and the associated treatment costs are compelling individuals to seek financial protection, thereby accelerating the demand for dental insurance policies. The market's dynamism is further evident in the diverse range of offerings, catering to various needs through Dental Health Maintenance Organizations (DHMO), Dental Preferred Provider Organizations (DEPO), Dental Indemnity Plans (DIP), and Dental Point of Service (DPS) plans. The procedural segmentation also highlights the market's comprehensive nature, covering preventive, basic, and major dental procedures.

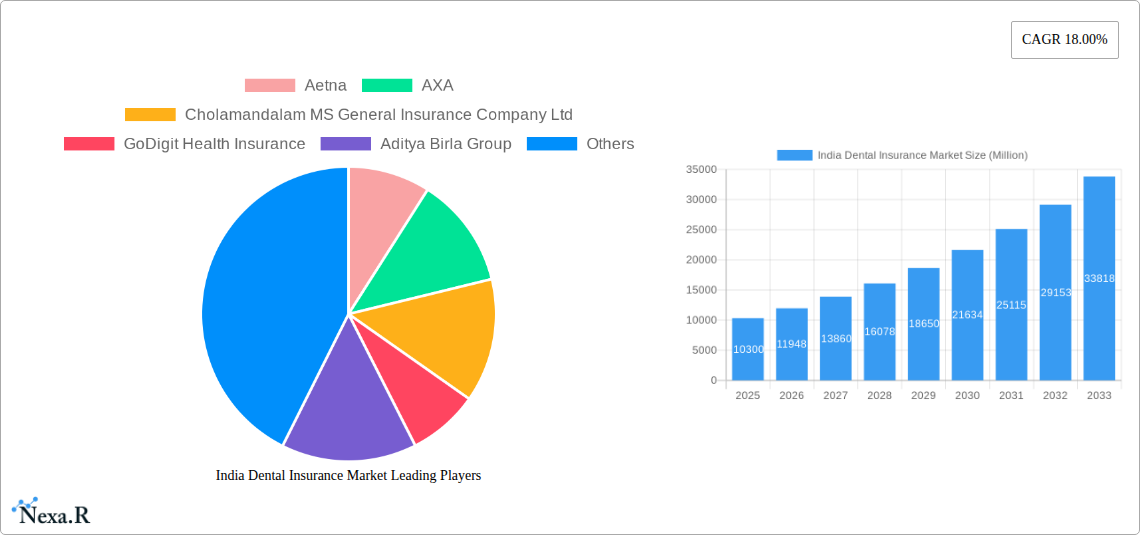

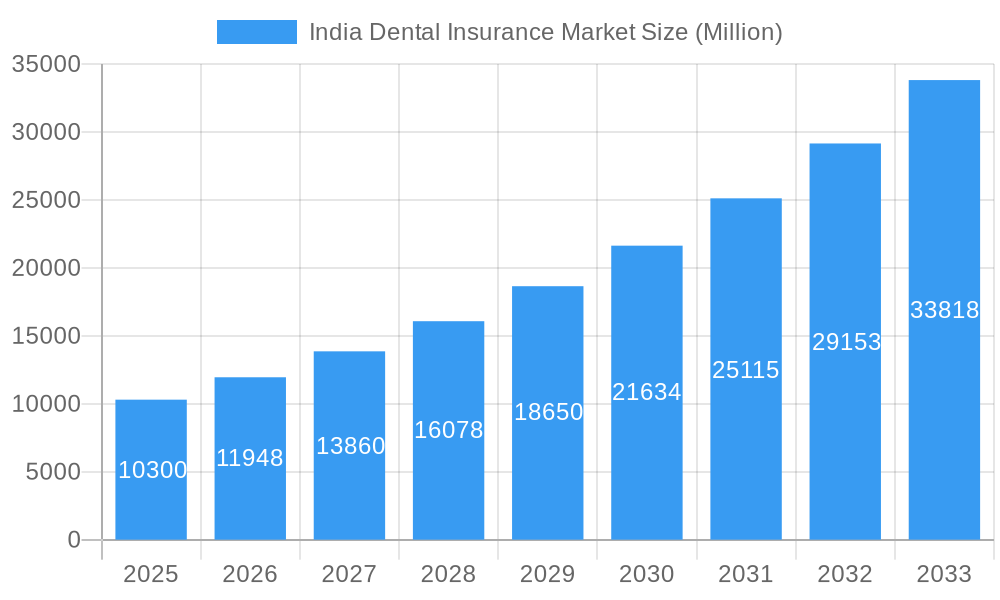

India Dental Insurance Market Market Size (In Billion)

The demographic landscape of India presents substantial opportunities, with senior citizens and minors emerging as significant customer segments due to their specific dental health needs. The expansion of dental healthcare infrastructure and the availability of advanced treatment options are also contributing factors to market growth. While the market enjoys strong tailwinds, potential restraints such as limited awareness in certain rural areas and the perceived high cost of premiums for some segments need to be strategically addressed by insurers. However, the consistent innovation in product design, including the introduction of customized plans and digital platforms for policy management and claims, is actively mitigating these challenges. Major insurance players like Aetna, AXA, Cholamandalam MS General Insurance Company Ltd, GoDigit Health Insurance, Aditya Birla Group, Delta Dental, Star Health & Allied Insurance, and others are actively vying for market share, fostering a competitive environment that benefits consumers with better products and services. This competitive landscape, coupled with favorable government initiatives promoting health insurance, paints a very promising picture for the future of dental insurance in India.

India Dental Insurance Market Company Market Share

India Dental Insurance Market: Comprehensive Market Analysis, Growth Prospects, and Competitive Landscape 2019-2033

This in-depth report provides an exhaustive analysis of the India Dental Insurance Market, meticulously forecasting its trajectory from 2019 to 2033. With the base year set at 2025, the report offers critical insights into market size, growth drivers, segmentation, competitive strategies, and future opportunities, essential for stakeholders navigating this rapidly evolving sector. The Indian dental insurance market, projected to reach $X.XX billion by 2033, is experiencing robust expansion driven by increasing oral health awareness and the growing demand for specialized healthcare coverage.

Companies Covered: Aetna, AXA, Cholamandalam MS General Insurance Company Ltd, GoDigit Health Insurance, Aditya Birla Group, Delta Dental, Star Health & Allied Insurance, Policy bazaar, Allianz, Humana Dental Insurance. (List Not Exhaustive)

Segments Covered:

- Coverage: Dental Health Maintenance Organizations (DHMO), Dental Preferred Provider Organization (DEPO), Dental Indemnity Plan (DIP), Dental Point of Service (DPS)

- Procedure: Preventive, Major, Basic

- End User: Individual, Corporates

- Demographics: Senior Citizen, Minors, Other Demographics

India Dental Insurance Market Market Dynamics & Structure

The India Dental Insurance Market exhibits a dynamic structure characterized by increasing competition and evolving consumer demands. Market concentration is gradually shifting as new entrants leverage digital platforms and innovative product offerings. Technological innovation plays a pivotal role, with advancements in data analytics and AI enabling personalized policy design and streamlined claims processing. The regulatory framework, guided by IRDAI, is becoming more conducive to standalone dental insurance products, fostering a growth environment. Competitive product substitutes, primarily out-of-pocket expenditure and general health insurance policies with limited dental coverage, are being increasingly challenged by comprehensive dental plans. End-user demographics, particularly the growing middle class and a rising awareness among senior citizens and minors about oral hygiene's long-term impact, are significantly shaping market penetration. Mergers and acquisitions (M&A) trends are anticipated to consolidate the market, with larger players potentially acquiring smaller, niche providers to expand their portfolio and reach.

- Market Concentration: Moderate concentration with increasing fragmentation due to new digital-first insurers.

- Technological Innovation Drivers: AI-powered diagnostics, personalized policy recommendations, blockchain for claims transparency.

- Regulatory Frameworks: IRDAI's supportive stance on standalone dental products and increased transparency measures.

- Competitive Product Substitutes: Out-of-pocket spending, general health insurance exclusions.

- End-User Demographics: Growing influence of the urban middle class and increased health consciousness across age groups.

- M&A Trends: Expected consolidation through strategic acquisitions to enhance market share and product diversification.

India Dental Insurance Market Growth Trends & Insights

The India Dental Insurance Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period (2025–2033), reaching an estimated $X.XX billion by 2033. This significant market size evolution is fueled by an increasing adoption rate of dental insurance as a distinct financial planning tool, moving beyond its traditional inclusion in broader health policies. Technological disruptions, including tele-dentistry and AI-driven diagnostic tools, are enhancing the perceived value and accessibility of dental care, thereby boosting insurance uptake. Consumer behavior shifts are evident, with a growing emphasis on preventive dental care and a proactive approach to managing oral health expenses. The market penetration, currently at XX.X%, is expected to climb as awareness campaigns and employer-sponsored programs gain traction. The increasing incidence of dental ailments, coupled with rising healthcare costs, further propels the demand for affordable and comprehensive dental coverage solutions. The parent market, encompassing overall healthcare insurance, provides a strong foundation, with the child market of dental insurance carving out a distinct and rapidly growing niche.

- Market Size Evolution: From an estimated $X.XX billion in 2025, projected to reach $X.XX billion by 2033.

- Adoption Rates: Steadily increasing as standalone dental plans gain prominence over bundled health insurance.

- Technological Disruptions: Tele-dentistry, AI for treatment planning, digital claims management.

- Consumer Behavior Shifts: Proactive approach to oral health, preference for preventive care, increased demand for specialized coverage.

- Market Penetration: Expected to grow from XX.X% in 2025 to XX.X% by 2033.

- CAGR: Projected at XX.X% from 2025 to 2033.

Dominant Regions, Countries, or Segments in India Dental Insurance Market

The India Dental Insurance Market's dominance is multifaceted, driven by specific regions, segments, and demographic groups. Within the coverage segment, Dental Preferred Provider Organization (DEPO) plans are expected to lead due to their balance of cost-effectiveness and provider choice, appealing to a broad spectrum of the population. In terms of procedures, Preventive care coverage is gaining significant traction, reflecting a growing emphasis on long-term oral health and reduced future treatment costs. The Individual end-user segment is anticipated to exhibit the strongest growth, fueled by increasing health literacy and a desire for personalized financial protection, though Corporates will remain a substantial contributor through employee benefits programs. Demographically, Other Demographics, encompassing the working-age population and young families, are poised to drive significant expansion, while Senior Citizens represent a growing segment with specific dental needs. Key economic policies promoting health and wellness, coupled with improving healthcare infrastructure in Tier 2 and Tier 3 cities, are instrumental in expanding the market's reach. The projected market share of the leading segment is estimated at XX.X% in 2025, with robust growth potential driven by these factors.

- Dominant Coverage: Dental Preferred Provider Organization (DEPO) plans are expected to lead, offering a balance of choice and cost.

- Key Procedure Focus: Preventive dental care coverage is a major growth driver, emphasizing long-term health.

- Leading End User: Individual segment to exhibit highest growth, followed by Corporate segment.

- Primary Demographic Driver: "Other Demographics" (working-age population, young families) are key, with Senior Citizens as a rapidly expanding segment.

- Growth Potential: Significant, particularly in urban and semi-urban areas with increasing disposable incomes.

- Market Share (Leading Segment): Estimated at XX.X% in 2025.

India Dental Insurance Market Product Landscape

The product landscape in the India Dental Insurance Market is characterized by an increasing array of specialized offerings designed to meet diverse consumer needs. Innovations are focused on providing comprehensive coverage for a wide range of dental procedures, from routine check-ups and cleanings to more complex treatments like root canals and orthodontics. Unique selling propositions often lie in the flexibility of policy terms, cashless claim settlements, and the inclusion of riders for specific advanced treatments. Technological advancements are enabling insurers to offer digital-first policy management, virtual consultations, and personalized health recommendations through mobile applications. Performance metrics for these products are evaluated based on claim settlement ratios, customer satisfaction scores, and the breadth of the dental network.

Key Drivers, Barriers & Challenges in India Dental Insurance Market

Key Drivers:

- Rising Oral Health Awareness: Increased understanding of the link between oral health and overall well-being.

- Growing Disposable Incomes: Enabling individuals to invest more in healthcare protection.

- Employer-Sponsored Programs: Corporates increasingly offering dental insurance as an employee benefit.

- Technological Advancements: Digital platforms and tele-dentistry improving accessibility and affordability.

- Government Initiatives: Policies promoting health insurance penetration and consumer protection.

Barriers & Challenges:

- Low Penetration: Dental insurance is still a relatively nascent market in India.

- Perception of Dental Care as Elective: Many consumers still view dental treatments as non-essential.

- Affordability Concerns: High premiums can be a deterrent for a significant portion of the population.

- Limited Provider Networks: Insufficient availability of dentists contracted with insurance companies in certain regions.

- Regulatory Hurdles: While improving, certain complexities in policy design and claims can pose challenges.

- Competition from Out-of-Pocket Expenses: A significant portion of dental expenses is still borne directly by consumers.

Emerging Opportunities in India Dental Insurance Market

Emerging opportunities in the India Dental Insurance Market lie in tapping into the vast untapped rural population, which has a high unmet need for dental care. Innovative product designs catering to specific demographic needs, such as affordable plans for senior citizens with a focus on dentures and age-related dental issues, present a significant growth avenue. The increasing adoption of digital health platforms opens doors for telemedicine-enabled dental consultations and remote diagnosis, making insurance more accessible and cost-effective. Furthermore, partnerships with dental clinics and hospitals to offer bundled services and loyalty programs can enhance customer acquisition and retention. The growing trend of wellness and preventive healthcare also presents an opportunity to promote dental insurance as an integral part of a holistic health strategy.

Growth Accelerators in the India Dental Insurance Market Industry

Several catalysts are accelerating the growth of the India Dental Insurance Market. Technological breakthroughs, such as the use of AI for claims fraud detection and personalized risk assessment, are streamlining operations and reducing costs. Strategic partnerships between insurance providers and dental technology companies are fostering innovation in policy offerings and service delivery. The increasing focus on preventative care by both insurers and consumers is a significant growth accelerator, shifting the paradigm from treatment to long-term oral health management. Market expansion strategies targeting Tier 2 and Tier 3 cities, coupled with aggressive digital marketing campaigns, are crucial for increasing penetration and driving adoption. The favorable regulatory environment, with its push for standalone dental products, is also a key growth accelerant.

Key Players Shaping the India Dental Insurance Market Market

- Aetna

- AXA

- Cholamandalam MS General Insurance Company Ltd

- GoDigit Health Insurance

- Aditya Birla Group

- Delta Dental

- Star Health & Allied Insurance

- Policy bazaar

- Allianz

- Humana Dental Insurance

Notable Milestones in India Dental Insurance Market Sector

- November 2022: IRDAI relaxed regulations related to market-linked products, increased transparency of data with account aggregators, and increased the maximum number of tie-ups from 6 to 9 for corporate agents and IMFs. These relaxations shall increase the scope for small insurers to expand in India with niche offerings such as dental insurance.

- November 2022: IRDAI relaxed a regulation supporting more dilution of promoter shares up to 26% in insurance companies. Since IRDAI asked health insurers in 2018 to remove dental insurance as an inclusion in health products to promote dental insurance as a standalone business line, many small insurers have come up with niche offerings related to the same. This reduction in promoter share option can potentially help raise more funds by the small players and expand their reach in India.

In-Depth India Dental Insurance Market Market Outlook

The future outlook for the India Dental Insurance Market is highly promising, driven by a confluence of accelerating factors. The increasing penetration of digital technologies, including AI and tele-dentistry, will continue to enhance service delivery and accessibility, making dental care more affordable and convenient. Strategic alliances between insurance providers, dental practitioners, and healthcare technology firms will foster innovation in product development and service integration. The shift in consumer mindset towards prioritizing preventive health measures and long-term well-being will further boost the demand for comprehensive dental coverage. As regulatory frameworks continue to evolve and support specialized insurance products, the market is poised for sustained and robust growth, creating significant strategic opportunities for stakeholders to capitalize on the burgeoning demand for oral healthcare protection in India.

India Dental Insurance Market Segmentation

-

1. Coverage

- 1.1. Dental Health Maintenance Organizations(DHMO)

- 1.2. Dental Preferred Provider Organization(DEPO)

- 1.3. Dental Indemnity Plan(DIP)

- 1.4. Dental Point of Service(DPS)

-

2. Procedure

- 2.1. Preventive

- 2.2. Major

- 2.3. Basic

-

3. End User

- 3.1. Individual

- 3.2. Corporates

-

4. Demographics

- 4.1. Senior Citizen

- 4.2. Minors

- 4.3. Other Demographics

India Dental Insurance Market Segmentation By Geography

- 1. India

India Dental Insurance Market Regional Market Share

Geographic Coverage of India Dental Insurance Market

India Dental Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate

- 3.3. Market Restrains

- 3.3.1. Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards.

- 3.4. Market Trends

- 3.4.1 Changing eating habits affecting dental insurance market

- 3.4.2 because of early tooth diseases.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Dental Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Dental Health Maintenance Organizations(DHMO)

- 5.1.2. Dental Preferred Provider Organization(DEPO)

- 5.1.3. Dental Indemnity Plan(DIP)

- 5.1.4. Dental Point of Service(DPS)

- 5.2. Market Analysis, Insights and Forecast - by Procedure

- 5.2.1. Preventive

- 5.2.2. Major

- 5.2.3. Basic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Individual

- 5.3.2. Corporates

- 5.4. Market Analysis, Insights and Forecast - by Demographics

- 5.4.1. Senior Citizen

- 5.4.2. Minors

- 5.4.3. Other Demographics

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aetna

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AXA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cholamandalam MS General Insurance Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GoDigit Health Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aditya Birla Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delta Dental

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Star Health & Allied Insurance**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Policy bazaar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Allianz

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Humana Dental Insurance

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aetna

List of Figures

- Figure 1: India Dental Insurance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Dental Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: India Dental Insurance Market Revenue undefined Forecast, by Coverage 2020 & 2033

- Table 2: India Dental Insurance Market Revenue undefined Forecast, by Procedure 2020 & 2033

- Table 3: India Dental Insurance Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: India Dental Insurance Market Revenue undefined Forecast, by Demographics 2020 & 2033

- Table 5: India Dental Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: India Dental Insurance Market Revenue undefined Forecast, by Coverage 2020 & 2033

- Table 7: India Dental Insurance Market Revenue undefined Forecast, by Procedure 2020 & 2033

- Table 8: India Dental Insurance Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: India Dental Insurance Market Revenue undefined Forecast, by Demographics 2020 & 2033

- Table 10: India Dental Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Dental Insurance Market?

The projected CAGR is approximately 16%.

2. Which companies are prominent players in the India Dental Insurance Market?

Key companies in the market include Aetna, AXA, Cholamandalam MS General Insurance Company Ltd, GoDigit Health Insurance, Aditya Birla Group, Delta Dental, Star Health & Allied Insurance**List Not Exhaustive, Policy bazaar, Allianz, Humana Dental Insurance.

3. What are the main segments of the India Dental Insurance Market?

The market segments include Coverage, Procedure, End User, Demographics.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate.

6. What are the notable trends driving market growth?

Changing eating habits affecting dental insurance market. because of early tooth diseases..

7. Are there any restraints impacting market growth?

Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards..

8. Can you provide examples of recent developments in the market?

On 25 November 2022, IRDAI relaxed regulations related to market-linked products, increased transparency of data with account aggregators, and increased the maximum number of tie-ups from 6 to 9 for corporate agents and IMFs. These relaxations shall increase the scope for small insurers to expand in India with niche offerings such as dental insurance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Dental Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Dental Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Dental Insurance Market?

To stay informed about further developments, trends, and reports in the India Dental Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence