Key Insights

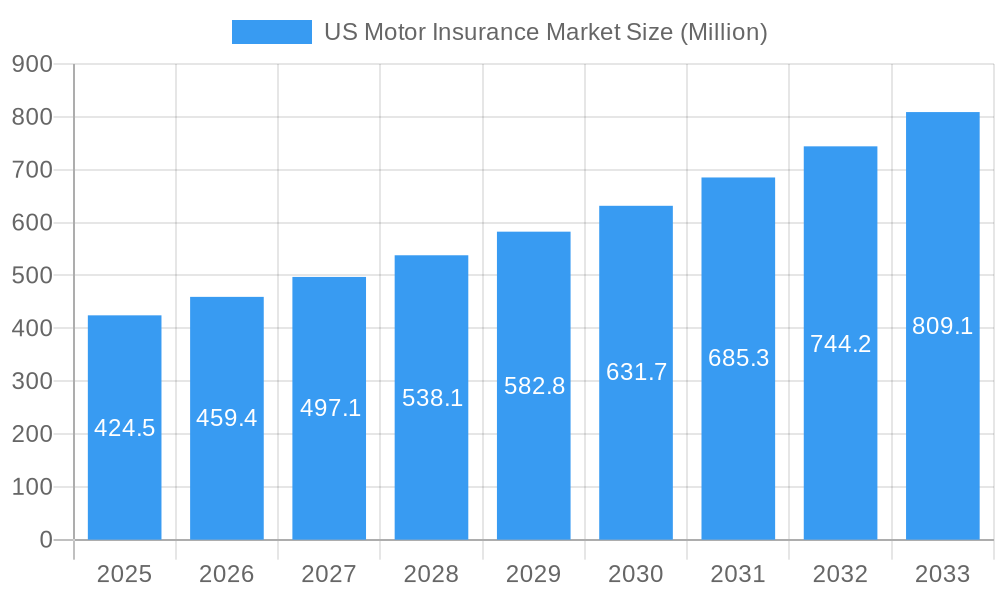

The US motor insurance market is poised for significant growth, projected to reach $424.5 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.13% anticipated through 2033. This expansion is primarily fueled by an increasing vehicle parc, the ongoing adoption of telematics and connected car technology, and a rising demand for more comprehensive and personalized insurance solutions. The personal segment is expected to continue its dominance, driven by a growing population and higher disposable incomes, while commercial vehicle insurance will see steady progress owing to increased trade and logistics activities. Innovations in policy coverage, such as the growing popularity of usage-based insurance and advanced driver assistance system (ADAS) integration, are also contributing to market dynamism. Furthermore, the shift towards digital distribution channels, including online platforms and mobile applications, is reshaping customer acquisition and service delivery, offering greater convenience and competitive pricing.

US Motor Insurance Market Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. Intense competition among insurers, coupled with evolving regulatory landscapes, can impact profitability and market entry strategies. Additionally, the increasing frequency and severity of weather-related events and the rising costs of vehicle repairs and medical expenses associated with accidents are critical factors influencing premium rates and overall market stability. However, emerging trends like the development of autonomous vehicle insurance, the integration of AI for risk assessment and claims processing, and the growing emphasis on cybersecurity for connected vehicles are creating new avenues for innovation and revenue generation. The market's ability to adapt to these challenges and capitalize on technological advancements will be crucial for sustained and profitable growth in the coming years.

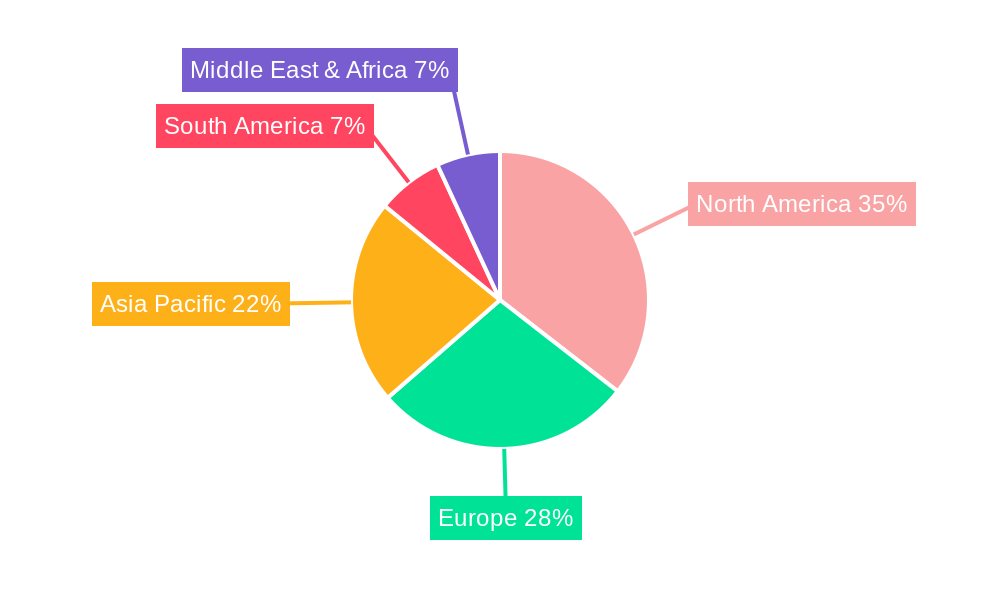

US Motor Insurance Market Company Market Share

US Motor Insurance Market: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report provides a meticulous analysis of the US Motor Insurance Market, covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025. The report delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, emerging opportunities, and the strategic landscape shaped by leading industry players. Leveraging high-traffic keywords such as "US auto insurance," "commercial vehicle insurance," "personal auto insurance," "motor insurance market share," and "insurance technology," this report is optimized for maximum search engine visibility and is designed to engage industry professionals seeking actionable intelligence. All monetary values are presented in Million USD units for clarity and comparability.

US Motor Insurance Market Market Dynamics & Structure

The US Motor Insurance Market exhibits a moderately concentrated structure, with several large, established players holding significant market share alongside a growing number of specialized insurers and insurtech startups. Technological innovation, particularly in telematics, AI-driven underwriting, and digital claims processing, is a primary driver, enhancing efficiency and personalized customer experiences. Regulatory frameworks, including state-specific mandates for minimum liability coverage and consumer protection laws, significantly influence market operations and product offerings. Competitive product substitutes, such as alternative risk transfer mechanisms and emerging mobility services, are beginning to exert pressure on traditional insurance models. End-user demographics are shifting, with a growing demand for flexible, usage-based insurance options among younger generations and an increasing need for comprehensive commercial coverage from a diversifying business landscape. Mergers and Acquisitions (M&A) trends indicate a strategic consolidation, with larger entities acquiring innovative startups to gain technological capabilities and expand market reach.

- Market Concentration: A few dominant players control a significant portion of the market, but competition is intensifying from niche players and insurtech firms.

- Technological Innovation Drivers:

- Telematics for usage-based insurance (UBI) and risk assessment.

- AI and machine learning for enhanced underwriting accuracy and fraud detection.

- Digital platforms for streamlined policy management and claims processing.

- Regulatory Frameworks: State-level regulations dictate minimum coverage requirements, pricing factors, and consumer complaint handling.

- Competitive Product Substitutes: Peer-to-peer car sharing, ride-sharing services, and potential autonomous vehicle insurance models.

- End-User Demographics: Growing preference for digital interactions, personalized policies, and value-added services across both personal and commercial segments.

- M&A Trends: Strategic acquisitions focused on technology integration, market expansion, and customer base consolidation. For instance, the acquisition of specialty underwriters by larger carriers.

US Motor Insurance Market Growth Trends & Insights

The US Motor Insurance Market is projected to experience steady growth driven by an expanding vehicle parc, evolving consumer preferences, and continuous technological advancements. The market size is anticipated to increase from approximately $295,800 million in 2019 to an estimated $380,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 2.1% during the forecast period. The adoption rate of innovative insurance products, such as pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) policies, is steadily increasing as consumers become more aware of potential cost savings. Technological disruptions, including the integration of IoT devices in vehicles and advancements in AI for claims automation, are reshaping the industry by improving risk management and operational efficiency. Shifts in consumer behavior are also significant, with a growing demand for seamless digital experiences, transparent pricing, and tailored coverage options that align with individual driving habits and vehicle usage. The increasing complexity of commercial vehicle operations and the rise of the gig economy are also contributing to the demand for specialized commercial auto insurance solutions.

- Market Size Evolution: Expected to grow from $295,800 million in 2019 to an estimated $380,500 million by 2033.

- CAGR: Approximately 2.1% during the forecast period (2025–2033).

- Adoption Rates: Increasing uptake of Usage-Based Insurance (UBI) products like PAYD and PHYD.

- Technological Disruptions: Impact of telematics, AI in claims processing, and data analytics on underwriting and risk assessment.

- Consumer Behavior Shifts: Demand for digital channels, personalized policies, and integrated services.

- Market Penetration: High penetration in personal auto insurance, with opportunities for deeper penetration in specialized commercial segments and among emerging vehicle types.

Dominant Regions, Countries, or Segments in US Motor Insurance Market

Within the US Motor Insurance Market, Personal vehicle type insurance consistently drives significant market share due to the sheer volume of passenger vehicles on the road. This segment benefits from sustained demand across all age groups and income levels. The Comprehensive Insurance policy coverage is also a major contributor, as consumers increasingly seek robust protection beyond basic liability. In terms of distribution channels, Agents and Brokers continue to hold substantial influence, providing personalized advice and complex policy solutions, especially for commercial clients. However, the Online distribution channel is experiencing rapid growth, appealing to tech-savvy consumers seeking convenience and competitive quotes.

- Dominant Vehicle Type Segment:

- Personal: Accounts for the largest share due to the high number of privately owned vehicles, characterized by diverse risk profiles and policy needs.

- Dominant Policy Coverage:

- Comprehensive Insurance: High demand driven by the desire for protection against theft, vandalism, and non-collision damage, reflecting a rising consumer awareness of asset protection.

- Dominant Distribution Channels:

- Agents & Brokers: Crucial for complex commercial needs and providing personalized advice, maintaining a strong foothold in riskier segments.

- Online: Rapidly growing channel due to its convenience, transparency, and ability to offer competitive pricing, attracting a younger demographic and individuals seeking straightforward policy purchases.

The dominance of the Personal segment is further bolstered by economic stability and consistent vehicle ownership trends across major metropolitan and suburban areas. Comprehensive insurance uptake is influenced by factors like vehicle value, economic conditions, and perceived risk of theft and damage. The continued relevance of agents and brokers is linked to the complexity of commercial insurance and the need for expert guidance in managing fleets and specialized vehicles. Meanwhile, the surge in online channel adoption is a testament to evolving consumer digital habits and the increasing efficiency of online underwriting and customer service platforms.

US Motor Insurance Market Product Landscape

The US Motor Insurance Market is characterized by a dynamic product landscape, with a continuous influx of innovative offerings designed to meet evolving consumer needs and leverage technological advancements. Insurers are increasingly focusing on developing personalized policies, including usage-based insurance (UBI) programs that reward safe driving habits with lower premiums. Telematics technology plays a pivotal role, enabling real-time data collection for accurate risk assessment and personalized feedback. Furthermore, specialized coverage options for emerging vehicle types, such as electric vehicles (EVs) and autonomous vehicles, are gaining traction, addressing unique repair costs and technological considerations. Product differentiation is also evident in enhanced claims services, with many companies investing in digital tools for faster, more efficient claims processing and virtual damage assessments. The integration of AI and machine learning is further refining underwriting accuracy, leading to more competitive pricing and customized policy features.

- Product Innovations: Introduction of usage-based insurance (UBI) programs, pay-as-you-drive (PAYD), and pay-how-you-drive (PHYD) policies.

- Applications: Telematics for data collection, AI for underwriting and claims, and digital platforms for customer engagement.

- Performance Metrics: Focus on premium reductions for safe drivers, faster claims settlement times, and improved customer satisfaction scores.

- Unique Selling Propositions: Personalized pricing, enhanced digital customer experience, specialized coverage for emerging vehicle technologies.

- Technological Advancements: Integration of IoT sensors, AI-powered claims assessment, and blockchain for secure data management.

Key Drivers, Barriers & Challenges in US Motor Insurance Market

Key Drivers: The US Motor Insurance Market is propelled by several key drivers, including consistent vehicle ownership across a large population, leading to a stable demand for auto insurance. Technological advancements, particularly in telematics and AI, are enabling insurers to offer more personalized products and improve underwriting accuracy, driving efficiency and customer engagement. Regulatory mandates for minimum liability coverage across states ensure a baseline market presence. Furthermore, the increasing complexity of commercial vehicle operations and the growth of the gig economy create a sustained demand for specialized commercial auto insurance.

Key Barriers & Challenges: Despite robust growth drivers, the market faces significant barriers and challenges. Intense competition among numerous insurers, including traditional giants and agile insurtech startups, puts pressure on pricing and margins. Regulatory hurdles and varying compliance requirements across different states add complexity and operational costs. Rising repair costs, due to advanced vehicle technology and inflation, contribute to increasing claim payouts. Furthermore, the growing incidence of auto theft and fraud poses a continuous challenge, impacting profitability. Supply chain disruptions can also affect vehicle repair times and costs, indirectly influencing insurance claims.

Emerging Opportunities in US Motor Insurance Market

Emerging opportunities in the US Motor Insurance Market lie in several key areas. The growing adoption of electric vehicles (EVs) presents a significant opportunity for specialized insurance products that address unique repair needs and battery concerns. The continued expansion of the sharing economy and ride-sharing services necessitates innovative insurance solutions tailored to these dynamic usage patterns. Furthermore, the increasing integration of advanced driver-assistance systems (ADAS) and the eventual advent of autonomous vehicles will require insurers to develop new underwriting models and coverage options. Digital transformation continues to offer avenues for enhanced customer experience, with opportunities in leveraging AI for personalized offerings, streamlined claims processing, and proactive risk mitigation through telematics data.

Growth Accelerators in the US Motor Insurance Market Industry

Several catalysts are accelerating growth within the US Motor Insurance Market. Technological breakthroughs, such as sophisticated AI algorithms for predictive analytics and sophisticated telematics devices for granular risk assessment, are enabling insurers to refine pricing and personalize policies, thereby attracting and retaining customers. Strategic partnerships between traditional insurers and insurtech companies are fostering innovation and expanding market reach, allowing for the rapid deployment of new digital solutions and specialized products. Market expansion strategies, including targeted product development for underserved segments like young drivers or small businesses, are also contributing to overall growth. The increasing focus on customer-centricity and the demand for seamless digital experiences are pushing the industry towards greater efficiency and responsiveness.

Key Players Shaping the US Motor Insurance Market Market

- Progressive Corp

- Travelers Companies Inc

- Old Republic International Corp

- Liberty Mutual

- Nationwide Mutual Group

- Berkshire Hathaway Inc

- Zurich Insurance Group

- Marsh & Mc Lennan Company

- Arthur J Gallagher & Co

- Hub International

- Brown & Brown Inc

- Acrisure

Notable Milestones in US Motor Insurance Market Sector

- January 2024: The Travelers Companies, Inc. finalized its acquisition of Corvus Insurance Holdings, Inc., a top-tier cyber insurance managing general underwriter known for its cutting-edge proprietary technology.

- August 2023: Zurich Holding Company of America acquired SpearTip, a cyber counterintelligence firm. SpearTip specializes in proactive and responsive services designed to protect clients from cyber threats.

In-Depth US Motor Insurance Market Market Outlook

The US Motor Insurance Market is poised for continued growth and transformation, driven by a confluence of factors. Technological advancements in telematics and AI will further personalize insurance offerings, rewarding safe driving and enabling more accurate risk assessment. The expansion of specialized coverage for electric and autonomous vehicles presents a significant growth frontier. Insurers will increasingly focus on enhancing digital customer experiences through intuitive online platforms and AI-powered support. Strategic partnerships and acquisitions will likely continue as companies seek to integrate innovative technologies and expand their market presence. Emerging opportunities in data analytics and proactive risk management will allow insurers to move beyond traditional reactive claims processing to more predictive and preventative models, ultimately shaping a more efficient, customer-centric, and resilient motor insurance ecosystem.

US Motor Insurance Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial

- 1.1.1. Passenger-Carrying Vehicle Insurance

- 1.1.2. Goods-Carrying Vehicle Insurance

- 1.1.3. Miscellaneous and Special Vehicle Insurance

- 1.2. Personal

-

1.1. Commercial

-

2. Policy Coverage

- 2.1. Third-Party Liability

- 2.2. Partial Coverage

- 2.3. Comprehensive Insurance

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Brokers

- 3.3. Online

- 3.4. Banks

- 3.5. Other Distribution Channels

US Motor Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Motor Insurance Market Regional Market Share

Geographic Coverage of US Motor Insurance Market

US Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Motor vehicles registration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial

- 5.1.1.1. Passenger-Carrying Vehicle Insurance

- 5.1.1.2. Goods-Carrying Vehicle Insurance

- 5.1.1.3. Miscellaneous and Special Vehicle Insurance

- 5.1.2. Personal

- 5.1.1. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Policy Coverage

- 5.2.1. Third-Party Liability

- 5.2.2. Partial Coverage

- 5.2.3. Comprehensive Insurance

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Brokers

- 5.3.3. Online

- 5.3.4. Banks

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America US Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Commercial

- 6.1.1.1. Passenger-Carrying Vehicle Insurance

- 6.1.1.2. Goods-Carrying Vehicle Insurance

- 6.1.1.3. Miscellaneous and Special Vehicle Insurance

- 6.1.2. Personal

- 6.1.1. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Policy Coverage

- 6.2.1. Third-Party Liability

- 6.2.2. Partial Coverage

- 6.2.3. Comprehensive Insurance

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Agents

- 6.3.2. Brokers

- 6.3.3. Online

- 6.3.4. Banks

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America US Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Commercial

- 7.1.1.1. Passenger-Carrying Vehicle Insurance

- 7.1.1.2. Goods-Carrying Vehicle Insurance

- 7.1.1.3. Miscellaneous and Special Vehicle Insurance

- 7.1.2. Personal

- 7.1.1. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Policy Coverage

- 7.2.1. Third-Party Liability

- 7.2.2. Partial Coverage

- 7.2.3. Comprehensive Insurance

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Agents

- 7.3.2. Brokers

- 7.3.3. Online

- 7.3.4. Banks

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe US Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Commercial

- 8.1.1.1. Passenger-Carrying Vehicle Insurance

- 8.1.1.2. Goods-Carrying Vehicle Insurance

- 8.1.1.3. Miscellaneous and Special Vehicle Insurance

- 8.1.2. Personal

- 8.1.1. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Policy Coverage

- 8.2.1. Third-Party Liability

- 8.2.2. Partial Coverage

- 8.2.3. Comprehensive Insurance

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Agents

- 8.3.2. Brokers

- 8.3.3. Online

- 8.3.4. Banks

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa US Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Commercial

- 9.1.1.1. Passenger-Carrying Vehicle Insurance

- 9.1.1.2. Goods-Carrying Vehicle Insurance

- 9.1.1.3. Miscellaneous and Special Vehicle Insurance

- 9.1.2. Personal

- 9.1.1. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Policy Coverage

- 9.2.1. Third-Party Liability

- 9.2.2. Partial Coverage

- 9.2.3. Comprehensive Insurance

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Agents

- 9.3.2. Brokers

- 9.3.3. Online

- 9.3.4. Banks

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific US Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Commercial

- 10.1.1.1. Passenger-Carrying Vehicle Insurance

- 10.1.1.2. Goods-Carrying Vehicle Insurance

- 10.1.1.3. Miscellaneous and Special Vehicle Insurance

- 10.1.2. Personal

- 10.1.1. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Policy Coverage

- 10.2.1. Third-Party Liability

- 10.2.2. Partial Coverage

- 10.2.3. Comprehensive Insurance

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Agents

- 10.3.2. Brokers

- 10.3.3. Online

- 10.3.4. Banks

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Progressive Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Travelers Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Old Republic International Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Liberty Mutual

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nationwide Mutual Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Berkshire Hathaway Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zurich Insurance Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marsh & Mc Lennan Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arthur J Gallagher & Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hub International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Brown & Brown Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Acrisure

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Progressive Corp

List of Figures

- Figure 1: Global US Motor Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Motor Insurance Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America US Motor Insurance Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 4: North America US Motor Insurance Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 5: North America US Motor Insurance Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America US Motor Insurance Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 7: North America US Motor Insurance Market Revenue (Million), by Policy Coverage 2025 & 2033

- Figure 8: North America US Motor Insurance Market Volume (Billion), by Policy Coverage 2025 & 2033

- Figure 9: North America US Motor Insurance Market Revenue Share (%), by Policy Coverage 2025 & 2033

- Figure 10: North America US Motor Insurance Market Volume Share (%), by Policy Coverage 2025 & 2033

- Figure 11: North America US Motor Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: North America US Motor Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: North America US Motor Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America US Motor Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America US Motor Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America US Motor Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America US Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America US Motor Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America US Motor Insurance Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 20: South America US Motor Insurance Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 21: South America US Motor Insurance Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: South America US Motor Insurance Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 23: South America US Motor Insurance Market Revenue (Million), by Policy Coverage 2025 & 2033

- Figure 24: South America US Motor Insurance Market Volume (Billion), by Policy Coverage 2025 & 2033

- Figure 25: South America US Motor Insurance Market Revenue Share (%), by Policy Coverage 2025 & 2033

- Figure 26: South America US Motor Insurance Market Volume Share (%), by Policy Coverage 2025 & 2033

- Figure 27: South America US Motor Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: South America US Motor Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 29: South America US Motor Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America US Motor Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America US Motor Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America US Motor Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America US Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America US Motor Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe US Motor Insurance Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 36: Europe US Motor Insurance Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 37: Europe US Motor Insurance Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: Europe US Motor Insurance Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 39: Europe US Motor Insurance Market Revenue (Million), by Policy Coverage 2025 & 2033

- Figure 40: Europe US Motor Insurance Market Volume (Billion), by Policy Coverage 2025 & 2033

- Figure 41: Europe US Motor Insurance Market Revenue Share (%), by Policy Coverage 2025 & 2033

- Figure 42: Europe US Motor Insurance Market Volume Share (%), by Policy Coverage 2025 & 2033

- Figure 43: Europe US Motor Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Europe US Motor Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Europe US Motor Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Europe US Motor Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Europe US Motor Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe US Motor Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe US Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe US Motor Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa US Motor Insurance Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 52: Middle East & Africa US Motor Insurance Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 53: Middle East & Africa US Motor Insurance Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 54: Middle East & Africa US Motor Insurance Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 55: Middle East & Africa US Motor Insurance Market Revenue (Million), by Policy Coverage 2025 & 2033

- Figure 56: Middle East & Africa US Motor Insurance Market Volume (Billion), by Policy Coverage 2025 & 2033

- Figure 57: Middle East & Africa US Motor Insurance Market Revenue Share (%), by Policy Coverage 2025 & 2033

- Figure 58: Middle East & Africa US Motor Insurance Market Volume Share (%), by Policy Coverage 2025 & 2033

- Figure 59: Middle East & Africa US Motor Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 60: Middle East & Africa US Motor Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 61: Middle East & Africa US Motor Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East & Africa US Motor Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa US Motor Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa US Motor Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa US Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa US Motor Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific US Motor Insurance Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 68: Asia Pacific US Motor Insurance Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 69: Asia Pacific US Motor Insurance Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 70: Asia Pacific US Motor Insurance Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 71: Asia Pacific US Motor Insurance Market Revenue (Million), by Policy Coverage 2025 & 2033

- Figure 72: Asia Pacific US Motor Insurance Market Volume (Billion), by Policy Coverage 2025 & 2033

- Figure 73: Asia Pacific US Motor Insurance Market Revenue Share (%), by Policy Coverage 2025 & 2033

- Figure 74: Asia Pacific US Motor Insurance Market Volume Share (%), by Policy Coverage 2025 & 2033

- Figure 75: Asia Pacific US Motor Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 76: Asia Pacific US Motor Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 77: Asia Pacific US Motor Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Asia Pacific US Motor Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific US Motor Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific US Motor Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Asia Pacific US Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific US Motor Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Motor Insurance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global US Motor Insurance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global US Motor Insurance Market Revenue Million Forecast, by Policy Coverage 2020 & 2033

- Table 4: Global US Motor Insurance Market Volume Billion Forecast, by Policy Coverage 2020 & 2033

- Table 5: Global US Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global US Motor Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global US Motor Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global US Motor Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global US Motor Insurance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 10: Global US Motor Insurance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global US Motor Insurance Market Revenue Million Forecast, by Policy Coverage 2020 & 2033

- Table 12: Global US Motor Insurance Market Volume Billion Forecast, by Policy Coverage 2020 & 2033

- Table 13: Global US Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global US Motor Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global US Motor Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global US Motor Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global US Motor Insurance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global US Motor Insurance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global US Motor Insurance Market Revenue Million Forecast, by Policy Coverage 2020 & 2033

- Table 26: Global US Motor Insurance Market Volume Billion Forecast, by Policy Coverage 2020 & 2033

- Table 27: Global US Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global US Motor Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global US Motor Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global US Motor Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Brazil US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Global US Motor Insurance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 38: Global US Motor Insurance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 39: Global US Motor Insurance Market Revenue Million Forecast, by Policy Coverage 2020 & 2033

- Table 40: Global US Motor Insurance Market Volume Billion Forecast, by Policy Coverage 2020 & 2033

- Table 41: Global US Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global US Motor Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global US Motor Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global US Motor Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Germany US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: France US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Italy US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Spain US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Russia US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Benelux US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Nordics US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global US Motor Insurance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 64: Global US Motor Insurance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 65: Global US Motor Insurance Market Revenue Million Forecast, by Policy Coverage 2020 & 2033

- Table 66: Global US Motor Insurance Market Volume Billion Forecast, by Policy Coverage 2020 & 2033

- Table 67: Global US Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global US Motor Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global US Motor Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global US Motor Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Turkey US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Israel US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: GCC US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: North Africa US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: South Africa US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Global US Motor Insurance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 84: Global US Motor Insurance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 85: Global US Motor Insurance Market Revenue Million Forecast, by Policy Coverage 2020 & 2033

- Table 86: Global US Motor Insurance Market Volume Billion Forecast, by Policy Coverage 2020 & 2033

- Table 87: Global US Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 88: Global US Motor Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 89: Global US Motor Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global US Motor Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 91: China US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: India US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: Japan US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: South Korea US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: ASEAN US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 101: Oceania US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific US Motor Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific US Motor Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Motor Insurance Market?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the US Motor Insurance Market?

Key companies in the market include Progressive Corp, Travelers Companies Inc, Old Republic International Corp, Liberty Mutual, Nationwide Mutual Group, Berkshire Hathaway Inc, Zurich Insurance Group, Marsh & Mc Lennan Company, Arthur J Gallagher & Co, Hub International, Brown & Brown Inc, Acrisure.

3. What are the main segments of the US Motor Insurance Market?

The market segments include Vehicle Type, Policy Coverage, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 424.5 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Motor vehicles registration:.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2024, The Travelers Companies, Inc. finalized its acquisition of Corvus Insurance Holdings, Inc., a top-tier cyber insurance managing general underwriter known for its cutting-edge proprietary technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Motor Insurance Market?

To stay informed about further developments, trends, and reports in the US Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence