Key Insights

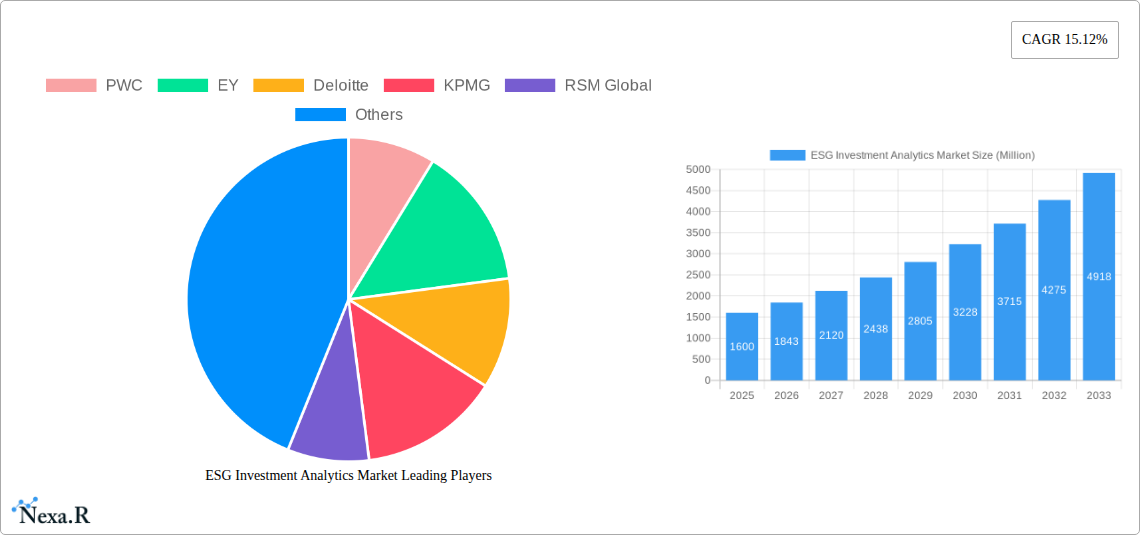

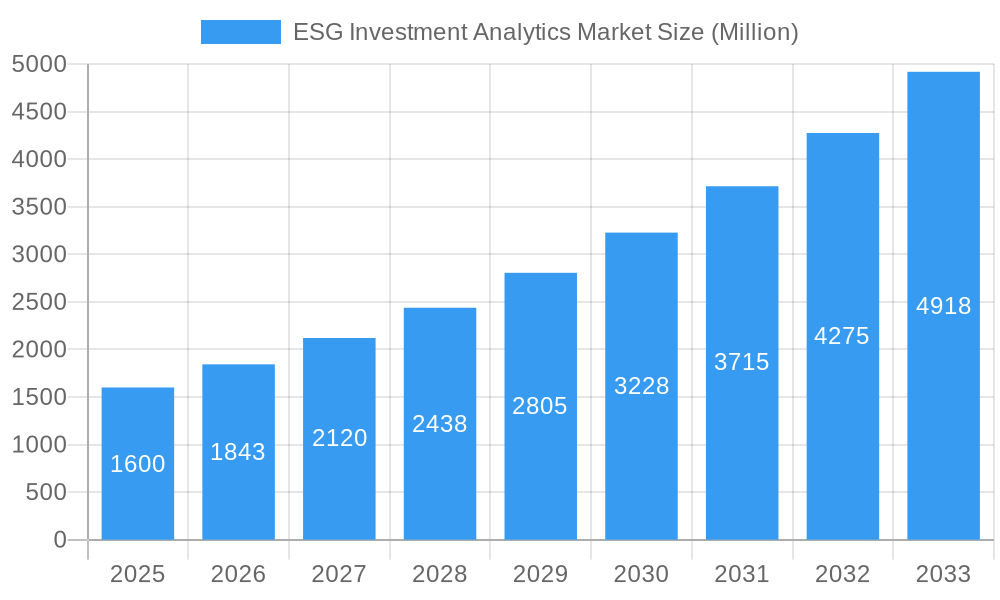

The ESG Investment Analytics Market is poised for substantial expansion, projected to reach a market size of $1.60 billion in 2025. This robust growth is fueled by an impressive CAGR of 15.12%, indicating a dynamic and rapidly evolving industry. A primary driver of this surge is the increasing demand from the financial industry and consumer & retail sectors to address evolving Environmental, Social, and Governance (ESG) expectations. Companies are actively preparing comprehensive ESG reports, driven by regulatory pressures, investor scrutiny, and a growing awareness of sustainability's impact on long-term value. The need for sophisticated analytics tools and services to accurately measure, report, and manage ESG performance is paramount, transforming how investments are evaluated and managed.

ESG Investment Analytics Market Market Size (In Billion)

Further propelling the market are key trends such as the integration of AI and machine learning for enhanced data analysis and predictive capabilities in ESG scoring, alongside the growing prominence of impact investing and sustainable finance frameworks. The market's expansion is also supported by a widening array of specialized services catering to specific ESG concerns, such as climate risk assessment and supply chain sustainability. While challenges like data standardization and the complexity of ESG metrics exist, the overwhelming demand for transparency and accountability in investment decisions is creating significant opportunities. Leading players like PwC, EY, Deloitte, and MSCI Inc. are at the forefront, offering a suite of solutions that empower businesses to navigate this complex landscape and capitalize on the opportunities presented by sustainable investing.

ESG Investment Analytics Market Company Market Share

This definitive report offers an in-depth analysis of the ESG Investment Analytics Market, a critical and rapidly expanding sector driven by the increasing demand for sustainable and responsible investment strategies. Covering the Study Period of 2019–2033, with 2025 as the Base Year and Estimated Year, this research provides unparalleled insights into market dynamics, growth trajectories, and competitive landscapes. It examines the evolving role of ESG data in financial decision-making, regulatory influences, and technological advancements shaping investment analytics. The report meticulously analyzes parent and child markets, offering a holistic view of the ecosystem, with all values presented in Million Units.

ESG Investment Analytics Market Market Dynamics & Structure

The ESG Investment Analytics Market exhibits a moderately concentrated structure, with a few key players holding significant market share, yet with ample room for specialized and emerging firms. Technological innovation is the primary driver, fueled by advancements in Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP) to process vast amounts of unstructured ESG data. Regulatory frameworks are increasingly stringent, compelling businesses to adopt robust ESG reporting and analytics. Competitive product substitutes are emerging, ranging from internal data aggregation tools to specialized ESG consulting services. End-user demographics are shifting towards institutional investors, asset managers, and corporations actively integrating ESG factors into their investment and operational strategies. Mergers and acquisitions (M&A) are a significant trend, as larger firms acquire innovative startups to bolster their ESG capabilities and expand their service offerings.

- Market Concentration: Moderately concentrated, with dominant players like MSCI Inc., ISS ESG, and RepRisk.

- Technological Innovation Drivers: AI, ML, NLP for data extraction and sentiment analysis; blockchain for data integrity.

- Regulatory Frameworks: Growing influence of frameworks like SFDR, TCFD, and GRI; increasing demand for standardized ESG disclosures.

- Competitive Product Substitutes: Proprietary ESG scoring platforms, sustainability consulting services, and bespoke data solutions.

- End-User Demographics: Institutional investors, pension funds, sovereign wealth funds, asset managers, corporations, and regulators.

- M&A Trends: Strategic acquisitions to enhance data coverage, analytical capabilities, and client reach. The market has seen several strategic consolidations in recent years to gain competitive advantage.

ESG Investment Analytics Market Growth Trends & Insights

The ESG Investment Analytics Market is poised for substantial growth, projected to expand from an estimated $XX Million in 2025 to $XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the Forecast Period of 2025–2033. This robust expansion is underpinned by several key trends. Market size evolution is directly correlated with the increasing adoption of ESG principles by investors seeking to align their portfolios with environmental, social, and governance objectives. Adoption rates for ESG investment analytics are rapidly increasing across all investor types, driven by a growing awareness of climate risks and social impact. Technological disruptions, particularly in data analytics and AI, are transforming how ESG information is processed and utilized, leading to more sophisticated and actionable insights. Consumer behavior shifts are also playing a role, with a growing demand for transparency and sustainability from end consumers, indirectly influencing corporate ESG strategies and investment decisions. The historical period (2019-2024) has laid the groundwork for this accelerated growth, marked by initial skepticism transitioning into mainstream acceptance of ESG investing.

The market penetration of ESG investment analytics is expanding beyond its traditional stronghold in developed economies, with emerging markets showing significant interest. This growth is further amplified by the increasing demand for customized ESG solutions tailored to specific investment mandates and regulatory requirements. The ability of analytics platforms to integrate diverse data sources, including financial statements, news articles, social media, and corporate reports, provides investors with a more holistic view of a company's ESG performance. This comprehensive approach is crucial for identifying potential risks and opportunities that might be missed by traditional financial analysis alone. The ongoing evolution of ESG metrics and standards, while sometimes complex, also contributes to a greater need for sophisticated analytics to navigate the landscape effectively. Furthermore, the integration of ESG data into mainstream financial modeling and risk management frameworks is no longer a niche practice but a growing imperative, driving the demand for reliable and insightful ESG investment analytics.

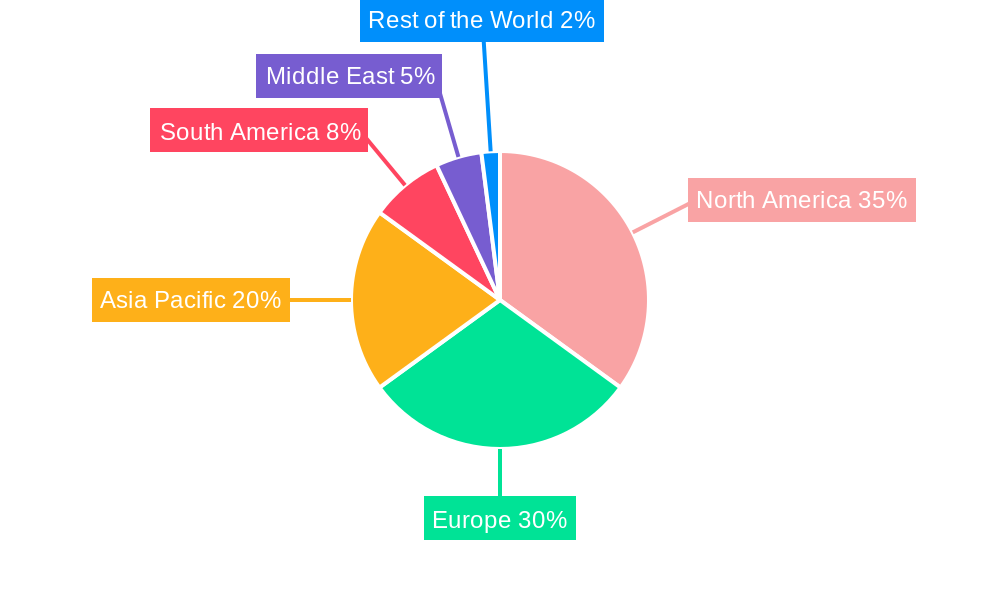

Dominant Regions, Countries, or Segments in ESG Investment Analytics Market

The Financial Industry segment stands as the dominant force driving growth within the ESG Investment Analytics Market. This dominance stems from the industry's inherent need for data-driven decision-making, risk assessment, and regulatory compliance. Asset managers, banks, and investment firms are at the forefront of ESG integration, actively seeking sophisticated analytics to inform portfolio construction, identify sustainable investment opportunities, and meet the growing demands of their clients for responsible investing. The Consumer and Retail sector, while not as dominant as the financial industry, represents a significant and rapidly growing segment. As consumer preferences increasingly lean towards ethically and sustainably produced goods and services, companies in this sector are compelled to enhance their ESG performance and reporting, thereby driving demand for related analytics.

North America currently leads in the ESG Investment Analytics Market, largely due to established regulatory frameworks, high investor awareness, and the presence of major financial institutions and technology providers. The region benefits from significant investments in sustainability initiatives and a strong appetite for data-driven investment strategies.

- Key Drivers in the Financial Industry:

- Regulatory Pressure: Mandates for ESG disclosure and integration are becoming more common.

- Investor Demand: Growing preference for sustainable and impact investments.

- Risk Management: Identifying and mitigating ESG-related financial risks.

- Competitive Advantage: Differentiating through ESG-focused investment products.

- Key Drivers in the Consumer and Retail Sector:

- Brand Reputation: Enhancing brand image through demonstrated sustainability commitments.

- Consumer Loyalty: Attracting and retaining customers who prioritize ethical consumption.

- Supply Chain Transparency: Ensuring responsible sourcing and production practices.

- Innovation: Developing sustainable products and business models.

- Dominance Factors in North America:

- Developed Financial Markets: Deep and liquid markets facilitate the adoption of new investment strategies.

- Strong ESG Advocacy: Proactive engagement from institutional investors and NGOs.

- Technological Hubs: Presence of leading technology firms driving innovation in data analytics.

- Government Initiatives: Support for green finance and sustainable development.

- Growth Potential in Other Regions:

- Europe: Strong regulatory push (e.g., SFDR) and established ESG investment culture.

- Asia-Pacific: Rapidly growing interest driven by increasing awareness of climate change and social issues, alongside economic development.

ESG Investment Analytics Market Product Landscape

The product landscape of the ESG Investment Analytics Market is characterized by a sophisticated array of solutions designed to provide actionable insights into environmental, social, and governance factors. These products range from comprehensive ESG data platforms offering scores and ratings to specialized tools for carbon footprint analysis, supply chain due diligence, and impact reporting. Innovations are focused on enhancing data accuracy, expanding data coverage across diverse asset classes and geographies, and improving the usability of analytical outputs through intuitive dashboards and customizable reports. Unique selling propositions often lie in the proprietary methodologies for data collection and scoring, the integration of advanced AI and ML algorithms for sentiment analysis and predictive modeling, and the ability to provide granular, company-specific ESG insights. Technological advancements are enabling real-time data processing, real-time risk alerts, and the seamless integration of ESG data into existing investment workflows, thereby empowering users to make more informed and sustainable investment decisions.

Key Drivers, Barriers & Challenges in ESG Investment Analytics Market

Key Drivers:

- Growing Investor Demand for Sustainable Investments: A fundamental shift towards aligning investments with ethical and environmental values.

- Increasing Regulatory Scrutiny and Disclosure Requirements: Governments worldwide are mandating greater ESG transparency.

- Awareness of ESG Risks and Opportunities: Recognition of how ESG factors can impact financial performance.

- Technological Advancements in Data Analytics: AI, ML, and big data capabilities enabling more sophisticated ESG analysis.

- Corporate Commitments to Sustainability: Companies actively seeking to improve their ESG profiles.

Barriers & Challenges:

- Data Inconsistency and Lack of Standardization: Diverse ESG reporting frameworks and varying data quality pose challenges.

- Greenwashing Concerns: The risk of misrepresentation of ESG credentials can erode investor trust.

- Complexity of ESG Metrics: Interpreting and integrating various ESG factors into financial models can be intricate.

- Talent Gap: A shortage of skilled professionals with expertise in both finance and ESG analysis.

- Cost of Implementation: Setting up robust ESG analytics systems can be a significant investment for smaller firms.

- Regulatory Fragmentation: Differing ESG regulations across jurisdictions can create compliance complexities.

Emerging Opportunities in ESG Investment Analytics Market

Emerging opportunities in the ESG Investment Analytics Market are abundant, driven by evolving stakeholder expectations and technological frontiers. Untapped markets in developing economies are presenting significant growth potential as ESG awareness and regulatory frameworks expand. Innovative applications such as the integration of ESG analytics with climate risk modeling, biodiversity assessment, and human rights due diligence are gaining traction. The evolving consumer preferences for socially responsible products are also creating opportunities for companies to leverage ESG analytics for brand differentiation and market expansion. Furthermore, the development of more granular and forward-looking ESG metrics, coupled with the potential for standardized global ESG reporting, offers fertile ground for new analytical tools and services. The increasing focus on the "S" and "G" in ESG, beyond environmental concerns, is opening avenues for specialized analytics in areas like labor practices, diversity and inclusion, and corporate governance.

Growth Accelerators in the ESG Investment Analytics Market Industry

Several catalysts are accelerating the growth of the ESG Investment Analytics Market. Technological breakthroughs, particularly in AI and machine learning, are enhancing the ability to process and analyze vast, unstructured ESG data, leading to more accurate and insightful analytics. Strategic partnerships between data providers, analytics firms, and financial institutions are expanding the reach and applicability of ESG insights. Market expansion strategies, including the development of specialized ESG solutions for niche industries and asset classes, are also driving growth. The increasing demand for impact investing and sustainable finance products, fueled by both retail and institutional investors, is a significant growth accelerator. Furthermore, the proactive approach of regulatory bodies in establishing clear guidelines for ESG reporting and investment is creating a more predictable and supportive environment for market participants.

Key Players Shaping the ESG Investment Analytics Market Market

- PWC

- EY

- Deloitte

- KPMG

- RSM Global

- RPS Group

- MSCI Inc

- Crowe

- RepRisk

- ISS ESG

- Kroll

Notable Milestones in ESG Investment Analytics Market Sector

- June 2023: ESG Book, a global leader, and Arcesium, a leading global financial technology firm, announced a new partnership to deliver market-leading sustainability data for institutional investors.

- May 2023: The top creator marketplace in India, Collective Artists Network, partnered with DialESG, a recognized authority in the ESG domain, to provide brands, businesses, and rights holders with India's first all-inclusive 360-degree solution for managing and executing their ESG initiatives and informing internal and external stakeholders.

In-Depth ESG Investment Analytics Market Market Outlook

The future outlook for the ESG Investment Analytics Market is exceptionally strong, driven by a confluence of enduring growth accelerators. The increasing mainstream adoption of ESG investing principles by institutional and retail investors alike will continue to fuel demand for sophisticated analytical tools. Regulatory bodies are expected to further harmonize and strengthen ESG disclosure requirements globally, creating a more robust and transparent market. Technological advancements, particularly in AI and big data, will enable more precise, forward-looking, and integrated ESG risk and opportunity assessments. Strategic collaborations between technology providers and financial institutions will lead to the development of innovative solutions that embed ESG considerations seamlessly into investment processes. The evolving understanding of sustainability, encompassing climate resilience, social equity, and robust governance, will spur the creation of specialized analytical products and services, solidifying ESG investment analytics as an indispensable component of modern finance.

ESG Investment Analytics Market Segmentation

-

1. Type

- 1.1. Addressing ESG Expectations

- 1.2. Preparing ESG Reports

-

2. Application

- 2.1. Financial Industry

- 2.2. Consumer and Retail

ESG Investment Analytics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Russia

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

ESG Investment Analytics Market Regional Market Share

Geographic Coverage of ESG Investment Analytics Market

ESG Investment Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus on Corporate Social Responsibility

- 3.3. Market Restrains

- 3.3.1. Increased Focus on Corporate Social Responsibility

- 3.4. Market Trends

- 3.4.1. Increasing Consumer and Retail Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Addressing ESG Expectations

- 5.1.2. Preparing ESG Reports

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Financial Industry

- 5.2.2. Consumer and Retail

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Addressing ESG Expectations

- 6.1.2. Preparing ESG Reports

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Financial Industry

- 6.2.2. Consumer and Retail

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Addressing ESG Expectations

- 7.1.2. Preparing ESG Reports

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Financial Industry

- 7.2.2. Consumer and Retail

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Addressing ESG Expectations

- 8.1.2. Preparing ESG Reports

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Financial Industry

- 8.2.2. Consumer and Retail

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Addressing ESG Expectations

- 9.1.2. Preparing ESG Reports

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Financial Industry

- 9.2.2. Consumer and Retail

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Addressing ESG Expectations

- 10.1.2. Preparing ESG Reports

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Financial Industry

- 10.2.2. Consumer and Retail

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Addressing ESG Expectations

- 11.1.2. Preparing ESG Reports

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Financial Industry

- 11.2.2. Consumer and Retail

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PWC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 EY

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Deloitte

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 KPMG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 RSM Global

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 RPS Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MSCI Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Crowe

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 RepRisk

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ISS ESG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Kroll**List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 PWC

List of Figures

- Figure 1: Global ESG Investment Analytics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global ESG Investment Analytics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 17: Europe ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 29: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 33: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 41: South America ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 44: South America ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 45: South America ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 63: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 64: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 65: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 67: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 68: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 69: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 71: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 72: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 73: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global ESG Investment Analytics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global ESG Investment Analytics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of North America ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Germany ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 35: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 37: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: India ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: China ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: China ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Japan ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 49: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 51: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 53: Brazil ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Brazil ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Argentina ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Argentina ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of South America ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of South America ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 60: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 61: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 62: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 63: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 66: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 67: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 69: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Saudi Arabia ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: South Africa ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ESG Investment Analytics Market?

The projected CAGR is approximately 15.12%.

2. Which companies are prominent players in the ESG Investment Analytics Market?

Key companies in the market include PWC, EY, Deloitte, KPMG, RSM Global, RPS Group, MSCI Inc, Crowe, RepRisk, ISS ESG, Kroll**List Not Exhaustive.

3. What are the main segments of the ESG Investment Analytics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus on Corporate Social Responsibility.

6. What are the notable trends driving market growth?

Increasing Consumer and Retail Fueling the Market.

7. Are there any restraints impacting market growth?

Increased Focus on Corporate Social Responsibility.

8. Can you provide examples of recent developments in the market?

June 2023: ESG Book, a global leader, and Arcesium, a leading global financial technology firm, announced a new partnership to deliver market-leading sustainability data for institutional investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ESG Investment Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ESG Investment Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ESG Investment Analytics Market?

To stay informed about further developments, trends, and reports in the ESG Investment Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence