Key Insights

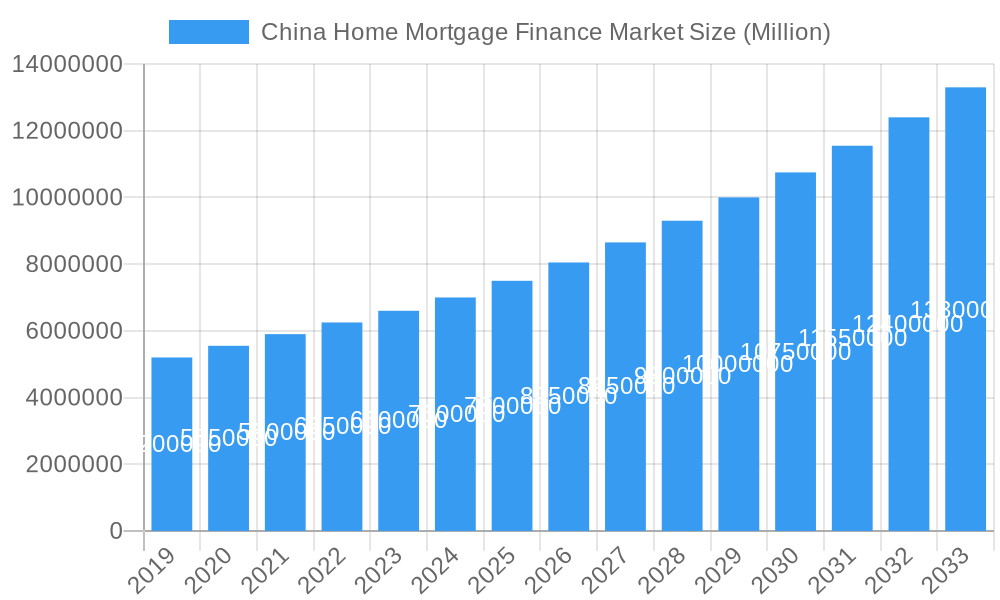

The China Home Mortgage Finance Market is projected to reach $8.5 billion in 2025, exhibiting a strong Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033. This growth is driven by urbanization, increasing disposable incomes, and supportive government policies. The market's foundation in 2025 anticipates further acceleration due to demographic shifts and evolving consumer demand for residential properties and financing.

China Home Mortgage Finance Market Market Size (In Billion)

The forecast period (2025-2033) indicates sustained momentum in China's home mortgage finance sector. Key drivers include continued urbanization, a growing middle class with enhanced purchasing power, and evolving regulatory frameworks. While specific regional market shares are not detailed, major economic hubs and developing urban centers will likely dominate. Interest rate dynamics, housing market stability, and mortgage product availability will be critical factors influencing market trajectory and growth sustainability.

China Home Mortgage Finance Market Company Market Share

China Home Mortgage Finance Market Report Description: Navigating a Dynamic Landscape

This comprehensive report provides an in-depth analysis of the China Home Mortgage Finance Market, a critical sector within China's burgeoning real estate ecosystem. We delve into the intricate dynamics, growth trajectories, and future outlook of this multi-trillion dollar market, offering actionable insights for financial institutions, real estate developers, investors, and policymakers. With a focus on high-traffic keywords such as "China mortgage," "housing finance China," "real estate loans," and "home equity China," this report is meticulously designed to maximize search engine visibility and attract industry professionals seeking strategic intelligence. Our analysis spans the Study Period: 2019–2033, with a Base Year: 2025 and Forecast Period: 2025–2033, encompassing a detailed Historical Period: 2019–2024.

This report meticulously dissects the parent market of China's broader financial services and the child market of mortgage lending, providing a holistic view. We examine key segments including Types of Lenders (Banks, House Provident Fund (HPF)), Financing Options (Personal New Housing Loan, Personal Second-hand Housing Loan, Personal Housing Provident Fund (Portfolio) Loan), and Types of Mortgage (Fixed, Variable). With an estimated market size of XX Million units for the base year, this report is an indispensable resource for understanding the forces shaping homeownership and investment in China.

China Home Mortgage Finance Market Market Dynamics & Structure

The China Home Mortgage Finance Market is characterized by a concentrated structure, dominated by a few large state-owned commercial banks that hold significant market share. Technological innovation is increasingly driving efficiency and customer experience, with the adoption of digital platforms for loan application and processing gaining momentum. Regulatory frameworks, while evolving, continue to exert considerable influence, aiming to balance economic growth with financial stability and prudent risk management. Competitive product substitutes, though limited in direct mortgage offerings, emerge from alternative investment avenues and the evolving rental market. End-user demographics are shifting, with a growing middle class, urbanization, and changing household formation patterns influencing demand. Mergers and Acquisitions (M&A) activity, while not as prevalent as in some mature markets, are present as financial institutions consolidate to enhance scale and market reach.

- Market Concentration: Dominated by state-owned banks, holding an estimated XX% market share.

- Technological Innovation Drivers: Fintech adoption in loan origination and servicing, AI-powered risk assessment.

- Regulatory Frameworks: Government policies on loan-to-value ratios, interest rate controls, and property market cooling measures.

- Competitive Product Substitutes: Wealth management products, government-backed housing schemes.

- End-User Demographics: Urbanization trends, rising disposable incomes, demand from first-time homebuyers and upgraders.

- M&A Trends: Limited but strategically focused deals aimed at expanding digital capabilities or market penetration.

China Home Mortgage Finance Market Growth Trends & Insights

The China Home Mortgage Finance Market has experienced robust growth over the historical period, driven by sustained urbanization, a growing middle class, and government policies supporting homeownership. The market size has expanded significantly, with an estimated XX Million units in 2019 to XX Million units in 2024. Adoption rates for mortgages have been high, reflecting the cultural significance of property ownership in China. Technological disruptions, such as the integration of big data and artificial intelligence in credit scoring and loan approval processes, are enhancing efficiency and reducing turnaround times. Consumer behavior shifts are also playing a crucial role; younger generations are increasingly seeking personalized loan products and digital-first application experiences. The market penetration of mortgages is expected to continue its upward trajectory, fueled by ongoing economic development and evolving housing demand. Projections indicate a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Key insights reveal a growing preference for variable-rate mortgages as interest rate environments fluctuate, alongside a persistent demand for new housing loans driven by urban expansion and housing supply initiatives. The Personal New Housing Loan segment is anticipated to remain the largest contributor to market volume.

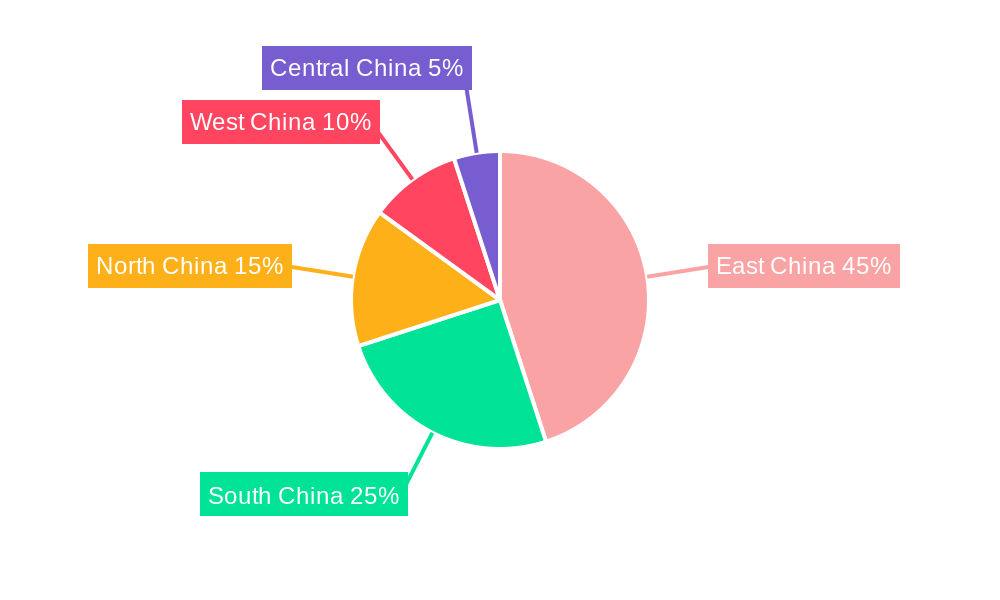

Dominant Regions, Countries, or Segments in China Home Mortgage Finance Market

The China Home Mortgage Finance Market's dominance is intricately linked to the economic vibrancy and population density of its major urban centers and coastal regions. While the entire nation experiences significant activity, the Eastern Coastal Region, particularly cities like Shanghai, Beijing, Shenzhen, and Guangzhou, consistently leads in mortgage finance due to their status as economic hubs, higher disposable incomes, and robust real estate markets. Within the specified segments, Banks as Types of Lenders unequivocally dominate the market, commanding an estimated XX% market share. Among Financing Options, the Personal New Housing Loan segment is the primary driver of market growth, reflecting ongoing urbanization and the construction of new residential properties, accounting for approximately XX% of all mortgage disbursements. Furthermore, within the Types of Mortgage, both Fixed and Variable rates cater to different borrower preferences, with Variable rate mortgages gaining traction due to their potential for lower initial payments in certain economic climates.

- Dominant Region: Eastern Coastal Region (e.g., Shanghai, Beijing, Guangdong Province) due to high economic activity and population.

- Dominant Lender Type: Banks, with state-owned commercial banks holding a substantial majority.

- Dominant Financing Option: Personal New Housing Loan, driven by new property development and urban expansion.

- Key Drivers for Dominance:

- Economic Policies: Government support for housing construction and urban development.

- Infrastructure Development: Extensive transportation and urban infrastructure facilitating residential growth.

- Population Density & Urbanization: High concentration of population in key urban areas.

- Disposable Income: Higher average disposable incomes in dominant regions, enabling mortgage uptake.

- Real Estate Market Activity: Robust sales and development cycles in leading metropolitan areas.

China Home Mortgage Finance Market Product Landscape

The product landscape within the China Home Mortgage Finance Market is evolving to meet diverse borrower needs. Innovations focus on streamlining the application process through digital channels, offering flexible repayment options, and tailoring loan products to specific demographic groups. Banks are increasingly integrating personalized digital interfaces, allowing for faster pre-approvals and loan management. Performance metrics are largely driven by interest rates, loan tenure, and the loan-to-value ratio. Unique selling propositions often lie in competitive interest rates, extended repayment periods, and specialized loan packages for first-time buyers or those looking to upgrade. Technological advancements are leading to more sophisticated risk assessment models, enabling lenders to offer customized solutions.

Key Drivers, Barriers & Challenges in China Home Mortgage Finance Market

Key Drivers: The China Home Mortgage Finance Market is propelled by sustained urbanization, a strong cultural emphasis on homeownership, and supportive government policies aimed at stabilizing the real estate sector. Economic growth and rising disposable incomes are fundamental drivers, enabling a larger segment of the population to access home financing. Technological advancements in digital lending platforms enhance accessibility and efficiency.

- Technological Drivers: Digitalization of loan applications, AI-powered credit assessment.

- Economic Drivers: Sustained GDP growth, rising household incomes.

- Policy Drivers: Government initiatives to promote affordable housing and stabilize the property market.

Barriers & Challenges: Regulatory shifts, including tighter lending standards and property market controls, can act as significant barriers. Fluctuations in interest rates and potential economic slowdowns pose challenges to loan demand and repayment capacity. Intense competition among lenders and the persistent issue of non-performing loans in certain market segments are also considerable challenges. Supply chain disruptions in the construction sector can indirectly impact mortgage demand by affecting property delivery timelines.

- Regulatory Hurdles: Evolving property market regulations, credit control measures.

- Economic Pressures: Interest rate volatility, potential economic slowdowns.

- Competitive Landscape: Intense competition leading to pressure on margins.

- Risk Management: Managing non-performing loan ratios in a dynamic market.

Emerging Opportunities in China Home Mortgage Finance Market

Emerging opportunities in the China Home Mortgage Finance Market lie in catering to niche segments and leveraging technological advancements. The growing demand for rental properties and the potential for property-backed financing solutions present new avenues. The expansion of financial inclusion initiatives could unlock access for previously underserved populations. Innovative digital mortgage platforms offering end-to-end solutions, from property search to loan servicing, are gaining traction. Evolving consumer preferences for sustainable housing and green financing options also present a significant opportunity for differentiation.

Growth Accelerators in the China Home Mortgage Finance Market Industry

Long-term growth in the China Home Mortgage Finance Market is being accelerated by several key catalysts. Technological breakthroughs in blockchain for secure and transparent transaction processing and AI for personalized financial advisory services are poised to revolutionize the industry. Strategic partnerships between financial institutions and real estate technology companies are enhancing customer acquisition and service delivery. Market expansion strategies targeting second- and third-tier cities, as well as the development of specialized mortgage products for specific demographics, such as the elderly or young professionals, will further drive growth.

Key Players Shaping the China Home Mortgage Finance Market Market

- China Construction Bank

- Industrial and Commercial Bank of China

- Agricultural Bank of China

- Bank of China

- HSBC

- Bank of Communications

- Postal Savings Bank of China

Notable Milestones in China Home Mortgage Finance Market Sector

- October 2022: HSBC expands China's private banking network and launches in two new cities, indicating a strategic focus on high-net-worth individuals and wealth management services that can be integrated with mortgage offerings.

- September 2022: China Construction Bank Corp. will set up a 30-billion-yuan (USD 4.2 billion) fund to buy properties from developers. This move aims to support the real estate sector by easing liquidity pressures on developers and stabilizing the property market, indirectly influencing mortgage finance by ensuring project completion.

In-Depth China Home Mortgage Finance Market Market Outlook

The outlook for the China Home Mortgage Finance Market remains robust, underpinned by ongoing urbanization and a continued cultural emphasis on homeownership. Growth accelerators such as digital transformation and the exploration of green financing will shape future market dynamics. Strategic opportunities lie in developing more inclusive and personalized mortgage products, leveraging big data for enhanced risk assessment, and expanding into less saturated urban areas. The market is expected to witness sustained growth, driven by innovative financial solutions and supportive government policies aimed at maintaining economic stability and fostering domestic consumption.

China Home Mortgage Finance Market Segmentation

-

1. Types of Lenders

- 1.1. Banks

- 1.2. House Provident Fund (HPF)

-

2. Financing Options

- 2.1. Personal New Housing Loan

- 2.2. Personal Second-hand Housing Loan

- 2.3. Personal Housing Provident Fund (Portfolio) Loan

-

3. Types of Mortgage

- 3.1. Fixed

- 3.2. Variable

China Home Mortgage Finance Market Segmentation By Geography

- 1. China

China Home Mortgage Finance Market Regional Market Share

Geographic Coverage of China Home Mortgage Finance Market

China Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Favorable Mortgage Rates is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Home Mortgage Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types of Lenders

- 5.1.1. Banks

- 5.1.2. House Provident Fund (HPF)

- 5.2. Market Analysis, Insights and Forecast - by Financing Options

- 5.2.1. Personal New Housing Loan

- 5.2.2. Personal Second-hand Housing Loan

- 5.2.3. Personal Housing Provident Fund (Portfolio) Loan

- 5.3. Market Analysis, Insights and Forecast - by Types of Mortgage

- 5.3.1. Fixed

- 5.3.2. Variable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Types of Lenders

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Construction Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Industrial and Commercial Bank of China

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agricultural Bank of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bank of China

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HSBC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bank of Communications

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Postal Savings Bank of China**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 China Construction Bank

List of Figures

- Figure 1: China Home Mortgage Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Home Mortgage Finance Market Share (%) by Company 2025

List of Tables

- Table 1: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Lenders 2020 & 2033

- Table 2: China Home Mortgage Finance Market Revenue billion Forecast, by Financing Options 2020 & 2033

- Table 3: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Mortgage 2020 & 2033

- Table 4: China Home Mortgage Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Lenders 2020 & 2033

- Table 6: China Home Mortgage Finance Market Revenue billion Forecast, by Financing Options 2020 & 2033

- Table 7: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Mortgage 2020 & 2033

- Table 8: China Home Mortgage Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Home Mortgage Finance Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the China Home Mortgage Finance Market?

Key companies in the market include China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, HSBC, Bank of Communications, Postal Savings Bank of China**List Not Exhaustive.

3. What are the main segments of the China Home Mortgage Finance Market?

The market segments include Types of Lenders, Financing Options, Types of Mortgage.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Favorable Mortgage Rates is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: HSBC expands China's private banking network and launches in two new cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the China Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence