Key Insights

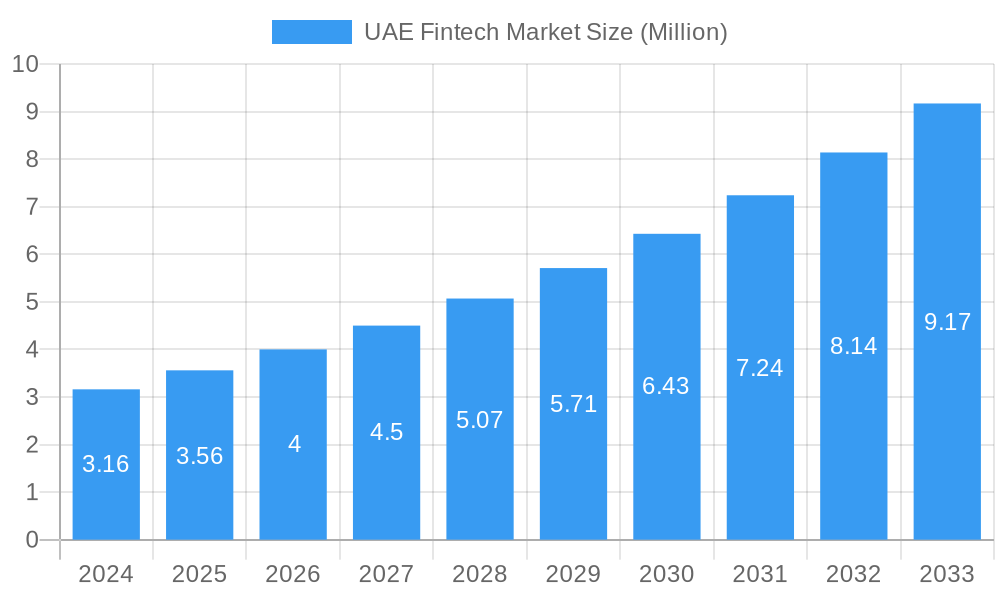

The UAE Fintech Market is poised for substantial expansion, currently valued at an estimated USD 3.16 billion. This dynamic sector is projected to grow at an impressive Compound Annual Growth Rate (CAGR) of 12.56% through 2033, indicating a robust trajectory driven by increasing digital adoption and supportive government initiatives. Key growth drivers include the surging demand for seamless digital payment solutions, the burgeoning interest in accessible savings and investment platforms, and the rapid development of innovative digital lending and peer-to-peer (P2P) lending marketplaces. Furthermore, the online insurance and insurance marketplace segments are witnessing significant traction as consumers embrace digital channels for their financial protection needs. This confluence of factors is creating a fertile ground for fintech innovation and investment in the region.

UAE Fintech Market Market Size (In Million)

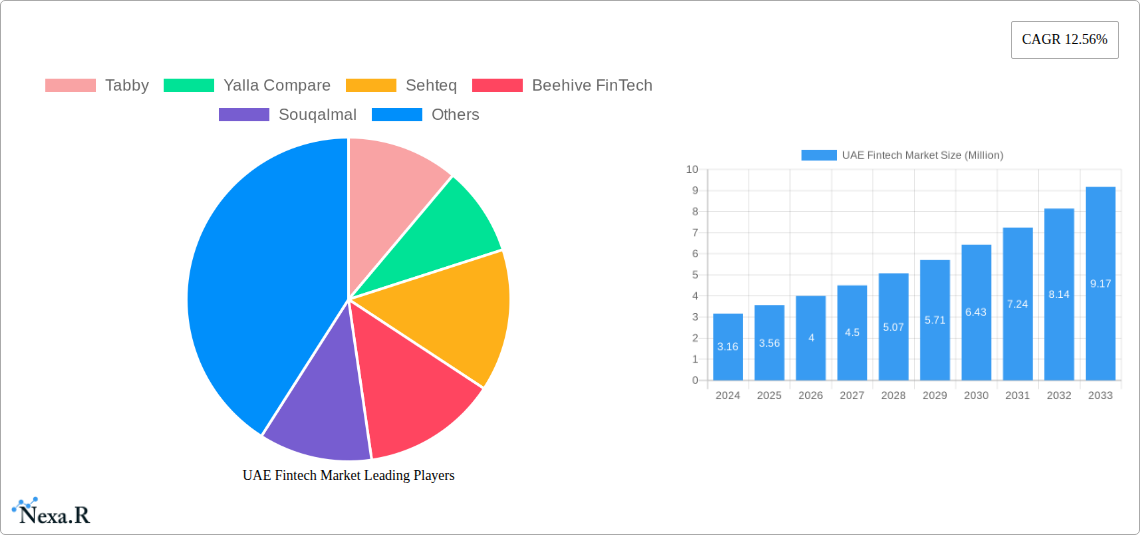

Emerging trends such as the increasing adoption of AI and blockchain technologies are set to revolutionize the UAE's fintech landscape, enhancing security, efficiency, and personalized customer experiences. The growing penetration of smartphones and widespread internet access further empowers these digital financial services. While the market benefits from a favorable regulatory environment and a young, tech-savvy population, potential restraints could arise from evolving cybersecurity threats and the need for continuous upskilling of the workforce to keep pace with technological advancements. Leading players like Tabby, Yalla Compare, Souqalmal, and Sarwa are actively shaping the market through diverse service propositions, from money transfers and payments to comprehensive savings and investment solutions, underscoring the competitive and innovative spirit within the UAE's fintech ecosystem.

UAE Fintech Market Company Market Share

Here is a compelling, SEO-optimized report description for the UAE Fintech Market:

UAE Fintech Market Analysis: Growth, Trends, and Investment Opportunities (2019-2033)

Uncover the dynamic evolution of the UAE Fintech Market, a burgeoning hub for financial innovation in the Middle East. This comprehensive report provides an in-depth analysis of the United Arab Emirates fintech sector, delving into its market size, growth trajectories, and the strategic imperatives shaping its future. With a keen focus on digital payments UAE, online lending UAE, savings and investments UAE, and insurtech UAE, this report is your indispensable guide to understanding the forces driving this rapidly expanding industry.

Explore the parent market of the MENA Fintech Market and its intricate child markets within the UAE, identifying key growth drivers, emerging technologies, and regulatory shifts. Discover critical insights into market concentration, competitive landscapes, and the technological advancements propelling fintech companies UAE. We provide quantitative data, including projected market values in millions, and qualitative assessments to inform your strategic decisions.

This report meticulously examines the UAE fintech market size, its projected growth through 2033, and the pivotal role of key players like Tabby, Yalla Compare, Sehteq, Beehive FinTech, Souqalmal, Sarwa, Mamo Pay, Channel VAS, Zinna, and Now Money. Gain a competitive edge by understanding market dynamics, technological disruptions, consumer behavior shifts, and the dominant segments and regions within the UAE.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

UAE Fintech Market Market Dynamics & Structure

The UAE fintech market is characterized by a dynamic interplay of innovation, supportive regulatory frameworks, and evolving consumer demands. Market concentration is gradually shifting as both established financial institutions and agile startups vie for market share. Technological innovation serves as a primary driver, with advancements in AI, blockchain, and open banking fostering new service propositions and enhancing existing ones. Regulatory bodies like the Dubai Financial Services Authority (DFSA) and the Abu Dhabi Global Market (ADGM) are instrumental in creating sandboxes and guidelines that encourage responsible fintech development, mitigating risks and fostering trust. Competitive product substitutes are emerging rapidly, particularly in the payments and lending sectors, forcing incumbents to adapt and innovate. End-user demographics are increasingly tech-savvy and accustomed to digital interactions, driving higher adoption rates for fintech solutions. Mergers and acquisitions (M&A) are becoming a significant trend as larger entities seek to integrate innovative fintech capabilities or gain access to new customer bases, further consolidating the market.

- Market Concentration: Moderate to high in payments, evolving in other segments.

- Innovation Drivers: AI, Blockchain, Open Banking, Cloud Computing.

- Regulatory Frameworks: Proactive sandboxes and supportive regulations in Dubai and Abu Dhabi.

- Competitive Substitutes: Rapid emergence of digital wallets, Buy Now Pay Later (BNPL) schemes, and peer-to-peer lending platforms.

- End-User Demographics: Young, urban, digitally connected population with high smartphone penetration.

- M&A Trends: Increasing consolidation as larger players acquire smaller, innovative fintechs.

UAE Fintech Market Growth Trends & Insights

The UAE fintech market is poised for substantial growth, driven by a confluence of factors including government initiatives promoting digital transformation, a young and increasingly affluent population, and a robust financial infrastructure. The market size is projected to experience a significant upward trajectory in the coming years, fueled by a growing appetite for convenient and accessible financial services. Adoption rates for digital payments and online banking solutions are soaring, reflecting a paradigm shift in consumer behavior away from traditional banking methods. Technological disruptions, such as the widespread adoption of mobile-first solutions and the integration of AI in customer service and risk assessment, are reshaping the competitive landscape. Consumer behavior is increasingly dictated by the demand for seamless, personalized, and secure digital financial experiences, leading to a greater reliance on fintech platforms for everyday transactions, investments, and credit needs. The market penetration of digital financial services is expected to reach unprecedented levels, driven by continuous innovation and a focus on financial inclusion.

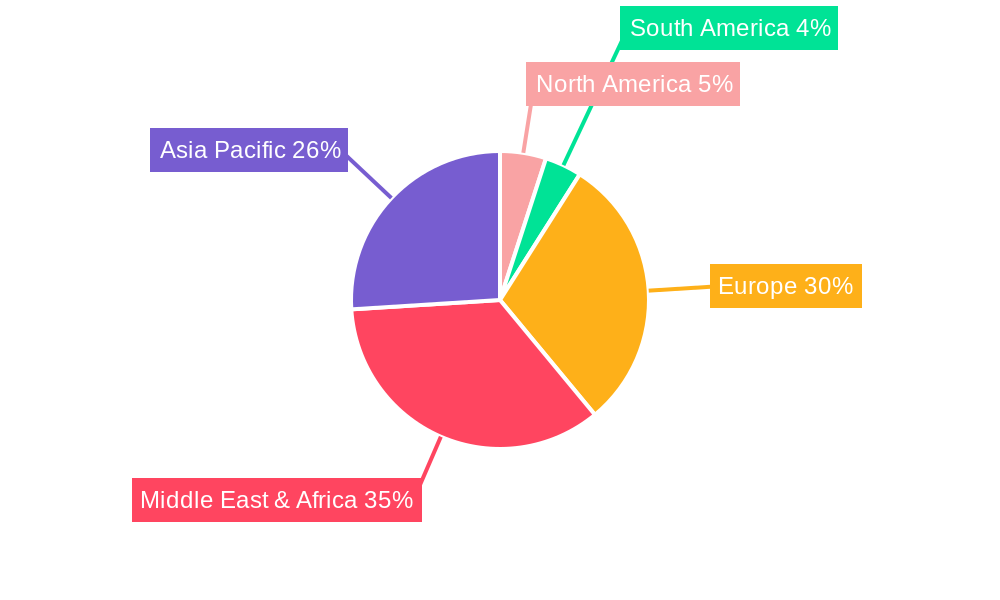

Dominant Regions, Countries, or Segments in UAE Fintech Market

Within the UAE fintech landscape, the Money Transfer and Payments segment stands out as a dominant force, driving significant market growth. This leadership is attributable to several key drivers, including the UAE's status as a major global hub for remittances and its large expatriate population, necessitating efficient and cost-effective cross-border payment solutions. Government initiatives aimed at digitizing the economy and promoting cashless transactions have further propelled the adoption of digital payment platforms. Economic policies favoring business growth and technological integration provide a fertile ground for payment innovators. The robust financial infrastructure, characterized by widespread internet and smartphone penetration, ensures accessibility for a broad segment of the population.

- Money Transfer and Payments: This segment benefits from the high volume of international remittances and the increasing adoption of digital wallets and mobile payment solutions for daily transactions.

- Growth Potential: Fueled by continuous innovation in instant payment systems, cross-border payment efficiency, and the rise of BNPL solutions.

- Market Share: Holds the largest share due to its foundational role in digital commerce and financial inclusion efforts.

- Key Drivers: Government push for cashless society, high smartphone penetration, large expatriate population, and e-commerce growth.

The Savings and Investments segment is also experiencing rapid expansion, driven by a growing awareness of wealth management and the accessibility of digital investment platforms. Digital Lending & Lending Marketplaces are gaining traction as individuals and SMEs seek flexible and faster access to credit. Online Insurance & Insurance Marketplaces (Insurtech) are beginning to mature, offering digitized policy management and innovative insurance products, though their market share is currently smaller compared to payments.

UAE Fintech Market Product Landscape

The UAE fintech market is abuzz with innovative product offerings that redefine financial services. From AI-powered investment advisory platforms offering personalized portfolios to seamless digital wallets facilitating instant peer-to-peer transactions, the product landscape is diverse and rapidly evolving. Unique selling propositions often lie in the hyper-personalization of services, enhanced security features leveraging biometrics and blockchain, and user-friendly interfaces designed for maximum convenience. Technological advancements are evident in the integration of advanced analytics for credit scoring, the development of Sharia-compliant digital financial products, and the creation of integrated platforms that bundle multiple financial services. These innovations are not only enhancing customer experience but also expanding financial inclusion and democratizing access to sophisticated financial tools.

Key Drivers, Barriers & Challenges in UAE Fintech Market

Key Drivers:

- Government Support: Proactive regulatory sandboxes, digital transformation initiatives, and vision for a cashless economy.

- Technological Adoption: High smartphone penetration and a digitally native population eager for innovative financial solutions.

- Demographic Profile: Young, affluent, and tech-savvy population with a growing demand for convenient financial services.

- Economic Diversification: Focus on non-oil sectors, including technology and finance, creating fertile ground for fintech growth.

- Investment Inflow: Significant venture capital and strategic investment flowing into the UAE fintech ecosystem.

Barriers & Challenges:

- Regulatory Evolution: While supportive, navigating evolving and sometimes complex regulatory frameworks can be challenging.

- Cybersecurity Threats: Protecting sensitive financial data from sophisticated cyberattacks remains a paramount concern.

- Customer Trust & Adoption: Building and maintaining customer trust, especially among less digitally inclined segments, requires continuous effort.

- Competition: Intense competition from both domestic and international fintech players, as well as traditional financial institutions.

- Talent Acquisition: Securing skilled talent in areas like AI, blockchain, and data science can be a challenge.

- Interoperability: Ensuring seamless integration and data exchange between various fintech platforms and legacy systems.

- Initial Infrastructure Investment: High upfront costs for developing and scaling new fintech solutions.

Emerging Opportunities in UAE Fintech Market

Emerging opportunities in the UAE fintech market are abundant, particularly in underserved segments and innovative applications. The increasing demand for Sharia-compliant fintech solutions presents a significant untapped market, catering to the region's cultural and religious preferences. The burgeoning e-commerce sector continues to fuel growth in embedded finance, offering opportunities for fintechs to integrate payment and lending solutions directly into online retail experiences. Furthermore, the development of personalized financial advisory services powered by AI and big data analytics holds immense potential for catering to the wealth management needs of the region's affluent population. Open banking initiatives are expected to unlock new avenues for data-driven services and collaborative innovation, fostering the creation of super-apps and integrated financial ecosystems. The focus on financial inclusion also opens doors for low-cost, accessible digital solutions targeting SMEs and unbanked populations.

Growth Accelerators in the UAE Fintech Market Industry

Several key catalysts are accelerating the growth of the UAE Fintech Market. Technological breakthroughs, such as advancements in AI for personalized financial services and blockchain for secure transaction processing, are fundamental to this acceleration. Strategic partnerships between fintech startups and established financial institutions are crucial, enabling wider reach, enhanced credibility, and access to larger customer bases. Market expansion strategies, including the exploration of regional markets and the development of localized product offerings, are also significant growth drivers. The UAE government's continued commitment to fostering innovation through regulatory sandboxes, incubation programs, and strategic investments further amplifies these accelerators. The increasing digital literacy and adoption of smartphones among the population create a receptive environment for the rollout of new fintech solutions, driving rapid market penetration.

Key Players Shaping the UAE Fintech Market Market

- Tabby

- Yalla Compare

- Sehteq

- Beehive FinTech

- Souqalmal

- Sarwa

- Mamo Pay

- Channel VAS

- Zinna

- Now Money

Notable Milestones in UAE Fintech Market Sector

- August 2023: Tabby, MENA’s leading shopping and fintech app, launched Tabby Shop, an all-in-one shopping tool integrating over 500,000 products from 10,000+ brands, marking its most significant app update.

- January 2023: Tabby secured USD 58 million in a Series C funding round led by Sequoia Capital India, STV, and PayPal Ventures, with participation from Mubadala Investment Capital and Arbor Ventures. This funding round valued Tabby at USD 660 million, positioning it as the second most valuable startup in MENA and the top in the GCC.

In-Depth UAE Fintech Market Market Outlook

The future outlook for the UAE Fintech Market is exceptionally bright, characterized by sustained high growth potential and a strategic focus on innovation and inclusivity. Growth accelerators such as the ongoing digital transformation agenda, robust government support, and increasing venture capital investment will continue to fuel expansion. The market is anticipated to witness further maturation in segments like insurtech and digital lending, alongside the continued dominance of payments. Strategic opportunities lie in the development of advanced AI-driven financial solutions, the expansion of embedded finance within the rapidly growing e-commerce sector, and the creation of comprehensive financial super-apps that cater to a wide array of consumer needs. As the UAE solidifies its position as a regional fintech hub, the market is poised for significant evolution, attracting further global investment and fostering groundbreaking financial innovations.

UAE Fintech Market Segmentation

-

1. Service proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

UAE Fintech Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Fintech Market Regional Market Share

Geographic Coverage of UAE Fintech Market

UAE Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Fintech Startups is Driving the Market; Favorable Regulatory Compliance Landscape is Promoting the Fintech Market

- 3.3. Market Restrains

- 3.3.1. Rise in the Number of Fintech Startups is Driving the Market; Favorable Regulatory Compliance Landscape is Promoting the Fintech Market

- 3.4. Market Trends

- 3.4.1. The Market is Being Driven by the Development of New Technologies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 6. North America UAE Fintech Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service proposition

- 6.1.1. Money Transfer and Payments

- 6.1.2. Savings and Investments

- 6.1.3. Digital Lending & Lending Marketplaces

- 6.1.4. Online Insurance & Insurance Marketplaces

- 6.1. Market Analysis, Insights and Forecast - by Service proposition

- 7. South America UAE Fintech Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service proposition

- 7.1.1. Money Transfer and Payments

- 7.1.2. Savings and Investments

- 7.1.3. Digital Lending & Lending Marketplaces

- 7.1.4. Online Insurance & Insurance Marketplaces

- 7.1. Market Analysis, Insights and Forecast - by Service proposition

- 8. Europe UAE Fintech Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service proposition

- 8.1.1. Money Transfer and Payments

- 8.1.2. Savings and Investments

- 8.1.3. Digital Lending & Lending Marketplaces

- 8.1.4. Online Insurance & Insurance Marketplaces

- 8.1. Market Analysis, Insights and Forecast - by Service proposition

- 9. Middle East & Africa UAE Fintech Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service proposition

- 9.1.1. Money Transfer and Payments

- 9.1.2. Savings and Investments

- 9.1.3. Digital Lending & Lending Marketplaces

- 9.1.4. Online Insurance & Insurance Marketplaces

- 9.1. Market Analysis, Insights and Forecast - by Service proposition

- 10. Asia Pacific UAE Fintech Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service proposition

- 10.1.1. Money Transfer and Payments

- 10.1.2. Savings and Investments

- 10.1.3. Digital Lending & Lending Marketplaces

- 10.1.4. Online Insurance & Insurance Marketplaces

- 10.1. Market Analysis, Insights and Forecast - by Service proposition

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tabby

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yalla Compare

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sehteq

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beehive FinTech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Souqalmal

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sarwa

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mamo Pay

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Channel VAS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zinna

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Now Money**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tabby

List of Figures

- Figure 1: Global UAE Fintech Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UAE Fintech Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America UAE Fintech Market Revenue (Million), by Service proposition 2025 & 2033

- Figure 4: North America UAE Fintech Market Volume (Billion), by Service proposition 2025 & 2033

- Figure 5: North America UAE Fintech Market Revenue Share (%), by Service proposition 2025 & 2033

- Figure 6: North America UAE Fintech Market Volume Share (%), by Service proposition 2025 & 2033

- Figure 7: North America UAE Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America UAE Fintech Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America UAE Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America UAE Fintech Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America UAE Fintech Market Revenue (Million), by Service proposition 2025 & 2033

- Figure 12: South America UAE Fintech Market Volume (Billion), by Service proposition 2025 & 2033

- Figure 13: South America UAE Fintech Market Revenue Share (%), by Service proposition 2025 & 2033

- Figure 14: South America UAE Fintech Market Volume Share (%), by Service proposition 2025 & 2033

- Figure 15: South America UAE Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 16: South America UAE Fintech Market Volume (Billion), by Country 2025 & 2033

- Figure 17: South America UAE Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America UAE Fintech Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe UAE Fintech Market Revenue (Million), by Service proposition 2025 & 2033

- Figure 20: Europe UAE Fintech Market Volume (Billion), by Service proposition 2025 & 2033

- Figure 21: Europe UAE Fintech Market Revenue Share (%), by Service proposition 2025 & 2033

- Figure 22: Europe UAE Fintech Market Volume Share (%), by Service proposition 2025 & 2033

- Figure 23: Europe UAE Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe UAE Fintech Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe UAE Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe UAE Fintech Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa UAE Fintech Market Revenue (Million), by Service proposition 2025 & 2033

- Figure 28: Middle East & Africa UAE Fintech Market Volume (Billion), by Service proposition 2025 & 2033

- Figure 29: Middle East & Africa UAE Fintech Market Revenue Share (%), by Service proposition 2025 & 2033

- Figure 30: Middle East & Africa UAE Fintech Market Volume Share (%), by Service proposition 2025 & 2033

- Figure 31: Middle East & Africa UAE Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East & Africa UAE Fintech Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa UAE Fintech Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific UAE Fintech Market Revenue (Million), by Service proposition 2025 & 2033

- Figure 36: Asia Pacific UAE Fintech Market Volume (Billion), by Service proposition 2025 & 2033

- Figure 37: Asia Pacific UAE Fintech Market Revenue Share (%), by Service proposition 2025 & 2033

- Figure 38: Asia Pacific UAE Fintech Market Volume Share (%), by Service proposition 2025 & 2033

- Figure 39: Asia Pacific UAE Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Asia Pacific UAE Fintech Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UAE Fintech Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 2: Global UAE Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 3: Global UAE Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UAE Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global UAE Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 6: Global UAE Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 7: Global UAE Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global UAE Fintech Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Global UAE Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 16: Global UAE Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 17: Global UAE Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UAE Fintech Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Brazil UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Argentina UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Argentina UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Global UAE Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 26: Global UAE Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 27: Global UAE Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global UAE Fintech Market Volume Billion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Germany UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: France UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Italy UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Spain UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Russia UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Benelux UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Nordics UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Nordics UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global UAE Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 48: Global UAE Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 49: Global UAE Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global UAE Fintech Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: Turkey UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Turkey UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Israel UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Israel UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: GCC UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: GCC UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: North Africa UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Africa UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global UAE Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 64: Global UAE Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 65: Global UAE Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global UAE Fintech Market Volume Billion Forecast, by Country 2020 & 2033

- Table 67: China UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: India UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Japan UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: South Korea UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Korea UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: ASEAN UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Oceania UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Oceania UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific UAE Fintech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific UAE Fintech Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Fintech Market?

The projected CAGR is approximately 12.56%.

2. Which companies are prominent players in the UAE Fintech Market?

Key companies in the market include Tabby, Yalla Compare, Sehteq, Beehive FinTech, Souqalmal, Sarwa, Mamo Pay, Channel VAS, Zinna, Now Money**List Not Exhaustive.

3. What are the main segments of the UAE Fintech Market?

The market segments include Service proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Fintech Startups is Driving the Market; Favorable Regulatory Compliance Landscape is Promoting the Fintech Market.

6. What are the notable trends driving market growth?

The Market is Being Driven by the Development of New Technologies.

7. Are there any restraints impacting market growth?

Rise in the Number of Fintech Startups is Driving the Market; Favorable Regulatory Compliance Landscape is Promoting the Fintech Market.

8. Can you provide examples of recent developments in the market?

August 2023: MENA’s number one shopping and fintech app, Tabby, launched its latest all-in-one shopping tool, Tabby Shop. This is the biggest update to Tabby’s app since its inception. Tabi Shop is a comprehensive shopping app that brings together more than 500,000+ products from over 10,000+ brands in the Fashion, Beauty, Home, and Electronics categories. Tabby Shop offers several shopping tools, such as smarter search, better wishlists, deal notifications, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Fintech Market?

To stay informed about further developments, trends, and reports in the UAE Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence