Key Insights

The Asia-Pacific e-bike market is experiencing substantial growth, fueled by increasing urbanization, rising fuel costs, and a heightened environmental consciousness. This surge is driving demand for sustainable transportation alternatives. Supportive government policies promoting green mobility and investments in cycling infrastructure across key nations like China, Japan, and India further accelerate this trend. Evolving consumer preferences for convenient and eco-friendly commuting are key contributors to the market's expansion, with an estimated market size of $14.51 billion and a projected Compound Annual Growth Rate (CAGR) of 5.22% from a base year of 2025.

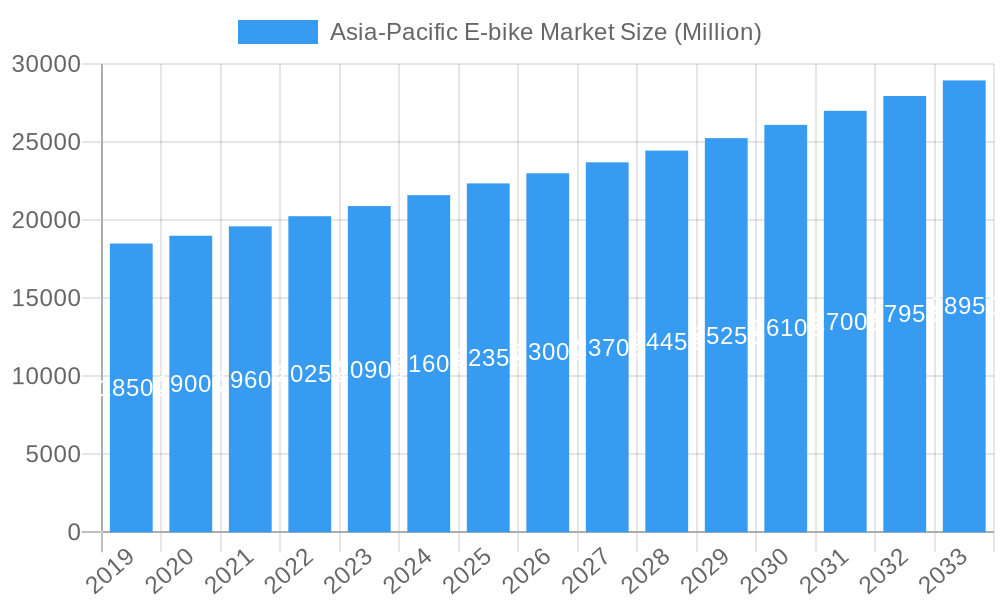

Asia-Pacific E-bike Market Market Size (In Billion)

The market features diverse propulsion types, with "Pedal Assisted" and "Throttle Assisted" segments expected to lead, serving varied needs from leisure to efficient commuting. "City/Urban" and "Cargo/Utility" applications are poised for significant growth, driven by their use in daily errands, commuting, and last-mile delivery. While Lithium-ion batteries currently dominate due to their performance and lifespan, advancements in "Lead Acid Battery" technology and emerging "Other" battery types will add to market diversity. Leading companies such as Giant Manufacturing Co., Hero Cycles Limited, and Yamaha Bicycle are innovating and expanding their offerings to capture this dynamic market. China, as a major manufacturing hub and consumer market, spearheads the Asia-Pacific region's dominance in the global e-bike landscape.

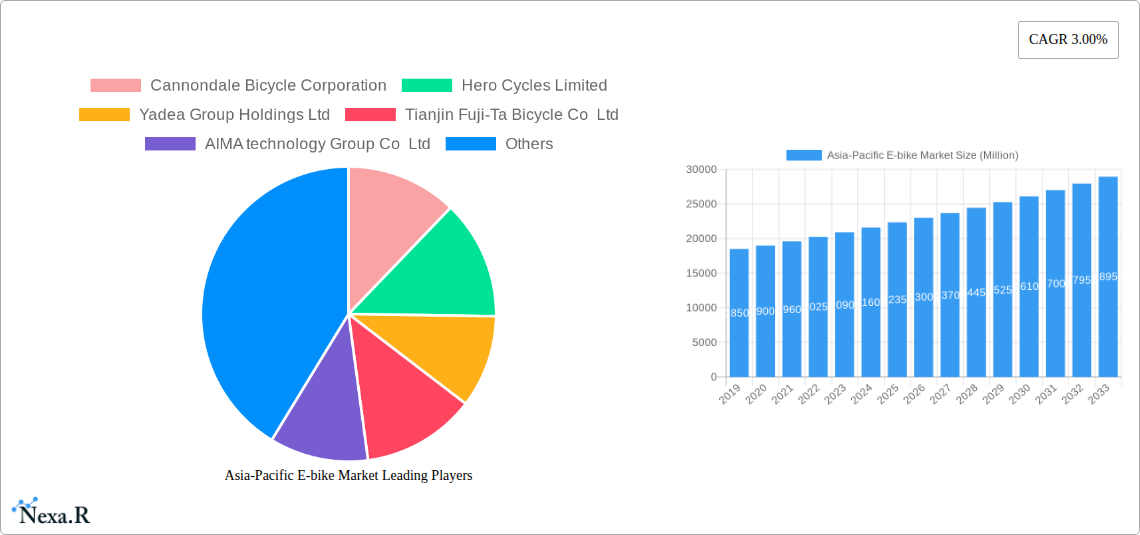

Asia-Pacific E-bike Market Company Market Share

Gain critical insights into the expanding Asia-Pacific e-bike market, driven by urbanization, environmental awareness, and shifting mobility demands. This analysis covers market dynamics, growth trajectories, regional leadership, product innovation, key players, and future projections from 2019 to 2033, with 2025 as the estimated base year. Understand the significant potential of electric bicycles in Asia and identify emerging opportunities. This report provides actionable intelligence for industry professionals, investors, and stakeholders.

Asia-Pacific E-bike Market Market Dynamics & Structure

The Asia-Pacific e-bike market is characterized by a dynamic interplay of market concentration, rapid technological innovation, and evolving regulatory frameworks. While dominated by a few large manufacturers, the market also fosters considerable competition from emerging players, particularly in China e-bike market and Southeast Asia. Technological innovation is a significant driver, with continuous advancements in battery technology, motor efficiency, and smart connectivity enhancing e-bike performance and user experience. The increasing emphasis on sustainable transportation and government initiatives promoting green mobility are further fueling market growth.

- Market Concentration: The market exhibits moderate to high concentration, with a significant share held by leading companies.

- Technological Innovation Drivers: Advancements in Lithium-ion battery technology, lightweight materials, and integrated GPS/app connectivity are key innovation catalysts.

- Regulatory Frameworks: Government incentives for e-mobility, evolving safety standards, and local manufacturing policies significantly influence market entry and growth.

- Competitive Product Substitutes: Traditional bicycles, scooters, and public transportation remain key substitutes, though the convenience and efficiency of e-bikes are steadily gaining traction.

- End-User Demographics: A diverse demographic, including urban commuters, recreational riders, and the elderly, are increasingly adopting e-bikes.

- M&A Trends: The sector has witnessed strategic acquisitions and partnerships aimed at expanding market reach and integrating new technologies.

Asia-Pacific E-bike Market Growth Trends & Insights

The Asia-Pacific e-bike market is poised for remarkable expansion, projecting a compound annual growth rate (CAGR) of approximately 12.5% from 2025 to 2033. This robust growth is underpinned by several key trends. Increasing urbanization across the region, leading to greater demand for efficient and sustainable last-mile connectivity solutions, is a primary catalyst. The escalating price of fuel and growing environmental concerns are pushing consumers towards greener alternatives like e-bikes, thereby boosting adoption rates. Furthermore, continuous technological disruptions, such as the development of more affordable and longer-lasting batteries and smarter integrated features, are making e-bikes more appealing and accessible to a wider consumer base.

Consumer behavior is also shifting significantly. There's a noticeable trend towards the adoption of e-bikes for daily commutes, recreational activities, and even for delivery services. The growing awareness about the health benefits associated with cycling, coupled with the reduced physical exertion offered by electric assistance, is attracting a broader demographic. Government initiatives, including subsidies, tax incentives, and the development of dedicated cycling infrastructure in major cities, are further accelerating market penetration. The evolving product landscape, with a wider variety of e-bike types catering to specific needs – from compact urban models to robust cargo bikes – is also contributing to increased market adoption. The e-bike sales in Asia are expected to reach over 35 million units by 2033.

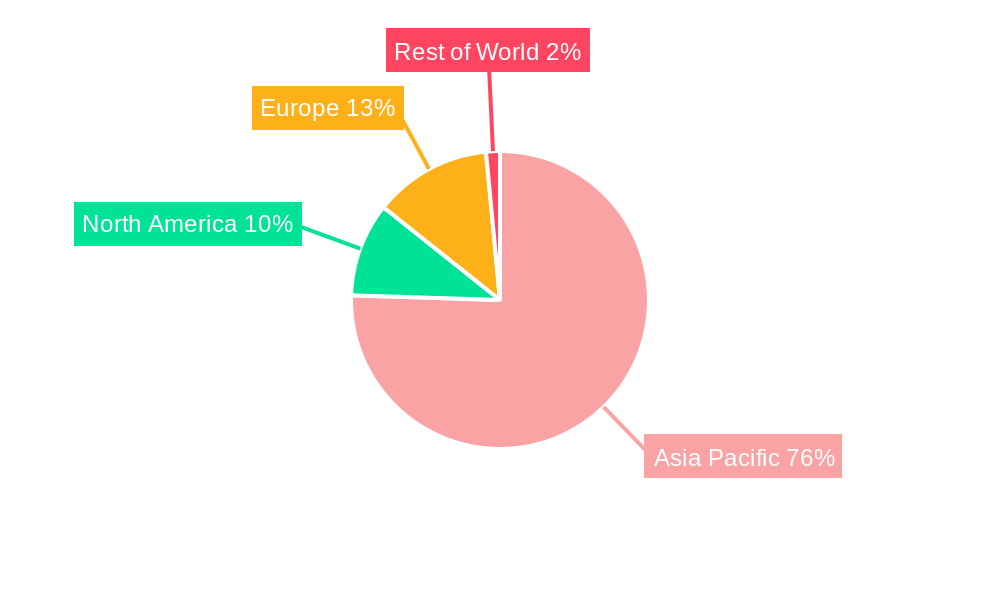

Dominant Regions, Countries, or Segments in Asia-Pacific E-bike Market

China stands as the undisputed leader in the Asia-Pacific e-bike market, contributing over 60% of the total market volume. This dominance is attributed to a combination of factors including strong government support for electric mobility, a well-established manufacturing base, and a large domestic market with a high adoption rate for electric two-wheelers. The China e-bike market is further driven by its extensive network of cycling paths and the growing popularity of e-bikes for commuting and logistics.

Among the segments, Pedal Assisted e-bikes command the largest market share, accounting for approximately 70% of the total volume. This preference is driven by their versatility, offering a balance between exercise and electric assistance, making them suitable for a wide range of applications.

- Propulsion Type Dominance: Pedal Assisted e-bikes are the leading segment due to their user-friendliness and suitability for diverse riding conditions.

- Application Type Dominance: The City/Urban application segment is the largest, reflecting the increasing use of e-bikes for commuting and navigating congested city environments.

- Battery Type Dominance: Lithium-ion batteries are the dominant technology, offering superior energy density, longer lifespan, and faster charging compared to Lead Acid batteries.

The Asia-Pacific e-bike market size is projected to reach over 60 million units by 2033, with China spearheading this growth. Other significant markets include Japan, South Korea, and increasingly, Southeast Asian nations like Vietnam and Indonesia, driven by similar trends of urbanization and a shift towards sustainable transportation. The growth potential in these emerging markets is substantial, fueled by improving economic conditions and a growing middle class.

Asia-Pacific E-bike Market Product Landscape

The Asia-Pacific e-bike market is witnessing a wave of product innovations aimed at enhancing performance, user experience, and sustainability. Manufacturers are focusing on developing lighter frames using advanced materials, integrating smarter connectivity features like GPS tracking and app-based diagnostics, and improving battery technology for extended range and faster charging. Innovations in motor efficiency and braking systems are also key, ensuring safer and more enjoyable rides. The product landscape now includes a diverse range of e-bikes, from compact and foldable urban models designed for multi-modal commuting to robust trekking e-bikes capable of handling off-road terrains, and specialized cargo e-bikes supporting logistics and delivery services.

Key Drivers, Barriers & Challenges in Asia-Pacific E-bike Market

The Asia-Pacific electric bicycle market is propelled by several key drivers. Technological advancements in battery technology, offering longer range and faster charging, are significantly increasing adoption. Growing environmental concerns and government initiatives promoting sustainable transportation, including subsidies and tax incentives, are also major catalysts. Furthermore, increasing urbanization and the need for efficient last-mile connectivity solutions are driving demand.

However, the market faces several barriers and challenges. High initial purchase costs can deter some consumers, despite the long-term cost savings. Inadequate charging infrastructure in certain regions and a lack of standardized regulations across different countries pose significant hurdles. Supply chain disruptions and the increasing cost of raw materials, particularly for batteries, can impact pricing and availability. Intense competition from established players and new entrants also presents a challenge.

Emerging Opportunities in Asia-Pacific E-bike Market

Emerging opportunities in the Asia-Pacific e-bike market are abundant. The development of subscription-based e-bike models and shared e-bike services presents a significant untapped market, particularly in densely populated urban areas. Innovative applications such as e-bikes for tourism, adventure sports, and specialized commercial uses like mobile vending are gaining traction. Evolving consumer preferences towards customization and personalized e-bike features are creating niche markets. Furthermore, the growing demand for smart and connected e-bikes, with advanced safety features and integrated digital ecosystems, offers substantial growth potential.

Growth Accelerators in the Asia-Pacific E-bike Market Industry

Growth accelerators for the Asia-Pacific e-bike industry are primarily driven by continuous technological breakthroughs, particularly in battery energy density and charging speeds, which are making e-bikes more practical and affordable. Strategic partnerships between e-bike manufacturers and technology companies are fostering innovation in areas like AI-powered route optimization and enhanced safety features. Market expansion strategies, including the development of robust sales and service networks in emerging economies and the introduction of a wider range of affordable e-bike models, are also critical growth catalysts.

Key Players Shaping the Asia-Pacific E-bike Market Market

- Cannondale Bicycle Corporation

- Hero Cycles Limited

- Yadea Group Holdings Ltd

- Tianjin Fuji-Ta Bicycle Co Ltd

- AIMA technology Group Co Ltd

- Riese & Müller

- Merida Industry Co Ltd

- Trek Bicycle Corporation

- Yamaha Bicycle

- Giant Manufacturing Co

Notable Milestones in Asia-Pacific E-bike Market Sector

- December 2022: Yadea joined with New U.S. Partner Recruitment Drive for its Ebike Products as part of its 2023 national dealership promotion plan, seeking local agents and distributors for global expansion.

- November 2022: Cannondale announced a new global unified organizational structure to leverage Pon.Bike for enhanced operations and growth, eliminating regional GMs.

- November 2022: Cannondale entered the urban e-mobility market with the launch of its Compact Neo electric bicycle.

In-Depth Asia-Pacific E-bike Market Market Outlook

The Asia-Pacific e-bike market is projected for sustained and accelerated growth. Key future potential lies in the integration of advanced connectivity features, creating smarter and safer riding experiences. Strategic opportunities include the expansion of e-bike sharing platforms and subscription services to cater to the growing demand for flexible mobility solutions. Furthermore, focusing on developing robust charging infrastructure and advocating for supportive government policies will be crucial. The increasing disposable income in developing Asian economies, coupled with a growing eco-consciousness, presents a fertile ground for increased adoption of e-bikes across various demographics and applications, solidifying the region's position as a global leader in e-mobility.

Asia-Pacific E-bike Market Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Asia-Pacific E-bike Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific E-bike Market Regional Market Share

Geographic Coverage of Asia-Pacific E-bike Market

Asia-Pacific E-bike Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Air Pollution Awareness and Health Concern is Driving the Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific E-bike Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cannondale Bicycle Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hero Cycles Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yadea Group Holdings Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tianjin Fuji-Ta Bicycle Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AIMA technology Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Riese & Müller

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Merida Industry Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trek Bicycle Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamaha Bicycle

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Giant Manufacturing Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cannondale Bicycle Corporation

List of Figures

- Figure 1: Asia-Pacific E-bike Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific E-bike Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific E-bike Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 2: Asia-Pacific E-bike Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Asia-Pacific E-bike Market Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 4: Asia-Pacific E-bike Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific E-bike Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 6: Asia-Pacific E-bike Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: Asia-Pacific E-bike Market Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 8: Asia-Pacific E-bike Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific E-bike Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific E-bike Market?

The projected CAGR is approximately 5.22%.

2. Which companies are prominent players in the Asia-Pacific E-bike Market?

Key companies in the market include Cannondale Bicycle Corporation, Hero Cycles Limited, Yadea Group Holdings Ltd, Tianjin Fuji-Ta Bicycle Co Ltd, AIMA technology Group Co Ltd, Riese & Müller, Merida Industry Co Ltd, Trek Bicycle Corporation, Yamaha Bicycle, Giant Manufacturing Co.

3. What are the main segments of the Asia-Pacific E-bike Market?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Air Pollution Awareness and Health Concern is Driving the Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

December 2022: As part of its 2023 national dealership promotion plan, Yadea has joined with New U.S. Partner Recruitment Drive for its Ebike Products. Yadea's Ebike is looking for local agents and distributors in the US as part of its plans for global expansion.November 2022: Cannondale announced a new global unified organizational structure that will eliminate regional GM and, the company said, leverage Pon.Bike to enhance operations and growth.November 2022: Cannondale enters urban e-mobility market with Compact Neo electric bicycle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific E-bike Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific E-bike Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific E-bike Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific E-bike Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence