Key Insights

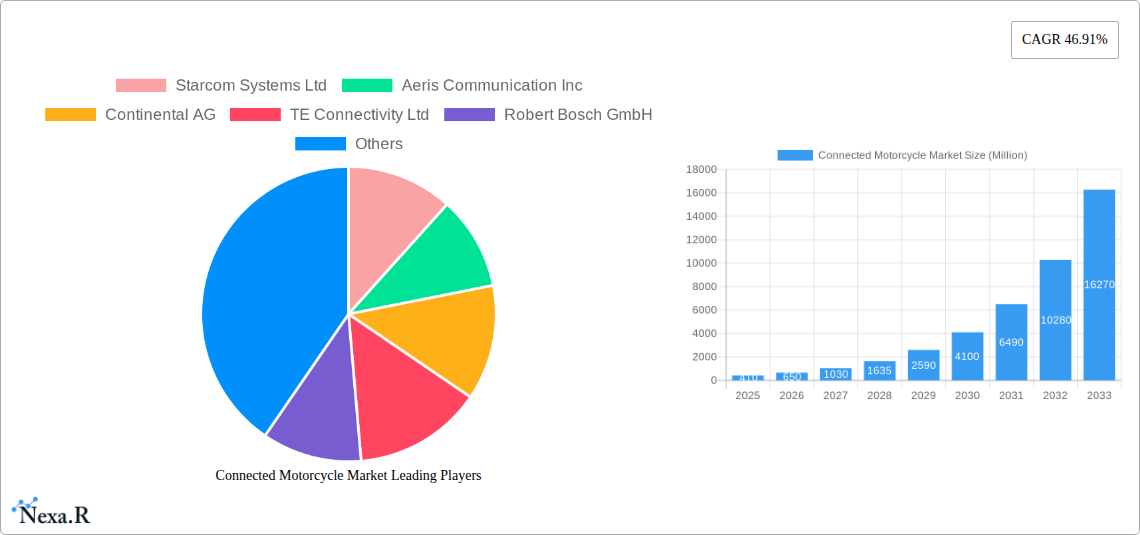

The global Connected Motorcycle Market is poised for remarkable expansion, projected to surge from an estimated USD 410 million in 2025 to an impressive USD 3,020 million by 2033, registering a robust Compound Annual Growth Rate (CAGR) of 46.91% during the forecast period of 2025-2033. This phenomenal growth is underpinned by a confluence of factors, chief among them being the escalating integration of advanced driver-assistance systems (ADAS) that enhance rider safety and vehicle performance. The increasing demand for sophisticated infotainment solutions, offering seamless connectivity for navigation, communication, and entertainment, is also a significant catalyst. Furthermore, the paramount importance of safety features, including real-time diagnostics and emergency communication, is driving adoption among both private and commercial motorcycle users. Key industry players like Continental AG, Robert Bosch GmbH, and Panasonic Corporation are investing heavily in research and development, introducing innovative technologies that further accelerate market penetration.

Connected Motorcycle Market Market Size (In Million)

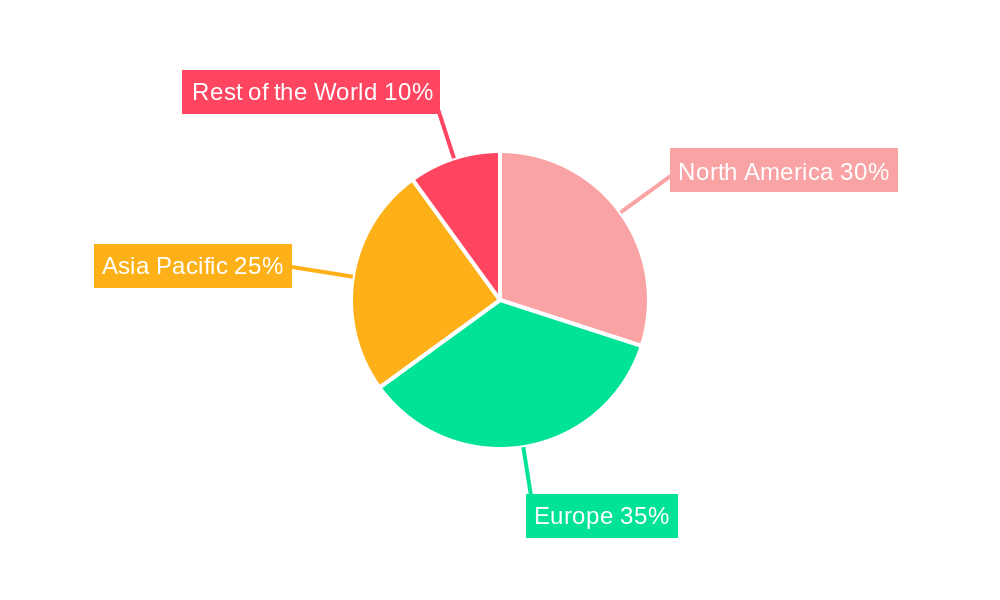

The market's trajectory is further shaped by key trends such as the burgeoning adoption of Vehicle-to-Everything (V2X) communication technologies, enabling motorcycles to interact with their surroundings, thereby improving traffic flow and accident prevention. The growing preference for smart and connected mobility solutions, coupled with stringent government regulations promoting motorcycle safety, is also fueling market expansion. While the market is experiencing vigorous growth, certain restraints such as the high cost of integrated technologies and potential cybersecurity concerns need to be addressed. However, these are expected to be overcome by ongoing technological advancements and increased consumer awareness. Geographically, North America and Europe are anticipated to lead the market, owing to high disposable incomes and a strong inclination towards technological adoption. The Asia Pacific region, driven by rapid urbanization and a growing two-wheeler segment, presents a significant opportunity for future growth.

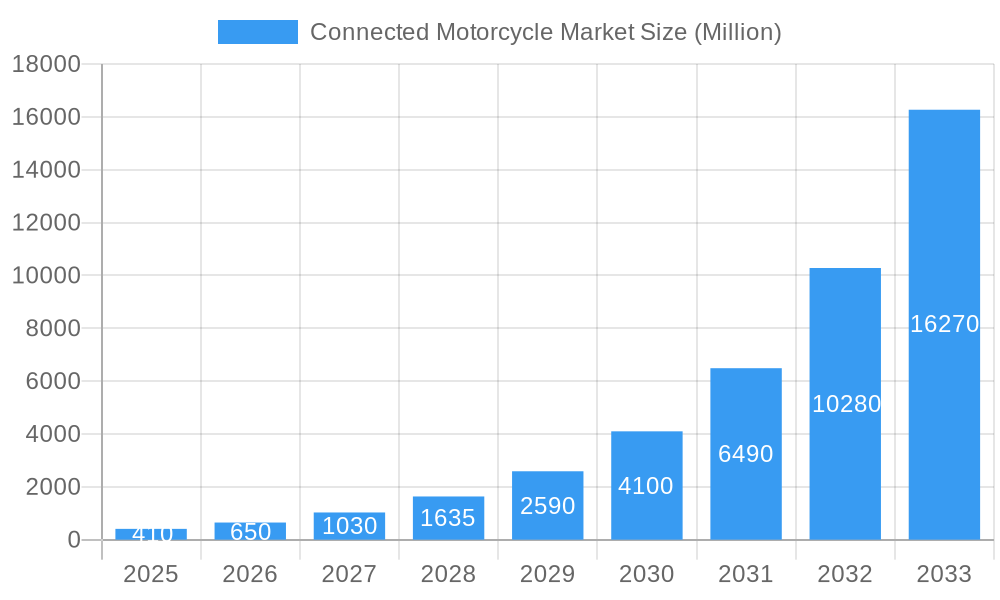

Connected Motorcycle Market Company Market Share

This in-depth report provides a definitive analysis of the global connected motorcycle market, offering critical insights into its present state and future trajectory. Covering the historical period (2019–2024), base year (2025), and forecast period (2025–2033), this research delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, and emerging opportunities. With a focus on parent market and child market segments, and presenting all values in million units, this report is an indispensable resource for industry professionals, strategists, and investors seeking to understand and capitalize on the evolving landscape of smart motorcycle technology, V2X communication for two-wheelers, and IoT in transportation.

Connected Motorcycle Market Dynamics & Structure

The connected motorcycle market exhibits a dynamic structure driven by rapid technological advancements and increasing consumer demand for enhanced safety and convenience. Market concentration is gradually shifting as more established automotive component manufacturers, like Continental AG and Robert Bosch GmbH, invest heavily in developing integrated solutions for motorcycles. Simultaneously, specialized technology firms such as Autotalks and Aeris Communication Inc. are carving out significant niches, particularly in V2X communication and telematics solutions. Technological innovation is a primary driver, fueled by the pursuit of features like advanced rider assistance systems (ARAS), real-time diagnostics, and seamless smartphone integration. Regulatory frameworks are evolving to support vehicle-to-everything (V2X) communication and data privacy, influencing product development and market entry strategies. Competitive product substitutes are emerging in the form of enhanced traditional motorcycle features, but the unique benefits of connectivity are creating a distinct market segment. End-user demographics are diverse, encompassing both private and commercial users, each with distinct needs and willingness to adopt connected features. Mergers and acquisitions (M&A) trends are anticipated to rise as larger players seek to acquire innovative technologies and expand their market reach, further consolidating the industry.

- Market Concentration: Moderate to high, with increasing competition from tech-focused entrants.

- Technological Innovation Drivers: Demand for safety, infotainment, predictive maintenance, and remote diagnostics.

- Regulatory Frameworks: Developing standards for V2X, data security, and cybersecurity.

- Competitive Product Substitutes: Advanced non-connected features, but limited in scope compared to connected solutions.

- End-User Demographics: Growing adoption among tech-savvy younger riders and fleet operators.

- M&A Trends: Expected to increase as key players consolidate market share and acquire specialized technologies.

Connected Motorcycle Market Growth Trends & Insights

The connected motorcycle market is poised for significant expansion, driven by escalating demand for rider safety, advanced infotainment, and seamless connectivity. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period, reaching an estimated XX million units by 2033. This growth trajectory is underpinned by increasing consumer awareness regarding the benefits of smart motorcycle features, such as real-time navigation, emergency alerts, and remote diagnostics. Technological disruptions, including the advancement of 5G connectivity and the proliferation of Internet of Things (IoT) devices, are paving the way for more sophisticated and integrated connected solutions. Consumer behavior shifts are also playing a crucial role, with riders increasingly expecting the same level of connectivity on their motorcycles as they experience with their smartphones and automobiles. This has led to a higher adoption rate of connected features, particularly in developed economies.

Key growth trends include:

- Service Adoption: A substantial increase in the uptake of Driver Assistance services, with an estimated market penetration of XX% by 2033, driven by their potential to significantly reduce accidents and improve rider confidence.

- Infotainment Integration: The integration of advanced Infotainment systems, offering features like music streaming, voice commands, and smartphone mirroring, is expected to see a market penetration of XX%, enhancing the overall riding experience.

- Safety Enhancements: Safety features, including eCall systems, fall detection, and predictive maintenance alerts, are becoming standard, with an anticipated market penetration of XX%.

- End-User Penetration: The Private end-user segment is expected to dominate, accounting for approximately XX% of the market share, owing to rising disposable incomes and a growing desire for premium riding experiences. The Commercial segment, encompassing delivery fleets and law enforcement, will also see steady growth, reaching XX%.

The evolution of motorcycle platforms to accommodate sophisticated electronic architectures and the increasing focus of manufacturers like BMW Motorrad on digital integration are critical factors supporting this expansion. Furthermore, the development of Vehicle-to-Everything (V2X) communication protocols is expected to unlock new levels of safety and traffic management for motorcycles, further accelerating adoption. The forecast period will witness a paradigm shift from basic connectivity to intelligent, proactive, and personalized riding experiences.

Dominant Regions, Countries, or Segments in Connected Motorcycle Market

The connected motorcycle market's dominance is a complex interplay of regional adoption rates, governmental initiatives, economic prosperity, and specific segment growth. Globally, Asia Pacific is emerging as the leading region, driven by its massive motorcycle production and consumption base, coupled with rapid urbanization and increasing disposable incomes in countries like India and China. The Suzuki Avenis launch in India, featuring comprehensive smartphone connectivity, exemplifies this trend. Within this region, India stands out as a pivotal market, expected to contribute significantly to the global volume, driven by the demand for affordable yet feature-rich connected motorcycles for both personal use and delivery services.

The Service: Driver Assistance segment is a key growth driver across all dominant regions, projected to reach an estimated XX million units by 2033. This is propelled by a strong emphasis on rider safety and the integration of advanced technologies aimed at preventing accidents.

- Key Drivers for Asia Pacific Dominance:

- High Motorcycle Penetration: Extensive use of motorcycles for daily commuting and commercial purposes.

- Government Initiatives: Policies promoting smart city development and digital infrastructure.

- Increasing Disposable Incomes: Greater affordability of premium and technologically advanced motorcycles.

- Growing Awareness: Rising consciousness about rider safety and the benefits of connectivity.

The End User: Private segment is also a major contributor to market growth, with an estimated XX million units forecast for 2033. This segment's growth is fueled by a desire for enhanced riding experiences, personalization, and the integration of smart features that mirror smartphone functionalities.

- Key Drivers for Private Segment Dominance:

- Tech-Savvy Demographics: Younger riders embracing digital technologies and smart devices.

- Demand for Convenience: Features like seamless navigation, music streaming, and communication.

- Brand Differentiation: Manufacturers offering connected features as a premium selling point.

While Europe and North America have a strong foundation in advanced rider assistance and safety technologies, Asia Pacific's sheer volume and rapid adoption of connected features are positioning it as the frontrunner in terms of unit sales and market expansion. The Commercial end-user segment, though smaller, is showing substantial growth potential, particularly in logistics and delivery services, where real-time tracking and fleet management are crucial.

Connected Motorcycle Market Product Landscape

The product landscape of the connected motorcycle market is characterized by rapid innovation, focusing on integrating advanced telematics, infotainment, and safety systems. Manufacturers are increasingly equipping motorcycles with sophisticated TFT displays that serve as central hubs for connectivity, mirroring features seen in automobiles. Notable innovations include built-in navigation systems integrated via smartphone apps, as announced by BMW, replacing traditional turn-by-turn navigation. Suzuki's Avenis showcases a practical application of connectivity, offering real-time alerts for calls, messages, and critical riding information directly on the display. Performance metrics are being enhanced through over-the-air (OTA) updates, allowing for continuous improvement of software and features without physical intervention. The integration of V2X communication technologies by companies like Autotalks is a significant advancement, enabling motorcycles to communicate with other vehicles, infrastructure, and pedestrians, thereby drastically improving safety.

Key Drivers, Barriers & Challenges in Connected Motorcycle Market

The connected motorcycle market is propelled by several key drivers, including the escalating demand for enhanced rider safety through advanced driver-assistance systems (ADAS) and V2X communication. The increasing integration of infotainment and navigation features, mirroring smartphone capabilities, significantly boosts consumer appeal. Technological advancements in connectivity, such as 5G deployment and IoT integration, are enabling more sophisticated functionalities. Furthermore, government initiatives promoting smart mobility and safety standards contribute to market growth.

However, the market faces significant barriers and challenges:

- High Cost of Implementation: Advanced connected technologies can significantly increase the manufacturing cost of motorcycles, potentially impacting affordability for a broad consumer base.

- Regulatory Hurdles: The nascent stage of V2X communication standards and cybersecurity regulations can create complexity and delays in product deployment.

- Consumer Adoption and Awareness: Educating a diverse rider base about the benefits and usability of connected features is crucial for widespread adoption.

- Infrastructure Development: The full potential of V2X communication relies on the widespread availability of compatible roadside units and robust communication networks, which are still under development in many regions.

- Data Security and Privacy Concerns: Ensuring the secure handling of rider data is paramount and requires robust cybersecurity measures, which add to development and operational costs.

Emerging Opportunities in Connected Motorcycle Market

Emerging opportunities in the connected motorcycle market lie in the expansion of predictive maintenance services, offering real-time diagnostics and proactive alerts to riders and service centers, thereby reducing downtime and enhancing reliability. The integration of AI-powered rider coaching systems that provide personalized feedback on riding techniques for improved safety and efficiency presents a significant untapped market. Furthermore, the development of blockchain-based solutions for secure data sharing and ownership, particularly in the context of insurance and ownership history, offers a unique value proposition. The increasing focus on electric motorcycles also opens avenues for specialized connected features related to battery management, charging optimization, and range prediction.

Growth Accelerators in the Connected Motorcycle Market Industry

Several catalysts are accelerating the growth of the connected motorcycle market. Technological breakthroughs in sensor fusion and edge computing are enabling more sophisticated and real-time processing of data on the motorcycle itself, reducing reliance on constant cloud connectivity. Strategic partnerships between motorcycle manufacturers, telematics providers like Starcom Systems Ltd and Aeris Communication Inc., and component suppliers such as TE Connectivity Ltd and KPIT Technologies Ltd are streamlining the development and integration of connected solutions. The increasing consumer preference for digital integration in all aspects of life, including their vehicles, is a powerful market expansion strategy. Moreover, the ongoing development of V2X communication infrastructure and standards by entities like Autotalks is crucial for unlocking the full potential of vehicle-to-vehicle and vehicle-to-infrastructure interactions, further driving long-term growth.

Key Players Shaping the Connected Motorcycle Market Market

- Starcom Systems Ltd

- Aeris Communication Inc

- Continental AG

- TE Connectivity Ltd

- Robert Bosch GmbH

- KPIT Technologies Ltd

- Autotalks

- Panasonic Corporation

- Vodafone Group PLC

- BMW Motorrad

Notable Milestones in Connected Motorcycle Market Sector

- November 2021: Suzuki Motorcycle launched Suzuki Avenis connected motorcycle in India, featuring caller ID, SMS alert, WhatsApp alert, speed exceeding warning, phone battery level display, and the estimated time of arrival, with iOS and Android platform connectivity.

- February 2021: Autotalks Ltd and Commsignia completed C-Roads cross-border testing in Austria and France, proving the compliance of Commsignia's ITS-G5 V2X solutions with pan-European C-Roads project specifications.

- September 2020: BMW announced the launch of a new TFT display with a built-in navigation system via its Connectivity App, replacing traditional turn-by-turn navigation.

- September 2020: Continental AG announced an investment in Aeye as part of its strategy to enhance its short-range LiDAR technology, with the first production series slated for launch in 2024.

In-Depth Connected Motorcycle Market Market Outlook

The connected motorcycle market is set for a period of sustained growth, driven by a convergence of technological advancements and evolving consumer expectations. The increasing adoption of smart safety features, advanced infotainment systems, and robust V2X communication capabilities will form the bedrock of this expansion. Strategic partnerships and ongoing research and development in areas like AI, 5G, and cybersecurity will further accelerate innovation. The market's outlook is characterized by opportunities for deeper integration, personalized rider experiences, and enhanced vehicle intelligence, promising a future where motorcycles are not just modes of transport but intelligent, connected companions.

Connected Motorcycle Market Segmentation

-

1. Service

- 1.1. Driver Assistance

- 1.2. Infotainment

- 1.3. Safety

-

2. End User

- 2.1. Private

- 2.2. Commercial

Connected Motorcycle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Connected Motorcycle Market Regional Market Share

Geographic Coverage of Connected Motorcycle Market

Connected Motorcycle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 46.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. Infotainment Segment Anticipated to Hold Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Connected Motorcycle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Driver Assistance

- 5.1.2. Infotainment

- 5.1.3. Safety

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Private

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Connected Motorcycle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Driver Assistance

- 6.1.2. Infotainment

- 6.1.3. Safety

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Private

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Connected Motorcycle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Driver Assistance

- 7.1.2. Infotainment

- 7.1.3. Safety

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Private

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Connected Motorcycle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Driver Assistance

- 8.1.2. Infotainment

- 8.1.3. Safety

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Private

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Rest of the World Connected Motorcycle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Driver Assistance

- 9.1.2. Infotainment

- 9.1.3. Safety

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Private

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Starcom Systems Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Aeris Communication Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Continental AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TE Connectivity Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Robert Bosch GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KPIT Technologies Lt

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Autotalks

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Panasonic Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vodafone Group PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BMW Motorrad

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Starcom Systems Ltd

List of Figures

- Figure 1: Global Connected Motorcycle Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Connected Motorcycle Market Revenue (Million), by Service 2025 & 2033

- Figure 3: North America Connected Motorcycle Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Connected Motorcycle Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Connected Motorcycle Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Connected Motorcycle Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Connected Motorcycle Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Connected Motorcycle Market Revenue (Million), by Service 2025 & 2033

- Figure 9: Europe Connected Motorcycle Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Connected Motorcycle Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Connected Motorcycle Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Connected Motorcycle Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Connected Motorcycle Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Connected Motorcycle Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Asia Pacific Connected Motorcycle Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific Connected Motorcycle Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Connected Motorcycle Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Connected Motorcycle Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Connected Motorcycle Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Connected Motorcycle Market Revenue (Million), by Service 2025 & 2033

- Figure 21: Rest of the World Connected Motorcycle Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Rest of the World Connected Motorcycle Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World Connected Motorcycle Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Connected Motorcycle Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Connected Motorcycle Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Connected Motorcycle Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Connected Motorcycle Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Connected Motorcycle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Connected Motorcycle Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Connected Motorcycle Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Connected Motorcycle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Connected Motorcycle Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Connected Motorcycle Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Connected Motorcycle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Connected Motorcycle Market Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global Connected Motorcycle Market Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Global Connected Motorcycle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: China Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Connected Motorcycle Market Revenue Million Forecast, by Service 2020 & 2033

- Table 26: Global Connected Motorcycle Market Revenue Million Forecast, by End User 2020 & 2033

- Table 27: Global Connected Motorcycle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: South America Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Middle East and Africa Connected Motorcycle Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Connected Motorcycle Market?

The projected CAGR is approximately 46.91%.

2. Which companies are prominent players in the Connected Motorcycle Market?

Key companies in the market include Starcom Systems Ltd, Aeris Communication Inc, Continental AG, TE Connectivity Ltd, Robert Bosch GmbH, KPIT Technologies Lt, Autotalks, Panasonic Corporation, Vodafone Group PLC, BMW Motorrad.

3. What are the main segments of the Connected Motorcycle Market?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

Infotainment Segment Anticipated to Hold Significant Share in the Market.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

In November 2021, Suzuki Motorcycle launched Suzuki Avenis connected motorcycle in India. It comes with features such as caller ID, SMS alert, WhatsApp alert, speed exceeding warning, phone battery level display, and the estimated time of arrival. It is connected with iOS and Android platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Connected Motorcycle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Connected Motorcycle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Connected Motorcycle Market?

To stay informed about further developments, trends, and reports in the Connected Motorcycle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence