Key Insights

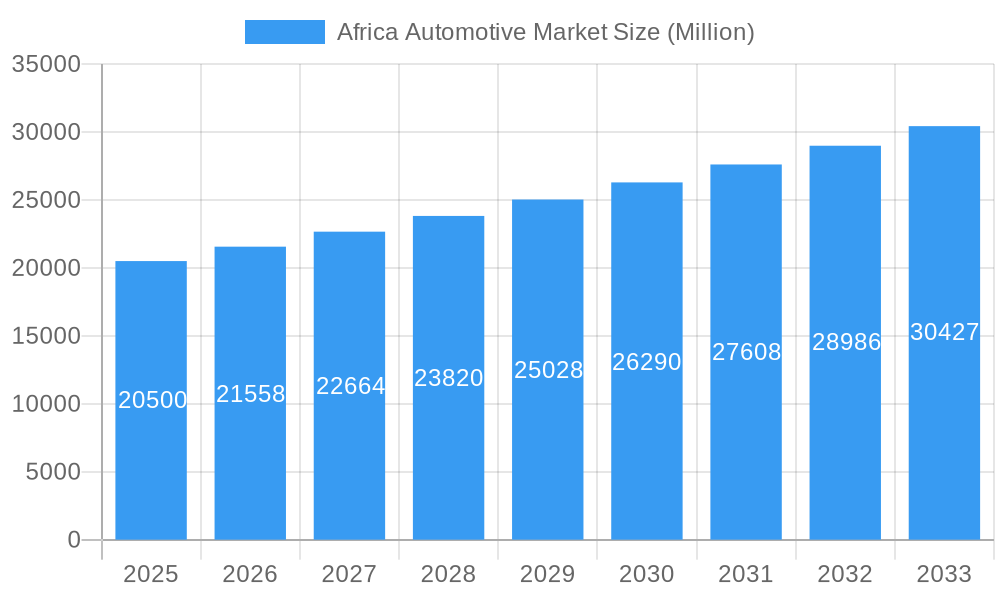

The African automotive market is poised for robust expansion, with an estimated market size of $20.5 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.10% through 2033. This growth trajectory is primarily fueled by a burgeoning middle class, increasing disposable incomes, and a rising demand for both passenger cars and commercial vehicles across the continent. Significant investments in infrastructure development and expanding logistics networks are creating a strong need for commercial vehicles, while the growing urban populations and shifting consumer preferences towards personal mobility are driving passenger car sales. Key players like Toyota Motor Corporation, Volkswagen AG, and Tata Motors Limited are strategically positioning themselves to capitalize on these opportunities, with a focus on developing markets and adapting to local demands. The expansion of manufacturing capabilities within Africa, exemplified by Innoson Vehicle Manufacturing Company, is also a pivotal factor, contributing to localized production and potentially lower costs.

Africa Automotive Market Market Size (In Billion)

The market, however, faces certain headwinds that could temper its full potential. Economic volatility in some regions, coupled with infrastructure challenges such as inadequate road networks and unreliable power supply, can present operational hurdles for manufacturers and consumers alike. Furthermore, the affordability of new vehicles remains a significant concern for a large segment of the African population, leading to a continued reliance on the used car market. Nevertheless, the overarching trend of increasing vehicle penetration, coupled with government initiatives aimed at boosting local automotive industries and improving infrastructure, paints a positive outlook. Countries like Nigeria, South Africa, and Egypt are expected to lead this growth, with significant contributions also anticipated from Kenya, Ethiopia, and Morocco, as they experience economic diversification and demographic shifts. The emphasis will be on innovative financing solutions, localized product offerings, and the development of a more robust automotive ecosystem to unlock the full potential of this dynamic market.

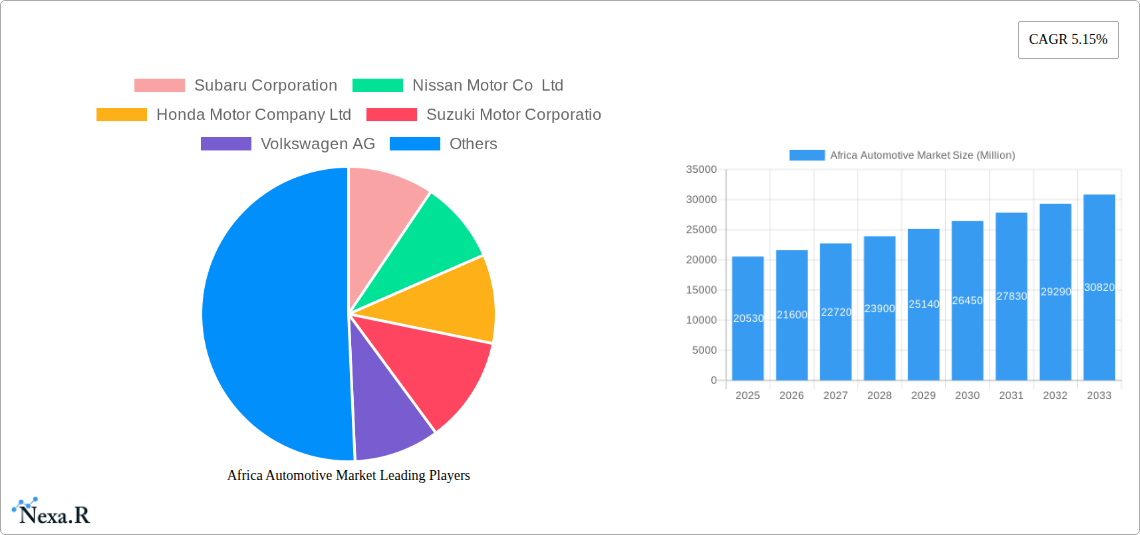

Africa Automotive Market Company Market Share

This comprehensive report provides an in-depth analysis of the Africa Automotive Market, encompassing the passenger cars and commercial vehicles segments. With a study period from 2019 to 2033, and a base year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and the competitive environment. We offer critical insights for industry professionals, investors, and stakeholders looking to capitalize on the evolving automotive landscape across the African continent. All values are presented in Million Units.

Africa Automotive Market Market Dynamics & Structure

The Africa Automotive Market is characterized by a dynamic interplay of market concentration, technological innovation drivers, and evolving regulatory frameworks. While some countries exhibit nascent stages of local manufacturing, the market is largely influenced by global automotive giants, leading to a diverse competitive landscape. Technological innovation, particularly in areas like electric vehicle (EV) infrastructure and sustainable mobility solutions, is gaining traction, albeit at a varying pace across different regions. Regulatory frameworks, including import duties, local content requirements, and emission standards, play a crucial role in shaping market entry and operational strategies for both global and emerging local players.

- Market Concentration: Dominated by a few global manufacturers in terms of sales volume, with growing influence of local players like Innoson Vehicle Manufacturing Company, particularly in specific regions.

- Technological Innovation Drivers: Increasing demand for fuel-efficient vehicles, growing interest in EVs, and advancements in connectivity features are key drivers.

- Regulatory Frameworks: Policies related to vehicle import, local assembly, environmental standards, and safety regulations significantly impact market growth and structure.

- Competitive Product Substitutes: The market sees a mix of new and used vehicle imports, with used vehicles posing a significant competitive challenge in certain price-sensitive segments.

- End-User Demographics: A growing middle class, expanding urbanization, and increasing disposable incomes are driving demand for both passenger and commercial vehicles.

- M&A Trends: While large-scale mergers are less prevalent within the continent, strategic partnerships and joint ventures are emerging, particularly for local assembly and distribution.

Africa Automotive Market Growth Trends & Insights

The Africa Automotive Market is poised for significant growth, driven by a confluence of economic development, demographic shifts, and increasing vehicle penetration rates. Market size evolution is projected to witness a robust upward trajectory as economies expand and infrastructure development accelerates. The adoption rates of new vehicles are expected to climb, fueled by a young and growing population, coupled with a rising middle class that demands greater mobility and improved transportation solutions. Technological disruptions, including the gradual introduction of electric vehicles and advanced driver-assistance systems (ADAS), are beginning to influence consumer preferences, even as the market remains heavily reliant on internal combustion engine (ICE) vehicles. Consumer behavior shifts are becoming evident, with an increasing awareness of fuel efficiency, vehicle safety, and brand reputation. This evolving landscape presents a fertile ground for innovation and strategic investment. The CAGR for the Africa Automotive Market is estimated to be around 7.5% for the forecast period. Market penetration for new vehicles, currently around 15%, is anticipated to rise to approximately 22% by 2033. The commercial vehicles segment, vital for trade and infrastructure development, is expected to see a steady 6.8% CAGR, while passenger cars are projected to grow at a slightly higher 8.2% CAGR, reflecting increased personal mobility aspirations. The total market volume is forecast to grow from approximately 1.8 million units in 2024 to over 3.5 million units by 2033. This growth is underpinned by increased foreign direct investment in local assembly plants and a growing demand for durable and cost-effective transportation solutions essential for the continent's economic progress.

Dominant Regions, Countries, or Segments in Africa Automotive Market

The Commercial Vehicles segment is emerging as a dominant force driving market growth across the Africa Automotive Market. This segment's ascendancy is intrinsically linked to the continent's burgeoning economies, rapid urbanization, and the critical need for robust logistics and transportation infrastructure to support trade and development. The demand for trucks, buses, and other utility vehicles is propelled by expanding construction projects, the growth of the agricultural sector, and the increasing need for efficient goods distribution networks.

- Key Drivers for Commercial Vehicles Dominance:

- Infrastructure Development: Ongoing and planned infrastructure projects across the continent necessitate a significant influx of commercial vehicles for construction, material transport, and logistics.

- Economic Growth & Trade: As African economies expand, inter-regional trade and domestic commerce rely heavily on an efficient commercial vehicle fleet to move goods and services.

- Urbanization: The rapid growth of urban centers creates a sustained demand for public transport (buses) and delivery vehicles for e-commerce and retail.

- Agriculture & Mining: These vital sectors require specialized commercial vehicles for the transport of raw materials, produce, and equipment, underpinning demand in resource-rich regions.

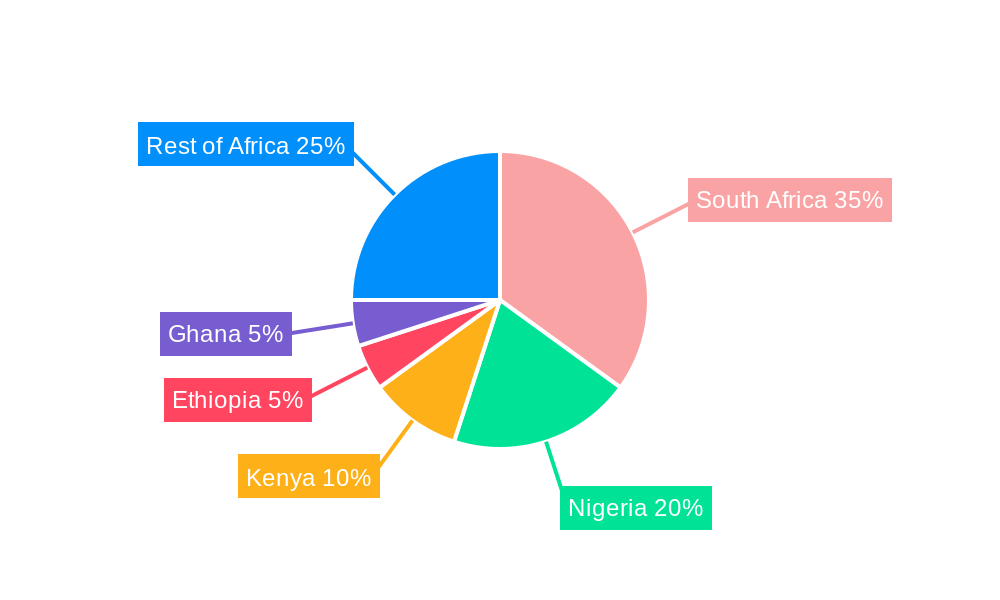

South Africa stands out as the leading country, historically and currently, in terms of automotive sales volume and manufacturing capacity. Its well-established automotive industry, coupled with significant foreign investment and a relatively developed infrastructure, positions it as a primary market. However, other regions and countries are exhibiting substantial growth potential. For instance, North Africa, particularly Egypt and Morocco, represents a significant market for both passenger and commercial vehicles due to their large populations and strategic trade positions. West African nations like Nigeria and Ghana are also crucial markets, driven by their large consumer bases and growing economies. East African countries such as Kenya and Ethiopia are increasingly important as their economies diversify and infrastructure improves.

- Market Share & Growth Potential:

- South Africa currently holds approximately 35% of the African automotive market share.

- The Commercial Vehicles segment accounts for roughly 45% of the total market volume, with Passenger Cars making up the remaining 55%.

- The forecast period anticipates a higher Compound Annual Growth Rate (CAGR) for the Commercial Vehicles segment, projected at 7.2%, compared to Passenger Cars at 6.5%.

- Emerging markets in West and East Africa are expected to exhibit growth rates exceeding 8% annually, driven by pent-up demand and economic liberalization.

Africa Automotive Market Product Landscape

The Africa Automotive Market's product landscape is characterized by a growing diversification, moving beyond basic utility to incorporate more sophisticated features. While rugged and reliable vehicles remain paramount, there's an increasing demand for fuel-efficient models, with a gradual introduction of hybrid and electric options in key markets. Innovations focus on durability, cost-effectiveness, and adaptability to diverse African road conditions. Unique selling propositions often lie in robust after-sales support and readily available spare parts, crucial for maintaining fleet operations across vast distances. Technological advancements are slowly integrating features like advanced infotainment systems and enhanced safety features, particularly in higher-end passenger vehicles, while commercial vehicles are seeing improvements in fuel economy and load-carrying capacities.

Key Drivers, Barriers & Challenges in Africa Automotive Market

Key Drivers: The Africa Automotive Market is propelled by several key drivers. Economic growth across the continent is increasing disposable incomes and demand for personal and commercial mobility. Demographic trends, including a young and rapidly urbanizing population, create a sustained need for transportation solutions. Infrastructure development projects, both in construction and logistics, directly fuel the demand for commercial vehicles. Furthermore, increasing foreign direct investment in local assembly plants and the gradual emergence of local manufacturing capabilities are significant growth accelerators.

Barriers & Challenges: Despite its potential, the market faces considerable barriers and challenges. High import duties and taxes in many countries increase vehicle costs, impacting affordability. Inadequate road infrastructure in rural and some urban areas can limit the adoption of advanced vehicle technologies and increase maintenance costs. Currency volatility and limited access to financing for both consumers and businesses pose significant restraints. Supply chain disruptions, coupled with the dominance of the used car market, present competitive pressures. The slow pace of EV infrastructure development and the lack of widespread access to affordable charging solutions remain a major hurdle for electric mobility adoption.

Emerging Opportunities in Africa Automotive Market

Emerging opportunities in the Africa Automotive Market lie in several key areas. The growing demand for affordable and fuel-efficient vehicles, particularly in the passenger car segment, presents a significant opportunity for manufacturers focusing on value-for-money propositions. The expansion of the e-commerce sector is driving a need for specialized last-mile delivery vehicles and logistics solutions. There is also an untapped potential for electric mobility solutions in urban centers, supported by government incentives and the development of charging infrastructure. Furthermore, the increasing focus on sustainable mobility opens doors for hybrid vehicles and vehicles powered by alternative fuels.

Growth Accelerators in the Africa Automotive Market Industry

Several catalysts are accelerating growth in the Africa Automotive Market industry. Technological breakthroughs in battery technology and charging infrastructure are paving the way for increased electric vehicle adoption. Strategic partnerships between global automakers and local entities for manufacturing and distribution are crucial for expanding market reach and reducing costs. Government initiatives promoting local content, offering tax incentives for vehicle production, and investing in infrastructure development are vital growth accelerators. The increasing adoption of digital sales channels and online platforms is also enhancing market accessibility and consumer engagement.

Key Players Shaping the Africa Automotive Market Market

- Innoson Vehicle Manufacturing Company

- Volkswagen AG

- Daimler AG

- Tata Motors Limited

- Volvo Group

- Hyundai Motor Company

- Ashok Leylan

- Groupe Renault

- Isuzu Motors Ltd

- Toyota Motor Corporation

- Ford Motor Company

Notable Milestones in Africa Automotive Market Sector

- October 2023: BMW AG and Sasol Ltd planned to work together to develop infrastructure to encourage the production and use of hydrogen-powered vehicles in South Africa. BMW will provide its fuel-cell iX5 sport utility vehicle, while Sasol will supply green hydrogen, signaling a commitment to future mobility technologies.

- February 2024: Tata Motors, India’s automobile manufacturer, along with its authorized distributor, Tata Africa Holdings Limited, announced the commercial launch of its successful range of multipurpose heavy-duty trucks, Ultra T.9 and Ultra T.14, in South Africa, bolstering the commercial vehicle segment.

In-Depth Africa Automotive Market Market Outlook

The Africa Automotive Market outlook is characterized by sustained growth, driven by a confluence of demographic, economic, and technological factors. The increasing demand for both passenger cars and essential commercial vehicles will continue to be the primary growth engines. Strategic investments in local manufacturing, coupled with advancements in EV technology and charging infrastructure, are poised to reshape the market landscape. Emerging opportunities in specialized vehicle segments, such as last-mile delivery solutions and fuel-efficient personal mobility, will further fuel expansion. Navigating regulatory environments and addressing infrastructure challenges will be critical for unlocking the full potential of this dynamic and promising automotive market.

Africa Automotive Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

Africa Automotive Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Automotive Market Regional Market Share

Geographic Coverage of Africa Automotive Market

Africa Automotive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in The Passenger Car Sales Across the Region

- 3.3. Market Restrains

- 3.3.1. Transportation Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Passenger Car holds Highest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Automotive Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Innoson Vehicle Manufacturing Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Volkswagen AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daimler AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tata Motors Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volvo Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyundai Motor Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashok Leylan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Groupe Renault

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Isuzu Motors Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Motor Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ford Motor Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Innoson Vehicle Manufacturing Company

List of Figures

- Figure 1: Africa Automotive Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Automotive Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Africa Automotive Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Africa Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Africa Automotive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Nigeria Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: South Africa Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Egypt Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Kenya Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Ethiopia Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Morocco Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Ghana Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Algeria Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Tanzania Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ivory Coast Africa Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Automotive Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Africa Automotive Market?

Key companies in the market include Innoson Vehicle Manufacturing Company, Volkswagen AG, Daimler AG, Tata Motors Limited, Volvo Group, Hyundai Motor Company, Ashok Leylan, Groupe Renault, Isuzu Motors Ltd, Toyota Motor Corporation, Ford Motor Company.

3. What are the main segments of the Africa Automotive Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in The Passenger Car Sales Across the Region.

6. What are the notable trends driving market growth?

Passenger Car holds Highest Share in the Market.

7. Are there any restraints impacting market growth?

Transportation Infrastructure Development.

8. Can you provide examples of recent developments in the market?

October 2023: Th BMW AG and Sasol Ltd planned to work together to develop infrastructure to encourage the production and use of hydrogen-powered vehicles in South Africa. According to the companies, BMW will provide its fuel-cell iX5 sport utility vehicle, while Sasol will supply green hydrogen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Automotive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Automotive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Automotive Market?

To stay informed about further developments, trends, and reports in the Africa Automotive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence