Key Insights

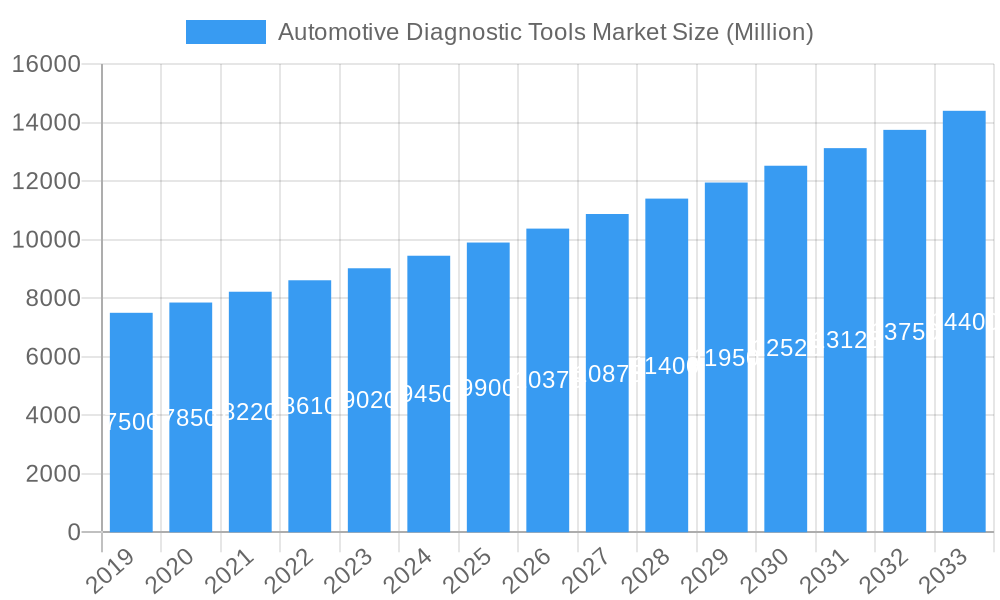

The global Automotive Diagnostic Tools Market is poised for substantial growth, projected to reach a significant market size, driven by a robust Compound Annual Growth Rate (CAGR) of 5.48% from 2019 to 2033. This expansion is fueled by a confluence of factors, prominently the increasing complexity of vehicle electronics and software, necessitating advanced diagnostic capabilities. The proliferation of Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS) further escalates the demand for sophisticated diagnostic solutions, as these technologies introduce new layers of intricate systems requiring specialized tools for effective troubleshooting and maintenance. Furthermore, stringent government regulations worldwide mandating vehicle emissions testing and safety standards indirectly boost the adoption of these diagnostic tools. The aftermarket services sector, driven by the growing need for efficient vehicle repair and maintenance, is a key contributor, as is the increasing consumer awareness regarding vehicle health and performance. The trend towards connected car technologies and over-the-air (OTA) updates also necessitates robust diagnostic infrastructure to manage and maintain these evolving vehicle systems.

Automotive Diagnostic Tools Market Market Size (In Billion)

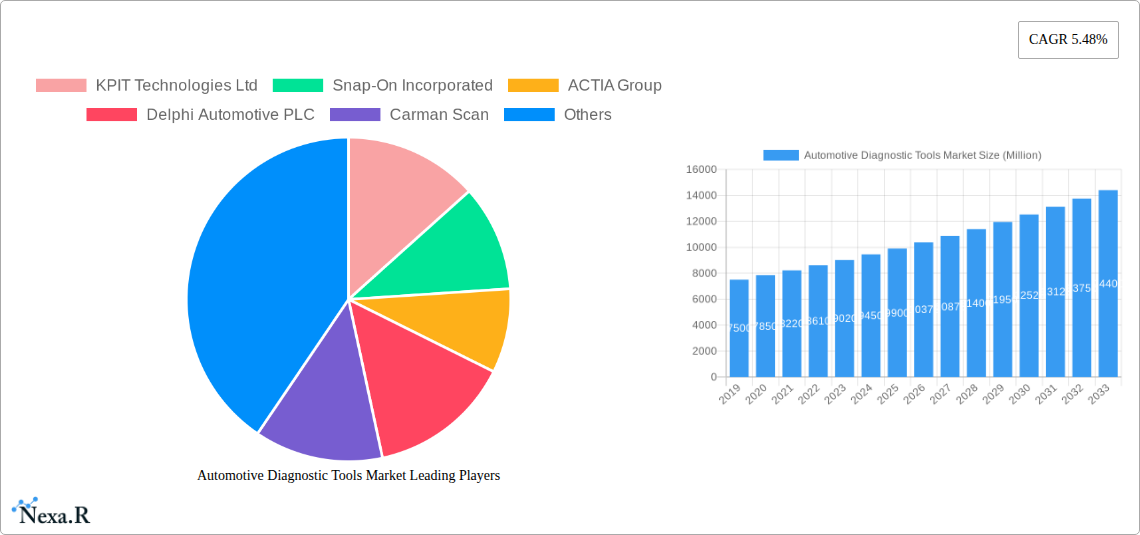

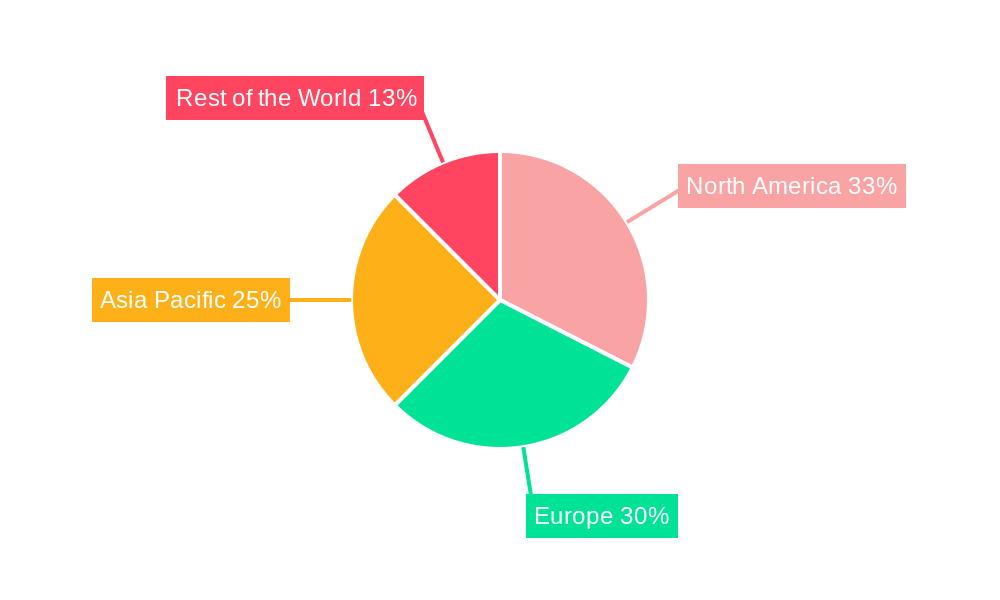

The market segments are characterized by diverse product offerings, including On-Board Diagnostics (OBD) devices, Electric System Analyzers, and comprehensive Scan Tools, catering to both Passenger Cars and Commercial Vehicles. North America and Europe are expected to remain dominant regions, owing to well-established automotive industries, high vehicle parc, and the early adoption of advanced automotive technologies. However, the Asia Pacific region, particularly China and India, is anticipated to witness the most rapid growth, driven by a burgeoning automotive manufacturing base, increasing vehicle ownership, and significant investments in automotive R&D. Key players like KPIT Technologies Ltd, Snap-On Incorporated, and Robert Bosch GmbH are at the forefront, continuously innovating and expanding their product portfolios to address the evolving demands of this dynamic market. Restraints include the high initial cost of some advanced diagnostic equipment and the availability of counterfeit products.

Automotive Diagnostic Tools Market Company Market Share

Automotive Diagnostic Tools Market: Unlocking Future Vehicle Maintenance & Repair

This comprehensive report delves into the dynamic Automotive Diagnostic Tools Market, presenting a meticulous analysis of its current state and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this research offers in-depth insights into market size, growth drivers, emerging trends, and competitive landscapes. We dissect the market by product type (OBD, Electric System Analyzer, Scan Tool) and vehicle type (Passenger Cars, Commercial Vehicles), providing granular data and actionable intelligence for industry stakeholders. With a focus on technological advancements and evolving industry needs, this report is your definitive guide to navigating the evolving world of automotive diagnostics. The global Automotive Diagnostic Tools Market is projected to reach xx Million units by 2033, exhibiting a robust CAGR of xx% from 2025 to 2033.

Automotive Diagnostic Tools Market Dynamics & Structure

The Automotive Diagnostic Tools Market exhibits a moderately concentrated structure, with a blend of established global players and emerging innovators. Technological innovation serves as a primary driver, fueled by the increasing complexity of vehicle electronics, advanced driver-assistance systems (ADAS), and the burgeoning electric vehicle (EV) sector. Robust regulatory frameworks, particularly those mandating standardized diagnostic interfaces like OBD (On-Board Diagnostics), further shape market dynamics. Competitive product substitutes are emerging, ranging from advanced software solutions to cloud-based diagnostic platforms, pushing traditional hardware manufacturers to innovate. End-user demographics are shifting, with professional repair shops and dealership networks demanding more sophisticated, efficient, and integrated diagnostic solutions. Mergers and acquisitions (M&A) are a significant trend, with larger players acquiring smaller, specialized companies to expand their technological capabilities and market reach. For instance, the automotive industry witnessed approximately xx M&A deals in the historical period (2019-2024), indicating consolidation and strategic growth. Innovation barriers include the high cost of R&D for cutting-edge technologies and the need for continuous software updates to keep pace with evolving vehicle architectures.

- Market Concentration: Moderately concentrated, with top players holding significant market share.

- Technological Innovation Drivers: ADAS, EV integration, complex vehicle electronics, over-the-air updates.

- Regulatory Frameworks: OBD mandates, emissions testing regulations, data privacy laws.

- Competitive Product Substitutes: Cloud-based diagnostics, AI-powered analysis tools, mobile diagnostic applications.

- End-User Demographics: Professional repair shops, dealerships, fleet managers, DIY enthusiasts.

- M&A Trends: Strategic acquisitions for technology enhancement, market penetration, and portfolio expansion.

Automotive Diagnostic Tools Market Growth Trends & Insights

The Automotive Diagnostic Tools Market is poised for significant expansion, driven by a confluence of technological advancements, evolving vehicle complexities, and the increasing demand for efficient and accurate vehicle maintenance. The market size has experienced a steady growth from xx Million units in 2019 to xx Million units in 2024, underscoring its robust performance. The adoption rate of advanced diagnostic tools is accelerating, propelled by the growing number of vehicles equipped with sophisticated electronic control units (ECUs) and ADAS features. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) into diagnostic software, are revolutionizing fault detection and repair processes, enabling predictive maintenance and reducing downtime. Consumer behavior shifts towards proactive vehicle health monitoring and a desire for quicker, more reliable repair services are also contributing to market growth. The increasing penetration of electric vehicles (EVs) presents a unique growth opportunity, as they require specialized diagnostic tools to assess battery health, charging systems, and software configurations. The market penetration for advanced diagnostic solutions is expected to reach xx% by 2033. The CAGR for the forecast period (2025-2033) is estimated at xx%. Furthermore, the increasing average age of vehicles on the road globally necessitates more frequent and comprehensive diagnostics, further fueling market demand. The integration of over-the-air (OTA) diagnostic capabilities is also gaining traction, allowing for remote monitoring and troubleshooting, which enhances customer convenience and reduces service costs. The continuous evolution of vehicle architectures, from internal combustion engines to hybrid and fully electric powertrains, mandates a parallel evolution in diagnostic capabilities, creating a perpetual demand for cutting-edge tools and technologies.

Dominant Regions, Countries, or Segments in Automotive Diagnostic Tools Market

The North America region currently dominates the Automotive Diagnostic Tools Market, driven by a mature automotive aftermarket, high adoption rates of advanced vehicle technologies, and stringent emission control regulations. The United States, in particular, plays a pivotal role due to its large vehicle parc, significant investment in automotive R&D, and a well-established network of repair facilities. The strong presence of leading automotive manufacturers and diagnostic tool providers in this region further solidifies its dominance.

The Passenger Cars segment within the Vehicle Type category is the primary growth engine for the Automotive Diagnostic Tools Market. This is attributed to the sheer volume of passenger vehicles on global roads and the increasing sophistication of their onboard electronics. The growing demand for enhanced safety features, infotainment systems, and fuel efficiency technologies in passenger cars necessitates advanced diagnostic capabilities.

Within the Type segment, OBD (On-Board Diagnostics) tools continue to hold a significant market share due to their universal applicability across most vehicle models and their critical role in emissions testing and regulatory compliance. However, the Scan Tool segment is experiencing rapid growth, driven by its versatility in diagnosing a wide range of issues beyond emissions, including powertrain, chassis, and body control systems.

Key drivers contributing to the dominance of these segments and regions include:

- Economic Policies: Favorable economic conditions in North America and the increasing disposable income in emerging economies fuel vehicle sales and aftermarket service demand.

- Infrastructure: Well-developed automotive repair infrastructure and a high density of service centers in dominant regions facilitate the widespread adoption of diagnostic tools.

- Technological Advancement: The early adoption of advanced vehicle technologies in North America drives the demand for sophisticated diagnostic solutions.

- Regulatory Landscape: Strict emission standards and vehicle safety regulations in regions like North America compel the use of advanced diagnostic tools for compliance and maintenance.

- Consumer Demand: Growing consumer awareness about vehicle health and performance, coupled with a preference for efficient and reliable repairs, bolsters the demand for advanced diagnostic solutions in the passenger car segment.

- Market Share: North America accounts for approximately xx% of the global Automotive Diagnostic Tools Market, with Passenger Cars representing over xx% of the total vehicle type market.

Automotive Diagnostic Tools Market Product Landscape

The product landscape of the Automotive Diagnostic Tools Market is characterized by continuous innovation aimed at enhancing diagnostic accuracy, efficiency, and user-friendliness. OBD-II scanners remain fundamental, offering essential data retrieval for emissions and general troubleshooting. Electric System Analyzers are evolving to tackle the complexities of EV powertrains, including battery management systems and high-voltage circuits. Sophisticated Scan Tools are now integrated with advanced software capabilities, offering live data streaming, guided diagnostics, coding, and programming functions. Product innovations often focus on cloud connectivity, enabling remote diagnostics, software updates, and data sharing among repair professionals. Unique selling propositions include AI-powered fault prediction, wireless connectivity for greater maneuverability, and intuitive user interfaces designed for both novice and expert technicians. Technological advancements are driven by the need to support emerging vehicle architectures, such as advanced ADAS calibration and complex powertrain diagnostics.

Key Drivers, Barriers & Challenges in Automotive Diagnostic Tools Market

The Automotive Diagnostic Tools Market is propelled by several key drivers. The increasing complexity of modern vehicles, with their intricate electronic systems and advanced driver-assistance features, necessitates sophisticated diagnostic tools. The rapid growth of the electric vehicle (EV) market also creates a demand for specialized diagnostic equipment. Furthermore, stringent government regulations on vehicle emissions and safety standards mandate the use of advanced diagnostic technologies for compliance and maintenance.

- Technological Advancements: Integration of AI, cloud computing, and IoT in diagnostic tools.

- EV Growth: Demand for specialized diagnostic solutions for electric and hybrid powertrains.

- Regulatory Mandates: Emission standards and safety regulations driving tool adoption.

- Aftermarket Demand: Increasing vehicle parc and the need for efficient repairs.

However, the market faces several barriers and challenges. The high cost of advanced diagnostic tools can be a significant barrier for smaller repair shops and independent technicians. The rapid pace of technological change requires continuous investment in software updates and new hardware, posing a challenge for manufacturers and users alike. Supply chain disruptions, as witnessed in recent years, can impact the availability and cost of components.

- High Cost of Technology: Affordability concerns for smaller businesses.

- Rapid Technological Obsolescence: Need for constant upgrades and new investments.

- Supply Chain Volatility: Disruptions affecting component availability and pricing.

- Skilled Labor Shortage: Lack of trained technicians to operate advanced tools.

- Data Security and Privacy: Concerns related to vehicle data handling.

Emerging Opportunities in Automotive Diagnostic Tools Market

Emerging opportunities within the Automotive Diagnostic Tools Market are abundant, particularly in the realm of predictive maintenance and AI-driven diagnostics. The growing emphasis on sustainability and the increasing adoption of electric and hybrid vehicles present a substantial untapped market for specialized diagnostic tools capable of assessing battery health, charging infrastructure, and electric powertrain efficiency. Furthermore, the expansion of the aftermarket services for autonomous driving systems and advanced driver-assistance systems (ADAS) opens new avenues for diagnostic tool manufacturers. The rise of connected car technology also creates opportunities for remote diagnostics and over-the-air (OTA) software updates, enhancing customer convenience and reducing service costs.

- Predictive Maintenance Solutions: Leveraging AI for proactive fault identification.

- EV and Hybrid Vehicle Diagnostics: Specialized tools for battery, motor, and charging systems.

- ADAS and Autonomous Driving Calibration: Tools for advanced sensor and system diagnostics.

- Connected Car and OTA Diagnostics: Remote monitoring and software update capabilities.

- Aftermarket Services Expansion: Catering to a wider range of vehicle complexities.

Growth Accelerators in the Automotive Diagnostic Tools Market Industry

Several catalysts are accelerating the growth of the Automotive Diagnostic Tools Market. The continuous evolution of vehicle architectures, particularly the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), creates an ongoing demand for new and sophisticated diagnostic solutions. Strategic partnerships between diagnostic tool manufacturers and original equipment manufacturers (OEMs) are crucial for ensuring compatibility and access to proprietary vehicle data, further enhancing diagnostic capabilities. Market expansion strategies, including targeting emerging economies with growing vehicle populations and increasing demand for automotive services, also contribute significantly to long-term growth. The growing trend of vehicle longevity also means older vehicles require more frequent and complex repairs, boosting the need for diagnostic tools.

Key Players Shaping the Automotive Diagnostic Tools Market Market

- KPIT Technologies Ltd

- Snap-On Incorporated

- ACTIA Group

- Delphi Automotive PLC

- Carman Scan

- Continental AG

- Robert Bosch GmbH

- Vector Informatik GmbH

- Hella KGaA Hueck & Co

- Softing AG

Notable Milestones in Automotive Diagnostic Tools Market Sector

- May 2023: Opus IVS, a leading provider of automotive diagnostic tools and services, announced its joined strategic partnership with CARS Co-Op Network, a network of automotive collision and repair shops. This collaboration is set to boost the mutual growth of both companies by leveraging Opus IVS's advanced diagnostic capabilities.

- October 2022: Reparify launched the new asTech all-in-one solution, offering local and remote automotive diagnostic, calibration, and detailed programming tools designed to streamline the vehicle repair and maintenance process.

In-Depth Automotive Diagnostic Tools Market Market Outlook

The future outlook for the Automotive Diagnostic Tools Market is exceptionally promising, driven by the relentless pace of automotive innovation and the increasing demand for efficient vehicle maintenance. Growth accelerators such as the burgeoning electric vehicle segment, the widespread implementation of advanced driver-assistance systems (ADAS), and the ongoing digitalization of automotive services will continue to shape the market landscape. Strategic collaborations between diagnostic providers and automotive manufacturers, coupled with the expansion into underserved geographical markets, will further fuel growth. The market is poised to witness a surge in demand for intelligent, cloud-connected, and AI-powered diagnostic solutions that offer predictive capabilities and remote troubleshooting, ultimately transforming the way vehicles are serviced and maintained.

Automotive Diagnostic Tools Market Segmentation

-

1. Type

- 1.1. OBD

- 1.2. Electric System Analyzer

- 1.3. Scan Tool

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Automotive Diagnostic Tools Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Diagnostic Tools Market Regional Market Share

Geographic Coverage of Automotive Diagnostic Tools Market

Automotive Diagnostic Tools Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Passenger Vehicle Sales Across the Globe

- 3.3. Market Restrains

- 3.3.1. High Cost may Restrict the Growth Potential

- 3.4. Market Trends

- 3.4.1. Passenger Cars Segment Likely to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Diagnostic Tools Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. OBD

- 5.1.2. Electric System Analyzer

- 5.1.3. Scan Tool

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Diagnostic Tools Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. OBD

- 6.1.2. Electric System Analyzer

- 6.1.3. Scan Tool

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Diagnostic Tools Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. OBD

- 7.1.2. Electric System Analyzer

- 7.1.3. Scan Tool

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Diagnostic Tools Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. OBD

- 8.1.2. Electric System Analyzer

- 8.1.3. Scan Tool

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Automotive Diagnostic Tools Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. OBD

- 9.1.2. Electric System Analyzer

- 9.1.3. Scan Tool

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 KPIT Technologies Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Snap-On Incorporated

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ACTIA Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Delphi Automotive PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Carman Scan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vector Informatik GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hella KGaA Hueck & Co

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Softing AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 KPIT Technologies Ltd

List of Figures

- Figure 1: Global Automotive Diagnostic Tools Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Diagnostic Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Automotive Diagnostic Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Diagnostic Tools Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Diagnostic Tools Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Diagnostic Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Diagnostic Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Diagnostic Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Automotive Diagnostic Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Automotive Diagnostic Tools Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Diagnostic Tools Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Diagnostic Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Diagnostic Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Diagnostic Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Diagnostic Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Diagnostic Tools Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Diagnostic Tools Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Diagnostic Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Diagnostic Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Diagnostic Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Automotive Diagnostic Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Automotive Diagnostic Tools Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Rest of the World Automotive Diagnostic Tools Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Rest of the World Automotive Diagnostic Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Diagnostic Tools Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: India Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Automotive Diagnostic Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South America Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Automotive Diagnostic Tools Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Diagnostic Tools Market?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the Automotive Diagnostic Tools Market?

Key companies in the market include KPIT Technologies Ltd, Snap-On Incorporated, ACTIA Group, Delphi Automotive PLC, Carman Scan, Continental AG, Robert Bosch GmbH, Vector Informatik GmbH, Hella KGaA Hueck & Co, Softing AG.

3. What are the main segments of the Automotive Diagnostic Tools Market?

The market segments include Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Passenger Vehicle Sales Across the Globe.

6. What are the notable trends driving market growth?

Passenger Cars Segment Likely to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost may Restrict the Growth Potential.

8. Can you provide examples of recent developments in the market?

May 2023: Opus IVS, which is the leading provider of automotive diagnostic tools and services, announced its joined strategic partnership with CARS Co-Op Network, which is the automotive collision and repair shop. The partnership would boost the mutual growth of companies with diagnostic capabilities of the firms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Diagnostic Tools Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Diagnostic Tools Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Diagnostic Tools Market?

To stay informed about further developments, trends, and reports in the Automotive Diagnostic Tools Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence