Key Insights

The South Korea automotive air filters market is projected for significant growth, anticipated to reach $453.47 million by 2025, exhibiting a compound annual growth rate (CAGR) of 4.65%. This expansion is driven by a heightened focus on vehicle performance, fuel efficiency, and passenger well-being within South Korea’s developed automotive sector. Factors contributing to this positive trajectory include rising disposable incomes, demand for advanced filtration technologies for engine longevity and emission reduction, and stringent air quality regulations. Increased passenger car sales and consistent demand for commercial vehicle maintenance further support market growth. The aftermarket segment is expected to see substantial activity as vehicle owners prioritize regular maintenance for optimal performance and value retention. Key players are investing in product innovation, developing filters with advanced synthetic fibers and high-efficiency paper media to meet evolving consumer and regulatory requirements.

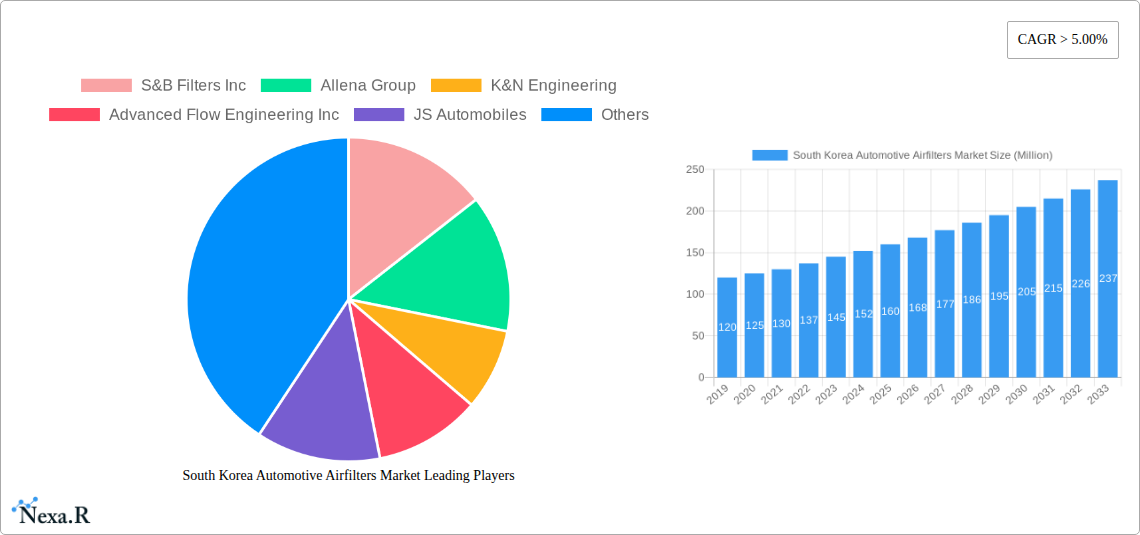

South Korea Automotive Airfilters Market Market Size (In Million)

The market is segmented by material, with paper filters expected to lead due to their cost-effectiveness and broad adoption, alongside gauze and foam filters. Intake and cabin filters are the primary types, addressing distinct vehicle filtration needs. Passenger cars are anticipated to dominate the vehicle type segment, followed by commercial vehicles, reflecting the national fleet composition. Sales channels are divided between Original Equipment Manufacturers (OEMs) and the aftermarket. While OEMs benefit from direct integration, the aftermarket provides extensive reach for replacement needs. Emerging trends include smart air filters with real-time monitoring and advanced media to combat fine particulate matter, aligning with national environmental and public health goals. Potential challenges involve intense price competition and the presence of lower-quality alternatives, though the long-term market favors quality-driven solutions.

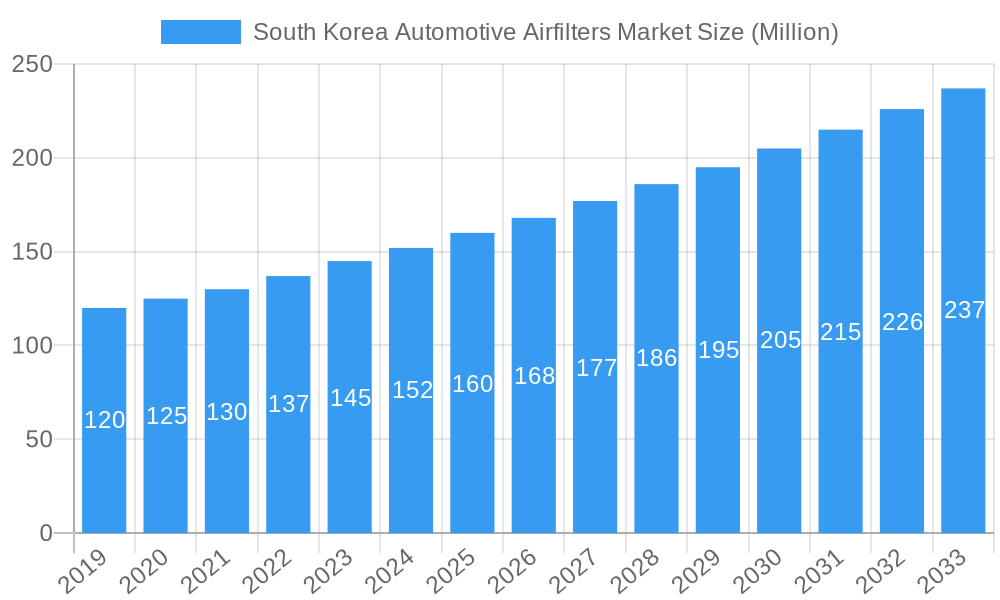

South Korea Automotive Airfilters Market Company Market Share

South Korea Automotive Airfilters Market: Comprehensive Industry Report 2019-2033

This comprehensive report provides an in-depth analysis of the South Korea automotive airfilters market, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, and key players. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand the evolving automotive airfilters landscape in South Korea. All values are presented in Million units.

South Korea Automotive Airfilters Market Market Dynamics & Structure

The South Korean automotive airfilters market exhibits a moderately consolidated structure, with key players continuously investing in technological advancements to enhance filtration efficiency and durability. Innovation drivers are primarily centered around developing advanced filtration materials that improve air quality within vehicles and reduce engine wear. Stringent environmental regulations regarding vehicle emissions and air quality are shaping the demand for high-performance air filters, influencing product development and compliance strategies. Competitive product substitutes, such as advanced cabin filters with activated carbon layers for odor removal, are gaining traction, pushing manufacturers to differentiate their offerings. End-user demographics are shifting towards a greater demand for sustainable and long-lasting air filter solutions, driven by environmental consciousness and a desire for reduced maintenance costs. Mergers and acquisitions (M&A) activity, while not extensive, are observed as companies seek to expand their product portfolios and market reach. The market share for leading companies in 2025 is estimated to be around xx% for Mann+Hummel and xx% for Purolator Filters LLC, reflecting a degree of concentration. Barriers to innovation include the high cost of research and development for advanced filtration technologies and the need for extensive testing to meet evolving automotive standards.

- Market Concentration: Moderately consolidated with a few dominant global players.

- Technological Innovation: Focus on enhanced filtration efficiency, durability, and sustainability.

- Regulatory Frameworks: Driven by emission standards and air quality regulations.

- Competitive Substitutes: Rise of advanced cabin filters and other air purification solutions.

- End-User Demographics: Increasing demand for eco-friendly and long-life filters.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

- Estimated Market Share (2025): Mann+Hummel (xx%), Purolator Filters LLC (xx%).

- Innovation Barriers: High R&D costs and stringent testing requirements.

South Korea Automotive Airfilters Market Growth Trends & Insights

The South Korea automotive airfilters market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. This expansion is significantly influenced by the increasing production of both passenger cars and commercial vehicles, contributing to a higher demand for both OEM and aftermarket automotive airfilters. The adoption rate of advanced filtration technologies, such as multi-layer paper filters and synthetic media, is steadily rising, driven by their superior performance in capturing finer particulate matter and prolonging engine life. Technological disruptions are emerging in the form of smart airfilters that can monitor their own condition and alert drivers for replacement, potentially impacting traditional replacement cycles. Consumer behavior shifts are evident, with vehicle owners becoming more aware of the impact of airfilter quality on fuel efficiency and engine health. This increased awareness is leading to a preference for premium and high-performance airfilters. The market penetration of high-efficiency particulate air (HEPA) filters in cabin applications is also expected to grow, catering to the rising demand for improved in-cabin air quality. The overall market size is estimated to reach xx Million units by 2033, a substantial increase from xx Million units in 2025, reflecting sustained demand and industry expansion. The historical growth from 2019-2024 averaged xx%, demonstrating a consistent upward trajectory.

- Market Size Evolution: Projected to reach xx Million units by 2033.

- CAGR: Expected to be xx% during the forecast period.

- Adoption Rates: Increasing for advanced filtration media and HEPA filters.

- Technological Disruptions: Emergence of smart airfilters and condition monitoring.

- Consumer Behavior Shifts: Growing awareness of airfilter impact on fuel efficiency and engine health.

- Market Penetration: Rise of HEPA filters in cabin applications.

- Historical Growth (2019-2024): Averaged xx% annually.

Dominant Regions, Countries, or Segments in South Korea Automotive Airfilters Market

The Passenger Cars segment, within the Vehicle Type category, is the dominant force driving growth in the South Korea automotive airfilters market. This is underpinned by South Korea's strong domestic automotive manufacturing sector and a high rate of passenger car ownership among its population. The increasing sophistication of passenger car engines and the growing emphasis on fuel efficiency and emission control further bolster the demand for high-quality intake and cabin filters. In terms of Material Type, Paper Airfilters continue to hold the largest market share due to their cost-effectiveness and widespread availability, meeting the requirements of a vast number of vehicles. However, there is a discernible upward trend in the adoption of Gauze Airfilters and advanced synthetic materials for performance-oriented applications, particularly in the aftermarket segment. The OEM sales channel is a significant contributor, directly reflecting new vehicle production volumes. Simultaneously, the Aftermarket segment is exhibiting robust growth, fueled by vehicle parc expansion and increasing consumer awareness about regular maintenance and filter replacement. The Intake Filters segment, crucial for engine performance and longevity, remains a cornerstone of the market, while Cabin Filters are experiencing accelerated growth driven by consumer demand for improved in-cabin air quality and the proliferation of advanced HVAC systems. Economic policies supporting the automotive industry and infrastructure development for vehicular transportation play a vital role in sustaining this dominance. Market share for passenger cars in 2025 is estimated at xx%, with Intake Filters at xx% and OEMs at xx%.

- Dominant Vehicle Type: Passenger Cars (estimated market share 2025: xx%).

- Dominant Material Type: Paper Airfilters (significant market share, with growth in Gauze Airfilters).

- Dominant Type: Intake Filters (essential for engine performance, estimated market share 2025: xx%).

- Dominant Sales Channel: OEMs (closely tied to new vehicle production, estimated market share 2025: xx%), with strong Aftermarket growth.

- Key Drivers: High passenger car ownership, advanced engine technologies, fuel efficiency focus, emission control mandates.

- Economic Influence: Favorable automotive industry policies and transportation infrastructure.

South Korea Automotive Airfilters Market Product Landscape

The product landscape of the South Korea automotive airfilters market is characterized by continuous innovation aimed at enhancing filtration efficiency and durability. Manufacturers are focusing on developing multi-layer filtration media that effectively capture finer particulate matter, allergens, and pollutants. Advanced paper airfilters with enhanced pleating techniques and synthetic media offering superior airflow and contaminant retention are gaining prominence. Applications extend beyond basic engine protection to include improved cabin air quality, with a growing demand for filters equipped with activated carbon layers for odor neutralization and VOC reduction. Performance metrics such as filtration efficiency (e.g., capturing particles down to xx microns), airflow resistance, and lifespan are key differentiators. Unique selling propositions include extended service intervals, improved fuel economy benefits, and superior in-cabin air quality. Technological advancements are leading to lighter, more robust, and environmentally friendly filter designs.

Key Drivers, Barriers & Challenges in South Korea Automotive Airfilters Market

Key Drivers:

- Increasing Vehicle Production: Rising demand for both passenger cars and commercial vehicles directly fuels the need for airfilters.

- Stringent Emission Standards: Growing regulatory pressure to reduce vehicle emissions necessitates the use of high-performance airfilters.

- Consumer Awareness: Greater understanding among vehicle owners about the impact of airfilter quality on engine health, fuel efficiency, and in-cabin air.

- Technological Advancements: Development of more efficient and durable filtration materials and designs.

- Aftermarket Demand: Expansion of the vehicle parc and a focus on regular vehicle maintenance.

Key Barriers & Challenges:

- Price Sensitivity: Competition from low-cost alternatives can challenge the adoption of premium filters.

- Supply Chain Disruptions: Global and regional supply chain issues can impact the availability and cost of raw materials.

- Counterfeit Products: The presence of counterfeit airfilters can dilute brand reputation and compromise safety.

- Technological Obsolescence: Rapid advancements can make existing filter technologies less competitive.

- Economic Downturns: Fluctuations in the automotive industry due to economic instability can affect overall demand.

Emerging Opportunities in South Korea Automotive Airfilters Market

Emerging opportunities in the South Korea automotive airfilters market lie in the growing demand for sustainable and eco-friendly filter solutions. The development of biodegradable filtration materials and filters with extended lifespans presents a significant avenue for growth. The increasing adoption of electric vehicles (EVs) also presents a unique opportunity, albeit with a shift in focus from traditional engine intake filters to cabin air filtration and potentially battery cooling system filtration. The integration of smart technologies, enabling real-time air quality monitoring and predictive maintenance alerts, will also drive demand for advanced, connected airfilter solutions. Untapped markets within niche commercial vehicle segments and the increasing popularity of recreational vehicles also offer potential for specialized airfilter products. Evolving consumer preferences for healthier living environments will continue to boost the demand for high-performance cabin airfilters, including those with advanced antiviral and antibacterial properties.

Growth Accelerators in the South Korea Automotive Airfilters Market Industry

Growth accelerators for the South Korea automotive airfilters market are firmly rooted in continuous technological innovation and strategic market expansions. The ongoing development of advanced filtration media, such as nanofibers and composite materials, promises enhanced particle capture and improved airflow, directly impacting engine performance and fuel efficiency. Strategic partnerships between airfilter manufacturers and automotive OEMs are crucial for integrating next-generation filtration systems into new vehicle models from the design phase. Furthermore, the expansion of the aftermarket distribution network, coupled with targeted marketing campaigns emphasizing the long-term benefits of premium airfilters, will significantly drive sales volume. Government initiatives promoting cleaner transportation and stricter environmental regulations serve as powerful catalysts, compelling both manufacturers and consumers to opt for superior air filtration solutions.

Key Players Shaping the South Korea Automotive Airfilters Market Market

- S&B Filters Inc

- Allena Group

- K&N Engineering

- Advanced Flow Engineering Inc

- JS Automobiles

- Purolator Filters LLC

- Wsmridhi Manufacturing Co Pvt Ltd

- Mann+Hummel

- AL Filters

- AIRAID

Notable Milestones in South Korea Automotive Airfilters Market Sector

- 2019: Launch of new multi-layer paper airfilters with enhanced dust-holding capacity by Mann+Hummel.

- 2020: K&N Engineering introduces a range of performance airfilters with improved airflow for the South Korean aftermarket.

- 2021: Purolator Filters LLC expands its cabin filter line with activated carbon for enhanced odor reduction.

- 2022: Advanced Flow Engineering Inc pioneers the use of advanced synthetic media for longer-lasting automotive airfilters.

- 2023: S&B Filters Inc develops innovative air intake systems for performance-oriented passenger vehicles in South Korea.

- 2024: AL Filters focuses on developing cost-effective yet efficient paper airfilters for the mass-market passenger car segment.

In-Depth South Korea Automotive Airfilters Market Market Outlook

The future outlook for the South Korea automotive airfilters market remains exceptionally positive, driven by an unwavering commitment to technological innovation and expanding market reach. Growth accelerators such as the development of advanced filtration materials, strategic OEM collaborations, and robust aftermarket penetration will continue to propel the industry forward. The increasing demand for cleaner air, both within vehicles and from an environmental perspective, ensures a sustained market for high-quality airfilters. Strategic opportunities will arise from the burgeoning electric vehicle sector's unique filtration needs and the ongoing trend towards smart, connected automotive components. Manufacturers that can effectively leverage these trends and deliver innovative, sustainable, and high-performance airfilter solutions are best positioned for significant success in this dynamic market.

South Korea Automotive Airfilters Market Segmentation

-

1. Material Type

- 1.1. Paper Airfilter

- 1.2. Gauze Airfilter

- 1.3. Foam Airfilter

- 1.4. Others

-

2. Type

- 2.1. Intake Filters

- 2.2. Cabin Filters

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Sales Channel

- 4.1. OEMs

- 4.2. Aftermarket

South Korea Automotive Airfilters Market Segmentation By Geography

- 1. South Korea

South Korea Automotive Airfilters Market Regional Market Share

Geographic Coverage of South Korea Automotive Airfilters Market

South Korea Automotive Airfilters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automotive Vehicle Sales Anticipated to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Acting as Barrier for the Market

- 3.4. Market Trends

- 3.4.1. Commercial Vehicle Segment Captures Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Automotive Airfilters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper Airfilter

- 5.1.2. Gauze Airfilter

- 5.1.3. Foam Airfilter

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Intake Filters

- 5.2.2. Cabin Filters

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. OEMs

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 S&B Filters Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Allena Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 K&N Engineering

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advanced Flow Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JS Automobiles

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Purolator Filters LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wsmridhi Manufacturing Co Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mann+Hummel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AL Filters

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AIRAID

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 S&B Filters Inc

List of Figures

- Figure 1: South Korea Automotive Airfilters Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South Korea Automotive Airfilters Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Automotive Airfilters Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 2: South Korea Automotive Airfilters Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: South Korea Automotive Airfilters Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 4: South Korea Automotive Airfilters Market Revenue million Forecast, by Sales Channel 2020 & 2033

- Table 5: South Korea Automotive Airfilters Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: South Korea Automotive Airfilters Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 7: South Korea Automotive Airfilters Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: South Korea Automotive Airfilters Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 9: South Korea Automotive Airfilters Market Revenue million Forecast, by Sales Channel 2020 & 2033

- Table 10: South Korea Automotive Airfilters Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Automotive Airfilters Market?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the South Korea Automotive Airfilters Market?

Key companies in the market include S&B Filters Inc, Allena Group, K&N Engineering, Advanced Flow Engineering Inc, JS Automobiles, Purolator Filters LLC, Wsmridhi Manufacturing Co Pvt Ltd, Mann+Hummel, AL Filters, AIRAID.

3. What are the main segments of the South Korea Automotive Airfilters Market?

The market segments include Material Type, Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 453.47 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Automotive Vehicle Sales Anticipated to Drive the Market.

6. What are the notable trends driving market growth?

Commercial Vehicle Segment Captures Market.

7. Are there any restraints impacting market growth?

High Initial Cost Acting as Barrier for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Automotive Airfilters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Automotive Airfilters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Automotive Airfilters Market?

To stay informed about further developments, trends, and reports in the South Korea Automotive Airfilters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence