Key Insights

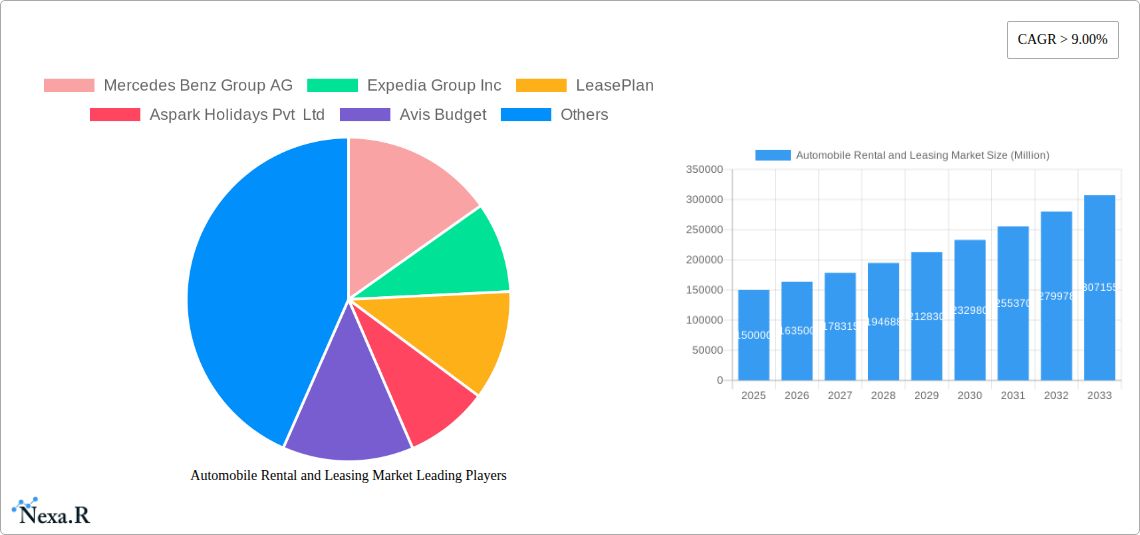

The global Automobile Rental and Leasing Market is projected to reach $301.81 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8.2%. This growth is driven by increasing demand for flexible mobility solutions, the rise of vehicle subscription models, and growing need for specialized vehicle segments. Enhanced digital platforms and online booking services are improving accessibility and customer convenience. Corporate adoption of efficient fleet management and outsourcing of vehicle acquisition and maintenance are significant contributors. Passenger car rentals and leasing will lead, supported by personal and business travel, while truck and utility trailer rentals will benefit from logistics and e-commerce growth.

Automobile Rental and Leasing Market Market Size (In Billion)

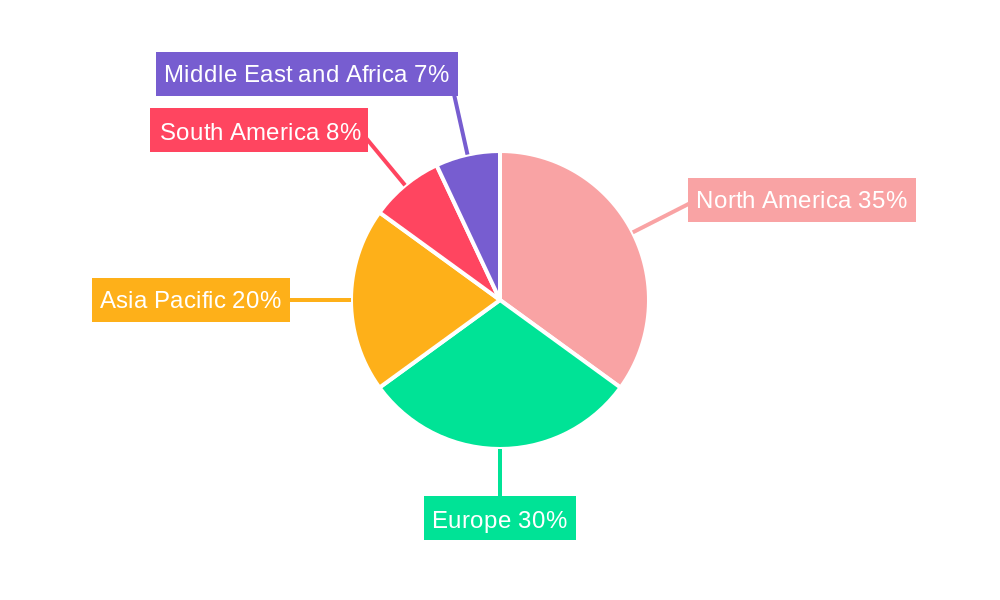

Key growth drivers include automotive technology advancements, cost reduction in vehicle ownership, and the expansion of ride-sharing and car-sharing services. Market restraints involve volatile fuel prices, regulatory complexities, and high initial fleet investment. Emerging trends such as electric vehicle fleets, AI integration for predictive maintenance and personalized experiences, and commercial vehicle leasing options will reshape the market. North America and Europe currently dominate due to established infrastructure and high disposable incomes, while the Asia Pacific region, particularly China and India, shows rapid expansion driven by urbanization, a growing middle class, and a burgeoning automotive sector.

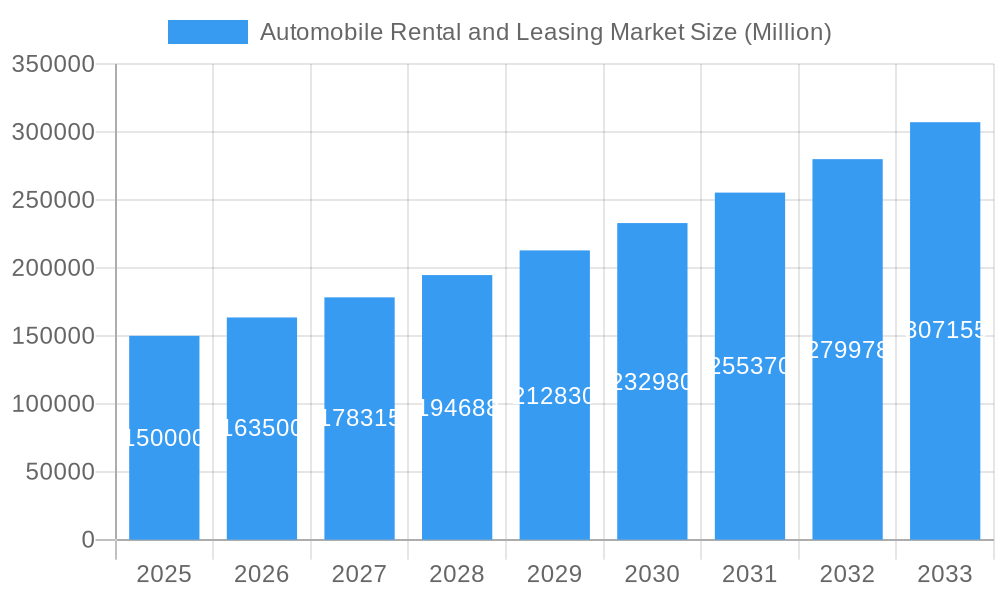

Automobile Rental and Leasing Market Company Market Share

Automobile Rental and Leasing Market: Comprehensive Growth Analysis 2019–2033

This in-depth report provides a comprehensive analysis of the global Automobile Rental and Leasing Market, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and future outlook. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report leverages extensive data and expert analysis to guide industry stakeholders. The market size is presented in Million units, with a focus on Passenger Car Rental, Passenger Car Leasing, Truck, Utility Trailer, and Recreational Vehicle Rental and Leasing, across Offline and Online modes, and Open and Close lease types, serving Individual and Corporate end-users.

Automobile Rental and Leasing Market Market Dynamics & Structure

The Automobile Rental and Leasing Market is characterized by a dynamic interplay of market concentration, rapid technological innovation, evolving regulatory frameworks, and intense competition from both direct players and indirect product substitutes. Major players like Enterprise Holdings, Avis Budget, and The Hertz Corporation maintain significant market share, though the competitive landscape is continually shaped by the emergence of new entrants and strategic alliances. Technological innovation, particularly in areas of fleet management software, telematics, and electric vehicle (EV) integration, acts as a key driver, enhancing operational efficiency and customer experience. Regulatory frameworks, encompassing emissions standards, safety regulations, and consumer protection laws, influence operational costs and service offerings. The increasing penetration of online booking platforms and the growing preference for flexible mobility solutions by end-users, particularly millennials and Gen Z, are reshaping demand patterns. Mergers and acquisitions (M&A) remain a significant trend, with companies consolidating to achieve economies of scale, expand geographic reach, and acquire specialized technological capabilities. For instance, the ongoing consolidation aims to optimize fleet utilization and reduce operational overheads. The barrier to entry for new players is moderated by substantial capital requirements for fleet acquisition and the need for robust operational infrastructure.

- Market Concentration: Dominated by a few large players but with increasing influence of new digital-first entrants.

- Technological Innovation: Driven by advancements in AI-powered fleet management, IoT for vehicle tracking, and the integration of EVs.

- Regulatory Frameworks: Impacting vehicle procurement, operational compliance, and environmental sustainability.

- Competitive Product Substitutes: Ride-sharing services and public transportation offer alternatives, especially in urban areas.

- End-User Demographics: Shift towards younger, tech-savvy consumers demanding convenience and flexibility.

- M&A Trends: Strategic acquisitions and partnerships to enhance market position and service portfolios.

Automobile Rental and Leasing Market Growth Trends & Insights

The Automobile Rental and Leasing Market is projected to experience robust growth, fueled by shifting consumer preferences towards flexible mobility solutions and the increasing adoption of fleet management services by corporations. The market size evolution is a testament to the growing reliance on rental and leasing for both personal and business needs. This growth is underpinned by a rising adoption rate of car-sharing services and subscription-based models, which cater to the demand for convenient, cost-effective, and flexible transportation. Technological disruptions, including the integration of Artificial Intelligence (AI) for predictive maintenance and dynamic pricing, alongside the expanding availability of electric vehicles (EVs) within rental fleets, are significantly enhancing operational efficiency and attractiveness. Consumer behavior shifts are notable, with a growing segment of individuals opting for rental and leasing over outright ownership, driven by factors such as avoiding depreciation, maintenance costs, and insurance hassles. Furthermore, the corporate sector's increasing reliance on leasing for fleet management, to optimize capital expenditure and gain access to updated vehicle technology, is a major growth accelerator. The market penetration of online booking platforms has democratized access to rental and leasing services, making them more accessible to a wider demographic. The projected Compound Annual Growth Rate (CAGR) indicates a sustained upward trajectory, supported by ongoing infrastructure development and favorable economic conditions in key regions. The impact of shared mobility services, while presenting a competitive dynamic, also fosters a broader acceptance of non-ownership-based transportation models, ultimately benefiting the rental and leasing ecosystem. The COVID-19 pandemic initially posed challenges but has also accelerated the adoption of contactless rental solutions and a renewed appreciation for personal mobility.

Dominant Regions, Countries, or Segments in Automobile Rental and Leasing Market

North America, particularly the United States, is a dominant region in the Automobile Rental and Leasing Market, driven by a mature transportation infrastructure, a strong corporate sector, and a significant tourism industry. The Passenger Car Rental segment within North America commands a substantial market share due to high population density, widespread availability of rental agencies, and the convenience offered to travelers and individuals seeking temporary vehicle access. The Online mode of booking continues to gain traction, surpassing traditional offline channels in terms of transaction volume and customer preference, owing to its ease of use and competitive pricing facilitated by platforms like Expedia Group Inc. Corporate end-users represent a significant portion of the market, leveraging leasing agreements for their extensive fleets to manage costs and ensure operational efficiency. Key drivers for dominance in this region include favorable economic policies, robust consumer spending, and a well-established network of rental and leasing providers, including major players like Enterprise Holdings and Avis Budget. The growth potential in North America remains high, with continuous innovation in fleet management and the increasing adoption of subscription services.

- Dominant Segment: Passenger Car Rental, driven by high demand from leisure and business travelers.

- Leading Mode: Online booking platforms, offering convenience and price transparency.

- Key End-User: Corporate clients, utilizing leasing for fleet optimization.

- Regional Strength: North America, owing to developed infrastructure and a large market base.

- Growth Potential: Sustained by technological integration and evolving mobility needs.

In Europe, the Passenger Car Leasing segment is experiencing significant growth, propelled by a strong emphasis on sustainability and the increasing popularity of long-term leasing solutions. Countries like Germany, the UK, and France are major contributors, with companies such as LeasePlan and Europcar Mobility Group SA playing pivotal roles. The Close Lease option is particularly favored by corporate clients seeking predictable costs and asset management. Stringent environmental regulations in Europe are accelerating the adoption of electric and hybrid vehicles within leasing fleets, making it a key differentiator. The increasing affordability of leasing compared to outright purchase, coupled with attractive tax incentives in some nations, further bolsters its appeal. Infrastructure development, including the expansion of charging networks for EVs, also plays a crucial role in supporting this segment's growth.

- Dominant Segment: Passenger Car Leasing, driven by economic advantages and fleet management benefits.

- Prominent Lease Type: Close Lease, offering cost predictability for corporate users.

- Key Market Influencers: Stringent environmental regulations and government incentives.

- Regional Strength: Europe, with significant contributions from Germany, UK, and France.

- Growth Potential: Enhanced by the growing EV market and evolving consumer ownership models.

Asia-Pacific is emerging as a high-growth region, particularly in Passenger Car Rental and the increasing adoption of Online booking channels. Countries like China and India, with their rapidly expanding middle class and burgeoning tourism sectors, are significant contributors. The affordability and convenience of renting vehicles for short trips and business purposes are driving demand. The presence of local players and increasing investments from international companies are further fueling market expansion. The growth is also supported by government initiatives to promote tourism and enhance transportation infrastructure.

- Emerging Segment: Passenger Car Rental, driven by economic growth and increased travel.

- Dominant Mode: Rapidly shifting towards Online booking for accessibility.

- Key End-User: Growing individual segment, influenced by rising disposable incomes.

- Regional Strength: Asia-Pacific, exhibiting rapid expansion and market potential.

- Growth Potential: Significant, fueled by demographic shifts and infrastructure development.

Automobile Rental and Leasing Market Product Landscape

The product landscape within the Automobile Rental and Leasing Market is increasingly diverse, encompassing a wide range of vehicles and service packages. Beyond standard passenger cars, there is a growing demand for specialized vehicles such as Trucks and Utility Trailers for commercial purposes, and Recreational Vehicle Rentals and Leasing for the burgeoning adventure tourism sector. Innovations are focused on enhancing customer experience through advanced booking platforms, contactless pick-up/drop-off services, and integrated telematics for real-time vehicle monitoring. The integration of electric and hybrid vehicles is a significant technological advancement, catering to environmental consciousness and reducing operational costs. Performance metrics are continually being optimized through data analytics for fleet utilization, predictive maintenance, and dynamic pricing strategies. Companies are differentiating themselves through value-added services, including insurance packages, GPS navigation, and child seats, to cater to diverse end-user needs.

Key Drivers, Barriers & Challenges in Automobile Rental and Leasing Market

Key Drivers:

- Growing Demand for Flexible Mobility: Consumers and businesses increasingly prefer rental and leasing over ownership for cost-effectiveness and flexibility.

- Technological Advancements: AI-powered fleet management, telematics, and the integration of EVs enhance efficiency and appeal.

- Corporate Fleet Management Needs: Businesses leverage leasing for capital optimization and access to modern fleets.

- Tourism and Travel Industry Growth: Increased travel fuels demand for rental vehicles.

- Urbanization and Congestion: Rental and leasing offer convenient alternatives to private vehicle ownership in crowded cities.

Barriers & Challenges:

- High Capital Investment: Acquiring and maintaining large fleets requires substantial financial resources.

- Intense Competition: The market is highly competitive, with numerous global and local players, leading to price pressures.

- Regulatory Hurdles: Evolving environmental regulations, safety standards, and local permits can increase operational complexity and costs.

- Economic Downturns: Recessions can significantly reduce demand for both leisure and business travel, impacting rental volumes.

- Supply Chain Disruptions: Vehicle shortages and delays in manufacturing can impact fleet availability and growth.

- Insurance Costs and Liability: Managing insurance premiums and potential liabilities associated with vehicle usage presents ongoing challenges.

Emerging Opportunities in Automobile Rental and Leasing Market

Emerging opportunities in the Automobile Rental and Leasing Market are centered around the growing demand for sustainable mobility solutions, the expansion of specialized vehicle rentals, and the further digitalization of the customer journey. The increasing adoption of electric vehicles (EVs) by rental and leasing companies presents a significant opportunity to cater to environmentally conscious consumers and corporate sustainability goals. The development of integrated mobility platforms that combine rental, ride-sharing, and public transport options offers a seamless experience for users. Furthermore, the expansion of rental and leasing services into emerging markets with growing disposable incomes and a rising tourism sector presents untapped potential. The growth of subscription-based models, offering long-term flexibility and predictable costs, is another key area for expansion.

Growth Accelerators in the Automobile Rental and Leasing Market Industry

Several catalysts are accelerating long-term growth in the Automobile Rental and Leasing Market. Technological breakthroughs in autonomous driving and connected car technologies are poised to revolutionize fleet management and enhance safety. Strategic partnerships between rental companies, technology providers, and automotive manufacturers are fostering innovation and expanding service offerings. Market expansion strategies, including venturing into underserved geographic regions and developing niche rental segments (e.g., luxury vehicles, commercial vans), are crucial growth accelerators. The increasing focus on customer-centric solutions, such as personalized rental experiences and flexible contract terms, is driving customer loyalty and market penetration.

Key Players Shaping the Automobile Rental and Leasing Market Market

- Mercedes Benz Group AG

- Expedia Group Inc

- LeasePlan

- Aspark Holidays Pvt Ltd

- Avis Budget

- Green Motion International

- The Hertz Corporation

- Europcar Mobility Group SA

- Enterprise Holdings

- BlueLine Rental

Notable Milestones in Automobile Rental and Leasing Market Sector

- January 2022: Coca-Cola Philippines (CCBPI) established a partnership with ORIX Rental Corporation to supply fleet solutions and delivered 300 new vehicles for Coca-Cola's salesforce.

- January 2022: Arval partnered with Ridecell to deploy next-generation shared mobility solutions offering seamless global mobility coverage.

In-Depth Automobile Rental and Leasing Market Market Outlook

The future outlook for the Automobile Rental and Leasing Market is exceptionally promising, driven by a confluence of factors that are reshaping transportation paradigms. Growth accelerators such as the rapid electrification of fleets, advancements in AI for predictive maintenance and customer service, and the expansion of mobility-as-a-service (MaaS) platforms will continue to propel the market forward. Strategic partnerships between key industry players and technology innovators will unlock new revenue streams and enhance operational efficiencies. Furthermore, the increasing consumer and corporate focus on sustainability will drive demand for eco-friendly rental and leasing options. The market is poised for significant expansion as it continues to adapt to evolving consumer preferences, technological disruptions, and the global imperative for cleaner, more efficient transportation solutions.

Automobile Rental and Leasing Market Segmentation

-

1. Type

- 1.1. Passenger Car Rental

- 1.2. Passenger Car Leasing

- 1.3. Truck

- 1.4. Utility Trailer

- 1.5. Recreational Vehicle Rental and Leasing

-

2. Mode

- 2.1. Offline

- 2.2. Online

-

3. Lease

- 3.1. Open

- 3.2. Close

-

4. End-User

- 4.1. Individual

- 4.2. Corporate

Automobile Rental and Leasing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 5. Middle East and Africa

- 6. Saudi Arabia

- 7. South Africa

- 8. Rest of Middle East and Africa

Automobile Rental and Leasing Market Regional Market Share

Geographic Coverage of Automobile Rental and Leasing Market

Automobile Rental and Leasing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. Growing Popularity Of Electric Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Passenger Car Rental

- 5.1.2. Passenger Car Leasing

- 5.1.3. Truck

- 5.1.4. Utility Trailer

- 5.1.5. Recreational Vehicle Rental and Leasing

- 5.2. Market Analysis, Insights and Forecast - by Mode

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Lease

- 5.3.1. Open

- 5.3.2. Close

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Individual

- 5.4.2. Corporate

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.5.6. Saudi Arabia

- 5.5.7. South Africa

- 5.5.8. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Passenger Car Rental

- 6.1.2. Passenger Car Leasing

- 6.1.3. Truck

- 6.1.4. Utility Trailer

- 6.1.5. Recreational Vehicle Rental and Leasing

- 6.2. Market Analysis, Insights and Forecast - by Mode

- 6.2.1. Offline

- 6.2.2. Online

- 6.3. Market Analysis, Insights and Forecast - by Lease

- 6.3.1. Open

- 6.3.2. Close

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Individual

- 6.4.2. Corporate

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Passenger Car Rental

- 7.1.2. Passenger Car Leasing

- 7.1.3. Truck

- 7.1.4. Utility Trailer

- 7.1.5. Recreational Vehicle Rental and Leasing

- 7.2. Market Analysis, Insights and Forecast - by Mode

- 7.2.1. Offline

- 7.2.2. Online

- 7.3. Market Analysis, Insights and Forecast - by Lease

- 7.3.1. Open

- 7.3.2. Close

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Individual

- 7.4.2. Corporate

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Passenger Car Rental

- 8.1.2. Passenger Car Leasing

- 8.1.3. Truck

- 8.1.4. Utility Trailer

- 8.1.5. Recreational Vehicle Rental and Leasing

- 8.2. Market Analysis, Insights and Forecast - by Mode

- 8.2.1. Offline

- 8.2.2. Online

- 8.3. Market Analysis, Insights and Forecast - by Lease

- 8.3.1. Open

- 8.3.2. Close

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Individual

- 8.4.2. Corporate

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Passenger Car Rental

- 9.1.2. Passenger Car Leasing

- 9.1.3. Truck

- 9.1.4. Utility Trailer

- 9.1.5. Recreational Vehicle Rental and Leasing

- 9.2. Market Analysis, Insights and Forecast - by Mode

- 9.2.1. Offline

- 9.2.2. Online

- 9.3. Market Analysis, Insights and Forecast - by Lease

- 9.3.1. Open

- 9.3.2. Close

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Individual

- 9.4.2. Corporate

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Passenger Car Rental

- 10.1.2. Passenger Car Leasing

- 10.1.3. Truck

- 10.1.4. Utility Trailer

- 10.1.5. Recreational Vehicle Rental and Leasing

- 10.2. Market Analysis, Insights and Forecast - by Mode

- 10.2.1. Offline

- 10.2.2. Online

- 10.3. Market Analysis, Insights and Forecast - by Lease

- 10.3.1. Open

- 10.3.2. Close

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Individual

- 10.4.2. Corporate

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Passenger Car Rental

- 11.1.2. Passenger Car Leasing

- 11.1.3. Truck

- 11.1.4. Utility Trailer

- 11.1.5. Recreational Vehicle Rental and Leasing

- 11.2. Market Analysis, Insights and Forecast - by Mode

- 11.2.1. Offline

- 11.2.2. Online

- 11.3. Market Analysis, Insights and Forecast - by Lease

- 11.3.1. Open

- 11.3.2. Close

- 11.4. Market Analysis, Insights and Forecast - by End-User

- 11.4.1. Individual

- 11.4.2. Corporate

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. South Africa Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Passenger Car Rental

- 12.1.2. Passenger Car Leasing

- 12.1.3. Truck

- 12.1.4. Utility Trailer

- 12.1.5. Recreational Vehicle Rental and Leasing

- 12.2. Market Analysis, Insights and Forecast - by Mode

- 12.2.1. Offline

- 12.2.2. Online

- 12.3. Market Analysis, Insights and Forecast - by Lease

- 12.3.1. Open

- 12.3.2. Close

- 12.4. Market Analysis, Insights and Forecast - by End-User

- 12.4.1. Individual

- 12.4.2. Corporate

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Rest of Middle East and Africa Automobile Rental and Leasing Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Passenger Car Rental

- 13.1.2. Passenger Car Leasing

- 13.1.3. Truck

- 13.1.4. Utility Trailer

- 13.1.5. Recreational Vehicle Rental and Leasing

- 13.2. Market Analysis, Insights and Forecast - by Mode

- 13.2.1. Offline

- 13.2.2. Online

- 13.3. Market Analysis, Insights and Forecast - by Lease

- 13.3.1. Open

- 13.3.2. Close

- 13.4. Market Analysis, Insights and Forecast - by End-User

- 13.4.1. Individual

- 13.4.2. Corporate

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Mercedes Benz Group AG

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Expedia Group Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 LeasePlan

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Aspark Holidays Pvt Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Avis Budget

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Green Motion International

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 The Hertz Corporation*List Not Exhaustive

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Europcar Mobility Group SA

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Enterprise Holdings

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 BlueLine Rental

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Mercedes Benz Group AG

List of Figures

- Figure 1: Automobile Rental and Leasing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Automobile Rental and Leasing Market Share (%) by Company 2025

List of Tables

- Table 1: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 3: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 4: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Automobile Rental and Leasing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 8: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 9: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Automobile Rental and Leasing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 16: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 17: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Automobile Rental and Leasing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 26: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 27: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Automobile Rental and Leasing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: China Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Japan Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Australia Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 35: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 36: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 37: Automobile Rental and Leasing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Brazil Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Argentina Automobile Rental and Leasing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 42: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 43: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 44: Automobile Rental and Leasing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 45: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 46: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 47: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 48: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 49: Automobile Rental and Leasing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 51: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 52: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 53: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 54: Automobile Rental and Leasing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 55: Automobile Rental and Leasing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 56: Automobile Rental and Leasing Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 57: Automobile Rental and Leasing Market Revenue billion Forecast, by Lease 2020 & 2033

- Table 58: Automobile Rental and Leasing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 59: Automobile Rental and Leasing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automobile Rental and Leasing Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the Automobile Rental and Leasing Market?

Key companies in the market include Mercedes Benz Group AG, Expedia Group Inc, LeasePlan, Aspark Holidays Pvt Ltd, Avis Budget, Green Motion International, The Hertz Corporation*List Not Exhaustive, Europcar Mobility Group SA, Enterprise Holdings, BlueLine Rental.

3. What are the main segments of the Automobile Rental and Leasing Market?

The market segments include Type, Mode, Lease, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Growing Popularity Of Electric Vehicles.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

January 2022: Coca-Cola Philippines (CCBPI) established a partnership with ORIX Rental Corporation to supply fleet solutions and delivered 300 new vehicles for Coca-Cola's salesforce.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automobile Rental and Leasing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automobile Rental and Leasing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automobile Rental and Leasing Market?

To stay informed about further developments, trends, and reports in the Automobile Rental and Leasing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence