Key Insights

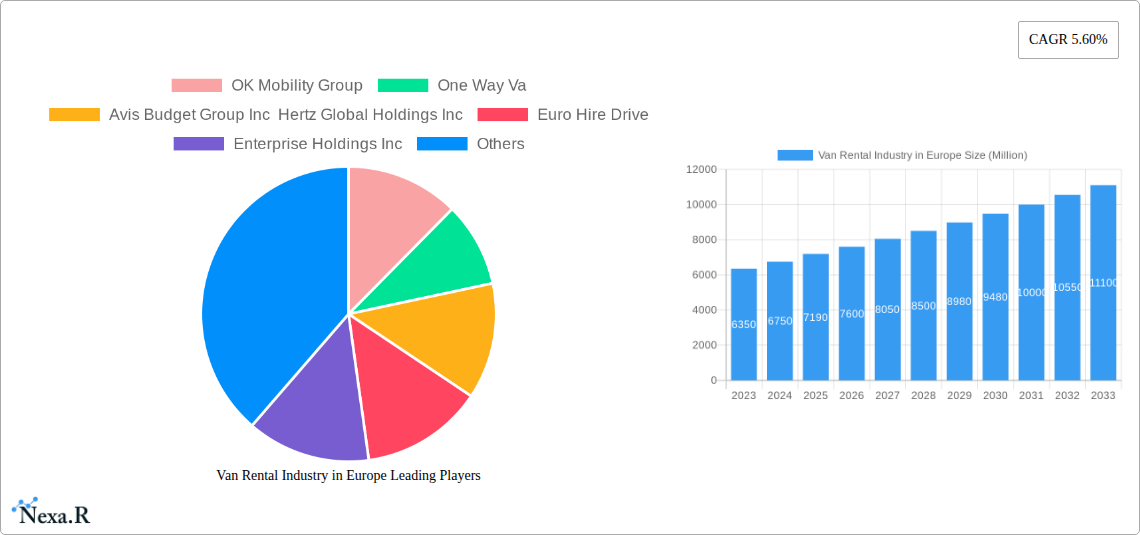

The European Van Rental market is poised for robust expansion, projected to reach a valuation of approximately $7.19 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 5.60% through 2033. This growth is fueled by a confluence of factors, including the burgeoning e-commerce sector, which necessitates increased delivery and logistics services, thereby driving demand for rental vans. Furthermore, the resurgence of tourism and leisure activities post-pandemic is contributing significantly to the market's upward trajectory, with individuals and businesses opting for van rentals for personal travel and event logistics. The increasing adoption of flexible business models and the growing need for cost-effective transportation solutions for both short-term and long-term projects are also key drivers. Companies are increasingly recognizing the operational and financial benefits of van rental over outright ownership, leading to a sustained demand. The market is segmented across various applications, with Leisure/Tourism and Business segments representing significant demand pools.

Van Rental Industry in Europe Market Size (In Billion)

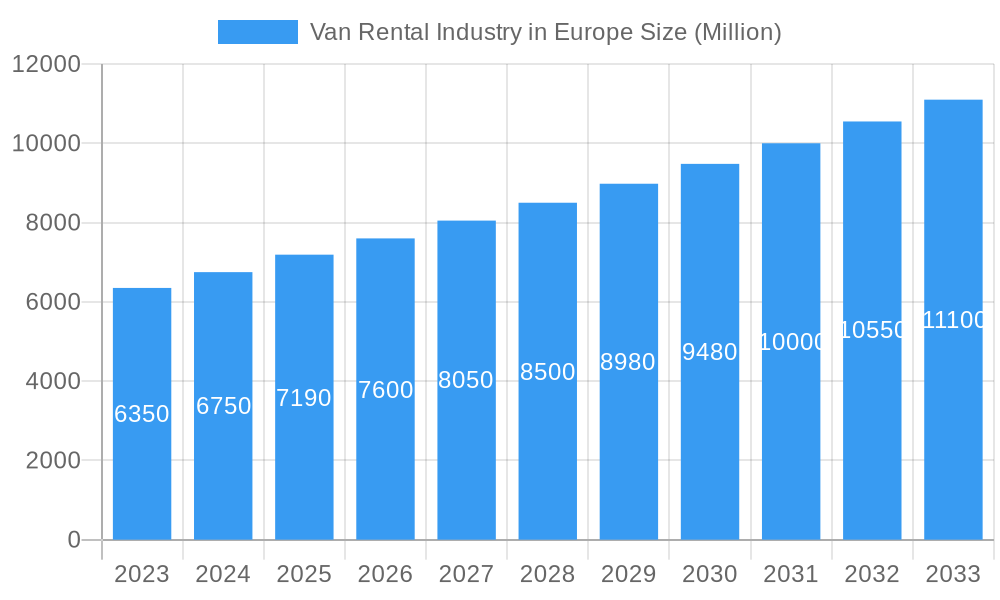

Technological advancements and evolving consumer preferences are shaping the van rental landscape. The shift towards online booking platforms is a dominant trend, offering convenience and a wider selection of vehicles. Simultaneously, offline booking channels continue to cater to specific customer segments. Short-term rentals are experiencing high demand driven by seasonal needs and project-based requirements, while long-term rentals are gaining traction among businesses seeking predictable operational costs and fleet management solutions. Key players such as Avis Budget Group Inc, Hertz Global Holdings Inc, Enterprise Holdings Inc, and Europcar Mobility Group are actively innovating and expanding their services to capture market share. Geographically, the market in major European economies like Germany, France, the United Kingdom, and Spain is expected to demonstrate substantial growth, supported by strong economic activity and a well-established rental infrastructure. The competitive landscape is characterized by strategic partnerships, fleet modernization, and the integration of digital solutions to enhance customer experience and operational efficiency.

Van Rental Industry in Europe Company Market Share

Van Rental Industry in Europe: Market Analysis & Future Outlook 2019-2033

This comprehensive report provides an in-depth analysis of the European Van Rental Industry, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and a detailed forecast period spanning 2025-2033, this study examines market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, and emerging opportunities. Leveraging data from the historical period of 2019-2024, this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to navigate and capitalize on the evolving European van rental market.

Van Rental Industry in Europe Market Dynamics & Structure

The European Van Rental Industry is characterized by a moderately concentrated market, with a few key players holding significant market share. Technological innovation, particularly in electrification and digital booking platforms, is a primary driver of change, compelling companies to invest heavily in sustainable fleets and enhanced customer experiences. Regulatory frameworks surrounding emissions and fleet management are increasingly influencing operational strategies. Competitive product substitutes, such as commercial vehicle leasing and outright fleet purchase, present ongoing challenges, while shifting end-user demographics, with a growing demand for flexible and efficient transport solutions for both leisure and business, reshape demand patterns. Mergers and acquisitions (M&A) remain a strategic tool for consolidation and market expansion.

- Market Concentration: Dominated by a mix of global rental giants and specialized regional providers.

- Technological Innovation: Driven by the urgent need for electric vehicles (EVs) and integrated digital solutions.

- Regulatory Frameworks: Increasing focus on sustainability targets and emission standards impacting fleet composition.

- Competitive Substitutes: Leasing, contract hire, and outright purchase options offer alternative solutions.

- End-User Demographics: Growing demand from SMEs, e-commerce logistics, and the gig economy for versatile van solutions.

- M&A Trends: Strategic acquisitions to expand geographical reach and service portfolios.

Van Rental Industry in Europe Growth Trends & Insights

The European Van Rental Industry is poised for robust growth, driven by an expanding market size and increasing adoption rates of rental solutions across various sectors. The study period of 2019-2033, with a focus on the forecast period 2025-2033, will witness a significant evolution in market penetration. Technological disruptions, primarily the widespread adoption of electric vans and the integration of advanced telematics, are reshaping the operational landscape and customer offerings. Consumer behavior shifts towards flexible, on-demand mobility solutions for both personal and professional needs are further fueling this expansion. The market is projected to grow at a substantial Compound Annual Growth Rate (CAGR) of xx% during the forecast period. The increasing reliance on e-commerce and the 'last-mile' delivery segment are key contributors to this upward trend. Furthermore, the growing emphasis on sustainability and reducing carbon footprints among businesses is accelerating the demand for eco-friendly van rental options. The digitalization of booking processes and the availability of diverse vehicle types catering to specific business requirements are also key growth enablers. The inherent flexibility offered by van rentals, allowing businesses to scale their logistics operations without significant capital investment, is a critical factor driving market penetration, particularly among small and medium-sized enterprises (SMEs). The report predicts a market size of approximately €XX billion by 2033, a significant increase from historical figures.

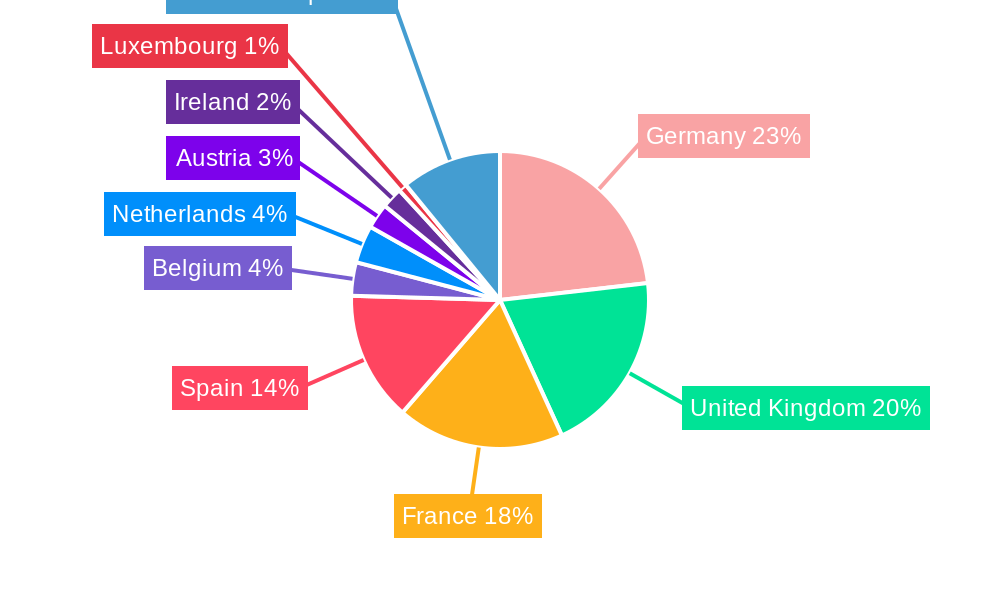

Dominant Regions, Countries, or Segments in Van Rental Industry in Europe

The Business segment within the European Van Rental Industry is expected to drive significant market growth, owing to the burgeoning e-commerce sector and the increasing need for efficient logistics and last-mile delivery solutions across the continent. Countries like Germany, the United Kingdom, and France are projected to remain dominant due to their strong economic foundations, extensive transportation infrastructure, and high concentration of businesses requiring commercial vehicle rentals. The Online booking type is rapidly gaining prominence, reflecting a broader digital shift in consumer and business behavior. This preference for digital platforms streamlines the rental process, offering greater convenience and accessibility.

- Dominant Segment: Business:

- E-commerce & Logistics: Surging demand for vans for delivery fleets and supply chain operations.

- SME Support: Providing flexible transportation solutions for small and medium-sized enterprises without the burden of ownership.

- Construction & Trades: Continued reliance on vans for equipment and material transport.

- Event Management: Temporary vehicle needs for setup, teardown, and transport.

- Dominant Countries:

- Germany: Strong industrial base, high density of logistics companies, and significant fleet operator presence.

- United Kingdom: Robust e-commerce growth and a mature rental market with established players.

- France: Growing emphasis on sustainable logistics and increasing demand for flexible transport solutions.

- Dominant Booking Type: Online:

- Convenience & Efficiency: 24/7 booking, real-time availability, and simplified payment processes.

- Comparison & Choice: Easy access to compare prices and vehicle options from multiple providers.

- Data Analytics: Enables rental companies to gather insights into customer preferences and optimize offerings.

- Dominant Rental Duration:

- Short-term Rental: Driven by project-based needs, seasonal demands, and emergency replacements.

- Long-term Rental: Increasingly adopted by businesses seeking predictable costs and fleet management solutions.

Van Rental Industry in Europe Product Landscape

The European van rental product landscape is evolving rapidly with a strong emphasis on sustainability and technological integration. The introduction of electric vans (EVs) is a paramount innovation, offering environmentally friendly alternatives for businesses and individuals. Rental companies are expanding their fleets to include a diverse range of electric models, from compact city vans to larger cargo vehicles. Advanced telematics systems are being integrated to enhance fleet management, optimize routes, and monitor vehicle performance, thereby improving efficiency and reducing operational costs. Furthermore, smart booking platforms and mobile applications are becoming standard, offering seamless user experiences for reservations, pick-ups, and returns. The performance metrics of rental vans are increasingly being evaluated based on their fuel efficiency (or electric range), cargo capacity, payload, and driver comfort, all contributing to the overall value proposition for customers.

Key Drivers, Barriers & Challenges in Van Rental Industry in Europe

Key Drivers:

The European Van Rental Industry is propelled by several significant drivers. The burgeoning e-commerce sector is a primary catalyst, necessitating robust logistics and last-mile delivery solutions. Increased adoption of flexible working models and the gig economy also boosts demand for on-demand vehicle access. Furthermore, the growing corporate focus on sustainability and reducing carbon footprints is a major impetus for the adoption of electric and low-emission vans. Government incentives and regulations promoting cleaner transportation also play a crucial role.

Barriers & Challenges:

Despite its growth potential, the industry faces several barriers and challenges. The high initial cost of electric vehicles remains a significant hurdle for fleet electrification, impacting rental pricing. The development of adequate charging infrastructure across Europe is crucial and requires substantial investment. Regulatory complexities and varying emissions standards across different member states can also pose operational challenges. Moreover, intense competition from established rental companies, leasing providers, and the growth of peer-to-peer van sharing platforms exerts pressure on pricing and market share. Supply chain disruptions for new vehicle acquisition, particularly for EVs, can also impact fleet availability.

Emerging Opportunities in Van Rental Industry in Europe

Emerging opportunities in the European Van Rental Industry are deeply intertwined with sustainability and digital transformation. The rapid expansion of the e-commerce market presents a continuous demand for efficient and flexible delivery solutions, particularly in urban areas, creating a niche for smaller, electric last-mile delivery vans. The increasing demand for specialized vehicles for niche markets, such as mobile workshops, refrigerated transport, and camper van rentals for the growing tourism sector, offers significant untapped potential. Furthermore, the integration of advanced telematics and IoT solutions can unlock opportunities for data-driven services, predictive maintenance, and optimized fleet management, creating value-added propositions for corporate clients. The ongoing development of battery technology and charging infrastructure will also pave the way for greater adoption of long-term EV rentals.

Growth Accelerators in the Van Rental Industry in Europe Industry

Several catalysts are accelerating long-term growth in the European Van Rental Industry. The ongoing transition to electric mobility is a monumental accelerator, driven by both regulatory mandates and increasing consumer preference for eco-friendly transportation. Strategic partnerships between rental companies, EV manufacturers, and charging infrastructure providers are crucial for overcoming adoption barriers and expanding EV rental availability. Furthermore, the development and adoption of advanced digital platforms, offering seamless booking, fleet management, and ancillary services, are enhancing customer experience and operational efficiency. Market expansion into underserved regions and the development of specialized rental packages tailored to specific industry needs, such as construction, events, and healthcare logistics, will also significantly contribute to sustained growth.

Key Players Shaping the Van Rental Industry in Europe Market

- OK Mobility Group

- One Way Va

- Avis Budget Group Inc

- Hertz Global Holdings Inc

- Euro Hire Drive

- Enterprise Holdings Inc

- Fraikin SAS

- SIXT SE

- Peugeot Europe

- Lease Plan Corporation

- Europcar Mobility Group

Notable Milestones in Van Rental Industry in Europe Sector

- September 2022: SIXT approved a comprehensive package of measures to electrify the fleet and establish its own charging infrastructure. The global SIXT fleet's electrified vehicle share (including plug-in hybrid electric vehicles (PHEVs) and mild hybrid electric vehicles (MHEV)) is expected to reach 12 to 15% by the end of 2023. By 2030, 70 to 90% of the company's vehicles in Europe will be electrified, and all of them will be bookable through the SIXT App.

- February 2022: Hertz announced an investment to expand electric vehicle commitment with a new UFODRIVE partnership. As Hertz's commitment to leading the future of mobility, the company invested in UFODRIVE - the leading self-service electric vehicle rental company and e-Mobility service provider in Europe.

- February 2022: Inzileand, the Spanish OK Mobility Group, formed a joint venture company to commercialize electric vehicles (EV) for the European rental sector. With the assistance and experience of OK Mobility Group and its marketing organization, Inzilewill design, homologate, and manufacture compact electric vehicles for delivery to this sector.

In-Depth Van Rental Industry in Europe Market Outlook

The future outlook for the European Van Rental Industry is exceptionally promising, fueled by the accelerating shift towards sustainable mobility and the persistent growth of the digital economy. Key growth accelerators include the increasing availability and affordability of electric vans, supported by robust government incentives and a maturing charging infrastructure. Strategic alliances and mergers will continue to shape market consolidation, enhancing service offerings and geographical reach. The industry is poised to benefit from the evolving consumer preference for flexible, on-demand access to vehicles, particularly for business-related needs such as logistics and last-mile delivery. Innovations in telematics and fleet management software will further optimize operations and create new service revenue streams. The report projects continued strong market penetration for van rental services across both leisure and business segments, with a significant surge in demand for environmentally friendly options.

Van Rental Industry in Europe Segmentation

-

1. Application Type

- 1.1. Leisure/Tourism

- 1.2. Business

-

2. Booking Type

- 2.1. Offline

- 2.2. Online

-

3. Rental Duration

- 3.1. Short-term

- 3.2. Long-term

Van Rental Industry in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Belgium

- 6. Netherlands

- 7. Austria

- 8. Ireland

- 9. Luxembourg

- 10. Rest of Europe

Van Rental Industry in Europe Regional Market Share

Geographic Coverage of Van Rental Industry in Europe

Van Rental Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Logistics Company may Drive the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Government Incentives for Buying New EV May Hamper the Market

- 3.4. Market Trends

- 3.4.1. Business Rental Segment Anticipated to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Leisure/Tourism

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Rental Duration

- 5.3.1. Short-term

- 5.3.2. Long-term

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Spain

- 5.4.5. Belgium

- 5.4.6. Netherlands

- 5.4.7. Austria

- 5.4.8. Ireland

- 5.4.9. Luxembourg

- 5.4.10. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Germany Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Leisure/Tourism

- 6.1.2. Business

- 6.2. Market Analysis, Insights and Forecast - by Booking Type

- 6.2.1. Offline

- 6.2.2. Online

- 6.3. Market Analysis, Insights and Forecast - by Rental Duration

- 6.3.1. Short-term

- 6.3.2. Long-term

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. United Kingdom Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Leisure/Tourism

- 7.1.2. Business

- 7.2. Market Analysis, Insights and Forecast - by Booking Type

- 7.2.1. Offline

- 7.2.2. Online

- 7.3. Market Analysis, Insights and Forecast - by Rental Duration

- 7.3.1. Short-term

- 7.3.2. Long-term

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. France Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Leisure/Tourism

- 8.1.2. Business

- 8.2. Market Analysis, Insights and Forecast - by Booking Type

- 8.2.1. Offline

- 8.2.2. Online

- 8.3. Market Analysis, Insights and Forecast - by Rental Duration

- 8.3.1. Short-term

- 8.3.2. Long-term

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Spain Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Leisure/Tourism

- 9.1.2. Business

- 9.2. Market Analysis, Insights and Forecast - by Booking Type

- 9.2.1. Offline

- 9.2.2. Online

- 9.3. Market Analysis, Insights and Forecast - by Rental Duration

- 9.3.1. Short-term

- 9.3.2. Long-term

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Belgium Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 10.1.1. Leisure/Tourism

- 10.1.2. Business

- 10.2. Market Analysis, Insights and Forecast - by Booking Type

- 10.2.1. Offline

- 10.2.2. Online

- 10.3. Market Analysis, Insights and Forecast - by Rental Duration

- 10.3.1. Short-term

- 10.3.2. Long-term

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 11. Netherlands Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application Type

- 11.1.1. Leisure/Tourism

- 11.1.2. Business

- 11.2. Market Analysis, Insights and Forecast - by Booking Type

- 11.2.1. Offline

- 11.2.2. Online

- 11.3. Market Analysis, Insights and Forecast - by Rental Duration

- 11.3.1. Short-term

- 11.3.2. Long-term

- 11.1. Market Analysis, Insights and Forecast - by Application Type

- 12. Austria Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application Type

- 12.1.1. Leisure/Tourism

- 12.1.2. Business

- 12.2. Market Analysis, Insights and Forecast - by Booking Type

- 12.2.1. Offline

- 12.2.2. Online

- 12.3. Market Analysis, Insights and Forecast - by Rental Duration

- 12.3.1. Short-term

- 12.3.2. Long-term

- 12.1. Market Analysis, Insights and Forecast - by Application Type

- 13. Ireland Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application Type

- 13.1.1. Leisure/Tourism

- 13.1.2. Business

- 13.2. Market Analysis, Insights and Forecast - by Booking Type

- 13.2.1. Offline

- 13.2.2. Online

- 13.3. Market Analysis, Insights and Forecast - by Rental Duration

- 13.3.1. Short-term

- 13.3.2. Long-term

- 13.1. Market Analysis, Insights and Forecast - by Application Type

- 14. Luxembourg Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Application Type

- 14.1.1. Leisure/Tourism

- 14.1.2. Business

- 14.2. Market Analysis, Insights and Forecast - by Booking Type

- 14.2.1. Offline

- 14.2.2. Online

- 14.3. Market Analysis, Insights and Forecast - by Rental Duration

- 14.3.1. Short-term

- 14.3.2. Long-term

- 14.1. Market Analysis, Insights and Forecast - by Application Type

- 15. Rest of Europe Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Application Type

- 15.1.1. Leisure/Tourism

- 15.1.2. Business

- 15.2. Market Analysis, Insights and Forecast - by Booking Type

- 15.2.1. Offline

- 15.2.2. Online

- 15.3. Market Analysis, Insights and Forecast - by Rental Duration

- 15.3.1. Short-term

- 15.3.2. Long-term

- 15.1. Market Analysis, Insights and Forecast - by Application Type

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 OK Mobility Group

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 One Way Va

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Avis Budget Group Inc Hertz Global Holdings Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Euro Hire Drive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Enterprise Holdings Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Fraikin SAS

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SIXT SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Peugeot Europe

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Lease Plan Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Europcar Mobility Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 OK Mobility Group

List of Figures

- Figure 1: Van Rental Industry in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Van Rental Industry in Europe Share (%) by Company 2025

List of Tables

- Table 1: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 4: Van Rental Industry in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 8: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 10: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 11: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 12: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 14: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 15: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 16: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 18: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 19: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 20: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 22: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 23: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 24: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 26: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 27: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 28: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 30: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 31: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 32: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 34: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 35: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 36: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 38: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 39: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 40: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 42: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 43: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 44: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Van Rental Industry in Europe?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Van Rental Industry in Europe?

Key companies in the market include OK Mobility Group, One Way Va, Avis Budget Group Inc Hertz Global Holdings Inc, Euro Hire Drive, Enterprise Holdings Inc, Fraikin SAS, SIXT SE, Peugeot Europe, Lease Plan Corporation, Europcar Mobility Group.

3. What are the main segments of the Van Rental Industry in Europe?

The market segments include Application Type, Booking Type, Rental Duration.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Logistics Company may Drive the Growth of the Market.

6. What are the notable trends driving market growth?

Business Rental Segment Anticipated to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

Government Incentives for Buying New EV May Hamper the Market.

8. Can you provide examples of recent developments in the market?

September 2022: SIXT approved a comprehensive package of measures to electrify the fleet and establish its own charging infrastructure. The global SIXT fleet's electrified vehicle share (including plug-in hybrid electric vehicles (PHEVs) and mild hybrid electric vehicles (MHEV)) is expected to reach 12 to 15% by the end of 2023. By 2030, 70 to 90% of the company's vehicles in Europe will be electrified, and all of them will be bookable through the SIXT App.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Van Rental Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Van Rental Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Van Rental Industry in Europe?

To stay informed about further developments, trends, and reports in the Van Rental Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence