Key Insights

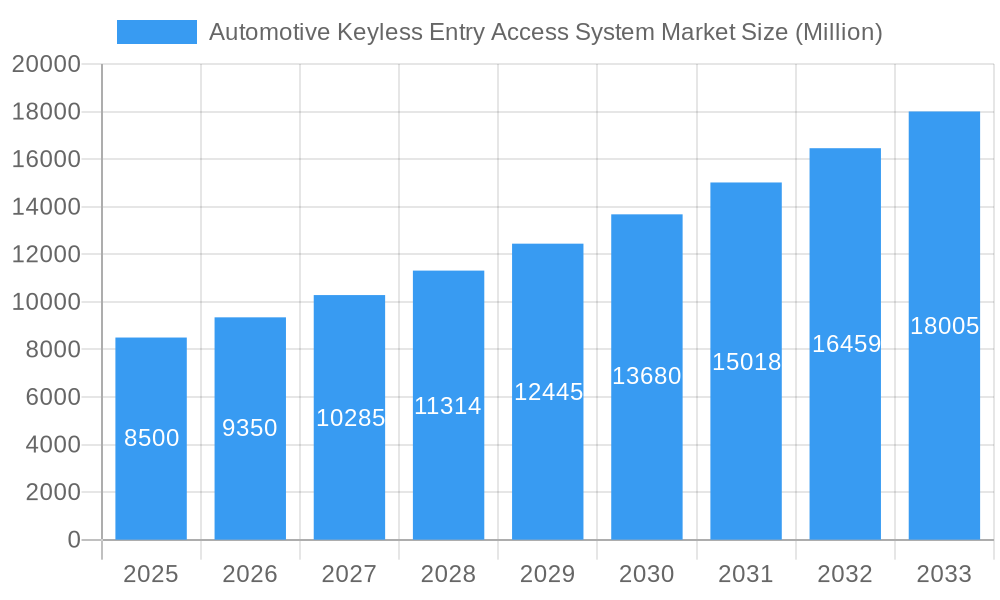

The global Automotive Keyless Entry Access System Market is projected for significant expansion, with an estimated market size of $8.5 billion by 2025, driven by a robust CAGR of 12.8% through 2033. Increasing consumer demand for convenience and advanced vehicle security is the primary growth catalyst. The integration of technologies like Passive Keyless Entry (PKE) systems enhances user experience by enabling seamless vehicle access and ignition. The proliferation of smart automotive technologies and sophisticated vehicle interiors further fuels market growth. The aftermarket segment is particularly active as vehicle owners upgrade existing security and convenience features.

Automotive Keyless Entry Access System Market Market Size (In Billion)

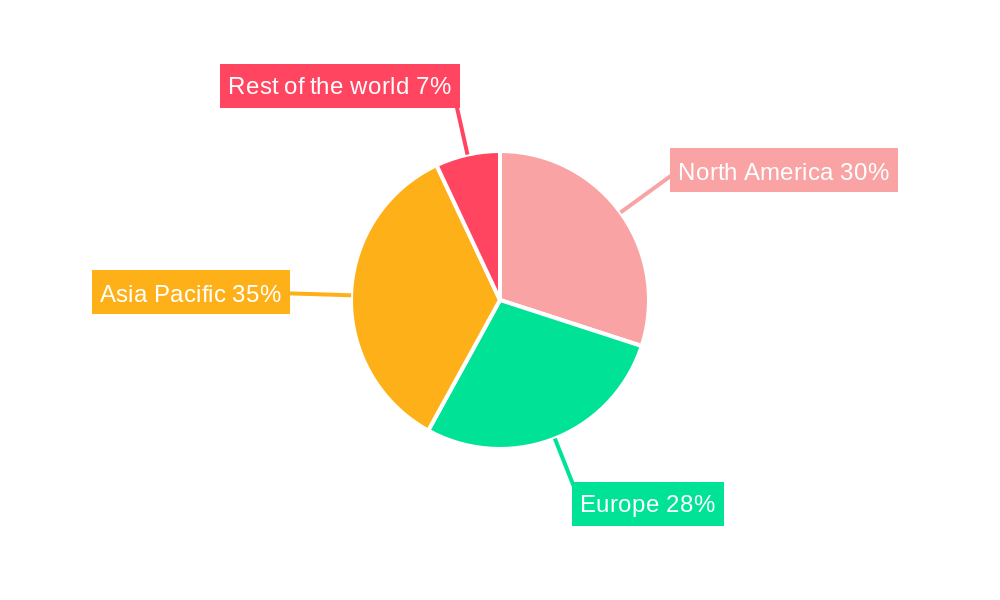

Passenger cars dominate the market due to their high volume and widespread adoption of keyless entry technology. However, the growing integration of these systems in commercial vehicles, driven by fleet management efficiency and enhanced security needs, represents a notable emerging trend. North America and Europe currently lead adoption due to mature automotive industries and a strong consumer preference for advanced features. The Asia Pacific region, particularly China and South Korea, is anticipated to experience the fastest growth, supported by rapid urbanization, a growing middle class, and the increasing manufacturing prowess of key automotive suppliers. While challenges such as implementation costs and cybersecurity vulnerabilities exist, industry players are actively addressing these through innovation and robust security protocols.

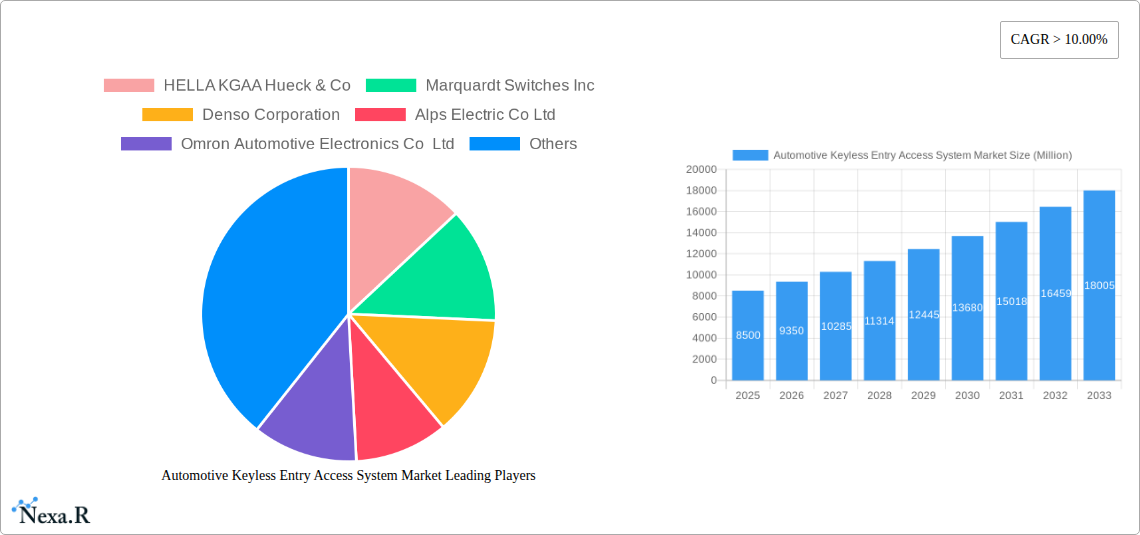

Automotive Keyless Entry Access System Market Company Market Share

Gain comprehensive insights into the Automotive Keyless Entry Access System Market with this in-depth analysis. This report details market dynamics, growth trends, competitive landscape, and future opportunities critical for stakeholders in the evolving automotive sector.

Key Report Metrics:

- Base Year: 2024

- Market Size: $2.1 billion

- CAGR: 12.8%

- Market Size Unit: billion

Automotive Keyless Entry Access System Market Market Dynamics & Structure

The Automotive Keyless Entry Access System Market is characterized by a dynamic and evolving landscape driven by technological advancements and increasing consumer demand for convenience and security. Market concentration is moderate, with a mix of established automotive suppliers and emerging technology providers vying for market share. Technological innovation is a key driver, with continuous development in areas like digital keys, smartphone integration, and enhanced security protocols. Regulatory frameworks, particularly those related to vehicle safety and data privacy, play a crucial role in shaping product development and market access. Competitive product substitutes, such as traditional key fobs and emerging biometric access systems, are present but are increasingly being integrated or surpassed by advanced keyless solutions. End-user demographics are shifting towards younger, tech-savvy consumers who prioritize seamless and integrated vehicle experiences. Mergers and acquisitions (M&A) activity in the market is ongoing as companies seek to expand their technological capabilities and market reach. For instance, the integration of advanced software and cybersecurity solutions is becoming paramount.

- Market Concentration: Moderate, with key players like Continental Automotive GmbH, HELLA KGAA Hueck & Co, Denso Corporation, and Delphi Automotive holding significant influence.

- Technological Innovation Drivers: Development of Bluetooth Low Energy (BLE) digital keys, NFC technology, ultra-wideband (UWB) for precise location detection, and integration with vehicle infotainment systems.

- Regulatory Frameworks: Evolving standards for cybersecurity, data protection, and interoperability (e.g., Car Connectivity Consortium standards).

- Competitive Product Substitutes: Traditional mechanical keys, advanced key fobs with rolling codes, and emerging biometric authentication systems (fingerprint, facial recognition).

- End-User Demographics: Growing demand from millennials and Gen Z for integrated digital experiences, driving adoption of smartphone-based keyless entry.

- M&A Trends: Strategic acquisitions to enhance capabilities in areas like software development, cybersecurity, and advanced sensor technology.

Automotive Keyless Entry Access System Market Growth Trends & Insights

The Automotive Keyless Entry Access System Market is poised for substantial growth, fueled by increasing vehicle production, the proliferation of smart features, and a growing consumer preference for enhanced convenience and security. The market size is projected to expand significantly over the forecast period, with a compelling Compound Annual Growth Rate (CAGR). Adoption rates of both Passive Keyless Entry (PKE) systems and Remote Keyless Entry (RKE) systems are on an upward trajectory, driven by their integration as standard features in an increasing number of vehicle segments. Technological disruptions, such as the rise of digital keys leveraging smartphone technology, are reshaping the market, offering unparalleled convenience and flexibility. Consumer behavior is shifting towards a desire for seamless integration of their digital lives with their vehicles, making keyless entry systems a highly desirable feature. The growing emphasis on connected car technologies and the Internet of Things (IoT) further bolsters the demand for sophisticated access solutions. As vehicle electrification and autonomous driving technologies mature, the need for advanced and secure digital access solutions will only intensify, creating a robust growth environment for keyless entry systems. The market penetration of these systems is expected to reach new heights as manufacturers increasingly equip even entry-level vehicles with these advanced functionalities to remain competitive and cater to evolving consumer expectations for a modern automotive experience.

Dominant Regions, Countries, or Segments in Automotive Keyless Entry Access System Market

The Automotive Keyless Entry Access System Market is experiencing robust growth, with the Asia Pacific region emerging as a dominant force, driven by the burgeoning automotive industry in countries like China, Japan, and South Korea. This dominance is attributed to several key factors, including strong government initiatives promoting smart manufacturing and vehicle connectivity, a rapidly expanding middle class with increasing disposable income, and the presence of major global automotive manufacturers and their extensive supply chains. Within the Asia Pacific, China stands out as a critical market, characterized by high vehicle production volumes and a significant demand for advanced automotive technologies, including sophisticated keyless entry systems. The Original Equipment Manufacturer (OEMs) segment represents the largest share within the end-user category, as automotive manufacturers integrate these systems as standard features in new vehicles to enhance their product appeal and meet consumer expectations. Passenger Cars constitute the largest segment by vehicle type, reflecting the overall higher production volumes of passenger vehicles globally.

- Dominant Region: Asia Pacific, driven by China's large automotive market and significant production capabilities.

- Key Drivers: Strong government support for automotive innovation, increasing consumer demand for smart features, and a well-established automotive manufacturing ecosystem.

- Market Share: Asia Pacific is estimated to hold a substantial market share, projected to grow by xx% over the forecast period.

- Dominant End-User Segment: Original Equipment Manufacturers (OEMs).

- Growth Potential: OEMs are integrating keyless entry systems as standard features in an increasing number of vehicle models.

- Market Penetration: Expected to reach xx% of new vehicle production by 2033.

- Dominant Vehicle Type Segment: Passenger Cars.

- Influence: Higher production volumes of passenger cars directly translate to a larger market for keyless entry systems.

- Market Size: Passenger cars contribute to over xx% of the total Automotive Keyless Entry Access System Market.

- Dominant Product Type Segment: Passive Keyless Entry (PKE) Systems.

- Consumer Preference: PKE systems offer superior convenience and are increasingly favored by consumers for their seamless operation.

- Adoption Rate: PKE systems are projected to witness a CAGR of xx% during the forecast period.

Automotive Keyless Entry Access System Market Product Landscape

The product landscape of the Automotive Keyless Entry Access System Market is characterized by rapid innovation, focusing on enhanced security, user convenience, and seamless integration. Key product types include Passive Keyless Entry (PKE) systems, which allow users to unlock and start vehicles by simply carrying a key fob or smartphone, and Remote Keyless Entry (RKE) systems, which enable locking and unlocking via a button on the key fob. Emerging trends include the development of digital keys leveraging smartphone Near Field Communication (NFC) and Bluetooth Low Energy (BLE) technologies, offering a more personalized and flexible access experience. Innovations are also directed towards integrating ultra-wideband (UWB) technology for precise localization, preventing relay attacks and enhancing security. Performance metrics such as response time, range, and power consumption are continuously being optimized.

Key Drivers, Barriers & Challenges in Automotive Keyless Entry Access System Market

Key Drivers: The primary forces propelling the Automotive Keyless Entry Access System Market include the escalating consumer demand for convenience and enhanced vehicle security, the increasing integration of smart technologies in vehicles, and the growing production of vehicles across the globe. Technological advancements, such as the development of sophisticated digital key solutions and the adoption of cybersecurity protocols, further accelerate market growth.

Key Barriers & Challenges: Significant challenges within the market include the high cost of integrating advanced keyless entry systems, particularly for entry-level vehicles, leading to adoption hurdles. Cybersecurity threats, such as relay attacks and signal jamming, pose a persistent concern, necessitating continuous investment in robust security measures. Regulatory compliance and standardization across different regions can also present complexities. Supply chain disruptions and the availability of critical components can impact production and availability. The competitive pressure from established players and the need for continuous innovation to stay ahead of technological shifts also present ongoing challenges. The overall market volume is estimated at xx million units in the base year 2025, facing a growth rate influenced by these factors.

Emerging Opportunities in Automotive Keyless Entry Access System Market

Emerging opportunities in the Automotive Keyless Entry Access System Market lie in the expanding integration of digital key solutions with multimodal vehicle access. The growing adoption of electric vehicles (EVs) presents a significant opportunity, as EV manufacturers are more inclined to incorporate advanced digital technologies. Furthermore, the aftermarket segment for retrofitting keyless entry systems in older vehicles offers untapped potential. The development of interoperable digital key standards, enabling seamless access across different vehicle brands and service providers, is another promising avenue. The increasing trend of vehicle sharing and fleet management services necessitates secure and flexible access solutions, creating a niche for specialized keyless entry systems.

Growth Accelerators in the Automotive Keyless Entry Access System Market Industry

Long-term growth in the Automotive Keyless Entry Access System Market is being significantly accelerated by groundbreaking technological breakthroughs, particularly in the realm of digital and smartphone-based access. Strategic partnerships between automotive manufacturers, technology providers, and cybersecurity firms are crucial for developing secure and user-friendly solutions. Market expansion strategies, including the increasing adoption of keyless entry systems in emerging economies and the development of cost-effective solutions for a wider range of vehicle segments, are also vital growth catalysts. The continuous innovation in sensor technology and wireless communication protocols further fuels sustained growth by enabling more advanced functionalities and improved user experiences.

Key Players Shaping the Automotive Keyless Entry Access System Market Market

- HELLA KGAA Hueck & Co

- Marquardt Switches Inc

- Denso Corporation

- Alps Electric Co Ltd

- Omron Automotive Electronics Co Ltd

- Calsonic Kansei Corporation

- TRW Automotive Holdings Corp

- Hyundai Mobis Co Ltd

- Mitsubishi Electric Corporation

- Delphi Automotive

- Atmel Corporation

- Panasonic Corporation

- EyeLock Corporation

- Continental Automotive GmbH

Notable Milestones in Automotive Keyless Entry Access System Market Sector

- May 2022: Alps Alpine Co., Ltd. announced the joint development of a wireless digital key system with Giesecke+Devrient GmbH, a German company that develops security solutions. This co-developed system complies with the Car Connectivity Consortium (CCC) global standard. Both companies plan to expand sales of the system with the aim of adopting it for vehicles to be launched in the market in 2025.

- February 2022: Grupo Antolin announced its commitment to diversify its product portfolio within the automotive sector by developing systems such as vehicle remote access systems (Keyless Entry Systems), Driver Monitoring Systems, and decorative modules with built-in displays, among others.

- December 2021: LETIN, an electric vehicle brand in China, completed the production start-up of the all-new 4-door Mengo Pro small battery electric vehicle, which is equipped with a keyless entry/start system.

- January 2021: United Automotive Electronic Systems Co., Ltd. (UAES) announced that its first Bluetooth digital key rolled off the production line. This product utilizes Bluetooth Low Energy and multiple Bluetooth antennas to calculate the location of the smartphone, enabling keyless entry and vehicle start with a smartphone.

In-Depth Automotive Keyless Entry Access System Market Market Outlook

The Automotive Keyless Entry Access System Market outlook is exceptionally positive, driven by the relentless pursuit of innovation and evolving consumer expectations for integrated and convenient vehicle access. Growth accelerators will continue to be fueled by advancements in digital key technology, including the seamless integration of smartphones and wearables as vehicle credentials. Strategic collaborations between automotive OEMs, technology providers, and cybersecurity experts will be critical in navigating the complex security landscape and ensuring widespread adoption of advanced solutions. The expanding global automotive production, particularly in emerging markets, and the increasing penetration of smart features in vehicles across all segments will further solidify the market's upward trajectory. Opportunities arising from the connected car ecosystem, autonomous driving, and shared mobility services will pave the way for novel applications and sustained growth in the coming years.

Automotive Keyless Entry Access System Market Segmentation

-

1. Product Type

- 1.1. Passive Keyless Entry (PKE) System

- 1.2. Remote Keyless Entry (RKE) System

-

2. End-User

- 2.1. Aftermarket

- 2.2. Original Equipment Manufacturer (OEMs)

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Keyless Entry Access System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the world

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Keyless Entry Access System Market Regional Market Share

Geographic Coverage of Automotive Keyless Entry Access System Market

Automotive Keyless Entry Access System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Vehicle Electrification

- 3.3. Market Restrains

- 3.3.1. The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 3.4. Market Trends

- 3.4.1. Increased Penetration of Keyless Entry for Passenger Cars to Enhance Market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Keyless Entry Access System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Passive Keyless Entry (PKE) System

- 5.1.2. Remote Keyless Entry (RKE) System

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Aftermarket

- 5.2.2. Original Equipment Manufacturer (OEMs)

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the world

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Automotive Keyless Entry Access System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Passive Keyless Entry (PKE) System

- 6.1.2. Remote Keyless Entry (RKE) System

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Aftermarket

- 6.2.2. Original Equipment Manufacturer (OEMs)

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Automotive Keyless Entry Access System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Passive Keyless Entry (PKE) System

- 7.1.2. Remote Keyless Entry (RKE) System

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Aftermarket

- 7.2.2. Original Equipment Manufacturer (OEMs)

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Automotive Keyless Entry Access System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Passive Keyless Entry (PKE) System

- 8.1.2. Remote Keyless Entry (RKE) System

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Aftermarket

- 8.2.2. Original Equipment Manufacturer (OEMs)

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the world Automotive Keyless Entry Access System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Passive Keyless Entry (PKE) System

- 9.1.2. Remote Keyless Entry (RKE) System

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Aftermarket

- 9.2.2. Original Equipment Manufacturer (OEMs)

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 HELLA KGAA Hueck & Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Marquardt Switches Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Denso Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Alps Electric Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Omron Automotive Electronics Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Calsonic Kansei Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 TRW Automotive Holdings Corp*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Mobis Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi Electric Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Delphi Automotive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Atmel Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Panasonic Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 EyeLock Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Continental Automotive GmbH

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 HELLA KGAA Hueck & Co

List of Figures

- Figure 1: Global Automotive Keyless Entry Access System Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Keyless Entry Access System Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Automotive Keyless Entry Access System Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Automotive Keyless Entry Access System Market Revenue (billion), by End-User 2025 & 2033

- Figure 5: North America Automotive Keyless Entry Access System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Automotive Keyless Entry Access System Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Keyless Entry Access System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Keyless Entry Access System Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Automotive Keyless Entry Access System Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Keyless Entry Access System Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Automotive Keyless Entry Access System Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Automotive Keyless Entry Access System Market Revenue (billion), by End-User 2025 & 2033

- Figure 13: Europe Automotive Keyless Entry Access System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 14: Europe Automotive Keyless Entry Access System Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Keyless Entry Access System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Keyless Entry Access System Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Automotive Keyless Entry Access System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Keyless Entry Access System Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Keyless Entry Access System Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Keyless Entry Access System Market Revenue (billion), by End-User 2025 & 2033

- Figure 21: Asia Pacific Automotive Keyless Entry Access System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 22: Asia Pacific Automotive Keyless Entry Access System Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Keyless Entry Access System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Keyless Entry Access System Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Keyless Entry Access System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the world Automotive Keyless Entry Access System Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of the world Automotive Keyless Entry Access System Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of the world Automotive Keyless Entry Access System Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: Rest of the world Automotive Keyless Entry Access System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Rest of the world Automotive Keyless Entry Access System Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the world Automotive Keyless Entry Access System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the world Automotive Keyless Entry Access System Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the world Automotive Keyless Entry Access System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 23: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: China Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 31: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 32: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Keyless Entry Access System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Keyless Entry Access System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Keyless Entry Access System Market?

The projected CAGR is approximately 12.8%.

2. Which companies are prominent players in the Automotive Keyless Entry Access System Market?

Key companies in the market include HELLA KGAA Hueck & Co, Marquardt Switches Inc, Denso Corporation, Alps Electric Co Ltd, Omron Automotive Electronics Co Ltd, Calsonic Kansei Corporation, TRW Automotive Holdings Corp*List Not Exhaustive, Hyundai Mobis Co Ltd, Mitsubishi Electric Corporation, Delphi Automotive, Atmel Corporation, Panasonic Corporation, EyeLock Corporation, Continental Automotive GmbH.

3. What are the main segments of the Automotive Keyless Entry Access System Market?

The market segments include Product Type, End-User, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Vehicle Electrification.

6. What are the notable trends driving market growth?

Increased Penetration of Keyless Entry for Passenger Cars to Enhance Market growth.

7. Are there any restraints impacting market growth?

The Cost of Raw Materials Used in the Manufacturing of Switches is High.

8. Can you provide examples of recent developments in the market?

In May 2022, Alps Alpine Co., Ltd. announced the joint development of a wireless digital key system with Giesecke+Devrient GmbH, a German company that develops security solutions. This co-developed system complies with the Car Connectivity Consortium (CCC) global standard. Both companies plan to expand sales of the system with the aim of adopting it for vehicles to be launched in the market in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Keyless Entry Access System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Keyless Entry Access System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Keyless Entry Access System Market?

To stay informed about further developments, trends, and reports in the Automotive Keyless Entry Access System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence