Key Insights

The Europe Used Construction Machinery Market is projected for robust growth, anticipated to reach $46.15 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. Key growth drivers include escalating infrastructure development across the UK, Germany, and France, alongside the increasing preference for cost-effective, pre-owned equipment by SMEs to manage capital expenditure. The strong presence of manufacturers like Caterpillar Inc., Komatsu, and Volvo Construction Equipment ensures a reliable supply of quality used machinery, further supported by the demand for technologically advanced yet affordable options, particularly for excavators and loaders.

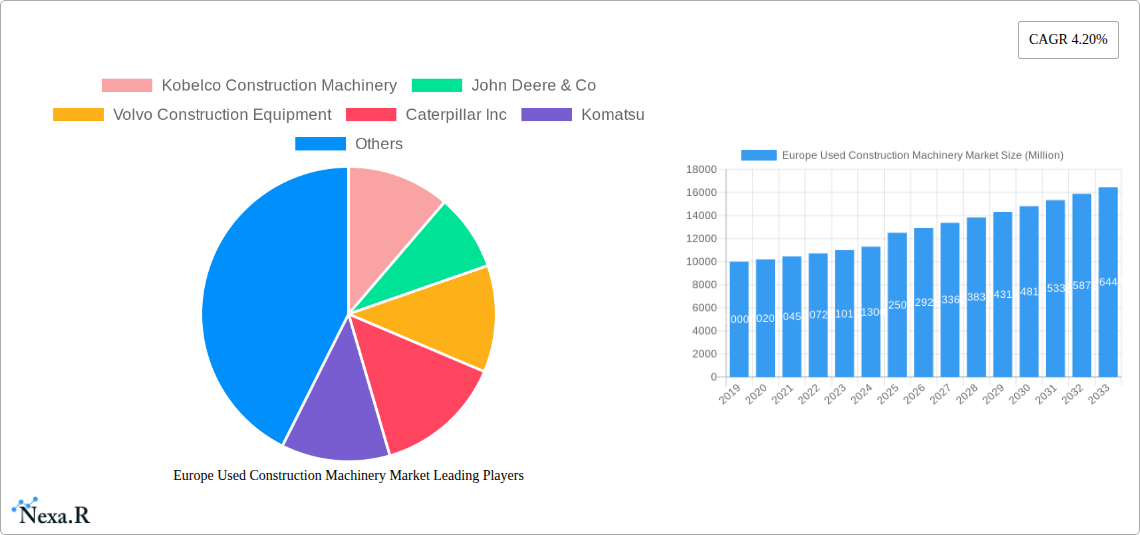

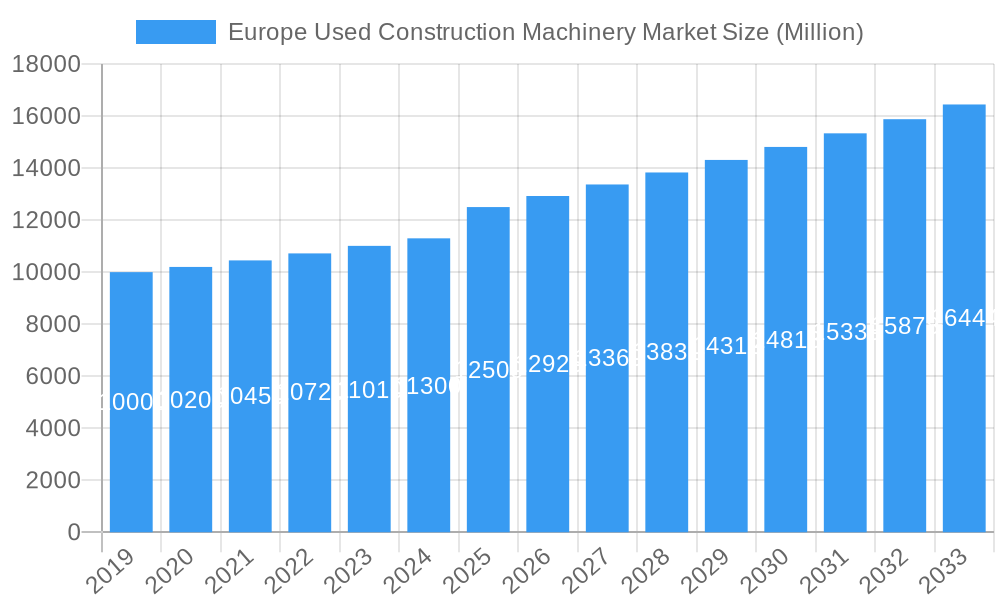

Europe Used Construction Machinery Market Market Size (In Billion)

While challenges such as concerns over machinery lifespan, maintenance costs, and environmental regulations exist, the market is actively addressing these through remanufacturing and refurbishment initiatives by major players including Liebherr International and Kobelco Construction Machinery. This trend offers more sustainable and dependable machinery solutions. Segmentation analysis highlights excavators and loaders as leading segments due to their broad application in construction. The market predominantly features IC engines, with a gradual integration of electric and hybrid models for smaller machinery types, aligning with Europe's green initiatives.

Europe Used Construction Machinery Market Company Market Share

Europe Used Construction Machinery Market: Key Trends and Forecast (2025-2033)

This report offers in-depth analysis of the Europe Used Construction Machinery Market, a critical segment of the construction equipment industry. It provides comprehensive insights into market size, growth drivers, technological innovations, and regional dynamics, essential for stakeholder decision-making. The report covers both parent and child markets, offering a detailed understanding of the market landscape, with projections from 2025 to 2033, based on the 2025 base year.

Europe Used Construction Machinery Market Market Dynamics & Structure

The Europe Used Construction Machinery Market is characterized by a moderately concentrated landscape, with major global manufacturers like Caterpillar Inc., Komatsu, and Volvo Construction Equipment holding significant market shares. The resurgence in infrastructure development across key European nations, coupled with the growing preference for cost-effective solutions among small and medium-sized enterprises (SMEs), fuels demand for pre-owned equipment. Technological innovation is primarily driven by advancements in telematics and digitalization, enabling better tracking, maintenance, and resale value of used machinery. Regulatory frameworks, particularly concerning emissions standards and safety certifications for used equipment, play a crucial role in shaping market entry and product suitability. Competitive product substitutes include rental services and new, more fuel-efficient machinery, though the price advantage of used equipment remains a strong differentiator. End-user demographics are diverse, ranging from large construction conglomerates to independent contractors and agricultural businesses. Merger and acquisition (M&A) activity, while not as prevalent as in the new machinery segment, is observed as established players seek to expand their certified pre-owned offerings and service networks.

- Market Concentration: Moderately concentrated, dominated by key global players.

- Technological Drivers: Telematics, digitalization for asset management and maintenance.

- Regulatory Frameworks: Emission standards, safety certifications for used equipment.

- Competitive Substitutes: Rental machinery, new equipment.

- End-User Demographics: SMEs, large construction firms, agricultural sector.

- M&A Trends: Strategic acquisitions to bolster certified pre-owned programs.

Europe Used Construction Machinery Market Growth Trends & Insights

The Europe Used Construction Machinery Market is poised for significant expansion, driven by robust economic recovery and substantial government investments in infrastructure projects. The estimated market size for used construction machinery in Europe is expected to reach XXX million units by 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This growth is underpinned by a heightened awareness of the total cost of ownership and the increasing availability of certified pre-owned machinery from reputable manufacturers. The adoption rates for used equipment are escalating, particularly among emerging economies within Europe and for specific applications where new machinery may be prohibitively expensive. Technological disruptions, such as the integration of AI-powered diagnostics and predictive maintenance for used equipment, are further enhancing their appeal and longevity. Consumer behavior shifts towards sustainability and the circular economy also favor the purchase of used machinery, reducing the environmental footprint associated with manufacturing new equipment. The base year of 2025 highlights a critical juncture where these trends are solidifying, setting a strong trajectory for future market penetration. Historical data from 2019–2024 indicates a steady recovery post-pandemic, with a growing appetite for reliable, cost-effective solutions. The demand for specific machinery types, such as excavators and loaders, is expected to outpace others due to their widespread application in both urban and rural development projects.

Dominant Regions, Countries, or Segments in Europe Used Construction Machinery Market

Within the Europe Used Construction Machinery Market, Excavators stand out as the dominant machinery type, significantly driving market growth. The demand for excavators, both as parent and child markets for various attachments and sub-types, is fueled by their indispensable role in a wide array of construction activities, including demolition, excavation, material handling, and road construction. Countries like Germany, France, and the United Kingdom are leading the charge, owing to their extensive infrastructure renewal programs and a high concentration of construction firms actively seeking cost-efficient equipment solutions. The IC Engine drive type continues to dominate the used construction machinery market, accounting for an estimated xx% of the total market share in 2025. This dominance stems from the established infrastructure and widespread availability of fuel and maintenance for these machines, particularly in regions where electric infrastructure is still developing.

- Dominant Machinery Type: Excavators

- Key Drivers: Essential for diverse construction tasks (demolition, excavation, road building), widespread adoption in infrastructure projects.

- Market Share: Exhibiting a substantial portion of the used machinery market.

- Growth Potential: High due to ongoing and planned infrastructure development across Europe.

- Dominant Drive Type: IC Engine

- Key Drivers: Established fueling and maintenance infrastructure, proven reliability, lower upfront cost compared to electric counterparts.

- Market Share: Estimated xx% in 2025.

- Growth Potential: Stable, with continued demand from sectors prioritizing immediate availability and lower initial investment.

- Leading Countries: Germany, France, United Kingdom

- Key Drivers: Significant government investments in infrastructure, large construction industry, strong presence of major OEMs and dealerships.

- Economic Policies: Favorable policies supporting construction and infrastructure development.

- Market Dynamics: High volume of transactions and a well-developed resale market.

Europe Used Construction Machinery Market Product Landscape

The Europe Used Construction Machinery Market product landscape is characterized by a wide array of well-maintained and refurbished equipment. Key innovations in this segment focus on extending the lifespan and enhancing the performance of pre-owned machinery. Manufacturers and specialized dealers are increasingly offering certified pre-owned programs that include thorough inspections, refurbishment, and warranty packages. Applications range from heavy-duty earthmoving with excavators and loaders to material handling with telescopic handlers. Performance metrics are often evaluated based on hours of operation, maintenance history, and component wear. Unique selling propositions include significant cost savings compared to new machinery, immediate availability, and reduced environmental impact. Technological advancements are seeing the integration of telematics and diagnostic tools even into older models, providing buyers with greater transparency and confidence.

Key Drivers, Barriers & Challenges in Europe Used Construction Machinery Market

Key Drivers: The Europe Used Construction Machinery Market is propelled by strong economic drivers, including government investments in infrastructure projects and the sustained demand from small and medium-sized enterprises seeking cost-effective equipment solutions. The growing emphasis on sustainability and the circular economy also fuels the preference for used machinery, aligning with environmental goals. Technological advancements in refurbishment and certification processes are enhancing buyer confidence.

Barriers & Challenges: Significant challenges include varying emission standards across different European countries, which can impact the resale value and usability of older machinery. The availability of genuine spare parts for older models can also be a concern. Furthermore, the competitive pressure from the rental market and the increasing availability of financing options for new equipment pose a threat. Supply chain disruptions for essential components during refurbishment can also create bottlenecks.

Emerging Opportunities in Europe Used Construction Machinery Market

Emerging opportunities in the Europe Used Construction Machinery Market lie in the expansion of digital marketplaces for used equipment, offering greater transparency and accessibility to buyers and sellers across the continent. The increasing demand for specialized attachments for used machinery, catering to niche applications, presents a significant growth avenue. Furthermore, the development of robust remanufacturing and refurbishment programs by original equipment manufacturers (OEMs) and independent service providers can unlock higher-value segments of the used market. Growing interest in sustainable construction practices is also creating opportunities for companies offering eco-friendly refurbished machinery.

Growth Accelerators in the Europe Used Construction Machinery Market Industry

Growth accelerators in the Europe Used Construction Machinery Market industry are primarily driven by intensified government spending on infrastructure development, particularly in areas like renewable energy, transportation, and urban regeneration. The increasing adoption of telematics and IoT solutions for managing and tracking used equipment enhances their value proposition by providing data-driven insights into performance and maintenance needs. Strategic partnerships between OEMs, dealerships, and third-party service providers are crucial for expanding certified pre-owned programs and offering comprehensive support, thereby building trust and facilitating sales. Market expansion strategies focusing on regions with nascent construction industries also present significant opportunities.

Key Players Shaping the Europe Used Construction Machinery Market Market

- Kobelco Construction Machinery

- John Deere & Co

- Volvo Construction Equipment

- Caterpillar Inc

- Komatsu

- Liebherr International

- Mitsubishi Heavy Industries Ltd

- Manitou B

Notable Milestones in Europe Used Construction Machinery Market Sector

- 2021/03: Increased government stimulus packages across major European economies to boost construction and infrastructure projects, leading to higher demand for used machinery.

- 2022/07: Launch of new digital platforms by major OEMs for selling certified pre-owned construction equipment, enhancing transparency and reach.

- 2023/01: Introduction of stricter emission regulations for certain types of construction machinery in key European markets, influencing the resale value and demand for compliant used equipment.

- 2023/09: Major construction equipment manufacturers report a surge in demand for refurbished and certified used machinery due to supply chain challenges for new equipment.

- 2024/02: Growing adoption of electric and hybrid used construction machinery models, signaling a shift towards more sustainable options.

In-Depth Europe Used Construction Machinery Market Market Outlook

The future market outlook for the Europe Used Construction Machinery Market is exceptionally promising, driven by a confluence of economic, technological, and environmental factors. Continued government commitment to large-scale infrastructure projects across the continent will sustain the demand for excavators, loaders, and cranes. The burgeoning emphasis on the circular economy and sustainability will further solidify the position of used machinery as a preferred, eco-conscious choice. Technological advancements in diagnostics, refurbishment, and digital sales platforms will continue to enhance buyer confidence and market accessibility. Strategic collaborations and the expansion of certified pre-owned programs will be pivotal in capturing market share. The market is expected to witness sustained growth, offering significant opportunities for stakeholders to capitalize on the evolving needs of the European construction industry.

Europe Used Construction Machinery Market Segmentation

-

1. Machinery Type

- 1.1. Crane

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders & Backhoe

- 1.5. Motor Grader

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric

Europe Used Construction Machinery Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Used Construction Machinery Market Regional Market Share

Geographic Coverage of Europe Used Construction Machinery Market

Europe Used Construction Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Integration With Telematics And Fleet Management Systems; Others

- 3.3. Market Restrains

- 3.3.1. The Initial Costs Associated With Purchasing And Installing ELD Systems is High; Others

- 3.4. Market Trends

- 3.4.1. Used Cranes to Drive the Construction Machinery Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Used Construction Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders & Backhoe

- 5.1.5. Motor Grader

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 John Deere & Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volvo Construction Equipment

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Caterpillar Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Komatsu

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Liebherr International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Manitou B

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Europe Used Construction Machinery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Used Construction Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Used Construction Machinery Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 2: Europe Used Construction Machinery Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Europe Used Construction Machinery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Used Construction Machinery Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 5: Europe Used Construction Machinery Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Europe Used Construction Machinery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Used Construction Machinery Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Europe Used Construction Machinery Market?

Key companies in the market include Kobelco Construction Machinery, John Deere & Co, Volvo Construction Equipment, Caterpillar Inc, Komatsu, Liebherr International, Mitsubishi heavy Industries Ltd, Manitou B.

3. What are the main segments of the Europe Used Construction Machinery Market?

The market segments include Machinery Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Integration With Telematics And Fleet Management Systems; Others.

6. What are the notable trends driving market growth?

Used Cranes to Drive the Construction Machinery Market Growth.

7. Are there any restraints impacting market growth?

The Initial Costs Associated With Purchasing And Installing ELD Systems is High; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Used Construction Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Used Construction Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Used Construction Machinery Market?

To stay informed about further developments, trends, and reports in the Europe Used Construction Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence