Key Insights

The Africa Middle East Automotive Thermoplastic Polymer Composites Market is projected for significant growth, anticipated to reach a market size of USD 25.89 billion by 2033. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 8.17% from a base year of 2023. Key factors fueling this trend include the escalating demand for lightweight materials to improve fuel efficiency and reduce emissions, alongside advancements in manufacturing that enhance the cost-effectiveness and accessibility of thermoplastic composites for automotive applications. Furthermore, regional regulatory mandates for improved fuel economy are accelerating the adoption of these materials for various vehicle components.

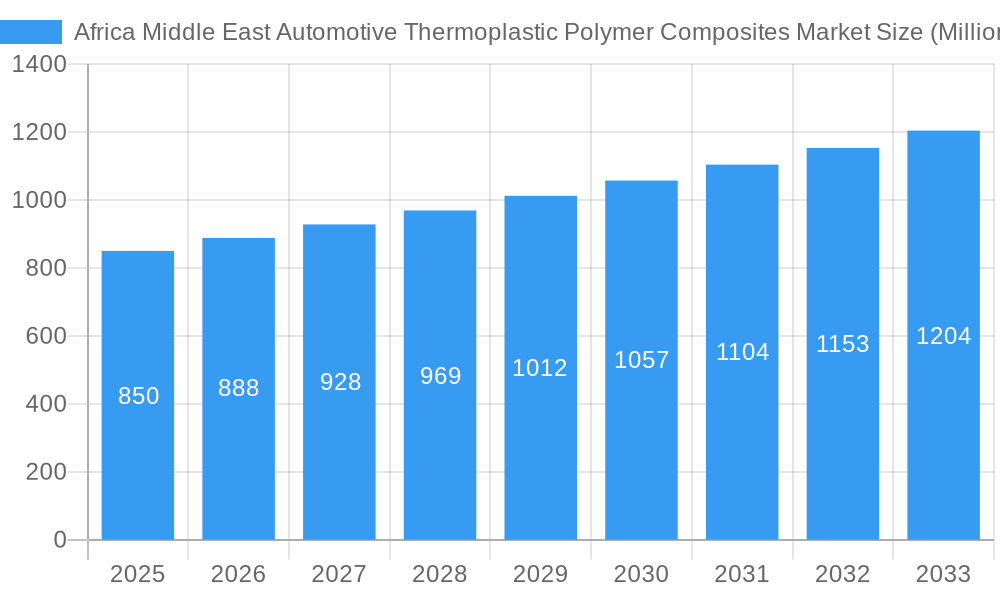

Africa Middle East Automotive Thermoplastic Polymer Composites Market Market Size (In Billion)

The market's trajectory will be influenced by the rising adoption of hybrid and electric vehicles, necessitating lightweighting for optimized performance. While established production methods will continue to be significant, advanced techniques are gaining traction. The inherent advantages of thermoplastic composites, such as recyclability and simplified processing, position them for sustained growth. Initial high tooling costs and the need for specialized manufacturing expertise are being addressed through ongoing technological innovation and strategic collaborations. Key automotive markets within the region are increasingly recognizing the value of these high-performance materials.

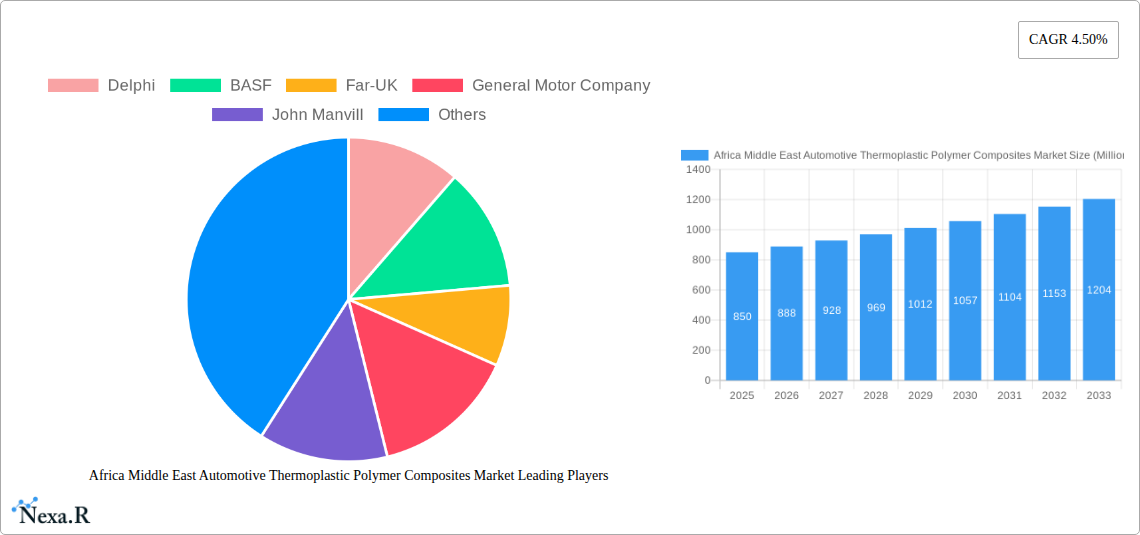

Africa Middle East Automotive Thermoplastic Polymer Composites Market Company Market Share

This report offers a comprehensive analysis of the Africa Middle East Automotive Thermoplastic Polymer Composites Market, focusing on the period of 2023–2033. It provides critical insights for industry stakeholders, including automakers, material suppliers, and investors. The analysis covers production types such as Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, and Compression Molding, and application types including Structural Assembly, Power Train Component, Interior, Exterior, and Others. All data is presented in billion units.

Africa Middle East Automotive Thermoplastic Polymer Composites Market Market Dynamics & Structure

The Africa Middle East automotive thermoplastic polymer composites market is characterized by a dynamic interplay of growth drivers and competitive forces. Market concentration is moderate, with several global players vying for significant market share, alongside emerging regional manufacturers. Technological innovation remains a primary driver, fueled by the relentless pursuit of fuel efficiency, reduced emissions, and enhanced vehicle performance. Stringent automotive regulations in both Africa and the Middle East, particularly those pertaining to emissions standards and lightweighting mandates, are instrumental in shaping material adoption. Competitive product substitutes, such as traditional metals and advanced plastics, present ongoing challenges, necessitating continuous innovation and cost-effectiveness in composite solutions. End-user demographics, increasingly valuing sustainable and advanced vehicle features, are indirectly influencing material choices. Mergers and acquisitions (M&A) trends are also noteworthy, as companies seek to consolidate their market positions, gain access to new technologies, and expand their geographical reach. For instance, recent M&A activities have seen strategic collaborations aimed at enhancing R&D capabilities and optimizing supply chains. The estimated market size for automotive thermoplastic polymer composites in the region for 2025 is expected to reach $2,150 million units.

- Market Concentration: Moderate, with a mix of established global players and growing regional competitors.

- Technological Innovation Drivers: Pursuit of fuel efficiency, CO2 emission reduction, improved safety, and enhanced vehicle performance.

- Regulatory Frameworks: Increasing stringency of emission standards and lightweighting mandates across key African and Middle Eastern automotive markets.

- Competitive Product Substitutes: Ongoing competition from advanced steels, aluminum alloys, and traditional plastics.

- End-User Demographics: Growing demand for sustainable, high-performance, and feature-rich vehicles.

- M&A Trends: Strategic acquisitions and partnerships aimed at market consolidation, technology acquisition, and supply chain integration.

Africa Middle East Automotive Thermoplastic Polymer Composites Market Growth Trends & Insights

The Africa Middle East automotive thermoplastic polymer composites market is poised for robust expansion, driven by a confluence of factors that are reshaping the automotive landscape. The estimated market size for automotive thermoplastic polymer composites in the Africa Middle East region is projected to reach $3,980 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.2% from 2025 to 2033. This growth is underpinned by a rising adoption rate of advanced materials in automotive manufacturing, primarily to meet evolving regulatory requirements and consumer preferences. Technological disruptions, such as advancements in composite manufacturing processes and the development of novel resin systems and reinforcing fibers, are continuously enhancing the performance and cost-effectiveness of thermoplastic polymer composites. Consumers' growing awareness of environmental sustainability and the desire for lighter, more fuel-efficient vehicles are significantly influencing purchasing decisions, thereby accelerating the demand for composite materials. The increasing penetration of electric vehicles (EVs) also presents a substantial growth avenue, as lightweighting is paramount for optimizing battery range and overall vehicle performance. Furthermore, the expanding automotive production bases in countries like South Africa, Egypt, and the UAE are creating fertile ground for the adoption of these advanced materials. The shift from traditional materials to composites is not merely a trend but a strategic imperative for automakers aiming to remain competitive in this dynamic market. Innovations in materials science, including the development of bio-based and recycled thermoplastic composites, are further bolstering adoption rates and aligning with sustainability goals. The increasing complexity of vehicle designs and the demand for integrated functionalities are also driving the use of injection-molded thermoplastic composites, offering design freedom and efficient production.

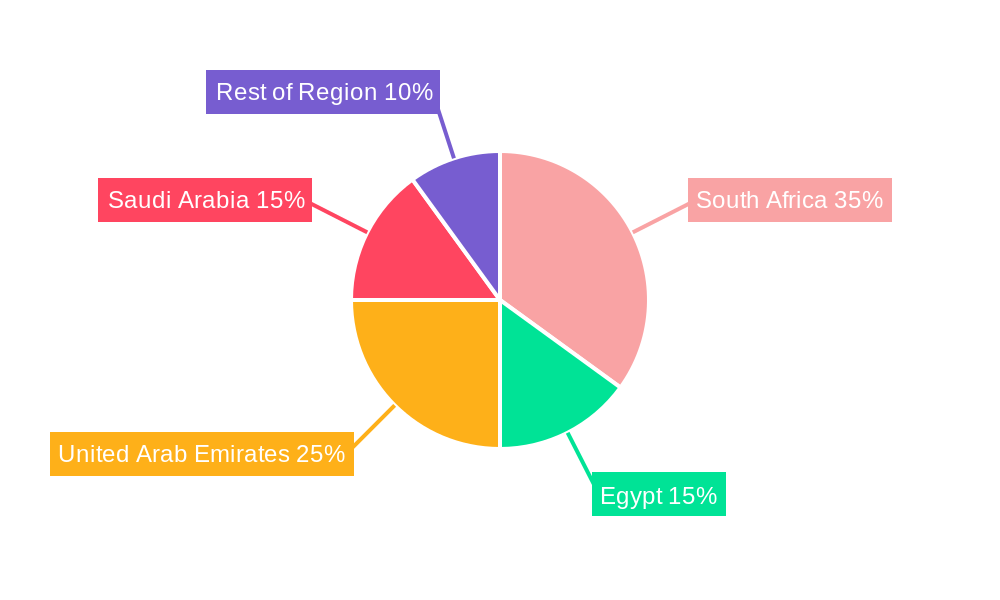

Dominant Regions, Countries, or Segments in Africa Middle East Automotive Thermoplastic Polymer Composites Market

Within the Africa Middle East automotive thermoplastic polymer composites market, the Structural Assembly application segment is emerging as a dominant force, driven by its critical role in enhancing vehicle safety and fuel efficiency. This segment is expected to account for an estimated market share of 35% in 2025, reaching $752.5 million units. The increasing emphasis on lightweighting for improved performance and reduced emissions makes structural components prime candidates for composite material integration. Countries like South Africa, with its established automotive manufacturing hub and stringent vehicle emission standards, are significant contributors to the dominance of structural assembly applications. Furthermore, the growing adoption of advanced driver-assistance systems (ADAS) and the push towards electric vehicles necessitate lighter yet stronger chassis, body-in-white components, and impact absorption structures, all of which are effectively addressed by thermoplastic polymer composites.

The Injection Molding production type is another key driver of market dominance, projected to hold an estimated 40% market share in 2025, valued at $860 million units. This manufacturing process offers high throughput, intricate part design capabilities, and excellent cost-effectiveness for mass production, making it ideal for various automotive components. The integration of complex interior and exterior parts, as well as some powertrain components, is significantly facilitated by injection molding.

Dominant Application Segment: Structural Assembly

- Key Drivers: Lightweighting mandates for fuel efficiency and reduced emissions, enhanced vehicle safety, integration of EV components (battery enclosures, chassis), and growing automotive production in key regions.

- Market Share (2025 Estimate): 35% ($752.5 million units)

- Growth Potential: High, driven by continuous innovation in composite materials and automotive design trends.

Dominant Production Type: Injection Molding

- Key Drivers: High production volumes, design flexibility for complex parts, cost-efficiency in mass production, ability to integrate multiple functions into a single component.

- Market Share (2025 Estimate): 40% ($860 million units)

- Growth Potential: Strong, particularly with advancements in injection molding technologies for composites and increasing demand for customized vehicle interiors and exteriors.

Leading Countries: South Africa, Egypt, and the United Arab Emirates are at the forefront due to established automotive manufacturing infrastructure, favorable investment policies, and a growing demand for advanced vehicles.

Africa Middle East Automotive Thermoplastic Polymer Composites Market Product Landscape

The product landscape of the Africa Middle East automotive thermoplastic polymer composites market is defined by continuous innovation focused on delivering superior performance, enhanced sustainability, and cost-effectiveness. Key product developments include high-strength, impact-resistant thermoplastic composites tailored for structural applications, such as carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP). These materials offer significant weight savings over traditional metals without compromising safety or durability. Innovations in resin systems are enabling faster processing times and improved recyclability, aligning with the growing demand for eco-friendly automotive solutions. Furthermore, the development of thermoplastic composites with integrated functionalities, such as electromagnetic shielding and improved thermal management, is opening up new application possibilities in electric vehicles and advanced automotive electronics. The estimated market for these products in 2025 is valued at $2,150 million units.

Key Drivers, Barriers & Challenges in Africa Middle East Automotive Thermoplastic Polymer Composites Market

Key Drivers: The Africa Middle East automotive thermoplastic polymer composites market is propelled by several key drivers. Stringent government regulations mandating fuel efficiency and reduced emissions are compelling automakers to adopt lightweight materials like thermoplastic composites. Technological advancements in material science are leading to higher performance, improved durability, and more cost-effective composite solutions. The growing demand for electric vehicles (EVs), where weight reduction is critical for battery range, is a significant catalyst. Furthermore, increasing consumer awareness and preference for sustainable and advanced vehicle features are indirectly driving adoption.

Barriers & Challenges: Despite the strong growth potential, the market faces several barriers and challenges. The relatively higher initial cost of some advanced composite materials compared to traditional metals can be a deterrent, particularly for price-sensitive segments in emerging markets. The complexity of composite manufacturing processes and the need for specialized tooling and expertise can also pose challenges. Supply chain disruptions and the availability of raw materials can impact production and pricing. Additionally, the lack of standardized recycling infrastructure for composite materials remains a significant environmental and economic challenge. Competitive pressures from established metal suppliers and the need for extensive validation and testing can also slow down adoption rates. The impact of these challenges on market growth could lead to a potential reduction in projected growth by up to 5% annually if not adequately addressed.

Emerging Opportunities in Africa Middle East Automotive Thermoplastic Polymer Composites Market

Emerging opportunities in the Africa Middle East automotive thermoplastic polymer composites market lie in the burgeoning electric vehicle (EV) sector, where lightweighting is crucial for optimizing battery range and performance. The development of novel, sustainable composite materials, including bio-based and recycled thermoplastics, presents a significant avenue for capturing environmentally conscious consumers. The growing demand for advanced automotive interiors and exteriors, offering enhanced aesthetics and functionalities, creates opportunities for customized composite solutions. Furthermore, expanding manufacturing capabilities in regions like North Africa and the GCC presents untapped markets for composite suppliers. The adoption of advanced manufacturing techniques like additive manufacturing (3D printing) for composite parts also opens up avenues for rapid prototyping and localized production.

Growth Accelerators in the Africa Middle East Automotive Thermoplastic Polymer Composites Market Industry

Several catalysts are accelerating the long-term growth of the Africa Middle East automotive thermoplastic polymer composites market. Technological breakthroughs in high-performance reinforcing fibers and advanced resin formulations are continuously improving the strength-to-weight ratio and cost-effectiveness of composites. Strategic partnerships between material manufacturers, automotive OEMs, and Tier 1 suppliers are crucial for co-development and faster market penetration of new composite solutions. Expansion of automotive production facilities and the establishment of local composite manufacturing capabilities within the region are also significant growth accelerators. The increasing focus on circular economy principles, leading to the development of robust recycling processes for thermoplastic composites, will further bolster their adoption and appeal.

Key Players Shaping the Africa Middle East Automotive Thermoplastic Polymer Composites Market Market

- Delphi

- BASF

- Far-UK

- General Motor Company

- John Manvill

- Cytec Industries

- Gurit

- 3B-Fiberglass

- Base Group

- BMW

Notable Milestones in Africa Middle East Automotive Thermoplastic Polymer Composites Market Sector

- 2019: Launch of new lightweight composite materials by BASF, enhancing fuel efficiency in passenger vehicles.

- 2020: Delphi announces significant investment in advanced composite research for automotive applications.

- 2021: General Motor Company intensifies its use of thermoplastic composites for interior and exterior components.

- 2022: Cytec Industries (now Solvay) showcases advanced composite solutions for EV structural integrity.

- 2022: Far-UK develops innovative composite solutions for enhanced automotive safety.

- 2023: Gurit expands its presence in the Middle East, focusing on automotive composite solutions.

- 2023: 3B-Fiberglass introduces new glass fiber composites for automotive structural applications.

- 2024: BMW continues its commitment to lightweighting through extensive use of thermoplastic composites in its vehicle lineup.

- 2024: Base Group establishes a new regional hub to cater to the growing automotive composite demand.

In-Depth Africa Middle East Automotive Thermoplastic Polymer Composites Market Market Outlook

The Africa Middle East automotive thermoplastic polymer composites market is on a trajectory of significant expansion, fueled by a proactive regulatory environment and an evolving automotive industry. The continuous innovation in material science and manufacturing processes promises lighter, stronger, and more sustainable automotive components. Strategic collaborations between industry players and the increasing adoption of these advanced materials in the rapidly growing EV segment are key growth accelerators. The market's outlook is highly positive, with substantial opportunities for market penetration and innovation in areas like advanced structural components, interior systems, and powertrain applications. The estimated market size for automotive thermoplastic polymer composites in the Africa Middle East region is projected to reach $3,980 million units by 2033, indicating a robust and sustained growth phase.

Africa Middle East Automotive Thermoplastic Polymer Composites Market Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

- 1.5. Compression Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Power Train Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

Africa Middle East Automotive Thermoplastic Polymer Composites Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. United Arab Emirates

- 4. Saudi Arabia

- 5. Rest of Region

Africa Middle East Automotive Thermoplastic Polymer Composites Market Regional Market Share

Geographic Coverage of Africa Middle East Automotive Thermoplastic Polymer Composites Market

Africa Middle East Automotive Thermoplastic Polymer Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Glass Fiber Composites in Automobiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Middle East Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.1.5. Compression Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Power Train Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. United Arab Emirates

- 5.3.4. Saudi Arabia

- 5.3.5. Rest of Region

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. South Africa Africa Middle East Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 6.1.1. Hand Layup

- 6.1.2. Resin Transfer Molding

- 6.1.3. Vacuum Infusion Processing

- 6.1.4. Injection Molding

- 6.1.5. Compression Molding

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Structural Assembly

- 6.2.2. Power Train Component

- 6.2.3. Interior

- 6.2.4. Exterior

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 7. Egypt Africa Middle East Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 7.1.1. Hand Layup

- 7.1.2. Resin Transfer Molding

- 7.1.3. Vacuum Infusion Processing

- 7.1.4. Injection Molding

- 7.1.5. Compression Molding

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Structural Assembly

- 7.2.2. Power Train Component

- 7.2.3. Interior

- 7.2.4. Exterior

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 8. United Arab Emirates Africa Middle East Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 8.1.1. Hand Layup

- 8.1.2. Resin Transfer Molding

- 8.1.3. Vacuum Infusion Processing

- 8.1.4. Injection Molding

- 8.1.5. Compression Molding

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Structural Assembly

- 8.2.2. Power Train Component

- 8.2.3. Interior

- 8.2.4. Exterior

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 9. Saudi Arabia Africa Middle East Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 9.1.1. Hand Layup

- 9.1.2. Resin Transfer Molding

- 9.1.3. Vacuum Infusion Processing

- 9.1.4. Injection Molding

- 9.1.5. Compression Molding

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Structural Assembly

- 9.2.2. Power Train Component

- 9.2.3. Interior

- 9.2.4. Exterior

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 10. Rest of Region Africa Middle East Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 10.1.1. Hand Layup

- 10.1.2. Resin Transfer Molding

- 10.1.3. Vacuum Infusion Processing

- 10.1.4. Injection Molding

- 10.1.5. Compression Molding

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Structural Assembly

- 10.2.2. Power Train Component

- 10.2.3. Interior

- 10.2.4. Exterior

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Delphi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Far-UK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Motor Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 John Manvill

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cytec Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gurit

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3B-Fiberglass

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Base Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BMW

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Delphi

List of Figures

- Figure 1: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Middle East Automotive Thermoplastic Polymer Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 2: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 5: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 8: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 11: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 12: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 14: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 15: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 17: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Africa Middle East Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Middle East Automotive Thermoplastic Polymer Composites Market?

The projected CAGR is approximately 8.17%.

2. Which companies are prominent players in the Africa Middle East Automotive Thermoplastic Polymer Composites Market?

Key companies in the market include Delphi, BASF, Far-UK, General Motor Company, John Manvill, Cytec Industries, Gurit, 3B-Fiberglass, Base Group, BMW.

3. What are the main segments of the Africa Middle East Automotive Thermoplastic Polymer Composites Market?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.89 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Increasing Adoption of Glass Fiber Composites in Automobiles.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Middle East Automotive Thermoplastic Polymer Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Middle East Automotive Thermoplastic Polymer Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Middle East Automotive Thermoplastic Polymer Composites Market?

To stay informed about further developments, trends, and reports in the Africa Middle East Automotive Thermoplastic Polymer Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence