Key Insights

The Global Baobab Ingredient Market is poised for significant growth, projected to expand from $6.9 billion in the base year 2025 to $850 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 5.9%. This expansion is driven by escalating consumer demand for nutrient-dense, plant-based ingredients, particularly baobab, recognized for its rich Vitamin C, fiber, and antioxidant content. Key industries fueling this growth include food & beverage, nutraceuticals, and personal care. The food & beverage sector is anticipated to lead consumption, capitalizing on baobab’s distinct flavor and functional properties in products like juices, smoothies, and fortified foods. The nutraceutical segment is also experiencing robust interest, integrating baobab into supplements and health drinks for its purported immune and digestive health benefits.

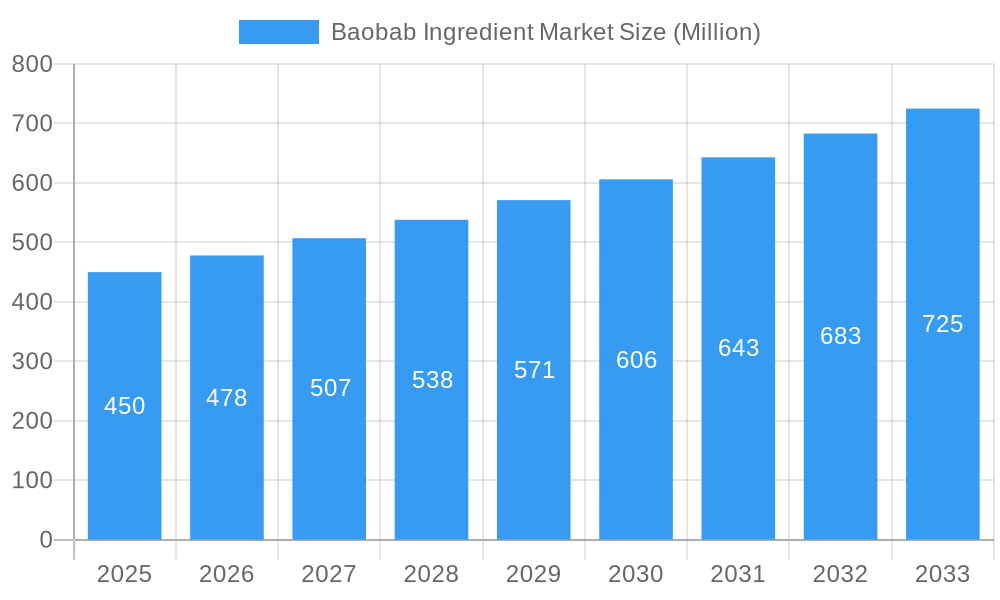

Baobab Ingredient Market Market Size (In Billion)

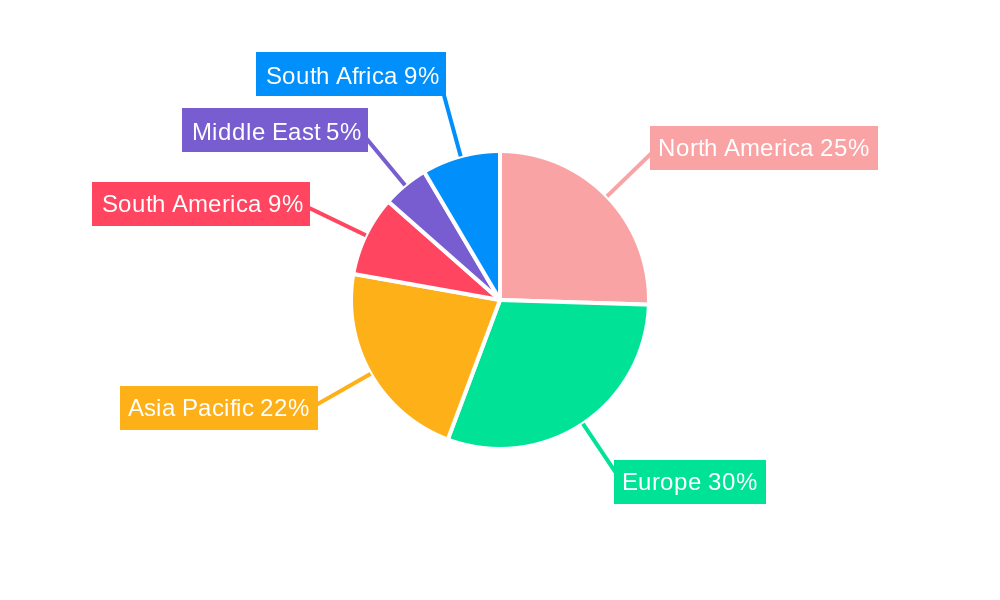

Further market acceleration stems from product innovation and a growing emphasis on sustainable sourcing practices. Companies are actively developing novel applications, leading to a diversified product portfolio. Potential market restraints include supply chain inconsistencies in some regions and the necessity for enhanced consumer education on baobab’s comprehensive benefits. The market is segmented by form, including oil, powder, and pulp. Baobab powder is expected to dominate due to its superior versatility and ease of integration into diverse product formulations. Geographically, Europe is anticipated to lead market share, supported by a strong preference for natural and organic products and favorable regulatory environments. North America and the Asia Pacific regions are also set for substantial growth, driven by rising health awareness and the expansion of the functional food and beverage industry. Leading market participants are prioritizing research and development and strategic collaborations to broaden their market reach and leverage emerging opportunities.

Baobab Ingredient Market Company Market Share

Baobab Ingredient Market: Unlocking Natural Power for Global Wellness & Sustainability

This comprehensive report delves into the dynamic Baobab Ingredient Market, a burgeoning sector fueled by rising consumer demand for natural, nutrient-rich, and sustainable ingredients. Explore market trends, growth drivers, key players, and future opportunities shaping this vital industry from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033.

Baobab Ingredient Market Market Dynamics & Structure

The Baobab Ingredient Market is characterized by a moderately concentrated landscape, with a few key players dominating a significant portion of the supply chain. Technological innovation, particularly in extraction and processing techniques, is a crucial driver, enabling the production of high-quality baobab oil, powder, and pulp with enhanced shelf life and bioavailability. Stringent regulatory frameworks surrounding food additives and cosmetic ingredients, especially in North America and Europe, are influencing product development and market entry strategies. The competitive landscape includes established food and beverage ingredient suppliers and emerging specialty ingredient companies. Substitutes for baobab's unique nutritional profile and functional properties are limited, but alternative superfoods and vitamin C sources pose indirect competition. End-user demographics are expanding beyond niche health food enthusiasts to a broader consumer base seeking natural, functional ingredients. Mergers and acquisitions (M&A) activity is expected to rise as larger ingredient manufacturers seek to integrate sustainable and high-value botanical ingredients into their portfolios, further consolidating market share.

- Market Concentration: Moderately concentrated with key players holding substantial market share.

- Technological Innovation: Driven by advancements in extraction, purification, and bioavailability enhancement.

- Regulatory Frameworks: Evolving regulations in key markets (e.g., FDA, EFSA) impact product approval and claims.

- Competitive Substitutes: Limited direct substitutes, but alternative superfoods and nutrient sources present indirect competition.

- End-User Demographics: Expanding consumer base interested in natural, functional, and ethically sourced ingredients.

- M&A Trends: Anticipated increase in M&A activity for market consolidation and portfolio expansion.

Baobab Ingredient Market Growth Trends & Insights

The Baobab Ingredient Market is poised for substantial growth, projected to expand significantly in value and volume. This expansion is driven by a confluence of evolving consumer preferences, increasing awareness of baobab's exceptional nutritional benefits, and a growing demand for sustainable and ethically sourced ingredients. The market size is projected to reach USD 325.8 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 15.2% during the forecast period. This impressive growth trajectory is a testament to baobab's versatility and its ability to meet the demand for natural solutions in a health-conscious world.

Consumer adoption rates are accelerating across various applications, from the Food and Beverage sector, where baobab powder is increasingly integrated into smoothies, baked goods, and snacks for its vitamin C and fiber content, to the Nutraceuticals segment, where its antioxidant and anti-inflammatory properties are highly valued in dietary supplements. The Personal Care industry is also witnessing a surge in baobab oil incorporation due to its moisturizing, anti-aging, and skin-rejuvenating benefits. Technological disruptions, such as advanced processing methods that preserve baobab's delicate nutrients and improve solubility, are further enhancing its market appeal.

Consumer behavior shifts towards plant-based diets, clean labels, and functional foods are directly benefiting the Baobab Ingredient Market. Consumers are actively seeking ingredients with proven health benefits and transparent sourcing. Baobab's unique story of sustainable harvesting and its contribution to rural African economies resonate with ethically conscious consumers. The market penetration of baobab ingredients is expected to deepen as more product developers and manufacturers recognize its potential to deliver both nutritional value and a compelling brand narrative. The shift from simply seeking "healthy" to demanding "wellness-enhancing" ingredients positions baobab as a frontrunner. The increasing emphasis on gut health and immune support further elevates the importance of fiber-rich and antioxidant-laden ingredients like baobab.

Dominant Regions, Countries, or Segments in Baobab Ingredient Market

The Baobab Ingredient Market exhibits distinct regional and segment dominance, with North America currently leading market growth, primarily driven by its sophisticated and health-conscious consumer base, robust R&D infrastructure, and high disposable incomes. The Food and Beverage segment commands the largest market share, valued at USD 95.5 Million in 2025, due to the widespread adoption of baobab powder and pulp in functional foods and beverages, including smoothies, juices, protein bars, and baking mixes.

Key Drivers of Dominance:

- North America:

- High consumer awareness of superfoods and functional ingredients.

- Strong demand for natural and organic products.

- Well-established distribution channels for health and wellness products.

- Government support for agricultural innovation and sustainable sourcing.

- Food and Beverage Segment:

- Versatility of baobab powder and pulp as nutrient enhancers.

- Growing popularity of plant-based diets and "superfood" trends.

- Innovation in product formulations incorporating baobab for taste and nutritional profile.

- Increasing use in baked goods, cereals, and snacks for added fiber and vitamin C.

- Baobab Powder:

- Ease of incorporation into various food and beverage formulations.

- High nutrient density and perceived health benefits.

- Cost-effectiveness compared to some other superfood powders.

- Strong antioxidant and prebiotic properties appealing to health-conscious consumers.

- Baobab Oil:

- Growing demand in the personal care and cosmetic industries for its moisturizing and anti-aging properties.

- Rich in fatty acids and antioxidants, making it a premium ingredient.

- Increasing interest in natural and sustainable skincare solutions.

The Baobab Powder segment is expected to witness the fastest growth within the form categories, driven by its widespread applicability in functional foods and beverages. The Nutraceuticals segment, while currently smaller than Food and Beverage, is projected to grow at a significant CAGR of 16.5%, fueled by the increasing demand for dietary supplements focused on immune support and digestive health. The Personal Care segment is also experiencing robust expansion, with baobab oil gaining traction for its superior emollient and antioxidant properties. The Others segment, encompassing applications in animal feed and industrial uses, represents a nascent but promising area for future diversification.

Baobab Ingredient Market Product Landscape

The Baobab Ingredient Market is defined by its innovation in delivering pure, potent, and versatile baobab products. Key offerings include premium baobab oil, extracted using cold-pressing methods to preserve its rich profile of fatty acids and antioxidants, and nutrient-dense baobab powder, derived from the fruit pulp and celebrated for its exceptional vitamin C, calcium, and fiber content. Innovative processing techniques ensure enhanced solubility and stability, expanding their application potential. Unique selling propositions lie in baobab's unparalleled nutrient density and its sustainable sourcing model, appealing to conscious consumers and manufacturers alike. Technological advancements are focused on maximizing nutrient retention and developing specialized grades for specific applications, further diversifying the product landscape and driving market growth.

Key Drivers, Barriers & Challenges in Baobab Ingredient Market

The Baobab Ingredient Market is propelled by several key drivers. The escalating global demand for natural, nutrient-rich, and functional ingredients, particularly those with antioxidant and prebiotic properties, is a primary growth catalyst. The increasing consumer awareness and preference for sustainable and ethically sourced products further bolster baobab's appeal. Technological advancements in extraction and processing are enhancing the quality and usability of baobab ingredients. The growing popularity of plant-based diets and clean-label products also contributes significantly to market expansion.

Conversely, the market faces significant barriers and challenges. Supply chain complexities, including seasonal availability, harvesting challenges, and logistical hurdles in remote African regions, can impact consistent supply. Fluctuations in raw material prices and transportation costs pose economic challenges. Regulatory hurdles and the need for product certification in different international markets can also impede market entry and expansion. Intense competition from established superfoods and the need for greater consumer education regarding baobab's benefits are additional restraints. The limited cultivation and reliance on wild harvesting can also present sustainability concerns if not managed properly.

Emerging Opportunities in Baobab Ingredient Market

Emerging opportunities in the Baobab Ingredient Market lie in untapped geographic markets, particularly in Asia and South America, where consumer awareness of superfoods is growing. Innovative applications in the burgeoning sports nutrition sector, leveraging baobab's energy-boosting and recovery properties, represent a significant avenue. The development of specialized baobab extracts for targeted health benefits, such as cognitive function or gut health, presents further potential. Evolving consumer preferences for personalized nutrition and functional ingredients in convenience foods also offer fertile ground for baobab's integration. Furthermore, exploring the synergistic benefits of baobab with other natural ingredients could unlock novel product formulations and market segments.

Growth Accelerators in the Baobab Ingredient Market Industry

Several factors are acting as growth accelerators for the Baobab Ingredient Market. Technological breakthroughs in creating highly bioavailable baobab extracts are enhancing their efficacy and appeal in nutraceuticals and functional foods. Strategic partnerships between baobab producers and global food, beverage, and cosmetic manufacturers are crucial for expanding market reach and product penetration. Market expansion strategies targeting emerging economies with growing disposable incomes and increasing health consciousness will further fuel demand. The development of clear and scientifically validated health claims for baobab ingredients, supported by robust research, will accelerate consumer acceptance and product adoption. Investment in sustainable harvesting practices and traceability initiatives will enhance the brand value and consumer trust.

Key Players Shaping the Baobab Ingredient Market Market

- Organic Africa

- Henry Lamotte OILS GmbH

- Afriplex Pty Ltd

- Baobab Foods

- Mighty Baobab Limited

- Woodland Foods

- BFCS - Baobab Fruit Company Senegal

- Nexira

Notable Milestones in Baobab Ingredient Market Sector

- 2020: Increased research publication on baobab's antioxidant and prebiotic properties, boosting scientific validation.

- 2021: Launch of new baobab-infused functional beverages and snacks in North American and European markets.

- 2022: Expansion of ethical sourcing initiatives and community empowerment programs by key baobab suppliers, enhancing brand appeal.

- 2023: Introduction of novel baobab oil formulations for high-end cosmetic products, emphasizing anti-aging and skin repair benefits.

- 2024: Growing interest in baobab's potential for animal nutrition, with pilot studies commencing.

In-Depth Baobab Ingredient Market Market Outlook

The Baobab Ingredient Market outlook is exceptionally promising, driven by persistent consumer demand for natural wellness solutions. Growth accelerators such as enhanced bioavailability technologies, strategic alliances with global brands, and targeted expansion into emerging markets will solidify its upward trajectory. The increasing emphasis on sustainable and traceable ingredients positions baobab as a preferred choice for ethically conscious manufacturers and consumers. Further investment in scientific research to substantiate baobab's health benefits will unlock new product categories and drive deeper market penetration, ensuring a robust and sustainable future for this nutrient-rich ingredient.

Baobab Ingredient Market Segmentation

-

1. Form

- 1.1. Oil

- 1.2. Powder

- 1.3. Pulp

-

2. Application

- 2.1. Food and Beverage

- 2.2. Nutraceuticals

- 2.3. Personal Care

- 2.4. Others

Baobab Ingredient Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Baobab Ingredient Market Regional Market Share

Geographic Coverage of Baobab Ingredient Market

Baobab Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Organic Personal Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Baobab Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Oil

- 5.1.2. Powder

- 5.1.3. Pulp

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Nutraceuticals

- 5.2.3. Personal Care

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. North America Baobab Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Oil

- 6.1.2. Powder

- 6.1.3. Pulp

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.2. Nutraceuticals

- 6.2.3. Personal Care

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Europe Baobab Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Oil

- 7.1.2. Powder

- 7.1.3. Pulp

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.2. Nutraceuticals

- 7.2.3. Personal Care

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Asia Pacific Baobab Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Oil

- 8.1.2. Powder

- 8.1.3. Pulp

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.2. Nutraceuticals

- 8.2.3. Personal Care

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. South America Baobab Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Oil

- 9.1.2. Powder

- 9.1.3. Pulp

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.2. Nutraceuticals

- 9.2.3. Personal Care

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Middle East Baobab Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Oil

- 10.1.2. Powder

- 10.1.3. Pulp

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.2. Nutraceuticals

- 10.2.3. Personal Care

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. South Africa Baobab Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Form

- 11.1.1. Oil

- 11.1.2. Powder

- 11.1.3. Pulp

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Food and Beverage

- 11.2.2. Nutraceuticals

- 11.2.3. Personal Care

- 11.2.4. Others

- 11.1. Market Analysis, Insights and Forecast - by Form

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Organic Africa*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Henry Lamotte OILS GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Afriplex Pty Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Baobab Foods

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Mighty Baobab Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Woodland Foods

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 BFCS - Baobab Fruit Company Senegal

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nexira

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Organic Africa*List Not Exhaustive

List of Figures

- Figure 1: Global Baobab Ingredient Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Baobab Ingredient Market Revenue (billion), by Form 2025 & 2033

- Figure 3: North America Baobab Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 4: North America Baobab Ingredient Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Baobab Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Baobab Ingredient Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Baobab Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Baobab Ingredient Market Revenue (billion), by Form 2025 & 2033

- Figure 9: Europe Baobab Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 10: Europe Baobab Ingredient Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Baobab Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Baobab Ingredient Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Baobab Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Baobab Ingredient Market Revenue (billion), by Form 2025 & 2033

- Figure 15: Asia Pacific Baobab Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 16: Asia Pacific Baobab Ingredient Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Baobab Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Baobab Ingredient Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Baobab Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Baobab Ingredient Market Revenue (billion), by Form 2025 & 2033

- Figure 21: South America Baobab Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 22: South America Baobab Ingredient Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Baobab Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Baobab Ingredient Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Baobab Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Baobab Ingredient Market Revenue (billion), by Form 2025 & 2033

- Figure 27: Middle East Baobab Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 28: Middle East Baobab Ingredient Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Baobab Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Baobab Ingredient Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Baobab Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa Baobab Ingredient Market Revenue (billion), by Form 2025 & 2033

- Figure 33: South Africa Baobab Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 34: South Africa Baobab Ingredient Market Revenue (billion), by Application 2025 & 2033

- Figure 35: South Africa Baobab Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: South Africa Baobab Ingredient Market Revenue (billion), by Country 2025 & 2033

- Figure 37: South Africa Baobab Ingredient Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Baobab Ingredient Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: Global Baobab Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Baobab Ingredient Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Baobab Ingredient Market Revenue billion Forecast, by Form 2020 & 2033

- Table 5: Global Baobab Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Baobab Ingredient Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Baobab Ingredient Market Revenue billion Forecast, by Form 2020 & 2033

- Table 12: Global Baobab Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Baobab Ingredient Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Baobab Ingredient Market Revenue billion Forecast, by Form 2020 & 2033

- Table 22: Global Baobab Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Baobab Ingredient Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Baobab Ingredient Market Revenue billion Forecast, by Form 2020 & 2033

- Table 30: Global Baobab Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Baobab Ingredient Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Baobab Ingredient Market Revenue billion Forecast, by Form 2020 & 2033

- Table 36: Global Baobab Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Baobab Ingredient Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Baobab Ingredient Market Revenue billion Forecast, by Form 2020 & 2033

- Table 39: Global Baobab Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Baobab Ingredient Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Baobab Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Baobab Ingredient Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Baobab Ingredient Market?

Key companies in the market include Organic Africa*List Not Exhaustive, Henry Lamotte OILS GmbH, Afriplex Pty Ltd, Baobab Foods, Mighty Baobab Limited, Woodland Foods, BFCS - Baobab Fruit Company Senegal, Nexira.

3. What are the main segments of the Baobab Ingredient Market?

The market segments include Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Growing Demand for Organic Personal Care Products.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Baobab Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Baobab Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Baobab Ingredient Market?

To stay informed about further developments, trends, and reports in the Baobab Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence