Key Insights

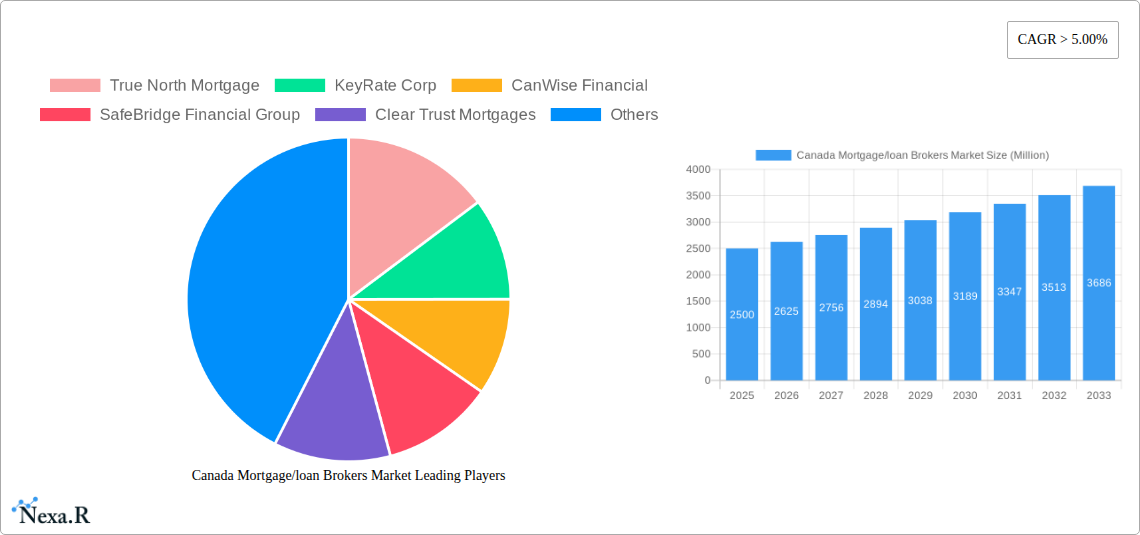

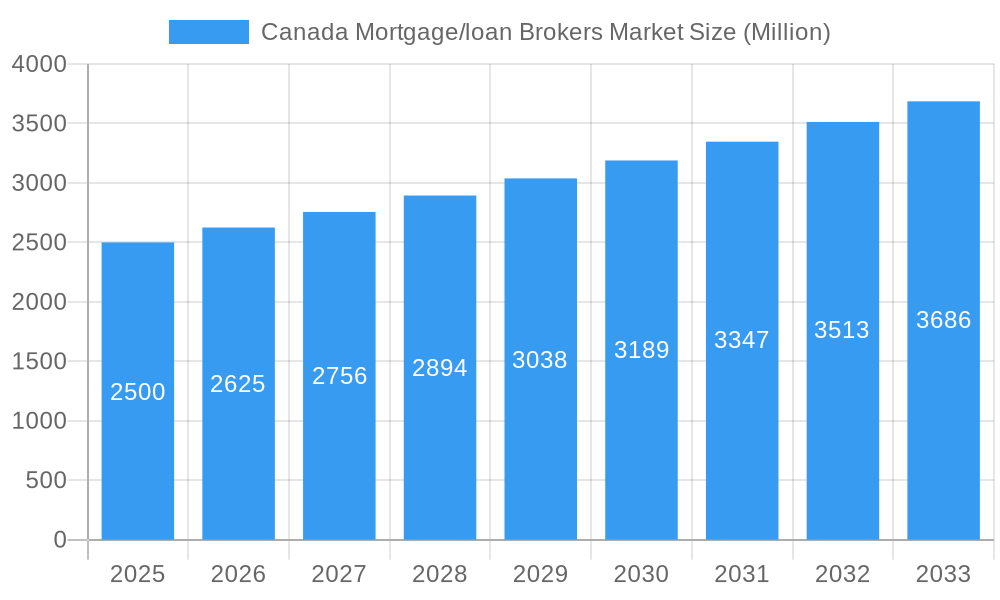

The Canadian mortgage and loan broker market, exhibiting a CAGR exceeding 5% from 2019 to 2024, is poised for continued growth through 2033. This robust expansion is fueled by several key factors. Increasing homeownership aspirations among Canadians, coupled with rising real estate prices, create a greater need for mortgage financing expertise. The complexity of the mortgage landscape, with diverse product offerings and evolving regulations, drives demand for brokers who can navigate this intricacy and secure the best rates for clients. Furthermore, the growing adoption of digital mortgage platforms and technological advancements streamlines the application process, enhancing efficiency and accessibility for borrowers and brokers alike. Competition among established players like True North Mortgage, KeyRate Corp, and CanWise Financial, alongside newer entrants, fosters innovation and drives market dynamism. Regulatory changes impacting lending practices and consumer protection continue to shape the market landscape.

Canada Mortgage/loan Brokers Market Market Size (In Billion)

Despite the positive trajectory, the market faces certain challenges. Fluctuations in interest rates and economic conditions can directly influence borrowing activity. Tightening lending criteria from financial institutions might restrict accessibility to mortgages, impacting broker volumes. Maintaining consumer trust and ethical standards amidst increasing competition is crucial for sustaining market integrity. The market's future growth hinges on successfully navigating these hurdles and adapting to shifting regulatory environments and technological disruptions. This necessitates strategic investments in technology, robust client relationship management, and a commitment to transparency and ethical business practices. The segmentation of the market, though not fully detailed, likely includes variations based on loan type (residential, commercial), client demographics, and geographical location, influencing marketing and business development strategies. Further research into these segments would reveal valuable insights for market players.

Canada Mortgage/loan Brokers Market Company Market Share

Canada Mortgage/Loan Brokers Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian mortgage/loan brokers market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) and forecasts market trends until 2033. This report is invaluable for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. Market values are presented in millions of units.

Canada Mortgage/Loan Brokers Market Market Dynamics & Structure

The Canadian mortgage/loan broker market is characterized by a moderately concentrated landscape with several large players and numerous smaller firms. Market share is estimated at xx% for the top 5 players in 2025, indicating a competitive environment. Technological innovation, particularly in digital platforms and fintech solutions, is a major driver of market growth. Stringent regulatory frameworks govern the industry, influencing operational practices and consumer protection. The rise of alternative lending options and direct-to-consumer lending poses competitive pressure. End-user demographics are shifting towards younger, tech-savvy consumers demanding streamlined processes and personalized solutions. The market has witnessed a moderate level of M&A activity, with xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, top 5 players hold xx% market share (2025).

- Technological Innovation: Digital platforms, AI-powered tools, and fintech integrations drive efficiency and customer experience.

- Regulatory Framework: OSFI, provincial regulations, and consumer protection laws shape market practices.

- Competitive Substitutes: Direct lenders, online lending platforms, and alternative financial institutions.

- End-User Demographics: Shifting towards younger, tech-savvy consumers seeking personalized services.

- M&A Activity: xx deals between 2019-2024, indicating consolidation trends.

Canada Mortgage/Loan Brokers Market Growth Trends & Insights

The Canadian mortgage/loan brokers market has exhibited steady growth over the past five years, with a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024. Market size is estimated at xx million in 2025, projected to reach xx million by 2033, driven by factors such as increasing homeownership aspirations, low-interest rates (historically), and the growing adoption of digital mortgage solutions. Technological advancements like AI-powered lending platforms and online mortgage applications are streamlining processes and improving customer experience. Consumer behavior is shifting towards increased online engagement and demand for personalized financial advice. Market penetration is estimated at xx% in 2025 and projected to increase to xx% by 2033.

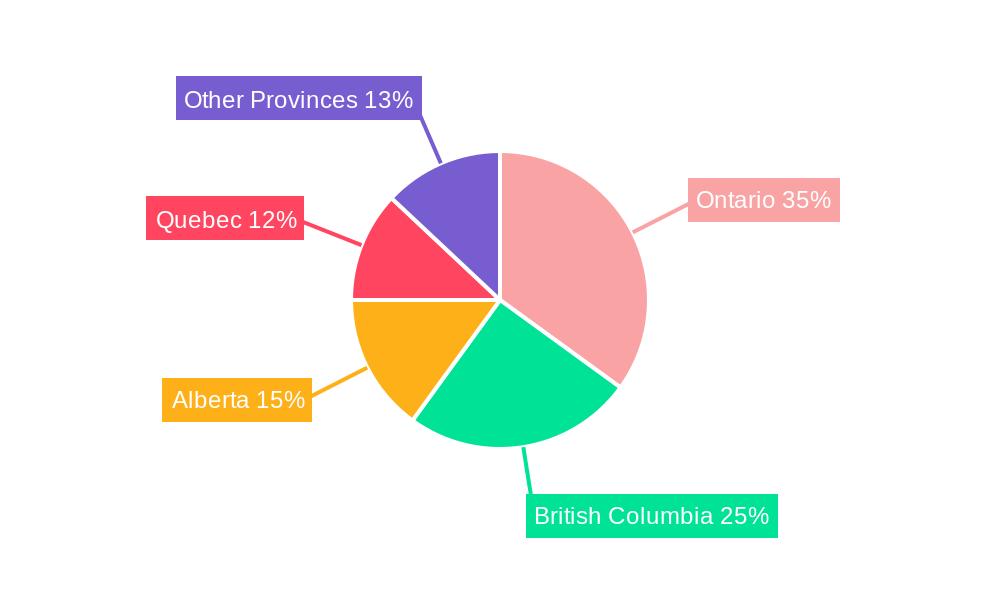

Dominant Regions, Countries, or Segments in Canada Mortgage/Loan Brokers Market

Ontario and British Columbia are the dominant regions, contributing xx% and xx% of the total market value in 2025 respectively, due to higher population density, strong real estate markets, and robust economic activity. The segment focusing on first-time homebuyers shows significant growth potential, driven by government incentives and increasing demand for affordable housing.

- Key Drivers (Ontario & British Columbia): High population density, strong real estate markets, favorable economic conditions.

- Dominance Factors: High market share, strong growth potential, established infrastructure.

- First-Time Homebuyer Segment: High growth potential due to government incentives and affordability concerns.

Canada Mortgage/Loan Brokers Market Product Landscape

The market offers a range of products, from traditional mortgage brokerage services to specialized solutions catering to niche segments like self-employed individuals or those with unique credit profiles. Recent innovations include digital platforms that offer instant rate comparisons, online applications, and AI-powered pre-approvals. These innovations enhance efficiency, improve customer experience, and expand market access. Key selling propositions include personalized advice, competitive rate comparisons, and streamlined processes.

Key Drivers, Barriers & Challenges in Canada Mortgage/Loan Brokers Market

Key Drivers:

- Increasing homeownership demand fueled by population growth and economic stability.

- Technological advancements enabling efficient and convenient mortgage applications.

- Government initiatives supporting affordable housing and first-time homebuyers.

Challenges:

- Increasing competition from direct lenders and online platforms. This competition resulted in a xx% decrease in average broker commission in 2024.

- Stringent regulatory compliance requirements increasing operational costs.

- Fluctuations in interest rates impacting market demand and profitability.

Emerging Opportunities in Canada Mortgage/Loan Brokers Market

Untapped markets include underserved communities, remote areas, and specialized lending segments (e.g., commercial real estate). Opportunities also exist in developing innovative fintech solutions, personalized financial planning services integrated with mortgage brokerage, and expanding into adjacent financial services. Evolving consumer preferences towards digital channels and personalized financial advice present key growth opportunities.

Growth Accelerators in the Canada Mortgage/Loan Brokers Market Industry

Technological innovation, strategic partnerships with fintech companies, and expansion into new geographical markets or product segments are significant growth catalysts. Government initiatives supporting affordable housing and financial inclusion can also accelerate market growth. The adoption of advanced data analytics to personalize services and improve risk assessment also represents a key growth driver.

Key Players Shaping the Canada Mortgage/Loan Brokers Market Market

- True North Mortgage

- KeyRate Corp

- CanWise Financial

- SafeBridge Financial Group

- Clear Trust Mortgages

- Premiere Mortgage Centre

- Bespoke Mortgage Group

- TMG The Mortgage Group

- Yorkshire BS

- Smart Debt (List Not Exhaustive)

Notable Milestones in Canada Mortgage/Loan Brokers Market Sector

- October 2023: True North Mortgage expands its Rate Relief product lineup with a new 1-year option.

- November 2022: Home Capital Group Inc. acquired by Smith Financial Corporation.

- August 2022: Rocket Mortgage Canada rebrands from Edison Financial and plans direct lending in Canada.

In-Depth Canada Mortgage/Loan Brokers Market Market Outlook

The Canadian mortgage/loan brokers market is poised for continued growth, driven by technological advancements, changing consumer preferences, and evolving regulatory frameworks. Strategic partnerships, expansion into niche markets, and the adoption of innovative business models will shape the market landscape in the coming years. The market presents significant opportunities for established players and new entrants alike to capitalize on the growing demand for efficient and personalized mortgage solutions. The long-term outlook is positive, with substantial potential for expansion and innovation.

Canada Mortgage/loan Brokers Market Segmentation

-

1. Enterprise

- 1.1. Large

- 1.2. Small

- 1.3. Mid-sized

-

2. Applications

- 2.1. Home Loans

- 2.2. Commercial and Industrial Loans

- 2.3. Vehicle Loans

- 2.4. Loans to Governments

- 2.5. Other Applications

-

3. End- User

- 3.1. Businesses

- 3.2. Individuals

Canada Mortgage/loan Brokers Market Segmentation By Geography

- 1. Canada

Canada Mortgage/loan Brokers Market Regional Market Share

Geographic Coverage of Canada Mortgage/loan Brokers Market

Canada Mortgage/loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Booming Alternative or Private Lending Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Mortgage/loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 5.1.1. Large

- 5.1.2. Small

- 5.1.3. Mid-sized

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Home Loans

- 5.2.2. Commercial and Industrial Loans

- 5.2.3. Vehicle Loans

- 5.2.4. Loans to Governments

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Businesses

- 5.3.2. Individuals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 True North Mortgage

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KeyRate Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CanWise Financial

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SafeBridge Financial Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Clear Trust Mortgages

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Premiere Mortgage Centre

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bespoke Mortgage Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TMG The Mortgage Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yorkshire BS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Smart Debt**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 True North Mortgage

List of Figures

- Figure 1: Canada Mortgage/loan Brokers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Mortgage/loan Brokers Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Mortgage/loan Brokers Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 2: Canada Mortgage/loan Brokers Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 3: Canada Mortgage/loan Brokers Market Revenue Million Forecast, by End- User 2020 & 2033

- Table 4: Canada Mortgage/loan Brokers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Mortgage/loan Brokers Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 6: Canada Mortgage/loan Brokers Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 7: Canada Mortgage/loan Brokers Market Revenue Million Forecast, by End- User 2020 & 2033

- Table 8: Canada Mortgage/loan Brokers Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Mortgage/loan Brokers Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Canada Mortgage/loan Brokers Market?

Key companies in the market include True North Mortgage, KeyRate Corp, CanWise Financial, SafeBridge Financial Group, Clear Trust Mortgages, Premiere Mortgage Centre, Bespoke Mortgage Group, TMG The Mortgage Group, Yorkshire BS, Smart Debt**List Not Exhaustive.

3. What are the main segments of the Canada Mortgage/loan Brokers Market?

The market segments include Enterprise, Applications, End- User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Booming Alternative or Private Lending Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, True North Mortgage expands its Rate Relief product lineup, which initially launched with the lowest 6-month fixed rate around. The new 1-year Rate Relief mortgage is for those buying a home or who want to switch lenders at renewal to a better rate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Mortgage/loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Mortgage/loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Mortgage/loan Brokers Market?

To stay informed about further developments, trends, and reports in the Canada Mortgage/loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence