Key Insights

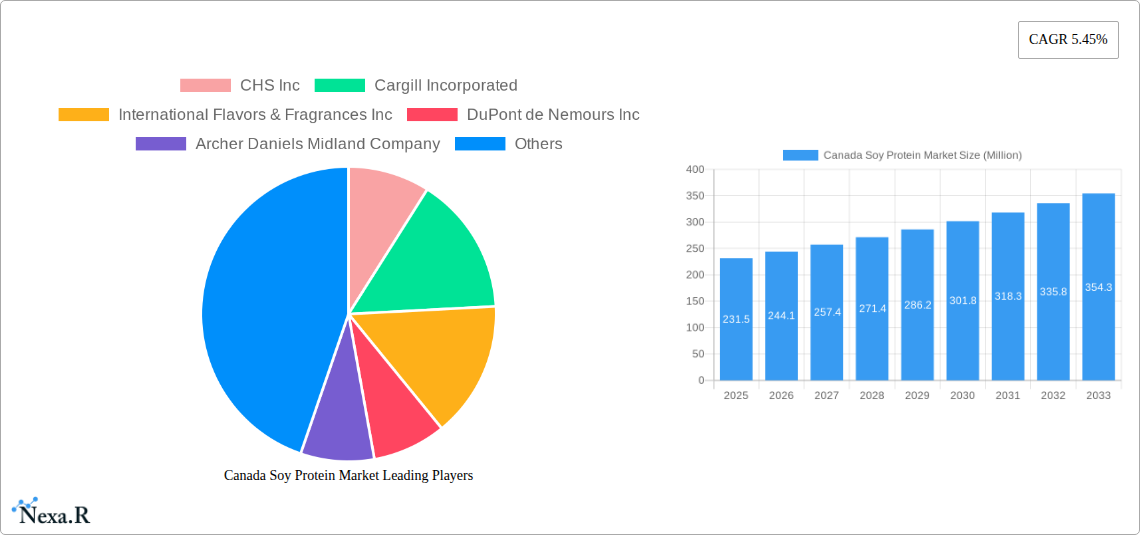

The Canadian soy protein market is poised for robust expansion, projected to reach approximately USD 231.5 million by 2025 and exhibit a Compound Annual Growth Rate (CAGR) of 5.45% through to 2033. This growth is underpinned by a confluence of escalating consumer demand for plant-based alternatives, a heightened awareness of the health benefits associated with soy protein, and its increasing integration across diverse food and beverage applications. Key market drivers include the rising popularity of meatless diets, driven by both ethical and environmental concerns, and the demand for functional ingredients that enhance nutritional profiles. The versatility of soy protein, available in forms such as concentrates, isolates, and textured/hydrolyzed varieties, allows for widespread adoption in animal feed, food and beverages, and nutritional supplements. Within the food and beverage sector, significant growth is anticipated in bakery products, dairy and dairy alternative items, and meat alternatives, reflecting shifting consumer preferences towards healthier and more sustainable options. The supplements segment, particularly baby food, infant formula, elderly nutrition, and sports nutrition, also presents substantial growth opportunities due to its recognized nutritional value.

Canada Soy Protein Market Market Size (In Million)

Navigating this dynamic market presents certain challenges, including fluctuating raw material prices and intensified competition among prominent players such as Cargill Incorporated, Archer Daniels Midland Company, and DuPont de Nemours Inc. However, ongoing innovation in processing technologies and product development, focusing on improved taste, texture, and functionality, is expected to mitigate these restraints. The Canadian market is influenced by global trends towards plant-based diets and sustainable food systems. Key segments are expected to see considerable growth, with Textured/Hydrolyzed soy protein gaining traction due to its meat-like texture in alternative meat products. The food and beverage sector will continue to dominate, fueled by an increasing number of product launches incorporating soy protein. Furthermore, the growing emphasis on clean labels and non-GMO ingredients will shape product development and consumer choices. As research continues to unveil the multifaceted health benefits of soy protein, its market penetration is likely to deepen, solidifying its position as a cornerstone ingredient in Canada's evolving food landscape.

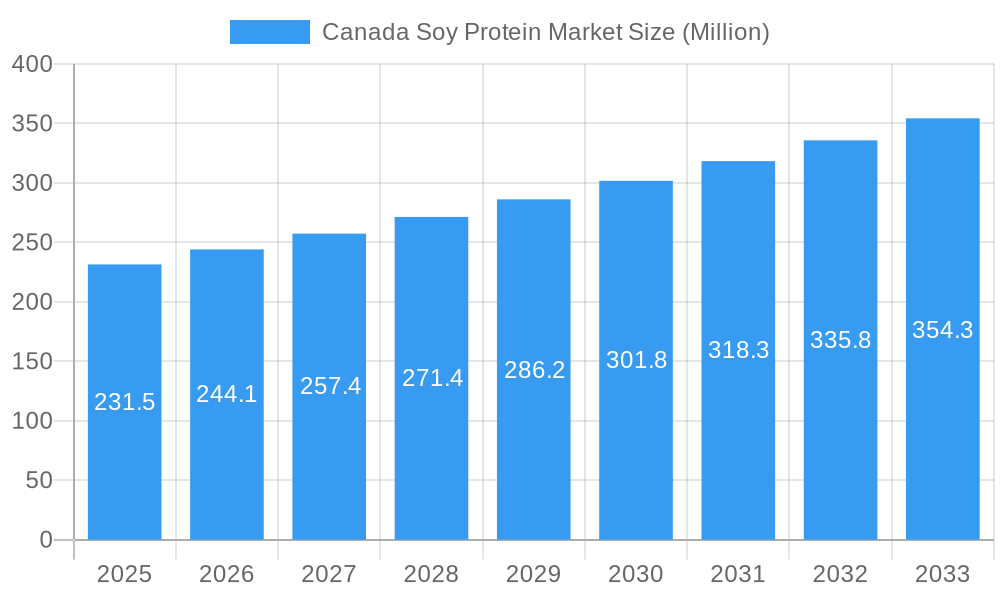

Canada Soy Protein Market Company Market Share

Canada Soy Protein Market: Comprehensive Analysis & Future Outlook (2019-2033)

This report offers an in-depth analysis of the Canadian Soy Protein Market, dissecting its dynamics, growth trends, and future potential from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study provides actionable insights for industry stakeholders, including manufacturers, ingredient suppliers, food and beverage companies, animal feed producers, and investors. We delve into the intricate parent and child market structures, identifying key drivers, emerging opportunities, and competitive landscapes to illuminate the path forward for this vital sector. The report covers a comprehensive range of soy protein forms, including concentrates, isolates, and textured/hydrolyzed varieties, and scrutinizes their application across diverse end-user segments such as animal feed, food and beverages (including bakery, breakfast cereals, condiments/sauces, dairy and dairy alternative products, meat/poultry/seafood and meat alternative products, RTE/RTC food products, and snacks), and supplements (baby food and infant formula, elderly nutrition and medical nutrition, and sport/performance nutrition). All values are presented in million units for clarity and actionable decision-making.

Canada Soy Protein Market Market Dynamics & Structure

The Canadian soy protein market exhibits a moderately concentrated structure, with key players like ADM, Cargill, and IFF (following the DuPont merger) holding significant market shares. Technological innovation plays a crucial role, driven by advancements in processing techniques to enhance protein functionality, taste, and texture, catering to evolving consumer preferences for plant-based alternatives. Regulatory frameworks surrounding food safety, labeling (e.g., non-GMO claims), and import/export policies influence market access and product development. Competitive product substitutes, including pea protein, whey protein, and other plant-based protein sources, exert pressure, necessitating continuous innovation and cost-effectiveness from soy protein manufacturers. End-user demographics, particularly the growing health-conscious and flexitarian population, are a significant driver. Mergers and acquisitions (M&A) are notable trends, as exemplified by ADM's acquisition of Kansas Protein Foods, aimed at expanding capabilities and market reach. Barriers to innovation include the capital investment required for advanced processing technologies and the need for extensive research and development to meet specific application requirements. The market is dynamic, with a constant interplay between established players and emerging entities vying for a larger share through product differentiation and strategic partnerships.

- Market Concentration: Moderate, with a few major players dominating.

- Technological Innovation: Focus on improved functionality, taste, and texture.

- Regulatory Frameworks: Stringent food safety and clear labeling requirements.

- Competitive Substitutes: Pea protein, whey protein, and other plant proteins.

- End-User Demographics: Growing demand from health-conscious and flexitarian consumers.

- M&A Trends: Strategic acquisitions to enhance capacity and product portfolios.

- Innovation Barriers: High capital investment and R&D costs.

Canada Soy Protein Market Growth Trends & Insights

The Canadian soy protein market has witnessed robust growth driven by a confluence of factors, including increasing consumer demand for plant-based proteins, growing awareness of health and wellness, and the expanding applications of soy protein across various industries. The market size has experienced a steady upward trajectory, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.5% during the historical and forecast periods. Adoption rates for soy protein ingredients in food and beverage applications, particularly in meat alternatives and dairy-free products, have surged. Technological disruptions, such as the development of novel extraction and modification techniques, have led to improved protein quality and functionality, making soy protein a more versatile ingredient. Consumer behavior shifts towards sustainable and ethically sourced food products have further propelled the demand for soy-based ingredients. The market penetration of soy protein in the Canadian food industry is estimated to be around 15-20% of the total protein ingredient market, with significant potential for further expansion. The rising popularity of plant-based diets, driven by environmental concerns and perceived health benefits, is a primary catalyst for this growth. Furthermore, the cost-effectiveness of soy protein compared to some other protein sources makes it an attractive option for manufacturers looking to maintain competitive pricing. The increasing acceptance of genetically modified (GM) soy in Canada, coupled with a growing segment focused on non-GMO and organic soy, showcases a bifurcated consumer demand that manufacturers are increasingly catering to. The "free-from" trend, where consumers actively seek products free from common allergens and artificial ingredients, also favors soy protein, which is often perceived as a natural and less allergenic option compared to some other plant-based proteins.

Dominant Regions, Countries, or Segments in Canada Soy Protein Market

Within the Canadian soy protein market, the Food and Beverages end-user segment demonstrably drives significant growth. Within this broad category, Meat/Poultry/Seafood and Meat Alternative Products stands out as a particularly dominant sub-segment, experiencing exceptional demand due to the burgeoning plant-based movement and consumers actively seeking to reduce their meat consumption. The market share for soy protein in this specific application is estimated to be around 35-40% of its total food and beverage utilization. This dominance is fueled by the versatility of soy protein, particularly textured soy protein (TSP), in mimicking the texture and mouthfeel of traditional meat products. Key drivers include the widespread availability of innovative meat alternative products, extensive marketing efforts by food manufacturers, and a growing consumer perception of these alternatives as healthier and more sustainable choices. The economic policies in Canada that support innovation in the food sector and encourage the development of value-added agricultural products also contribute to the strength of this segment.

- Dominant End-User Segment: Food and Beverages

- Most Dominant Sub-Segment: Meat/Poultry/Seafood and Meat Alternative Products

- Key Drivers:

- Surge in demand for plant-based meat alternatives.

- Versatility of textured soy protein in replicating meat textures.

- Consumer perception of health and sustainability benefits.

- Supportive economic policies for food innovation.

- Extensive product availability and marketing.

Another significant contributor to the overall market dominance is the Supplements segment, with Sport/Performance Nutrition being a high-growth sub-segment. The increasing focus on health and fitness, coupled with the growing popularity of plant-based diets among athletes and fitness enthusiasts, has propelled the demand for soy protein isolates and concentrates in protein powders, bars, and ready-to-drink beverages. The market share for soy protein in sport nutrition is estimated at approximately 20-25%. This segment benefits from established scientific backing for the benefits of protein supplementation and a well-developed retail and e-commerce distribution network for nutritional products.

Canada Soy Protein Market Product Landscape

The Canadian soy protein market is characterized by continuous product innovation aimed at enhancing functionality and catering to specific application needs. Soy protein concentrates, offering around 65-70% protein content, are widely used in bakery and snack applications for their binding and emulsifying properties. Soy protein isolates, boasting a purity of 90% or more, are favored in performance nutrition supplements and dairy-alternative products for their neutral flavor and excellent solubility. Textured and hydrolyzed soy proteins are pivotal in the burgeoning meat alternative sector, providing diverse textural profiles that mimic animal proteins effectively. Performance metrics like solubility, emulsification, gelation, and water-holding capacity are continuously being improved through advanced processing techniques, making soy proteins increasingly competitive against other protein sources. Unique selling propositions often revolve around non-GMO, organic, or allergen-free certifications, aligning with evolving consumer demands for natural and clean-label ingredients.

Key Drivers, Barriers & Challenges in Canada Soy Protein Market

Key Drivers:

The Canadian soy protein market is propelled by several key drivers. The escalating consumer demand for plant-based diets, fueled by health consciousness and environmental sustainability concerns, is a primary growth catalyst. Advancements in processing technologies enabling the production of high-quality, functional soy protein ingredients with improved taste and texture are also significant. The cost-effectiveness of soy protein compared to animal-derived proteins makes it an attractive option for food manufacturers. Furthermore, government initiatives promoting agricultural innovation and the development of value-added food products contribute to market expansion.

Barriers & Challenges:

Despite strong growth, the market faces certain barriers and challenges. The perception of soy as a common allergen among some consumers can pose a restraint, necessitating clear labeling and educational efforts. Competition from other plant-based protein sources, such as pea and rice protein, intensifies the market. Supply chain volatilities, including fluctuations in raw material prices and availability due to weather patterns or geopolitical factors, can impact production costs. Regulatory hurdles related to novel food ingredients and labeling requirements can also present challenges.

Emerging Opportunities in Canada Soy Protein Market

Emerging opportunities within the Canadian soy protein market lie in the continued innovation of novel applications and the expansion of niche product segments. The development of specialized soy protein ingredients for plant-based dairy alternatives, such as cheeses and yogurts, presents a significant avenue for growth. Furthermore, the increasing demand for convenient, ready-to-eat (RTE) and ready-to-cook (RTC) plant-based meals offers substantial potential for the incorporation of soy protein for both nutritional and functional benefits. Opportunities also exist in exploring the use of soy protein in innovative food formats and functional foods targeting specific health benefits, such as improved gut health or enhanced cognitive function. The growing elderly population in Canada also presents an opportunity for soy protein-based nutritional supplements for elderly nutrition and medical nutrition.

Growth Accelerators in the Canada Soy Protein Market Industry

Several catalysts are accelerating the long-term growth of the Canada Soy Protein Market industry. Technological breakthroughs in protein extraction and modification are yielding ingredients with superior functionalities, broadening their applicability. Strategic partnerships between ingredient manufacturers and food companies are fostering innovation and market penetration for new soy protein-based products. Market expansion strategies, including increased investment in R&D and targeted marketing campaigns highlighting the health and sustainability benefits of soy protein, are crucial growth accelerators. Furthermore, the global trend towards plant-based diets, driven by both consumer choice and increasing awareness of environmental impact, provides a sustained tailwind for the Canadian market.

Key Players Shaping the Canada Soy Protein Market Market

- CHS Inc

- Cargill Incorporated

- International Flavors & Fragrances Inc

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- Bunge Limited

- Ag Processing Inc

- Kerry Group PLC

- The Scoular Company

- Fuji Oil Group

Notable Milestones in Canada Soy Protein Market Sector

- January 2023: ADM made a significant acquisition by taking over Kansas Protein Foods, a company based in the United States. This strategic move has endowed ADM with enhanced flexibility and capacity in the production of unflavored textured soy protein, flavored alternatives, and non-GMO proteins. Kansas Protein Foods' offerings are expected to complement ADM's global sales efforts, including those in the Canadian market.

- August 2022: ADM and Benson Hill Inc., both United States-based companies, entered into a strategic agreement. Under this agreement, ADM gained exclusive rights for the development and commercialization of plant-based ingredients derived from Benson Hill's ultra-high protein soybeans. This partnership is driven by the shared goal of meeting the growing demand from North American customers, including those in Canada.

- February 2021: DuPont merged its Nutrition Business with International Flavors & Fragrances (IFF), establishing a company poised to become a leading supplier of ingredients to the food industry in the United States and Canada. With a substantial revenue of USD 11 billion, this newly formed entity is well-positioned to provide a wide range of ingredients, including soy proteins, for consumer products.

In-Depth Canada Soy Protein Market Market Outlook

The future outlook for the Canada Soy Protein Market remains exceptionally positive, driven by persistent growth accelerators such as ongoing technological advancements in protein processing and formulation. Strategic partnerships between key industry players and food manufacturers are expected to unlock new product categories and enhance market penetration. The sustained global shift towards plant-based diets, coupled with Canadian consumers' increasing focus on health and environmental sustainability, will continue to fuel demand across all segments. Emerging opportunities in specialized applications, such as advanced meat and dairy alternatives, and the expansion of protein fortification in functional foods, present significant avenues for future market expansion and revenue growth. The market is poised for continued innovation and increased consumption, solidifying soy protein's role as a cornerstone ingredient in Canada's evolving food landscape.

Canada Soy Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End-User

- 2.1. Animal Feed

-

2.2. Food and Beverages

- 2.2.1. Bakery

- 2.2.2. Breakfast Cereals

- 2.2.3. Condiments/Sauces

- 2.2.4. Dairy and Dairy Alternative Products

- 2.2.5. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.6. RTE/RTC Food Products

- 2.2.7. Snacks

-

2.3. Supplements

- 2.3.1. Baby Food and Infant Formula

- 2.3.2. Elderly Nutrition and Medical Nutrition

- 2.3.3. Sport/Performance Nutrition

Canada Soy Protein Market Segmentation By Geography

- 1. Canada

Canada Soy Protein Market Regional Market Share

Geographic Coverage of Canada Soy Protein Market

Canada Soy Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for meat alternatives

- 3.3. Market Restrains

- 3.3.1. Presence of numerous alternatives in the plant proteins

- 3.4. Market Trends

- 3.4.1. Rise in health consciousness across the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Soy Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. Bakery

- 5.2.2.2. Breakfast Cereals

- 5.2.2.3. Condiments/Sauces

- 5.2.2.4. Dairy and Dairy Alternative Products

- 5.2.2.5. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.6. RTE/RTC Food Products

- 5.2.2.7. Snacks

- 5.2.3. Supplements

- 5.2.3.1. Baby Food and Infant Formula

- 5.2.3.2. Elderly Nutrition and Medical Nutrition

- 5.2.3.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CHS Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cargill Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 International Flavors & Fragrances Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DuPont de Nemours Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniels Midland Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bunge Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ag Processing Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kerry Group PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Scoular Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fuji Oil Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CHS Inc

List of Figures

- Figure 1: Canada Soy Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Soy Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Soy Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Canada Soy Protein Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 3: Canada Soy Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Canada Soy Protein Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 5: Canada Soy Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Canada Soy Protein Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Canada Soy Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 8: Canada Soy Protein Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 9: Canada Soy Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Canada Soy Protein Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 11: Canada Soy Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Canada Soy Protein Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Soy Protein Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Canada Soy Protein Market?

Key companies in the market include CHS Inc, Cargill Incorporated, International Flavors & Fragrances Inc, DuPont de Nemours Inc, Archer Daniels Midland Company, Bunge Limited, Ag Processing Inc, Kerry Group PLC, The Scoular Company, Fuji Oil Grou.

3. What are the main segments of the Canada Soy Protein Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 231.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for meat alternatives.

6. What are the notable trends driving market growth?

Rise in health consciousness across the country.

7. Are there any restraints impacting market growth?

Presence of numerous alternatives in the plant proteins.

8. Can you provide examples of recent developments in the market?

January 2023: ADM made a significant acquisition by taking over Kansas Protein Foods, a company based in the United States. This strategic move has endowed ADM with enhanced flexibility and capacity in the production of unflavored textured soy protein, flavored alternatives, and non-GMO proteins. Kansas Protein Foods' offerings are expected to complement ADM's global sales efforts, including those in the Canadian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Soy Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Soy Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Soy Protein Market?

To stay informed about further developments, trends, and reports in the Canada Soy Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence