Key Insights

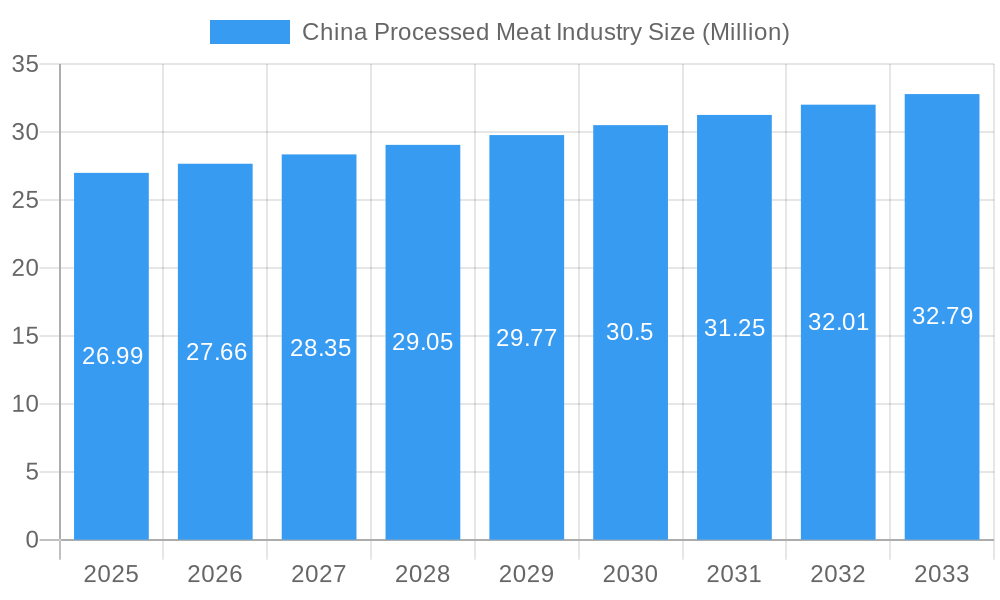

The processed meat industry in China is experiencing robust growth, with a current market size of $26.99 million in 2025. This expansion is fueled by a growing middle class with increasing disposable incomes, a rising demand for convenient and ready-to-eat food options, and evolving consumer preferences towards a wider variety of processed meat products. Key drivers include the escalating adoption of modern retail formats like supermarkets and hypermarkets, alongside the rapid growth of online retailing, which enhances product accessibility and consumer reach. Furthermore, the increasing popularity of diverse meat types, including poultry, beef, and pork, alongside innovative product formats such as chilled, frozen, and canned or preserved options, are significantly contributing to market dynamism. The industry anticipates a compound annual growth rate (CAGR) of 2.50% over the forecast period of 2025-2033, indicating sustained and healthy market expansion.

China Processed Meat Industry Market Size (In Million)

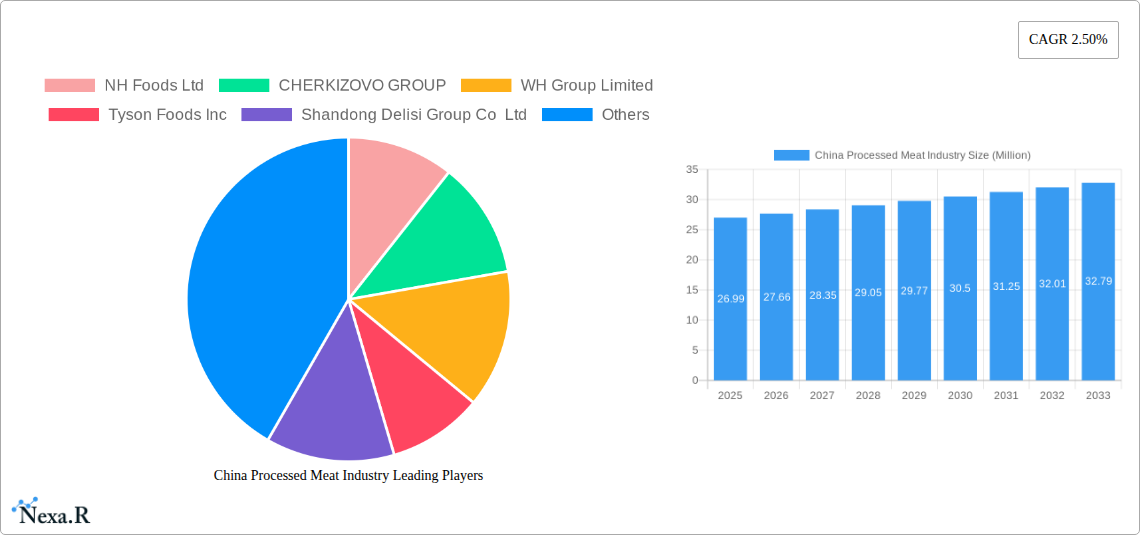

The processed meat market in China is characterized by a strong competitive landscape, featuring major players like NH Foods Ltd, CHERIZOVO GROUP, WH Group Limited, and Tyson Foods Inc. These companies are actively involved in product innovation, market penetration strategies, and leveraging their extensive distribution networks to capture a larger market share. While the market presents significant opportunities, it also faces certain restraints. These include evolving consumer concerns regarding health and the nutritional content of processed foods, stringent food safety regulations, and fluctuating raw material prices. Despite these challenges, the overall outlook for the China processed meat industry remains positive, driven by ongoing urbanization, changing dietary habits, and the continuous introduction of new and appealing processed meat products. The market is segmented across various meat types, product forms, and distribution channels, reflecting a diverse and evolving consumer demand landscape.

China Processed Meat Industry Company Market Share

China Processed Meat Industry Report: Market Analysis, Trends, and Forecasts (2019-2033)

Unlock comprehensive insights into the dynamic China processed meat industry. This in-depth report provides a detailed analysis of market size, growth drivers, competitive landscape, and future opportunities. Covering the study period of 2019–2033, with a base year of 2025, and a forecast period of 2025–2033, this report offers critical intelligence for stakeholders navigating the evolving Chinese food and beverage sector. Our analysis meticulously segments the market by Meat Type (Poultry, Beef, Pork, Mutton, Other Meat Types), Product Type (Chilled, Frozen, Canned/Preserved), and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailing, Other Distribution Channels).

This report delves into the parent and child market dynamics, offering a granular understanding of the Chinese processed meat ecosystem. We explore the impact of key industry developments, including strategic acquisitions and product diversification strategies, to provide a forward-looking perspective. High-traffic keywords such as "China processed meat market," "Chinese meat processing," "food industry China," "poultry processing China," "beef processing China," "pork processing China," and "frozen meat market China" are integrated to maximize search engine visibility and reach industry professionals seeking critical market intelligence. All values are presented in Million units for straightforward interpretation.

China Processed Meat Industry Market Dynamics & Structure

The China processed meat industry is characterized by a moderate to high market concentration, with leading players like WH Group Limited, Tyson Foods Inc., and NH Foods Ltd. holding significant sway. Technological innovation is primarily driven by advancements in preservation techniques, automation in processing, and the development of novel product formulations catering to evolving consumer tastes. Regulatory frameworks, encompassing food safety standards and import/export regulations, play a crucial role in shaping market access and operational practices. Competitive product substitutes, including plant-based alternatives and fresh meat options, present a continuous challenge, necessitating differentiation through quality, convenience, and value. End-user demographics are shifting, with a growing middle class demanding higher quality, diverse, and convenient processed meat products. Mergers and acquisitions (M&A) trends are notable, with companies strategically acquiring capabilities and market share. For instance, in 2021, Smithfield Foods Inc. acquired Mecom Group, a move aimed at bolstering its production of ham, soft salami, dry salami, sausages, bacon, smoked items, and other meat products, leveraging Mecom Group's capacity to produce 4,000 tonnes per month.

- Market Concentration: Dominated by a few key global and domestic players.

- Technological Innovation Drivers: Automation, advanced preservation, novel product development.

- Regulatory Frameworks: Stringent food safety standards, evolving import/export policies.

- Competitive Product Substitutes: Plant-based alternatives, fresh meat.

- End-User Demographics: Growing demand from urbanizing populations and middle-class consumers.

- M&A Trends: Strategic acquisitions for capacity expansion and portfolio diversification.

China Processed Meat Industry Growth Trends & Insights

The China processed meat industry is poised for substantial growth, propelled by a confluence of economic, demographic, and behavioral shifts. The market size is projected to experience a significant expansion, driven by increasing disposable incomes and a burgeoning demand for convenient and ready-to-eat food options. Adoption rates for processed meats are accelerating, particularly in urban centers, as consumers embrace modern lifestyles and seek time-saving culinary solutions. Technological disruptions are continuously reshaping the industry, from enhanced cold chain logistics ensuring product freshness to advanced processing technologies that improve efficiency and product quality. Consumer behavior is undergoing a noticeable transformation, with a growing emphasis on health and wellness influencing purchasing decisions, leading to a demand for processed meats with reduced sodium, fat, and added preservatives. The CAGR is estimated at xx% for the forecast period. The market penetration of processed meats in urban households is xx% and is expected to reach xx% by 2033.

- Market Size Evolution: Consistent upward trajectory driven by economic development and urbanization.

- Adoption Rates: Increasing consumer acceptance and integration into daily diets.

- Technological Disruptions: Impact on production efficiency, product quality, and distribution networks.

- Consumer Behavior Shifts: Growing preference for convenience, health-conscious options, and diverse product offerings.

- Market Penetration: Expansion into lower-tier cities and rural areas.

Dominant Regions, Countries, or Segments in China Processed Meat Industry

The Pork segment significantly dominates the China processed meat industry, reflecting the country's strong cultural affinity and high per capita consumption of pork. This dominance is further reinforced by its versatility in various processed forms, from traditional Chinese charcuterie to modern deli meats. Within product types, Frozen processed meats hold a substantial market share due to their longer shelf life, ease of storage, and cost-effectiveness, making them accessible across a wider geographical distribution. Supermarkets/Hypermarkets continue to be the primary distribution channel, offering a broad selection and catering to the majority of consumers. However, Online Retailing is rapidly emerging as a significant growth channel, driven by the convenience and expanding reach of e-commerce platforms in China.

Key drivers for this dominance include:

- Pork:

- Deep-rooted culinary traditions and consumer preference.

- Abundant domestic supply and established farming infrastructure.

- Versatility in processing for diverse product categories.

- Frozen Processed Meat:

- Extended shelf life and reduced spoilage.

- Cost-effectiveness for both producers and consumers.

- Facilitates wider distribution and accessibility.

- Supermarkets/Hypermarkets:

- Wide product availability and competitive pricing.

- Established consumer shopping habits.

- Effective point-of-sale marketing opportunities.

- Online Retailing:

- Unprecedented convenience and home delivery.

- Access to a broader consumer base, including in remote areas.

- Growth of specialized online food platforms.

The market share of Pork in the processed meat sector is estimated at xx%, followed by Poultry at xx%, Beef at xx%, Mutton at xx%, and Other Meat Types at xx%. The Frozen segment accounts for xx% of the total market, with Chilled at xx% and Canned/Preserved at xx%. Supermarkets/Hypermarkets represent xx% of the distribution channel market share, Online Retailing xx%, Convenience Stores xx%, and Other Distribution Channels xx%.

China Processed Meat Industry Product Landscape

The China processed meat industry is witnessing a surge in product innovations, driven by consumer demand for healthier, more convenient, and diverse options. Product applications are expanding beyond traditional offerings to include ready-to-cook meals, gourmet sausages, and seasoned meat snacks. Performance metrics are increasingly focusing on nutritional profiles, such as reduced sodium and fat content, alongside enhanced flavor profiles and textures. Unique selling propositions often revolve around premium ingredients, artisanal processing methods, and convenient packaging formats tailored for modern lifestyles. Technological advancements in areas like sous-vide cooking and advanced curing techniques are enabling the creation of higher-quality, shelf-stable products that appeal to discerning consumers seeking both taste and convenience.

Key Drivers, Barriers & Challenges in China Processed Meat Industry

Key Drivers:

- Urbanization and Rising Disposable Incomes: Fueling demand for convenient and premium processed meats.

- Evolving Consumer Lifestyles: Increased preference for ready-to-eat and quick meal solutions.

- Technological Advancements: Enhancing production efficiency, product quality, and shelf life.

- Government Support and Policies: Initiatives promoting agricultural modernization and food processing.

- Growing Middle Class: Seeking diverse and high-quality food options.

Barriers & Challenges:

- Food Safety Concerns and Regulations: Stringent standards require continuous investment in compliance and quality control.

- Supply Chain Volatility: Fluctuations in raw material prices and availability of livestock.

- Intense Competition: Both from domestic and international players, as well as alternative protein sources.

- Consumer Perception and Health Consciousness: Growing demand for healthier options, creating pressure to reformulate products.

- Logistical Complexities: Ensuring efficient and temperature-controlled distribution across vast regions. The cost of compliance and maintaining cold chain logistics can add xx% to operational expenses.

Emerging Opportunities in China Processed Meat Industry

Emerging opportunities in the China processed meat industry lie in the development of niche products catering to specific dietary needs and preferences, such as high-protein, low-fat, or low-sodium options. The increasing popularity of Western-style processed meats, including premium sausages and deli meats, presents a significant avenue for growth. Furthermore, the expansion of online food delivery services and e-commerce platforms opens up new channels for reaching consumers, particularly in lower-tier cities. The integration of traceability technologies, ensuring product authenticity and safety, will also be a key differentiator. Innovative packaging solutions that enhance convenience and shelf appeal will further drive market penetration.

Growth Accelerators in the China Processed Meat Industry Industry

Long-term growth in the China processed meat industry will be significantly accelerated by strategic partnerships and collaborations between local and international companies, facilitating the transfer of technology and best practices. Continued investment in research and development will drive the creation of novel, healthier, and more sustainable processed meat products. The expansion of processing capabilities through M&A activities and greenfield investments will be crucial for meeting escalating demand. Furthermore, effective marketing campaigns that educate consumers about the quality, safety, and convenience of processed meats will play a pivotal role in sustained market penetration and consumer trust. The adoption of advanced automation and AI in processing plants can boost production efficiency by up to xx%.

Key Players Shaping the China Processed Meat Industry Market

- WH Group Limited

- Tyson Foods Inc.

- NH Foods Ltd.

- Shandong Delisi Group Co Ltd

- Hormel Foods Corporation

- CHERKIZOVO GROUP

- Zhucheng Waimao Co Ltd

- China Xiangtai Food Co Ltd

- China Yurun Food Group Ltd

- Foster Farms

Notable Milestones in China Processed Meat Industry Sector

- 2021: Smithfield Foods Inc. acquired Mecom Group, a meat processing company, to expand its production of ham, soft salami, dry salami, sausages, bacon, smoked items, and meat products. Mecom Group's two large plants have a combined production capacity of 4,000 tonnes per month.

- 2021: Hormel Foods acquired Kraft Heinz's snack division, Planters, to diversify its product portfolio, complementing its core business of producing a massive volume of chili and deli meat products.

In-Depth China Processed Meat Industry Market Outlook

The outlook for the China processed meat industry remains exceptionally strong, fueled by enduring consumer demand and a continually evolving marketplace. Growth accelerators such as technological innovation in processing and preservation, coupled with strategic market expansion, will propel the sector forward. Emerging opportunities in health-conscious product development and the expanding reach of e-commerce channels present substantial avenues for increased market penetration. Strategic partnerships and investments in sustainable practices will further solidify the industry's growth trajectory, ensuring its continued prominence within China's vibrant food landscape. The projected market value is expected to reach $xx Billion by 2033.

China Processed Meat Industry Segmentation

-

1. Meat Type

- 1.1. Poultry

- 1.2. Beef

- 1.3. Pork

- 1.4. Mutton

- 1.5. Other Meat Types

-

2. Product Type

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Canned/Preserved

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Retailing

- 3.4. Other Distribution Channels

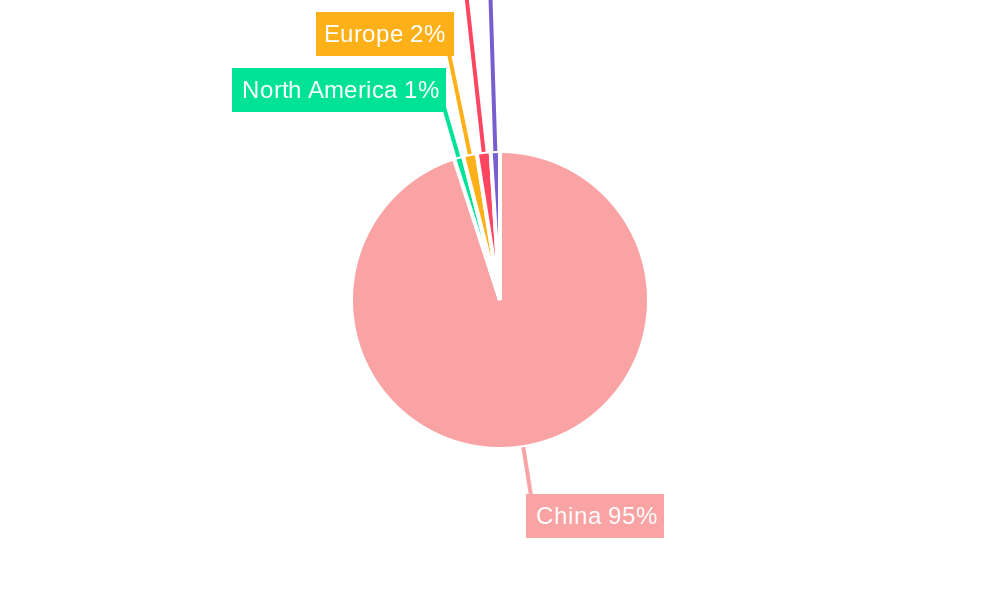

China Processed Meat Industry Segmentation By Geography

- 1. China

China Processed Meat Industry Regional Market Share

Geographic Coverage of China Processed Meat Industry

China Processed Meat Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for convenient and ready-to-eat food products boosts the processed meat market

- 3.3. Market Restrains

- 3.3.1. Rising health awareness and concerns about the consumption of processed meats

- 3.4. Market Trends

- 3.4.1. Growing trend towards healthier and lower-fat options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Processed Meat Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Meat Type

- 5.1.1. Poultry

- 5.1.2. Beef

- 5.1.3. Pork

- 5.1.4. Mutton

- 5.1.5. Other Meat Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Canned/Preserved

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Retailing

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Meat Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NH Foods Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CHERKIZOVO GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WH Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tyson Foods Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shandong Delisi Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Foster Farms

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hormel Foods Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zhucheng Waimao Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Xiangtai Food Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Yurun Food Group Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 NH Foods Ltd

List of Figures

- Figure 1: China Processed Meat Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Processed Meat Industry Share (%) by Company 2025

List of Tables

- Table 1: China Processed Meat Industry Revenue Million Forecast, by Meat Type 2020 & 2033

- Table 2: China Processed Meat Industry Volume K Tons Forecast, by Meat Type 2020 & 2033

- Table 3: China Processed Meat Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: China Processed Meat Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 5: China Processed Meat Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: China Processed Meat Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: China Processed Meat Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: China Processed Meat Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: China Processed Meat Industry Revenue Million Forecast, by Meat Type 2020 & 2033

- Table 10: China Processed Meat Industry Volume K Tons Forecast, by Meat Type 2020 & 2033

- Table 11: China Processed Meat Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: China Processed Meat Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 13: China Processed Meat Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: China Processed Meat Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 15: China Processed Meat Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Processed Meat Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Processed Meat Industry?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the China Processed Meat Industry?

Key companies in the market include NH Foods Ltd, CHERKIZOVO GROUP, WH Group Limited, Tyson Foods Inc, Shandong Delisi Group Co Ltd, Foster Farms, Hormel Foods Corporation, Zhucheng Waimao Co Ltd, China Xiangtai Food Co Ltd, China Yurun Food Group Ltd.

3. What are the main segments of the China Processed Meat Industry?

The market segments include Meat Type, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for convenient and ready-to-eat food products boosts the processed meat market.

6. What are the notable trends driving market growth?

Growing trend towards healthier and lower-fat options.

7. Are there any restraints impacting market growth?

Rising health awareness and concerns about the consumption of processed meats.

8. Can you provide examples of recent developments in the market?

In 2021, Smithfield Foods Inc. acquired Mecom Group, which is a meat processing company for rising its production in terms of ham, soft salami, dry salami and sausages, bacon, smoked items, and meat products as Mecom Group has two large plants which produce 4,000 tonnes of production per month.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Processed Meat Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Processed Meat Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Processed Meat Industry?

To stay informed about further developments, trends, and reports in the China Processed Meat Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence