Key Insights

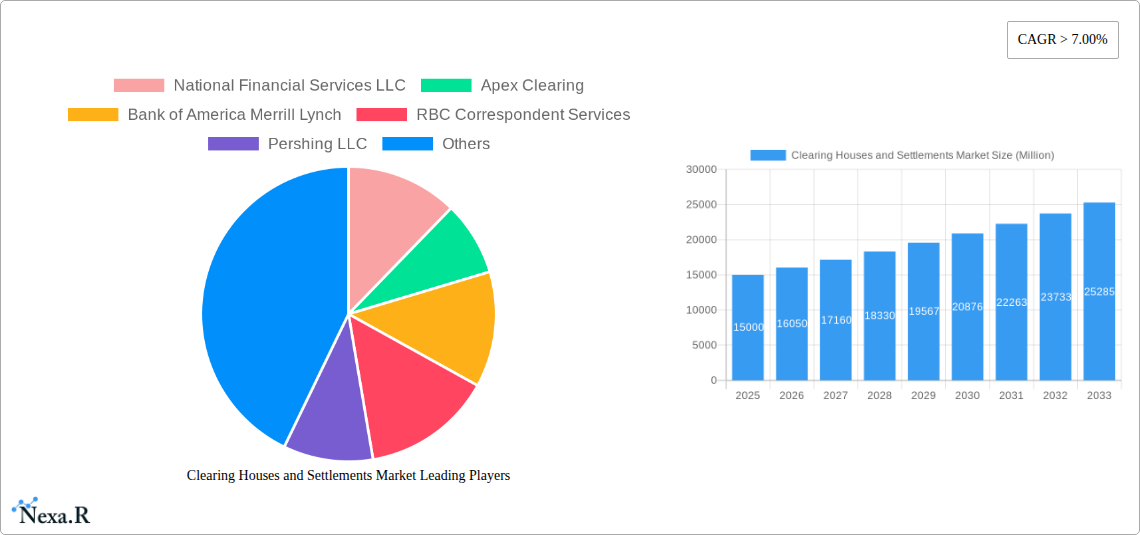

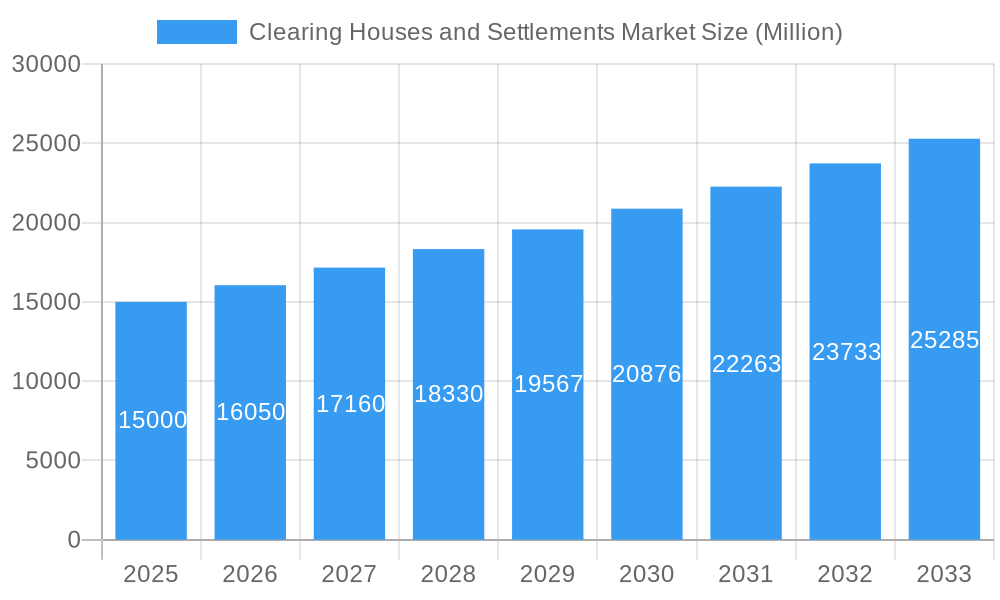

The Clearing Houses and Settlements Market is poised for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of 8% from a base year of 2025. The market size is projected to reach 150 billion in the forecast period. This robust growth is driven by an increasing volume of global financial transactions, amplified by e-commerce expansion and cross-border payment activities. The adoption of advanced technologies such as blockchain and AI for automation and risk management is further catalyzing market potential. Additionally, evolving regulatory frameworks designed to enhance transparency and mitigate systemic risk within the financial sector are positively influencing market dynamics. Key growth drivers include the segmentation by clearing house type (inward and outward) and service type (TARGET, SEPA, EBICS, and others). Leading market players, including National Financial Services LLC, Apex Clearing, and JP Morgan Clearing Corp., are spearheading innovation and fostering a competitive environment. Geographically, growth is anticipated across North America, Europe, Asia-Pacific, and other emerging regions, with North America and Europe currently dominating market share. Emerging markets, particularly within Asia-Pacific, represent substantial untapped potential for future expansion due to developing financial infrastructures.

Clearing Houses and Settlements Market Market Size (In Billion)

The Clearing Houses and Settlements Market offers diverse service solutions to meet the evolving requirements of financial institutions and corporations. The ongoing digital transformation and automation are profoundly reshaping service delivery, with a growing emphasis on sophisticated, cloud-based solutions. The integration of novel technologies is not only elevating operational efficiency but also enhancing settlement speed and security. This paradigm shift presents considerable opportunities for market participants to develop cutting-edge solutions and drive competitive advancements. The market's future trajectory hinges on its capacity to adapt to dynamic regulatory landscapes, effectively address cybersecurity vulnerabilities, and deliver increasingly integrated and advanced clearing and settlement solutions aligned with the demands of a rapidly evolving global financial ecosystem. Continued growth in electronic trading and the increasing interconnectedness of global financial markets will sustain the demand for efficient and dependable clearing and settlement services.

Clearing Houses and Settlements Market Company Market Share

Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Clearing Houses and Settlements Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, and key players. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report utilizes a robust methodology, incorporating both quantitative and qualitative data to deliver actionable insights for industry professionals. The market is segmented by type (Outward Clearing House, Inward Clearing House) and service (TARGET, SEPA, EBICS, Other Services). The total market size is projected to reach xx Million by 2033.

Clearing Houses and Settlements Market Market Dynamics & Structure

The Clearing Houses and Settlements market exhibits a moderately concentrated structure, with several large players dominating the landscape. Market concentration is influenced by factors including technological capabilities, regulatory compliance, and established client relationships. Technological innovation, particularly in areas like blockchain and AI, is a key driver, enhancing efficiency and security. Stringent regulatory frameworks, such as those imposed by bodies like the SEC and FCA, shape market dynamics. Competitive product substitutes, such as decentralized finance (DeFi) solutions, pose challenges but also offer potential for integration. End-user demographics, largely consisting of financial institutions and corporations, influence market demand. Mergers and acquisitions (M&A) activity has been moderate, with xx deals recorded between 2019 and 2024, representing a xx% increase compared to the previous period.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Blockchain, AI, and automation drive efficiency gains and reduced costs.

- Regulatory Framework: Stringent regulations (e.g., KYC/AML) influence operational strategies and compliance costs.

- M&A Activity: xx deals recorded between 2019 and 2024, indicating consolidation within the market.

- Competitive Substitutes: Emergence of DeFi platforms presents both threats and opportunities for integration.

Clearing Houses and Settlements Market Growth Trends & Insights

The Clearing Houses and Settlements market experienced significant growth during the historical period (2019-2024), driven by increasing transaction volumes, stricter regulatory compliance needs, and the growing adoption of digital payment systems. The market is expected to continue this growth trajectory during the forecast period (2025-2033), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by the ongoing digital transformation across financial services, increasing cross-border payments, and the expanding use of advanced clearing technologies. Technological disruptions, particularly the implementation of innovative solutions such as real-time gross settlement (RTGS) systems, have significantly impacted adoption rates. Consumer behavior shifts towards digital banking and contactless payments further support market expansion. Market penetration in key regions is expected to reach xx% by 2033.

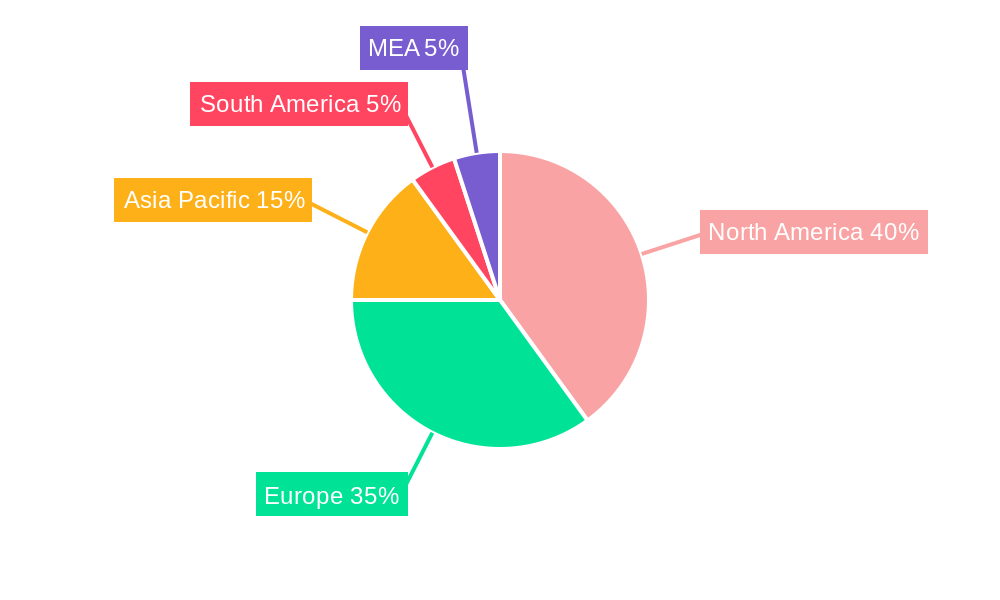

Dominant Regions, Countries, or Segments in Clearing Houses and Settlements Market

North America currently dominates the Clearing Houses and Settlements market, driven by factors like robust financial infrastructure, higher regulatory compliance, and the presence of major financial institutions. Europe follows as a significant market, with strong growth anticipated in emerging economies in Asia-Pacific. The Outward Clearing House segment holds a larger market share than the Inward Clearing House segment due to the greater volume of outbound transactions. Within services, TARGET and SEPA command substantial shares due to their widespread adoption in the European Union.

- North America: Strong financial infrastructure, high regulatory compliance, and major market players drive dominance.

- Europe: High adoption of TARGET and SEPA, significant presence of major financial institutions.

- Asia-Pacific: Rapid growth potential due to increasing digital adoption and expanding financial markets.

- Outward Clearing House Segment: Larger market share due to high outbound transaction volumes.

- TARGET and SEPA Services: High market penetration in Europe due to widespread adoption.

Clearing Houses and Settlements Market Product Landscape

The product landscape is characterized by a diverse range of clearing and settlement solutions, including specialized software, hardware infrastructure, and related services. These solutions offer varying levels of functionality, scalability, and security. Key performance metrics include transaction speed, processing costs, and security protocols. Unique selling propositions (USPs) often center on enhanced efficiency, improved security, and cost optimization, with many vendors leveraging AI and machine learning to enhance their offerings.

Key Drivers, Barriers & Challenges in Clearing Houses and Settlements Market

Key Drivers: Increased regulatory scrutiny demanding improved transparency and security; rising adoption of digital payments and fintech innovations; growing demand for cross-border payments and global trade.

Key Challenges: High initial investment costs for implementing new technologies; complex regulatory compliance requirements; cybersecurity threats and the potential for fraud; competition from emerging fintech players and innovative payment solutions. These challenges could lead to a xx% reduction in market growth if not adequately addressed.

Emerging Opportunities in Clearing Houses and Settlements Market

The market presents significant opportunities in areas such as the integration of blockchain technology for enhanced security and transparency; development of innovative solutions for cross-border payments; expansion into underserved markets and the provision of customized clearing solutions for niche segments like digital assets. Growing adoption of open banking APIs creates opportunities for greater interoperability and data-driven insights.

Growth Accelerators in the Clearing Houses and Settlements Market Industry

Technological advancements, particularly in areas such as artificial intelligence (AI) and machine learning (ML), are driving efficiency gains and cost reductions. Strategic partnerships between established players and fintech companies are fostering innovation and expansion into new markets. Furthermore, ongoing expansion into emerging economies and increased regulatory support for digital financial services are expected to fuel long-term market growth.

Key Players Shaping the Clearing Houses and Settlements Market Market

- National Financial Services LLC

- Apex Clearing

- Bank of America Merrill Lynch

- RBC Correspondent Services

- Pershing LLC

- J P Morgan Clearing Corp

- FOLIOfn Inc

- Goldman Sachs Execution and Clearing LP

- StoneX

- Southwest Securities Inc *List Not Exhaustive

Notable Milestones in Clearing Houses and Settlements Market Sector

- January 2023: The Clearing House (TCH) announced the retirement of its President and CEO, Jim Aramanda, and the appointment of David Watson as his successor. This transition signifies a potential shift in strategic direction.

- December 2022: Airwallex's partnership with Plaid streamlines ACH payments, enhancing efficiency and security for businesses. This integration showcases the growing importance of fintech partnerships in the sector.

- November 2022: Finxact and KPMG's collaboration promotes embedded finance, highlighting the industry's focus on innovation and modernization. This collaboration is likely to further enhance market competitiveness.

In-Depth Clearing Houses and Settlements Market Market Outlook

The Clearing Houses and Settlements market is poised for sustained growth, driven by continuous technological advancements, increasing regulatory pressure, and the burgeoning adoption of digital financial services. Strategic opportunities lie in developing innovative solutions tailored to the evolving needs of the financial industry, focusing on enhancing security, efficiency, and interoperability. The market presents attractive prospects for companies capable of navigating regulatory complexities and leveraging emerging technologies to offer superior value propositions to clients.

Clearing Houses and Settlements Market Segmentation

-

1. Type

- 1.1. Outward Clearing House

- 1.2. Inward Clearing House

-

2. Service

- 2.1. TARGET2

- 2.2. SEPA

- 2.3. EBICS

-

2.4. Other Services

- 2.4.1. EURO1

- 2.4.2. CCBM

Clearing Houses and Settlements Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of Clearing Houses and Settlements Market

Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Target2 is Driving Europe's Clearing and Settlements Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Outward Clearing House

- 5.1.2. Inward Clearing House

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. TARGET2

- 5.2.2. SEPA

- 5.2.3. EBICS

- 5.2.4. Other Services

- 5.2.4.1. EURO1

- 5.2.4.2. CCBM

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Outward Clearing House

- 6.1.2. Inward Clearing House

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. TARGET2

- 6.2.2. SEPA

- 6.2.3. EBICS

- 6.2.4. Other Services

- 6.2.4.1. EURO1

- 6.2.4.2. CCBM

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Outward Clearing House

- 7.1.2. Inward Clearing House

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. TARGET2

- 7.2.2. SEPA

- 7.2.3. EBICS

- 7.2.4. Other Services

- 7.2.4.1. EURO1

- 7.2.4.2. CCBM

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Outward Clearing House

- 8.1.2. Inward Clearing House

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. TARGET2

- 8.2.2. SEPA

- 8.2.3. EBICS

- 8.2.4. Other Services

- 8.2.4.1. EURO1

- 8.2.4.2. CCBM

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Outward Clearing House

- 9.1.2. Inward Clearing House

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. TARGET2

- 9.2.2. SEPA

- 9.2.3. EBICS

- 9.2.4. Other Services

- 9.2.4.1. EURO1

- 9.2.4.2. CCBM

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Outward Clearing House

- 10.1.2. Inward Clearing House

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. TARGET2

- 10.2.2. SEPA

- 10.2.3. EBICS

- 10.2.4. Other Services

- 10.2.4.1. EURO1

- 10.2.4.2. CCBM

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 National Financial Services LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apex Clearing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bank of America Merrill Lynch

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RBC Correspondent Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pershing LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 J P Morgan Clearing Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FOLIOfn Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldman Sachs Execution and Clearing LP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 StoneX

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Southwest Securities Inc*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 National Financial Services LLC

List of Figures

- Figure 1: Global Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 5: North America Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 11: Europe Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 17: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 23: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 24: Latin America Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 29: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 9: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 12: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 15: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clearing Houses and Settlements Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Clearing Houses and Settlements Market?

Key companies in the market include National Financial Services LLC, Apex Clearing, Bank of America Merrill Lynch, RBC Correspondent Services, Pershing LLC, J P Morgan Clearing Corp, FOLIOfn Inc, Goldman Sachs Execution and Clearing LP, StoneX, Southwest Securities Inc*List Not Exhaustive.

3. What are the main segments of the Clearing Houses and Settlements Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Target2 is Driving Europe's Clearing and Settlements Market.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

January 2023: The Clearing House (TCH) announced that President and CEO Jim Aramanda will be retiring in early 2023, after 15 years leading the company. Aramanda will be succeeded by David Watson, who most recently served as Chief Product Officer of Swift.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence