Key Insights

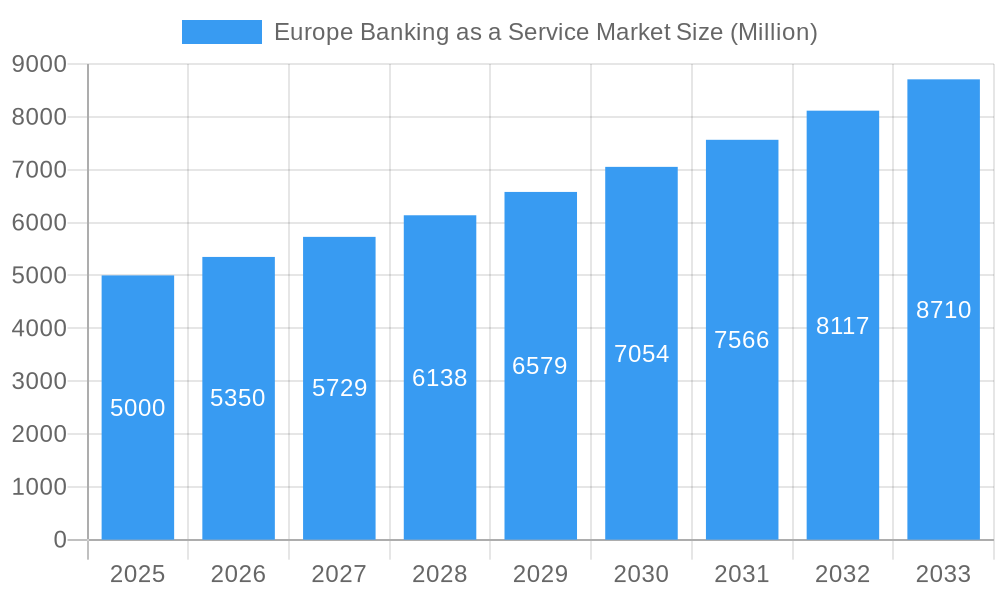

The European Banking-as-a-Service (BaaS) market is poised for significant expansion, driven by the escalating demand for agile and efficient financial solutions. With a projected Compound Annual Growth Rate (CAGR) of 26.5% from 2024 to 2033, the market is expected to reach approximately 1674.36 million by 2033. Key growth drivers include the widespread adoption of open banking frameworks, enabling enhanced interoperability and data exchange; the imperative for swift product innovation and deployment by both fintech firms and incumbent financial institutions; and a growing consumer and business preference for bespoke banking services. The proliferation of advanced BaaS platforms, offering robust APIs and simplified integration, further accelerates market penetration. Despite navigating regulatory complexities and security considerations, the sector's trajectory is overwhelmingly positive, underscored by the pervasive digital transformation within the financial services industry.

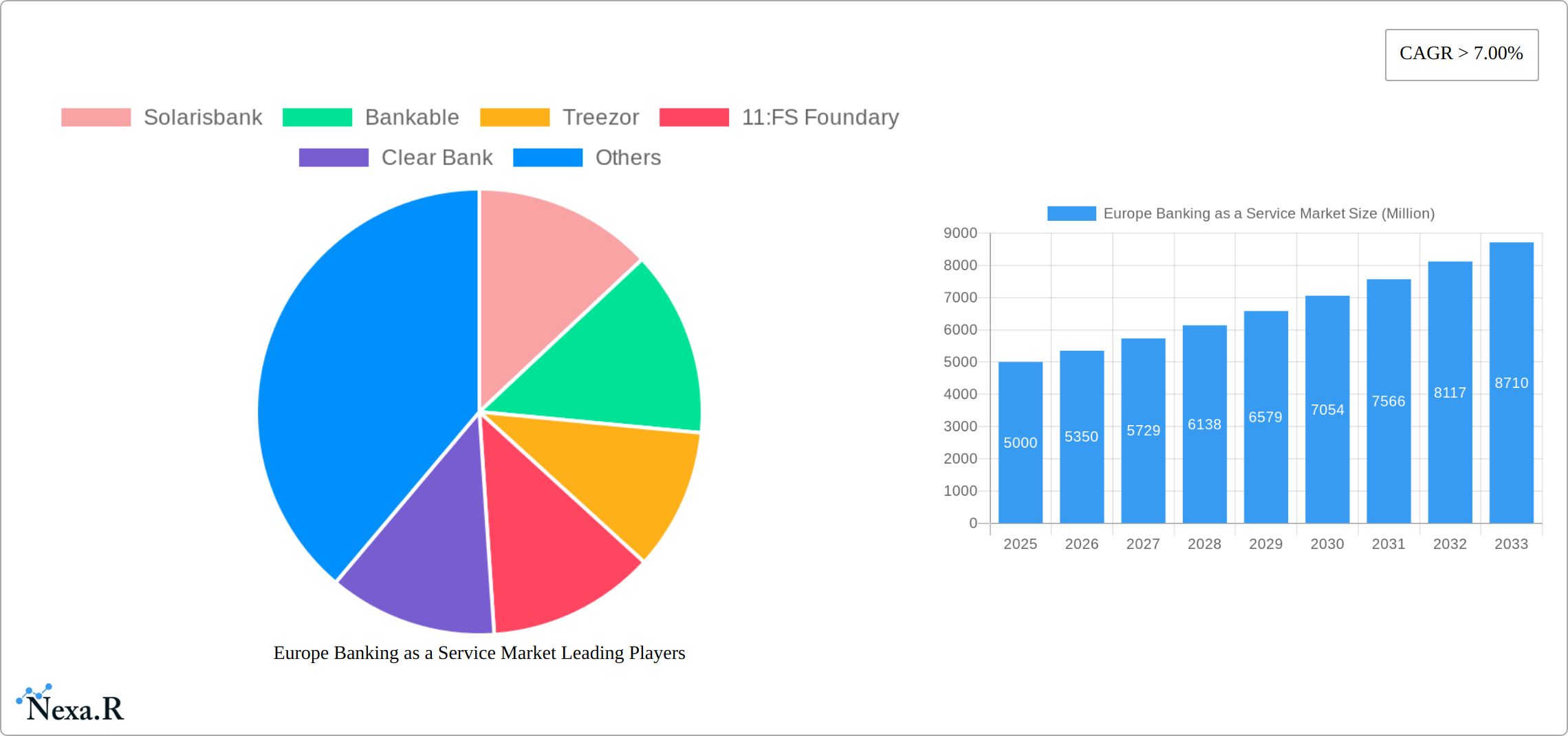

Europe Banking as a Service Market Market Size (In Billion)

Leading entities such as Solarisbank, Bankable, Treezor, 11:FS Foundry, Clear Bank, Unnax, Cambr, Railsbank, Deposits Solutions, Fidor Bank, True Layer, and FintechOS are instrumental in shaping the European BaaS ecosystem. These companies offer a comprehensive suite of services, encompassing core banking functions, payment processing, account administration, and lending capabilities. The competitive environment is dynamic, marked by the collaborative and competitive efforts of established institutions and innovative startups, fostering continuous advancement in service delivery. Market segmentation is anticipated to cater to a broad spectrum of clientele, including individual consumers, small and medium-sized enterprises (SMEs), and large enterprises. Regional disparities in growth are expected, influenced by diverse regulatory landscapes and varying levels of digital maturity across European nations, with more digitally progressive economies likely exhibiting accelerated growth.

Europe Banking as a Service Market Company Market Share

Europe Banking as a Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Europe Banking as a Service (BaaS) market, offering invaluable insights for industry professionals, investors, and strategists. We delve into market dynamics, growth trends, regional dominance, key players, and future opportunities, providing a complete picture of this rapidly evolving sector. The report covers the period 2019-2033, with a focus on the estimated year 2025. Market values are presented in million units.

Europe Banking as a Service Market Market Dynamics & Structure

The European Banking-as-a-Service (BaaS) market is a dynamic landscape shaped by a complex interplay of factors driving its growth and evolution. While currently exhibiting moderate market concentration, with several key players vying for dominance, the sector is undergoing rapid consolidation through mergers and acquisitions (M&A). Technological advancements, particularly in cloud computing, artificial intelligence (AI), and open banking APIs, are primary catalysts for growth. The impact of stringent regulatory frameworks, such as PSD2, is multifaceted; while initially presenting challenges, these regulations ultimately foster market expansion by promoting interoperability and innovation. The rise of Fintechs and the burgeoning demand for embedded finance solutions significantly contribute to the competitive intensity. Although traditional banking solutions remain competitors, the pace of innovation and the escalating demand for tailored financial products are gradually shifting the competitive balance in favor of agile BaaS providers.

- Market Concentration: Moderate, with a clear trend toward increased consolidation. (Specific market share data for top 5 players in 2024 would be beneficial here).

- Technological Innovation: Cloud computing, AI, and the evolution of open banking APIs are pivotal growth drivers, enabling scalability, efficiency, and enhanced customer experiences.

- Regulatory Framework: PSD2 and subsequent regulations play a crucial role in shaping market development, ensuring compliance, and fostering a secure environment for BaaS operations.

- Competitive Landscape: Characterized by competition from both established traditional banking services and a diverse range of niche Fintech solutions, each offering unique value propositions.

- M&A Activity: Significant M&A activity has been observed, reflecting the consolidating nature of the market. (Including the number of deals between 2019 and 2024 would add valuable context).

- End-User Demographics: The primary users include Fintech companies, small and medium-sized enterprises (SMEs), and large corporations seeking to integrate financial services into their offerings.

Europe Banking as a Service Market Growth Trends & Insights

The European BaaS market has experienced substantial growth in recent years, fueled by the increasing demand for flexible and scalable financial solutions. Between 2019 and 2024, the market exhibited a Compound Annual Growth Rate (CAGR) of [Insert CAGR Percentage]% reaching [Insert Market Size in Millions] in 2024. This robust growth trajectory is projected to continue, with a forecasted CAGR of [Insert CAGR Percentage]% from 2025 to 2033, reaching an estimated [Insert Market Size in Millions] by 2033. This positive outlook is driven by several factors, including the widespread adoption of digital banking, the expansion of open banking initiatives, and the accelerating demand for embedded finance solutions across a multitude of industries. A notable shift in consumer behavior towards personalized and on-demand financial services further propels the market's expansion. Moreover, technological disruptions, such as the emergence of advanced APIs and robust cloud-based infrastructure, are contributing to the market's dynamic evolution and improved service delivery.

Dominant Regions, Countries, or Segments in Europe Banking as a Service Market

The UK and Germany currently hold leading positions in the European BaaS market, driven by thriving Fintech ecosystems, supportive regulatory environments, and high levels of digital adoption. However, other key European countries, including France and the Netherlands, are demonstrating rapid growth and are actively closing the gap. The embedded finance segment exhibits the most rapid expansion, as businesses across various sectors increasingly integrate financial services into their core offerings, enhancing customer value and creating new revenue streams.

- Key Drivers:

- UK: A robust Fintech ecosystem and early adoption of open banking initiatives have fueled substantial growth.

- Germany: The presence of a large, established banking sector coupled with significant digitalization efforts create a fertile ground for BaaS.

- France: A burgeoning Fintech sector, combined with supportive regulatory policies, is driving market expansion.

- Netherlands: High digital literacy rates and a strong technological infrastructure provide a favorable environment for BaaS adoption.

- Dominance Factors: Market size, the regulatory landscape, the strength of technological infrastructure, and the level of Fintech activity are key factors determining market dominance.

- Growth Potential: Southern and Eastern European countries represent significant untapped potential, presenting substantial opportunities for future market expansion.

Europe Banking as a Service Market Product Landscape

The BaaS market offers a diverse range of products, including account-as-a-service, payment processing, lending-as-a-service, and other financial APIs. These solutions provide businesses with the ability to quickly and easily integrate financial functionalities into their products and services. Key product innovations include the integration of AI and machine learning for enhanced risk assessment and customer personalization, along with improved security features to ensure data protection. These innovations offer unique selling propositions by providing businesses with faster onboarding processes, lower operational costs, and more efficient customer experiences.

Key Drivers, Barriers & Challenges in Europe Banking as a Service Market

Key Drivers:

- The surging demand for embedded finance solutions across various industries.

- The ongoing expansion and improvement of open banking APIs.

- The increasing adoption of secure and scalable cloud-based solutions.

- The proliferation of digital-first businesses and their need for flexible financial services.

Challenges and Restraints:

- Navigating the complexities of regulatory compliance and meeting stringent requirements.

- Addressing security and data privacy concerns to maintain customer trust.

- Overcoming the challenges of integrating BaaS solutions with existing systems.

- Competition from established traditional banking institutions. (Quantifying the impact with specific data, such as the estimated percentage reduction in market growth in 2024, would add valuable context).

Emerging Opportunities in Europe Banking as a Service Market

- Untapped markets: Expanding into less developed European markets.

- Innovative applications: Integration of BaaS into new sectors (e.g., healthcare, IoT).

- Evolving consumer preferences: Catering to the demand for personalized and seamless financial experiences.

Growth Accelerators in the Europe Banking as a Service Market Industry

Strategic partnerships between established financial institutions and innovative Fintechs are key to accelerating growth. Technological advancements, such as the development of more robust and secure APIs and the wider adoption of cloud-based infrastructure, are critical catalysts. Market expansion strategies, including entering new geographic regions and targeting new customer segments, will further fuel long-term growth.

Key Players Shaping the Europe Banking as a Service Market Market

- Solarisbank

- Bankable

- Treezor

- 11:FS Foundary

- Clear Bank

- Unnax

- Cambr

- Railsbank

- Deposits Solutions

- Fidor Bank

- True Layer

- FintechOS

- List Not Exhaustive

Notable Milestones in Europe Banking as a Service Market Sector

- July 22, 2021: Bankable partnered with Paysafe, launching integrated omnichannel banking services.

- May 05, 2022: Solarisbank partnered with Snowflake to enhance its cloud infrastructure.

In-Depth Europe Banking as a Service Market Market Outlook

The future of the European BaaS market is bright, with continued growth fueled by technological innovation, regulatory support, and increasing demand for embedded finance. Strategic partnerships and expansion into new markets will play a crucial role in shaping the market's future. The focus on enhanced security and personalized financial experiences will continue to drive market expansion and create significant opportunities for industry players.

Europe Banking as a Service Market Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Type

- 2.1. API Based BaaS

- 2.2. Cloud Based BaaS

-

3. Enterprise

- 3.1. Large Enterprise

- 3.2. Small & Medium Enterprise

-

4. End User

- 4.1. Banks

- 4.2. Fintech Corporations/NBFC

- 4.3. Others

Europe Banking as a Service Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

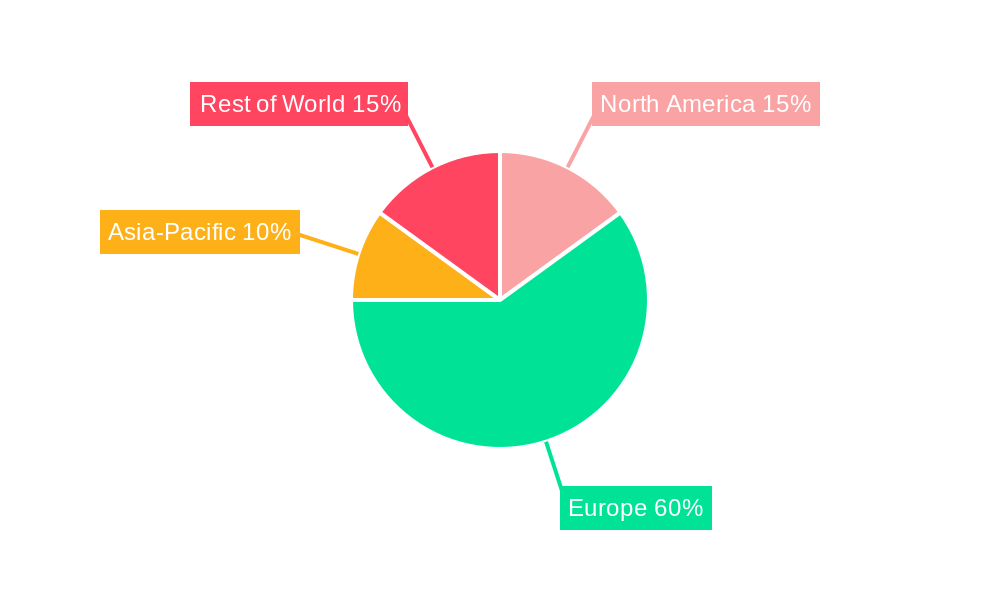

Europe Banking as a Service Market Regional Market Share

Geographic Coverage of Europe Banking as a Service Market

Europe Banking as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Embedded Finance Driving Banking as a Service.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Banking as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. API Based BaaS

- 5.2.2. Cloud Based BaaS

- 5.3. Market Analysis, Insights and Forecast - by Enterprise

- 5.3.1. Large Enterprise

- 5.3.2. Small & Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Banks

- 5.4.2. Fintech Corporations/NBFC

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solarisbank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bankable

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Treezor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 11

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 Solarisbank

List of Figures

- Figure 1: Europe Banking as a Service Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Banking as a Service Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Banking as a Service Market Revenue million Forecast, by Component 2020 & 2033

- Table 2: Europe Banking as a Service Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Europe Banking as a Service Market Revenue million Forecast, by Enterprise 2020 & 2033

- Table 4: Europe Banking as a Service Market Revenue million Forecast, by End User 2020 & 2033

- Table 5: Europe Banking as a Service Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Banking as a Service Market Revenue million Forecast, by Component 2020 & 2033

- Table 7: Europe Banking as a Service Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Banking as a Service Market Revenue million Forecast, by Enterprise 2020 & 2033

- Table 9: Europe Banking as a Service Market Revenue million Forecast, by End User 2020 & 2033

- Table 10: Europe Banking as a Service Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Banking as a Service Market?

The projected CAGR is approximately 26.5%.

2. Which companies are prominent players in the Europe Banking as a Service Market?

Key companies in the market include Solarisbank, Bankable, Treezor, 11:FS Foundary, Clear Bank, Unnax, Cambr, Rails bank, Deposits Solutions, Fidor Bank, True Layer, FintechOS**List Not Exhaustive.

3. What are the main segments of the Europe Banking as a Service Market?

The market segments include Component, Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1674.36 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand for Embedded Finance Driving Banking as a Service..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On May 05, 2022, Solaris bank announced that it would partner with Snowflake, the Data Cloud company, to double down on creating a cloud-fluent organization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Banking as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Banking as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Banking as a Service Market?

To stay informed about further developments, trends, and reports in the Europe Banking as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence