Key Insights

The European neobanking market is projected for substantial expansion, driven by increasing smartphone penetration, widespread adoption of digital banking apps, and a growing consumer preference for convenient, transparent, and cost-effective financial solutions. Key demographics, particularly millennials and Gen Z, are actively seeking these digital-first services, which neobanks are well-equipped to deliver. Supportive regulatory environments fostering fintech innovation and accessible entry points for new entrants further contribute to a dynamic and competitive landscape. The market is estimated to reach $210.16 billion by 2025, with a projected CAGR of 48.9%. Established players like Revolut, N26, and Monzo, alongside emerging regional entities, highlight a maturing yet rapidly evolving sector. This competitive intensity is spurring innovation in personalized financial management tools and enhanced customer service.

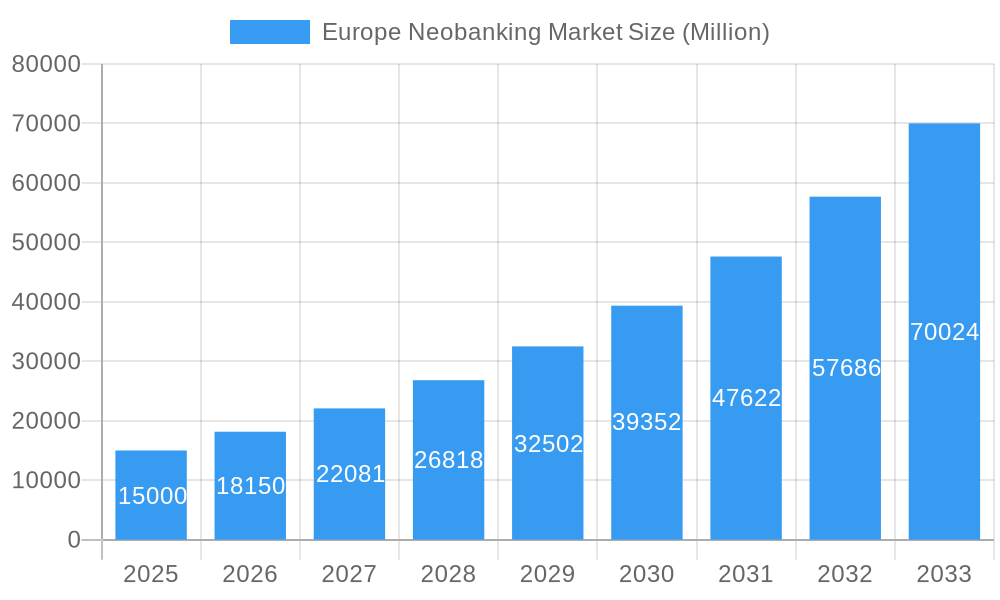

Europe Neobanking Market Market Size (In Billion)

Despite this rapid growth, significant challenges persist. Intense market competition necessitates continuous innovation and differentiation to secure and retain customer loyalty. Evolving regulatory landscapes, particularly concerning data privacy and security, present ongoing compliance demands. Furthermore, achieving consistent profitability remains a key hurdle for many neobanks, requiring a delicate balance between customer acquisition costs and operational efficiency. Future success hinges on effectively navigating these challenges while building and maintaining customer trust and delivering an exceptional user experience. Strategic expansion into new geographic territories and the introduction of diversified financial services, including lending and investment products, are anticipated to be pivotal for sustained growth.

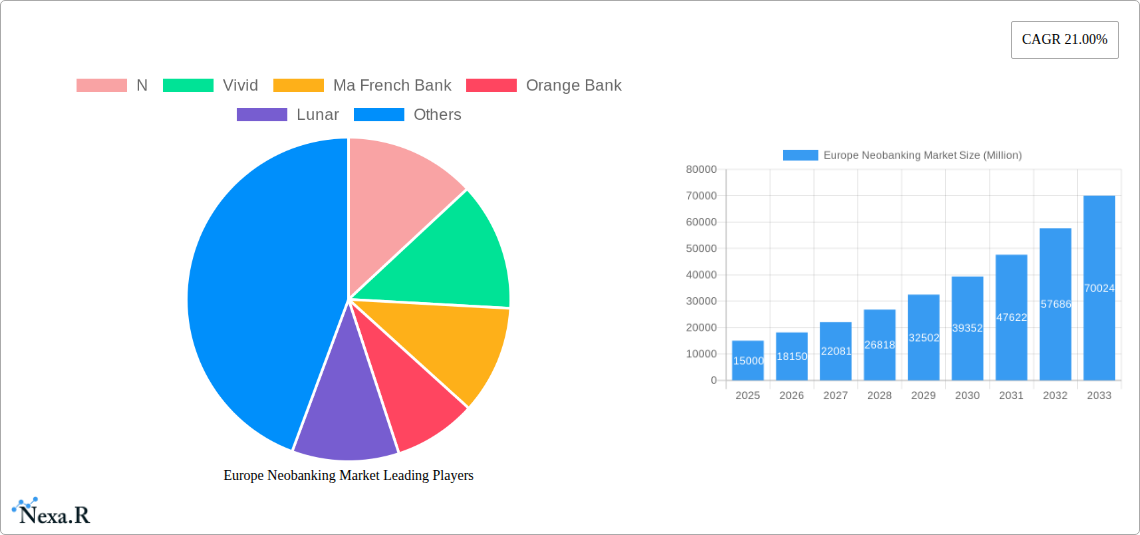

Europe Neobanking Market Company Market Share

This comprehensive report offers an in-depth analysis of the European neobanking market, detailing market dynamics, growth trajectories, regional leadership, product segmentation, critical challenges, emerging opportunities, and prominent industry players. The study encompasses the period from 2019 to 2033, with 2025 serving as the base year. This research is an indispensable resource for investors, industry professionals, and strategic decision-makers aiming to understand and leverage the significant potential within this fast-paced sector. The report includes detailed analyses of the parent market (Financial Services) and sub-markets (Digital Banking, Mobile Banking).

Europe Neobanking Market Dynamics & Structure

The European neobanking market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is currently moderate, with a few major players holding significant market share, while numerous smaller neobanks are vying for position. Technological innovation, driven by AI, machine learning, and open banking APIs, is a key driver, constantly pushing the boundaries of service offerings and user experience. Regulatory frameworks, such as PSD2, are shaping market access and data privacy. The emergence of sophisticated fintech solutions presents competitive substitutes, while M&A activity is consolidating the market.

- Market Concentration: Moderate, with top 5 players holding approximately xx% of the market in 2024.

- Technological Drivers: AI-powered personalization, biometric security, blockchain integration.

- Regulatory Frameworks: PSD2, GDPR, and varying national regulations impacting operations.

- Competitive Substitutes: Traditional banks offering digital solutions, specialized fintech apps.

- End-User Demographics: Primarily millennials and Gen Z, with increasing adoption across age groups.

- M&A Trends: Consolidation expected to continue, with larger players acquiring smaller competitors to expand market share and product offerings. Approximately xx M&A deals occurred between 2019 and 2024.

Europe Neobanking Market Growth Trends & Insights

The European neobanking market is experiencing robust growth, driven by increasing smartphone penetration, rising consumer demand for convenient and personalized financial services, and a growing preference for digital-first banking solutions. The market size exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to reach xx Million by 2025, further expanding to xx Million by 2033. Market penetration is increasing steadily, particularly amongst younger demographics. Technological disruptions, such as the rise of embedded finance, are further accelerating growth. Shifting consumer behaviors, such as the demand for seamless cross-border payments and personalized financial management tools, are influencing neobank strategies.

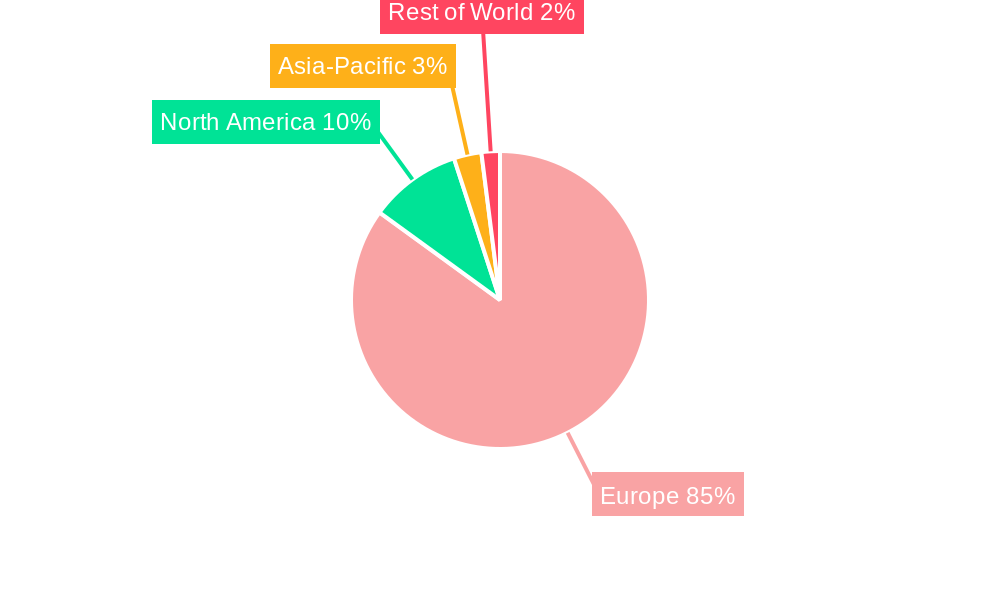

Dominant Regions, Countries, or Segments in Europe Neobanking Market

The UK, Germany, and France represent the most significant national markets within the European neobanking landscape, driven by robust digital infrastructure, high smartphone penetration, and a receptive consumer base. These countries exhibit higher market penetration rates compared to other European regions. The UK's established fintech ecosystem and regulatory environment fosters innovation, while Germany's large population and robust economy contribute to high market potential. France's burgeoning fintech sector also contributes to significant growth.

- Key Drivers: Strong digital infrastructure, high smartphone adoption rates, supportive regulatory environments.

- Dominance Factors: Large population base, established fintech ecosystems, high consumer adoption rates.

- Growth Potential: Significant potential exists in other European countries with growing digital economies.

Europe Neobanking Market Product Landscape

Neobanks offer a diverse range of products, including current accounts, savings accounts, debit/credit cards, peer-to-peer payments, and investment options. Product innovations focus on user-friendly interfaces, personalized financial management tools, and seamless integration with other financial services. Key performance metrics include customer acquisition cost, customer lifetime value, and Net Promoter Score (NPS). Unique selling propositions often center on transparent pricing, superior customer service, and advanced technology features.

Key Drivers, Barriers & Challenges in Europe Neobanking Market

Key Drivers: Technological advancements (AI, open banking), increasing consumer demand for digital banking, supportive regulatory frameworks (in certain regions).

Challenges: Intense competition, regulatory hurdles (varying across countries), cybersecurity threats, maintaining profitability with low-fee models, scaling operations efficiently, and managing customer expectations. These challenges result in xx% of neobanks failing to achieve profitability in 2024.

Emerging Opportunities in Europe Neobanking Market

Untapped markets in Southern and Eastern Europe present significant growth opportunities. Innovative applications, such as embedded finance within e-commerce platforms and personalized financial advice tools, are gaining traction. Evolving consumer preferences towards sustainable and ethical banking practices are opening new avenues for differentiation.

Growth Accelerators in the Europe Neobanking Market Industry

Technological breakthroughs in AI and machine learning, strategic partnerships with established financial institutions, and expansion into new geographic markets are key growth accelerators. Innovative business models that address specific consumer needs and leverage open banking capabilities will further drive expansion.

Key Players Shaping the Europe Neobanking Market Market

- N26

- Vivid Money

- Ma French Bank

- Orange Bank

- Lunar

- Revolut

- Bnext

- Holvi

- Monzo Bank Ltd

- Atom Bank Plc

- Bunq

- List Not Exhaustive

Notable Milestones in Europe Neobanking Market Sector

- March 2022: Lunar raises USD 77 Million, launches crypto trading and B2B payments.

- October 2021: N26 secures over $900 million in Series E funding.

In-Depth Europe Neobanking Market Market Outlook

The European neobanking market is poised for continued strong growth, fueled by technological advancements, regulatory changes, and evolving consumer preferences. Strategic partnerships, international expansion, and the development of innovative financial products will be crucial for success. The market presents significant opportunities for both established players and new entrants, demanding a keen understanding of market dynamics and a proactive approach to innovation.

Europe Neobanking Market Segmentation

-

1. Account Type

- 1.1. Business Account

- 1.2. Savings Account

-

2. Services

- 2.1. Mobile Banking

- 2.2. Payments and Money Transfers

- 2.3. Savings Account

- 2.4. Loans

- 2.5. Other Sevices

Europe Neobanking Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Neobanking Market Regional Market Share

Geographic Coverage of Europe Neobanking Market

Europe Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 48.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing user penetration of Neobanking Apps

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Business Account

- 5.1.2. Savings Account

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Mobile Banking

- 5.2.2. Payments and Money Transfers

- 5.2.3. Savings Account

- 5.2.4. Loans

- 5.2.5. Other Sevices

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 N

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vivid

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ma French Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orange Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lunar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Revolut

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bnext

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Holvi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Monzo Bank Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atom Bank Plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bunq**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 N

List of Figures

- Figure 1: Europe Neobanking Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Neobanking Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Neobanking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 2: Europe Neobanking Market Revenue billion Forecast, by Services 2020 & 2033

- Table 3: Europe Neobanking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Neobanking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 5: Europe Neobanking Market Revenue billion Forecast, by Services 2020 & 2033

- Table 6: Europe Neobanking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Neobanking Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Neobanking Market?

The projected CAGR is approximately 48.9%.

2. Which companies are prominent players in the Europe Neobanking Market?

Key companies in the market include N, Vivid, Ma French Bank, Orange Bank, Lunar, Revolut, Bnext, Holvi, Monzo Bank Ltd, Atom Bank Plc, Bunq**List Not Exhaustive.

3. What are the main segments of the Europe Neobanking Market?

The market segments include Account Type, Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 210.16 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing user penetration of Neobanking Apps.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2022, Nordic neobank Lunar raises USD 77 Million at a USD 2 Billion valuation, and launches a crypto trading platform and B2B payments for its small and medium business customers. It has now raised EUR 345 million in total, with other past investors including Seed Capital, Greyhound Capital, Socii Capital and Chr. Augustinus Fabrikker.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Neobanking Market?

To stay informed about further developments, trends, and reports in the Europe Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence