Key Insights

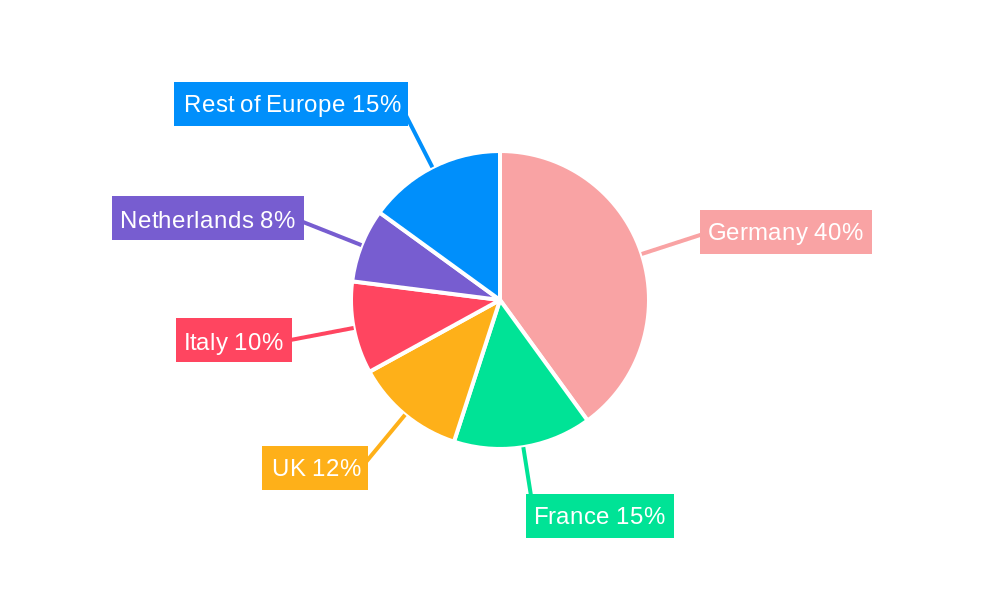

The German Fintech market is poised for significant expansion, driven by escalating digitalization, a digitally adept populace, and favorable regulatory environments. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.4%. Key growth catalysts include the widespread adoption of mobile payments, the proliferation of digital lending and investment platforms such as neobrokers and crowdlending, and a heightened demand for innovative banking solutions, including neo-banking services. The market is diversified by product categories including mobile POS payments, digital capital raising, crowdlending, digital investment, neobrokers, neo-banking, and digital assets, alongside service propositions like digital payments, effectively addressing evolving consumer and business requirements. Leading entities such as Mambu, Finleap Connect, N26, OneFor, Trade Republic, AirBank, Wefox Group, Raisin DS, NeuFund, and HoneyBook are instrumental in shaping the market's trajectory. The symbiotic relationship between established financial institutions and agile FinTech startups fosters a dynamic and collaborative ecosystem. While key geographical hubs include Germany, France, Italy, the United Kingdom, and the Netherlands, the market's influence extends nationally and internationally.

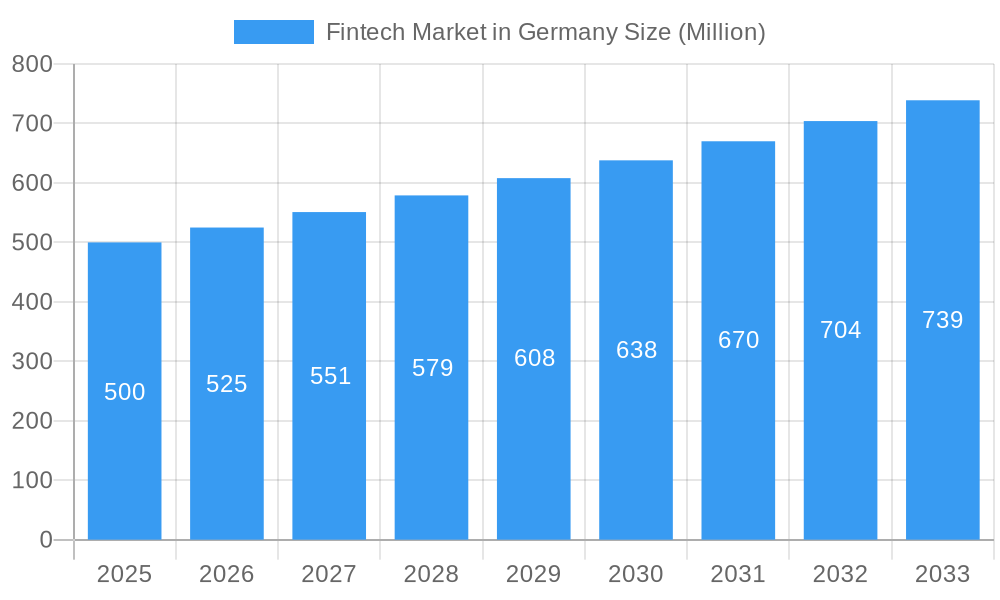

Fintech Market in Germany Market Size (In Billion)

Future growth of the German Fintech market will be shaped by technological advancements, particularly in Artificial Intelligence and blockchain, which will facilitate the creation of novel financial products and services. Evolving regulatory frameworks, designed to promote competition and innovation while ensuring financial stability, will also be critical. Increasing consumer preference for personalized, streamlined, and cost-efficient financial solutions will further stimulate market expansion. Nonetheless, challenges persist, including cybersecurity threats, data privacy compliances, and the imperative for robust consumer education to ensure optimal adoption of new technologies. Despite these hurdles, the outlook remains highly promising, indicating substantial growth opportunities for the German Fintech sector. The market size is estimated to reach $13.59 billion by 2025, with detailed projections available in comprehensive market research reports.

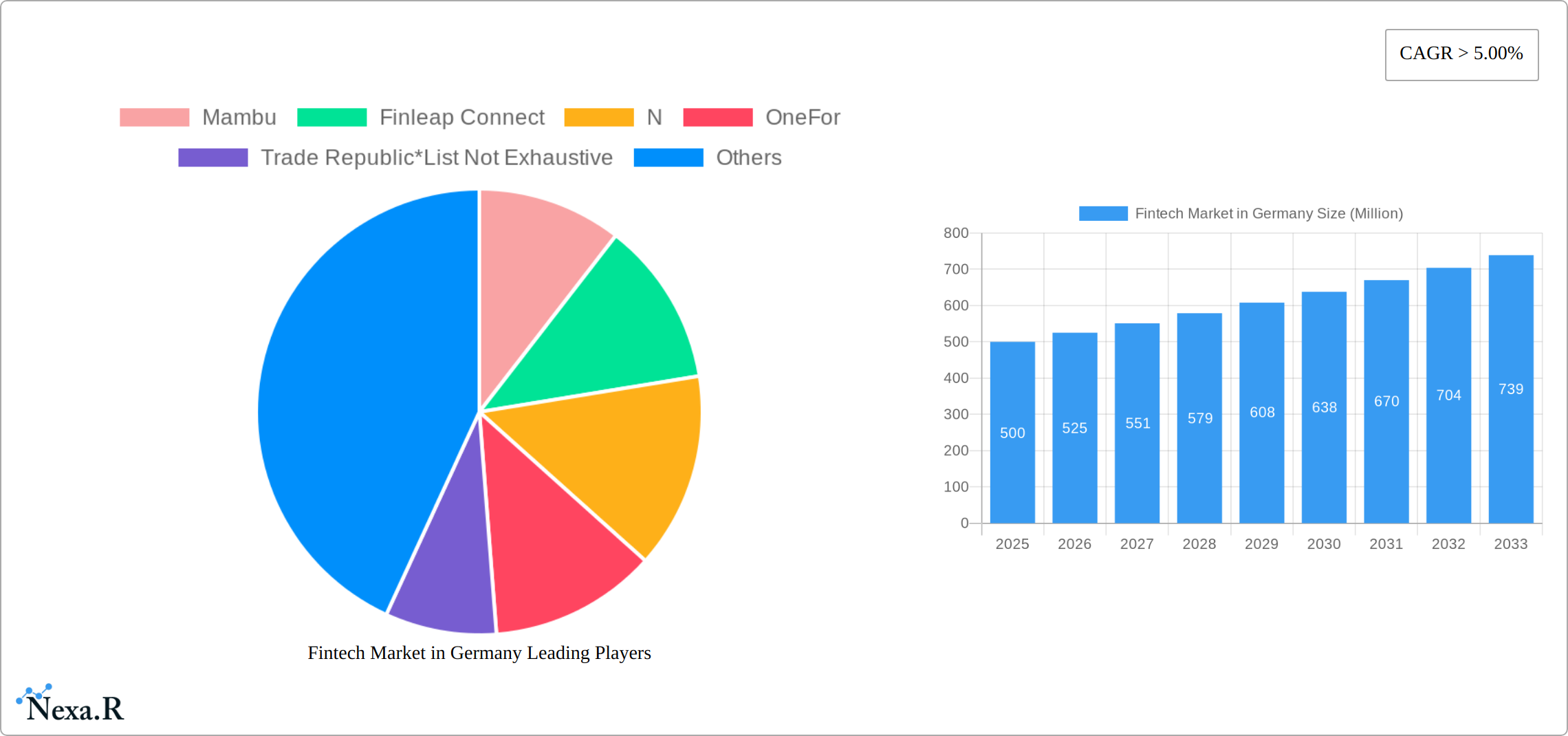

Fintech Market in Germany Company Market Share

Fintech Market in Germany: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the German Fintech market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report utilizes a robust methodology incorporating both qualitative and quantitative data to deliver actionable insights for industry professionals. Parent markets encompass the broader financial services sector in Germany, while child markets include specific Fintech niches like Neobanking and Digital Payments.

Fintech Market in Germany Market Dynamics & Structure

The German Fintech market, valued at xx Million in 2025, exhibits a dynamic landscape characterized by high competition, rapid technological innovation, and evolving regulatory frameworks. Market concentration is relatively high, with several large players alongside a thriving ecosystem of startups. Technological advancements, particularly in AI and blockchain, are driving significant disruption. The regulatory environment, while supportive of innovation, presents challenges for compliance. The market witnesses considerable M&A activity, with deal volumes averaging xx per year during the historical period (2019-2024). Substitutes for Fintech products include traditional banking services, however, Fintech solutions are increasingly preferred due to their convenience and efficiency. End-user demographics show a strong adoption among younger generations, driven by digital fluency and preference for mobile-first solutions.

- Market Concentration: High, with a few dominant players and numerous smaller firms.

- Technological Innovation: Strong influence of AI, blockchain, and open banking APIs.

- Regulatory Framework: Supportive but requires ongoing adaptation to emerging technologies.

- Competitive Substitutes: Traditional banking services, but Fintech offers superior user experience.

- M&A Activity: Average xx deals annually (2019-2024), indicating consolidation.

- End-User Demographics: High adoption among younger generations (Millennials and Gen Z).

Fintech Market in Germany Growth Trends & Insights

The German Fintech market has witnessed significant growth during the historical period (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to increasing smartphone penetration, rising digital literacy, and a shift towards mobile-first financial services. Technological disruptions, such as the rise of open banking and embedded finance, have further accelerated market expansion. Consumer behavior shifts, including the growing preference for personalized and convenient financial solutions, also contribute significantly. Market penetration for key Fintech products like digital payments and Neobanking are increasing rapidly, exceeding xx% in 2025. The forecast period (2025-2033) anticipates continued strong growth, albeit at a slightly moderated CAGR of xx%, reaching a market value of xx Million by 2033.

Dominant Regions, Countries, or Segments in Fintech Market in Germany

The German Fintech landscape is characterized by a dynamic concentration of innovation and investment in its major urban centers, notably Berlin, Munich, and Frankfurt. These cities serve as vibrant hubs fostering the development and growth of the sector. Within the product segmentation, the NeoBanking and Digital Payments segments are demonstrating exceptional growth trajectories. This surge is largely attributable to widespread consumer adoption of digital banking services and an escalating demand for seamless, intuitive financial experiences. The Digital Payments segment, in particular, has established a dominant position, propelled by the high penetration of smartphones across the population and a robust, ever-expanding e-commerce ecosystem. A confluence of factors underpins this segment's success, including a supportive and evolving regulatory framework, a highly developed and reliable digital infrastructure, and strong, consistent consumer spending patterns.

- Key Growth Drivers:

- Extensive smartphone penetration across the German population.

- A steadily increasing level of digital literacy and comfort with online financial services among consumers.

- A flourishing and robust e-commerce sector that necessitates efficient digital payment solutions.

- A proactive and supportive regulatory environment designed to foster fintech innovation.

- A well-established and highly reliable digital infrastructure, including widespread internet access.

- Dominant Segments: NeoBanking and Digital Payments.

Fintech Market in Germany Product Landscape

The German Fintech market showcases a diverse product landscape, including mobile POS payments, digital capital raising platforms, crowdlending services, digital investment platforms (including Neobrokers), NeoBanking solutions, and platforms facilitating trading in digital assets. These products leverage cutting-edge technologies, such as AI-powered fraud detection, blockchain-based security, and personalized financial management tools. Key innovations involve seamless integration with existing financial systems, improved user interfaces, and enhanced security features. Performance metrics reveal high customer satisfaction rates and increased transaction volumes for many leading Fintech products.

Key Drivers, Barriers & Challenges in Fintech Market in Germany

Key Drivers:

- The ongoing and accelerating digitalization of the traditional financial services sector, creating fertile ground for new entrants.

- A burgeoning consumer demand for financial products and services that are both convenient to access and highly personalized to individual needs and preferences.

- Proactive government initiatives and policy frameworks aimed at encouraging and promoting innovation within the financial technology space.

- The continued rise in smartphone penetration rates and ubiquitous internet access, enabling broader reach for digital financial solutions.

Key Barriers & Challenges:

- The intricate and often stringent nature of regulatory compliance requirements within the financial services industry.

- Persistent cybersecurity threats and significant concerns surrounding data privacy and protection of sensitive financial information.

- Intense competition stemming from well-established, traditional financial institutions with significant market share and brand recognition.

- The inherent risks associated with potential fraud and financial crime, necessitating robust security measures and ongoing vigilance. The impact of these challenges can be quantified by the estimated [Insert Specific Percentage Here, e.g., 60%]% of Fintech startups that struggle to secure Series A funding due to perceived risks or market entry hurdles.

Emerging Opportunities in Fintech Market in Germany

Significant untapped market potential exists within Germany's fintech sector, particularly in areas such as embedded finance, where financial services are integrated seamlessly into non-financial platforms, and in offering highly personalized wealth management solutions. The growing global emphasis on sustainability also presents a burgeoning opportunity in the realm of sustainable finance. Furthermore, innovative applications of blockchain technology hold immense promise for revolutionizing supply chain finance, enhancing transparency, and streamlining cross-border payments. Evolving consumer preferences, with a distinct shift towards sustainable and ethical investment options, are actively driving demand for specialized fintech solutions catering to these values. The increasing adoption and mandated implementation of open banking APIs are poised to unlock further avenues for collaborative innovation and strategic partnerships across the industry.

Growth Accelerators in the Fintech Market in Germany Industry

Technological breakthroughs in AI, machine learning, and blockchain are significant catalysts. Strategic partnerships between Fintech startups and established financial institutions are fostering growth. Market expansion strategies focusing on underserved demographics and geographic regions offer substantial potential. The government’s continued support for Fintech innovation through grants and tax incentives will drive further expansion.

Key Players Shaping the Fintech Market in Germany Market

- Mambu

- Finleap Connect

- N

- OneFor

- Trade Republic

- AirBank

- Wefox Group

- Raisin DS

- NeuFund

- HoneyBook

- Hawk:AI

Notable Milestones in Fintech Market in Germany Sector

- June 2022: Airbank successfully raised USD 20 million in funding to fuel the expansion of its global SMB banking solution, with a strategic focus on enhancing real-time cash flow management capabilities for businesses.

- March 2022: Raisin DS enriched its investment marketplace by introducing private equity as a new asset class, broadening investment opportunities for its users.

In-Depth Fintech Market in Germany Market Outlook

The German Fintech market is on a robust trajectory for sustained and significant growth, propelled by relentless technological innovation, ever-increasing consumer adoption of digital financial services, and a continually evolving and supportive regulatory landscape. Strategic opportunities are abundant for companies that can adeptly focus on delivering highly personalized financial solutions, pioneering advancements in embedded finance, and championing innovative approaches in sustainable investments. The market's future potential is substantial, with predictions indicating continued expansion and maturation across all major segments throughout the foreseeable forecast period, solidifying Germany's position as a leading European fintech hub.

Fintech Market in Germany Segmentation

-

1. Service proposition

-

1.1. Digital Payments

- 1.1.1. Digital Commerce

- 1.1.2. Mobile POS Payments

-

1.2. Digital Capital Raising

- 1.2.1. Crowdfunding

- 1.2.2. Crowdinvesting

- 1.2.3. Crowdlending

-

1.3. Digital Investment

- 1.3.1. Robo-Advisors

- 1.3.2. Neobrokers

- 1.4. NeoBanking

-

1.5. Digital Assets

- 1.5.1. Cryptocurrencies

- 1.5.2. NFT

-

1.1. Digital Payments

Fintech Market in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fintech Market in Germany Regional Market Share

Geographic Coverage of Fintech Market in Germany

Fintech Market in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Efficient and Cost-Effective Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Scrutiny and Compliance Requirements

- 3.4. Market Trends

- 3.4.1. Increase in Investments in Fintech Sector is Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 5.1.1. Digital Payments

- 5.1.1.1. Digital Commerce

- 5.1.1.2. Mobile POS Payments

- 5.1.2. Digital Capital Raising

- 5.1.2.1. Crowdfunding

- 5.1.2.2. Crowdinvesting

- 5.1.2.3. Crowdlending

- 5.1.3. Digital Investment

- 5.1.3.1. Robo-Advisors

- 5.1.3.2. Neobrokers

- 5.1.4. NeoBanking

- 5.1.5. Digital Assets

- 5.1.5.1. Cryptocurrencies

- 5.1.5.2. NFT

- 5.1.1. Digital Payments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 6. North America Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service proposition

- 6.1.1. Digital Payments

- 6.1.1.1. Digital Commerce

- 6.1.1.2. Mobile POS Payments

- 6.1.2. Digital Capital Raising

- 6.1.2.1. Crowdfunding

- 6.1.2.2. Crowdinvesting

- 6.1.2.3. Crowdlending

- 6.1.3. Digital Investment

- 6.1.3.1. Robo-Advisors

- 6.1.3.2. Neobrokers

- 6.1.4. NeoBanking

- 6.1.5. Digital Assets

- 6.1.5.1. Cryptocurrencies

- 6.1.5.2. NFT

- 6.1.1. Digital Payments

- 6.1. Market Analysis, Insights and Forecast - by Service proposition

- 7. South America Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service proposition

- 7.1.1. Digital Payments

- 7.1.1.1. Digital Commerce

- 7.1.1.2. Mobile POS Payments

- 7.1.2. Digital Capital Raising

- 7.1.2.1. Crowdfunding

- 7.1.2.2. Crowdinvesting

- 7.1.2.3. Crowdlending

- 7.1.3. Digital Investment

- 7.1.3.1. Robo-Advisors

- 7.1.3.2. Neobrokers

- 7.1.4. NeoBanking

- 7.1.5. Digital Assets

- 7.1.5.1. Cryptocurrencies

- 7.1.5.2. NFT

- 7.1.1. Digital Payments

- 7.1. Market Analysis, Insights and Forecast - by Service proposition

- 8. Europe Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service proposition

- 8.1.1. Digital Payments

- 8.1.1.1. Digital Commerce

- 8.1.1.2. Mobile POS Payments

- 8.1.2. Digital Capital Raising

- 8.1.2.1. Crowdfunding

- 8.1.2.2. Crowdinvesting

- 8.1.2.3. Crowdlending

- 8.1.3. Digital Investment

- 8.1.3.1. Robo-Advisors

- 8.1.3.2. Neobrokers

- 8.1.4. NeoBanking

- 8.1.5. Digital Assets

- 8.1.5.1. Cryptocurrencies

- 8.1.5.2. NFT

- 8.1.1. Digital Payments

- 8.1. Market Analysis, Insights and Forecast - by Service proposition

- 9. Middle East & Africa Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service proposition

- 9.1.1. Digital Payments

- 9.1.1.1. Digital Commerce

- 9.1.1.2. Mobile POS Payments

- 9.1.2. Digital Capital Raising

- 9.1.2.1. Crowdfunding

- 9.1.2.2. Crowdinvesting

- 9.1.2.3. Crowdlending

- 9.1.3. Digital Investment

- 9.1.3.1. Robo-Advisors

- 9.1.3.2. Neobrokers

- 9.1.4. NeoBanking

- 9.1.5. Digital Assets

- 9.1.5.1. Cryptocurrencies

- 9.1.5.2. NFT

- 9.1.1. Digital Payments

- 9.1. Market Analysis, Insights and Forecast - by Service proposition

- 10. Asia Pacific Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service proposition

- 10.1.1. Digital Payments

- 10.1.1.1. Digital Commerce

- 10.1.1.2. Mobile POS Payments

- 10.1.2. Digital Capital Raising

- 10.1.2.1. Crowdfunding

- 10.1.2.2. Crowdinvesting

- 10.1.2.3. Crowdlending

- 10.1.3. Digital Investment

- 10.1.3.1. Robo-Advisors

- 10.1.3.2. Neobrokers

- 10.1.4. NeoBanking

- 10.1.5. Digital Assets

- 10.1.5.1. Cryptocurrencies

- 10.1.5.2. NFT

- 10.1.1. Digital Payments

- 10.1. Market Analysis, Insights and Forecast - by Service proposition

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mambu

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Finleap Connect

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 N

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OneFor

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trade Republic*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AirBank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wefox Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Raisin DS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NeuFund

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HoneyBook

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hawk

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Mambu

List of Figures

- Figure 1: Global Fintech Market in Germany Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 3: North America Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 4: North America Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 7: South America Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 8: South America Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 11: Europe Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 12: Europe Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 15: Middle East & Africa Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 16: Middle East & Africa Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 19: Asia Pacific Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 20: Asia Pacific Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 2: Global Fintech Market in Germany Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 4: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 9: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 14: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 25: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 33: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fintech Market in Germany?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Fintech Market in Germany?

Key companies in the market include Mambu, Finleap Connect, N, OneFor, Trade Republic*List Not Exhaustive, AirBank, Wefox Group, Raisin DS, NeuFund, HoneyBook, Hawk:AI.

3. What are the main segments of the Fintech Market in Germany?

The market segments include Service proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Efficient and Cost-Effective Healthcare Services.

6. What are the notable trends driving market growth?

Increase in Investments in Fintech Sector is Fueling the Market.

7. Are there any restraints impacting market growth?

Increasing Regulatory Scrutiny and Compliance Requirements.

8. Can you provide examples of recent developments in the market?

June 2022: Airbank raised USD 20 million to make a comprehensive global SMB banking solution. The firm is focused on enabling real-time cash flow management instead of forcing small to medium-sized businesses (SMBs) to rely on weekly or monthly reporting to gain financial insights. This funding will help the company to expand its operation and capture more market share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fintech Market in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fintech Market in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fintech Market in Germany?

To stay informed about further developments, trends, and reports in the Fintech Market in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence