Key Insights

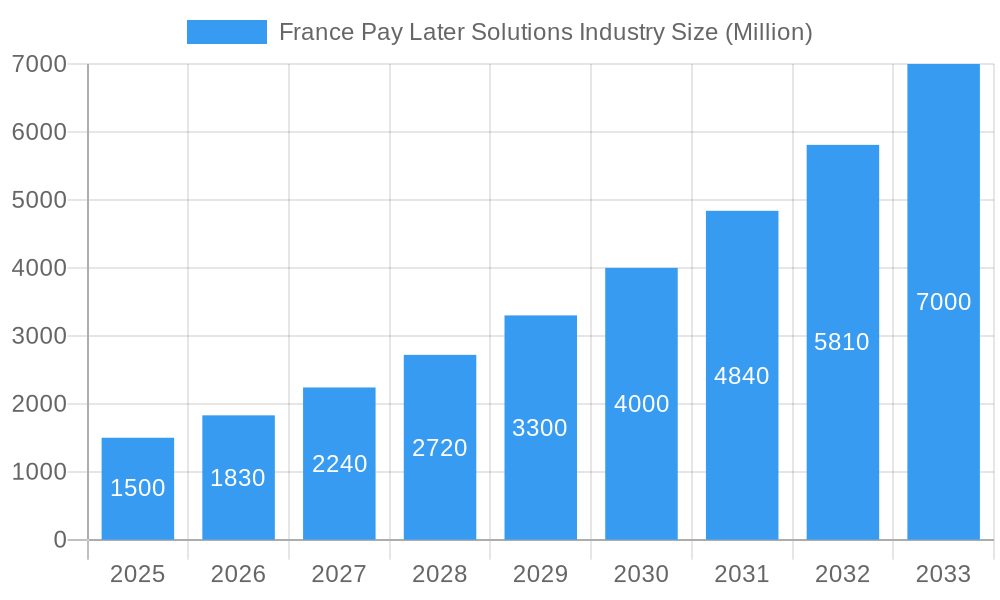

The French Pay Later Solutions market is exhibiting significant expansion, driven by increased e-commerce penetration, consumer demand for flexible payment options, and the growing adoption of Buy Now, Pay Later (BNPL) services. The market is projected to reach a size of 12.68 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 11.3% from the 2025 base year. Key growth drivers include enhanced smartphone affordability and internet accessibility, alongside effective marketing of BNPL's convenience. Primary market segments are online channels, with particular strength in Consumer Electronics, Fashion & Personal Care, and Healthcare, where BNPL enhances purchasing power. The competitive environment features established providers and innovative fintechs, supported by robust regulatory frameworks ensuring consumer protection and sustainable market growth through seamless platform integration.

France Pay Later Solutions Industry Market Size (In Billion)

France's economic standing within the EU, characterized by high disposable income, fosters a conducive environment for Pay Later Solutions market growth. Potential challenges include consumer debt concerns and evolving regulations. However, advancements in fraud detection and personalized customer experiences are expected to mitigate these risks. The market's attractiveness is underscored by the presence of major international and domestic players. Future success hinges on maintaining consumer trust, adapting to technological shifts, and navigating regulatory landscapes to sustain its pivotal role in the French digital economy.

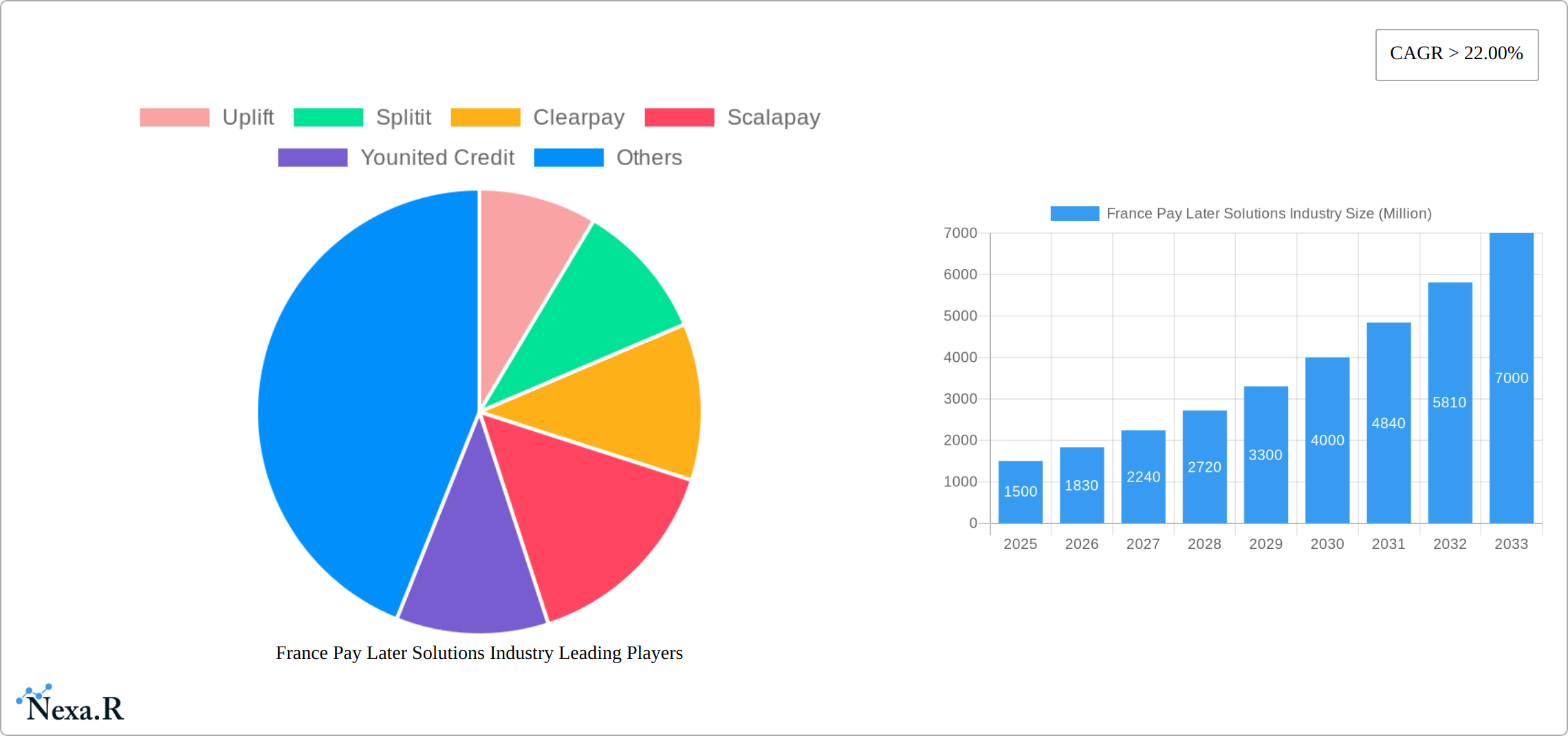

France Pay Later Solutions Industry Company Market Share

This report offers an exhaustive analysis of the France Pay Later Solutions industry, covering market dynamics, growth trajectories, competitive intelligence, and future projections from 2019-2033, with 2025 serving as the base and estimated year. Market size is estimated at 12.68 billion by 2033. Essential for industry stakeholders, investors, and strategists aiming to leverage opportunities in this dynamic sector.

France Pay Later Solutions Industry Market Dynamics & Structure

The French Pay Later Solutions market is experiencing significant growth, driven by rising consumer adoption, technological advancements, and supportive regulatory frameworks. Market concentration is moderate, with key players like Klarna, Alma, and Younited Credit holding significant shares but facing competition from emerging fintechs and established payment processors. Technological innovation, particularly in AI-powered risk assessment and seamless integration with e-commerce platforms, is a major driver. The regulatory landscape is evolving, with authorities focusing on consumer protection and responsible lending. The market faces competition from traditional credit cards and installment loan providers. End-user demographics show a strong skew towards younger, digitally savvy consumers. M&A activity is expected to remain robust, with larger players seeking to consolidate market share and expand their product offerings.

- Market Concentration: Moderate (xx% market share held by top 5 players in 2025)

- Technological Innovation: AI-powered risk assessment, seamless e-commerce integration.

- Regulatory Framework: Evolving, focusing on consumer protection and responsible lending.

- Competitive Substitutes: Traditional credit cards, installment loans.

- End-User Demographics: Predominantly younger, digitally native consumers.

- M&A Trends: High activity projected, driven by consolidation and expansion strategies. (xx M&A deals expected between 2025-2033).

France Pay Later Solutions Industry Growth Trends & Insights

The French Pay Later Solutions market exhibits robust growth, fueled by increasing e-commerce penetration, changing consumer preferences towards flexible payment options, and the rising popularity of Buy Now, Pay Later (BNPL) services. The market size expanded from xx Million in 2019 to xx Million in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is projected to continue, with the market expected to reach xx Million by 2033, driven by factors such as increasing smartphone penetration, improved digital financial literacy, and the ongoing expansion of e-commerce across various product categories. The adoption rate of BNPL services among French consumers is growing rapidly, contributing to the overall market expansion. Technological disruptions, including advancements in mobile payment technologies and embedded finance solutions, are further accelerating market growth. Shifts in consumer behavior, such as a preference for flexible payment options and a willingness to embrace new technologies, are also significant contributing factors.

Dominant Regions, Countries, or Segments in France Pay Later Solutions Industry

The online channel currently dominates the French Pay Later Solutions market, capturing xx% of the market share in 2025, followed by POS at xx%. Within product categories, Fashion and Personal Care demonstrate strong growth, followed by Consumer Electronics. This dominance is primarily attributed to higher online shopping penetration and the inherent suitability of BNPL for discretionary purchases.

- Online Channel: High growth due to e-commerce expansion and consumer preference for digital transactions.

- POS Channel: Moderate growth potential, driven by increasing retailer adoption.

- Fashion & Personal Care: Strong growth driven by high consumer spending and suitability of BNPL for these categories.

- Consumer Electronics: Significant growth potential, driven by increasing demand and high average transaction values.

- Healthcare: Moderate growth, with potential for expansion through partnerships with healthcare providers.

- Other Products: Steady growth, driven by diverse applications across various sectors.

France Pay Later Solutions Industry Product Landscape

The French Pay Later Solutions market is characterized by a dynamic and evolving product landscape. It encompasses a spectrum of offerings, from traditional installment plans and point-of-sale financing to sophisticated embedded Buy Now, Pay Later (BNPL) options seamlessly integrated into e-commerce platforms and merchant checkouts. Core product features prioritize flexibility in repayment terms, often with zero-interest options for shorter durations, and highly convenient and rapid application processes. Innovation is a key differentiator, with significant investment in advanced AI and machine learning for improved risk assessment and fraud detection, the creation of personalized offers to enhance user experience, and the expansion of integrations across diverse retail channels and leading payment gateways. These advancements are collectively aimed at boosting customer adoption, mitigating financial risks, and optimizing the profitability of BNPL providers.

Key Drivers, Barriers & Challenges in France Pay Later Solutions Industry

Key Drivers:

- Accelerating E-commerce Penetration: The sustained growth of online shopping fuels the demand for intuitive and accessible payment solutions like BNPL, directly contributing to higher conversion rates for merchants.

- Shifting Consumer Preferences: A pronounced and growing consumer appetite for flexible payment options, enabling them to manage cash flow effectively and increase purchasing power without immediate financial strain.

- Technological Advancements: The continuous evolution of technology, including APIs, data analytics, and AI, facilitates seamless integration with merchant platforms and enables more robust and accurate risk management capabilities.

- Merchant Demand for Increased Sales: Retailers are increasingly adopting BNPL solutions to drive higher average order values, reduce cart abandonment rates, and attract new customer segments.

Key Challenges and Restraints:

- Navigating Regulatory Uncertainty: The evolving regulatory landscape, particularly concerning consumer protection, responsible lending practices, and data privacy, presents ongoing challenges and requires continuous adaptation from providers.

- Intensifying Competition: The market is marked by vigorous competition from established global BNPL giants, local payment providers, and innovative startups, potentially leading to price pressures and a need for continuous differentiation.

- Managing Default Risks: While sophisticated risk assessment is improving, the inherent nature of deferred payment products carries the risk of customer defaults, which can impact provider profitability. (Estimated default rates are subject to market fluctuations and provider-specific strategies, with industry-wide estimates varying but generally being closely monitored).

- Consumer Over-indebtedness Concerns: Societal and regulatory concerns regarding potential consumer over-indebtedness due to the proliferation of easy credit options remain a significant consideration.

Emerging Opportunities in France Pay Later Solutions Industry

- Expansion into Underserved Markets: Identifying and serving micro, small, and medium-sized enterprises (MSMEs) and niche retail sectors that may not have been traditionally catered to by larger financial institutions.

- Development of Innovative and Segmented BNPL Products: Creating highly customized BNPL solutions tailored to specific industry verticals (e.g., healthcare, education, home improvement) or distinct customer demographics with unique spending patterns and financial needs.

- Strategic Partnerships and Ecosystem Integration: Forging robust collaborations with a wider array of retailers, financial institutions, e-commerce platforms, and technology providers to expand market reach, enhance service offerings, and create a more integrated payment experience.

- Cross-border BNPL Solutions: Developing and offering seamless BNPL services for cross-border e-commerce transactions, capitalizing on the growing international online shopping trend.

- Focus on Sustainability and Ethical Lending: Developing BNPL models that emphasize financial well-being and responsible consumer behavior, potentially attracting environmentally and socially conscious consumers and investors.

Growth Accelerators in the France Pay Later Solutions Industry

Technological advancements in AI-driven risk assessment and fraud prevention are crucial for sustainable growth. Strategic partnerships with leading e-commerce platforms and retailers will expand market reach and enhance product visibility. Expansion into new market segments, such as healthcare and education, will unlock further growth potential.

Notable Milestones in France Pay Later Solutions Industry Sector

- July 2021: Air Tahiti partners with Uplift to offer BNPL for flight bookings.

- November 2021: Younited Credit partners with Bankable and LiftForward to launch a BNPL product in Italy.

In-Depth France Pay Later Solutions Industry Market Outlook

The outlook for the French Pay Later Solutions market remains exceptionally positive and indicative of sustained, robust growth. This expansion will be propelled by a confluence of factors, including ongoing technological advancements that enhance user experience and operational efficiency, the formation of strategic alliances that broaden accessibility and service portfolios, and the ever-increasing acceptance and adoption by a diverse consumer base. The market is ripe with opportunities for further penetration into less-served segments, the innovative creation of differentiated BNPL products catering to specialized needs, and the deepening of partnerships across the entire retail and financial ecosystem. We anticipate significant market expansion, with the potential for strategic consolidation among players and the emergence of new, influential leaders who can effectively navigate the dynamic regulatory and competitive landscape. The continuous evolution of consumer behavior and the increasing demand for seamless, flexible payment options position BNPL as a cornerstone of modern commerce in France.

France Pay Later Solutions Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS

-

2. Product Category

- 2.1. Consumer Electronics

- 2.2. Fashion and Personal Care

- 2.3. Health Care

- 2.4. Other Products

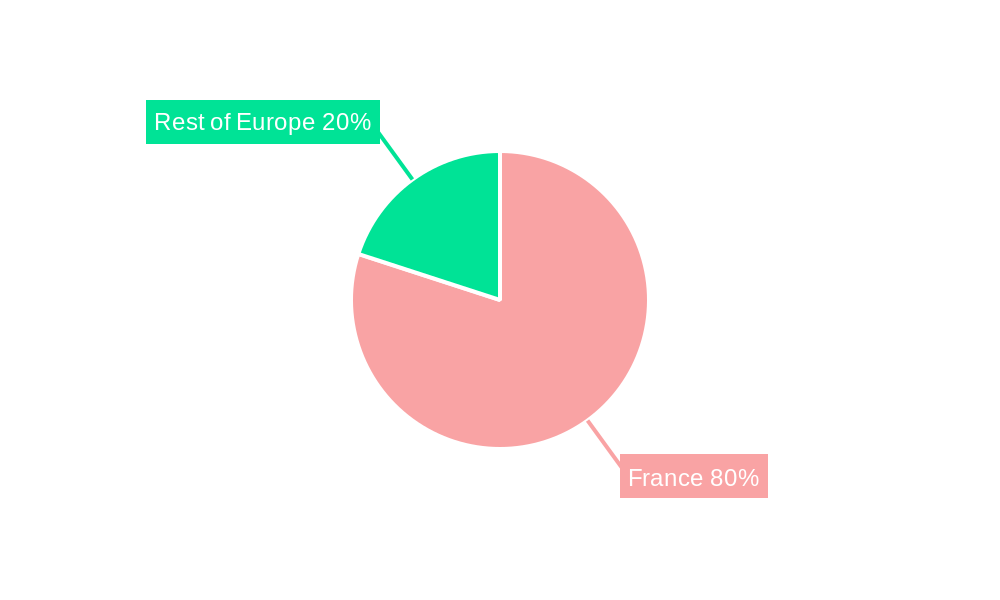

France Pay Later Solutions Industry Segmentation By Geography

- 1. France

France Pay Later Solutions Industry Regional Market Share

Geographic Coverage of France Pay Later Solutions Industry

France Pay Later Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Affordable and Convenient Payment Service of Buy Now Pay Later Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Pay Later Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Consumer Electronics

- 5.2.2. Fashion and Personal Care

- 5.2.3. Health Care

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Uplift

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Splitit

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Clearpay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scalapay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Younited Credit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Klarna

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alma

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thunes**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Paypal

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sezzle

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Uplift

List of Figures

- Figure 1: France Pay Later Solutions Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Pay Later Solutions Industry Share (%) by Company 2025

List of Tables

- Table 1: France Pay Later Solutions Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 2: France Pay Later Solutions Industry Revenue billion Forecast, by Product Category 2020 & 2033

- Table 3: France Pay Later Solutions Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Pay Later Solutions Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 5: France Pay Later Solutions Industry Revenue billion Forecast, by Product Category 2020 & 2033

- Table 6: France Pay Later Solutions Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Pay Later Solutions Industry?

The projected CAGR is approximately 11.3%.

2. Which companies are prominent players in the France Pay Later Solutions Industry?

Key companies in the market include Uplift, Splitit, Clearpay, Scalapay, Younited Credit, Klarna, Alma, Thunes**List Not Exhaustive, Paypal, Sezzle.

3. What are the main segments of the France Pay Later Solutions Industry?

The market segments include Channel, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Affordable and Convenient Payment Service of Buy Now Pay Later Platforms.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

July 2021: Air Tahiti entered into a strategic partnership with Fly Now Pay Later provider, Uplift. Under the collaboration, travelers booking Air Tahiti can pay in installments using the BNPL payment method offered by Uplift. Notably, Uplift has partnered with over 200 airlines to offer its BNPL payment method to travelers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Pay Later Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Pay Later Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Pay Later Solutions Industry?

To stay informed about further developments, trends, and reports in the France Pay Later Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence