Key Insights

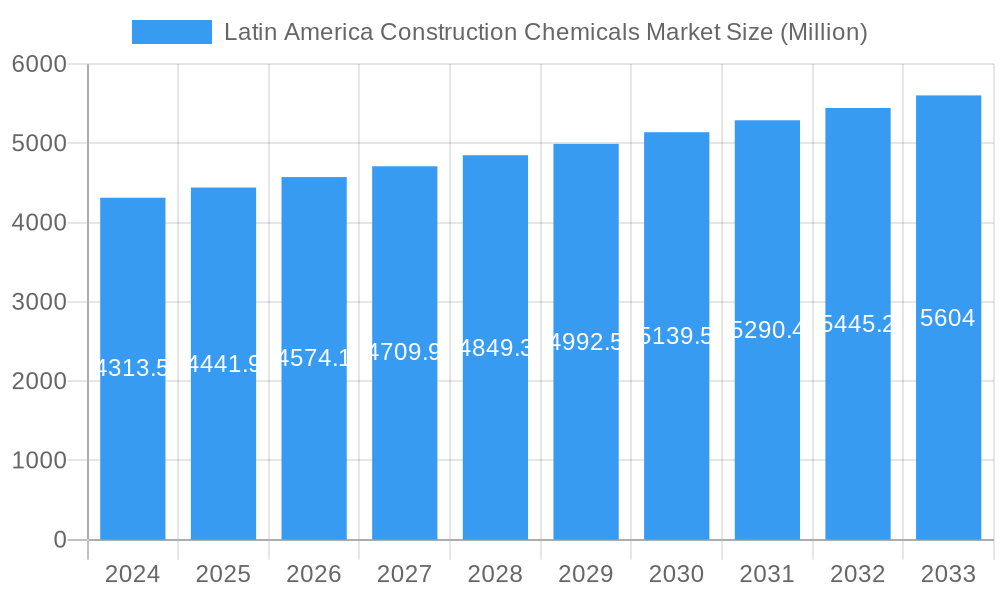

The Latin America Construction Chemicals Market is projected to reach USD 4313.5 million in 2024, exhibiting a steady Compound Annual Growth Rate (CAGR) of 2.9% during the forecast period of 2025-2033. This growth is primarily fueled by robust infrastructure development initiatives across the region, including significant investments in transportation networks, utilities, and public facilities. The increasing urbanization and a rising middle class in countries like Brazil, Mexico, and Colombia are driving demand for residential and commercial construction projects, further bolstering the market. Furthermore, a growing emphasis on sustainable building practices and the demand for advanced construction materials that enhance durability, energy efficiency, and performance are acting as key growth catalysts. The market is segmented across various product types, including concrete admixtures, cement grinding aids, surface treatments, repair and rehabilitation solutions, protective coatings, waterproofing agents, adhesives and sealants, and grouts and anchors, catering to diverse end-user industries such as commercial, industrial, infrastructure, and residential.

Latin America Construction Chemicals Market Market Size (In Billion)

The market's trajectory is significantly influenced by trends such as the adoption of green building materials and technologies, an increased focus on the longevity and resilience of structures against environmental challenges, and the adoption of advanced chemical formulations to improve construction efficiency and reduce overall project costs. However, the market also faces certain restraints, including the fluctuating raw material prices, which can impact the cost-effectiveness of construction chemicals, and the regulatory landscape, which, while evolving, can sometimes present challenges in terms of compliance and product approvals. Geographically, Brazil and Mexico are expected to lead the market, followed by other significant economies like Colombia and Argentina. Key industry players are actively engaged in research and development, strategic partnerships, and product innovation to capitalize on the burgeoning opportunities within the Latin America construction chemicals sector.

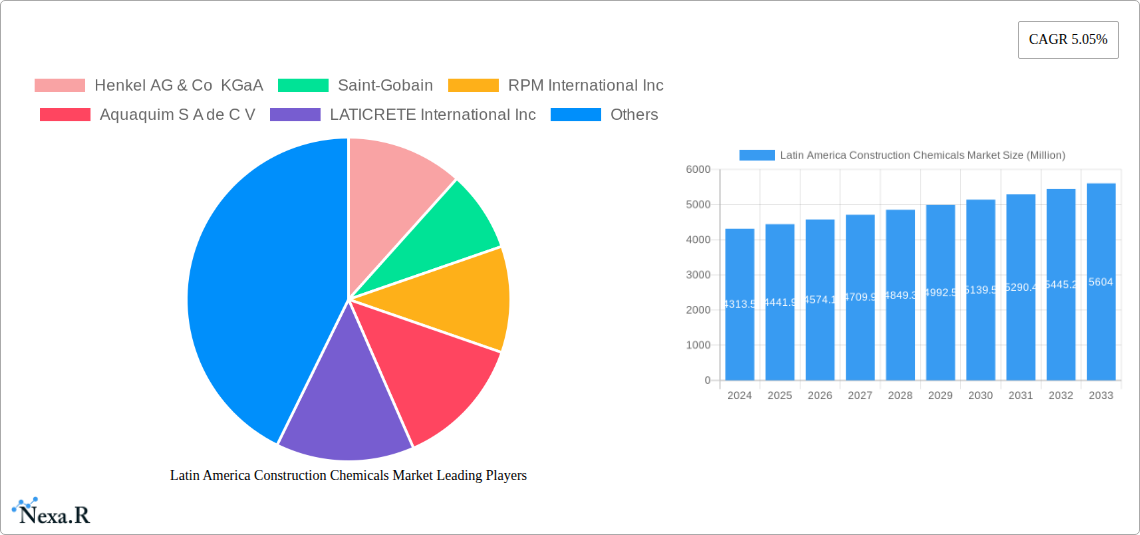

Latin America Construction Chemicals Market Company Market Share

This comprehensive report delivers an in-depth analysis of the Latin America construction chemicals market, a vital sector poised for significant expansion driven by robust infrastructure development, increasing urbanization, and evolving construction practices across the region. Covering the study period of 2019–2033, with 2025 as the base and estimated year, and a forecast period of 2025–2033, this report provides actionable intelligence for stakeholders. We meticulously examine the market size in million units, dissecting intricate dynamics, growth trends, product landscapes, and competitive strategies. This report is your definitive guide to navigating the opportunities and challenges within the burgeoning Latin America construction chemicals market.

Latin America Construction Chemicals Market Dynamics & Structure

The Latin America construction chemicals market exhibits a moderately fragmented structure, with key players like Sika AG, BASF SE, and CEMEX S A B de C V holding significant market shares, alongside emerging regional manufacturers. Technological innovation is a primary growth driver, with continuous advancements in formulations for enhanced performance, sustainability, and ease of application. Regulatory frameworks, particularly those focusing on environmental impact and building codes, are increasingly influencing product development and adoption rates. Competitive product substitutes, while present, are often outmatched by the specialized performance benefits offered by advanced construction chemicals. End-user demographics are shifting, with a growing demand for sustainable and durable construction solutions from both commercial and residential sectors. Mergers and acquisitions (M&A) are a notable trend, with companies like Arkema Group and Henkel AG & Co KGaA strategically acquiring smaller players to expand their product portfolios and geographical reach.

- Market Concentration: Moderately fragmented with a mix of multinational corporations and regional specialists.

- Technological Innovation Drivers: Focus on sustainability, enhanced durability, faster curing times, and energy-efficient solutions.

- Regulatory Frameworks: Increasing emphasis on green building standards, VOC emissions, and product safety certifications.

- Competitive Product Substitutes: Traditional materials often lack the specialized performance of advanced chemical solutions.

- End-User Demographics: Growing demand for premium, sustainable, and high-performance products from developers and contractors.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand product offerings.

Latin America Construction Chemicals Market Growth Trends & Insights

The Latin America construction chemicals market is projected to witness substantial growth, with an estimated market size of over XXX million units by 2025, and is anticipated to expand at a compelling Compound Annual Growth Rate (CAGR) of approximately X.XX% throughout the forecast period (2025–2033). This surge is primarily attributed to intensified infrastructure development initiatives across key economies like Brazil, Mexico, and Colombia, fueled by government investments in transportation networks, energy projects, and urban renewal. The escalating demand for resilient and sustainable construction materials, driven by heightened awareness of climate change and a need for long-term structural integrity, is further accelerating the adoption of advanced construction chemicals.

Technological disruptions are playing a pivotal role, with the introduction of innovative solutions like self-healing concrete, advanced waterproofing membranes, and high-performance adhesives and sealants revolutionizing construction practices. These innovations not only enhance the durability and lifespan of structures but also contribute to reduced maintenance costs and improved energy efficiency. Consumer behavior is also evolving; developers and contractors are increasingly prioritizing solutions that offer superior performance, faster application times, and a reduced environmental footprint. This shift in preference is creating significant opportunities for manufacturers who can deliver cutting-edge, eco-friendly, and cost-effective construction chemical products. The residential construction sector, particularly in burgeoning urban centers, is a significant contributor, with a rising middle class demanding modern and durable housing solutions.

- Market Size Evolution: Expected to grow significantly from XXX million units in 2025 to over XXX million units by 2033.

- Adoption Rates: Increasing adoption of specialized construction chemicals across diverse project types, from large-scale infrastructure to residential buildings.

- Technological Disruptions: Introduction of smart materials, eco-friendly formulations, and advanced application technologies.

- Consumer Behavior Shifts: Greater emphasis on sustainability, durability, performance, and cost-effectiveness in product selection.

- Market Penetration: Deeper penetration into emerging markets and specialized application segments.

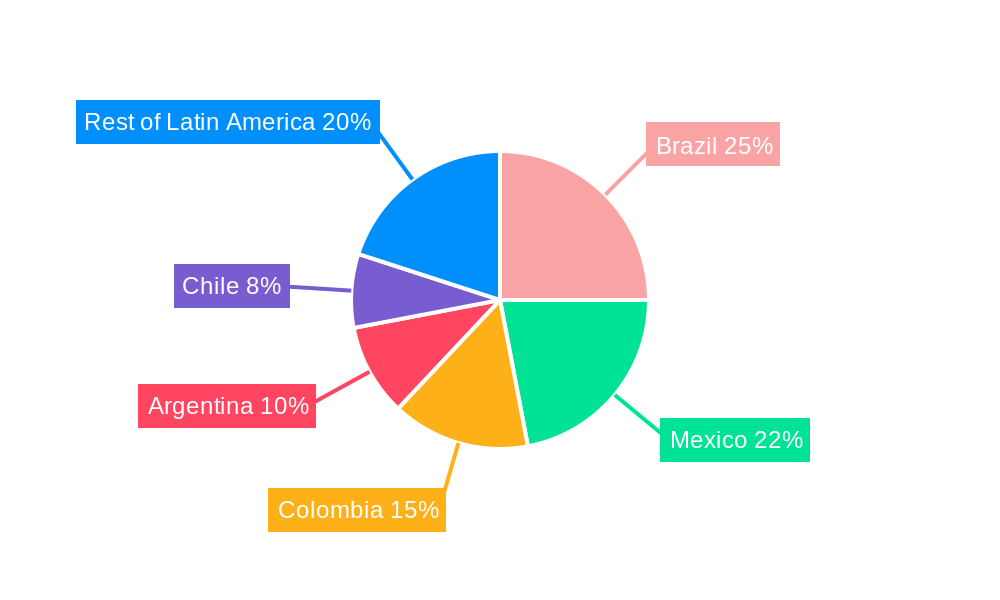

Dominant Regions, Countries, or Segments in Latin America Construction Chemicals Market

Brazil stands out as the dominant region in the Latin America construction chemicals market, driven by its substantial economic scale, ongoing infrastructure modernization programs, and a large population contributing to sustained residential and commercial construction activity. The country's diverse end-user industry landscape, encompassing robust Infrastructure, Commercial, and Residential segments, provides a broad base for the consumption of a wide array of construction chemicals. Key product segments, particularly Concrete Admixture and Cement Grinding Aids, are witnessing remarkable growth due to the high demand for enhanced concrete performance in large-scale projects like dams, bridges, and high-rise buildings.

Dominant Region: Brazil

- Key Drivers: Significant government investment in infrastructure projects (transportation, energy), large-scale urban development, and a strong residential construction sector.

- Market Share: Brazil accounts for an estimated XX% of the total Latin America construction chemicals market in 2025.

- Growth Potential: Continuous pipeline of mega-projects and a growing demand for sustainable construction solutions.

Leading Product Segments:

- Concrete Admixture and Cement Grinding Aids: Essential for improving the workability, strength, and durability of concrete, crucial for Brazil's infrastructure boom. Estimated market value of over XXX million units in 2025.

- Waterproofing: High demand due to varying climatic conditions and the need to protect structures from moisture damage, especially in coastal and high-humidity areas. Estimated market value of over XXX million units in 2025.

- Protective Coatings: Essential for extending the lifespan of structures by providing resistance against corrosion, weathering, and chemical attacks. Estimated market value of over XXX million units in 2025.

Key End-User Industries:

- Infrastructure: Major driver with ongoing and planned projects in transportation, utilities, and public works.

- Commercial: Driven by new office buildings, retail spaces, and hospitality projects.

- Residential: Sustained demand due to population growth and urbanization trends.

Mexico emerges as another significant contributor, with ongoing infrastructure development and a thriving industrial sector boosting the demand for specialized construction chemicals. Its strategic location and strong manufacturing base further enhance its market prominence. Colombia and Chile are also exhibiting robust growth, fueled by government initiatives aimed at improving infrastructure and a rising demand for modern construction solutions. The Rest of Latin America segment, though fragmented, presents considerable untapped potential with developing economies and increasing construction activities.

Latin America Construction Chemicals Market Product Landscape

The Latin America construction chemicals market is characterized by a dynamic product landscape featuring innovations aimed at enhancing performance, sustainability, and ease of application. Concrete admixtures, including superplasticizers and retarders, are crucial for optimizing concrete properties for diverse construction needs. Waterproofing solutions, such as membranes and coatings, are vital for protecting structures from moisture ingress. Protective coatings are engineered to resist harsh environmental conditions and chemical attacks, extending asset life. Adhesives and sealants are indispensable for bonding various construction materials and ensuring joint integrity. The development of eco-friendly formulations, with low volatile organic compound (VOC) content, is a significant trend, aligning with growing environmental regulations and a demand for sustainable building practices.

Key Drivers, Barriers & Challenges in Latin America Construction Chemicals Market

Key Drivers:

- Infrastructure Development: Significant government investment in roads, bridges, airports, and energy projects across the region.

- Urbanization: Increasing population density in cities driving demand for residential, commercial, and industrial construction.

- Technological Advancements: Introduction of high-performance, durable, and sustainable construction chemical solutions.

- Growing Awareness of Durability and Sustainability: Demand for longer-lasting structures and environmentally friendly building materials.

Barriers & Challenges:

- Economic Volatility and Political Instability: Fluctuations in regional economies and political uncertainties can impact construction spending.

- Supply Chain Disruptions: Global and local supply chain issues can affect the availability and cost of raw materials and finished products.

- Regulatory Hurdles and Compliance: Navigating diverse and evolving regulatory landscapes across different countries can be complex.

- Price Sensitivity: While performance is valued, cost remains a significant consideration for many construction projects, especially in price-sensitive markets.

- Skilled Labor Shortages: Lack of adequately trained personnel for the application of specialized construction chemicals can hinder adoption.

Emerging Opportunities in Latin America Construction Chemicals Market

Emerging opportunities in the Latin America construction chemicals market lie in the increasing demand for sustainable building materials, particularly in light of growing environmental consciousness and stricter regulations. The development and adoption of green building chemicals, such as low-VOC paints, bio-based adhesives, and recycled content admixtures, present a significant growth avenue. Furthermore, the burgeoning adoption of smart construction technologies is creating a need for specialized chemicals that integrate with digital construction processes, such as those used in 3D printing concrete. Untapped markets in smaller Latin American countries, with their developing infrastructure needs, also offer substantial potential for market penetration and expansion. The retrofitting and rehabilitation of existing structures, driven by the need for energy efficiency and structural upgrades, represent another promising area.

Growth Accelerators in the Latin America Construction Chemicals Market Industry

Growth in the Latin America construction chemicals market is being accelerated by several key factors. Technological breakthroughs in material science are leading to the development of more advanced and specialized products, such as self-healing concrete and advanced waterproofing systems, which offer superior performance and longevity. Strategic partnerships between global chemical manufacturers and local distributors are crucial for expanding market reach and understanding regional specificities. Furthermore, market expansion strategies, including the establishment of local production facilities and robust distribution networks, are enabling companies to cater effectively to the diverse needs of Latin American construction projects. The increasing focus on green building certifications and sustainable construction practices acts as a significant catalyst, pushing the demand for eco-friendly chemical solutions.

Key Players Shaping the Latin America Construction Chemicals Market Market

- Henkel AG & Co KGaA

- Saint-Gobain

- RPM International Inc

- Aquaquim S A de C V

- LATICRETE International Inc

- HOLCIM

- 3M

- Dow Inc

- Ashland

- BASF SE

- Arkema Group

- CEMEX S A B de C V

- Sika AG

- MAPEI SpA

- Clariant International Ltd

Notable Milestones in Latin America Construction Chemicals Market Sector

- July 2022: Arkema announced the acquisition of Polimeros Especiales, a leading high-performance waterborne resin manufacturer in Mexico. The acquisition is expected to help Arkema further increase the production capacity of waterborne resins used in various construction applications.

- May 2022: Sika AG opened a new plant in Santa Cruz de la Sierra, Bolivia, to double its production capacity for mortar and concrete admixtures. The new plant is expected to help Sika AG to position itself for continued growth in the dynamic Bolivian construction market.

In-Depth Latin America Construction Chemicals Market Market Outlook

The future outlook for the Latin America construction chemicals market is highly promising, fueled by sustained infrastructure investments, rapid urbanization, and a growing emphasis on sustainable construction practices. Growth accelerators such as technological innovations in material science, strategic market expansion initiatives by key players, and the increasing demand for eco-friendly solutions will continue to propel the market forward. Strategic partnerships and acquisitions are expected to reshape the competitive landscape, enabling companies to broaden their product portfolios and strengthen their regional presence. The market is poised to witness significant opportunities in emerging economies and specialized application areas, making it an attractive sector for investment and innovation.

Latin America Construction Chemicals Market Segmentation

-

1. Product Type

- 1.1. Concrete Admixture and Cement Grinding Aids

- 1.2. Surface Treatment

- 1.3. Repair and Rehabilitation

- 1.4. Protective Coatings

- 1.5. Industrial Flooring

- 1.6. Waterproofing

- 1.7. Adhesives and Sealants

- 1.8. Grout and Anchor

-

2. End-user Industry

- 2.1. Commercial

- 2.2. Industrial

- 2.3. Infrastructure

- 2.4. Residential

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Chile

- 3.5. Mexico

- 3.6. Rest of Latin America

Latin America Construction Chemicals Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Mexico

- 6. Rest of Latin America

Latin America Construction Chemicals Market Regional Market Share

Geographic Coverage of Latin America Construction Chemicals Market

Latin America Construction Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Construction Activities in the Region; Increasing Investments in the Infrastructure Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Environmental Regulations Regarding VOC Emissions; Other Restrains

- 3.4. Market Trends

- 3.4.1. Residential Segment is Anticipated to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Construction Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Concrete Admixture and Cement Grinding Aids

- 5.1.2. Surface Treatment

- 5.1.3. Repair and Rehabilitation

- 5.1.4. Protective Coatings

- 5.1.5. Industrial Flooring

- 5.1.6. Waterproofing

- 5.1.7. Adhesives and Sealants

- 5.1.8. Grout and Anchor

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Commercial

- 5.2.2. Industrial

- 5.2.3. Infrastructure

- 5.2.4. Residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Chile

- 5.3.5. Mexico

- 5.3.6. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Chile

- 5.4.5. Mexico

- 5.4.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil Latin America Construction Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Concrete Admixture and Cement Grinding Aids

- 6.1.2. Surface Treatment

- 6.1.3. Repair and Rehabilitation

- 6.1.4. Protective Coatings

- 6.1.5. Industrial Flooring

- 6.1.6. Waterproofing

- 6.1.7. Adhesives and Sealants

- 6.1.8. Grout and Anchor

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Commercial

- 6.2.2. Industrial

- 6.2.3. Infrastructure

- 6.2.4. Residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Chile

- 6.3.5. Mexico

- 6.3.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina Latin America Construction Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Concrete Admixture and Cement Grinding Aids

- 7.1.2. Surface Treatment

- 7.1.3. Repair and Rehabilitation

- 7.1.4. Protective Coatings

- 7.1.5. Industrial Flooring

- 7.1.6. Waterproofing

- 7.1.7. Adhesives and Sealants

- 7.1.8. Grout and Anchor

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Commercial

- 7.2.2. Industrial

- 7.2.3. Infrastructure

- 7.2.4. Residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Chile

- 7.3.5. Mexico

- 7.3.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Colombia Latin America Construction Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Concrete Admixture and Cement Grinding Aids

- 8.1.2. Surface Treatment

- 8.1.3. Repair and Rehabilitation

- 8.1.4. Protective Coatings

- 8.1.5. Industrial Flooring

- 8.1.6. Waterproofing

- 8.1.7. Adhesives and Sealants

- 8.1.8. Grout and Anchor

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Commercial

- 8.2.2. Industrial

- 8.2.3. Infrastructure

- 8.2.4. Residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Chile

- 8.3.5. Mexico

- 8.3.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Chile Latin America Construction Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Concrete Admixture and Cement Grinding Aids

- 9.1.2. Surface Treatment

- 9.1.3. Repair and Rehabilitation

- 9.1.4. Protective Coatings

- 9.1.5. Industrial Flooring

- 9.1.6. Waterproofing

- 9.1.7. Adhesives and Sealants

- 9.1.8. Grout and Anchor

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Commercial

- 9.2.2. Industrial

- 9.2.3. Infrastructure

- 9.2.4. Residential

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Chile

- 9.3.5. Mexico

- 9.3.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Mexico Latin America Construction Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Concrete Admixture and Cement Grinding Aids

- 10.1.2. Surface Treatment

- 10.1.3. Repair and Rehabilitation

- 10.1.4. Protective Coatings

- 10.1.5. Industrial Flooring

- 10.1.6. Waterproofing

- 10.1.7. Adhesives and Sealants

- 10.1.8. Grout and Anchor

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Commercial

- 10.2.2. Industrial

- 10.2.3. Infrastructure

- 10.2.4. Residential

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Argentina

- 10.3.3. Colombia

- 10.3.4. Chile

- 10.3.5. Mexico

- 10.3.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Latin America Latin America Construction Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Concrete Admixture and Cement Grinding Aids

- 11.1.2. Surface Treatment

- 11.1.3. Repair and Rehabilitation

- 11.1.4. Protective Coatings

- 11.1.5. Industrial Flooring

- 11.1.6. Waterproofing

- 11.1.7. Adhesives and Sealants

- 11.1.8. Grout and Anchor

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Commercial

- 11.2.2. Industrial

- 11.2.3. Infrastructure

- 11.2.4. Residential

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Brazil

- 11.3.2. Argentina

- 11.3.3. Colombia

- 11.3.4. Chile

- 11.3.5. Mexico

- 11.3.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Henkel AG & Co KGaA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Saint-Gobain

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 RPM International Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Aquaquim S A de C V

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 LATICRETE International Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 HOLCIM

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 3M

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dow Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Ashland

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BASF SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Arkema Group

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 CEMEX S A B de C V

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Sika AG*List Not Exhaustive

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 MAPEI SpA

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Clariant International Ltd

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Latin America Construction Chemicals Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Construction Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Construction Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Construction Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Latin America Construction Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Latin America Construction Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Latin America Construction Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Latin America Construction Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 7: Latin America Construction Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Latin America Construction Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Latin America Construction Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Latin America Construction Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Latin America Construction Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Latin America Construction Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Latin America Construction Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Latin America Construction Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Latin America Construction Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Latin America Construction Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Latin America Construction Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Latin America Construction Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Latin America Construction Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Latin America Construction Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Latin America Construction Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Latin America Construction Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Latin America Construction Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Latin America Construction Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Latin America Construction Chemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: Latin America Construction Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 27: Latin America Construction Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Latin America Construction Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Construction Chemicals Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the Latin America Construction Chemicals Market?

Key companies in the market include Henkel AG & Co KGaA, Saint-Gobain, RPM International Inc, Aquaquim S A de C V, LATICRETE International Inc, HOLCIM, 3M, Dow Inc, Ashland, BASF SE, Arkema Group, CEMEX S A B de C V, Sika AG*List Not Exhaustive, MAPEI SpA, Clariant International Ltd.

3. What are the main segments of the Latin America Construction Chemicals Market?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Construction Activities in the Region; Increasing Investments in the Infrastructure Sector; Other Drivers.

6. What are the notable trends driving market growth?

Residential Segment is Anticipated to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Environmental Regulations Regarding VOC Emissions; Other Restrains.

8. Can you provide examples of recent developments in the market?

July 2022: Arkema announced the acquisition of Polimeros Especiales, a leading high-performance waterborne resin manufacturer in Mexico. The acquisition is expected to help Arkema further increase the production capacity of waterborne resins used in various construction applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Construction Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Construction Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Construction Chemicals Market?

To stay informed about further developments, trends, and reports in the Latin America Construction Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence