Key Insights

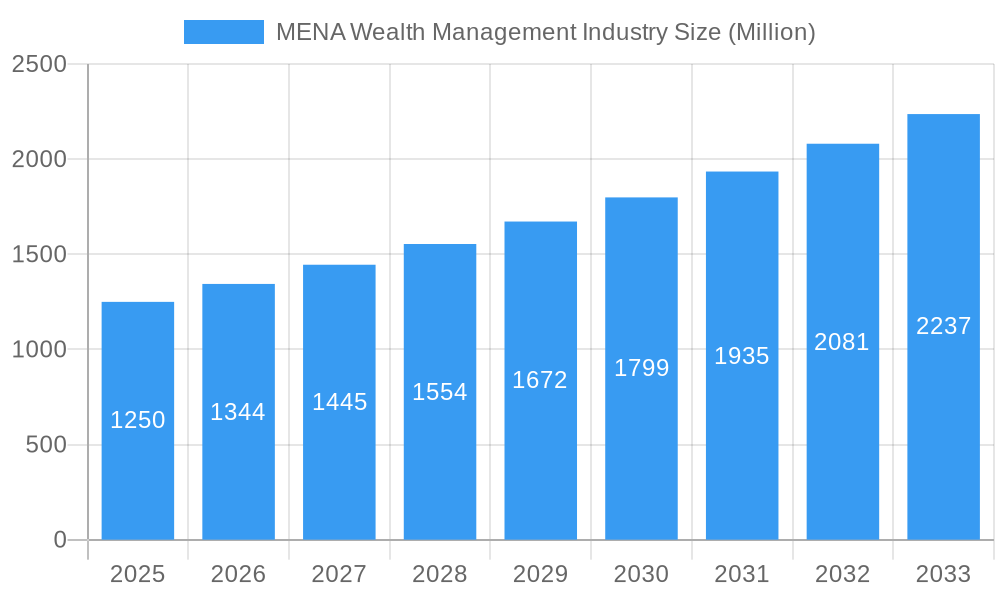

The MENA (Middle East and North Africa) wealth management industry is experiencing robust growth, projected to reach a market size of $1.25 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 7.49% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a burgeoning affluent population within the region is driving increased demand for sophisticated investment and wealth management services. Secondly, economic diversification initiatives across several MENA countries are fostering a more stable and attractive investment climate. Furthermore, technological advancements, particularly in fintech, are enhancing accessibility and efficiency within the wealth management sector, attracting a wider range of investors and improving service delivery. The industry is also witnessing a rising demand for personalized and tailored investment strategies, catering to the unique financial goals of high-net-worth individuals and families. Finally, increasing awareness of wealth preservation and succession planning further contributes to the market’s sustained growth.

MENA Wealth Management Industry Market Size (In Billion)

However, challenges remain. Regulatory changes and increasing competition from both established international players and nimble fintech startups pose ongoing hurdles. Geopolitical uncertainties within the region can also influence investment decisions and market volatility. Nevertheless, the long-term outlook for the MENA wealth management industry remains positive, with continued growth projected throughout the forecast period. Key players such as NCB Capital, Investcorp, Riyad Capital, and others are actively shaping the industry landscape through strategic partnerships, acquisitions, and the development of innovative product offerings. The expansion into digital channels and the adoption of advanced data analytics are expected to be critical success factors for firms seeking to thrive in this dynamic market.

MENA Wealth Management Industry Company Market Share

MENA Wealth Management Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and North Africa (MENA) wealth management industry, covering market dynamics, growth trends, key players, and future outlook from 2019 to 2033. The report utilizes data from 2019-2024 as its historical period, with 2025 as the base and estimated year, and forecasts extending to 2033. This analysis delves into both the parent market (MENA Financial Services) and child market (Wealth Management), offering granular insights for industry professionals, investors, and strategists. The total market size in 2025 is estimated at xx Million.

MENA Wealth Management Industry Market Dynamics & Structure

The MENA wealth management industry presents a dynamic landscape characterized by moderate market concentration, with established players alongside a growing number of smaller firms. Technological innovation, particularly within fintech and digital platforms, is a pivotal growth driver. However, this progress is tempered by regulatory hurdles and legacy infrastructure limitations hindering widespread adoption. The regulatory environment is undergoing significant evolution, with a heightened focus on robust investor protection and stringent compliance measures. Competitive pressures arise from direct investment options, alternative asset classes, and the rise of robo-advisors. A notable demographic shift towards a younger, tech-savvy population fuels the demand for personalized and digitally-enabled wealth management solutions. Mergers and acquisitions (M&A) activity remains substantial, with projections indicating a significant number of deals in 2025, primarily driven by consolidation and expansion strategies aimed at capturing market share and enhancing service offerings.

- Market Concentration: A moderately concentrated market, with the top 5 players anticipated to hold a substantial market share by 2025. Further consolidation is expected.

- Technological Innovation: Fintech's rapid advancement is driving digital transformation, but regulatory and infrastructural challenges impede seamless adoption.

- Regulatory Framework: The evolving regulatory landscape prioritizes investor protection and transparency, leading to increased compliance costs for firms.

- Competitive Landscape: Direct investments, alternative assets, and the expansion of robo-advisors create a competitive environment demanding innovation and adaptability.

- End-User Demographics: The burgeoning young, affluent population demands personalized and digital-first wealth management solutions.

- M&A Activity: Significant M&A activity is predicted for 2025, reflecting strategic moves for market consolidation and service expansion.

MENA Wealth Management Industry Growth Trends & Insights

The MENA wealth management market experienced significant growth during the historical period (2019-2024), driven by increasing high-net-worth individuals (HNWIs) and rising disposable incomes. The market size is projected to reach xx Million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, including the rise of robo-advisors and AI-powered investment platforms, are reshaping the industry landscape. Consumer behavior is shifting towards digital engagement, personalized services, and greater transparency. This necessitates continuous adaptation by wealth management firms. The increasing adoption of digital platforms leads to higher efficiency and reduced costs, fueling market growth. Regulatory changes will also impact growth, promoting transparency and security.

Dominant Regions, Countries, or Segments in MENA Wealth Management Industry

The UAE and Saudi Arabia remain the dominant forces within the MENA wealth management market, commanding a significant portion of the total market share in 2025. This leadership stems from several key factors: robust economic expansion, a high concentration of high-net-worth individuals (HNWIs), government policies supportive of financial sector development, and advanced infrastructure facilitating financial transactions. Other crucial drivers include the growth of financial literacy, rising investment awareness among the population, and the burgeoning Islamic finance sector. Significant growth potential is evident in other markets like Egypt and Qatar, fueled by the expansion of the middle class and improvements in their respective investment environments. The diversification of the regional economy also plays a significant role in the expansion of the wealth management industry.

- Key Drivers:

- Robust economic growth in the UAE and Saudi Arabia.

- High concentration of HNWIs and a growing affluent middle class.

- Government initiatives fostering financial sector development.

- Well-developed financial infrastructure and technological advancements.

- Increased financial literacy and investment awareness.

- Expansion of Islamic finance.

- Dominance Factors:

- Substantial market share (projected xx% in 2025 for UAE and Saudi Arabia).

- Strong regulatory frameworks and investor protection measures.

- Established positions as leading financial hubs in the region.

- Significant investment in technological infrastructure.

MENA Wealth Management Industry Product Landscape

The product landscape is diversifying, offering a range of services from traditional wealth management to sophisticated investment solutions. Innovative products include tailored investment portfolios, ESG (Environmental, Social, and Governance) focused investments, robo-advisory platforms, and digital banking services integrated with wealth management tools. These products are characterized by enhanced personalization, transparent fee structures, and user-friendly interfaces. The adoption of advanced analytics and AI improves investment strategies and risk management.

Key Drivers, Barriers & Challenges in MENA Wealth Management Industry

Key Drivers: The MENA wealth management industry is propelled by a confluence of factors including a rising HNWIs population, a favorable regulatory environment, government initiatives aimed at fostering financial inclusion, technological advancements, and a growing demand for sophisticated investment products and services catering to diverse investor needs.

Challenges: The industry faces significant challenges, including stringent regulatory compliance requirements, varying levels of financial literacy across different segments of the population, cybersecurity threats, intense competition from agile fintech disruptors, and the impact of regional geopolitical uncertainty. These factors can impede market expansion and impact profitability. Addressing these challenges requires a multi-faceted approach involving collaboration between regulatory bodies, financial institutions, and technology providers.

Emerging Opportunities in MENA Wealth Management Industry

Significant opportunities abound in the MENA wealth management sector. These include: expanding wealth management services to the burgeoning middle class, developing specialized solutions tailored to specific demographics (e.g., women, millennials), and capitalizing on the rising demand for sustainable and ethical investments. The vast untapped potential of the SME sector also presents a significant avenue for growth. Furthermore, technological innovations such as blockchain and AI offer avenues to enhance operational efficiency and client engagement, creating new value propositions.

Growth Accelerators in the MENA Wealth Management Industry

Technological advancements, particularly in AI and big data analytics, are poised to revolutionize client service and investment strategies, driving efficiency and fueling growth. Strategic partnerships between established financial institutions and innovative fintech companies can effectively bridge the gap between legacy systems and modern solutions. Expansion into untapped markets and strategic diversification of product offerings will also contribute to market expansion and growth. A focus on client-centricity and personalized financial planning will also drive customer acquisition and retention.

Key Players Shaping the MENA Wealth Management Industry Market

- NCB Capital

- Investcorp

- Riyad Capital

- Lazard Asset Management

- Arab National Investment Company

- Aljazira Capital

- Emirates NBD Asset Management

- Waha Capital

- Fippar Holdings

- Orange Asset Management (List Not Exhaustive)

Notable Milestones in MENA Wealth Management Industry Sector

- January 2023: Emirates NBD Securities partnered with Abu Dhabi Securities Exchange (ADX), enhancing trading access and digital onboarding. This improved efficiency and expanded market reach.

- January 2023: Emirates NBD successfully priced its inaugural AED 1 billion dirham-denominated bonds, showcasing financial strength and market confidence. This strengthened the bank's position and potentially influenced investor sentiment positively.

In-Depth MENA Wealth Management Industry Market Outlook

The MENA wealth management industry is poised for continued growth, driven by favorable demographics, economic expansion, and technological innovation. Strategic partnerships, investments in digital infrastructure, and expansion into underserved markets will be crucial for long-term success. The increasing focus on sustainable and ethical investments presents significant opportunities for firms to differentiate themselves and capture market share. The forecast period suggests a robust growth trajectory, promising attractive returns for investors and significant transformation for the industry.

MENA Wealth Management Industry Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluents

- 1.4. Other Client Types

-

2. Provider Type

- 2.1. Private Bankers

- 2.2. Fintech Advisors

- 2.3. Family Offices

- 2.4. Other Provider Types

MENA Wealth Management Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. Algeria

- 3. Egypt

- 4. United Arab Emirates

- 5. Rest of MENA Region

MENA Wealth Management Industry Regional Market Share

Geographic Coverage of MENA Wealth Management Industry

MENA Wealth Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region

- 3.3. Market Restrains

- 3.3.1. Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region

- 3.4. Market Trends

- 3.4.1. Saudi Arabia Asset Under Management Trend Shows Growth in Wealth Management Industry on MENA Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluents

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Private Bankers

- 5.2.2. Fintech Advisors

- 5.2.3. Family Offices

- 5.2.4. Other Provider Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Algeria

- 5.3.3. Egypt

- 5.3.4. United Arab Emirates

- 5.3.5. Rest of MENA Region

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Saudi Arabia MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluents

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. Private Bankers

- 6.2.2. Fintech Advisors

- 6.2.3. Family Offices

- 6.2.4. Other Provider Types

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Algeria MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluents

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. Private Bankers

- 7.2.2. Fintech Advisors

- 7.2.3. Family Offices

- 7.2.4. Other Provider Types

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. Egypt MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluents

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. Private Bankers

- 8.2.2. Fintech Advisors

- 8.2.3. Family Offices

- 8.2.4. Other Provider Types

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Arab Emirates MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluents

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. Private Bankers

- 9.2.2. Fintech Advisors

- 9.2.3. Family Offices

- 9.2.4. Other Provider Types

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of MENA Region MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluents

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. Private Bankers

- 10.2.2. Fintech Advisors

- 10.2.3. Family Offices

- 10.2.4. Other Provider Types

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NCB Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Investcorp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Riyad Capital

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lazard Asset Management

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arab National Investment Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aljazira Capital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emirates NBD Asset Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Waha Capital

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fippar Holdings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Orange Asset Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NCB Capital

List of Figures

- Figure 1: MENA Wealth Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MENA Wealth Management Industry Share (%) by Company 2025

List of Tables

- Table 1: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 3: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 4: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 5: MENA Wealth Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: MENA Wealth Management Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 9: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 10: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 11: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 15: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 17: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 20: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 21: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 22: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 23: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 26: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 27: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 28: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 29: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 32: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 33: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 34: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 35: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MENA Wealth Management Industry?

The projected CAGR is approximately 7.49%.

2. Which companies are prominent players in the MENA Wealth Management Industry?

Key companies in the market include NCB Capital, Investcorp, Riyad Capital, Lazard Asset Management, Arab National Investment Company, Aljazira Capital, Emirates NBD Asset Management, Waha Capital, Fippar Holdings, Orange Asset Management**List Not Exhaustive.

3. What are the main segments of the MENA Wealth Management Industry?

The market segments include Client Type, Provider Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region.

6. What are the notable trends driving market growth?

Saudi Arabia Asset Under Management Trend Shows Growth in Wealth Management Industry on MENA Region.

7. Are there any restraints impacting market growth?

Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region.

8. Can you provide examples of recent developments in the market?

January 2023: Emirates NBD Securities, a leading brokerage firm in the UAE, partnered with Abu Dhabi Securities Exchange (ADX) to provide traders with instant access to the exchange's listed companies, enabling it to offer instant trading account opening and digital onboarding to another UAE stock exchange.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MENA Wealth Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MENA Wealth Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MENA Wealth Management Industry?

To stay informed about further developments, trends, and reports in the MENA Wealth Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence