Key Insights

The Norwegian Property and Casualty (P&C) insurance market is poised for sustained growth, driven by key economic and demographic factors. With a projected Compound Annual Growth Rate (CAGR) of 6.4%, the market is anticipated to reach a valuation of $2533.39 billion by 2025. This expansion is fueled by increasing urbanization, leading to higher property values, and a heightened consumer awareness of essential insurance protection. Norway's stable economy and high per capita income further support market robustness. Technological integration, including telematics and AI for risk assessment, is enhancing operational efficiency and customer engagement, significantly contributing to market dynamics.

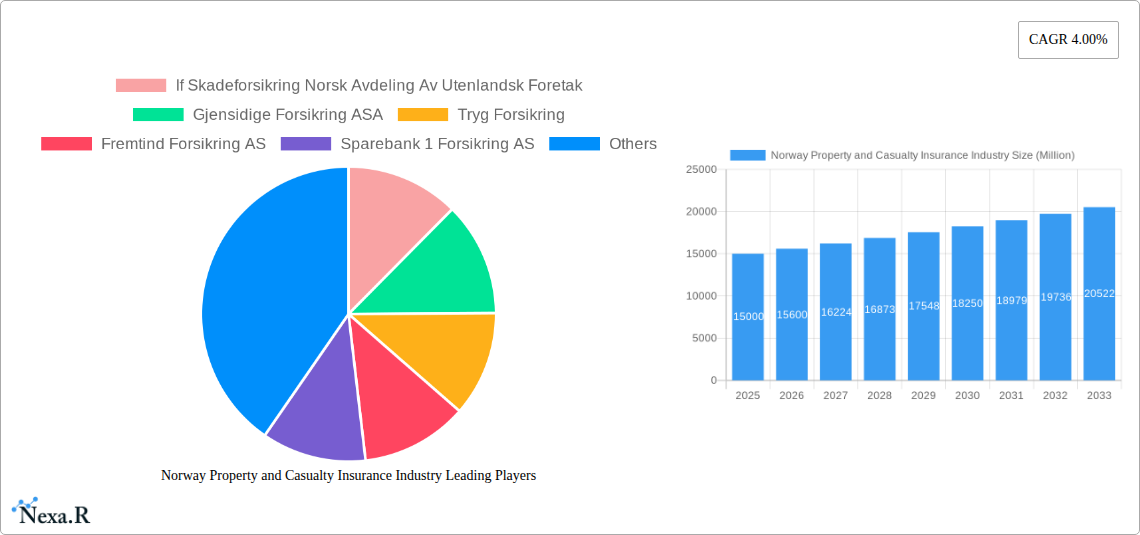

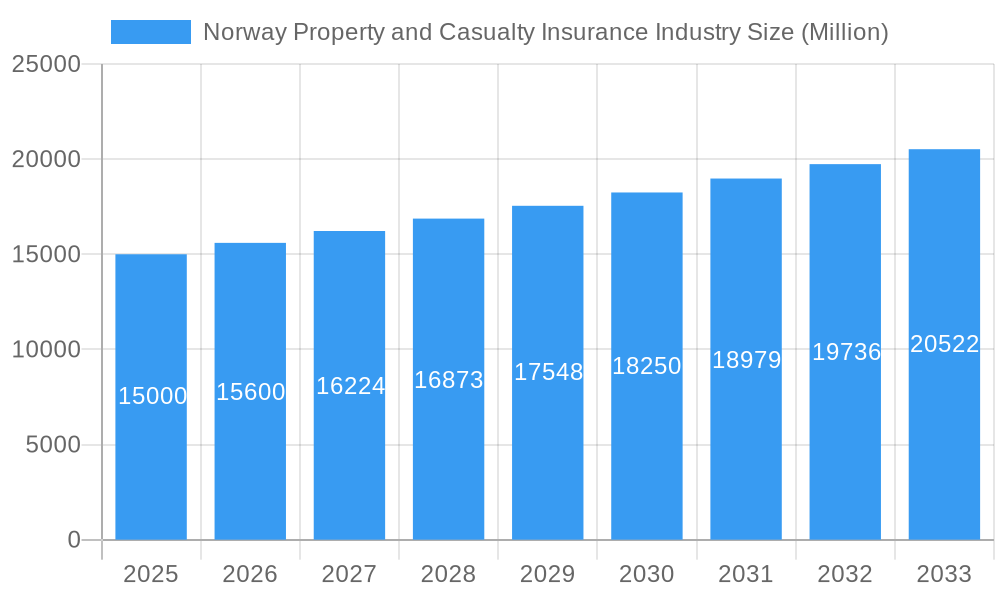

Norway Property and Casualty Insurance Industry Market Size (In Million)

Navigating the Norwegian P&C insurance landscape requires strategic consideration of both opportunities and challenges. While robust regulatory frameworks and significant competition from established players such as Gjensidige Forsikring ASA, Tryg Forsikring, and Fremtind Forsikring AS define the competitive arena, emerging trends offer avenues for growth. Future market expansion will likely be shaped by innovative insurance products that address evolving consumer needs, including personalized risk management and integrated offerings. Key growth drivers for the forecast period (2025-2033) include sustained economic stability and the development of specialized insurance solutions. Conversely, potential restraints such as rising operational costs, evolving consumer expectations, and the impact of climate change on insurance claims necessitate proactive strategies. Effective market participation hinges on adopting advanced risk management practices, leveraging technology for competitive pricing, and adapting to regulatory shifts within the Norwegian P&C insurance sector.

Norway Property and Casualty Insurance Industry Company Market Share

Norway Property and Casualty Insurance Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Norway Property and Casualty (P&C) insurance market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, growth trends, key players, and future opportunities within this dynamic sector. The report segments the market into various sub-sectors (specific segment details unavailable, denoted as xx) and analyzes leading players like Gjensidige Forsikring ASA and Tryg Forsikring, providing a granular understanding of the competitive landscape.

Norway Property and Casualty Insurance Industry Market Dynamics & Structure

This section analyzes the Norwegian P&C insurance market's structure, focusing on market concentration, technological innovation, regulatory frameworks, competitive dynamics, and M&A activity. The market is characterized by a moderate level of concentration, with a few dominant players and several smaller firms. Technological innovation is driven by the need for improved efficiency, customer experience, and risk management. The regulatory framework, overseen by the Financial Supervisory Authority of Norway (Finanstilsynet), plays a significant role in shaping market conduct and stability. The competitive landscape is influenced by product differentiation, pricing strategies, and distribution channels. M&A activity has been moderate in recent years.

- Market Concentration: xx% market share held by the top 3 players in 2024.

- Technological Innovation: Increased adoption of AI, telematics, and Insurtech solutions.

- Regulatory Framework: Stringent regulations impacting underwriting, pricing, and claims processing.

- Competitive Substitutes: Limited direct substitutes, with competition primarily amongst insurers.

- End-User Demographics: A largely mature market with evolving customer needs and digital expectations.

- M&A Activity: Moderate deal volume, with a few significant acquisitions in recent years (e.g., Gjensidige's acquisition of Falck's roadside assistance).

Norway Property and Casualty Insurance Industry Growth Trends & Insights

The Norwegian P&C insurance market has demonstrated steady growth in recent years (historical data unavailable, denoted as xx). Driven by factors such as economic growth, increasing insurance awareness, and technological advancements, the market is projected to maintain a positive Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033). Technological disruptions, such as the rise of Insurtech companies, are reshaping the industry landscape, while shifting consumer behavior towards digital channels and personalized services impacts the market. Market penetration rates vary across segments, with xx showing the highest penetration in 2024.

- Market Size (Million): xx (2019), xx (2024), xx (2025), xx (2033)

- CAGR (2025-2033): xx%

- Market Penetration (2024): xx% (specific segment)

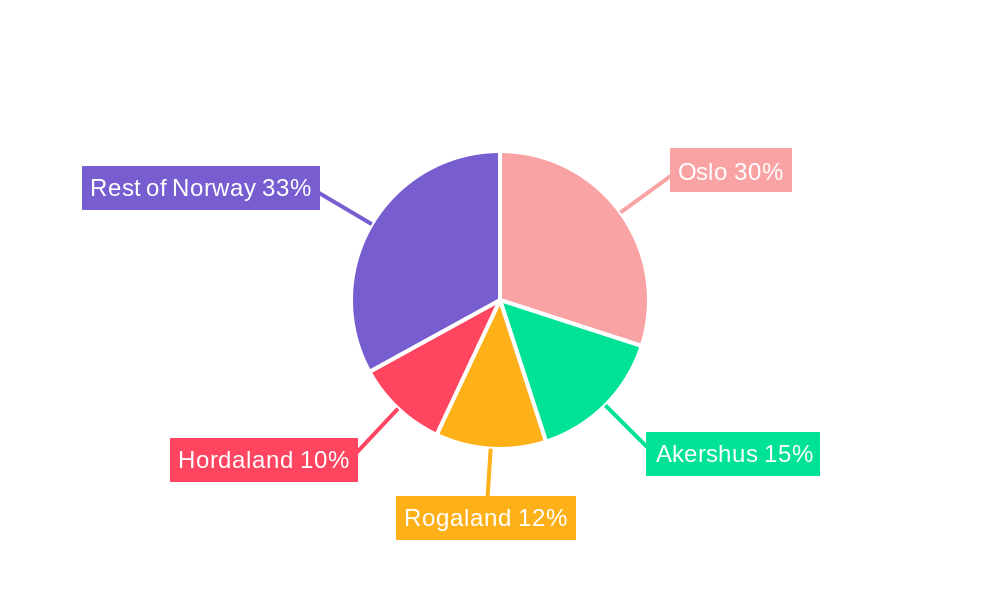

Dominant Regions, Countries, or Segments in Norway Property and Casualty Insurance Industry

While Norway is a relatively geographically homogenous market, certain regions might exhibit higher growth potential due to factors like population density, economic activity, and infrastructure development. Market dominance is largely driven by the presence of major insurers and their distribution networks. Specific regional or segmental dominance details unavailable, but larger urban areas are likely to show higher premiums.

- Key Growth Drivers: Strong economic growth in specific regions, improving infrastructure, and targeted marketing strategies.

- Dominance Factors: Market share of major insurers, established distribution networks, and brand recognition.

- Growth Potential: xx (specific segment/region) shows high growth potential due to (reason).

Norway Property and Casualty Insurance Industry Product Landscape

The Norwegian P&C insurance market offers a diverse range of products catering to both individual and corporate clients. Insurers are increasingly offering customized policies, bundled services, and digital platforms, improving customer experience and operational efficiency. Technological advancements, such as AI-powered claims processing and telematics-based risk assessment, are leading to product innovation and enhanced risk management capabilities. The competitive landscape is characterized by product differentiation and pricing strategies.

Key Drivers, Barriers & Challenges in Norway Property and Casualty Insurance Industry

Key Drivers:

- Increasing insurance awareness among consumers

- Economic growth and rising disposable incomes

- Technological advancements (AI, telematics)

- Government initiatives promoting financial inclusion

Challenges:

- Intense competition among insurers

- Regulatory scrutiny and compliance costs

- Cybersecurity threats and data privacy concerns

- Climate change-related risks (e.g., increased frequency of extreme weather events).

Emerging Opportunities in Norway Property and Casualty Insurance Industry

- Growth in niche segments such as cyber insurance and travel insurance.

- Expanding usage of Insurtech solutions for improved efficiency and customer experience.

- Leveraging big data and analytics for better risk assessment and pricing.

- Development of innovative products catering to the evolving needs of digitally-savvy consumers.

Growth Accelerators in the Norway Property and Casualty Insurance Industry

Long-term growth will be propelled by technological advancements, strategic partnerships between insurers and technology providers, and expansion into untapped market segments. Government policies promoting digitalization and financial inclusion will also play a crucial role. Investment in customer relationship management and data analytics will create competitive advantages.

Key Players Shaping the Norway Property and Casualty Insurance Industry Market

- Gjensidige Forsikring ASA

- Tryg Forsikring

- Fremtind Forsikring AS

- Sparebank 1 Forsikring AS

- Frende Forsikring

- Tide Forsikring AS

- Codan Forsikring

- Eika Forsikring

- If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak

Notable Milestones in Norway Property and Casualty Insurance Industry Sector

- February 2022: Gjensidige Forsikring completes acquisition of Falck's Roadside Assistance Nordic and Baltic.

- August 2021: Erika Forsikring signs a deal with Simplify for Documentbot and Emailbot technologies.

In-Depth Norway Property and Casualty Insurance Industry Market Outlook

The Norwegian P&C insurance market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and favorable economic conditions. Strategic partnerships, innovative product development, and effective risk management will be critical for success in this competitive landscape. Opportunities exist in expanding digital capabilities, improving customer service, and addressing emerging risks like cyber threats and climate change.

Norway Property and Casualty Insurance Industry Segmentation

-

1. Product Type

- 1.1. Property Insurance

- 1.2. Motor Insurance

- 1.3. Others

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Others

Norway Property and Casualty Insurance Industry Segmentation By Geography

- 1. Norway

Norway Property and Casualty Insurance Industry Regional Market Share

Geographic Coverage of Norway Property and Casualty Insurance Industry

Norway Property and Casualty Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Number of Registered Passenger Car is Driving the Motor Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Property and Casualty Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Property Insurance

- 5.1.2. Motor Insurance

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gjensidige Forsikring ASA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tryg Forsikring

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fremtind Forsikring AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sparebank 1 Forsikring AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Frende Forsikring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tide Forsikring AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Codan Forsikring

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eika Forsikring*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak

List of Figures

- Figure 1: Norway Property and Casualty Insurance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Property and Casualty Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Property and Casualty Insurance Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Norway Property and Casualty Insurance Industry?

Key companies in the market include If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak, Gjensidige Forsikring ASA, Tryg Forsikring, Fremtind Forsikring AS, Sparebank 1 Forsikring AS, Frende Forsikring, Tide Forsikring AS, Codan Forsikring, Eika Forsikring*List Not Exhaustive.

3. What are the main segments of the Norway Property and Casualty Insurance Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2533.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Number of Registered Passenger Car is Driving the Motor Insurance.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2022, Gjensidige Forsikring completed the acquisition of Falck's Road-side Assistance Nordic and Baltic. The relevant authorities approved the transaction, which is in accordance with the terms of the agreement entered into between the parties in December 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Property and Casualty Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Property and Casualty Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Property and Casualty Insurance Industry?

To stay informed about further developments, trends, and reports in the Norway Property and Casualty Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence