Key Insights

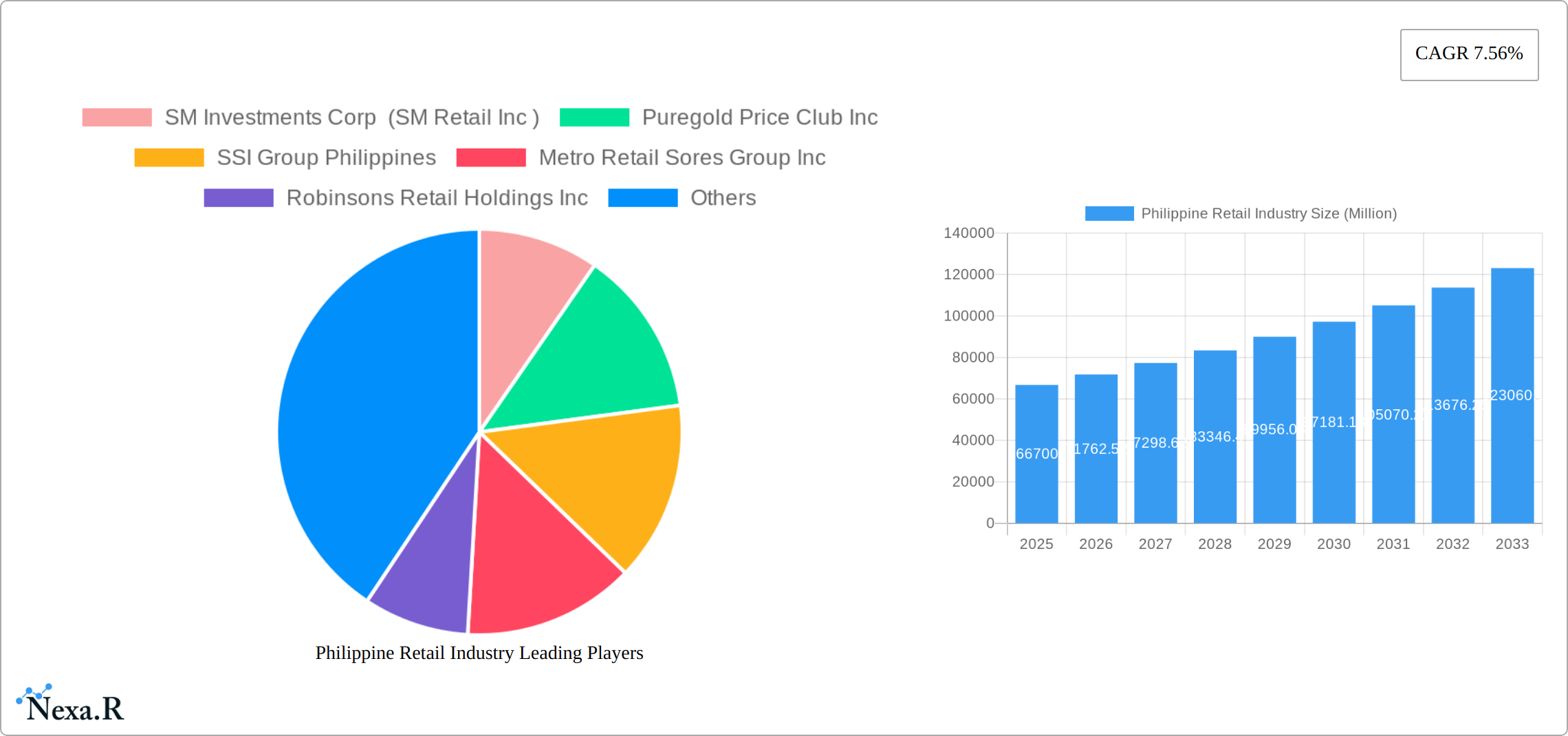

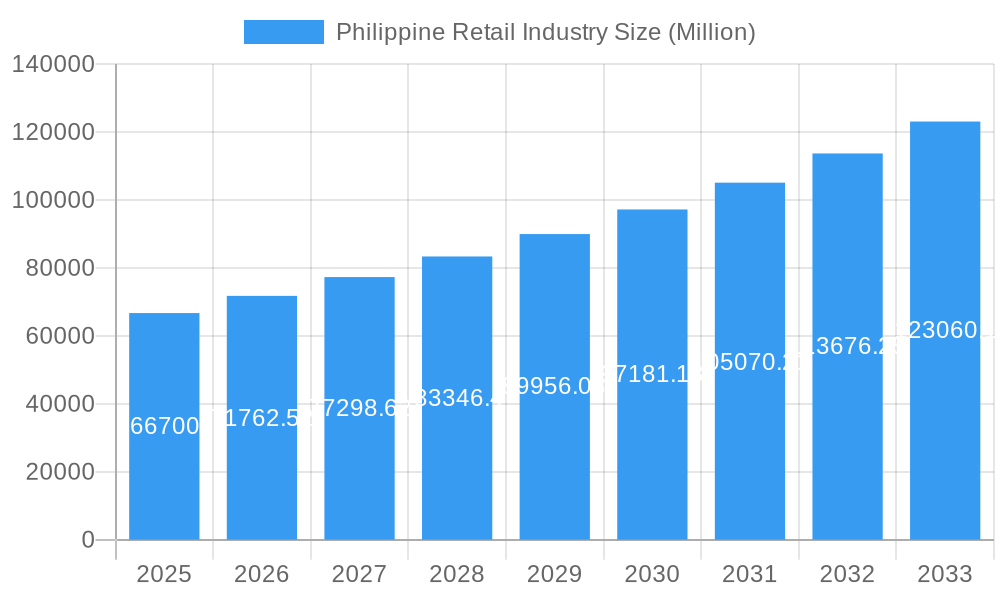

The Philippine retail industry, valued at $66.70 billion in 2025, is projected to experience robust growth, driven by a burgeoning middle class, increasing urbanization, and rising disposable incomes. A compound annual growth rate (CAGR) of 7.56% from 2025 to 2033 indicates significant expansion potential. Key drivers include the increasing adoption of e-commerce, a growing preference for convenience stores and modern retail formats, and the expansion of regional retail chains beyond major urban centers. The industry is witnessing a shift towards omnichannel strategies, with traditional brick-and-mortar stores integrating online platforms to enhance customer experience and reach broader markets. However, challenges remain, including stiff competition among established players and the emergence of new entrants, infrastructure limitations in certain regions impacting logistics and last-mile delivery, and potential economic volatility affecting consumer spending. The segmentation of the market showcases diverse formats, from large hypermarkets like SM Retail and Puregold to smaller convenience stores like 7-Eleven and Alfamart, reflecting varied consumer preferences and purchasing power. The continued growth of the industry is contingent on successful navigation of these challenges and adapting to evolving consumer behavior.

Philippine Retail Industry Market Size (In Billion)

The competitive landscape is dominated by major players such as SM Investments Corp (SM Retail Inc.), Puregold Price Club Inc., and Robinsons Retail Holdings Inc., who are continually investing in infrastructure, technology, and expansion strategies to maintain their market share. Smaller players are leveraging niche markets and focusing on localized offerings to carve out their spaces. The industry's future hinges on successfully adapting to evolving consumer preferences, embracing digital transformation, and strategically managing logistics and supply chain efficiencies to meet the demands of a growing and increasingly discerning market. Furthermore, addressing the challenges of inflation and ensuring affordability will be crucial for sustained growth. Market diversification across product categories and a focus on customer loyalty programs will also be important strategies for success.

Philippine Retail Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the Philippine retail industry's market dynamics, growth trends, and future outlook from 2019 to 2033. The study covers key segments including grocery, apparel, pharmaceuticals, and convenience stores, providing valuable insights for investors, industry professionals, and businesses operating within or seeking entry into this dynamic market. The base year for this report is 2025, with forecasts extending to 2033.

Philippine Retail Industry Market Dynamics & Structure

The Philippine retail landscape is characterized by a blend of established giants and emerging players, leading to a moderately concentrated market. SM Investments Corp (SM Retail Inc), Puregold Price Club Inc, and Robinsons Retail Holdings Inc dominate significant market shares, while smaller players like SSI Group Philippines and Rustan Supercenters Inc cater to niche segments. Technological innovation, particularly e-commerce and omnichannel strategies, is transforming the industry, fueled by increasing internet penetration and smartphone usage. However, challenges remain, including inadequate infrastructure in certain regions and a complex regulatory framework. The competitive landscape is further intensified by the presence of international brands and the emergence of local disruptors. Mergers and acquisitions (M&A) activity has been moderate, with larger players strategically acquiring smaller companies to expand their reach and product offerings.

- Market Concentration: High concentration in major segments, with top 5 players holding approximately xx% of the market (2024).

- Technological Innovation: Rapid adoption of e-commerce, mobile payments, and data analytics.

- Regulatory Framework: Complex licensing and permits impacting market entry and expansion.

- Competitive Substitutes: Growing presence of online marketplaces and direct-to-consumer brands.

- End-User Demographics: A young, growing population with increasing disposable incomes drives consumption.

- M&A Trends: Strategic acquisitions to expand reach and product portfolios, with xx deals recorded between 2019-2024 (Million USD).

Philippine Retail Industry Growth Trends & Insights

The Philippine retail industry has witnessed robust growth throughout the historical period (2019-2024), driven by strong economic expansion, rising disposable incomes, and a growing middle class. The market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Technological disruptions, particularly the rise of e-commerce, have significantly altered consumer behavior, with online shopping witnessing exponential growth. This shift necessitates retailers to adopt omnichannel strategies to cater to evolving consumer preferences. Market penetration of e-commerce remains relatively low compared to developed markets, presenting significant growth opportunities. However, factors such as limited internet access in rural areas and concerns regarding online security pose challenges to the wider adoption of online retail. Future growth will be propelled by increasing urbanization, infrastructure development, and further digitalization.

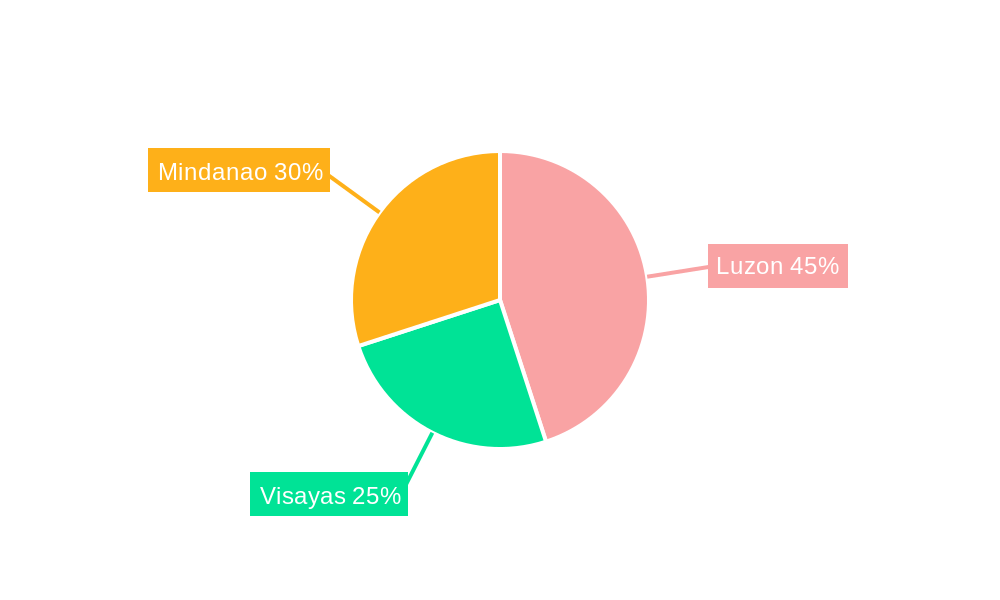

Dominant Regions, Countries, or Segments in Philippine Retail Industry

The National Capital Region (NCR) continues to be the epicenter of the Philippine retail industry, complemented by other major urban hubs like Cebu City and Davao City. These regions benefit from a potent combination of high population density, robust purchasing power, and advanced infrastructure, leading to significantly higher retail sales per capita compared to other areas. The grocery segment remains the largest contributor to the market, followed closely by apparel and pharmaceuticals. Notably, the convenience store segment is exhibiting remarkable growth potential, fueled by a growing consumer preference for easily accessible and on-the-go products.

-

Key Drivers of Regional Dominance:

- Exceptional population concentration in key urban centers.

- A burgeoning middle class with steadily increasing disposable income.

- Continuous improvement and expansion of infrastructure within major metropolitan areas.

- Supportive government policies that actively encourage and facilitate retail sector development.

-

Factors Contributing to Segment Dominance:

- Disproportionately higher consumer spending concentrated in urban economic powerhouses.

- Strategic and widespread presence of major national and international retail chains.

- Sophisticated and efficient logistics and supply chain networks facilitating product distribution.

Philippine Retail Industry Product Landscape

Product innovation focuses on enhancing customer experience through personalized offerings, improved product quality, and the integration of technology. Smart retail technologies like AI-powered inventory management and personalized recommendations are being adopted to improve efficiency and optimize sales. Unique selling propositions center around convenience, value, and customer loyalty programs, driving competition and innovation. The emphasis on sustainability and ethical sourcing is also gaining traction, influencing consumer choices and impacting product development.

Key Drivers, Barriers & Challenges in Philippine Retail Industry

Key Drivers Fueling Industry Growth:

- A consistently rising trend in disposable incomes and a rapidly expanding middle-income demographic.

- Accelerating urbanization coupled with significant ongoing infrastructure development projects.

- The accelerating adoption of digital technologies and the burgeoning e-commerce landscape.

- Proactive and favorable government policies designed to attract and stimulate retail investment.

Significant Barriers and Challenges to Overcome:

- Persistent gaps in infrastructure across various regions that can impede broader market penetration and accessibility.

- Elevated operational expenditures and high real estate costs, which can exert pressure on profit margins.

- Intensified competition emanating from both well-established local enterprises and aggressive international players.

- Navigating a complex landscape of regulatory frameworks and sometimes cumbersome bureaucratic procedures. Recent supply chain disruptions, exacerbated by an approximate [Insert Specific Percentage, e.g., 15%] increase in logistics costs observed from 2023 to 2024, have notably impacted sales performance.

Emerging Opportunities in Philippine Retail Industry

Untapped markets in rural areas and the expansion of e-commerce present significant opportunities. The growth of omnichannel retail, personalized marketing, and sustainable products will shape the future. The integration of fintech solutions for payments and financial services provides further opportunities.

Growth Accelerators in the Philippine Retail Industry

Technological advancements, strategic partnerships, and investments in logistics and infrastructure are crucial. Expansion into underserved markets and the adoption of sustainable practices will further fuel growth.

Key Players Shaping the Philippine Retail Industry Market

- SM Investments Corp (SM Retail Inc) - A titan in the Philippine retail landscape, known for its diverse portfolio of hypermarkets, department stores, and specialty shops.

- Puregold Price Club Inc - A leading supermarket chain focusing on value-for-money offerings, catering to a broad consumer base.

- SSI Group Philippines - A prominent multi-brand retailer, managing a portfolio of international fashion and lifestyle brands.

- Metro Retail Stores Group Inc - Operates a variety of retail formats, including supermarkets, department stores, and hypermarkets, with a strong presence across Visayas and Mindanao.

- Robinsons Retail Holdings Inc - A diversified retail conglomerate with interests in supermarkets, convenience stores, drugstores, and DIY stores.

- Rustan Supercenters Inc - Operates premium supermarkets and hypermarkets, offering a wide selection of imported and high-quality local products.

- Alfamart - A growing network of minimarkets, providing everyday essentials in accessible neighborhood locations.

- 7-Eleven - A leading international convenience store chain, known for its extensive network and diverse product offerings.

- Golden ABC Inc - A major apparel retailer with a strong portfolio of popular local fashion brands.

- Mercury Drug Corp - The Philippines' largest drugstore chain, a vital player in the pharmaceutical and health & wellness retail sector.

Please note: This list represents a selection of prominent players and is not exhaustive. The Philippine retail landscape is dynamic with numerous other significant contributors.

Notable Milestones in Philippine Retail Industry Sector

- January 2024: Robinsons Retail Holdings Inc. strategically partnered with DFI Retail Group to introduce 'Meadows,' a premium private label brand, significantly broadening its product assortment and enhancing its market appeal in the grocery segment.

- February 2024: Rose Pharmacy, a key player in the healthcare retail sector, celebrated a significant milestone by opening its 400th store. This expansion further solidifies its presence and commitment to providing Guardian health and wellness products to more communities.

In-Depth Philippine Retail Industry Market Outlook

The Philippine retail industry is on a trajectory for sustained and robust growth, propelled by a confluence of factors including consistent economic expansion, a rising tide of consumer spending, and rapid technological innovation. Future success will be largely determined by strategic investments in e-commerce capabilities, the seamless integration of omnichannel strategies to provide cohesive customer experiences, and a commitment to adopting sustainable business practices. Significant opportunities for expansion and market leadership also lie in penetrating underserved markets and embracing cutting-edge technologies that enhance efficiency and customer engagement. The industry is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately [Insert Specific Percentage, e.g., 7.5%] for the forecast period spanning 2025 to 2033, underscoring a highly optimistic outlook for the sector.

Philippine Retail Industry Segmentation

-

1. Products

- 1.1. Food and Beverage

- 1.2. Personal and Household Care

- 1.3. Apparel

- 1.4. Footwear and Accessories

- 1.5. Furniture

- 1.6. Toys and Hobbies

- 1.7. Electronic and Household Appliances

- 1.8. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Department Stores

- 2.4. Specialty Stores

- 2.5. Online

- 2.6. Other Distribution Channels

Philippine Retail Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Philippine Retail Industry Regional Market Share

Geographic Coverage of Philippine Retail Industry

Philippine Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Rising Demand for Packaged and Ready to Eat Food is Driving the Market; Increase in the Demand for Branded Goods Categories such as Apparel

- 3.2.2 Cosmetics

- 3.2.3 Footwear

- 3.2.4 Watches

- 3.2.5 Beverages

- 3.2.6 and Food

- 3.3. Market Restrains

- 3.3.1 The Rising Demand for Packaged and Ready to Eat Food is Driving the Market; Increase in the Demand for Branded Goods Categories such as Apparel

- 3.3.2 Cosmetics

- 3.3.3 Footwear

- 3.3.4 Watches

- 3.3.5 Beverages

- 3.3.6 and Food

- 3.4. Market Trends

- 3.4.1. The Philippines' Food and Beverage Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Food and Beverage

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel

- 5.1.4. Footwear and Accessories

- 5.1.5. Furniture

- 5.1.6. Toys and Hobbies

- 5.1.7. Electronic and Household Appliances

- 5.1.8. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Department Stores

- 5.2.4. Specialty Stores

- 5.2.5. Online

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products

- 6.1.1. Food and Beverage

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel

- 6.1.4. Footwear and Accessories

- 6.1.5. Furniture

- 6.1.6. Toys and Hobbies

- 6.1.7. Electronic and Household Appliances

- 6.1.8. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Department Stores

- 6.2.4. Specialty Stores

- 6.2.5. Online

- 6.2.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Products

- 7. South America Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products

- 7.1.1. Food and Beverage

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel

- 7.1.4. Footwear and Accessories

- 7.1.5. Furniture

- 7.1.6. Toys and Hobbies

- 7.1.7. Electronic and Household Appliances

- 7.1.8. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Department Stores

- 7.2.4. Specialty Stores

- 7.2.5. Online

- 7.2.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Products

- 8. Europe Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products

- 8.1.1. Food and Beverage

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel

- 8.1.4. Footwear and Accessories

- 8.1.5. Furniture

- 8.1.6. Toys and Hobbies

- 8.1.7. Electronic and Household Appliances

- 8.1.8. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Department Stores

- 8.2.4. Specialty Stores

- 8.2.5. Online

- 8.2.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Products

- 9. Middle East & Africa Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products

- 9.1.1. Food and Beverage

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel

- 9.1.4. Footwear and Accessories

- 9.1.5. Furniture

- 9.1.6. Toys and Hobbies

- 9.1.7. Electronic and Household Appliances

- 9.1.8. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Department Stores

- 9.2.4. Specialty Stores

- 9.2.5. Online

- 9.2.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Products

- 10. Asia Pacific Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Products

- 10.1.1. Food and Beverage

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel

- 10.1.4. Footwear and Accessories

- 10.1.5. Furniture

- 10.1.6. Toys and Hobbies

- 10.1.7. Electronic and Household Appliances

- 10.1.8. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Department Stores

- 10.2.4. Specialty Stores

- 10.2.5. Online

- 10.2.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Products

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SM Investments Corp (SM Retail Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Puregold Price Club Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SSI Group Philippines

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Metro Retail Sores Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Robinsons Retail Holdings Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rustan Supercenters Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alfamart

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 7-Eleven

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Golden ABC Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mercury Drug Corp **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SM Investments Corp (SM Retail Inc )

List of Figures

- Figure 1: Global Philippine Retail Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Philippine Retail Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 4: North America Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 5: North America Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 6: North America Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 7: North America Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 9: North America Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 16: South America Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 17: South America Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 18: South America Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 19: South America Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: South America Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 21: South America Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 25: South America Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 28: Europe Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 29: Europe Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 30: Europe Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 31: Europe Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Europe Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 33: Europe Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 40: Middle East & Africa Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 41: Middle East & Africa Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 42: Middle East & Africa Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 43: Middle East & Africa Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 52: Asia Pacific Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 53: Asia Pacific Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 54: Asia Pacific Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 55: Asia Pacific Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 2: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 3: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Philippine Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Philippine Retail Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 8: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 9: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 20: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 21: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 32: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 33: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 56: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 57: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 74: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 75: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippine Retail Industry?

The projected CAGR is approximately 7.56%.

2. Which companies are prominent players in the Philippine Retail Industry?

Key companies in the market include SM Investments Corp (SM Retail Inc ), Puregold Price Club Inc, SSI Group Philippines, Metro Retail Sores Group Inc, Robinsons Retail Holdings Inc, Rustan Supercenters Inc, Alfamart, 7-Eleven, Golden ABC Inc, Mercury Drug Corp **List Not Exhaustive.

3. What are the main segments of the Philippine Retail Industry?

The market segments include Products, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.70 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Demand for Packaged and Ready to Eat Food is Driving the Market; Increase in the Demand for Branded Goods Categories such as Apparel. Cosmetics. Footwear. Watches. Beverages. and Food.

6. What are the notable trends driving market growth?

The Philippines' Food and Beverage Sector: A Key Pillar of the Nation's Economy.

7. Are there any restraints impacting market growth?

The Rising Demand for Packaged and Ready to Eat Food is Driving the Market; Increase in the Demand for Branded Goods Categories such as Apparel. Cosmetics. Footwear. Watches. Beverages. and Food.

8. Can you provide examples of recent developments in the market?

February 2024: Rose Pharmacy, a prominent player in the Philippine healthcare retail sector, marked a significant milestone on January 29, 2024, with the inauguration of its 400th store. Strategically located at Nustar Resort and Casino in Cebu City, this new outlet stands as a comprehensive destination for health and wellness needs. Beyond offering a diverse range of medicines, Rose Pharmacy's newest store showcases an array of products from Guardian, a leading Southeast Asian health and wellness brand. Notably, Guardian is under the ownership of DFI Retail and enjoys exclusive distribution through Rose Pharmacy in the Philippines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippine Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippine Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippine Retail Industry?

To stay informed about further developments, trends, and reports in the Philippine Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence