Key Insights

The global Polyurea Coatings market is projected to reach $1.08 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.48% from 2025 to 2033. This growth is driven by the superior performance of polyurea coatings, including rapid curing, exceptional abrasion resistance, chemical inertness, and waterproofing. These properties make them essential for demanding applications across key sectors. The building and construction industry is a major contributor, utilizing polyurea for protective coatings on roofs, decks, foundations, and containment systems, especially in rapidly urbanizing areas. The industrial sector, including manufacturing, chemical plants, and mining, benefits from polyurea's resilience in harsh environments, protecting assets from corrosion and wear. The transportation industry, encompassing automotive and marine sectors, also fuels market expansion with applications in truck bed liners, vessel coatings, and infrastructure protection for bridges.

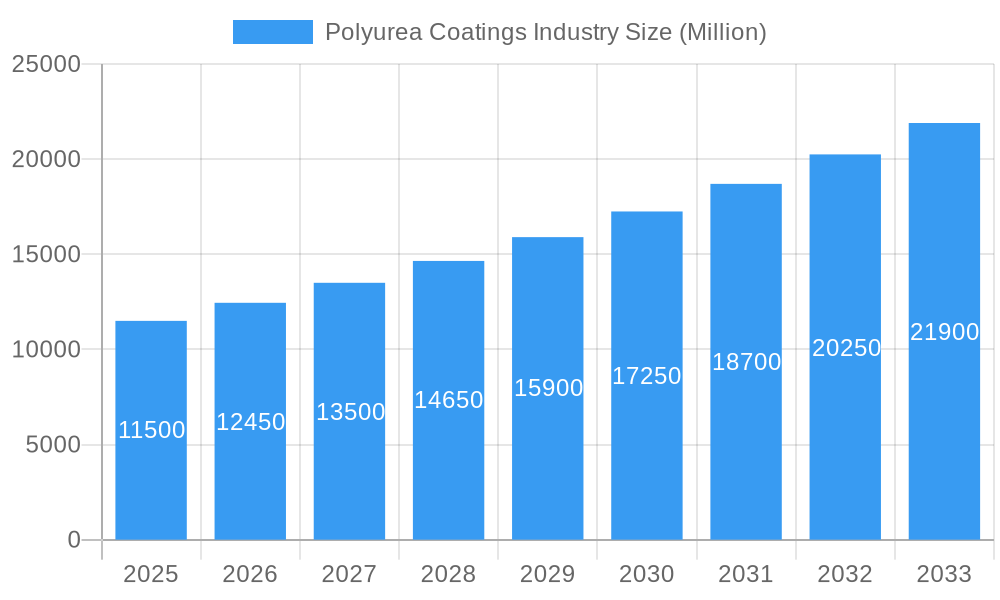

Polyurea Coatings Industry Market Size (In Billion)

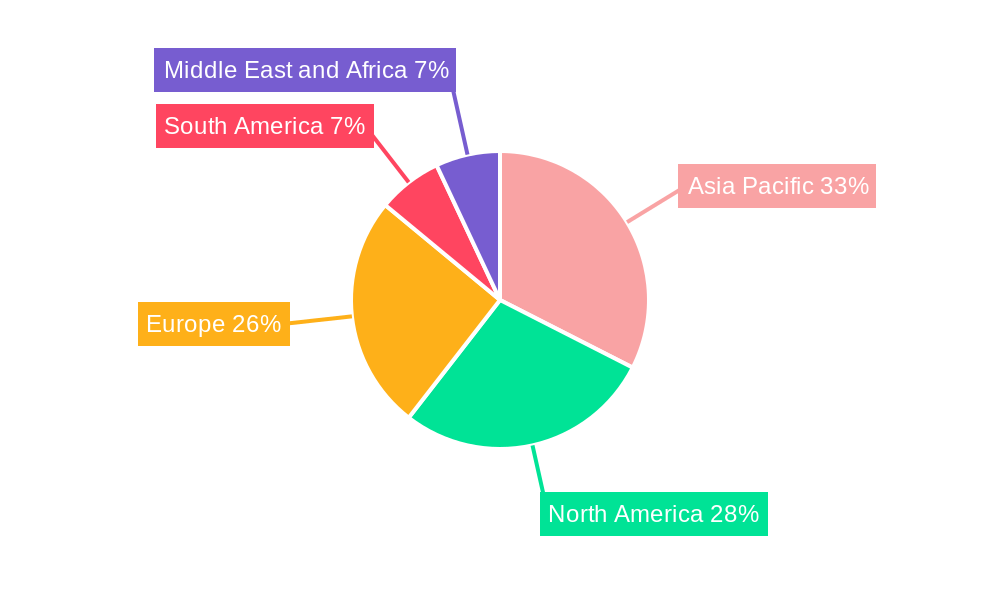

Market expansion is further supported by technological advancements, resulting in improved formulations with enhanced UV stability, flexibility, and application efficiency. The introduction of hybrid polyurea systems offers a balance of performance and cost-effectiveness, broadening customer appeal. Geographically, the Asia Pacific region is expected to lead growth, driven by significant infrastructure investments and a robust manufacturing sector in China and India. North America and Europe, with established industrial bases and stringent environmental regulations favoring durable, low-VOC coatings, will maintain substantial market shares. While the market is strong, potential challenges include higher initial costs compared to traditional coatings and the requirement for specialized application expertise, although long-term durability and reduced maintenance often offset these initial investments.

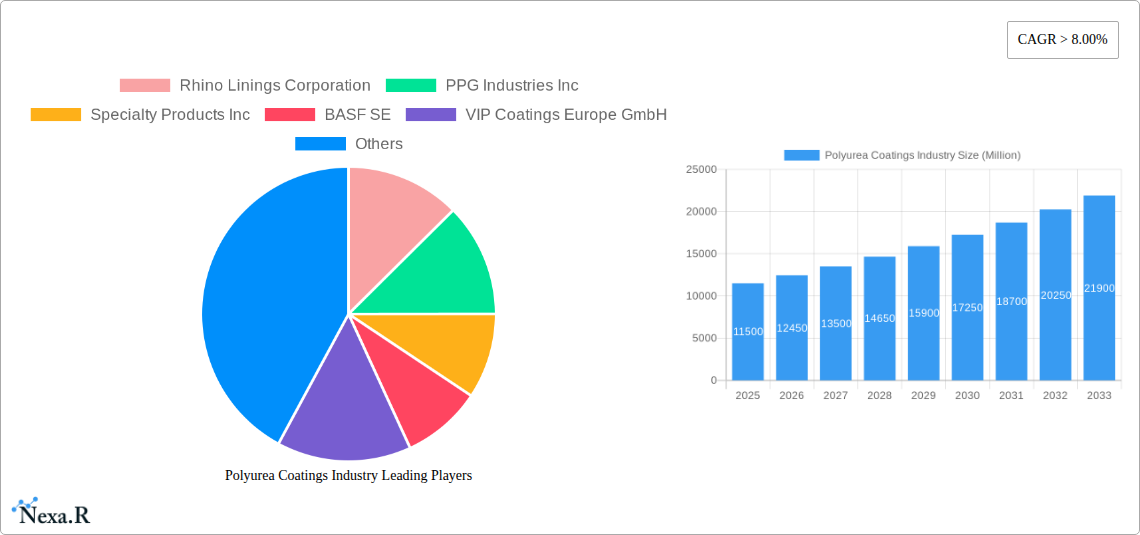

Polyurea Coatings Industry Company Market Share

Comprehensive Polyurea Coatings Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This in-depth report provides a granular analysis of the global Polyurea Coatings Industry, offering a strategic roadmap for stakeholders navigating this dynamic market. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report delves into market structure, growth drivers, regional dominance, product innovations, key challenges, and emerging opportunities. Optimized for high search visibility with relevant keywords, this report is essential for industry professionals seeking actionable insights.

Polyurea Coatings Industry Market Dynamics & Structure

The Polyurea Coatings Industry is characterized by a moderately concentrated market, with key players investing heavily in R&D to drive technological innovation. The primary drivers include the demand for high-performance, durable protective coatings across diverse applications, particularly in infrastructure development and industrial maintenance. Regulatory frameworks, focusing on environmental compliance and safety standards, are also shaping product development and adoption. Competitive substitutes like epoxies and urethanes, while present, are increasingly being outpaced by the superior properties of polyurea, such as its rapid cure times and exceptional chemical resistance. End-user demographics reveal a growing preference for sustainable and long-lasting coating solutions, especially within the building and construction and industrial sectors. Mergers and acquisitions (M&A) are an active trend, with companies strategically acquiring complementary technologies and market access. For instance, the acquisition of VersaFlex by PPG Industries Inc. signifies a consolidation trend focused on expanding product portfolios and market reach in critical infrastructure segments.

- Market Concentration: Moderate, with significant investment in proprietary technologies by leading manufacturers.

- Technological Innovation Drivers: Demand for enhanced durability, chemical resistance, and faster application times.

- Regulatory Frameworks: Growing emphasis on VOC reduction and long-term infrastructure protection standards.

- Competitive Product Substitutes: Epoxies and urethanes, with polyurea offering superior performance in key metrics.

- End-User Demographics: Increasing demand from infrastructure, industrial maintenance, and transportation sectors for high-performance, long-lifecycle solutions.

- M&A Trends: Strategic acquisitions aimed at expanding market share and technological capabilities, exemplified by PPG's acquisition of VersaFlex.

Polyurea Coatings Industry Growth Trends & Insights

The global Polyurea Coatings Industry is poised for substantial growth, driven by an escalating need for robust and resilient protective solutions across a multitude of applications. Market size evolution is projected to witness a significant uptick, fueled by increasing infrastructure investments worldwide, particularly in developing economies. Adoption rates for polyurea coatings are accelerating as their advantages over traditional materials become more evident, including their rapid curing capabilities, excellent flexibility, and superior resistance to abrasion, chemicals, and extreme temperatures. Technological disruptions are primarily centered around the development of advanced formulations offering enhanced UV stability, faster application methods, and lower VOC content, aligning with stringent environmental regulations. Consumer behavior shifts reflect a growing awareness of the lifecycle cost benefits associated with polyurea, leading to a preference for these high-performance coatings that offer extended service life and reduced maintenance requirements. The market penetration is expected to increase significantly in sectors such as building and construction for roofing and containment, industrial applications for asset protection, and transportation for vehicle coatings and bridge protection.

The market size of the Polyurea Coatings Industry is projected to grow from an estimated value of $1,200 million in 2025 to $2,100 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033). This robust growth is underpinned by several key factors. Firstly, the increasing global focus on infrastructure development and maintenance, including bridges, tunnels, water treatment facilities, and industrial plants, necessitates the use of highly durable and protective coatings like polyurea. Governments and private entities are investing heavily in these sectors to ensure longevity and safety, creating a sustained demand.

Secondly, the inherent properties of polyurea coatings—such as their rapid curing time, ability to be applied in a wide range of temperatures and humidity levels, and exceptional resistance to chemicals, abrasion, and impact—make them an ideal choice for demanding applications. This performance advantage translates into lower long-term maintenance costs and extended asset life, which are critical considerations for end-users across industrial, transportation, and construction sectors.

The report will delve deeper into the nuanced evolution of the market size by segmenting it into parent and child markets. The parent market, encompassing all polyurea coatings, will be analyzed alongside child markets such as:

- By Type:

- Pure Polyurea Coatings

- Hybrid Polyurea Coatings

- By Technology:

- Spraying

- Pouring

- Hand Mixing

- By Application:

- Building and Construction

- Industrial

- Transportation

- Other Applications

The analysis will meticulously track the market share evolution of each segment, highlighting which sub-segments are experiencing the most rapid growth and are poised to drive future market expansion. For example, the Spraying technology segment is expected to continue its dominance due to its efficiency and suitability for large-scale applications, while the demand for Hybrid Polyurea Coatings is likely to rise owing to their balanced performance characteristics and cost-effectiveness. In terms of applications, Building and Construction and Industrial segments are anticipated to be the primary growth engines.

Furthermore, the report will explore the impact of technological advancements in polyurea formulations. Innovations in areas like faster cure times, improved UV resistance, and enhanced flexibility are expanding the application scope and attractiveness of polyurea coatings. For instance, advancements in sprayable polyurea systems that can be applied at ambient temperatures without the need for specialized heating equipment are streamlining application processes, reducing labor costs, and enabling wider adoption in remote or challenging environments.

Consumer behavior is also shifting towards more sustainable and long-term protective solutions. The inherent durability of polyurea coatings, which significantly extends the lifespan of coated assets and reduces the need for frequent replacements or repairs, aligns perfectly with the growing emphasis on sustainability and lifecycle cost efficiency. This trend is particularly evident in the construction and infrastructure sectors, where longevity and reduced environmental impact are paramount. The report will quantify these trends through metrics such as CAGR, market penetration rates for specific applications, and projected adoption rates of new polyurea formulations.

Dominant Regions, Countries, or Segments in Polyurea Coatings Industry

North America currently stands as the dominant region in the Polyurea Coatings Industry, driven by a mature industrial base, significant investments in infrastructure renewal, and stringent regulatory requirements that favor high-performance, durable materials. The United States, in particular, leads in terms of market share and consumption due to its extensive transportation networks, robust building and construction sector, and a strong emphasis on asset protection within the industrial landscape. Economic policies promoting infrastructure development, coupled with a well-established awareness of polyurea’s superior protective capabilities, have solidified North America's leading position. The region’s market share within the global polyurea coatings market is estimated at approximately 35% in 2025, with a projected growth rate consistent with the overall industry.

Within the Type segment, Hybrid Polyurea Coatings are exhibiting significant growth potential, driven by their balanced performance characteristics, offering a blend of flexibility and strength at a competitive price point. While Pure Polyurea offers ultimate performance, the cost-effectiveness and broader applicability of hybrids are increasing their market penetration, particularly in the building and construction and general industrial sectors. The market share of hybrid polyurea coatings is estimated to be around 55% of the total market by 2025, with Pure Polyurea holding the remaining 45%.

The Spraying technology segment remains the most dominant due to its speed, efficiency, and ability to cover large and complex surfaces seamlessly. This method is essential for large-scale projects in building and construction, industrial asset protection, and transportation infrastructure. The spraying technology accounts for an estimated 70% of the total polyurea coatings market in 2025, with Pouring and Hand Mixing technologies catering to niche applications or smaller repair jobs, accounting for approximately 20% and 10%, respectively.

In terms of application, the Building and Construction sector is the largest and fastest-growing segment. This is attributed to the increasing use of polyurea for roofing systems, secondary containment, waterproofing, and protective coatings for concrete and steel structures. The demand for durable and weather-resistant solutions in this sector is a primary growth catalyst. The Building and Construction segment is projected to hold a market share of 40% in 2025. The Industrial segment follows closely, driven by the need for corrosion and chemical resistance in manufacturing plants, chemical processing facilities, and oil and gas infrastructure, accounting for an estimated 35% of the market. The Transportation sector, encompassing automotive, marine, and aerospace applications, represents a substantial market share of 20%, with continued growth expected due to demand for lightweight, durable coatings.

- Dominant Region: North America, with an estimated market share of 35% in 2025.

- Leading Country: United States, driven by infrastructure investment and industrial demand.

- Dominant Type: Hybrid Polyurea Coatings, holding an estimated 55% market share in 2025, due to their balance of performance and cost.

- Dominant Technology: Spraying, accounting for approximately 70% of the market in 2025, owing to its efficiency and versatility.

- Dominant Application: Building and Construction, projected to command 40% of the market share in 2025, fueled by infrastructure development and protective coating needs.

Polyurea Coatings Industry Product Landscape

The product landscape of the Polyurea Coatings Industry is characterized by continuous innovation focused on enhancing performance, application efficiency, and environmental sustainability. Manufacturers are developing advanced formulations that offer superior UV stability, improved flexibility, and faster cure times, thereby expanding their applicability in diverse environments and challenging conditions. Key product innovations include aliphatic polyureas for enhanced color retention and UV resistance in exterior applications, and specialized formulations for fire retardation and chemical resistance in critical industrial settings. Performance metrics such as tensile strength, elongation, abrasion resistance, and chemical compatibility are consistently being improved through refined chemistries. Unique selling propositions often revolve around rapid return-to-service capabilities, extended lifespan, and compatibility with various substrates, making polyurea coatings a preferred choice for protective and decorative applications. Technological advancements are also enabling the development of plural-component spray equipment that optimizes mixing and application, further enhancing efficiency and reducing waste.

Key Drivers, Barriers & Challenges in Polyurea Coatings Industry

Key Drivers:

- Infrastructure Development & Renewal: Significant global investment in upgrading and expanding infrastructure, including bridges, tunnels, and water treatment facilities, drives demand for durable protective coatings.

- Industrial Asset Protection: The need to protect critical assets from corrosion, chemical attack, and abrasion in sectors like oil and gas, manufacturing, and mining is a major growth catalyst.

- Technological Advancements: Continuous innovation in polyurea formulations, leading to faster cure times, enhanced flexibility, improved UV resistance, and lower VOC content.

- Environmental Regulations: Increasing stringency of environmental regulations favors coatings with low VOC emissions and extended service life, reducing the need for frequent replacements and waste.

Barriers & Challenges:

- High Initial Cost: The upfront cost of polyurea coatings can be higher compared to some traditional alternatives, posing a barrier for budget-conscious projects.

- Application Complexity & Equipment: Proper application requires specialized equipment and trained personnel, which can limit adoption in smaller projects or regions with limited expertise.

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials, such as isocyanates and polyols, can impact manufacturing costs and product pricing.

- Awareness & Education: Despite growing adoption, there is still a need for broader market education regarding the long-term benefits and diverse applications of polyurea coatings.

- Supply Chain Disruptions: Global supply chain issues can affect the availability and cost of raw materials and finished products, impacting project timelines and profitability. The impact of such disruptions can lead to project delays costing upwards of $50 million annually for large-scale industrial projects.

Emerging Opportunities in Polyurea Coatings Industry

Emerging opportunities in the Polyurea Coatings Industry lie in expanding applications within renewable energy infrastructure, such as wind turbine blade protection and solar panel coatings, where durability and weather resistance are paramount. The growing trend of modular construction also presents opportunities for pre-fabricated polyurea-coated components. Furthermore, the development of bio-based or recycled content polyurea formulations aligns with the increasing demand for sustainable building materials, offering a competitive edge. Untapped markets in developing economies with rapidly growing infrastructure needs also represent significant growth potential. Innovative applications in marine environments for anti-fouling coatings and in the automotive sector for lightweight, impact-resistant body panels are also on the rise.

Growth Accelerators in the Polyurea Coatings Industry Industry

Growth in the Polyurea Coatings Industry is being significantly accelerated by ongoing technological breakthroughs, particularly in the development of faster-curing formulations that minimize downtime for clients. Strategic partnerships between raw material suppliers and coating manufacturers are fostering innovation and ensuring supply chain stability. Market expansion strategies, including the penetration of emerging economies and the diversification into new application niches like protective coatings for advanced electronics or specialized sports surfaces, are also acting as key growth accelerators. The increasing emphasis on lifecycle cost analysis by end-users, highlighting the long-term savings offered by polyurea's durability and low maintenance requirements, further propels market growth.

Key Players Shaping the Polyurea Coatings Industry Market

- Rhino Linings Corporation

- PPG Industries Inc

- Specialty Products Inc

- BASF SE

- VIP Coatings Europe GmbH

- Huntsman International LLC

- Teknos Group

- Nukote Coating Systems

- KUKDO Chemical (Kunshan) Co Ltd

- Armorthane

Notable Milestones in Polyurea Coatings Industry Sector

- January 2021: PPG announced a definitive agreement to acquire VersaFlex, a specialist in polyurea, epoxy, and polyurethane coatings. This acquisition aims to bolster PPG's presence in water and wastewater infrastructure, flooring, transportation, and industrial applications, signifying a consolidation trend and strategic expansion in the coatings market.

In-Depth Polyurea Coatings Industry Market Outlook

The future outlook for the Polyurea Coatings Industry is exceptionally positive, driven by a confluence of factors that position it for sustained growth. The ongoing global push for resilient infrastructure, coupled with the increasing demand for protective coatings that offer superior durability and longevity, will continue to fuel market expansion. Technological advancements will remain a critical growth accelerator, leading to the development of even more specialized polyurea formulations catering to niche applications and addressing evolving environmental and performance requirements. Strategic market penetration into emerging economies and the continuous exploration of innovative applications will further bolster the industry's trajectory. The inherent advantages of polyurea coatings, particularly their rapid return-to-service capabilities and long-term cost-effectiveness, ensure their continued relevance and increasing adoption across a wide spectrum of industries. The market is expected to witness further consolidation and innovation as companies strive to capture market share and meet the evolving needs of a global clientele seeking high-performance, sustainable coating solutions. The projected market size of $2,100 million by 2033 underscores the immense potential and strategic importance of this sector.

Polyurea Coatings Industry Segmentation

-

1. Type

- 1.1. Pure

- 1.2. Hybrid

-

2. Technology

- 2.1. Spraying

- 2.2. Pouring

- 2.3. Hand Mixing

-

3. Application

- 3.1. Building and Construction

- 3.2. Industrial

- 3.3. Transportation

- 3.4. Other Applications

Polyurea Coatings Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polyurea Coatings Industry Regional Market Share

Geographic Coverage of Polyurea Coatings Industry

Polyurea Coatings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Industry; Adoption of Regulations on VOC Emissions; Technological Advancements of Processes and Techniques Involved in Manufacturing

- 3.3. Market Restrains

- 3.3.1. Poor Color Stability on Exposure to UV Light; Unfavorable Conditions Arising Due to the COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Building and Construction Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyurea Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pure

- 5.1.2. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Spraying

- 5.2.2. Pouring

- 5.2.3. Hand Mixing

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Building and Construction

- 5.3.2. Industrial

- 5.3.3. Transportation

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Polyurea Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pure

- 6.1.2. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Spraying

- 6.2.2. Pouring

- 6.2.3. Hand Mixing

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Building and Construction

- 6.3.2. Industrial

- 6.3.3. Transportation

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Polyurea Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pure

- 7.1.2. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Spraying

- 7.2.2. Pouring

- 7.2.3. Hand Mixing

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Building and Construction

- 7.3.2. Industrial

- 7.3.3. Transportation

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Polyurea Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pure

- 8.1.2. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Spraying

- 8.2.2. Pouring

- 8.2.3. Hand Mixing

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Building and Construction

- 8.3.2. Industrial

- 8.3.3. Transportation

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Polyurea Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pure

- 9.1.2. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Spraying

- 9.2.2. Pouring

- 9.2.3. Hand Mixing

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Building and Construction

- 9.3.2. Industrial

- 9.3.3. Transportation

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Polyurea Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pure

- 10.1.2. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Spraying

- 10.2.2. Pouring

- 10.2.3. Hand Mixing

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Building and Construction

- 10.3.2. Industrial

- 10.3.3. Transportation

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rhino Linings Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PPG Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Specialty Products Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VIP Coatings Europe GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huntsman International LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Teknos Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nukote Coating Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KUKDO Chemical (Kunshan) Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Armorthane

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rhino Linings Corporation

List of Figures

- Figure 1: Global Polyurea Coatings Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Polyurea Coatings Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Polyurea Coatings Industry Revenue (billion), by Type 2025 & 2033

- Figure 4: Asia Pacific Polyurea Coatings Industry Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Polyurea Coatings Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Polyurea Coatings Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Polyurea Coatings Industry Revenue (billion), by Technology 2025 & 2033

- Figure 8: Asia Pacific Polyurea Coatings Industry Volume (K Tons), by Technology 2025 & 2033

- Figure 9: Asia Pacific Polyurea Coatings Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Asia Pacific Polyurea Coatings Industry Volume Share (%), by Technology 2025 & 2033

- Figure 11: Asia Pacific Polyurea Coatings Industry Revenue (billion), by Application 2025 & 2033

- Figure 12: Asia Pacific Polyurea Coatings Industry Volume (K Tons), by Application 2025 & 2033

- Figure 13: Asia Pacific Polyurea Coatings Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Asia Pacific Polyurea Coatings Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: Asia Pacific Polyurea Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: Asia Pacific Polyurea Coatings Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: Asia Pacific Polyurea Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Polyurea Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Polyurea Coatings Industry Revenue (billion), by Type 2025 & 2033

- Figure 20: North America Polyurea Coatings Industry Volume (K Tons), by Type 2025 & 2033

- Figure 21: North America Polyurea Coatings Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: North America Polyurea Coatings Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: North America Polyurea Coatings Industry Revenue (billion), by Technology 2025 & 2033

- Figure 24: North America Polyurea Coatings Industry Volume (K Tons), by Technology 2025 & 2033

- Figure 25: North America Polyurea Coatings Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 26: North America Polyurea Coatings Industry Volume Share (%), by Technology 2025 & 2033

- Figure 27: North America Polyurea Coatings Industry Revenue (billion), by Application 2025 & 2033

- Figure 28: North America Polyurea Coatings Industry Volume (K Tons), by Application 2025 & 2033

- Figure 29: North America Polyurea Coatings Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: North America Polyurea Coatings Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: North America Polyurea Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: North America Polyurea Coatings Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: North America Polyurea Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Polyurea Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Polyurea Coatings Industry Revenue (billion), by Type 2025 & 2033

- Figure 36: Europe Polyurea Coatings Industry Volume (K Tons), by Type 2025 & 2033

- Figure 37: Europe Polyurea Coatings Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe Polyurea Coatings Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe Polyurea Coatings Industry Revenue (billion), by Technology 2025 & 2033

- Figure 40: Europe Polyurea Coatings Industry Volume (K Tons), by Technology 2025 & 2033

- Figure 41: Europe Polyurea Coatings Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Europe Polyurea Coatings Industry Volume Share (%), by Technology 2025 & 2033

- Figure 43: Europe Polyurea Coatings Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: Europe Polyurea Coatings Industry Volume (K Tons), by Application 2025 & 2033

- Figure 45: Europe Polyurea Coatings Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Europe Polyurea Coatings Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Europe Polyurea Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe Polyurea Coatings Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Europe Polyurea Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Polyurea Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Polyurea Coatings Industry Revenue (billion), by Type 2025 & 2033

- Figure 52: South America Polyurea Coatings Industry Volume (K Tons), by Type 2025 & 2033

- Figure 53: South America Polyurea Coatings Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Polyurea Coatings Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Polyurea Coatings Industry Revenue (billion), by Technology 2025 & 2033

- Figure 56: South America Polyurea Coatings Industry Volume (K Tons), by Technology 2025 & 2033

- Figure 57: South America Polyurea Coatings Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 58: South America Polyurea Coatings Industry Volume Share (%), by Technology 2025 & 2033

- Figure 59: South America Polyurea Coatings Industry Revenue (billion), by Application 2025 & 2033

- Figure 60: South America Polyurea Coatings Industry Volume (K Tons), by Application 2025 & 2033

- Figure 61: South America Polyurea Coatings Industry Revenue Share (%), by Application 2025 & 2033

- Figure 62: South America Polyurea Coatings Industry Volume Share (%), by Application 2025 & 2033

- Figure 63: South America Polyurea Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: South America Polyurea Coatings Industry Volume (K Tons), by Country 2025 & 2033

- Figure 65: South America Polyurea Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Polyurea Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Polyurea Coatings Industry Revenue (billion), by Type 2025 & 2033

- Figure 68: Middle East and Africa Polyurea Coatings Industry Volume (K Tons), by Type 2025 & 2033

- Figure 69: Middle East and Africa Polyurea Coatings Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: Middle East and Africa Polyurea Coatings Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: Middle East and Africa Polyurea Coatings Industry Revenue (billion), by Technology 2025 & 2033

- Figure 72: Middle East and Africa Polyurea Coatings Industry Volume (K Tons), by Technology 2025 & 2033

- Figure 73: Middle East and Africa Polyurea Coatings Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 74: Middle East and Africa Polyurea Coatings Industry Volume Share (%), by Technology 2025 & 2033

- Figure 75: Middle East and Africa Polyurea Coatings Industry Revenue (billion), by Application 2025 & 2033

- Figure 76: Middle East and Africa Polyurea Coatings Industry Volume (K Tons), by Application 2025 & 2033

- Figure 77: Middle East and Africa Polyurea Coatings Industry Revenue Share (%), by Application 2025 & 2033

- Figure 78: Middle East and Africa Polyurea Coatings Industry Volume Share (%), by Application 2025 & 2033

- Figure 79: Middle East and Africa Polyurea Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Polyurea Coatings Industry Volume (K Tons), by Country 2025 & 2033

- Figure 81: Middle East and Africa Polyurea Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Polyurea Coatings Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyurea Coatings Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Polyurea Coatings Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Polyurea Coatings Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Global Polyurea Coatings Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Global Polyurea Coatings Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Polyurea Coatings Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 7: Global Polyurea Coatings Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Polyurea Coatings Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Polyurea Coatings Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Polyurea Coatings Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Global Polyurea Coatings Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Global Polyurea Coatings Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 13: Global Polyurea Coatings Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Polyurea Coatings Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: Global Polyurea Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Polyurea Coatings Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: China Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: China Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Japan Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: South Korea Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Global Polyurea Coatings Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Polyurea Coatings Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 29: Global Polyurea Coatings Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 30: Global Polyurea Coatings Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 31: Global Polyurea Coatings Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Polyurea Coatings Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Global Polyurea Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Global Polyurea Coatings Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 35: United States Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: United States Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Canada Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Canada Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Mexico Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Mexico Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Global Polyurea Coatings Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Polyurea Coatings Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 43: Global Polyurea Coatings Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 44: Global Polyurea Coatings Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 45: Global Polyurea Coatings Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 46: Global Polyurea Coatings Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 47: Global Polyurea Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Polyurea Coatings Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Germany Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Germany Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: France Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: France Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Italy Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Italy Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Global Polyurea Coatings Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 60: Global Polyurea Coatings Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 61: Global Polyurea Coatings Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 62: Global Polyurea Coatings Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 63: Global Polyurea Coatings Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 64: Global Polyurea Coatings Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 65: Global Polyurea Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global Polyurea Coatings Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 67: Brazil Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Brazil Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: Argentina Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Argentina Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Rest of South America Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of South America Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Global Polyurea Coatings Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 74: Global Polyurea Coatings Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 75: Global Polyurea Coatings Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 76: Global Polyurea Coatings Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 77: Global Polyurea Coatings Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 78: Global Polyurea Coatings Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 79: Global Polyurea Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 80: Global Polyurea Coatings Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 81: Saudi Arabia Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Saudi Arabia Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 83: South Africa Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: South Africa Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Polyurea Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Polyurea Coatings Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyurea Coatings Industry?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the Polyurea Coatings Industry?

Key companies in the market include Rhino Linings Corporation, PPG Industries Inc, Specialty Products Inc, BASF SE, VIP Coatings Europe GmbH, Huntsman International LLC, Teknos Group, Nukote Coating Systems, KUKDO Chemical (Kunshan) Co Ltd, Armorthane.

3. What are the main segments of the Polyurea Coatings Industry?

The market segments include Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Industry; Adoption of Regulations on VOC Emissions; Technological Advancements of Processes and Techniques Involved in Manufacturing.

6. What are the notable trends driving market growth?

Building and Construction Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Poor Color Stability on Exposure to UV Light; Unfavorable Conditions Arising Due to the COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

In January 2021, PPG announced that it had reached a definitive agreement to acquire VersaFlex, a manufacturer specializing in polyurea, epoxy, and polyurethane coatings for water and wastewater infrastructure, flooring, transportation infrastructure, and industrial applications. VersaFlex is a portfolio company of DalFort Capital Partners. The transaction is expected to close in the first quarter of 2021, subject to customary closing conditions. Financial terms were not disclosed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyurea Coatings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyurea Coatings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyurea Coatings Industry?

To stay informed about further developments, trends, and reports in the Polyurea Coatings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence