Key Insights

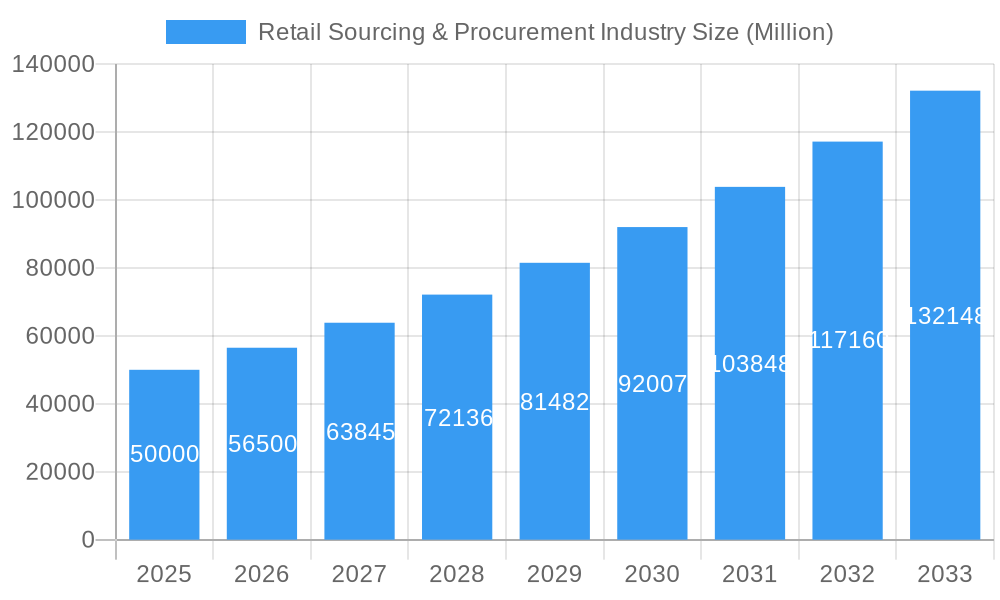

The global retail sourcing and procurement market is poised for significant expansion, driven by the critical need for enhanced efficiency and cost optimization in the ever-evolving retail sector. With a projected Compound Annual Growth Rate (CAGR) of 14.2%, the market is anticipated to grow from an estimated $6.37 billion in the base year of 2025 to a substantial valuation by 2033. This growth is propelled by the increasing adoption of advanced technologies such as AI and machine learning in procurement, the growing complexity of global supply chains demanding enhanced transparency and traceability, and the escalating pressure for sustainable sourcing practices. The continuous expansion of e-commerce further necessitates agile and responsive procurement strategies, contributing to market dynamics. The market is segmented across various dimensions, including procurement software (cloud-based vs. on-premise), deployment models (SaaS, on-premise), and functional areas (procurement, sourcing, supply chain management). Leading market participants, including Kinaxis, Coupa, and SAP, are instrumental in shaping the market through their innovative solution offerings.

Retail Sourcing & Procurement Industry Market Size (In Billion)

Despite the immense market potential, several challenges persist. These include the complexities of integrating legacy systems with emerging technologies, ensuring robust data security and privacy across interconnected systems, and effectively managing risks associated with global supply chain disruptions. The dynamic regulatory environment and the demand for skilled professionals proficient in advanced procurement technologies also present significant hurdles. Nevertheless, the long-term outlook for the retail sourcing and procurement market remains highly promising, underpinned by continuous technological innovation and the persistent drive for streamlined and efficient procurement processes within the competitive retail landscape. The market is projected to reach a considerable size by 2033, reflecting its robust growth trajectory.

Retail Sourcing & Procurement Industry Company Market Share

Retail Sourcing & Procurement Industry: Market Report 2019-2033

This comprehensive report delivers an in-depth analysis of the Retail Sourcing & Procurement market, providing crucial insights for businesses navigating this dynamic landscape. Covering the period from 2019 to 2033, with a focus on 2025, this report offers invaluable data on market size, growth trends, key players, and future opportunities within the parent market of Retail and the child market of Supply Chain Management. The report is meticulously researched and presented to offer actionable intelligence for strategic decision-making.

Retail Sourcing & Procurement Industry Market Dynamics & Structure

The Retail Sourcing & Procurement market, valued at XX million units in 2025, exhibits a moderately concentrated structure with key players holding significant market share. Technological innovation, particularly in areas like AI-powered procurement and blockchain-enabled supply chain transparency, is a primary growth driver. Regulatory changes concerning data privacy and sustainability are shaping industry practices, impacting sourcing strategies and procurement processes. Competitive substitutes, such as traditional manual procurement methods, are gradually losing ground to advanced solutions. The end-user demographic is broad, encompassing large retail chains, SMEs, and e-commerce businesses. M&A activity is consistent, with an estimated XX deals in 2024, consolidating market share and driving technological integration.

- Market Concentration: High, with top 5 players holding approximately xx% market share in 2025.

- Technological Drivers: AI, Blockchain, Machine Learning, RPA.

- Regulatory Frameworks: GDPR, CCPA, Sustainability regulations.

- Competitive Substitutes: Manual procurement processes, legacy systems.

- End-User Demographics: Large retailers (xx%), SMEs (xx%), E-commerce (xx%).

- M&A Trends: XX deals in 2024, focus on technology integration and market expansion. Average deal value: XX million units.

Retail Sourcing & Procurement Industry Growth Trends & Insights

The Retail Sourcing & Procurement market demonstrates robust growth, driven by increasing adoption of advanced procurement technologies and a growing emphasis on supply chain optimization. From 2019 to 2024, the market expanded at a CAGR of xx%, reaching XX million units in 2024. The adoption rate of cloud-based procurement solutions is accelerating, surpassing xx% penetration in 2025. Technological disruptions, such as the rise of AI-powered sourcing platforms and blockchain-enabled traceability, are reshaping market dynamics. Shifts in consumer behavior, including increasing demand for sustainable and ethically sourced products, are further influencing procurement strategies. The forecast period (2025-2033) projects continued growth, with a projected CAGR of xx%, reaching XX million units by 2033. This growth is fueled by the increasing adoption of digital transformation initiatives and the growing demand for supply chain visibility and resilience across the retail sector.

Dominant Regions, Countries, or Segments in Retail Sourcing & Procurement Industry

North America currently dominates the Retail Sourcing & Procurement market, holding approximately xx% of the global market share in 2025. This dominance is driven by factors such as high technological adoption rates, robust retail infrastructure, and the presence of major market players. Europe follows as a significant market, with a share of xx%, attributed to increasing digitalization efforts and stringent regulatory frameworks. The Asia-Pacific region exhibits the highest growth potential, projected to expand at a CAGR of xx% during the forecast period.

- North America: Strong technological adoption, established retail infrastructure.

- Europe: High regulatory compliance, increasing digitalization.

- Asia-Pacific: High growth potential, driven by emerging economies and expanding e-commerce.

Retail Sourcing & Procurement Industry Product Landscape

The market offers a diverse range of products, from basic procurement software to sophisticated cloud-based platforms incorporating AI and machine learning. These solutions streamline processes, optimize sourcing, and enhance supply chain visibility. Key features include automated purchase order generation, vendor management tools, and real-time performance dashboards. Technological advancements are focused on integrating AI for predictive analytics, blockchain for enhanced security and transparency, and robotic process automation (RPA) for increased efficiency. Unique selling propositions center around enhanced cost savings, risk mitigation, and improved supply chain resilience.

Key Drivers, Barriers & Challenges in Retail Sourcing & Procurement Industry

Key Drivers:

- Growing demand for supply chain optimization and visibility.

- Technological advancements in AI, Blockchain, and RPA.

- Increasing focus on sustainable and ethical sourcing.

- Government initiatives promoting digitalization in the retail sector.

Key Challenges:

- High implementation costs of advanced technologies.

- Integration complexities with existing legacy systems.

- Data security and privacy concerns.

- Supply chain disruptions caused by geopolitical events and natural disasters. These disruptions caused an estimated xx% decrease in procurement efficiency in 2022.

Emerging Opportunities in Retail Sourcing & Procurement Industry

- Growing demand for sustainable and ethical sourcing solutions.

- Expansion into emerging markets with high growth potential.

- Integration of advanced analytics and AI for improved decision-making.

- Development of specialized solutions for specific retail segments (e.g., fashion, grocery).

Growth Accelerators in the Retail Sourcing & Procurement Industry Industry

Technological breakthroughs, particularly in AI and blockchain, are significant growth catalysts. Strategic partnerships between technology providers and retail companies facilitate faster adoption and integration of advanced solutions. Market expansion strategies targeting emerging economies and untapped segments, combined with a focus on providing customizable and scalable solutions, will drive long-term growth.

Key Players Shaping the Retail Sourcing & Procurement Industry Market

Notable Milestones in Retail Sourcing & Procurement Industry Sector

- Jan 2022: Coupa Software launches its new AI-powered sourcing platform.

- Oct 2023: Basware acquires a smaller procurement technology firm, expanding its market reach.

- June 2024: SAP releases an updated supply chain management solution integrating blockchain technology.

In-Depth Retail Sourcing & Procurement Industry Market Outlook

The Retail Sourcing & Procurement market is poised for continued growth, driven by increasing adoption of advanced technologies and a greater emphasis on supply chain resilience. Strategic opportunities exist in developing specialized solutions for niche retail segments, expanding into emerging markets, and leveraging AI-powered analytics for enhanced efficiency and cost optimization. The market's future trajectory hinges on adapting to evolving consumer preferences, navigating regulatory changes, and proactively mitigating supply chain disruptions. The focus on sustainable and ethical sourcing will be paramount, shaping industry practices and driving innovation in the years to come.

Retail Sourcing & Procurement Industry Segmentation

-

1. Deployment Type

- 1.1. On-Premise

- 1.2. Cloud

-

2. Solution Type

- 2.1. Strategic Sourcing

- 2.2. Supplier Management

- 2.3. Contract Management

- 2.4. Procure-to-pay

- 2.5. Spend Analysis

Retail Sourcing & Procurement Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Retail Sourcing & Procurement Industry Regional Market Share

Geographic Coverage of Retail Sourcing & Procurement Industry

Retail Sourcing & Procurement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Advanced Retail Sourcing and Procurement Solutions and Services is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand for Advanced Retail Sourcing and Procurement Solutions and Services is Driving the Market Growth

- 3.4. Market Trends

- 3.4.1. Contract Management to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Solution Type

- 5.2.1. Strategic Sourcing

- 5.2.2. Supplier Management

- 5.2.3. Contract Management

- 5.2.4. Procure-to-pay

- 5.2.5. Spend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. On-Premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Solution Type

- 6.2.1. Strategic Sourcing

- 6.2.2. Supplier Management

- 6.2.3. Contract Management

- 6.2.4. Procure-to-pay

- 6.2.5. Spend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. On-Premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Solution Type

- 7.2.1. Strategic Sourcing

- 7.2.2. Supplier Management

- 7.2.3. Contract Management

- 7.2.4. Procure-to-pay

- 7.2.5. Spend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Pacific Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. On-Premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Solution Type

- 8.2.1. Strategic Sourcing

- 8.2.2. Supplier Management

- 8.2.3. Contract Management

- 8.2.4. Procure-to-pay

- 8.2.5. Spend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Latin America Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. On-Premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Solution Type

- 9.2.1. Strategic Sourcing

- 9.2.2. Supplier Management

- 9.2.3. Contract Management

- 9.2.4. Procure-to-pay

- 9.2.5. Spend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Middle East Retail Sourcing & Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. On-Premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Solution Type

- 10.2.1. Strategic Sourcing

- 10.2.2. Supplier Management

- 10.2.3. Contract Management

- 10.2.4. Procure-to-pay

- 10.2.5. Spend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kinaxis

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Proactis Holdings Plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coupa Software

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HighJump Software

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Basware Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SAP SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oracle Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IBM Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Epicor Software Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JDA Software Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 JAGGAER Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Infor Nexus

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zycus Inc *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Kinaxis

List of Figures

- Figure 1: Global Retail Sourcing & Procurement Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 3: North America Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 4: North America Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 5: North America Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 6: North America Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 9: Europe Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 10: Europe Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 11: Europe Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 12: Europe Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 15: Asia Pacific Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 16: Asia Pacific Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 17: Asia Pacific Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 18: Asia Pacific Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 21: Latin America Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 22: Latin America Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 23: Latin America Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 24: Latin America Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Retail Sourcing & Procurement Industry Revenue (billion), by Deployment Type 2025 & 2033

- Figure 27: Middle East Retail Sourcing & Procurement Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 28: Middle East Retail Sourcing & Procurement Industry Revenue (billion), by Solution Type 2025 & 2033

- Figure 29: Middle East Retail Sourcing & Procurement Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 30: Middle East Retail Sourcing & Procurement Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Retail Sourcing & Procurement Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 2: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 3: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 5: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 6: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 8: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 9: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 11: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 12: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 14: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 15: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Deployment Type 2020 & 2033

- Table 17: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Solution Type 2020 & 2033

- Table 18: Global Retail Sourcing & Procurement Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Sourcing & Procurement Industry?

The projected CAGR is approximately 14.2%.

2. Which companies are prominent players in the Retail Sourcing & Procurement Industry?

Key companies in the market include Kinaxis, Proactis Holdings Plc, Coupa Software, HighJump Software, Basware Corporation, SAP SE, Oracle Corporation, IBM Corporation, Epicor Software Corporation, JDA Software Group Inc, JAGGAER Inc, Infor Nexus, Zycus Inc *List Not Exhaustive.

3. What are the main segments of the Retail Sourcing & Procurement Industry?

The market segments include Deployment Type, Solution Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.37 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Advanced Retail Sourcing and Procurement Solutions and Services is Driving the Market Growth.

6. What are the notable trends driving market growth?

Contract Management to Dominate the Market.

7. Are there any restraints impacting market growth?

; Growing Demand for Advanced Retail Sourcing and Procurement Solutions and Services is Driving the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Sourcing & Procurement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Sourcing & Procurement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Sourcing & Procurement Industry?

To stay informed about further developments, trends, and reports in the Retail Sourcing & Procurement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence