Key Insights

The Saudi Arabia Casualty Lines Insurance Market is poised for substantial expansion, propelled by escalating vehicle ownership, intensified construction activities, and heightened risk management awareness among individuals and enterprises. The market's Compound Annual Growth Rate (CAGR) of 7.35% indicates a robust upward trend, projected through 2033. This growth is underpinned by government initiatives aimed at boosting insurance penetration, a growing middle class with increased disposable income, and stringent regulatory mandates for specific activities. Key market segments include motor insurance, general liability, and workers' compensation, all contributing to the overall market value. The competitive landscape features established entities such as The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, and MedGulf, alongside other prominent insurers. Potential growth impediments include economic volatility linked to oil price fluctuations and the necessity for advanced consumer education on insurance products.

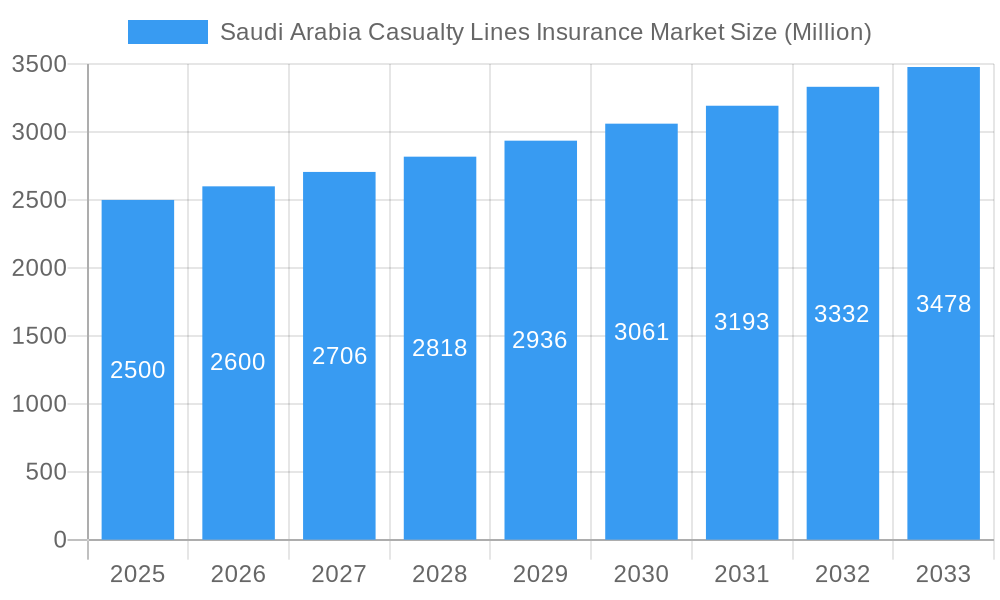

Saudi Arabia Casualty Lines Insurance Market Market Size (In Million)

The forecast period (2024-2033) anticipates sustained market growth, potentially accelerated by Vision 2030's infrastructural developments. While precise data is unavailable, based on the CAGR and typical market dynamics in developing economies, the market size is projected to reach approximately 44.15 million by 2033. Insurers can leverage targeted marketing highlighting value propositions and risk mitigation benefits, invest in digital technologies for improved customer experiences, and forge strategic partnerships to enhance market reach. Continued economic development, supportive regulatory frameworks, and product innovation will be critical for sustained market advancement.

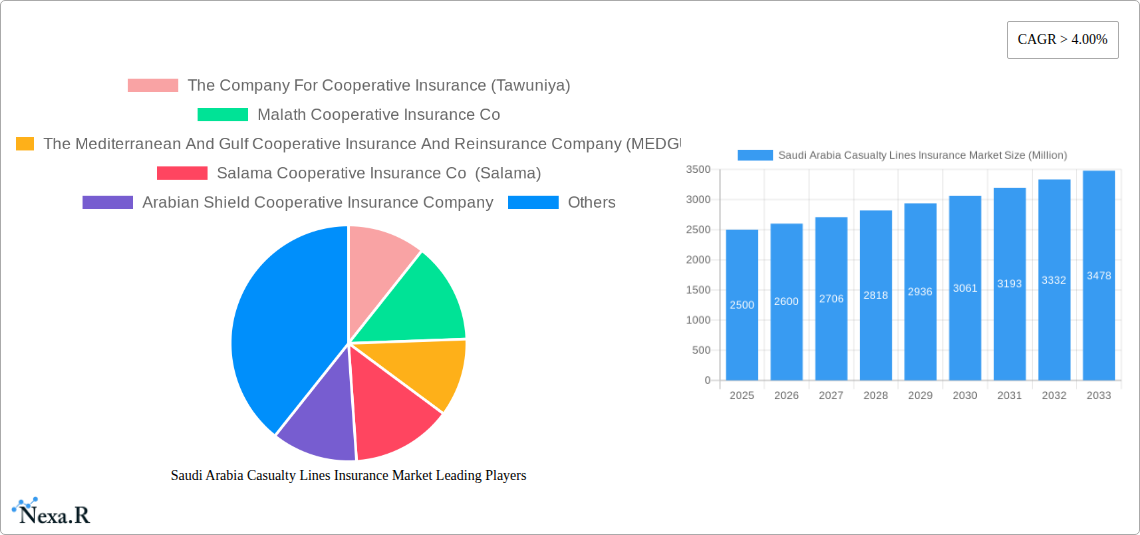

Saudi Arabia Casualty Lines Insurance Market Company Market Share

Saudi Arabia Casualty Lines Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia Casualty Lines Insurance Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is invaluable for insurance professionals, investors, and businesses seeking to understand and navigate this dynamic market. The report's parent market is the broader Saudi Arabian insurance market, while the child market focuses specifically on casualty lines insurance.

Market size is projected at XX Million in 2025 and is expected to reach XX Million by 2033.

Saudi Arabia Casualty Lines Insurance Market Dynamics & Structure

This section analyzes the structure and dynamics of the Saudi Arabia Casualty Lines Insurance market, offering a detailed understanding of its competitive landscape and influencing factors. The market exhibits a moderately concentrated structure, with key players such as The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, and others holding significant market share. Technological innovation, particularly in areas like telematics and AI-driven risk assessment, is a key driver. However, barriers to innovation include data privacy regulations and the need for significant IT infrastructure investments. The regulatory framework, governed by the Saudi Central Bank (Insurance Authority), is undergoing significant changes, impacting market dynamics. The introduction of new regulations, such as the Comprehensive Motor Insurance Rules (November 2022), are reshaping the market. M&A activity remains relatively moderate but is expected to increase with market consolidation.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% of market share in 2024.

- Technological Innovation: Key drivers include telematics and AI, but barriers include data privacy and IT infrastructure costs.

- Regulatory Framework: Significant changes driven by the Saudi Central Bank (Insurance Authority), including the recent Comprehensive Motor Insurance Rules.

- Competitive Substitutes: Limited direct substitutes, but alternative risk management strategies pose indirect competition.

- End-User Demographics: Predominantly driven by the growing population and increasing vehicle ownership.

- M&A Trends: Moderate activity currently, with potential for increased consolidation in the forecast period. Estimated xx M&A deals in the historical period (2019-2024).

Saudi Arabia Casualty Lines Insurance Market Growth Trends & Insights

The Saudi Arabia Casualty Lines Insurance market has witnessed significant growth in recent years, driven by factors such as economic expansion, increasing insurance awareness, and government initiatives. The market experienced a CAGR of xx% during the historical period (2019-2024). The adoption rate of various casualty insurance products, particularly motor insurance, continues to rise, fueled by rising vehicle ownership and government regulations mandating certain types of coverage. Technological disruptions, including the implementation of Insurtech solutions, are streamlining processes and enhancing customer experience. Shifting consumer behavior towards digital platforms and a preference for personalized insurance solutions further shape market trends. We anticipate a CAGR of xx% during the forecast period (2025-2033), driven by sustained economic growth and ongoing regulatory reforms. Market penetration is projected to increase from xx% in 2025 to xx% by 2033.

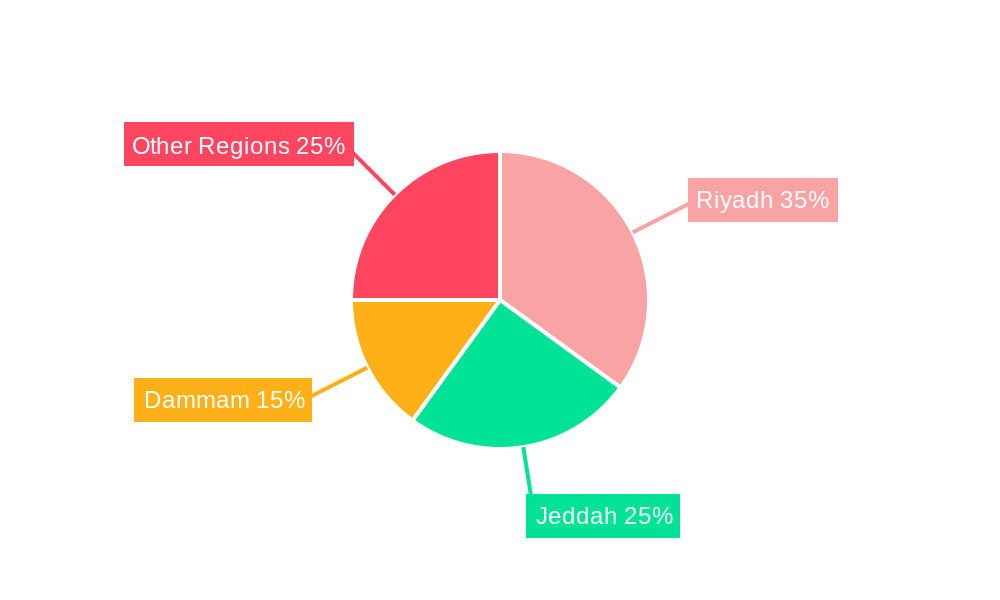

Dominant Regions, Countries, or Segments in Saudi Arabia Casualty Lines Insurance Market

The Saudi Arabia Casualty Lines Insurance market is largely concentrated within major urban centers, reflecting higher population density, economic activity, and vehicle ownership. The Riyadh region dominates the market, driven by its strong economic activity and sizable population. Other significant regions include Jeddah and Dammam, exhibiting robust growth in line with regional economic expansions. The motor insurance segment accounts for the largest market share, reflecting high vehicle ownership and mandatory insurance requirements. Other notable segments include general liability and workers' compensation.

- Key Drivers: Strong economic growth, rising urbanization, expanding infrastructure, government initiatives promoting insurance penetration.

- Riyadh Region Dominance: Largest market share due to high population density, economic activity, and vehicle ownership.

- Growth Potential: Significant potential in less-penetrated regions and untapped market segments.

Saudi Arabia Casualty Lines Insurance Market Product Landscape

The product landscape is characterized by a range of casualty insurance products, including motor insurance (compulsory and comprehensive), general liability, workers' compensation, and others. Product innovations focus on enhancing customer experience through digital platforms, personalized offerings, and bundled insurance packages. Key performance metrics include claims ratios, loss ratios, and customer satisfaction scores. The unique selling propositions of various insurers often center around their digital capabilities, customer service, and claims processing efficiency. Technological advancements are mainly focused on improving risk assessment and fraud detection through data analytics and AI.

Key Drivers, Barriers & Challenges in Saudi Arabia Casualty Lines Insurance Market

Key Drivers:

- Rapid economic growth and infrastructure development.

- Increasing vehicle ownership and mandatory insurance requirements.

- Government initiatives promoting insurance penetration.

Key Challenges & Restraints:

- Competition among established players and new entrants.

- Regulatory complexities and compliance requirements.

- Potential for increased claims due to traffic accidents.

- Workforce skills gaps in specific areas, such as actuarial science and risk management.

Emerging Opportunities in Saudi Arabia Casualty Lines Insurance Market

Emerging opportunities lie in leveraging digital technologies to provide personalized and efficient insurance solutions. This includes the development of innovative products such as parametric insurance and Insurtech applications focusing on customer acquisition and engagement. Untapped market segments, such as specialized insurance for SMEs and emerging industries, present significant growth potential.

Growth Accelerators in the Saudi Arabia Casualty Lines Insurance Market Industry

Long-term growth will be significantly driven by technological advancements, particularly the adoption of AI and machine learning for better risk assessment and fraud detection. Strategic partnerships between insurance companies and technology providers will also play a crucial role. Expansion into underserved markets and the development of innovative products tailored to specific customer needs will unlock further growth.

Key Players Shaping the Saudi Arabia Casualty Lines Insurance Market Market

- The Company For Cooperative Insurance (Tawuniya)

- Malath Cooperative Insurance Co

- The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF)

- Salama Cooperative Insurance Co (Salama)

- Arabian Shield Cooperative Insurance Company

- Saudi Arabian Cooperative Insurance Company (Saico)

- Gulf Union Al Ahlia Cooperative Insurance Co

- Allianz Saudi Fransi Cooperative Insurance Company

- Al-Etihad Co-operative Insurance Co

- Al Sagr Cooperative Insurance Company

- List Not Exhaustive

Notable Milestones in Saudi Arabia Casualty Lines Insurance Market Sector

- November 2022: The Saudi Central Bank (Insurance Authority) announces the issuance of the Comprehensive Motor Insurance Rules, aiming to standardize coverage and regulate insurer-insured relationships. This milestone is expected to increase market transparency and standardize insurance offerings.

- February 2023: The Saudi Central Bank (Insurance Authority) licenses Cigna Worldwide Insurance Company, marking the entry of the first foreign health insurance company branch into Saudi Arabia. This signifies increased foreign investment and competition in the insurance sector.

In-Depth Saudi Arabia Casualty Lines Insurance Market Market Outlook

The Saudi Arabia Casualty Lines Insurance market is poised for continued growth, fueled by economic expansion, rising insurance awareness, and ongoing regulatory reforms. Strategic opportunities exist in leveraging technological advancements, expanding into underserved markets, and developing innovative insurance products. The market’s future potential is substantial, particularly within the evolving digital landscape, presenting significant returns for proactive players.

Saudi Arabia Casualty Lines Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Motor

- 1.2. Property / Fire

- 1.3. Marine

- 1.4. Aviation

- 1.5. Energy

- 1.6. Engineering

- 1.7. Accident & Liability and Others

-

2. Distribution Channel

- 2.1. Insurance Agency

- 2.2. Bancassurance

- 2.3. Brokers

- 2.4. Direct Sales

- 2.5. Other Distribution Channels

Saudi Arabia Casualty Lines Insurance Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Casualty Lines Insurance Market Regional Market Share

Geographic Coverage of Saudi Arabia Casualty Lines Insurance Market

Saudi Arabia Casualty Lines Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Saudi Arabia Motor Insurance has Growth Potential

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Casualty Lines Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Motor

- 5.1.2. Property / Fire

- 5.1.3. Marine

- 5.1.4. Aviation

- 5.1.5. Energy

- 5.1.6. Engineering

- 5.1.7. Accident & Liability and Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Agency

- 5.2.2. Bancassurance

- 5.2.3. Brokers

- 5.2.4. Direct Sales

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Company For Cooperative Insurance (Tawuniya)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Malath Cooperative Insurance Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Salama Cooperative Insurance Co (Salama)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arabian Shield Cooperative Insurance Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Arabian Cooperative Insurance Company (Saico)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulf Union Al Ahlia Cooperative Insurance Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Allianz Saudi Fransi Cooperative Insurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Etihad Co-operative Insurance Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Sagr Cooperative Insurance Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Company For Cooperative Insurance (Tawuniya)

List of Figures

- Figure 1: Saudi Arabia Casualty Lines Insurance Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Casualty Lines Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Casualty Lines Insurance Market Revenue million Forecast, by Insurance Type 2020 & 2033

- Table 2: Saudi Arabia Casualty Lines Insurance Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Saudi Arabia Casualty Lines Insurance Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Casualty Lines Insurance Market Revenue million Forecast, by Insurance Type 2020 & 2033

- Table 5: Saudi Arabia Casualty Lines Insurance Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Saudi Arabia Casualty Lines Insurance Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Casualty Lines Insurance Market?

The projected CAGR is approximately 7.35%.

2. Which companies are prominent players in the Saudi Arabia Casualty Lines Insurance Market?

Key companies in the market include The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF), Salama Cooperative Insurance Co (Salama), Arabian Shield Cooperative Insurance Company, Saudi Arabian Cooperative Insurance Company (Saico), Gulf Union Al Ahlia Cooperative Insurance Co, Allianz Saudi Fransi Cooperative Insurance Company, Al-Etihad Co-operative Insurance Co, Al Sagr Cooperative Insurance Company**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Casualty Lines Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.15 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Saudi Arabia Motor Insurance has Growth Potential.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: The Saudi Central Bank (Insurance Authority (IA), is the current insurance regulator of the Kingdom of Saudi Arabia) announces the licensing of Cigna Worldwide Insurance Company; the first foreign health insurance company branch in Saudi Arabia

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Casualty Lines Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Casualty Lines Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Casualty Lines Insurance Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Casualty Lines Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence