Key Insights

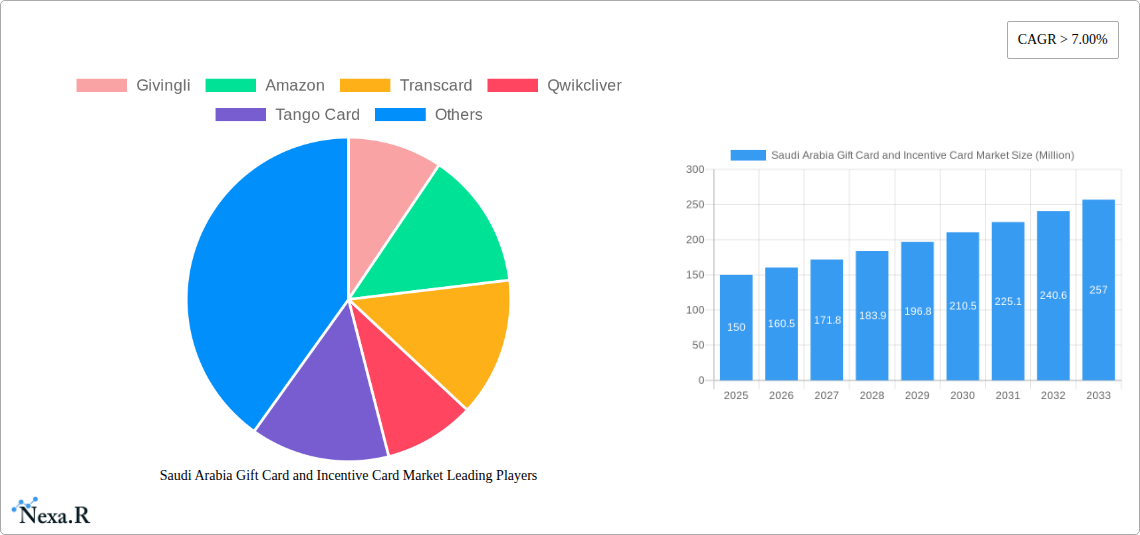

Saudi Arabia's gift and incentive card market is poised for significant expansion, fueled by robust consumer spending, a thriving e-commerce ecosystem, and the widespread adoption of digital payments. Corporate gifting, emphasizing employee rewards and client appreciation, is a key growth driver, underscoring a trend towards experience-based incentives. The market is estimated at $3.7 billion for the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of 12.3% through 2033. This market is segmented by consumer type (individual and corporate), distribution channel (online and offline), and product type (e-gift cards and physical cards). The online segment is anticipated to lead growth due to the increasing preference for digital transactions and convenience. Major players like Amazon and prominent regional entities are actively influencing market dynamics, with further consolidation expected amid intensifying competition.

Saudi Arabia Gift Card and Incentive Card Market Market Size (In Billion)

Challenges such as potential regulatory shifts and security concerns related to digital gift cards are being addressed through enhanced security measures and government support for digital transformation. The e-gift card segment is expected to maintain its dominance, offering ease of use and cost-effectiveness. Future growth will be further propelled by technological innovations, including personalized experiences and loyalty program integration. The corporate segment offers substantial expansion potential as businesses seek novel methods for employee engagement and client relationship building. Saudi Arabia represents a promising market for both established and emerging players in the gift and incentive card sector.

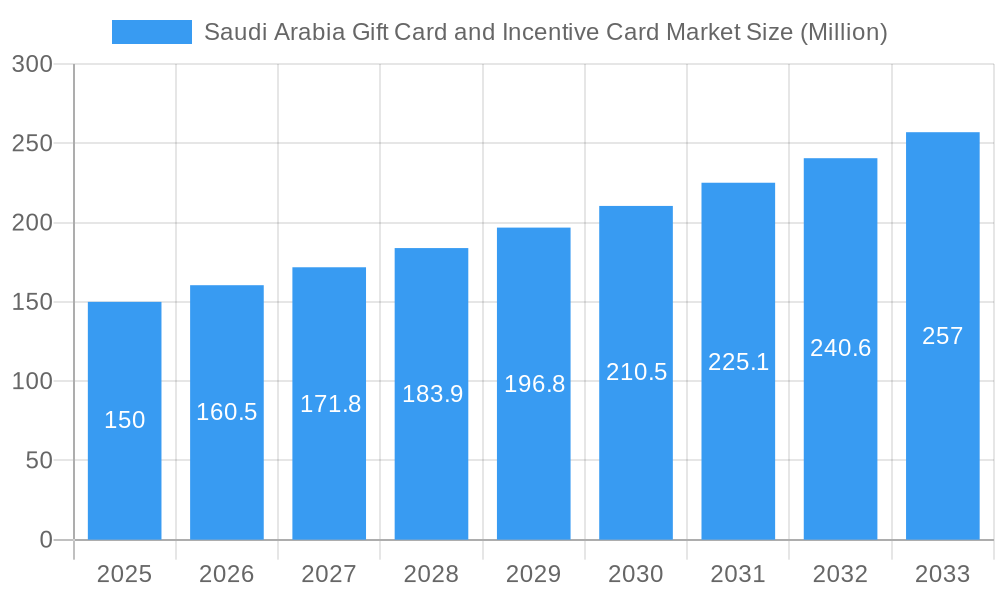

Saudi Arabia Gift Card and Incentive Card Market Company Market Share

Saudi Arabia Gift Card and Incentive Card Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia gift card and incentive card market, encompassing market size, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period spanning 2025-2033. This report is invaluable for industry professionals, investors, and businesses seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report segments the market by consumer (individual, corporate), distribution channel (online, offline), and product type (e-gift card, physical card).

Saudi Arabia Gift Card and Incentive Card Market Dynamics & Structure

The Saudi Arabia gift card and incentive card market is experiencing significant growth, driven by rising disposable incomes, increasing digital adoption, and a burgeoning e-commerce sector. Market concentration is moderate, with a mix of international and local players. Technological innovation, particularly in digital payment systems and personalized gifting options, is a key driver. The regulatory framework, while evolving, generally supports the growth of the sector. Competition from alternative reward systems and the increasing prevalence of mobile payment apps pose challenges. M&A activity remains relatively low, with xx deals recorded in the historical period (2019-2024), indicating potential for future consolidation.

- Market Concentration: Moderate, with a mix of large international and smaller local players. Market share held by top 5 players: xx%.

- Technological Innovation: Key drivers include mobile wallets, contactless payments, and personalized e-gift card platforms. Barriers include integration with existing systems and data security concerns.

- Regulatory Framework: Generally supportive, with ongoing developments in consumer protection and data privacy regulations.

- Competitive Substitutes: Mobile payment apps, loyalty programs, and experiential rewards compete for market share.

- End-User Demographics: Significant growth driven by young, tech-savvy consumers and increasing corporate adoption for employee rewards and incentives.

- M&A Trends: Low M&A activity historically (xx deals 2019-2024), with potential for increased consolidation in the forecast period.

Saudi Arabia Gift Card and Incentive Card Market Growth Trends & Insights

The Saudi Arabian gift card and incentive card market is experiencing robust growth, projected to reach xx Million units by 2025 and xx Million units by 2033. This translates to a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Increased consumer spending, coupled with the rising popularity of online shopping and corporate gifting programs, fuels this expansion. The market penetration rate for gift cards is currently at xx%, expected to rise to xx% by 2033. Technological disruptions, such as the introduction of blockchain-based gift cards and enhanced personalization features, are driving adoption. Consumer behavior shifts towards digital gifting and preference for e-gift cards are contributing to the market's growth. The increasing integration of gift cards into loyalty programs and corporate incentive schemes also boosts market demand.

Dominant Regions, Countries, or Segments in Saudi Arabia Gift Card and Incentive Card Market

The major growth driver within the Saudi Arabia gift card and incentive card market is the corporate segment. Driven by a robust business environment and increased focus on employee engagement and rewards programs, corporate spending on gift cards and incentives is substantially higher than individual consumer spending. Online distribution channels are witnessing faster growth than offline channels due to increasing internet and smartphone penetration. E-gift cards, owing to their convenience and immediate delivery, are outpacing the growth of physical gift cards.

- Corporate Segment: Strong growth driven by increased employee engagement initiatives and corporate gifting programs. Market share: xx%.

- Online Distribution Channel: Faster growth due to high internet penetration and preference for e-commerce. Market share: xx% in 2025.

- E-Gift Cards: High adoption rate driven by convenience and immediate delivery. Market share: xx% in 2025.

- Key Drivers: Rising disposable incomes, increasing digital adoption, and supportive government initiatives.

Saudi Arabia Gift Card and Incentive Card Market Product Landscape

The market offers a diverse range of products, including traditional physical gift cards, digital e-gift cards redeemable online and in-store, and mobile-based gift cards. Significant advancements are evident in personalization options, allowing corporations to tailor gift card designs and values for specific employee recognition or reward programs. Integration with loyalty programs enhances the value proposition and encourages customer retention. Technological advancements such as blockchain technology offer improved security and traceability while providing enhanced convenience.

Key Drivers, Barriers & Challenges in Saudi Arabia Gift Card and Incentive Card Market

Key Drivers: The market is propelled by increasing disposable incomes, expanding e-commerce, a growing preference for digital gifting, and government support for digital transactions. The increasing adoption of digital payment systems and the proliferation of loyalty programs further accelerate market growth.

Challenges: Challenges include the need for enhanced security measures against fraud and counterfeiting, the cost of implementing and maintaining robust technology infrastructure, and navigating a complex regulatory environment. Competition from alternative reward and incentive systems also presents a challenge.

Emerging Opportunities in Saudi Arabia Gift Card and Incentive Card Market

Untapped opportunities exist in expanding the market to smaller cities and towns, promoting gift cards for specific events and occasions (e.g., religious holidays, national celebrations), and integrating gift cards into more loyalty programs and customer engagement initiatives. The development of innovative applications, such as gift cards with embedded social features, could also drive market growth. Catering to niche consumer preferences (such as personalized gift cards or sustainable gift card options) presents further opportunity.

Growth Accelerators in the Saudi Arabia Gift Card and Incentive Card Market Industry

Long-term growth will be fueled by technological advancements (like contactless payments and blockchain), strategic partnerships between gift card platforms and retailers/service providers, and market expansion into underpenetrated segments. Government initiatives promoting digital payments and e-commerce will further accelerate market expansion. The continued integration of gift cards within loyalty programs and corporate reward systems will drive volume growth.

Key Players Shaping the Saudi Arabia Gift Card and Incentive Card Market Market

- Givingli

- Amazon

- Transcard

- Qwikcliver

- Tango Card

- Alyce

- Ininal

- Riskified

- Swile

- One4all

- List Not Exhaustive

Notable Milestones in Saudi Arabia Gift Card and Incentive Card Market Sector

- September 2021: Amazon One expands beyond retail, partnering with AXS for ticketing, enabling palm-based entry at venues in Saudi Arabia. This demonstrates the expansion of biometric payment technology into new sectors.

- August 2021: Hub Engage and Tango Card launch a strategic partnership to offer gift card incentives for employee engagement across the Gulf region, including Saudi Arabia. This collaboration expands the reach and functionality of gift card reward programs.

In-Depth Saudi Arabia Gift Card and Incentive Card Market Outlook

The Saudi Arabia gift card and incentive card market exhibits robust potential for sustained growth driven by digital transformation, rising consumer spending, and corporate adoption of rewards programs. Strategic partnerships, technological innovation, and effective marketing campaigns will be crucial for companies to capitalize on this growth and maintain a competitive edge. Focusing on personalization, security, and seamless integration with existing systems are key to maximizing market penetration and achieving long-term success.

Saudi Arabia Gift Card and Incentive Card Market Segmentation

-

1. Consumer

- 1.1. Individual

- 1.2. Corporate

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Product

- 3.1. E-Gift Card

- 3.2. Physical Card

Saudi Arabia Gift Card and Incentive Card Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Gift Card and Incentive Card Market Regional Market Share

Geographic Coverage of Saudi Arabia Gift Card and Incentive Card Market

Saudi Arabia Gift Card and Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Increase in the E-Commerce market in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 5.1.1. Individual

- 5.1.2. Corporate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. E-Gift Card

- 5.3.2. Physical Card

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Givingli

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Transcard

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qwikcliver

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tango Card

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alyce

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ininal

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Riskified

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Swile

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 One4all**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Givingli

List of Figures

- Figure 1: Saudi Arabia Gift Card and Incentive Card Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Gift Card and Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Gift Card and Incentive Card Market Revenue billion Forecast, by Consumer 2020 & 2033

- Table 2: Saudi Arabia Gift Card and Incentive Card Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Saudi Arabia Gift Card and Incentive Card Market Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Saudi Arabia Gift Card and Incentive Card Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Gift Card and Incentive Card Market Revenue billion Forecast, by Consumer 2020 & 2033

- Table 6: Saudi Arabia Gift Card and Incentive Card Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Saudi Arabia Gift Card and Incentive Card Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Saudi Arabia Gift Card and Incentive Card Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Gift Card and Incentive Card Market?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the Saudi Arabia Gift Card and Incentive Card Market?

Key companies in the market include Givingli, Amazon, Transcard, Qwikcliver, Tango Card, Alyce, Ininal, Riskified, Swile, One4all**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Gift Card and Incentive Card Market?

The market segments include Consumer, Distribution Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Increase in the E-Commerce market in Saudi Arabia.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

On September 2021, Amazon One has expanded beyond retail with first third-party customer, ticketing company AXS. Amazon One from then was available on AXS's mobile ticketing pedestals, giving Red Rocks Amphitheatre event goers the option to enter using just their palm across the globe including Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Gift Card and Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Gift Card and Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Gift Card and Incentive Card Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Gift Card and Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence